The UV Disinfection Equipment Market size was valued at USD 4.12 Billion in 2023 and the total UV Disinfection Equipment Market revenue is expected to grow at a CAGR of 8.23 % from 2024 to 2030, reaching nearly USD 7.17 Billion. UV disinfection equipment refers to devices that utilize ultraviolet (UV) radiation to eliminate or deactivate microorganisms such as bacteria, viruses, and protozoa from water, air, and surfaces. This technology works by exposing pathogens to UV light, which damages their DNA, rendering them unable to replicate and causing them to become inactive. UV disinfection equipment is widely used in various industries, including healthcare, food and beverage, municipal water treatment, and wastewater treatment, due to its effectiveness, efficiency, and environmentally friendly nature. These include stringent regulatory requirements pertaining to water and air quality standards, particularly in developed regions like North America and Europe. Additionally, increasing awareness of the importance of maintaining clean and sanitized environments, particularly in healthcare facilities, food processing plants, and public spaces, is driving the demand for UV disinfection equipment.To know about the Research Methodology:-Request Free Sample Report Continuous technological advancements are driving UV Disinfection Equipment Market growth by improving the efficiency and effectiveness of UV disinfection systems. For example, the development of UV-C LED technology has led to the creation of more compact, energy-efficient, and cost-effective UV disinfection devices. Moreover, increasing environmental concerns associated with chemical disinfection methods are driving the adoption of UV disinfection equipment, which offers a more sustainable and eco-friendlier alternative. Additionally, the emergence of new application areas, such as the residential and consumer markets, presents lucrative opportunities for UV Disinfection Equipment Market growth. North America and Asia Pacific, offers significant growth potential due to rapid industrialization, urbanization, and increasing investments in water and wastewater treatment infrastructure. Furthermore, strategic collaborations, partnerships, and mergers and acquisitions among key UV Disinfection Equipment Market players are driving innovation and product development in the UV disinfection equipment sector. For example, companies like Applied UV and Puro Lighting have announced mergers to strengthen their market presence and offer integrated UV disinfection solutions. Moreover, investments in research and development initiatives aimed at enhancing UV disinfection technology and expanding its applicability across various industries are further propelling market growth and creating new opportunities for UV Disinfection Equipment Market players.

Market Dynamics:

Healthcare Emphasis on Infection Control Fuels UV Disinfection Equipment Demand: Continuous technological advancements drive UV Disinfection Equipment Market growth by improving the efficiency and effectiveness of UV disinfection equipment. For instance, AquiSense Technologies' PearlAqua Deca 30C, launched on May 31, 2023, utilizes UV-C LED technology to achieve over 99.99% pathogen reduction at a flow rate of 4 gallons per minute. Such innovations enhance disinfection capabilities, thereby increasing the adoption of UV disinfection systems globally. Increasing awareness of the importance of maintaining clean and sanitized environments, particularly in healthcare facilities, food processing plants, and public spaces, fuels the demand for UV disinfection equipment. For example, AEG partnered with Puro Lighting to install UV disinfection devices at the Toyota Sports Performance Center, emphasizing its commitment to safety amidst the COVID-19 pandemic. This heightened awareness drives UV Disinfection Equipment Market growth as organizations prioritize infection control measures. Stringent regulatory requirements regarding water and air quality standards drive the adoption of UV disinfection equipment. Nuvonic, launched on May 8, 2023, offers UV-based solutions for water, surface, and air disinfection, addressing the need for chemical-free disinfection methods. Compliance with regulatory standards prompts industries to invest in UV disinfection systems to ensure compliance and maintain public health and safety. The entry of new players, such as Nuvonic, into UV Disinfection Equipment Market fosters competition and innovation. Nuvonic combines the UV expertise of multiple companies to offer comprehensive solutions, leveraging