The Titanium Market size was valued at USD 29.64 Bn in 2024. The Titanium Market revenue is growing at a CAGR of 6.2 % from 2025 to 2032, reaching nearly USD 47.96 Bn by 2032.Titanium Market Overview

Titanium, a versatile transition metal, stands at the forefront of industries requiring high-strength, corrosion-resistant, and thermally stable metal alloys, particularly in aerospace and shielding applications. Renowned for its durability, corrosion resistance, and impressive strength-to-weight ratio, 40% lighter than steel yet as strong as high-strength steel, titanium is a preferred choice in engineering applications. Widely recognized for its role in jewelry, prosthetics, sports equipment, and various high-performance products, titanium finds applications in diverse fields, including aerospace, due to its unique properties.To know about the Research Methodology :- Request Free Sample Report

Titanium Market Dynamics:

Rise in Adoption of Lightweight & High-Strength Materials in Aerospace Favors Market Growth Titanium is a crucial material in the manufacturing of aircraft components due to its strength and lightweight properties, reinforcing its importance in the Global Titanium Market and the aerospace titanium components market. As global air travel has been on the rise, driven by factors such as increasing middle-class populations, economic growth, and globalization, the demand for new aircraft has grown. Therefore, the commercial aviation sector has experienced substantial growth. Boeing and Airbus, two of the major aircraft manufacturers, have consistently reported increasing order backlogs and deliveries. For example, in 2020, Boeing reported more than 345 commercial aircraft deliveries, and Airbus delivered more than 863 commercial aircraft. Titanium leverages crucial attributes such as its strength-to-weight ratio and corrosion resistance. The demand for titanium within aerospace has increased in both commercial and military aircraft sectors, strengthening overall titanium demand in aerospace. With the global surge in air travel, manufacturers witness a heightened influx of orders and deliveries, intensifying the requirement for titanium-rich components and supporting overall titanium market growth. Rising Automotive Industry Creates Lucrative Growth Opportunities for the Titanium Market The surge in the automotive industry is responsible for significant growth within the Titanium Market and the broader titanium metal market. The escalating demand for titanium is attributed to its increasing integration into various components by automotive manufacturers. This versatile metal is gaining prominence due to its exceptional attributes, including a remarkable strength-to-weight ratio, corrosion resistance, and outstanding durability. These qualities position titanium as an ideal material for diverse applications within the automotive sector, ranging from engine components to lightweight structural elements, strengthening the titanium in the automotive segment. The industry's shift toward more fuel-efficient and environmentally sustainable vehicles is boosting the use of titanium. Its incorporation aids in reducing overall vehicle weight, contributing to improved fuel efficiency and reduced emissions. This aligns with global efforts to address environmental concerns and meet stringent regulatory standards. As automotive manufacturers seek to enhance performance and efficiency, titanium emerges as a key enabler in achieving these objectives. The ongoing growth of the automotive industry, coupled with the increasing preference for titanium-based solutions, presents substantial growth opportunities for the titanium industry. This trend is indicative of a symbiotic relationship between the automotive and titanium industries, where advancements in one industry contribute to the prosperity of the other, fostering innovation and sustainability in both sectors, and driving titanium market trends. Price Volatility of Titanium to hamper Titanium Market Growth The Titanium Market faces significant challenges due to the inherent price volatility of the metal. Titanium, renowned for its exceptional strength-to-weight ratio and corrosion resistance, finds applications in diverse industries such as aerospace, medical, and automotive, contributing to a wide range of titanium market applications. However, the unpredictable and fluctuating prices of titanium pose obstacles to sustained titanium market forecast growth. The complex and energy-intensive extraction process, primarily through the Kroll process titanium extraction, influences production costs. Additionally, the market is sensitive to fluctuations in demand from key industries like aerospace, which is influenced by economic conditions and geopolitical events.Titanium Market Segment Analysis

