Digital Pathology Market size was valued at USD 942.2 Mn. in 2022 and the total Digital Pathology revenue is expected to grow at 13.8% from 2023 to 2029, reaching nearly USD 2328.99 Mn.Digital Pathology Market Overview:

Digital pathology is a field that collects, interprets, analyses, and shares data using digital tools. Digital slides are made using either a full slide scanning device from previously prepared devices or a digital microscope directly. The digital slide is then analyzed using high throughput algorithms, disseminated over the air (OTA), or saved for future use. In the last few years, digital pathology and image analysis have grown rapidly. This is primarily due to the use of whole-slide scanning, advancements in software and computer processing power, and the growing relevance of tissue-based research for biomarker identification and stratified medicine. The market has been driven by an increased emphasis on enhancing workflow efficiency and a desire for rapid diagnosis tools for chronic illnesses such as cancer. The increased frequency of chronic diseases is expected to increase clinical urgency to embrace digital pathology to enhance existing patient diagnostic imaging measures and lower the high costs associated with conventional diagnostics. Likewise, the growing elderly population, which is sensitive to chronic illnesses, is expected to increase the demand for technologically advanced diagnostic techniques. Increasing technological advancements in digital pathology systems are also expected to drive market growth during the forecast period. Digital imaging, computerization, robotic light microscopy, and numerous fiber optic links are all contributing to the growth. Whole slide imaging is one such approach that has several benefits over traditional light microscopes and is expected to generate profitable chances in this industry. The use of AI in healthcare is increasing, with a growing emphasis on enhancing patient care quality by incorporating AI into many elements of healthcare services, such as pathological diagnosis.To know about the Research Methodology :- Request Free Sample Report

Digital Pathology Market Dynamics:

Digital pathology enhances lab efficiency Digital pathology enhances lab efficiency by lowering costs, shortening turnaround times, and providing users with subject-matter knowledge. Improvements in lab efficiency are crucial because patients and clinicians rely on lab data for diagnosis, and diagnostic tests must be conducted and reported swiftly and precisely. Similarly, pathologists may obtain digitized slides via web services, which minimizes shipping expenses and travel time. The breakout of the COVID-19 pandemic has resulted in lockdowns and social distancing measures. Such limitations have raised the demand for digital pathology technologies, which allow pathologists to evaluate diagnostic data for primary diagnosis remotely. High costs of digital pathology devices a Digital Pathology market restraint A typical digital pathology system costs between USD 500,000 and USD 700,000 and contains a slide scanner, an image server, and software. In the Asia Pacific, the typical price of a digital pathology scanner is between USD 110,000 and USD 130,000. Although major hospitals with substantial capital budgets may purchase these technologies, pathologists and academic institutes with limited funds are unable to buy them. Healthcare providers, particularly those in developing nations such as India, Brazil, and Mexico, lack the financial capacity to invest in such expensive technologies. Additionally, skilled professionals are necessary for the efficient operation and maintenance of digital pathology equipment. The expensive expense of these systems, along with the difficulty of finding competent individuals to run digital pathology equipment, is expected to reduce their deployment. Introduction of Artificial Intelligence (AI) to drive the Digital Pathology Market Pathology is the most significant field of Medical Science since it deals with the genesis, cause, and type of disease. This domain provides the majority of the diagnostic infrastructure. Tissues, organs, and bodily fluids are all examined during a pathological examination. In this examination, the tissue is mounted on a glass slide using certain methods and then examined for the disease under a microscope. With technological innovation, classic pathological surgery is evolving into Digital pathology. Digital pathology is the digitization of Histopathological slides using a Whole-slide scanner, which is a microscope under robotic and computer control, and the computational analysis of these digitalized pictures or whole-slide images. This digitization produces a high-resolution, improved pixel picture of diseased materials, resulting in massive amounts of data, up to terabytes per biopsy. Artificial intelligence and machine learning have grown their roots in healthcare and clinical applications in recent decades as a result of algorithmic improvement and more convenient computer capacity. The synergy between artificial intelligence and digital pathology is one example of how these two areas overlap. This collaboration would provide spectacular results in diagnostic, prognostic, and predictive analysis of whole-slide pictures. Lack of trained professionals one of the restraint for Digital Pathology Market growth Pathologists play an important role in executing laboratory tests that are required for disease diagnosis. However, there is a global supply-demand imbalance for pathologists, particularly in Africa and the Asia Pacific area. According to Springer's research (2020), Switzerland has 35,355 residents per pathologist, while Canada and the United States have 20,658 and 25,325, respectively. In Germany, there is one pathologist for every 47,989 people. Digital pathology enables healthcare professionals to safely and quickly communicate critical information with pathologists across geographical boundaries. Nevertheless, emerging technologies such as artificial intelligence (AI) and machine learning assist pathologists in identifying illnesses faster and improving their efficacy and efficiency. As a result, the worrisome lack of pathologists is expected to restrain the market growth.Digital Pathology Market Segment Analysis:

