The Acromegaly and Gigantism Treatment Market size was valued at USD 3.34 Billion in 2025 and the total Acromegaly and Gigantism Treatment revenue is expected to grow at a CAGR of 5.6% from 2025 to 2032, reaching nearly USD 4.89 Billion by 2032.Acromegaly and Gigantism Treatment Market Overview:

The pituitary glands present in the human body is the main producer of the growth hormone. This growth hormone helps in the development of bones, muscles, and many internal organs, and overproduction of growth hormones in children is called gigantism and in adults’ acromegaly. These acromegaly and gigantism cause great stature in children, deformed bones in adults, heart failure, weakness, vision problems, high blood pressure, and sleep apnea. The number of treatments available in the market is surgery, radiation therapy, and drug therapy. Increasing diseases rate and rapid technological advancement create the demand for acromegaly and gigantism treatment. As a result, the global acromegaly and gigantism treatment market is expected to reach USD 4.89 Bn. by 2032.To know about the Research Methodology :- Request Free Sample Report

Acromegaly and Gigantism Treatment Market Dynamics:

The increasing prevalence of hormonal diseases and rapid expansion of the pharmaceutical industry is driving the growth of the acromegaly and gigantism treatment market. The University of the West of England (UWE) and the Pituitary Foundation jointly conducted research and identified psychosocial issues related to pituitary disease like depression, anxiety, reduced quality of life, and wellbeing. Increasing technological advancement and rising investment in research activities are boosting the growth of the acromegaly and gigantism treatment market. In May 2025, “Amryt” an Irish rare-disease drug group based in Dublin has acquired “Chiasma” a US-based firm and expecting to develop a technology that treatments confined to injection to be given orally. And “Mycapssa” the first drug developed by them has been approved by US Food and Drug Administration for the use of oral acromegaly therapy. Ongoing development in “somatostatin analogs” (SSAs) drugs used for treating acromegaly and gigantism is expected to create huge demand for market growth. According to the recent report acromegaly and gigantism drugs sale in 7MM countries like the US, France, Germany, Italy, Spain, the UK, and Canada was stood at USD 1.4 Bn in 2025 and is expected to reach USD 2.8 Bn by 2032. Recently FDA has approved the orphan drug “SOMAVERT” for individuals who are providing an inadequate response to surgery and drug PASIREOTIDE for the individual where surgery is not an option. These developments can boost market growth by 2032. Some of the factors slowing the growth of the market are its high cost of treatment and non-availability of treatments in under developing countries. Furthermore, peoples are unaware of the treatment, and increasing side effects of treatments such as infection, ache, and reduction in immunity are becoming a roadblock for the development of the market.Acromegaly and Gigantism Treatment Market Segmentation:

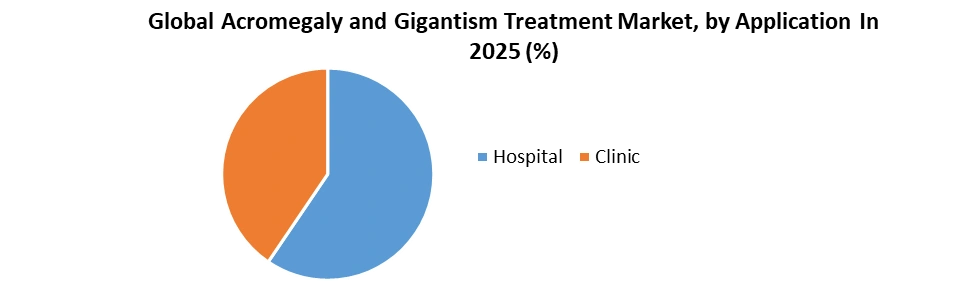

Based on Type, the Acromegaly and Gigantism Treatment Market is sub-segmented into somatostatin analogs and dopamine agonists. The somatostatin analogues segment dominates the global market and it held a share of 55 % in 2025. These are the drugs used to stop the production of hormones in the human body. Some of the somatostatin analogues drugs included in the acromegaly and gigantism treatment are octreotide and lanreotide. In May 2025, CHIASMA, a US biopharmaceutical company made an agreement with Swiss drug contractor LONZA for the supply of MYCAPSSA a first oral somatostatin analogue. Under this collaboration, both are investing in specialized equipment like large-scale LFHC coating equipment and in-house printing capabilities for supporting manufacturing activities performed by Lonza for MYCAPSSA manufacturing. Based on the Application, the Acromegaly and Gigantism Treatment Market is sub-segmented into hospitals and clinics. The hospital's segment dominates the global market and was valued at USD 2.1 Bn. in 2025. The increasing number of multi-specialty hospitals and growing government spending on healthcare infrastructure are driving the market growth. More people are attracted to hospitals due to their well-equipped structure and high utilization of technology in treating acromegaly and gigantisms like magnetic resonance imaging (MRI) for viewing pituitary tumors, Computed tomography scan, and radiation therapy, etc. The slowing the demand for the clinic is due to additional operating costs, staff dissatisfaction with staggered schedules does not support TCON intervention to manage demand, etc.