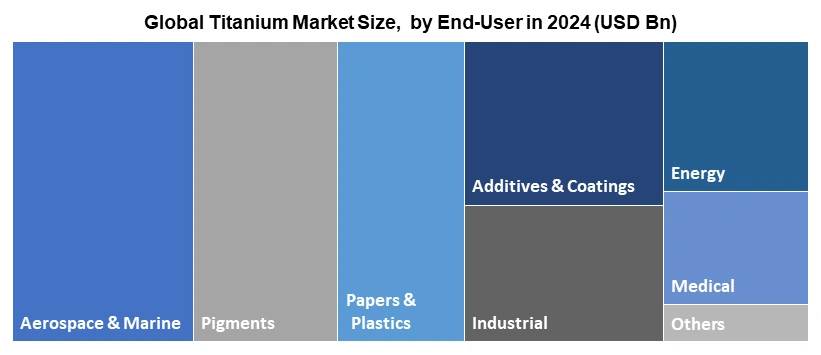

Based on Product Type, Titanium Dioxide (TiO2) dominates the product type segment of the Titanium Market due to its versatile and widespread applications. As a highly effective white pigment, TiO2 is integral in industries such as paints, coatings, plastics, and paper, providing excellent opacity and brightness, strengthening the titanium dioxide market (TiO2) segment. The construction and housing sectors heavily rely on TiO2 for its use in paints, making it a key component in architectural and decorative coatings. The cosmetics industry leverages TiO2 for its UV-blocking properties in sunscreens and personal care products. The extensive and diverse utility of Titanium Dioxide, coupled with its cost-effectiveness and essential role in various sectors, positions it as a high-demand, high-volume product, contributing significantly to its dominance in the Titanium Market's product type segment and supporting overall titanium dioxide demand in paints and coatings.Based on End-User The Aerospace & Marine industry dominated the Titanium Market during the forecast timeline. The Aerospace and Marine industry is the largest end-user segment of titanium metal, reinforcing the importance of aerospace titanium components. Titanium metal is mainly used in the production of turbine engines, apart from airframes and other components. In turbine engines, titanium is used to manufacture components such as inlet cases, compressor blades, disks, and hubs, as well as spacers and seals.

Titanium Market Regional Analysis:

The Asia-Pacific region dominated the Titanium Market during the forecast period, driving strong titanium market growth in Asia-Pacific. Rapid industrialization and urbanization in countries such as China and India have fueled significant demand for titanium in the construction, aerospace, and automotive sectors. These nations are witnessing substantial infrastructure development, driving the need for high-strength, corrosion-resistant materials like titanium. The flourishing manufacturing sector in Asia-Pacific has led to increased use of titanium in diverse applications, including the production of consumer goods, medical devices, and industrial equipment, supporting the rise of the titanium industry in Asia-Pacific.Asia-Pacific is home to some of the world's largest titanium producers, ensuring a stable supply chain. Countries including China are major players in both titanium mining and processing, providing a strategic advantage in terms of resource availability and cost-effective production, reinforcing the titanium supply chain Asia-Pacific. Supportive government policies, technological advancements, and investments in research and development have strengthened the titanium industry in the Asia-Pacific region. This combination of factors establishes Asia-Pacific as the epicenter of Titanium Market dominance, with sustained growth expected as industrial activities and technological advancements continue to drive demand.

Titanium Market Competitive Landscape

Titanium Market players are progressively putting more focus towards advanced material innovation and expanding their portfolios to offer high-purity, aerospace-grade, and specialty titanium products. Companies are focusing on developing lightweight, corrosion-resistant, and high-strength titanium grades to meet increasing demand from aerospace, automotive, marine, medical, and industrial applications. The adoption of digitalized production technologies, automated processing systems, and AI-based quality control is enhancing production accuracy, reducing waste, and improving operational efficiency across titanium manufacturing facilities. Market competitiveness is shaped by fluctuations in the availability and pricing of raw materials such as titanium sponge, ilmenite, and rutile, which directly influence production costs. Leading manufacturers are directing their efforts toward high-growth sectors such as aerospace, electric vehicles, renewable energy, and medical implants to strengthen their global market presence.Recent Development

• On 15 April 2025, Airbus Aerostructures and Norway's Norsk Titanium (NTI.OL), announced that they open a new tab which have completed Master Supply Agreement negotiations for the delivery of titanium parts. This agreement is likely to benefit both parties and will enhance their business processes and operations. • On 2 July 2024, IperionX is partnering with Aperam to improve a circular titanium supply chain. This partnership will showcase IperionX’s fully circular and sustainable solution for titanium supply. It will transform titanium scrap into high-performance titanium products for various industries.Titanium Market Scope: Inquire before buying