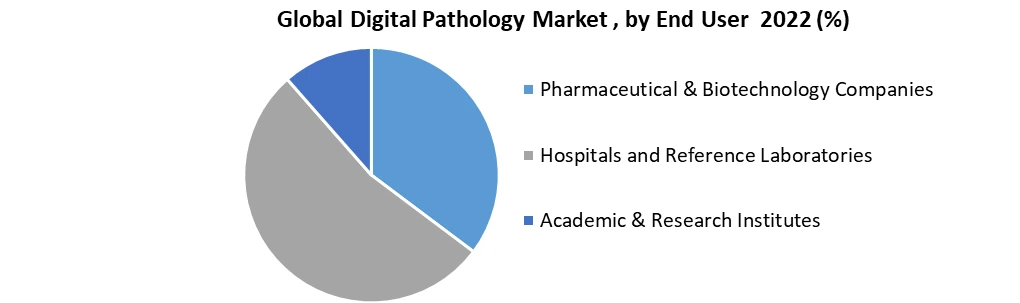

By Application, the Drug Discovery segment dominated the market with the highest market share in 2022 and is expected to maintain its dominance at the end of the forecast period. Rising R&D expenditures, driven by the requirement for multiple preclinical and clinical studies undertaken during the drug discovery and development process, are a primary driver of segment growth.Digital pathology is an innovative technology that provides an image-based environment for managing and interpreting the data generated by a digitized glass slide, resulting in significant improvements in pharmaceutical drug development across discovery, preclinical GLP pathology, and oncology clinical trials. As a result, the need for DP in drug development is growing. Digital pathology is revolutionizing global pharmaceutical research by allowing data exchange to connect disparate pharma-pathology laboratories all over the globe. The development of novel anticancer medicines relies heavily on biomarkers and drug discovery. Growing cancer projections and low success rates in the lengthy and costly drug development pipeline have created an increasing urgency for clinical development. DP seeks to speed drug discovery throughout all stages of the pharmaceutical pipeline by providing a full end-to-end solution in digital pathology that offers great flexibility in image processing and multi-site research. Tissue pathology is crucial to many aspects of drug development, ranging from biomarker and drug discovery to postmarket clinical trials. The ultrafast scanners turn glass microscope slides into whole-slide digital pictures, allowing for novel applications in image analysis and tissue documentation. And hence, the demand from end-users is increasing rapidly and driving the segment growth. By End-User, the Hospitals and Reference Laboratories segment held the largest market share in 2022 and is expected to dominate the market at the end of the forecast period. The segment's dominance is due to the rising number of hospital admissions and pathology services provided by major hospitals. The strategic collaborations to provide innovative solutions through partnerships with prominent hospitals, as well as increased usage of digital technologies due to increased footfall, is expected to support the segment's growth. Leading hospitals in the United States, the United Kingdom, and other industrialized nations have invested in pathology tools and systems to improve workflow, which has been critical in recruiting a big patient pool. Sectra, for example, signed an arrangement with UniHA, a cooperative of French public hospitals, in May 2022. The arrangement will allow UniHA-affiliated institutions to purchase Sectra's solution on predetermined terms and conditions. The collaboration enables the hospital network to manage its workflow, hence boosting the segment's growth. Besides that, the growing number of clinical laboratories creating databases by digitizing slides is expected to encourage the adoption of digital technologies in clinical laboratories. Additionally, leading solution providers are partnering to increase their product range by delivering customized solutions, which is expected to drive the segment's growth.

Digital Pathology Market Regional Insights:

North American regional market held the biggest revenue share and dominated the market in 2022. This region is expected to maintain its dominance at the end of the forecast period owing to the continuous deployment of R&D expenditures, favorable government initiatives aimed at the creation of technologically advanced equipment, increased usage of digital imaging, and the presence of major competitors. Digital microscopy (pathology) is gaining popularity all over the globe. In Canada, for example, the Canadian Association of Pathologists has recently created criteria for telepathology services for anatomic pathology, which is further expected to drive market growth. Likewise, increased use of digital pathology for disease diagnosis, along with advantageous reimbursement regulations in the United States, is expected to increase regional market growth during the forecast period. The rising prevalence of chronic diseases such as cardio-diabetic disorders among the patient population, as well as an aging population at an increased risk of developing such disorders, is anticipated to increase the demand for pathology testing. The increasing frequency of testing, combined with the increasing desire for simplifying workload, is expected to increase pathologists' use of digital technologies. According to a 2022 article published by the Journal of the American Medical Association Network, the overall number of adults in the United States suffering from diabetes was expected to be 13.0%, with 34.5% meeting the criteria for pre-diabetes. Pre-diabetes and diabetes were shown to be more prevalent in elderly persons. The rising frequency and risk of chronic illnesses among the aging population are expected to increase the demand for regular testing and drive market growth. Additionally, market players' focus on inorganic growth strategies, such as collaborations and partnerships, to introduce innovative digital tools to manage workflow to meet increased demand for customized solutions is one of the primary reasons driving the growth of the North American market. For example, Vital Signs Solutions Ltd. introduced the PocDoc test, a smartphone-based at-home diagnostic for cardiovascular disease, in January 2022. In less than six minutes, the test covers a full five-marker lipid panel, which has been recognized as the gold standard in cardiovascular evaluation.Europe accounted for the second-largest market share in 2022. An increase in the patient population's preference for digital pathology over conventional pathology, as well as strategic developments such as the patenting of proprietary technologies by key industry players in the area, are driving market growth. Additionally, the region's increasing use of technologically advanced solutions, as well as regulatory clearances for these products, are expected to increase regional growth. Visiopharm, for example, reported in September 2022 that it had been granted a European patent for a technological breakthrough developed for identifying histopathology images and training deep learning models. The patent now gives the corporation a competitive edge in the pathology sector, and it is expected to drive market growth in Europe. The Asia - pacific regional market is expected to grow at the highest growth rate during the forecast period. The growing number of healthcare chains collaborating with leading organizations to manage the growing weight of testing among diagnostic laboratories is expected to increase industry growth. Similarly, increased expenditures by commercial and governmental organizations, as well as the development of healthcare infrastructure, are to blame for the increased acceptance of digital tools and solutions among key players. Additionally, the growing patient population is driving market growth in developing countries. Latin America, the Middle East, and Africa are gaining traction in the global market. The rising number of patients as a result of increased medical tourism and rising digitalization adoption in these regions are expected to drive growth during the forecast period. However, factors such as increased healthcare expenditure by the patient population, as well as increased uses of digital technologies, such as remote evaluation of cases, virtual education, shorter response time, and enhanced workflow, are expected to increase market growth in these regions.

Digital Pathology Market Scope: Inquire before buying

Digital Pathology Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 942.26 Mn. Forecast Period 2023 to 2029 CAGR: 13.8% Market Size in 2029: US $ 2328.99 Mn. Segments Covered: by Type 1.Human Pathology 2.Veterinary Pathology by Product 1.Scanners 2.Software 3.Storage Systems by Application 1.Drug Discovery 2.Disease Diagnosis 3.Training & Education by End-User 1.Pharmaceutical & Biotechnology Companies 2.Hospitals and Reference Laboratories 3.Academic & Research Institutes Digital Pathology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Digital Pathology Market, Key Players are:

1.Glencoe Software (US) 2.Inspirata, Inc. (US) 3. PathAI Inc. (US) 4.Proscia Inc. (US) 5.Apollo Enterprise Imaging (US) 6.Akoya Biosciences (US) 7.Corista (US) 8.Indica Labs (US) 9.XIFIN, Inc. (US) 10.PerkinElmer Inc. (US) 11.Mikroscan Technologies (US) 12.Motic (US) 13. OptraSCAN (US) 14.General Electric (US) 15.Pathcore (Canada) 17.Objective Pathology Services (Canada) 18.Huron Digital Pathology (Canada) 19.Leica Biosystems (Germany) 20.Olympus Corporation (Japan) 21.Hamamatsu Photonics (Japan) 22. Koninklijke Philips N.V. (Netherlands) 23.F. Hoffmann-La Roche Ltd. (Switzerland) 24.3DHISTECH (Hungary) 25.Visiopharm A/S (Denmark) 26.Aiforia Technologies Oy (Finland) 27.Sectra AB (Sweden) 28.Kanteron Systems (UK) 29. Agfa-Gevaert Group (Belgium) FAQs: 1. Which is the potential market for Digital Pathology in terms of the region? Ans. North America is the potential market for Digital Pathology in terms of region. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is the Introduction of Artificial Intelligence (AI) in Digital Pathology. 3. What is expected to drive the growth of the Digital Pathology market in the forecast period? Ans. A major driver in the Digital Pathology market is the rising deployment of Digital pathology for enhanced lab efficiency. 4. What is the projected market size & growth rate of the Digital Pathology Market? Ans. Digital Pathology Market size was valued at USD 942.2 Mn. in 2022 and the total Digital Pathology revenue is expected to grow at 13.8% from 2023 to 2029, reaching nearly USD 2328.98 Mn. 5. What segments are covered in the Digital Pathology Market report? Ans. The segments covered are Type, Product, Application, End-User, and Region.

