Viral Vector Market was worth USD 0.60 billion in 2022 and is estimated to grow at a CAGR of 19.7% in the forecasted period. The forecasted revenue hints at a growth of around 2.13 billion USD by 2029. Viral vector is one of the most effective means of gene transfer to modify specific cell type and can be manipulated to express therapeutic genes. The pandemic impacted the Viral vector market as the investments increased, spending on health increased and also perspective towards vaccines and its importance also gained huge attention which directly affected the viral vector market dynamics. The understanding of viral biology has increased which has facilitated the development of therapeutic viral delivery vectors. This has opened many opportunities for new entrants in the Viral vector market. Also, there have been many public and private initiatives which have helped the market grow. North America leads the market in viral vector industry and has the majority of Viral vector market share. Asia pacific has saw the highest CAGR, with humongous potential to attain a very high market share. Increase demand, technological advancements and huge funding has made sure that the Viral vector market would rise upwardsTo know about the Research Methodology :- Request Free Sample Report

Viral Vector Market Drivers

The key driving factor for Viral vector market has been Gene therapy and its application. Gene Therapy has drawn huge attention and also a cure for potential deadly diseases. Viral vectors are vital tools for gene therapy because they play a crucial role in the delivery of therapeutic genes into target cells. The market for viral vectors is expanding as a result of the rising demand for efficient gene treatments. Viral vectors are not only used in gene therapy but also find applications in cell therapy and regenerative medicine. The field of cell and gene therapy is rapidly expanding, with an increasing number of clinical trials and approved therapies. The demand for viral vectors in these applications drives market growth. The prevalence of genetic disorders and diseases is increasing worldwide. Viral vectors offer a promising solution for delivering therapeutic genes to correct genetic mutations and restore normal cellular functions. The rising need for effective treatments for genetic disorders contributes to the growth of the viral vector market. Also, government has supported the use of viral vectors and have readily invested in such programs like FDA and EMA have established frameworks and recommendations and also the path to market for Disease containing viral vectors is streamlined by a supportive regulatory thus indicating a huge opportunity for investment in Viral vector market.Viral Vectors Market Challenges

The key challenges for Viral vectors market are choosing production system, optimize downstream processing and development of quality assays. All these factors directly act as challenges to Viral Vectors market. Viral vectors can trigger immune responses in the body, leading to the production of neutralizing antibodies against the vector or the transgene. This immune response can limit the effectiveness of gene therapy and may require the administration of higher vector doses or the use of immunosuppressive drugs. This also creates a certain amount of risk along with safety comptonization. It's still difficult to distribute viral vectors to target cells and tissues efficiently. The blood-brain barrier and certain cellular receptors, which are present in different tissues and cell types, can hinder the efficient transport of viral vectors. It's essential to create targeted and tissue-specific delivery methods to maximise viral vector-mediated gene therapy. So, failure in binding of the vector can cause problems within the host.Viral Vectors Market Trends

The market has a lot of potential and is bound to grow year on year. Thus, the trends suggest that, applications of Viral Vector would be at the helm of this changing trend. Also, technology and R&D are two crucial factors for this future trend of Viral vector industryViral Vector Market Segmentation

Viral Vector Market Segmentation Based on Application Gene Therapy is the most dominant application of Viral Vector Market and is currently around 66% of this total segment. Gene Therapy has Vaccinology on the other hand is an emerging segment in the market and has around 34%. The growth potential for vaccinology is huge, but the viral vector market is revolutionized because of Gene therapy and its applications. Thus, it holds the maximum share of this segment Market Segmentation Based on End user Pharma and Biotechnology companies & Research are the two main end users of viral vector studies. The Market has huge potential and is driven by its importance especially in curing people. Research has maximum viral vector market share while pharma and biotechnology companies lose out on a tough tie. Based on type Adenoviral Vectors, Adeno-associated Viral Vectors, Retroviral Vectors are three types in market segmentation by type. Adeno associated Viral Vectors are most commonly used and are predominant thus having a high market share since. Retroviral and Adenoviral are also gaining market share of this viral vector segment. vaBased on Disease For Cancer, the market is anticipated to be dominated by this segment. This is a result of both the rising incidence of cancer and the need for gene therapies as cancer treatments. Thus, giving the Cancer segment the highest CAGR. Both genetics and infectious diseases are also progressing slowly and would eventually overtake the market.