a century of combined experience. Increased competition spurs product development and technological advancements, driving UV Disinfection Equipment Market growth through enhanced product offerings. The healthcare sector's increasing focus on infection prevention and control drives the demand for UV disinfection equipment. AEG's partnership with Puro Lighting underscores the healthcare industry's commitment to implementing advanced disinfection solutions to ensure patient and staff safety. As healthcare-associated infections remain a concern, UV disinfection systems have become integral to healthcare facility operations.Food and Beverage Industry Drives Demand for UV Disinfection Solutions: The food and beverage industry's focus on maintaining hygiene standards and ensuring product safety propels the demand for UV disinfection equipment. Toshiba Lighting & Technology's initial focus on UV water disinfection systems for the food and beverage industry highlights the sector's demand for effective disinfection solutions. As food safety regulations become stricter, UV disinfection systems become indispensable for ensuring compliance and consumer protection. The COVID-19 pandemic has heightened awareness of the importance of effective disinfection methods, leading to increased demand for UV disinfection equipment. Applied UV's merger with Puro Lighting and LED Supply Co. in February 2023 reflects the industry's response to the growing need for air disinfection solutions. The pandemic has accelerated market growth as organizations prioritize infection prevention strategies. UV Disinfection Equipment Market players are expanding their geographical presence to tap into new markets and capitalize on emerging opportunities. Toshiba Lighting & Technology Corporation's partnership with ULTRAAQUA in October 2022 marked a full-scale entry into the UV disinfection business in Japan and the Asia-Pacific region. Such growth will drive UV Disinfection Equipment Market growth by increasing access to UV disinfection solutions in previously untapped regions. Continued investment in research and development initiatives drives innovation in UV disinfection technology, leading to improved product performance and efficiency. For example, ams OSRAM's introduction of the OSLON® UV 3535 series in March 2023 enhanced UV-C LED offerings with design innovations and leading performance. Research-driven advancements drive UV Disinfection Equipment Market growth by offering superior solutions to meet evolving customer needs. Increasing environmental concerns associated with chemical disinfection methods drive the adoption of UV disinfection equipment, which offers a more sustainable and eco-friendlier alternative. Nuvonic's chemical-free full-facility disinfection solutions align with environmental sustainability goals, attracting environmentally conscious consumers and businesses. The shift towards environmentally friendly disinfection methods contributes to the UV Disinfection Equipment Market growth as organizations prioritize sustainability initiatives. UV disinfection effectiveness varies based on pathogen type and environment: UV disinfection faces challenges due to regulations concerning UV radiation for disinfection applications, especially in healthcare. Stringent guidelines necessitate careful adherence to safety standards, limiting the widespread adoption of UV technologies in certain regions and industries. The UV disinfection equipment UV Disinfection Equipment Market is hindered by the high initial costs associated with purchasing and installing UV systems. For instance, the substantial upfront investment required for UV-C LED technology, like AquiSense Technologies' Pearl Aqua Deca 30C, deters budget-conscious consumers and businesses. UV disinfection equipment faces challenges reaching shaded or obstructed areas, limiting UV Disinfection Equipment Market effectiveness. This constraint compromises overall disinfection outcomes, especially in complex environments with intricate surfaces or structures. The use of handheld UV disinfection devices necessitates strict safety measures, such as personal protective equipment for the eyes and skin. Safety concerns impede the widespread adoption of handheld UV devices, particularly in consumer applications where ease of use is crucial. UV disinfection has limitations in the range of pathogens it effectively inactivates. Factors like the UV source's capabilities and the specific characteristics of the space or surfaces being disinfected impact the overall efficacy of UV disinfection systems.