Global Titanium Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 28.64 Bn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 47.96 Bn. Segments Covered: by Product Type Titanium Dioxide Titanium Metal by End User Aerospace & Marine Industrial Medical Energy Pigments Additives & Coatings Papers & Plastics Others by Distribution Channel Direct Sales Indirect Sales Titanium Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Titanium Market Key Players

1. Tronox Holdings plc (Stamford, Connecticut, USA) 2. Kronos Worldwide, Inc. (Dallas, Texas, USA) 3. Argex Titanium Inc. (Montreal, Quebec, Canada) 4. Huntsman Corporation (The Woodlands, Texas, USA) 5. Titanium Corporation Inc. (Calgary, Alberta, Canada) 6. Toho Titanium Co., Ltd. (Chigasaki, Kanagawa, Japan) 7. Pangang Group Vanadium Titanium & Resources Co., Ltd. (Panzhihua, Sichuan, China) 8. Indian Rare Earths Limited (IREL) (Mumbai, India) 9. Cristal (Tianjin) Co., Ltd. (Jiaozhou, Qingdao, China) 10. Osaka Titanium Technologies Co., Ltd. (Osaka, Japan) 11. Kishore Kumar & Co. (Mumbai, India) 12. Iluka Resources Limited (Australia) 13. Rio Tinto Limited (Australia) 14. Astron Limited (Sydney, Australia) 15. Venator Materials PLC(UK) 16. Bluejay Mining plc(London, United Kingdom) 17. VSMPO-AVISMA Corporation (Verkhnyaya Salda, Russia) 18. Titanium Metals Corporation (TIMET) – A PCC Company (Dallas, Texas, USA) 19. Arihant Metallica (Mumbai, India) 20. Aerospace Metal Finishers (AMF) (USA) 21. Lomon Billions Group Co., Ltd. (Henan, China) 22. TASMAN Metals Ltd. (Canada) 23. Kenmare Resources plc (Dublin, Ireland – Mozambique operations) 24. Base Titanium Limited (Nairobi, Kenya – Kwale Mineral Sands) 25. Sumitomo Corporation (Tokyo, Japan – Titanium materials & trading) 26. Allegheny Technologies Incorporated (ATI) (Pittsburgh, Pennsylvania, USA) 27. Western Titanium Technologies Ltd. (China) 28. OSAKA Titanium Technologies America (USA – subsidiary of Osaka Titanium) 29. Norsk Titanium AS (Hønefoss, Norway) 30. Toho International Inc. (USA – titanium trading & supply)Frequently Asked Questions:

1] What segments are covered in the Global Titanium Market report? Ans. The segments covered in the Titanium Market report are based on Product Type, End-Users, Distribution Channel and Regions. 2] Which region is expected to hold the highest share in the Global Titanium Market? Ans. The Asia Pacific region is expected to hold the largest share of the Titanium Market. 3] What is the Market size of the Global Titanium Market by 2032? Ans. The Market size of the Titanium Market by 2032 is expected to reach USD 47.96 Bn. 4] What is the forecast period for the Global Titanium Market? Ans. The forecast period for the Titanium Market is 2025-2032. 5] What was the Market size of the Global Titanium Market in 2024? Ans. The Market size of the Titanium Market in 2024 was valued at USD 29.64 Bn.

