The U.S. Integrated Operating Rooms Market size was valued at USD 2.04 Billion in 2022 and the total U.S. Market revenue is expected to grow at a CAGR of 10.2 % from 2023 to 2029, reaching nearly USD 4.02 Billion.U.S. Integrated Operating Rooms Market Overview:

Modern Operating Rooms continue to grow in complexity as new devices, processes, surgical technologies, communication methods and the need for real-time patient data enter the clinical environment. Operating Rooms integration enables faster data sharing between departments, improving patient care and efficiency. The demand for advanced medical equipment and the adoption of minimally invasive surgeries significantly drives the U.S. Integrated Operating Rooms Market growth. Integration of wireless technology and cloud connectivity transforms Operating Rooms equipment use, enabling smoother communication and information transfer. This accelerates the adoption rate of Operating Rooms integration systems to improve patient outcomes and reduce costs in healthcare. With the ongoing technological advancements and increasing awareness Integrated Operating Rooms Market U.S. market is expected to continue its growth in the future. The qualitative and quantitative approaches are included in the report to analyze the Market data. To know deeper information on the U.S. Integrated Operating Rooms Market penetration, competitive structure, pricing, and demand analysis are involved in the report. The report includes historical data, present and future trends, competitive environment of the U.S. Integrated Operating Rooms Market.To know about the Research Methodology :- Request Free Sample Report

U.S. Integrated Operating Rooms Market Dynamics:

Surging Wireless Technology Adoption Propels Growth in the U.S. Integrated Operating Rooms Market Wireless technologies and cloud connectivity are making it possible to implement remote monitoring and telemedicine in Operating Rooms settings. With the use of wireless devices, healthcare providers monitor patients’ vital signs and other important data in real time. Technologies like Wi-Fi, Bluetooth, ZigBee, IR, low-power wide-area networks, LoRaWAN, Near Field Communication, cellular, LTE, and 5G are examples of developing exceptional wireless technologies. These protocols are also used to communicate with cloud platforms and applications apart from communicating device to device. It truly helps organizations to take advantage of the latest technologies like AI/ML, and AR/VR to offer better customer experience to their users. Wireless tech is a boon to the healthcare industry. During the COVID-19 pandemic, Doctors serve patients through telehealth visits which improve the accessibility of people to healthcare. Moreover, medical professionals leverage Radio Frequency and wireless technology like smart sensors that detect certain medical conditions and provide remote assistance in emergency situations. The integration of wireless technologies and cloud connectivity is transforming the way Operating Rooms equipment is used in healthcare settings. Healthcare technologies are helping doctors and nurses communicate and share information more easily. This helps them take better care of patients. As these technologies keep getting better, they can make a big difference in healthcare and help patients get better faster. Therefore, the rising adoption of wireless technology in healthcare drives the growth of the U.S. Integrated Operating Rooms Market. Increasing surgical procedure volumes drive the U.S. Integrated Operating Rooms Market The Increasing surgical procedure volumes refer to the growing number of surgical interventions performed in healthcare facilities, including hospitals, ambulatory surgery centers, and specialized clinics. This trend increase in demand for surgical services. Increasing surgical procedure volumes are the aging population. As people get older, they experience more health problems and chronic diseases. Some of these issues need surgery to treat them, like getting new joints, removing cataracts from the eyes, or doing procedures to help the heart. The elder people frequently require surgical interventions to maintain and improve their quality of life, contributing significantly to the overall rise in surgical cases. Advancements in medical technology help to drive up surgical procedure volumes. Innovations in surgical techniques, instruments, and equipment made previously complex procedures more accessible and safer. Minimally invasive surgeries, for instance, offer shorter recovery times and reduced post-operative complications, leading to higher patient acceptance and increased surgical utilization. Also, the expansion of health insurance coverage enabled a broader segment of the population to access surgical care. The more people have insurance, they are to seek medical attention and undergo necessary surgical procedures. This increased access to healthcare services contributed to the overall growth in surgical volumes. According to MMR Study Report, A total of 13 ,108, 567 surgical procedures were identified from January 1, 2019, through January 30, 2021, based on 3498 Current Procedural Terminology. High Implementation Cost Hampers the Market Growth High implementation costs restraining the adoption of integrated operating rooms in the healthcare industry. Integrating advanced technologies, medical devices, and data networks to create fully functional integrated operating rooms require substantial investments. As Hardware and Software Expenses, Acquiring state-of-the-art medical equipment, surgical instruments, and specialized software for data integration and visualization are expensive. The integrated operating room requires significant infrastructure upgrades, such as installing high-speed networks, upgrading electrical systems, and building specialized storage facilities for medical data therefore it requires high upgradation costs. Also, Healthcare professionals need proper training to effectively utilize integrated operating room technologies. This training comes with additional costs for both initial education and ongoing support as new updates and features are introduced. Regulatory Compliance ensuring that the integrated operating rooms meet the stringent regulatory standards and compliance requirements adds to the overall costs. Complying with data privacy and security regulations, medical device regulations, and other industry standards demands additional resources and efforts. Technologic innovation creates lucrative growth opportunities for the Market Growth Technological innovation transforms the healthcare industry in the United States. With the help of integrated operating rooms, technological innovations have changed the way surgeries are conducted, enhancing patient outcomes, improving efficiency, and providing better support to healthcare professionals. One of the most significant technological innovations in integrated ORs is the development of advanced surgical imaging systems. New imaging technologies, like high-definition cameras and 3D visualization, help surgeons see the surgical area very clearly and in real time. They also use special MRI or CT scanners during surgery. This allows surgeons to do complex procedures with more accuracy, which leads to better results for patients and fewer problems during surgery. For instance, 3D visualization allows for improved depth perception, which is particularly beneficial in delicate surgeries such as neurosurgery or cardiovascular procedures. Robotics and minimally invasive surgical techniques have revolutionized surgery, enabling complex procedures to be performed with smaller incisions and reduced patient trauma. Integrated ORs often feature robotic surgical systems, which allow surgeons to perform procedures with enhanced dexterity and precision. Rising technological innovation and its adoption in the healthcare industry significantly open up tremendous growth opportunities for the U.S. Integrated Operating Rooms Market.Competitive Landscape:

The U.S. Integrated Operating Rooms Market is highly competitive. The report provides a comprehensive analysis of the key players in the U.S. Integrated Operating Rooms Market. The Major players in the market are Stryker, KARL STORZ Endoscopy-America, Inc., Getinge, Hill-Rom Holdings, Inc., Olympus Corporation, Siemens Healthcare GmbH, NDS Surgical Imaging, SKYTRON, LLC, EIZO INC., Alvo Medical, and Mizuho OSI The Companies majorly focus on mergers and acquisitions to innovate the products and maintain sustainability. Also, the key players rising focus on partnerships and investment to expand the product portfolio. Stryker is one of the major key players in the U.S. Integrated Operating Rooms Market. The company offers innovative products and services in Medical and Surgical, Neurotechnology, Orthopaedics, and Spine that help improve patient and healthcare outcomes. On, 11 July 2023, Stryker announces the commercial launch of the Q Guidance System with Cranial Guidance Software which uses both active and passive tracking technology to provide ground-breaking planning and guidance capabilities that include.U.S. Integrated Operating Rooms Market Segment Analysis:

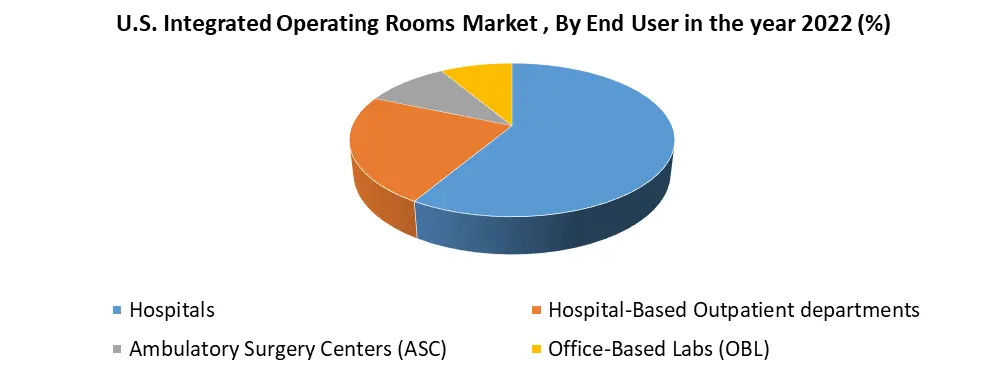

Based on the End User, U.S. Integrated Operating Rooms Market is segmented into Hospitals, Hospital-Based Outpatient departments (HOPD), Ambulatory Surgery Centers (ASC), and Office-Based Labs (OBL). The Hospital segment dominates the U.S. Integrated Operating Rooms Market in the year 2022. The US has a large and aging population, which is leading to an increase in the number of surgeries performed. The need for integrated operating rooms is increasing, as hospitals want to be more efficient and improve patient outcomes. In the US, hospitals are already advanced in healthcare innovations and use these integrated operating rooms. They are always seeking ways to make things better. New technologies are continuously being developed to make these integrated operating rooms even more efficient and effective. Hospitals perform a huge number and variety of surgical procedures, ranging from routine to complex cases. The demand for integrated operating rooms in these settings is naturally higher due to the scale of their operations. Therefore the Hospital dominates the end-user segment of the U.S. Integrated Operating Rooms Market.