UV Disinfection Equipment Market Segment Analysis:

Based on Component, The UV Lamp segment holds the highest dominance due to its crucial role in emitting UV-C light, which is essential for disinfection purposes. UV lamps are widely adopted across various industries, including healthcare, water treatment, and food processing, driving their current dominance. However, the Reactor Chamber segment is expected to witness significant growth and potentially dominate the UV Disinfection Equipment Market in the future. Reactor chambers are integral components where UV lamps are housed, facilitating the disinfection process. With the increasing demand for efficient disinfection solutions, particularly in healthcare facilities and municipal water treatment plants, the adoption of reactor chambers is projected to rise, driving their expected dominance. Quartz sleeves serve as protective barriers for UV lamps, while controller units regulate the operation of UV disinfection systems. While these segments contribute significantly to UV disinfection equipment, their dominance is expected to remain relatively stable, with gradual growth driven by advancements in technology and increasing UV Disinfection Equipment Market penetration across diverse applications.UV Disinfection Equipment Market Regional Insights:

North America dominated the UV Disinfection Equipment Market in 2023 and is expected to dominate during the forecast period, driven by stringent regulations regarding water and air quality standards, particularly in the United States. The region's advanced healthcare infrastructure and increasing investments in water and wastewater treatment facilities contribute to its dominance. For instance, the implementation of regulations such as the U.S. Environmental Protection Agency's (EPA) Disinfection By-Products (DBP) Rule and the Safe Drinking Water Act (SDWA) spurs the adoption of UV disinfection systems in water treatment plants across the region. Additionally, the demand for UV disinfection equipment in healthcare settings, spurred by the need to combat healthcare-associated infections (HAIs), further solidifies North America's dominance. Asia Pacific UV Disinfection Equipment Market is expected to witness significant growth in the forecast Period, driven by rapid industrialization, urbanization, and increasing awareness of water and air quality issues. Countries like China and India are experiencing robust growth in the adoption of UV disinfection equipment, particularly in the healthcare sector and municipal water treatment plants. For example, China's ambitious goals to improve environmental quality, coupled with investments in water infrastructure projects, are driving the demand for UV disinfection systems in the region. Competitive Landscape The recent advancements in UV technology by AquiSense Technologies, Nuvonic, Applied UV Inc., and ams OSRAM are poised to drive significant growth in the UV disinfection equipment market. AquiSense's cutting-edge PearlAqua Deca 30C offers highly effective pathogen reduction, while Nuvonic's comprehensive UV-based solutions address contamination across various sectors. Applied UV's strategic merger positions them to meet the increasing demand for air disinfection solutions, especially amid initiatives like the White House Clean Air Initiatives. Additionally, ams OSRAM's innovative OSLON® UV 3535 series enhances UV-C LED offerings, promising longevity, and higher output power. Together, these developments fuel market growth by providing advanced, efficient, and versatile solutions for disinfection needs. On May 31, 2023, AquiSense Technologies unveiled the PearlAqua Deca 30C, a cutting-edge UV disinfection product. Utilizing its UV-C LED technology, it achieves over 99.99% pathogen reduction at a flow rate of 4 gallons per minute. Encased in compact housing, it offers automatic on/off switching or external triggering. Dynamic power control minimizes energy usage, while configurable alarm outputs enhance functionality. AquiSense's President and CEO, Oliver Lawal, highlighted its innovation, boasting advanced UV-C LED devices, integrated UV intensity sensors, and enhanced assembly automation. On May 8, 2023, Nuvonic, based in Slough, UK, emerged as the pioneering force in UV technology, introducing a wide array of UV-based solutions for water, surface, and air disinfection. The company, a part of the Halma Group, amalgamates the