Vision Correction Market size was valued at USD 23.5 Mn. in 2022 and the total Vision Correction revenue is expected to grow by 8.9 % from 2023 to 2029, reaching nearly USD 42.7 Mn.Vision Correction Market Overview:

The vision correction market refers to the industry that provides products and services to correct vision problems such as nearsightedness, farsightedness, and astigmatism. The market includes a wide range of products and services such as eyeglasses, contact lenses, surgical procedures like LASIK and PRK, and implantable lenses. Eyeglasses and contact lenses are the most common forms of vision correction, and they account for a significant portion of the market. The demand for contact lenses is increasing thanks to factors such as their convenience and cosmetic appeal. Additionally, technological advancements have led to the development of multifocal and toric contact lenses that can correct a wider range of vision problems. Surgical procedures like LASIK and PRK are becoming increasingly popular thanks to their long-term effectiveness and convenience. These procedures involve the use of laser technology to reshape the cornea, which eliminates the need for glasses or contacts. Implantable lenses are also gaining popularity as an alternative to LASIK, especially among patients who are not suitable candidates for laser surgery. The vision correction market is highly competitive, with many players operating in the space. Major players include companies like Alcon Inc., Bausch Health Companies Inc., Carl Zeiss Meditec AG, Essilor International S.A., and Johnson & Johnson Vision Care, Inc. The vision correction market is also characterized by frequent mergers and acquisitions as companies seek to grow their product offerings and reach new markets.To know about the Research Methodology :- Request Free Sample Report

Vision Correction Market Dynamics:

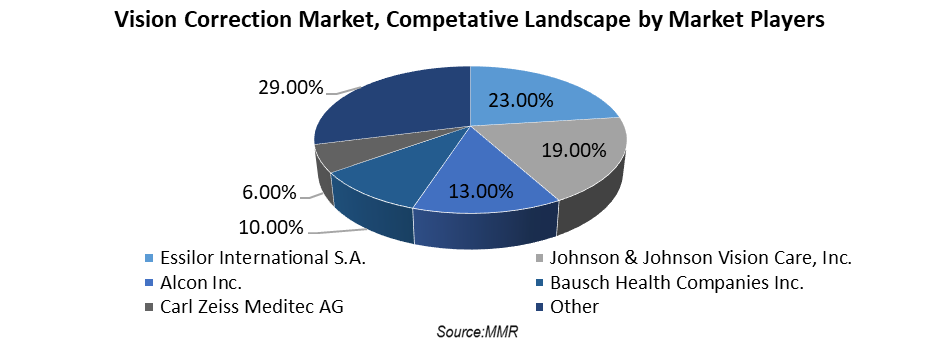

Competitive Landscape: The vision correction market is highly competitive, with numerous players operating in the space. The market is dominated by a few major players, but there are also several smaller players who cater to niche markets. Here are some key players in the vision correction market and their market share: Essilor International S.A. - With a market share of around 23%, Essilor is the largest player in the vision correction market. The company is a leading manufacturer of eyeglass lenses and owns several popular brands such as Varilux and Crizal. Johnson & Johnson Vision Care, Inc. - Johnson & Johnson's vision care division is the second-largest player in the market with a market share of around 19%. The company manufactures contact lenses and other vision correction products under popular brands such as Acuvue and Oasys. Alcon Inc. - Alcon is a global leader in the manufacture and distribution of surgical equipment and devices used in vision correction procedures. The company has a market share of around 13%. Bausch Health Companies Inc. - Bausch Health Companies is a diversified healthcare company that operates in several segments, including vision care. The company has a market share of around 10%. Additionally, the Carl Zeiss Meditec AG - Carl Zeiss Meditec is a leading manufacturer of ophthalmic devices and instruments used in vision correction procedures. The company has a market share of around 6%. Other notable players in the vision correction market include CooperVision, Hoya Corporation, STAAR Surgical, Inc., and SynergEyes, Inc. The market is characterized by frequent mergers and acquisitions, with companies seeking to grow their product offerings and reach new markets. For example, in 2019, Essilor merged with Luxottica to create the world's largest eyewear company.