Based on Expression System There are 2 types of Expression System: Stable and Transient. Stable refers to the large-scale, everlasting production of recombinant proteins, while Transient refers to temporary and small-scale production of Antibodies. The stable expression system nearly joys a 70% of a market share.

Viral Vector Market Segmentation Based on Region

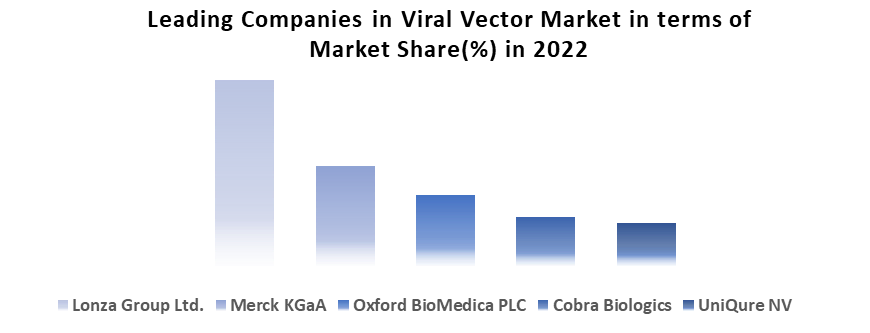

Global The advancement in technology, improvements in processes, and the growth of the biopharmaceutical sector in emerging economies are all factors that have an impact on the market. Thus, the global economy of the market has started rising steadily. Asia Pacific recorded the highest CAGR amongst the 5 regions. North America emerged as market leader with nearly 36.1% of the total market. The market has huge scope in global market due to its application in vaccines, diagnosis of diseases, gene editing and Gene therapy. Thus, on a global front, market has huge potential. Viral Vector Market: North America North America leads the market and occupies around 36% of market share in the total market. US leads the way with highest market share amongst the other countries. Big players have contributed thoroughly in this market growth. Therapeutics are some of the companies with highest contributions. Also, high investments in research and analysis have already increased growth potential of the Viral Vector industry.Viral Vector Market: Asia Pacific Asia Pacific is currently at a steady market share and is forecasted to grow at a rapid rate which is because of increased population, higher demand and well-developed technology. The increased healthcare sector has directly improved the investments and also the internal structure of the pharma and healthcare market. Countries such as China, Japan, South Korea, India, and Singapore are key contributors to the market. China leads the Viral Vector market and has one of the largest markets in the world Market: Europe Europe has a significant market share in market industry and falls just behind North America. UK is a dominant player in European Viral vector market which is chased down by Germany (Merck KGaA) and France (Genethon). Both the countries have a favourable regulatory environment that supports the development of viral vectors. Europe has been a dominant force because of its infrastructure and well-equipped research and academic institutions. Viral Vector Market: Middle East and Africa The Middle East is an emerging sector with many opportunities and risk. Saudi Arabia, UAE, Qatar have made significant investments to build a sustainable place for biotechnology and research. In Saudi Arabia, the government's Vision 2030 plan aims to diversify the economy and develop the healthcare sector. Other regions of UAE like Dubai, Qatar have also started making healthcare and biotechnology hub, attracting international biotechnology and pharmaceutical companies and research organizations. Egypt and South Africa are leading the African region with high-tech devices and proper facilities than can increase their market share. Viral Vector Market: South America South America expresses a steady market share and is mainly constricted to bigger countries like Brazil, Argentina, Mexico, but others countries are coming out as emerging markets. Argentina has focused on innovation, research and development, and quality manufacturing process and ensured that they expand their Viral Vector market share. Columbia has been investing in healthcare from past decade, which gives it an opportunity to have similar market share as of that of Brazil and Argentina. Other countries like Peru, Chile have also started focusing on Viral vectors market and are also slowly gaining the hold of the market. Market: Competitive Analysis The market is highly competitive, especially when the market is filled with well – established and new age companies. The established ones have maintained their focus on their robust infrastructure and followed acquisition strategy (Thermo Fisher Scientific and Brammer Bio) while new age companies have focused on building new age technologies like (Next-generation Viral Vector Platforms). US is the global leader in the Viral vector market and has nearly gained 36% of the market. US have invested huge funds in R&D and is home to many notable companies like Pfizer, Bluebird bio, Spark Therapeutics. Europe is 2nd on the list and has many known companies like Oxford Biomedica, a major viral vector manufacturer. Germany is home to companies like Merck KGaA, while France has Genethon and Cellectis among its prominent players. Switzerland is renowned for its expertise in biotechnology, with companies like Lonza Group Ltd. and Novartis AG leading the way. Thus, the market is dominated by 3-4 companies but has a huge scope for many diverse fields which are opening because of increasing investments and high demand.