UV expertise of Aquionics, Berson, Hanovia, and Orca to combat contamination. With a century of collective experience, Nuvonic delivers chemical-free full-facility disinfection, aiming to propel the global UV disinfection equipment market to a projected value of USD 9.1 billion by 2027. On February 3, 2023, Applied UV Inc. (NASDAQ: AUVI) experienced significant growth through a merger with Puro Lighting (PURO) and LED Supply Co. The merger has garnered attention in the UV disinfection equipment industry, with the potential to shape its future. Applied UV sees the PURO merger as a strategic move to capitalize on the rising demand for air disinfection solutions, particularly driven by initiatives like the White House Clean Air Initiatives during the COVID-19 pandemic. CEO Max Munn highlights the synergies between the companies and the growth of UV technology solutions in various sectors, including education, government, and healthcare, signaling robust growth opportunities On March 21, 2023, ams OSRAM unveiled the OSLON® UV 3535 series, enhancing their UV-C LED offerings. These mid-power LEDs boast a novel design, reducing optical losses and enhancing radiation characteristics for exceptional wall plug efficiency. Featuring an open package design with a reflector and no cover glass, these LEDs offer easy integration into various systems. With a typical wavelength of 275 nm, they cater to industrial and consumer applications, promising longevity, high output power, and seamless system integration.UV Disinfection Equipment Market Scope : Inquire before buying

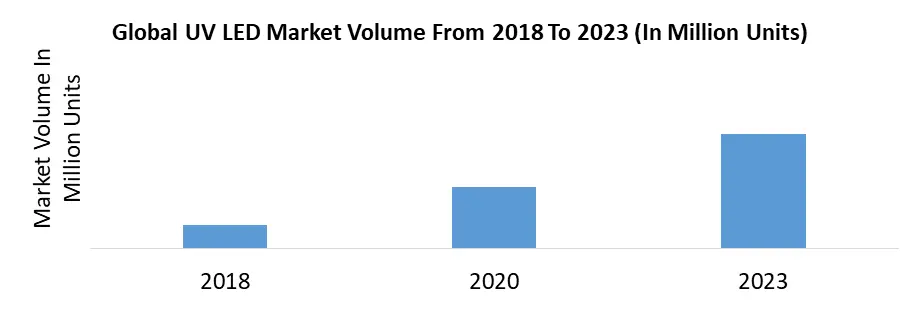

Global UV Disinfection Equipment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.12 Bn. Forecast Period 2024 to 2030 CAGR: 8.23% Market Size in 2030: US $ 7.17 Bn. Segments Covered: by Component Reactor Chamber UV Lamp Quartz Sleeve Controller Unit by Power Rating Low Medium High by Application Air Disinfection Surface Disinfection Process Water Disinfection Water and Wastewater Disinfection by End-User Industrial Residential Commercial Municipal UV Disinfection Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)UV Disinfection Equipment Market Key Players:

Key Players in North America: 1. Trojan Technologies (Ontario, Canada) 2. Xylem (New York, USA) 3. Calgon Carbon Corp. (Pennsylvania, USA) 4. Atlantic Ultraviolet Corp. (New York, USA) 5. Evoqua Water Technologies(Pennsylvania, USA) 6. American Ultraviolet (California, USA) 7. Lumalier Corp. (Tennessee, USA) 8. Xenex (Texas, USA) 9. ENAQUA (California, USA) 10. Sanuvox (Quebec, Canada) 11. LightSources (Connecticut, USA) Key Players in Europe: 12. Halma PLC (Buckinghamshire, UK) 13. Atlantium Technologies Ltd. (Israel) 14. Dr. Hönle AG (Gräfelfing, Germany) 15. Sita (Italy) 16. Lit Company (Italy) 17. UV-Technik (Germany) 18. Ultraaqua (Denmark) 19. Ceasa (Italy) Key Players in Asia Pacific: 20. Advanced UV, Inc. (South Korea) 21. Alfaa UV (Mumbai, India) 22. First Light Technologies (New Zealand) 23. Australian Ultra Violet Services (Australia) 24. Greenway Technologies (India) 25. Hitech Ultraviolet (India) Key Players in Middle East & Africa: 26. Aqualine Ii Water Systems (Headquarter: South Africa) FAQs: 1. What are the growth drivers for the UV Disinfection Equipment Market? Ans. Healthcare Emphasis on Infection Control Fuels UV Disinfection Equipment Demand and is expected to be the major driver for the UV Disinfection Equipment Market. 2. What is the major Opportunity for the UV Disinfection Equipment Market growth? Ans. Food and Beverage Industry Drives Demand for UV Disinfection Solution is the major opportunity for the UV Disinfection Equipment market. 3. Which country is expected to lead the global UV Disinfection Equipment Market during the forecast period? Ans. North America is expected to lead the UV Disinfection Equipment Market during the forecast period. 4. What is the projected market size and growth rate of the UV Disinfection Equipment Market? Ans. The UV Disinfection Equipment Market size was valued at USD 4.12 Billion in 2023 and the total UV Disinfection Equipment Market revenue is expected to grow at a CAGR of 8.23 % from 2024 to 2030, reaching nearly USD 7.17 Billion. 5. What segments are covered in the UV Disinfection Equipment Market report? Ans. The segments covered in the UV Disinfection Equipment Market report are by Component, Power Rating, Application, End User, and Region.