1. Titanium Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Titanium Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Titanium Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Titanium Market: Dynamics 3.1. Titanium Market Trends by Region 3.1.1. North America Titanium Market Trends 3.1.2. Europe Titanium Market Trends 3.1.3. Asia Pacific Titanium Market Trends 3.1.4. Middle East and Africa Titanium Market Trends 3.1.5. South America Titanium Market Trends 3.2. Titanium Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Titanium Market Drivers 3.2.1.2. North America Titanium Market Restraints 3.2.1.3. North America Titanium Market Opportunities 3.2.1.4. North America Titanium Market Challenges 3.2.2. Europe 3.2.2.1. Europe Titanium Market Drivers 3.2.2.2. Europe Titanium Market Restraints 3.2.2.3. Europe Titanium Market Opportunities 3.2.2.4. Europe Titanium Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Titanium Market Drivers 3.2.3.2. Asia Pacific Titanium Market Restraints 3.2.3.3. Asia Pacific Titanium Market Opportunities 3.2.3.4. Asia Pacific Titanium Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Titanium Market Drivers 3.2.4.2. Middle East and Africa Titanium Market Restraints 3.2.4.3. Middle East and Africa Titanium Market Opportunities 3.2.4.4. Middle East and Africa Titanium Market Challenges 3.2.5. South America 3.2.5.1. South America Titanium Market Drivers 3.2.5.2. South America Titanium Market Restraints 3.2.5.3. South America Titanium Market Opportunities 3.2.5.4. South America Titanium Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Titanium Industry 3.8. Analysis of Government Schemes and Initiatives For Titanium Industry 3.9. Titanium Market Trade Analysis 3.10. The Global Pandemic Impact on Titanium Market 4. Titanium Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Titanium Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Titanium Dioxide 4.1.2. Titanium Metal 4.2. Titanium Market Size and Forecast, by End User (2024-2032) 4.2.1. Aerospace & Marine 4.2.2. Industrial 4.2.3. Medical 4.2.4. Energy 4.2.5. Pigments 4.2.6. Additives & Coatings 4.2.7. Papers & Plastics 4.2.8. Others 4.3. Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1. Direct Sales 4.3.2. Indirect Sales 4.4. Titanium Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Titanium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Titanium Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Titanium Dioxide 5.1.2. Titanium Metal 5.2. North America Titanium Market Size and Forecast, by End User (2024-2032) 5.2.1. Aerospace & Marine 5.2.2. Industrial 5.2.3. Medical 5.2.4. Energy 5.2.5. Pigments 5.2.6. Additives & Coatings 5.2.7. Papers & Plastics 5.2.8. Others 5.3. North America Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1. Direct Sales 5.3.2. Indirect Sales 5.4. North America Titanium Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Titanium Market Size and Forecast, by Product Type (2024-2032) 5.4.1.1.1. Titanium Dioxide 5.4.1.1.2. Titanium Metal 5.4.1.2. United States Titanium Market Size and Forecast, by End User (2024-2032) 5.4.1.2.1. Aerospace & Marine 5.4.1.2.2. Industrial 5.4.1.2.3. Medical 5.4.1.2.4. Energy 5.4.1.2.5. Pigments 5.4.1.2.6. Additives & Coatings 5.4.1.2.7. Papers & Plastics 5.4.1.2.8. Others 5.4.1.3. United States Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1.3.1. Direct Sales 5.4.1.3.2. Indirect Sales 5.4.2. Canada 5.4.2.1. Canada Titanium Market Size and Forecast, by Product Type (2024-2032) 5.4.2.1.1. Titanium Dioxide 5.4.2.1.2. Titanium Metal 5.4.2.2. Canada Titanium Market Size and Forecast, by End User (2024-2032) 5.4.2.2.1. Aerospace & Marine 5.4.2.2.2. Industrial 5.4.2.2.3. Medical 5.4.2.2.4. Energy 5.4.2.2.5. Pigments 5.4.2.2.6. Additives & Coatings 5.4.2.2.7. Papers & Plastics 5.4.2.2.8. Others 5.4.2.3. Canada Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2.3.1. Direct Sales 5.4.2.3.2. Indirect Sales 5.4.3. Mexico 5.4.3.1. Mexico Titanium Market Size and Forecast, by Product Type (2024-2032) 5.4.3.1.1. Titanium Dioxide 5.4.3.1.2. Titanium Metal 5.4.3.2. Mexico Titanium Market Size and Forecast, by End User (2024-2032) 5.4.3.2.1. Aerospace & Marine 5.4.3.2.2. Industrial 5.4.3.2.3. Medical 5.4.3.2.4. Energy 5.4.3.2.5. Pigments 5.4.3.2.6. Additives & Coatings 5.4.3.2.7. Papers & Plastics 5.4.3.2.8. Others 5.4.3.3. Mexico Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3.3.1. Direct Sales 5.4.3.3.2. Indirect Sales 6. Europe Titanium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Titanium Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Titanium Market Size and Forecast, by End User (2024-2032) 6.3. Europe Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4. Europe Titanium Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. United Kingdom Titanium Market Size and Forecast, by End User (2024-2032) 6.4.1.3. United Kingdom Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2. France 6.4.2.1. France Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. France Titanium Market Size and Forecast, by End User (2024-2032) 6.4.2.3. France Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Germany Titanium Market Size and Forecast, by End User (2024-2032) 6.4.3.3. Germany Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. Italy