Acromegaly and Gigantism Treatment Market regional insights:

In 2025, Asia-Pacific held the largest share in the Acromegaly and Gigantism Treatment market. The rising prevalence of pituitary adenoma and increased research activity is driving this region's growth. The local demand for the Acromegaly and Gigantism Market is being fueled by key companies' efforts to build fresh and effective medication pipelines. In 13 investigations of acromegaly prevalence since 1980, experts from the National Institutes of Health (NIH) and the Endocrine Society estimate that around 24,000 persons in the United States have acromegaly, with an estimated 8,000 people receiving chronic somatostatin analog injections. Progressive treatment approaches, favorable reimbursement policies, and the growing usage of cocoa beans in the creation of cancer medicine are all driving the Acromegaly and Gigantism Market in North America forward. The objective of the report is to present a comprehensive analysis of the global acromegaly and gigantism Treatment market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Market dynamics, structure by analyzing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Acromegaly and Gigantism Treatment Market make the report investor’s guide.Acromegaly and Gigantism Treatment Market Scope: Inquiry Before Buying

Global Acromegaly and Gigantism Treatment Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 3.34 Bn. Forecast Period 2026 to 2032 CAGR: 5.6% Market Size in 2032: USD 4.89 Bn. Segments Covered: by Type Somatostatin analogues Dopamine agonists by Application Hospital Clinic Acromegaly and Gigantism Treatment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Acromegaly and Gigantism Treatment Market, Key Players are

1. Ipsen 2. Novartis 3. Pfizer 4. Glide Pharmaceutical 5. Aegis Therapeutics 6. Chiasma 7. Crinetics Pharmaceuticals 8. Daewoong Pharmaceutical 9. Peptron 10. Silence Therapeutics 11. Strongbridge Biopharma 12. Amryt Pharma 13. Foresee Pharmaceuticals 14. Validus Pharmaceuticals LLC 15. Ionis Pharmaceuticals Inc 16. Midatech Pharma Plc 17. Xeris Pharmaceuticals 18. Teijin Pharma Limited 19. Camurus 20. Aquestive Therapeutics Frequently Asked Questions: 1. Which region has the largest share in Acromegaly and Gigantism Treatment Market? Ans: Asia-Pacific held the largest share in 2025. 2. What is the growth rate of the Acromegaly and Gigantism Treatment Market? Ans: The Acromegaly and Gigantism Treatment Market is growing at a CAGR of 5.6 % during the forecasting period 2026-2032. 3. What segments are covered in Acromegaly and Gigantism Treatment Market? Ans: Acromegaly and Gigantism Treatment Market is segmented into type and application. 4. What is the study period of this market? Ans: The Market is studied from 2025 to 2032. 5. Who are the key players in Market? Ans: Ipsen, Novartis, Pfizer, Glide Pharmaceutical, Aegis Therapeutics, Chiasma, Crinetics Pharmaceuticals, Daewoong Pharmaceutical, Peptron, Silence Therapeutics, Strongbridge Biopharma, Amryt Pharma, Foresee Pharmaceuticals, Validus Pharmaceuticals LLC, Ionis Pharmaceuticals Inc, Midatech Pharma Plc, Xeris Pharmaceuticals, Teijin Pharma Limited, Camurus, Aquestive Therapeutics.

1. Acromegaly and Gigantism Treatment Market: Research Methodology 2. Acromegaly and Gigantism Treatment Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Acromegaly and Gigantism Treatment Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Acromegaly and Gigantism Treatment Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Acromegaly and Gigantism Treatment Market Segmentation 4.1 Acromegaly and Gigantism Treatment Market, by type (2025-2032) • Somatostatin analogues • Dopamine agonists 4.2 Acromegaly and Gigantism Treatment Market, by application (2025-2032) • Hospital • Clinic 5. North America Acromegaly and Gigantism Treatment Market (2025-2032) 5.1 Acromegaly and Gigantism Treatment Market, by type (2025-2032) • Somatostatin analogues • Dopamine agonists 5.2 Acromegaly and Gigantism Treatment Market, by application (2025-2032) • Hospital • Clinic 5.3 North America Acromegaly and Gigantism Treatment Market, by Country (2025-2032) • United States • Canada • Mexico 6. Asia Pacific Acromegaly and Gigantism Treatment Market (2025-2032) 6.1. Asia Pacific Acromegaly and Gigantism Treatment Market, by type (2025-2032) 6.2. Asia Pacific Acromegaly and Gigantism Treatment Market, by application (2025-2032) 6.3. Asia Pacific Acromegaly and Gigantism Treatment Market, by Country (2025-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Acromegaly and Gigantism Treatment Market (2025-2032) 7.1 Middle East and Africa Acromegaly and Gigantism Treatment Market, by type (2025-2032) 7.2. Middle East and Africa Acromegaly and Gigantism Treatment Market, by application (2025-2032) 7.3. Middle East and Africa Acromegaly and Gigantism Treatment Market, by Country (2025-2032) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Acromegaly and Gigantism Treatment Market (2025-2032) 8.1. Latin America Acromegaly and Gigantism Treatment Market, by type (2025-2032) 8.2. Latin America Acromegaly and Gigantism Treatment Market, by application (2025-2032) 8.3. Latin America Acromegaly and Gigantism Treatment Market, by Country (2025-2032) • Brazil • Argentina • Rest Of Latin America 9. European Acromegaly and Gigantism Treatment Market (2025-2032) 9.1. European Acromegaly and Gigantism Treatment Market, by type (2025-2032) 9.2. European Acromegaly and Gigantism Treatment Market, by application (2025-2032) 9.3. European Acromegaly and Gigantism Treatment Market, by Country (2025-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Ipsen 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Novartis 10.3 Pfizer 10.4 Glide Pharmaceutical 10.5 Aegis Therapeutics 10.6 Chiasma 10.7 Crinetics Pharmaceuticals 10.8 Daewoong Pharmaceutical 10.9 Peptron 10.10 Silence Therapeutics 10.11 Strongbridge Biopharma 10.12 Amryt Pharma 10.13 Foresee Pharmaceuticals 10.14 Validus Pharmaceuticals LLC 10.15 Ionis Pharmaceuticals Inc 10.16 Midatech Pharma Plc 10.17 Xeris Pharmaceuticals 10.18 Teijin Pharma Limited 10.19 Camurus 10.20 Aquestive Therapeutics