Market Scope: Inquire before buying

Viral Vector Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 0.60 Bn. Forecast Period 2023 to 2029 CAGR: 19.7% Market Size in 2029: USD 2.13Bn. Segments Covered: by Disease 1. Cancer 2. Genetic Disorders 3. Infectious Diseases by Expression System 1. Stable 2. Transient by End User 1. Biopharmaceuticals and Pharma companies 2. Research Organisations by Type 1. Adenoviral Vectors 2. Adeno-associated Viral Vectors 3. Lentiviral Vectors 4. Retroviral Vectors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Market, Key Players are

The players mentioned are top companies working in the Viral Vector Industry. All these companies have shown tremendous viral vector market strategy and have huge potential to maximize the viral vector market. 1. Pfizer Inc. (United States) 2. Bluebird bio, Inc. ( (United States) 3. Spark Therapeutics, Inc. (United States) 4. Sarepta Therapeutics, Inc. (United States) 5. Krystal Biotech, Inc. (United States) 6. MeiraGTx Holdings PLC (United States) 7. Regenxbio Inc.(United States) 8. Abeona Therapeutics Inc. (United States) 9. Genprex, Inc. (United States) 10. Cognate BioServices (United States) 11. Brammer Bio (United States) 12. Biogen Inc. (United States) 13. Dimension Therapeutics (United States) 14. Thermo Fisher Scientific Inc. (United States) 15. FUJIFILM Diosynth Biotechnologies (Japan) 16. Astellas Pharma Inc. (Japan) 17. Lonza Group Ltd. (Switzerland) 18. Viral Vector Market: Europe 19. Merck KGaA (Germany) 20. Sanofi S.A. (France) 21. UniQure N.V. (Netherlands) 22. Cellectis (France) 23. Oxford Biomedica PLC (United Kingdom) 24. GenSight Biologics (France) 25. Genethon (France) 26. Novartis AG (Switzerland) 27. Viral Vector Market: South America 28. GeneOne Life Sciences (Brazil) 29. GenCell (Colombia) 30. Viral Vector Market: Middle East and Africa 31. Medivir (South Africa) FAQ What is the CAGR of Market? Ans: The CAGR for is 19.7% Q.2) Which are the leading companies in Market? Ans: UniQure N.V. and Merck KGaA are some of the leading companies in the Market Q.3) Which region shows most potential in future to dominate Market? Ans: Asia Pacific is expected to grow exponentially and has the most potential in future due to dominate Market Q,4) Which is the leading region in Market? Ans: North America leads Market significantly Q.5) What was the forecasted period for Market report? Ans: The forecasted period for the Market research was 2023 – 2029

