The U.S Diabetes Devices Market size was valued at USD 5.70 Billion in 2023 and the total U.S Diabetes Devices revenue is expected to grow at a CAGR of 3.5% from 2023 to 2030, reaching nearly USD 7.25 Billion in 2030.U.S Diabetes Devices Industry Analysis

The US diabetes devices market presents a dynamic landscape characterized by technological advancements, increasing prevalence, and significant implications for healthcare expenditure. The MMR report aims to analyse the current state and future prospects of the US diabetes devices market. It explores various segments of diabetes devices, including glucose monitoring systems, insulin delivery devices, and emerging technologies.To know about the Research Methodology :- Request Free Sample Report Diabetes continues to pose a substantial health challenge in the United States diabetes devices market, with prevalence and incidence rates on a steady rise. Current statistics by MMR reveal, approximately 34.2 million individuals diagnosed, and an additional 7.3 million cases undiagnosed, totalling around 41.5 million people affected. The incidence rate remains concerning, with an estimated 1.5 million new cases diagnosed annually, mainly comprising type 2 diabetes cases linked to lifestyle factors and the aging population. The economic impact of diabetes on healthcare expenditure in the US is significant and accounting for an estimated $327 billion annually. The costs associated with diabetes management amount to $237 billion, including hospitalizations, medications, and complications management, contribute substantially to overall healthcare spending. Additionally, indirect costs related to productivity loss and disability further amplify the economic impact of diabetes.

U.S Diabetes Devices Market Dynamics:

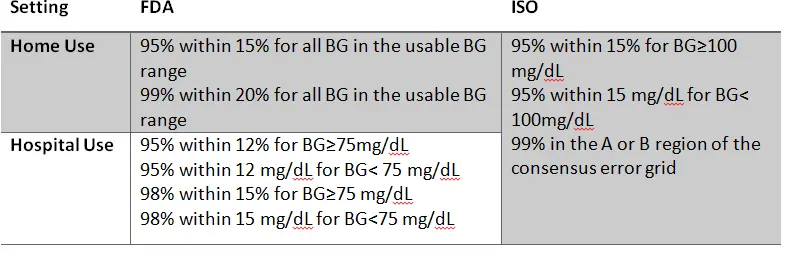

Technological Advancements Drives US Diabetes Devices Market Growth Technological advancements in the US diabetes devices market have ignited a pattern shift in diabetes care. The merging of innovation and healthcare has birthed a new era of devices that excel conventional methods. Continuous Glucose Monitoring (CGM) systems have evolved into sophisticated tools, offering real-time monitoring with exceptional accuracy of MARD values below 10-12% and seamless connectivity to mobile platforms. Simultaneously, insulin delivery devices, from pumps to pens have undergone a transformative renovation, integrating smart features that cater to individualized treatment needs. This surge in technology aligns with the surging diabetic population in the US, driving the US Diabetes Devices Market Growth. With 37 million people in the US dealing with diabetes, the demand for innovative devices that simplify self-monitoring and management has surged. This rise in demand is further driven by rising awareness among both patients and healthcare providers about the critical role of proactive self-monitoring in achieving better glycaemic control and preventing complications. The market’s path signifies a promising future, where technology continues to be the driving force behind better diabetes management, fostering improved patient outcomes and enhancing quality of life.Comparison of ISO and FDA Blood Glucose Meter Accuracy Standards

U.S Diabetes Devices Market Segment Analysis:

Based on Type, the blood glucose monitoring system segment held the largest market share of more than 60% and dominated the U.S. diabetes devices industry in 2023. The segment is further expected to grow at a CAGR of xx% and maintain its dominance during the forecast period. The rising demand for diabetes patients led to monitoring daily glucose levels is expected to be the major factor driving the segment growth. The self-monitoring blood glucose monitoring sub-segment dominated with the highest market share of 45% in 2023. It represents the largest share thanks to its widespread use for routine glucose. For Instance, 1. Continuous glucose monitoring systems represent 15% of the market share experiencing rapid growth thanks to its convenience and real-time glucose data. 2. Test strips/Test Papers acquire 5% of the segment growth thanks to their high consumption as it is highly competitive and price sensitive. 3. Lancets/lancing devices account for 5% of the segment growth as it is seeing innovation in pain reduction technology and newer lancing devices.The major key players of U.S diabetes devices, which produce diabetes device systems are Abbott, Roche, BD, Owen Mumford, and Ascensia. Thus, increasing demand for the U.S. diabetes devices market supports the segment growth.

