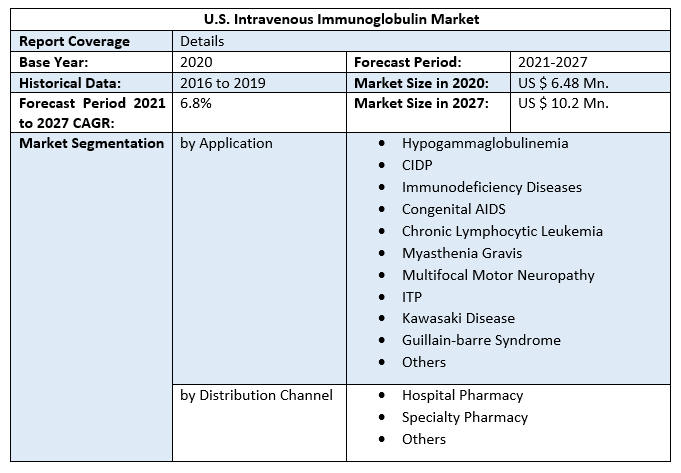

U.S. Intravenous Immunoglobulin Market size was valued at US$ 6.48 Mn. in 2020 and the total revenue is expected to grow at 6.8 % through 2021 to 2027, reaching nearly US$ 10.2 Mn.U.S. Intravenous Immunoglobulin Market Overview:

Intravenous immunoglobulin (IVIG) is a blood product made from the serum of 1000 to 15000 donors in a single batch. For individuals with antibody deficits, it is the treatment of choice. IVIG is given at a replacement dosage' of 200–400 mg/kg body weight every three weeks for this reason.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2026. 2019 is considered a base year however 2021's numbers are on the real output of the companies in the market. Special attention is given to 2021 and the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

U.S. Intravenous Immunoglobulin Market Dynamics:

IVIG is a medicinal preparation used to treat a variety of disorders, including primary immune deficiency, secondary immune deficiency, immunological thrombocytopenic purpura (ITP), and chronic inflammatory demyelinating polyneuropathy (CIDP). According to the National Institutes of Health, more than 500,000 persons in the United States have one of more than 200 types of primary immunodeficiency diseases (PIDs). In the near future, the rising prevalence of primary and acquired immunodeficiency illnesses, such as AIDS and X-linked hypogammaglobulinemia, is predicted to increase the need for immunoglobulin therapy. Over the projected period, increasing FDA approval and the introduction of novel IVIG medicines in the United States are likely to considerably support market growth. For example, ADMA Biologics, Inc., a biopharmaceutical firm based in the United States, got FDA approval for its Prior Approval Supplement (PAS) for BIVIGAM in May 2019. The treatment of primary humoral immunodeficiency with BIVIGAM (IVIG, 10% liquid) is suggested. In another case, CSL Behring, a prominent market competitor based in the United States, got FDA approval for its new IVIG medication, Privigen, in September 2017. Privigen is used to treat persons who have chronic inflammatory demyelinating polyneuropathy (CIDP). The high cost of IVIG therapy, on the other hand, is projected to be a major stumbling block to market expansion. Immunoglobulin infusions are usually given once every three to four weeks, and the treatment is ongoing (12-16 sessions annually). IVIG costs an average of USD 73.89 per gram, with a total cost of USD 10,000 depending on the severity of the illness. Immunoglobulin replacement therapies are long-term treatments that last on average six months. According to the ABIM Foundation, IgG treatment therapy costs more than USD 30,000 each year.U.S. Intravenous Immunoglobulin Market Segment Analysis:

The immunodeficiency diseases segment is anticipated to adhere to the growth of the U.S. Intravenous Immunoglobulin Market. Due to the established patient population and the long-term therapeutic requirements associated with these disorders, the immunodeficiency diseases category dominated the market with a share of over 22.0 % in 2020. Over 150 uncommon diseases are classified as primary immunodeficiency diseases. Primary immunodeficiency illnesses are one of the FDA-approved indications for IVIG and common use of the drug in the United States. In addition, due to its user-friendly application and minimally invasive procedure compared to other treatment choices, the CIDP market is expected to rise at a lucrative rate over the projected period. Traditional CIDP treatments, such as plasmapheresis, steroids, and immunosuppressive medicines, are known to develop resistance, and IVIG treatment is currently considered to be safer and more successful, propelling sector expansion throughout the forecast period. The Hospital pharmacy segment is projected to motivate the growth of the U.S. Intravenous Immunoglobulin Market Due to the vast number of hospitals and the convenient availability of products, hospital pharmacies held the largest market of about 58.0 % in 2020. In-patient and out-patient hospital pharmacies are included in the category of hospital pharmacies. The rising frequency of primary immunological deficiencies, hepatitis C, and other disorders has resulted in an increase in overall hospitalizations in the US, resulting in a larger client base for hospital pharmacies. Furthermore, hospitals provide prompt reimbursement as well as therapy and care to a large number of patients, allowing for an increase in the number of patients who choose to use hospital pharmacies. The objective of the report is to present a comprehensive analysis of the U.S. Intravenous Immunoglobulin Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. Intravenous Immunoglobulin Market dynamics, structure by analyzing the market segments and projecting the U.S. Intravenous Immunoglobulin Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the U.S. Intravenous Immunoglobulin Market make the report investor’s guide.U.S. Intravenous Immunoglobulin Market Scope: Inquire before buying