1. Viral Vector Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Viral Vector Market: Dynamics 2.1. Viral Vector Market Trends by Region 2.1.1. North America Viral Vector Market Trends 2.1.2. Europe Viral Vector Market Trends 2.1.3. Asia Pacific Viral Vector Market Trends 2.1.4. Middle East and Africa Viral Vector Market Trends 2.1.5. South America Viral Vector Market Trends 2.2. Viral Vector Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Viral Vector Market Drivers 2.2.1.2. North America Viral Vector Market Restraints 2.2.1.3. North America Viral Vector Market Opportunities 2.2.1.4. North America Viral Vector Market Challenges 2.2.2. Europe 2.2.2.1. Europe Viral Vector Market Drivers 2.2.2.2. Europe Viral Vector Market Restraints 2.2.2.3. Europe Viral Vector Market Opportunities 2.2.2.4. Europe Viral Vector Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Viral Vector Market Drivers 2.2.3.2. Asia Pacific Viral Vector Market Restraints 2.2.3.3. Asia Pacific Viral Vector Market Opportunities 2.2.3.4. Asia Pacific Viral Vector Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Viral Vector Market Drivers 2.2.4.2. Middle East and Africa Viral Vector Market Restraints 2.2.4.3. Middle East and Africa Viral Vector Market Opportunities 2.2.4.4. Middle East and Africa Viral Vector Market Challenges 2.2.5. South America 2.2.5.1. South America Viral Vector Market Drivers 2.2.5.2. South America Viral Vector Market Restraints 2.2.5.3. South America Viral Vector Market Opportunities 2.2.5.4. South America Viral Vector Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Viral Vector Industry 2.8. Analysis of Government Schemes and Initiatives For Viral Vector Industry 2.9. Viral Vector Market Trade Analysis 2.10. The Global Pandemic Impact on Viral Vector Market 3. Viral Vector Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Viral Vector Market Size and Forecast, by Disease (2022-2029) 3.1.1. Cancer 3.1.2. Genetic Disorders 3.1.3. Infectious Diseases 3.2. Viral Vector Market Size and Forecast, by Expression System (2022-2029) 3.2.1. Stable 3.2.2. Transient 3.3. Viral Vector Market Size and Forecast, by End User (2022-2029) 3.3.1. Biopharmaceuticals and Pharma companies 3.3.2. Research Organisations 3.4. Viral Vector Market Size and Forecast, by Type (2022-2029) 3.4.1. Adenoviral Vectors 3.4.2. Adeno-associated Viral Vectors 3.4.3. Lentiviral Vectors 3.4.4. Retroviral Vectors 3.7. Viral Vector Market Size and Forecast, by Region (2022-2029) 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 4. North America Viral Vector Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Viral Vector Market Size and Forecast, by Disease (2022-2029) 4.1.1. Cancer 4.1.2. Genetic Disorders 4.1.3. Infectious Diseases 4.2. North America Viral Vector Market Size and Forecast, by Expression System (2022-2029) 4.2.1. Stable 4.2.2. Transient 4.3. North America Viral Vector Market Size and Forecast, by End User (2022-2029) 4.3.1. Biopharmaceuticals and Pharma companies 4.3.2. Research Organisations 4.4. North America Viral Vector Market Size and Forecast, by Type (2022-2029) 4.4.1. Adenoviral Vectors 4.4.2. Adeno-associated Viral Vectors 4.4.3. Lentiviral Vectors 4.4.4. Retroviral Vectors 4.7. North America Viral Vector Market Size and Forecast, by Country (2022-2029) 4.7.1. United States 4.7.1.1. United States Viral Vector Market Size and Forecast, by Disease (2022-2029) 4.7.1.1.1. Cancer 4.7.1.1.2. Genetic Disorders 4.7.1.1.3. Infectious Diseases 4.7.1.2. United States Viral Vector Market Size and Forecast, by Expression System (2022-2029) 4.7.1.2.1. Stable 4.7.1.2.2. Transient 4.7.1.3. United States Viral Vector Market Size and Forecast, by End User (2022-2029) 4.7.1.3.1. Biopharmaceuticals and Pharma companies 4.7.1.3.2. Research Organisations 4.7.1.4. United States Viral Vector Market Size and Forecast, by Type (2022-2029) 4.7.1.4.1. Adenoviral Vectors 4.7.1.4.2. Adeno-associated Viral Vectors 4.7.1.4.3. Lentiviral Vectors 4.7.1.4.4. Retroviral Vectors 4.7.2. Canada 4.7.2.1. Canada Viral Vector Market