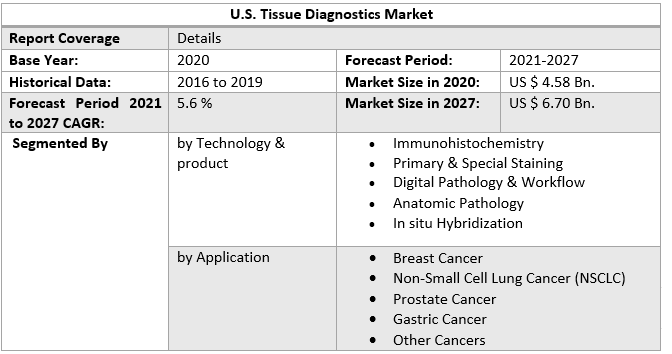

By 2027, the U.S. Tissue Diagnostics Market is expected to reach US $6.70 billion, thanks to growth in the Immunohistochemistry segment. The report U.S. Tissue Diagnostics market dynamics by region and Application industries.U.S. Tissue Diagnostics Market Overview:

One of the most essential tools for cancer diagnosis is tissue-based diagnostics. According to the International Agency for Research on Cancer (IARC), the global burden of cancer is expected to rise to 21.7 million new cases and 13 million deaths by 2030, owing to population growth and aging, as well as other factors such as smoking, poor diet, physical inactivity, and fewer childbirths. The disease insights and parameters that influence patient outcomes are captured by tissue diagnostics. Tissue pieces acquired through various procedures make up the majority of samples. Examples include little biopsies and large specimens extracted following surgery. Rising healthcare costs and technological improvements in tissue diagnostics are also major factors driving the market's growth.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2020is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report

U.S. Tissue Diagnostics Market Dynamics:

U.S. Tissue Diagnostics Market size was valued at US$ 4.58 Bn in 2020 and the total revenue is expected to grow at 5.6% through 2021 to 2027, reaching nearly US$ 6.70 Bn Emerging solutions relevant to digital tissue diagnostics, developments in imaging techniques & increasing diagnostic affordability, and the expansion of tailored medicines & diagnostics are all driving the market. Because of its accompanying benefits, such as adjustable magnification and remote access to slides, the usage of digital slides has expanded dramatically in recent years. Several organizations and firms in the United States are supporting the expanding emphasis on precision medicine, which is projected to contribute to market growth. Furthermore, the emergence of customized medicine can be due to advancements in genome sequencing techniques and diagnostic tools. With breakthrough oncology treatments, companies are assisting in the development of precision medicine. QIAGEN, for example, announced new cancer products in May 2020, such as the QCI Interpret One software solution for tumor genomic profiling. Imaging method innovations are projected to have a beneficial impact on market growth. Breast cancer is the most prevalent type of cancer diagnosed in American women, according to Breastcancer.org. Breast cancer is expected to account for roughly 30% of all new cancer cases in women by 2021. The sensitivity of detection and diagnosis of breast cancer has improved as a result of technological advancements in imaging techniques. Procedures for analyzing gene expression, cellular biochemistry, and molecular biology using digital technologies, tomosynthesis, CAD, and other approaches have been added to the technological growth in breast tissue analysis. Several areas of pathology laboratories have been impacted by the global COVID-19 epidemic, including specimen workflow, biosafety regulations, laboratory staffing, laboratory finances, and resident training.Key Developments:

• F. Hoffmann-La Roche Ltd. launched the CE-IVD digital automated algorithms for pathology, uPath HER2 Dual ISH image analysis, and uPath HER2 (4B5) image analysis for breast cancer diagnosis in January 2021. These methods make it easier to determine whether tumors are positive for HER2 biomarkers quickly. • Thermo Fisher Scientific, Inc. and (HTI) Hengrui Therapeutics, Inc., a U.S. subsidiary of a Chinese pharmaceutical business, signed an agreement in August 2020 to develop a Companion Diagnostic (CDx) for diagnosing NSCLC utilizing the Oncomine Precision Assay.U.S. Tissue Diagnostics Market Segment Analysis:

The Immunohistochemistry (IHC) segment is dominating the Procedure Type segment of the U.S. Tissue Diagnostics Market:

In 2020, the Immunohistochemistry (IHC) segment dominated the market, accounting for 26.5 % of revenue. A significant share of the sector can be ascribed to the widespread usage of IHC technology in clinical research and the development of cancer diagnostics and therapies. IHC is one of the most essential technologies for analyzing tissues in cancer patients for early disease diagnosis, prognosis, and therapy response prediction. Although traditional special enzyme staining methods only identify a limited number of enzymes, tissue structures, and proteins, it is commonly chosen. IHC tests, on the other hand, are more specific and useful in emphasizing the differences between different forms of cancer. Under tissue diagnostics, it is thought to be the most profitable sub-segment. The revenue generated by the IHC segment has been primarily driven by slide staining systems.The breast cancer segment is considered to supplement the growth of the U.S. Tissue Diagnostics Market. In 2020, the breast cancer application segment had the biggest revenue share, with over 47.7%. Tissue diagnostics are critical in determining whether or not a patient has breast cancer. Fine-needle aspiration biopsy, core needle biopsy, and surgical biopsy are the most common tissue biopsy tests for breast cancer. Companion diagnostics have been developed to help prevent the poor prognosis of breast cancer types with limited therapy options. For example, the United States Food and Drug Administration (FDA) authorized Agilent Technologies, Inc.'s PD-L1 IHC 22C3 pharmDx in November 2020, which aids in the detection of triple-negative breast cancer in patients who can be treated with KEYTRUDA (pembrolizumab). Tissue diagnostics, on the other hand, is expected to acquire a lot of momentum in gastric cancer and non-small cell lung cancer (NSCLC) applications. In forecast timeframe, the stomach cancer application segment is predicted to increase at a CAGR of 4.03 %. The segment is predicted to rise because of advancements in the detection of malignancies in samples/specimens. In the diagnosis of stomach ulcers, biopsy techniques have acquired a lot of attention. Companion diagnostic methods for the detection of stomach cancer are being developed by researchers and corporations. The objective of the report is to present a comprehensive analysis of the U.S. Tissue Diagnostics Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. Tissue Diagnostics Market dynamics, structure by analyzing the market segments and projecting the U.S. Tissue Diagnostics Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the U.S. Tissue Diagnostics Market make the report investor’s guide.

U.S. Tissue Diagnostics Market Scope: Inquire before buying

U.S. Tissue Diagnostics Market, by Region

• USU.S. Tissue Diagnostics Market Key Player

• Siemens Healthineers • bioMérieux SA • Merck KGaA • Thermo Fisher Scientific, Inc. • F. Hoffmann-La Roche Ltd. • Abbott Laboratories • Siemens Healthineers AG • Danaher • bioMérieux SA • QIAGEN • Becton, Dickinson & Company (BD) • Agilent Technologies, Inc. • General Electric Company (GE Healthcare) • BioGenex • Cell Signaling Technology, Inc. • Bio SB • DiaGenic ASA • Sakura Finetek Japan Co., Ltd. • Abcam plc • Enzo Life Sciences, Inc. • VITRO SA (Master Diagnóstica) • TissueGnostics GmbHFAQs:

1. What is the U.S. Tissue Diagnostics market value in 2020? Ans: U.S. Tissue Diagnostics market value in 2020 was estimated as 4.58 Billion USD. 2. What is the U.S. Tissue Diagnostics market growth? Ans: The U.S. Tissue Diagnostics market is anticipated to grow with a CAGR of 5.6 % in the forecast period and is likely to reach USD 6.70 Billion by the end of 2027. 3. Which segment is expected to dominate the U.S. Tissue Diagnostics market during the forecast period? Ans: The Immunohistochemistry (IHC) segment dominated the U.S. tissue diagnostics market in 2020 accounting for a revenue share of 26.5%. 4. Who are the key players in the U.S. Tissue Diagnostics market? Ans: Some key players operating in the U.S. tissue diagnostics market include Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; and Becton, Dickinson & Company (BD). 5. What is the key driving factor for the growth of the U.S. Tissue Diagnostics market? Ans: The U.S. tissue diagnostics market is driven by emerging solutions about digital tissue diagnostics, advancements in imaging techniques & increasing affordability of diagnostics, and growth of personalized therapeutics and diagnostics.

1. U.S. Tissue Diagnostics Market: Research Methodology 2. U.S. Tissue Diagnostics Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global U.S. Tissue Diagnostics Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. U.S. Tissue Diagnostics Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Drivers Developments by Companies 3.4 Market 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • US. 3.12 COVID-19 Impact 4. U.S. Tissue Diagnostics Market Segmentation 4.1 U.S. Tissue Diagnostics Market, by Procedure Type (2020-2027) • Immunohistochemistry • Primary & Special Staining • Digital Pathology & Workflow • Anatomic Pathology • In situ Hybridization 4.2 U.S. Tissue Diagnostics Market, by Application (2020-2027) • Breast Cancer • Non-Small Cell Lung Cancer (NSCLC) • Prostate Cancer • Gastric Cancer • Other Cancers 5. Company Profile: Key players 5.1 Cutera 5.1.1 Company Overview 5.1.2 Financial Overview 5.1.3 Global Presence 5.1.4 Procedure Type Portfolio 5.1.5 Business Strategy 5.1.6 Recent Developments 5.2 Siemens Healthineers 5.3 bioMérieux SA 5.4 Abbott Laboratories 5.5 Danaher Corporation (Beckman Coulter) 5.6 Quidel Corporation 5.7 Ortho Clinical Diagnostics 5.8 Sysmex Corporation 5.9 Bio-Rad Laboratories, Inc. 5.10 Becton, Dickinson and Company 5.11 F. Hoffmann-La Roche AG 5.12 Thermo Fisher Scientific, Inc. 5.13 Pfizer 5.14 Merck KGA 5.15 Olympus Corporation 5.16 Nova Century Scientific Inc.