U.S Diabetes Devices Market Scope:Inquire Before Buying

U.S Diabetes Devices Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3309.90 Mn. Forecast Period 2024 to 2030 CAGR: 6.9% Market Size in 2030: US $ 5280.30 Mn. Segments Covered: by Type Blood Glucose Monitoring Systems Self-Monitoring Blood Glucose Monitoring Systems Continuous Glucose Monitoring Systems Test Strips/Test Papers Lancets/Lancing Devices Insulin Delivery Devices Insulin Pumps Insulin Pens Insulin Syringes And Needles Diabetes Management Mobile Applications by End User Hospitals and Specialty Clinics Self and Home Care U.S Diabetes Devices Market Key Players:

1. Abbott Laboratories 2. Medtronic 3. Dexcom 4. Roche Diabetes Care 5. Insulet Corporation 6. Becton Dickinson 7. F.Hoffmann-La Roche AG 8. Tandem Diabetes Care 9. Sanofi 10. Novo Nordisk 11. Ascensia Diabetes Care 12. Tandem Diabetes Care 13. Ypsomed 14. Bigfoot Biomedical 15. ACON Laboratories, Inc 16. Boehringer Ingelheim 17. Johnson and Johnson Frequently Asked Questions: 1. What is the growth rate of U.S Diabetes Devices Market? Ans: The U.S Diabetes Devices Market is growing at a CAGR of 6.9% during forecasting period 2024-2030. 2. What is scope of the U.S Diabetes Devices Market report? Ans: U.S Diabetes Devices Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Who are the key players in U.S Diabetes Devices Market? Ans: The important key players in the U.S Diabetes Devices Market are – Abbott Laboratories, Medtronic , Dexcom , Roche Diabetes Care, Insulet Corporation, Becton Dickinson, F.Hoffmann-La Roche AG, Tandem Diabetes Care, Sanofi, Novo Nordisk, Ascensia Diabetes Care, Tandem Diabetes Care, Ypsomed, Bigfoot Biomedical, ACON Laboratories, Inc, Boehringer Ingelheim, Johnson and Johnson. 4. What is the study period of this Market? Ans: The U.S Diabetes Devices Market is studied from 2023 to 2030.

1. U.S Diabetes Devices Market: Executive Summary 1.1. Overview Of the Report 1.2. Diabetes Prevalence and Incidence in the US 1.3. Impact of Diabetes on Healthcare Expenditure 2. U.S Diabetes Devices Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape, Market Share, And Strategic Initiatives 2.3. Market Share Analysis of Key Players 2.4. Company Profile and Product Portfolio 2.5. Recent Mergers, Acquisitions, and Partnerships 2.6. Technology And Innovations 2.6.1. Advances in Diabetes Monitoring Technologies 2.6.2. Integration of AI and IoT in Diabetes Management Devices 2.6.3. Wearable Devices and Mobile Health Applications 2.7. Market Structure 2.7.1. Market Leaders 2.7.2. Market Followers 2.7.3. Emerging Players 2.8. Consolidation Of The Market 3. U.S Diabetes Devices Market: Dynamics 3.1. Market Trends and Drivers 3.1.1. Technological Advancements in Diabetes Devices 3.1.2. Growing Diabetic Population 3.1.3. Increasing Awareness and Focus on Self-Monitoring 3.2. Market Restraints and Challenges 3.2.1. Affordability and Accessibility Issues 3.2.2. Regulatory Compliance and Approval Challenges 3.2.2.1. FDA Regulations and Compliance Challenges 3.2.2.2. Impact of Regulatory Changes on Market Dynamics 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 4. U.S Diabetes Devices Market Size And Forecast By Segments (By Value USD) 4.1. U.S Diabetes Devices Market Size And Forecast, By Type (2023-2030) 4.1.1. Blood Glucose Monitoring Systems 4.1.1.1. Self-Monitoring Blood Glucose Monitoring Systems 4.1.1.2. Continuous Glucose Monitoring Systems 4.1.1.3. Test Strips/Test Papers 4.1.1.4. Lancets/Lancing Devices 4.1.2. Insulin Delivery Devices 4.1.2.1. Insulin Pumps 4.1.2.2. Insulin Pens 4.1.2.3. Insulin Syringes And Needles 4.1.3. Diabetes Management Mobile Applications 4.2. U.S Diabetes Devices Market Size And Forecast, By End-User (2023-2030) 4.2.1. Hospitals and Specialty Clinics 4.2.2. Self and Home Care 5. Company Profile: Key Players 5.1. Abbott Laboratories 5.1.1. Company Overview 5.1.2. Financial Overview 5.1.3. Business Portfolio 5.1.4. SWOT Analysis 5.1.5. Business Strategy 5.1.6. Recent Developments 5.2. Medtronic 5.3. Dexcom 5.4. Roche Diabetes Care 5.5. Insulet Corporation 5.6. Becton Dickinson 5.7. F.Hoffmann-La Roche AG 5.8. Tandem Diabetes Care 5.9. Sanofi 5.10. Novo Nordisk 5.11. Ascensia Diabetes Care 6. Key Findings 7. U.S Diabetes Devices Market: Research Methodology 8. Industry Recommendation