1. Global Digital Pathology Market: Research Methodology 2. Global Digital Pathology Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Digital Pathology Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Digital Pathology Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Digital Pathology Market Segmentation 4.1 Global Digital Pathology Market, by Type (2023-2029) • Human Pathology • Veterinary Pathology 4.2 Global Digital Pathology Market, by Product (2023-2029) • Scanners • Software • Storage Systems 4.3 Global Digital Pathology Market, by Application (2023-2029) • Drug Discovery • Disease Diagnosis • Training & Education 4.4 Global Digital Pathology Market, by End-user (2023-2029) • Pharmaceutical & Biotechnology Companies • Hospitals and Reference Laboratories • Academic & Research Institutes 5. North America Digital Pathology Market(2023-2029) 5.1 North America Digital Pathology Market, by Type (2023-2029) • Human Pathology • Veterinary Pathology 5.2 North America Digital Pathology Market, by Product (2023-2029) • Scanners • Software • Storage Systems 5.3 North America Digital Pathology Market, by Application (2023-2029) • Drug Discovery • Disease Diagnosis • Training & Education 5.4 North America Digital Pathology Market, by End-user (2023-2029) • Pharmaceutical & Biotechnology Companies • Hospitals and Reference Laboratories • Academic & Research Institutes 5.5 North America Digital Pathology Market, by Country (2023-2029) • United States • Canada • Mexico 6. Europe Digital Pathology Market (2023-2029) 6.1. European Digital Pathology Market, by Type (2023-2029) 6.2. European Digital Pathology Market, by Product (2023-2029) 6.3. European Digital Pathology Market, by Application (2023-2029) 6.4. European Digital Pathology Market, by End-user (2023-2029) 6.5. European Digital Pathology Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Digital Pathology Market (2023-2029) 7.1. Asia Pacific Digital Pathology Market, by Type (2023-2029) 7.2. Asia Pacific Digital Pathology Market, by Product (2023-2029) 7.3. Asia Pacific Digital Pathology Market, by Application (2023-2029) 7.4. Asia Pacific Digital Pathology Market, by End-user (2023-2029) 7.5. Asia Pacific Digital Pathology Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Digital Pathology Market (2023-2029) 8.1 Middle East and Africa Digital Pathology Market, by Type (2023-2029) 8.2. Middle East and Africa Digital Pathology Market, by Product (2023-2029) 8.3. Middle East and Africa Digital Pathology Market, by Application (2023-2029) 8.4. Middle East and Africa Digital Pathology Market, by End-user (2023-2029) 8.5. Middle East and Africa Digital Pathology Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Digital Pathology Market (2023-2029) 9.1. South America Digital Pathology Market, by Type (2023-2029) 9.2. South America Digital Pathology Market, by Product (2023-2029) 9.3. South America Digital Pathology Market, by Application (2023-2029) 9.4. South America Digital Pathology Market, by End-user (2023-2029) 9.5. South America Digital Pathology Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Glencoe Software (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Inspirata, Inc. (US) 10.3. PathAI Inc. (US) 10.4. Proscia Inc. (US) 10.5. Apollo Enterprise Imaging (US) 10.6. Akoya Biosciences (US) 10.7. Corista (US) 10.8. Indica Labs (US) 10.9. XIFIN, Inc. (US) 10.10. PerkinElmer Inc. (US) 10.11. Mikroscan Technologies (US) 10.12. Motic (US) 10.13. OptraSCAN (US) 10.14. General Electric (US) 10.15. Pathcore (Canada) 10.16. Objective Pathology Services (Canada) 10.17. Huron Digital Pathology (Canada) 10.18. Leica Biosystems (Germany) 10.19. Olympus Corporation (Japan) 10.20. Hamamatsu Photonics (Japan) 10.21. Koninklijke Philips N.V. (Netherlands) 10.22. F. Hoffmann-La Roche Ltd. (Switzerland) 10.23. 3DHISTECH (Hungary) 10.24. Visiopharm A/S (Denmark) 10.25. Aiforia Technologies Oy (Finland) 10.26. Sectra AB (Sweden) 10.27. Kanteron Systems (UK) 10.28. Agfa-Gevaert Group (Belgium)