Size and Forecast, by Disease (2022-2029) 4.7.2.1.1. Cancer 4.7.2.1.2. Genetic Disorders 4.7.2.1.3. Infectious Diseases 4.7.2.2. Canada Viral Vector Market Size and Forecast, by Expression System (2022-2029) 4.7.2.2.1. Stable 4.7.2.2.2. Transient 4.7.2.3. Canada Viral Vector Market Size and Forecast, by End User (2022-2029) 4.7.2.3.1. Biopharmaceuticals and Pharma companies 4.7.2.3.2. Research Organisations 4.7.2.4. Canada Viral Vector Market Size and Forecast, by Type (2022-2029) 4.7.2.4.1. Adenoviral Vectors 4.7.2.4.2. Adeno-associated Viral Vectors 4.7.2.4.3. Lentiviral Vectors 4.7.2.4.4. Retroviral Vectors 4.7.3. Mexico 4.7.3.1. Mexico Viral Vector Market Size and Forecast, by Disease (2022-2029) 4.7.3.1.1. Cancer 4.7.3.1.2. Genetic Disorders 4.7.3.1.3. Infectious Diseases 4.7.3.2. Mexico Viral Vector Market Size and Forecast, by Expression System (2022-2029) 4.7.3.2.1. Stable 4.7.3.2.2. Transient 4.7.3.3. Mexico Viral Vector Market Size and Forecast, by End User (2022-2029) 4.7.3.3.1. Biopharmaceuticals and Pharma companies 4.7.3.3.2. Research Organisations 4.7.3.4. Mexico Viral Vector Market Size and Forecast, by Type (2022-2029) 4.7.3.4.1. Adenoviral Vectors 4.7.3.4.2. Adeno-associated Viral Vectors 4.7.3.4.3. Lentiviral Vectors 4.7.3.4.4. Retroviral Vectors 5. Europe Viral Vector Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.2. Europe Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.3. Europe Viral Vector Market Size and Forecast, by End User (2022-2029) 5.4. Europe Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7. Europe Viral Vector Market Size and Forecast, by Country (2022-2029) 5.7.1. United Kingdom 5.7.1.1. United Kingdom Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.1.2. United Kingdom Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.1.3. United Kingdom Viral Vector Market Size and Forecast, by End User(2022-2029) 5.7.1.4. United Kingdom Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.2. France 5.7.2.1. France Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.2.2. France Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.2.3. France Viral Vector Market Size and Forecast, by End User(2022-2029) 5.7.2.4. France Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.3. Germany 5.7.3.1. Germany Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.3.2. Germany Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.3.3. Germany Viral Vector Market Size and Forecast, by End User (2022-2029) 5.7.3.4. Germany Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.4. Italy 5.7.4.1. Italy Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.4.2. Italy Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.4.3. Italy Viral Vector Market Size and Forecast, by End User(2022-2029) 5.7.4.4. Italy Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.5. Spain 5.7.5.1. Spain Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.5.2. Spain Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.5.3. Spain Viral Vector Market Size and Forecast, by End User (2022-2029) 5.7.5.4. Spain Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.6. Sweden 5.7.6.1. Sweden Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.6.2. Sweden Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.6.3. Sweden Viral Vector Market Size and Forecast, by End User (2022-2029) 5.7.6.4. Sweden Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.7. Austria 5.7.7.1. Austria Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.7.2. Austria Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.7.3. Austria Viral Vector Market Size and Forecast, by End User (2022-2029) 5.7.7.4. Austria Viral Vector Market Size and Forecast, by Type (2022-2029) 5.7.8. Rest of Europe 5.7.8.1. Rest of Europe Viral Vector Market Size and Forecast, by Disease (2022-2029) 5.7.8.2. Rest of Europe Viral Vector Market Size and Forecast, by Expression System (2022-2029) 5.7.8.3. Rest of Europe Viral Vector Market Size and Forecast, by End User (2022-2029) 5.7.8.4. Rest of Europe Viral Vector Market Size and Forecast, by Type (2022-2029) 6. Asia Pacific Viral Vector Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.2. Asia Pacific Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.3. Asia Pacific Viral Vector Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7. Asia Pacific Viral Vector Market Size and Forecast, by Country (2022-2029) 6.7.1. China 6.7.1.1. China Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.1.2. China Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.1.3. China Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.1.4. China Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.2. S Korea 6.7.2.1. S Korea Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.2.2. S Korea Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.2.3. S Korea Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.2.4. S Korea Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.3. Japan 6.7.3.1. Japan Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.3.2. Japan Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.3.3. Japan Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.3.4. Japan Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.4. India 6.7.4.1. India Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.4.2. India Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.4.3. India Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.4.4. India Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.5. Australia 6.7.5.1. Australia Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.5.2. Australia Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.5.3. Australia Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.5.4. Australia Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.6. Indonesia 6.7.6.1. Indonesia Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.6.2. Indonesia Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.6.3. Indonesia Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.6.4. Indonesia Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.7. Malaysia 6.7.7.1. Malaysia Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.7.2. Malaysia Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.7.3. Malaysia Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.7.4. Malaysia Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.8. Vietnam 6.7.8.1. Vietnam Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.8.2. Vietnam Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.8.3. Vietnam Viral Vector Market Size and Forecast, by End User(2022-2029) 6.7.8.4. Vietnam Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.9. Taiwan 6.7.9.1. Taiwan Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.9.2. Taiwan Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.9.3. Taiwan Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.9.4. Taiwan Viral Vector Market Size and Forecast, by Type (2022-2029) 6.7.10. Rest of Asia Pacific 6.7.10.1. Rest of Asia Pacific Viral Vector Market Size and Forecast, by Disease (2022-2029) 6.7.10.2. Rest of Asia Pacific Viral Vector Market Size and Forecast, by Expression System (2022-2029) 6.7.10.3. Rest of Asia Pacific Viral Vector Market Size and Forecast, by End User (2022-2029) 6.7.10.4. Rest of Asia Pacific Viral Vector Market Size and Forecast, by Type (2022-2029) 7. Middle East and Africa Viral Vector Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Viral Vector Market Size and Forecast, by Disease (2022-2029) 7.2. Middle East and Africa Viral Vector Market Size and Forecast, by Expression System (2022-2029) 7.3. Middle East and Africa Viral Vector Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Viral Vector Market Size and Forecast, by Type (2022-2029) 7.7. Middle East and Africa Viral Vector Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.7.1.1. South Africa Viral Vector Market Size and Forecast, by Disease (2022-2029) 7.7.1.2. South Africa Viral Vector Market Size and Forecast, by Expression System (2022-2029) 7.7.1.3. South Africa Viral Vector Market Size and Forecast, by End User (2022-2029) 7.7.1.4. South Africa Viral Vector Market Size