1. UV Disinfection Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. UV Disinfection Equipment Market: Dynamics 2.1. UV Disinfection Equipment Market Trends by Region 2.1.1. North America UV Disinfection Equipment Market Trends 2.1.2. Europe UV Disinfection Equipment Market Trends 2.1.3. Asia Pacific UV Disinfection Equipment Market Trends 2.1.4. Middle East and Africa UV Disinfection Equipment Market Trends 2.1.5. South America UV Disinfection Equipment Market Trends 2.2. UV Disinfection Equipment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America UV Disinfection Equipment Market Drivers 2.2.1.2. North America UV Disinfection Equipment Market Restraints 2.2.1.3. North America UV Disinfection Equipment Market Opportunities 2.2.1.4. North America UV Disinfection Equipment Market Challenges 2.2.2. Europe 2.2.2.1. Europe UV Disinfection Equipment Market Drivers 2.2.2.2. Europe UV Disinfection Equipment Market Restraints 2.2.2.3. Europe UV Disinfection Equipment Market Opportunities 2.2.2.4. Europe UV Disinfection Equipment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific UV Disinfection Equipment Market Drivers 2.2.3.2. Asia Pacific UV Disinfection Equipment Market Restraints 2.2.3.3. Asia Pacific UV Disinfection Equipment Market Opportunities 2.2.3.4. Asia Pacific UV Disinfection Equipment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa UV Disinfection Equipment Market Drivers 2.2.4.2. Middle East and Africa UV Disinfection Equipment Market Restraints 2.2.4.3. Middle East and Africa UV Disinfection Equipment Market Opportunities 2.2.4.4. Middle East and Africa UV Disinfection Equipment Market Challenges 2.2.5. South America 2.2.5.1. South America UV Disinfection Equipment Market Drivers 2.2.5.2. South America UV Disinfection Equipment Market Restraints 2.2.5.3. South America UV Disinfection Equipment Market Opportunities 2.2.5.4. South America UV Disinfection Equipment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For UV Disinfection Equipment Industry 2.8. Analysis of Government Schemes and Initiatives For UV Disinfection Equipment Industry 2.9. UV Disinfection Equipment Market Trade Analysis 2.10. The Global Pandemic Impact on UV Disinfection Equipment Market 3. UV Disinfection Equipment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 3.1.1. Reactor Chamber 3.1.2. UV Lamp 3.1.3. Quartz Sleeve 3.1.4. Controller Unit 3.2. UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 3.2.1. Low 3.2.2. Medium 3.2.3. High 3.3. UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 3.3.1. Air Disinfection 3.3.2. Surface Disinfection 3.3.3. Process Water Disinfection 3.3.4. Water and Wastewater Disinfection 3.4. UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 3.4.1. Industrial 3.4.2. Residential 3.4.3. Commercial 3.4.4. Municipal 3.5. UV Disinfection Equipment Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America UV Disinfection Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 4.1.1. Reactor Chamber 4.1.2. UV Lamp 4.1.3. Quartz Sleeve 4.1.4. Controller Unit 4.2. North America UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 4.2.1. Low 4.2.2. Medium 4.2.3. High 4.3. North America UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 4.3.1. Air Disinfection 4.3.2. Surface Disinfection 4.3.3. Process Water Disinfection 4.3.4. Water and Wastewater Disinfection 4.4. North America UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 4.4.1. Industrial 4.4.2. Residential 4.4.3. Commercial 4.4.4. Municipal 4.5. North America UV Disinfection Equipment Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Reactor Chamber 4.5.1.1.2. UV Lamp 4.5.1.1.3. Quartz Sleeve 4.5.1.1.4. Controller Unit 4.5.1.2. United States UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 4.5.1.2.1. Low 4.5.1.2.2. Medium 4.5.1.2.3. High 4.5.1.3. United States UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Air Disinfection 4.5.1.3.2. Surface Disinfection 4.5.1.3.3. Process Water Disinfection 4.5.1.3.4. Water and Wastewater Disinfection 4.5.1.4. United States UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Industrial 4.5.1.4.2. Residential 4.5.1.4.3. Commercial 4.5.1.4.4. Municipal 4.5.2. Canada 4.5.2.1. Canada UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Reactor Chamber 4.5.2.1.2. UV Lamp 4.5.2.1.3. Quartz Sleeve 4.5.2.1.4. Controller Unit 4.5.2.2. Canada UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 4.5.2.2.1. Low 4.5.2.2.2. Medium 4.5.2.2.3. High 4.5.2.3. Canada UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Air Disinfection 4.5.2.3.2. Surface Disinfection 4.5.2.3.3. Process Water Disinfection 4.5.2.3.4. Water and Wastewater Disinfection 4.5.2.4. Canada UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Industrial 4.5.2.4.2. Residential 4.5.2.4.3. Commercial 4.5.2.4.4. Municipal 4.5.3. Mexico 4.5.3.1. Mexico UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Reactor Chamber 4.5.3.1.2. UV Lamp 4.5.3.1.3. Quartz Sleeve 4.5.3.1.4. Controller