Vision Correction Market Trend

Increasing popularity of laser-assisted vision correction procedures The increasing popularity of laser-assisted vision correction procedures, such as LASIK (Laser-Assisted in Situ Keratomileusis) and PRK (Photorefractive Keratectomy). Laser-assisted vision correction procedures have gained popularity over the years thanks to their high success rates and relatively quick recovery times. These procedures use laser technology to reshape the cornea of the eye, correcting refractive errors such as myopia, hyperopia, and astigmatism. The growing popularity of these procedures is driving the growth of the vision correction market, as more people are opting for laser-assisted procedures over traditional methods such as eyeglasses and contact lenses. In addition, technological advancements in laser technology have made these procedures safer and more precise, which is expected to further increase their adoption in the forecast years. Moreover, the COVID-19 pandemic has also accelerated the trend toward laser-assisted procedures, as people are increasingly looking for contactless options for vision correction. This has resulted in a surge in demand for LASIK and other laser-assisted procedures, as people seek to reduce their reliance on contact lenses and eyeglasses.Vision Correction Market Drivers

Growing prevalence of vision problems and eye diseases The increasing prevalence of vision problems and eye diseases is expected to drive demand for vision correction products and services. According to the World Health Organization (WHO), an estimated 2.2 billion people worldwide have vision impairment or blindness, and this number is expected to increase in the forecast years due to aging populations and rising rates of myopia. As the number of people with vision problems increases, there is a growing need for vision correction products and services such as eyeglasses, contact lenses, and surgical procedures. This is creating opportunities for companies operating in the vision correction market to develop and market new products and technologies to meet the growing demand. Moreover, technological advancements in vision correction products and procedures are also driving the growth of the market. For example, the development of advanced intraocular lenses and laser-assisted cataract surgery has made vision correction procedures safer and more effective, which is expected to increase the adoption of these procedures.Vision Correction Market Restraints

High Cost of the Procedure The high cost of corrective procedures and devices is a significant restraint in the vision correction market. LASIK surgery, for example, cost thousands of dollars per eye, making it unaffordable for many people, particularly in low-income populations. Similarly, implantable contact lenses and other corrective devices also are prohibitively expensive, limiting access to these treatments. This results in many people continuing to rely on prescription eyeglasses or contact lenses, despite the potential limitations and inconveniences these options may present. Vision Correction Market Opportunity Bolstering demand for non-surgical vision correction solutions The increasing demand for non-surgical vision correction solutions. While corrective surgeries such as LASIK offer long-lasting results, they can also be expensive and carry some risks. As a result, many people are turning to non-surgical options such as orthokeratology (Ortho-K) and corneal refractive therapy (CRT) to correct their vision. Ortho-K and CRT are both non-surgical procedures that involve the use of specialized contact lenses to reshape the cornea and correct refractive errors such as myopia and astigmatism. These procedures offer several advantages over traditional corrective surgeries, including lower cost, lower risk, and the ability to be easily reversed or adjusted if necessary. The demand for non-surgical vision correction solutions is expected to continue to grow, driven by factors such as increasing awareness of these options among consumers, improvements in the technology and materials used in these procedures, and the convenience and flexibility they offer compared to traditional corrective surgeries. As a result, there is a growing opportunity for companies in the vision correction market to develop and market innovative new non-surgical vision correction solutions to meet this demand, and to differentiate themselves from competitors who focus primarily on surgical options.Vision Correction Market Segment Analysis:

Based on Method, the glasses segment has traditionally been the dominant segment of the vision correction market, and it continues to hold a significant share of the market. Eyeglasses have been a popular choice for vision correction for centuries, and they remain a popular choice thanks to factors such as affordability, accessibility, and convenience. With the increasing prevalence of vision problems worldwide, the demand for eyeglasses is expected to continue to grow, particularly in developing regions where access to other forms of vision correction may be limited. However, other segments of the vision correction market, such as contact lenses and corrective surgeries, are also growing rapidly and are expected to gain market share in the forecast years. For example, contact lenses are becoming increasingly popular thanks to factors such as advancements in technology that have made them more comfortable and easier to use, as well as the growing demand for non-surgical vision correction solutions. Similarly, corrective surgeries such as LASIK are becoming more widely available and affordable, making them an increasingly popular choice for people seeking long-term solutions to their vision problems. As a result, while the glasses segment remains dominant, other segments of the vision correction market are also gaining momentum and are expected to continue to grow in the forecast years.Based on the Application, The vision correction market is a large and diverse industry, encompassing a wide range of products and services. In addition to presbyopia correction, the market includes products and services for correcting myopia (nearsightedness), hyperopia (farsightedness), and astigmatism. The presbyopia segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to a rise in the prevalence of vision impairment disorder and a rise in the number of produclaunchesch and product approvals for vision correction devices, which can treat presbyopia, and increase in a number of geriatric populations, who are more susceptible to vision impairment.

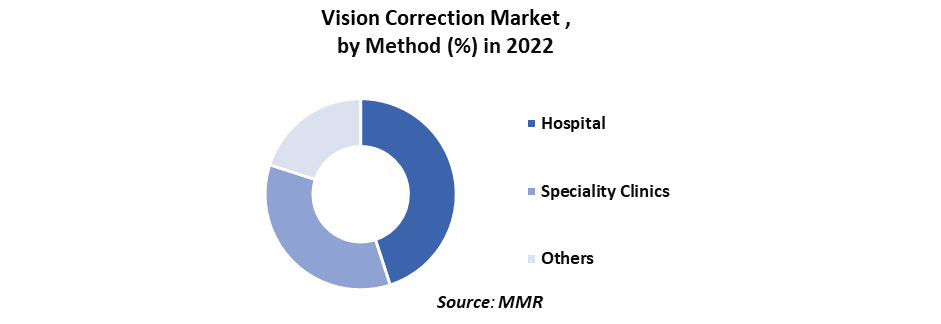

Based on the End-user, The vision correction market includes various segments such as hospitals, clinics, and ambulatory surgical centers, among others. Each segment offers different products and services for correcting vision problems. Hospitals are one of the segments of the vision correction market, and they typically offer a wide range of services related to vision correction. These include refractive surgeries such as LASIK, cataract surgeries, and other procedures for treating various eye conditions. Clinics and ambulatory surgical centers also play a significant role in the vision correction market. Clinics may offer services such as eye exams, prescription glasses or contact lenses, and minor procedures such as foreign body removal. Ambulatory surgical centers may specialize in procedures such as LASIK, cataract surgery, and other surgical procedures related to vision correction.

Vision Correction Market Regional Insights:

North America dominated the global vision correction market in 2021, accounting for the largest share of 40% of the market. This can be attributed to factors such as the high occurrence of vision problems in the region, as well as the presence of a large number of established companies in the vision correction market. In North America, the United States is the largest market for vision correction products and services, accounting for the majority of the regional market share. The high demand for vision correction in the United States is attributed to factors such as the aging population, the increasing prevalence of myopia among young people, and the high levels of disposable income that make vision correction procedures and devices more affordable for many consumers. In addition to North America, the Asia-Pacific region is expected to be a high-growth market for vision correction products and services in the forecast years, driven by factors such as the large and growing population, increasing disposable income, and rising awareness of vision correction options among consumers. Other regions such as Europe and South America also offer opportunities for growth in the vision correction market, driven by factors such as increasing demand for corrective procedures and devices among aging populations, and the presence of a large number of established companies in the region. Overall, a regional analysis of the vision correction market suggests that different regions offer unique opportunities and challenges, and companies in the market will need to tailor their strategies and offerings accordingly in order to succeed in each market.Vision Correction Market Scope: Inquiry Before Buying

