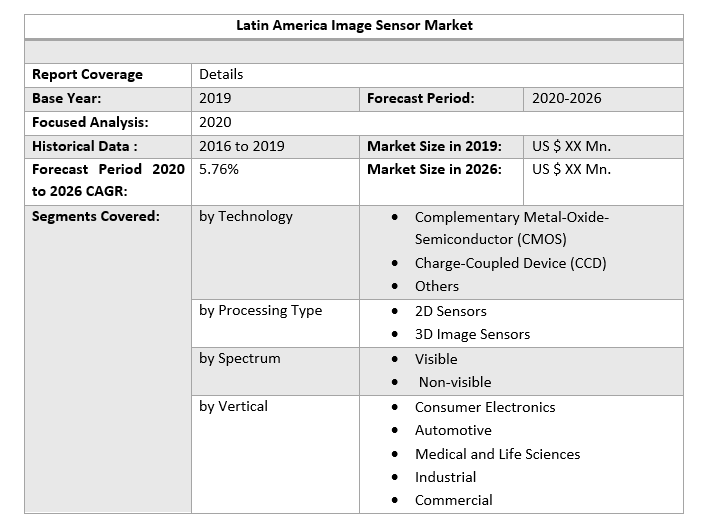

Latin America Image Sensor Market is expected to grow at a CAGR of 6.85% during the forecast period. Latin America Image Sensor Market is expected to reach US$ 1.12 Bn. by2027.To know about the Research Methodology :- Request Free Sample Report

Latin America Image Sensor Market Overview:

The increasing requirement for trivial pixel devices offering high resolution with a low-cost technique is projected to boost the market development during the forecast period. The Image Sensor Market has been facing a major change in the past few years. The automated improvements and sturdy usage of images over many applications have motivated the change of image sensors in the Latin America market. With the increasing R&D investments, detecting tools have become inexpensive, dense, & power-efficient, posing openings to the industrial firms. The increasing mobile phone segment, mainly smartphones, is expected to spur the sector growth during the forecast period.Latin America Image Sensor Market Dynamics:

Systems using cameras for distant sensing is regularly becoming a vital part of an active security system in vehicles. Sensing cameras deliver a higher level of presentation than overall purpose driving cameras, while also meeting the essential automotive superiority standards as cost-effective keys. These are smart safety systems with 2 important components: the distant sensors & the processing computer. A remote sensor is a device that gathers data about real-world situations through sensors, like radar, ultrasonic sensors, & cameras. The processing computer accepts data from these cameras & sensors then make the result & sends instructions to the vehicle subsystems. Mexican market has the fastest development rate: Latin America region includes geographies like Mexico, Brazil, and Argentina where the disposable income of consumers is increasing. Despite the aforementioned influence, automotive sales have dropped in the year 2019 but the market is estimated to show a good growth rate during the forecast period. In LA, the ADAS market is showing a growth rate of 20.01 percent owing to a quicker adoption rate among consumers. Many OEMs are now presenting parking support systems in mid & small-sector cars to make a point of difference from other OEMs. Another influence that is boosting the development of the automotive image sensor market is the occurrence of a big number of equipment manufacturers in the Latin America region. Manufacturers have realized economies of scale & are making devices at a cheaper rate. There are many active companies in the aftermarket.Latin America Image Sensor Market Segment Analysis:

Consumer electronics is expected to be the main application segment having the high penetration & accounted for over 50 percent of the global revenue share in the year 2019. Its revenue growth is also expected to be at a CAGR of 3.3 % between the years 2019 to 2026. These devices are widely planned in consumer electronics, for example, in smartphones or cameras. Increasing demand for consumer electronics: In the year 2019, the global market for consumer electronics accounted for approximately USD 1.4 trillion, & it is estimated to rise to over $1.9 trillion during the forecast period. Nations in Latin America & the Caribbean imported over USD 158 Bn in consumer electronics in the year 2019, with Mexico only importing nearly USD 93 Bn of goods in this class. In fact, Mexico was the eighth major electronics importer through the globe in the year 2019. Even smaller nations such as Honduras & Nicaragua have established fast growth in imports in this segment since 2014. Though the county represents a trivial portion of the whole global consumer electronics market, many influences are developing that will drive improved consumer demand during the forecast period. Each year, more Latin Americans join the middle class & have disposable income to spend. While imported products can often cost more than domestically available brands in several groups, with tech, Latin Americans tend to wish global brands over domestic ones. With more disposable income comes extra choice, & smart foreign brands can invest in customer desires. Absence of domestic producers in the consumer electronics area, Latin American customers have the minute option but to look abroad for their technological gadgets. With the increase of e-commerce, particularly in developing markets, it’s now easier for customers to find new brands & research purchases. Add to that the information that famous tech products from international brands such as Apple are hugely expensive when bought domestically, & it’s no miracle why global buying is on the rise. International customer electronics firms thus have more opportunities to attach to new consumers in the region before they head to a domestic retailer. Development in Latin America’s Consumer Electronics Market: In the year 2019, about 56 percent of Latin America’s populace had access to the Internet, but that number is projected to climb to closely 68 percent by 2022. The fast development in Internet usage throughout the Latin America region is compelled by smartphone adoption. Between the years 2011 & 2018, smartphone usage improved from 39.1 percent of the populace to 43.2 percent. While smartphone sales are aiding to drive the development in Latin America’s consumer electronics market, it’s at the expenditure of single-use products such as digital cameras. Smartphone adoption is also driving an extra portion of the equation, e-commerce sales. Owing to the enhanced R&D, sensing devices have become cheap, compressed, & consume a smaller amount of power, which aids as a striking opportunity for industry suppliers. Buyer inclination towards wearable devices is expected to rise the image sensor market over the forecast period. A rising inclination for multimedia devices is reinforced by growth in mobile devices. Multimedia-enabled products offer more features with more data safety over the Internet. These devices are strongly reinforced by sensing skill in the United States along with developing regions such as Brazil, Latin America, and Mexico. The usage of sensing devices for health nursing, indoor steering, and connected niche applications is expected to offer major development opportunities for the evolution of the Image sensor market. The Latin America Image Sensor Market report covers 2D Sensors, 3D Image Sensors with detailed analysis Latin America Image Sensor Market with the classifications of the market on the Converter Spectrum, Processing Type, Spectrum, Vertical & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The Latin America Image Sensor Market report has profiled key players in the market from different regions. However, the Latin America Image Sensor Market report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Types, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the Latin America Image Sensor Market report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing &Covid 19 impact on demand side are covered in the Latin America Image Sensor Market report.Latin America Image Sensor Market, Key Highlights:

• Latin America Image Sensor Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Latin America Image Sensor Market • Latin America Image Sensor Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Latin America Image Sensor Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Latin America Image Sensor Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Latin America Image Sensor Market are also profiled.Latin America Image Sensor Market Scope: Inquire before buying

Latin America Image Sensor Market, by Country

• Mexico • Brazil • Rest of Latin AmericaLatin America Image Sensor Market, Key Players:

• STMicroelectronics • Espros Photonics Corporation • Imasenic • Andanta • BAE Systems Inc. • Insightness • Integrated Detector Electronics AS • Multix • ON Semiconductor • IR Nova • Emberion • E2V • Omnivision • Samsung • Canon • Aptina Imaging • Nikon • Toshiba • EM Microelectronics • Melexis • SK Hynix.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Latin America Image Sensor Market Size, by Market Value (US$ Mn) 3.1. Latin America Market Segmentation 3.2. Latin America Market Segmentation Share Analysis, 2019 3.2.1. Latin America 3.2.2. By Country 3.3. Geographical Snapshot of the Latin America Image Sensor Market 3.4. Geographical Snapshot of the Latin America Image Sensor Market, By Manufacturer share 4. Latin America Image Sensor Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Types 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Latin America Image Sensor Market 5. Supply Side and Demand Side Indicators 6. Latin America Image Sensor Market Analysis and Forecast, 2019-2026 6.1. Latin America Image Sensor Market Size & Y-o-Y Growth Analysis. 7. Latin America Image Sensor Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 7.1.1. Complementary Metal-Oxide-Semiconductor (CMOS) 7.1.2. Charge-Coupled Device (CCD) 7.1.3. Others 7.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 7.2.1. 2D Sensors 7.2.2. 3D Image Sensors 7.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 7.3.1. Visible 7.3.2. Non-visible. 7.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 7.4.1. Consumer Electronics 7.4.2. Automotive 7.4.3. Medical and Life Sciences 7.4.4. Industrial 7.4.5. Commercial 7.4.6. Aerospace, Defense, and Homeland Security 8. Latin America Image Sensor Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 8.1.1. Mexico 8.1.2. Brazil 8.1.3. Rest of Latin America 9. Mexico Image Sensor Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 9.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 9.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 9.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 10. Brazil Image Sensor Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 10.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 10.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 10.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 11. Rest of Latin America Image Sensor Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 11.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 11.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 12. Competitive Landscape 12.1. Geographic Footprint of Major Players in the Latin America Image Sensor Market 12.2. Competition Matrix 12.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Services and R&D Investment 12.2.2. New Type Launches and Type Enhancements 12.2.3. Market Consolidation 12.2.3.1. M&A by Regions, Investment and Verticals 12.2.3.2. M&A, Forward Integration and Backward Integration 12.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 12.3. Company Profile : Key Players 12.3.1. PSC Group 12.3.1.1. Company Overview 12.3.1.2. Financial Overview 12.3.1.3. Geographic Footprint 12.3.1.4. Type Portfolio 12.3.1.5. Business Strategy 12.3.1.6. Recent Developments 12.3.2. STMicroelectronics 12.3.3. Espros Photonics Corporation 12.3.4. Imasenic 12.3.5. Andanta 12.3.6. BAE Systems Inc. 12.3.7. Insightness 12.3.8. Integrated Detector Electronics AS 12.3.9. Multix 12.3.10. ON Semiconductor 12.3.11. IR Nova 12.3.12. Emberion 12.3.13. E2V 12.3.14. Omnivision 12.3.15. Samsung 12.3.16. Canon 12.3.17. Aptina Imaging 12.3.18. Nikon 12.3.19. Toshiba 12.3.20. EM Microelectronics 12.3.21. Melexis 12.3.22. SK Hynix 13. Primary Key Insights.