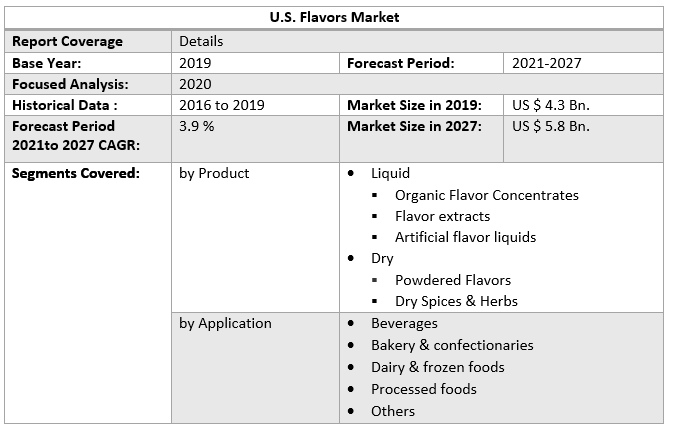

U.S. Flavors Market size was valued at US$ 4.3 Bn. in 2019 and the total revenue is expected to grow at 3.9 % through 2021 to 2027, reaching nearly US$ 5.8 Bn. The market is forecasted from 2021 to 2027 using 2019 as a base year. The market size for 2020 is based on actual figures and outputs from key companies and big players around the world. Previous five-year trends are considered while forecasting the market until 2026. 2020 is a year of exception, with the impact of lockdown broken out by area.U.S. Flavors Market Overview:

Flavours are added to food or drinks as supplementary ingredients to improve the flavour. Flavours are typically added to products that lack the desired flavour profile, such as sweets and candies. The primary goal of food flavouring is to eliminate bad smells while also increasing consumer acceptance.U.S. Flavors Market Dynamics:

Factors attributing to growth of the market are rising demand for ready-to-drink beverages and processed foods as a result of shorter meal preparation periods due to busy consumer lifestyles and rising consumer awareness regarding food products and their flavours. These additives are increasingly being used in a variety of consumer items to minimize undesirable blandness, fight preservative flavours, and improve overall consistency. Consumers in the United States are increasingly inspired by Far Eastern Asian food trends, which has boosted demand for dried herbs and spices in everyday meals. To fulfil changing customer demands, companies are increasingly importing exotic and unusual chemicals from growing economies such as China, India, Vietnam, and Malaysia, among others. The market is being driven by the usage of natural flavours in various applications, such as drinks and processed foods, such as citrus peels and juices, fruit essences, spice vanilla sugar, coffee flavourings, and so on. Increased consumer health concerns about artificial/synthetic flavours are likely to drive growth in the natural food flavour market.To know about the Research Methodology :- Request Free Sample Report The high cost of raw materials used in the creation of food tastes is a major stumbling block to the U.S. flavors market's growth. Furthermore, artificial food flavours are created by adding substances that can cause allergies and other health problems in some people, posing a threat to the U.S. flavors market's growth over the forecast period.

U.S. Flavors Market Segment Analysis:

The U.S. Flavors Market is segmented into product and application respectively.

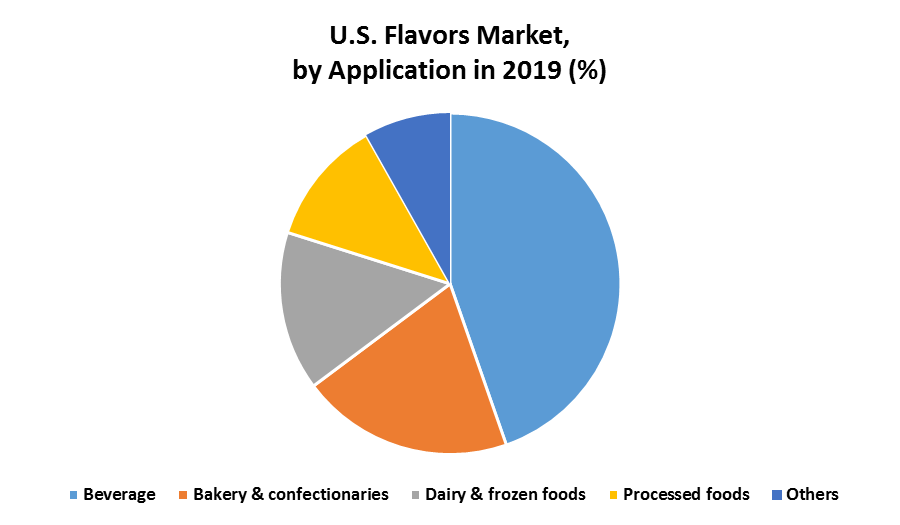

On the basis of product, the U.S. Flavors market is sub-segmented into liquid and dry. The liquid segment sub-segmented into organic flavor concentrates, flavor extracts, and artificial flavor liquids. The dry segment sub-segments into powdered flavors, and dry spices & herbs. The liquid segment held the largest market share of 58.9% in 2019. The demand for liquid segment is increasing because of high economic growth, rising disposable consumer income, increasing migration of the population from rural to urban, increasing consumer awareness regarding the nutritional benefits of natural and organic concentrates, growing popularity of fruit juice and alcoholic drinks in the U.S is expected to grow the market.On the basis of application, the U.S. Flavors market is sub-segmented into beverages, bakery & confectionaries, dairy & frozen foods, processed foods, others. The beverage segment held a large share of 53 % in 2019. The demand of beverage segment is increasing because increasing consumption of soft, carbonated, sports & energy, seasoned mineral water, growing demand of refreshment drinks, it giving energy while drinking, improves immunity power. Additionally, demand for processed organic beverages is the major growth factor in the beverage industry.