Vision Correction Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 23.5 Mn Forecast Period 2023 to 2029 CAGR: 8.9% Market Size in 2029: USD 42.7 Mn Segments Covered: by Method 1. Standalone 2. Mobile by Application 1. Orthopedic 2. Cancer 3. Cardiovascular 4. Others by End-user 1. Hospitals 2. Ambulatory Surgical Centers 3. Others Vision Correction Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vision Correction Market, Key Players

1. Alcon Inc 2. Bausch Health Companies Inc 3. Carl Zeiss Meditec AG 4. Essilor International S.A. 5. CooperVision 6. Hoya Corporation 7. STAAR Surgical, Inc. 8. SynergEyes, Inc 9. Johnson & Johnson Vision Care 10. MaxiVision Eye Hospital 11. The Cooper Companies Inc 12. Rayner Surgical Group Limited 13. Ziemer Group AG 14. SCHWIND eye-tech-solutions GmbH & co.kg 15. Novartis AG 16. Topcon Corporation 17. Abbott Laboratories 18. Menicon Co., Ltd. 19. Allergan, Inc. 20. Nidek Co., Ltd. 21. Lumenis Ltd. 22. Acufocus Inc. 23. ReVision Optics, Inc. 24. Lenstec, Inc. Frequently Asked Questions: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Vision Correction Market report are based on Method, Application, End-user, and Region. 2] Which region is expected to hold the highest share in the Global Market? Ans. The North America region is expected to hold the highest share of the Vision Correction Market. 3] What is the market size of the Global Market by 2029? Ans. The market size of the Vision Correction Market by 2029 is expected to reach US$ 42.7 Mn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Vision Correction Market is 2023-2029. 5] What was the market size of the Global Market in 2021? Ans. The market size of the Vision Correction Market in 2021 was valued at US$ 23.5 Mn.