Regional Analysis:

The Northeast region of the United States dominates the U.S. Integrated Operating Rooms Market in the year 2022. The Region includes states like New York, Massachusetts, Pennsylvania, and New Jersey. This state has a significant concentration of top-tier healthcare facilities and academic medical centers. These institutions lead in the adoption of advanced medical technologies, including Integrated Operating Rooms the region’s interest in healthcare research and innovation leads to a need for advanced operating room solutions.In big cities like New York City, Los Angeles, Chicago, and Houston, more Integrated Operating Rooms are used because there are many large hospitals, medical centers, and academic institutions there. These places tend to adopt such advanced technologies more often. These centers are top in implementing the latest medical technologies to provide cutting-edge healthcare services. While the demand for Integrated Operating Rooms is generally higher in urban centers, there is also a growing trend of implementing advanced medical technologies in rural healthcare facilities. Initiatives to improve healthcare access and enhance patient outcomes in rural areas may drive the adoption of Integrated Operating Rooms in smaller medical centres. For Example, in 2021, U.S. national health expenditure as a share of its gross domestic product (GDP) reached 18.3 percent, second highest in the provided time interval. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

U.S. Integrated Operating Rooms Market Scope: Inquire before buying

U.S. Integrated Operating Rooms Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.04 Billion Forecast Period 2023 to 2029 CAGR: 10.2% Market Size in 2029: US $ 4.02 Billion Segments Covered: by Device Audio System Video System Display Document Management by End User Hospitals Hospital-Based Outpatient departments (HOPD) Ambulatory Surgery Centers (ASC) Office-Based Labs (OBL) U.S. Integrated Operating Rooms Key Players:

1. Stryker 2. KARL STORZ Endoscopy-America, Inc. 3. Getinge 4. Hill-Rom Holdings, Inc. 5. Olympus Corporation 6. Siemens Healthcare GmbH 7. NDS Surgical Imaging 8. SKYTRON, LLC 9. EIZO INC. 10. Alvo Medical 11. Mizuho OSIFAQs:

1] What segments are covered in the U.S. Integrated Operating Rooms Market report? Ans. The segments covered in the U.S. Integrated Operating Rooms Market report based on, Device and End-user. 2] Which region is expected to hold the highest share in the U.S. Integrated Operating Rooms Market? Ans. Northeast region is expected to hold the highest share of the U.S. Integrated Operating Rooms Market. 3] What was the market size of the U.S. Integrated Operating Rooms Market by 2022? Ans. The market size of the U.S. Integrated Operating Rooms Market by 2022 is US$ 2.04 Bn. 4] What is the forecast period for the U.S. Integrated Operating Rooms Market? Ans. The forecast period for the U.S. Integrated Operating Rooms Market is 2023-2029. 5] What is the market size of the U.S. Integrated Operating Rooms Market in 2029? Ans. The market size of the U.S. Integrated Operating Rooms Market in 2029 is valued at US$ 4.02 Bn.

1. U.S. Integrated Operating Rooms Market: Research Methodology 2. U.S. Integrated Operating Rooms Market: Executive Summary 3. U.S. Integrated Operating Rooms Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. U.S. : Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. U.S. Integrated Operating Rooms Market: Segmentation (by Value USD) 5.1. U.S. Integrated Operating Rooms Market, by Device(2022-2029) 5.1.1. Audio System 5.1.2. Video System 5.1.3. Display System 5.1.4. Document Management 5.2. U.S. Integrated Operating Rooms Market, by End-User (2022-2029) 5.2.1. Hospitals 5.2.2. Hospital-Based Outpatient departments (HOPD) 5.2.3. Ambulatory Surgery Centers (ASC) 5.2.4. Office-Based Labs (OBL) 5.3. U.S. Integrated Operating Rooms Market, by Region (2022-2029) 5.3.1. Northeast 5.3.2. Southeast 5.3.3. Midwest 5.3.4. East 5.3.5. Rest of U.S.A. 6. Company Profile: Key players 6.1. Stryker 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. KARL STORZ Endoscopy-America, Inc. 6.3. Getinge 6.4. Hill-Rom Holdings, Inc. 6.5. Olympus Corporation 6.6. Siemens Healthcare GmbH 6.7. NDS Surgical Imaging 6.8. SKYTRON, LLC 6.9. EIZO INC. 6.10. Alvo Medical 6.11. Mizuho OSI 7. Key Findings 8. Industry Recommendation