and Forecast, by Type (2022-2029) 7.7.2. GCC 7.7.2.1. GCC Viral Vector Market Size and Forecast, by Disease (2022-2029) 7.7.2.2. GCC Viral Vector Market Size and Forecast, by Expression System (2022-2029) 7.7.2.3. GCC Viral Vector Market Size and Forecast, by End User (2022-2029) 7.7.2.4. GCC Viral Vector Market Size and Forecast, by Type (2022-2029) 7.7.3. Nigeria 7.7.3.1. Nigeria Viral Vector Market Size and Forecast, by Disease (2022-2029) 7.7.3.2. Nigeria Viral Vector Market Size and Forecast, by Expression System (2022-2029) 7.7.3.3. Nigeria Viral Vector Market Size and Forecast, by End User (2022-2029) 7.7.3.4. Nigeria Viral Vector Market Size and Forecast, by Type (2022-2029) 7.7.4. Rest of ME&A 7.7.4.1. Rest of ME&A Viral Vector Market Size and Forecast, by Disease (2022-2029) 7.7.4.2. Rest of ME&A Viral Vector Market Size and Forecast, by Expression System (2022-2029) 7.7.4.3. Rest of ME&A Viral Vector Market Size and Forecast, by End User (2022-2029) 7.7.4.4. Rest of ME&A Viral Vector Market Size and Forecast, by Type (2022-2029) 8. South America Viral Vector Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Viral Vector Market Size and Forecast, by Disease (2022-2029) 8.2. South America Viral Vector Market Size and Forecast, by Expression System (2022-2029) 8.3. South America Viral Vector Market Size and Forecast, by End User(2022-2029) 8.4. South America Viral Vector Market Size and Forecast, by Type (2022-2029) 8.7. South America Viral Vector Market Size and Forecast, by Country (2022-2029) 8.7.1. Brazil 8.7.1.1. Brazil Viral Vector Market Size and Forecast, by Disease (2022-2029) 8.7.1.2. Brazil Viral Vector Market Size and Forecast, by Expression System (2022-2029) 8.7.1.3. Brazil Viral Vector Market Size and Forecast, by End User (2022-2029) 8.7.1.4. Brazil Viral Vector Market Size and Forecast, by Type (2022-2029) 8.7.2. Argentina 8.7.2.1. Argentina Viral Vector Market Size and Forecast, by Disease (2022-2029) 8.7.2.2. Argentina Viral Vector Market Size and Forecast, by Expression System (2022-2029) 8.7.2.3. Argentina Viral Vector Market Size and Forecast, by End User (2022-2029) 8.7.2.4. Argentina Viral Vector Market Size and Forecast, by Type (2022-2029) 8.7.3. Rest Of South America 8.7.3.1. Rest Of South America Viral Vector Market Size and Forecast, by Disease (2022-2029) 8.7.3.2. Rest Of South America Viral Vector Market Size and Forecast, by Expression System (2022-2029) 8.7.3.3. Rest Of South America Viral Vector Market Size and Forecast, by End User (2022-2029) 8.7.3.4. Rest Of South America Viral Vector Market Size and Forecast, by Type (2022-2029) 9. Global Viral Vector Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Viral Vector Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pfizer Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bluebird bio, Inc. ( (United States) 10.3. Spark Therapeutics, Inc. (United States) 10.4. Sarepta Therapeutics, Inc. (United States) 10.5. Krystal Biotech, Inc. (United States) 10.6. MeiraGTx Holdings PLC (United States) 10.7. Regenxbio Inc.(United States) 10.8. Abeona Therapeutics Inc. (United States) 10.9. Genprex, Inc. (United States) 10.10. Cognate BioServices (United States) 10.11. Brammer Bio (United States) 10.12. Biogen Inc. (United States) 10.13. Dimension Therapeutics (United States) 10.14. Thermo Fisher Scientific Inc. (United States) 10.15. FUJIFILM Diosynth Biotechnologies (Japan) 10.16. Astellas Pharma Inc. (Japan) 10.17. Lonza Group Ltd. (Switzerland) 10.18. Viral Vector Market: Europe 10.19. Merck KGaA (Germany) 10.20. Sanofi S.A. (France) 10.21. UniQure N.V. (Netherlands) 10.22. Cellectis (France) 10.23. Oxford Biomedica PLC (United Kingdom) 10.24. GenSight Biologics (France) 10.25. Genethon (France) 10.26. Novartis AG (Switzerland) 10.27. Viral Vector Market: South America 10.28. GeneOne Life Sciences (Brazil) 10.29. GenCell (Colombia) 10.30. Viral Vector Market: Middle East and Africa 11. Key Findings 12. Industry Recommendations 13. Viral Vector Market: Research Methodology 14. Terms and Glossary