1. Vision Correction Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vision Correction Market: Dynamics 2.1. Vision Correction Market Trends by Region 2.1.1. North America Vision Correction Market Trends 2.1.2. Europe Vision Correction Market Trends 2.1.3. Asia Pacific Vision Correction Market Trends 2.1.4. Middle East and Africa Vision Correction Market Trends 2.1.5. South America Vision Correction Market Trends 2.2. Vision Correction Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vision Correction Market Drivers 2.2.1.2. North America Vision Correction Market Restraints 2.2.1.3. North America Vision Correction Market Opportunities 2.2.1.4. North America Vision Correction Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vision Correction Market Drivers 2.2.2.2. Europe Vision Correction Market Restraints 2.2.2.3. Europe Vision Correction Market Opportunities 2.2.2.4. Europe Vision Correction Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vision Correction Market Drivers 2.2.3.2. Asia Pacific Vision Correction Market Restraints 2.2.3.3. Asia Pacific Vision Correction Market Opportunities 2.2.3.4. Asia Pacific Vision Correction Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vision Correction Market Drivers 2.2.4.2. Middle East and Africa Vision Correction Market Restraints 2.2.4.3. Middle East and Africa Vision Correction Market Opportunities 2.2.4.4. Middle East and Africa Vision Correction Market Challenges 2.2.5. South America 2.2.5.1. South America Vision Correction Market Drivers 2.2.5.2. South America Vision Correction Market Restraints 2.2.5.3. South America Vision Correction Market Opportunities 2.2.5.4. South America Vision Correction Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Vision Correction Industry 2.8. Analysis of Government Schemes and Initiatives For Vision Correction Industry 2.9. Vision Correction Market Trade Analysis 2.10. The Global Pandemic Impact on Vision Correction Market 3. Vision Correction Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Vision Correction Market Size and Forecast, by Method (2022-2029) 3.1.1. Standalone 3.1.2. Mobile 3.2. Vision Correction Market Size and Forecast, by Application (2022-2029) 3.2.1. Orthopedic 3.2.2. Cancer 3.2.3. Cardiovascular 3.2.4. Others 3.3. Vision Correction Market Size and Forecast, by End-user (2022-2029) 3.3.1. Hospitals 3.3.2. Ambulatory Surgical Centers 3.3.3. Others 3.4. Vision Correction Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Vision Correction Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Vision Correction Market Size and Forecast, by Method (2022-2029) 4.1.1. Standalone 4.1.2. Mobile 4.2. North America Vision Correction Market Size and Forecast, by Application (2022-2029) 4.2.1. Orthopedic 4.2.2. Cancer 4.2.3. Cardiovascular 4.2.4. Others 4.3. North America Vision Correction Market Size and Forecast, by End-user (2022-2029) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers 4.3.3. Others 4.4. North America Vision Correction Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Vision Correction Market Size and Forecast, by Method (2022-2029) 4.4.1.1.1. Standalone 4.4.1.1.2. Mobile 4.4.1.2. United States Vision Correction Market Size and Forecast, by Application (2022-2029) 4.4.1.2.1. Orthopedic 4.4.1.2.2. Cancer 4.4.1.2.3. Cardiovascular 4.4.1.2.4.Others 4.4.1.3. United States Vision Correction Market Size and Forecast, by End-user (2022-2029) 4.4.1.3.1. Hospitals 4.4.1.3.2. Ambulatory Surgical Centers 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Vision Correction Market Size and Forecast, by Method (2022-2029) 4.4.2.1.1. Standalone 4.4.2.1.2. Mobile 4.4.2.2. Canada Vision Correction Market Size and Forecast, by Application (2022-2029) 4.4.2.2.1. Orthopedic 4.4.2.2.2. Cancer 4.4.2.2.3. Cardiovascular 4.4.2.2.4. Others 4.4.2.3. Canada Vision Correction Market Size and Forecast, by End-user (2022-2029) 4.4.2.3.1. Hospitals 4.4.2.3.2. Ambulatory Surgical Centers 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Vision Correction Market Size and Forecast, by Method (2022-2029) 4.4.3.1.1. Standalone 4.4.3.1.2. Mobile 4.4.3.2. Mexico Vision Correction Market Size and Forecast, by Application (2022-2029) 4.4.3.2.1. Orthopedic 4.4.3.2.2. Cancer 4.4.3.2.3. Cardiovascular 4.4.3.2.4. Others 4.4.3.3. Mexico Vision Correction Market Size and Forecast, by End-user (2022-2029) 4.4.3.3.1. Hospitals 4.4.3.3.2. Ambulatory Surgical Centers 4.4.3.3.3. Others 5. Europe Vision Correction Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Vision Correction Market Size and Forecast, by Method (2022-2029) 5.2. Europe Vision Correction Market Size and Forecast, by Application (2022-2029) 5.3. Europe Vision Correction Market Size and Forecast, by End-user (2022-2029) 5.4. Europe Vision Correction Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.1.2. United Kingdom Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.1.3. United Kingdom Vision Correction Market Size and Forecast, by End-user(2022-2029) 5.4.2. France 5.4.2.1. France Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.2.2. France Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.2.3. France Vision Correction Market Size and Forecast, by End-user(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.3.2. Germany Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.3.3. Germany Vision Correction Market Size and Forecast, by End-user (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.4.2. Italy Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.4.3. Italy Vision Correction Market Size and Forecast, by End-user(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.5.2. Spain Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.5.3. Spain Vision Correction Market Size and Forecast, by End-user (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.6.2. Sweden Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.6.3. Sweden Vision Correction Market Size and Forecast, by End-user (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.7.2. Austria Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.7.3. Austria Vision Correction Market Size and Forecast, by End-user (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Vision Correction Market Size and Forecast, by Method (2022-2029) 5.4.8.2. Rest of Europe Vision Correction Market Size and Forecast, by Application (2022-2029) 5.4.8.3. Rest of Europe Vision Correction Market Size and Forecast, by End-user (2022-2029) 6. Asia Pacific Vision Correction Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Vision Correction Market Size and Forecast, by Method (2022-2029) 6.2. Asia Pacific Vision Correction Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4. Asia Pacific Vision Correction Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.1.2. China Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.1.3. China Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.2.2. S Korea Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.2.3. S Korea Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.3.2. Japan Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.4. India 6.4.4.1. India Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.4.2. India Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.4.3. India Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.5.2. Australia Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Australia Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.6.2. Indonesia Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Indonesia Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.7.2. Malaysia Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Malaysia Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.8.2. Vietnam Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Vietnam Vision Correction Market Size and Forecast, by End-user(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.9.2. Taiwan Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.9.3. Taiwan Vision Correction Market Size and Forecast, by End-user (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Vision Correction Market Size and Forecast, by Method (2022-2029) 6.4.10.2. Rest of Asia Pacific Vision Correction Market Size and Forecast, by Application (2022-2029) 6.4.10.3. Rest of Asia Pacific Vision Correction Market Size and Forecast, by End-user (2022-2029) 7. Middle East and Africa Vision Correction Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Vision Correction Market Size and Forecast, by Method (2022-2029) 7.2. Middle East and Africa Vision Correction Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Vision Correction Market Size and Forecast, by End-user (2022-2029) 7.4. Middle East and Africa Vision Correction Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Vision Correction Market Size and Forecast, by Method (2022-2029) 7.4.1.2. South Africa Vision Correction Market Size and Forecast, by Application (2022-2029) 7.4.1.3. South Africa Vision Correction Market Size and Forecast, by End-user (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Vision Correction Market Size and Forecast, by Method (2022-2029) 7.4.2.2. GCC Vision Correction Market Size and Forecast, by Application (2022-2029) 7.4.2.3. GCC Vision Correction Market Size and Forecast, by End-user (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Vision Correction Market Size and Forecast, by Method (2022-2029) 7.4.3.2. Nigeria Vision Correction Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Nigeria Vision Correction Market Size and Forecast, by End-user (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Vision Correction Market Size and Forecast, by Method (2022-2029) 7.4.4.2. Rest of ME&A Vision Correction Market Size and Forecast, by Application (2022-2029) 7.4.4.3. Rest of ME&A Vision Correction Market Size and Forecast, by End-user (2022-2029) 8. South America Vision Correction Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Vision Correction Market Size and Forecast, by Method (2022-2029) 8.2. South America Vision Correction Market Size and Forecast, by Application (2022-2029) 8.3. South America Vision Correction Market Size and Forecast, by End-user(2022-2029) 8.4. South America Vision Correction Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Vision Correction Market Size and Forecast, by Method (2022-2029) 8.4.1.2. Brazil Vision Correction Market Size and Forecast, by Application (2022-2029) 8.4.1.3. Brazil Vision Correction Market Size and Forecast, by End-user (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Vision Correction Market Size and Forecast, by Method (2022-2029) 8.4.2.2. Argentina Vision Correction Market Size and Forecast, by Application (2022-2029) 8.4.2.3. Argentina Vision Correction Market Size and Forecast, by End-user (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Vision Correction Market Size and Forecast, by Method (2022-2029) 8.4.3.2. Rest Of South America Vision Correction Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Rest Of South America Vision Correction Market Size and Forecast, by End-user (2022-2029) 9. Global Vision Correction Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Vision Correction Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Alcon Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bausch Health Companies Inc 10.3. Carl Zeiss Meditec AG 10.4. Essilor International S.A. 10.5. CooperVision 10.6. Hoya Corporation 10.7. STAAR Surgical, Inc. 10.8. SynergEyes, Inc 10.9. Johnson & Johnson Vision Care 10.10. MaxiVision Eye Hospital 10.11. The Cooper Companies Inc 10.12. Rayner Surgical Group Limited 10.13. Ziemer Group AG 10.14. SCHWIND eye-tech-solutions GmbH & co.kg 10.15. Novartis AG 10.16. Topcon Corporation 10.17. Abbott Laboratories 10.18. Menicon Co., Ltd. 10.19. Allergan, Inc. 10.20. Nidek Co., Ltd. 10.21. Lumenis Ltd. 10.22. Acufocus Inc. 10.23. ReVision Optics, Inc. 10.24. Lenstec, Inc. 11. Key Findings 12. Industry Recommendations 13. Vision Correction Market: Research Methodology 14. Terms and Glossary