U.S. Intravenous Immunoglobulin Market Key Players

• Biotest AG • Octapharma AG • LFB Biotechnologies S.A.S • China Biologics Products Holdings, Inc. • Grifols, S.A. • Kedrion Biopharma, Inc. • CSL Behring • McKesson Corporation • Takeda Pharmaceutical Company Limited • Bio Products Laboratory Ltd. • Pfizer, Inc. • ADMA Biologics, Inc. • Hualan Biological Engineering Inc. • Omrix Biopharmaceuticals Ltd. • Behring GmbH • Shanghai RAAS Blood Products Co., LtdFAQs:

1. What is the U.S. Intravenous Immunoglobulin Market value in 2020? Ans: The U.S. Intravenous Immunoglobulin Market value in 2020 was estimated as 6.48 Mn. USD. 2. What is the U.S. Intravenous Immunoglobulin Market growth? Ans: The U.S. Intravenous Immunoglobulin Market is anticipated to grow with a CAGR of 6.8% in the forecast period and is likely to reach USD 10.2 Mn. by the end of 2027. 3. Which segment is expected to dominate the U.S. Intravenous Immunoglobulin Market during the forecast period? Ans: Hospital pharmacy held the largest share of over 58.0% in 2020 owing to a large number of hospitals and the easy availability of products. Hospital pharmacies include both in-patient and out-patient hospital pharmacies. 4. Who are the key players of the U.S. Intravenous Immunoglobulin Market? Ans: Some key players operating in the U.S. IVIG market includeBiotest AG, Octapharma AG, LFB Biotechnologies, Grifols, S.A., Kedrion Biopharma, Inc., CSL Behring, BDI Pharma, Inc., Takeda Pharmaceutical Company Limited (Shire plc), ADMA Biologics, Inc., Baxter International Inc., and, Bio Products Laboratory Ltd. 5. What is the key driving factor for the growth of the U.S. Intravenous Immunoglobulin Market? Ans: Key factors that are driving the market growth include increasing incidence of immunodeficiency disorders, robust pipeline, government initiatives, and approval of novel IVIG therapies.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Technology 2.3.2. Primary Research 2.3.2.1. Data from Primary Technology 2.3.2.2. Breakdown of Primary Technology 3. Executive Summary: U.S. Intravenous Immunoglobulin Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2020 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the U.S. Intravenous Immunoglobulin Market 3.4. Geographical Snapshot of the U.S. Intravenous Immunoglobulin Market, By Manufacturer share 4. U.S. Intravenous Immunoglobulin Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. By Region (U.S) 4.1.2. Restraints 4.1.2.1. By Region (U.S) 4.1.3. Opportunities 4.1.3.1. By Region (U.S) 4.1.4. Challenges 4.1.4.1. By Region (U.S) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the U.S. Intravenous Immunoglobulin Market 5. Supply Side and Demand Side Indicators 6. U.S. Intravenous Immunoglobulin Market Analysis and Forecast, 2020-2027 6.1. U.S. Intravenous Immunoglobulin Market Size & Y-o-Y Growth Analysis. 7. U.S. Intravenous Immunoglobulin Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Application, 2020-2027 7.1.1. Hypogammaglobulinemia 7.1.2. CIDP 7.1.3. Immunodeficiency Diseases 7.1.4. Congenital AIDS 7.1.5. Chronic Lymphocytic Leukemia 7.1.6. Myasthenia Gravis 7.1.7. Multifocal Motor Neuropathy 7.1.8. ITP 7.1.9. Kawasaki Disease 7.1.10. Guillain-barre Syndrome 7.1.11. Others 7.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2020-2027 7.2.1. Hospital Pharmacy 7.2.2. Specialty Pharmacy 7.2.3. Others 8. U.S. Intravenous Immunoglobulin Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. US 9. U.S. Intravenous Immunoglobulin Market Analysis and Forecasts, 2020-2027 9.1. Market Size (Value) Estimates & Forecast By Application, 2020-2027 9.1.1. Hypogammaglobulinemia 9.1.2. CIDP 9.1.3. Immunodeficiency Diseases 9.1.4. Congenital AIDS 9.1.5. Chronic Lymphocytic Leukemia 9.1.6. Myasthenia Gravis 9.1.7. Multifocal Motor Neuropathy 9.1.8. ITP 9.1.9. Kawasaki Disease 9.1.10. Guillain-barre Syndrome 9.1.11. Others 9.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2020-2027 9.2.1. Hospital Pharmacy 9.2.2. Specialty Pharmacy 9.2.3. Others 10. Competitive Landscape 10.1. Geographic Footprint of Major Players in the U.S. Intravenous Immunoglobulin Market 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 10.2.2. New Grade Launches and Grade Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Regions, Investment, and Verticals 10.2.3.2. M&A, Forward Integration and Backward Integration 10.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 10.3. Company Profile: Key Players 10.3.1. Treez Inc. 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Geographic Footprint 10.3.1.4. Grade Portfolio 10.3.1.5. Business Strategy 10.3.1.6. Recent Developments 10.3.2. Biotest AG 10.3.3. Octapharma AG 10.3.4. LFB Biotechnologies S.A.S 10.3.5. China Biologics Products Holdings, Inc. 10.3.6. Grifols, S.A. 10.3.7. Kedrion Biopharma, Inc. 10.3.8. CSL Behring 10.3.9. McKesson Corporation 10.3.10. Takeda Pharmaceutical Company Limited 10.3.11. Bio Products Laboratory Ltd. 10.3.12. Pfizer, Inc. 10.3.13. ADMA Biologics, Inc. 10.3.14. Hualan Biological Engineering Inc. 10.3.15. Omrix Biopharmaceuticals Ltd. 10.3.16. Behring GmbH 10.3.17. Shanghai RAAS Blood Products Co., Ltd. 11.Primary Key Insights