U.S. Flavors Market Regional Insights:

Factors attributing to growth of U.S. Flavors Market are increases advanced equipment, high urbanization, high spending power, industrialization, rising family income, and changing consumer food preference, increasing health awareness among people, rising new strategy and technology, increasing hotels and restaurant industry. The objective of the report is to present a comprehensive analysis of the U.S. Flavors market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. Flavors market dynamics, structure by analyzing the market segments and projects the U.S. Flavors market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the U.S. Flavors market make the report investor’s guide.Recent development:

• Givaudan is launching a new Virtual Reality instrument called The Virtual Taste Trek Citrus in 2020. This tool is designed to assist consumers in taste creation by allowing them to do it right at their workstations. • Symrise will collaborate with Kitchen Town Berlin, a culinary and food tech innovation network, in 2020. The agreement is expected to transform the food product line and meet the target audience's expanding demand.U.S. Flavors Market Scope: Inquire before buying

U.S. Flavors Market Key Players

• DuPont • Archer Daniels Midland • Givaudan • Kerry Group • International Flavors & Fragrances • Firmenich • Symrise • MANE • Taiyo International • T. Hasegawa • Synergy Flavors • Sensient • Bell Flavors and Fragrances • Flavorchem • Takasago • Keva Flavours • Huabao Flavours & Fragrances • Tate & Lyle • Robertet • McCormick & Company • Wanxiang International • Treatt • Lucta (Spain), and SolvayFrequently Asked Questions:

1. How big is the U.S. Flavors Market? Ans: The U.S. Flavors Market was estimated at USD 4.3 Billion in the year 2019 and is expected to reach USD 5.8 Billion in 2027. 2. What is the growth rate of U.S. Flavors Market? Ans: The U.S. Flavors Market is growing at a CAGR of 3.9 % during forecasting period 2019-2027. 3. What segments are covered in U.S. Flavors Market? Ans: U.S. Flavors Market is segmented into product, application and countries. 4. Who are the key players in U.S. Flavors Market? Ans: The important key players in the U.S. Flavors Market are DuPont, Archer Daniels Midland, Givaudan , Kerry Group , International Flavors & Fragrances, Firmenich , Symrise , MANE , Taiyo International , T. Hasegawa, Synergy Flavors, Sensient , Bell Flavors and Fragrances, Flavorchem, Takasago , Keva Flavours , Huabao Flavours & Fragrances, Treatt , Lucta (Spain), and Solvay. 5. What is the study period of this market? Ans: The U.S. Flavors Market is studied from 2019 to 2027.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: U.S. Flavors Market Size, by Market Value (US$ Bn) 3.1. U.S. Flavors Market Segmentation Share Analysis, 2019 3.2. Geographical Snapshot of the U.S. Flavors Market 3.3. Geographical Snapshot of the U.S. Flavors Market, By Manufacturer share 4. U.S. Flavors Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the U.S. Flavors Market 5. Supply Side and Demand Side Indicators 6. U.S. Flavors Market Analysis and Forecast, 2019-2027 6.1. U.S. Flavors Market Size & Y-o-Y Growth Analysis. 7. U.S. Flavors Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 7.1.1. Liquid 7.1.1.1. Organic Flavor Concentrates 7.1.1.2. Flavor extracts 7.1.1.3. Artificial flavor liquids 7.1.2. Dry 7.1.2.1. Powdered Flavors 7.1.2.2. Dry Spices & Herbs 7.2. Market Size (Value) Estimates & Forecast By Application, 2019-2027 7.2.1. Beverages 7.2.2. Bakery & confectionaries 7.2.3. Dairy & frozen foods 7.2.4. Processed foods 7.2.5. Others 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the U.S. Flavors Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. DuPont 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. Archer Daniels Midland 8.3.3. Givaudan 8.3.4. Kerry Group 8.3.5. International Flavors & Fragrances 8.3.6. Firmenich 8.3.7. Symrise 8.3.8. MANE 8.3.9. Taiyo International 8.3.10. T. Hasegawa 8.3.11. Synergy Flavors 8.3.12. Sensient 8.3.13. Bell Flavors and Fragrances 8.3.14. Flavorchem 8.3.15. Takasago 8.3.16. Keva Flavours 8.3.17. Huabao Flavours & Fragrances 8.3.18. Tate & Lyle 8.3.19. Robertet 8.3.20. McCormick & Company 8.3.21. Wanxiang International 8.3.22. Treatt 8.3.23. Lucta (Spain), and Solvay 9. Primary Key Insights