Unit 4.5.3.2. Mexico UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 4.5.3.2.1. Low 4.5.3.2.2. Medium 4.5.3.2.3. High 4.5.3.3. Mexico UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Air Disinfection 4.5.3.3.2. Surface Disinfection 4.5.3.3.3. Process Water Disinfection 4.5.3.3.4. Water and Wastewater Disinfection 4.5.3.4. Mexico UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Industrial 4.5.3.4.2. Residential 4.5.3.4.3. Commercial 4.5.3.4.4. Municipal 5. Europe UV Disinfection Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.2. Europe UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.3. Europe UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.4. Europe UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5. Europe UV Disinfection Equipment Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.1.3. United Kingdom UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.2.3. France UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.3.3. Germany UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.4.3. Italy UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.5.3. Spain UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.6.3. Sweden UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.7.3. Austria UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 5.5.8.3. Rest of Europe UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific UV Disinfection Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.3. Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.1.3. China UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.2.3. S Korea UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.3.3. Japan UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.4.3. India UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.5.3. Australia UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.6.3. Indonesia UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.7.3. Malaysia UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.8.3. Vietnam UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.9.3. Taiwan UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 6.5.10.3. Rest of Asia Pacific UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa UV Disinfection Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 7.3. Middle East and Africa UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa UV Disinfection Equipment Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 7.5.1.3. South Africa UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 7.5.2.3. GCC UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 7.5.3.3. Nigeria UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 7.5.4.3. Rest of ME&A UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 8. South America UV Disinfection Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 8.2. South America UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 8.3. South America UV Disinfection Equipment Market Size and Forecast, by Application(2023-2030) 8.4. South America UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 8.5. South America UV Disinfection Equipment Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 8.5.1.3. Brazil UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 8.5.2.3. Argentina UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America UV Disinfection Equipment Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America UV Disinfection Equipment Market Size and Forecast, by Power Rating (2023-2030) 8.5.3.3. Rest Of South America UV Disinfection Equipment Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America UV Disinfection Equipment Market Size and Forecast, by End User (2023-2030) 9. Global UV Disinfection Equipment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading UV Disinfection Equipment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Trojan Technologies (Ontario, Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Xylem (New York, USA) 10.3. Calgon Carbon Corp. (Pennsylvania, USA) 10.4. Atlantic Ultraviolet Corp. (New York, USA) 10.5. Evoqua Water Technologies LLC (Pennsylvania, USA) 10.6. American Ultraviolet (California, USA) 10.7. Lumalier Corp. (Tennessee, USA) 10.8. Xenex (Texas, USA) 10.9. ENAQUA (California, USA) 10.10. Sanuvox (Quebec, Canada) 10.11. LightSources (Connecticut, USA) 10.12. Halma PLC (Buckinghamshire, UK) 10.13. Atlantium Technologies Ltd. (Israel) 10.14. Dr. Hönle AG (Gräfelfing, Germany) 10.15. Sita (Italy) 10.16. Lit Company (Italy) 10.17. UV-Technik (Germany) 10.18. Ultraaqua (Denmark) 10.19. Ceasa (Italy) 10.20. Advanced UV, Inc. (South Korea) 10.21. Alfaa UV (Mumbai, India) 10.22. First Light Technologies (New Zealand) 10.23. Australian Ultra Violet Services (Australia) 10.24. Greenway Technologies (India) 10.25. Hitech Ultraviolet (India) 10.26. Aqualine Ii Water Systems (Headquarter: South Africa) 11. Key Findings 12. Industry Recommendations 13. UV Disinfection Equipment Market: Research Methodology 14. Terms and Glossary