Titanium Market Size and Forecast, by End User (2024-2032) 6.4.4.3. Italy Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Spain Titanium Market Size and Forecast, by End User (2024-2032) 6.4.5.3. Spain Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Sweden Titanium Market Size and Forecast, by End User (2024-2032) 6.4.6.3. Sweden Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Austria Titanium Market Size and Forecast, by End User (2024-2032) 6.4.7.3. Austria Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Titanium Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Rest of Europe Titanium Market Size and Forecast, by End User (2024-2032) 6.4.8.3. Rest of Europe Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Titanium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Titanium Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Titanium Market Size and Forecast, by End User (2024-2032) 7.3. Asia Pacific Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4. Asia Pacific Titanium Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. China Titanium Market Size and Forecast, by End User (2024-2032) 7.4.1.3. China Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. S Korea Titanium Market Size and Forecast, by End User (2024-2032) 7.4.2.3. S Korea Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Japan Titanium Market Size and Forecast, by End User (2024-2032) 7.4.3.3. Japan Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4. India 7.4.4.1. India Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. India Titanium Market Size and Forecast, by End User (2024-2032) 7.4.4.3. India Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.5.2. Australia Titanium Market Size and Forecast, by End User (2024-2032) 7.4.5.3. Australia Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.6.2. Indonesia Titanium Market Size and Forecast, by End User (2024-2032) 7.4.6.3. Indonesia Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.7.2. Malaysia Titanium Market Size and Forecast, by End User (2024-2032) 7.4.7.3. Malaysia Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.8.2. Vietnam Titanium Market Size and Forecast, by End User (2024-2032) 7.4.8.3. Vietnam Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.9.2. Taiwan Titanium Market Size and Forecast, by End User (2024-2032) 7.4.9.3. Taiwan Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Titanium Market Size and Forecast, by Product Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Titanium Market Size and Forecast, by End User (2024-2032) 7.4.10.3. Rest of Asia Pacific Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Titanium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Titanium Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Titanium Market Size and Forecast, by End User (2024-2032) 8.3. Middle East and Africa Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 8.4. Middle East and Africa Titanium Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Titanium Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. South Africa Titanium Market Size and Forecast, by End User (2024-2032) 8.4.1.3. South Africa Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Titanium Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. GCC Titanium Market Size and Forecast, by End User (2024-2032) 8.4.2.3. GCC Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Titanium Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Nigeria Titanium Market Size and Forecast, by End User (2024-2032) 8.4.3.3. Nigeria Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Titanium Market Size and Forecast, by Product Type (2024-2032) 8.4.4.2. Rest of ME&A Titanium Market Size and Forecast, by End User (2024-2032) 8.4.4.3. Rest of ME&A Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Titanium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Titanium Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Titanium Market Size and Forecast, by End User (2024-2032) 9.3. South America Titanium Market Size and Forecast, by Distribution Channel(2024-2032) 9.4. South America Titanium Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Titanium Market Size and Forecast, by Product Type (2024-2032) 9.4.1.2. Brazil Titanium Market Size and Forecast, by End User (2024-2032) 9.4.1.3. Brazil Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Titanium Market Size and Forecast, by Product Type (2024-2032) 9.4.2.2. Argentina Titanium Market Size and Forecast, by End User (2024-2032) 9.4.2.3. Argentina Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Titanium Market Size and Forecast, by Product Type (2024-2032) 9.4.3.2. Rest Of South America Titanium Market Size and Forecast, by End User (2024-2032) 9.4.3.3. Rest Of South America Titanium Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Tronox Holdings plc (Stamford, Connecticut, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Kronos Worldwide, Inc. (Dallas, Texas, USA) 10.3. Argex Titanium Inc. (Montreal, Quebec, Canada) 10.4. Huntsman Corporation (The Woodlands, Texas, USA) 10.5. Titanium Corporation Inc. (Calgary, Alberta, Canada) 10.6. Toho Titanium Co., Ltd. (Chigasaki, Kanagawa, Japan) 10.7. Pangang Group Vanadium Titanium & Resources Co., Ltd. (Panzhihua, Sichuan, China) 10.8. Indian Rare Earths Limited (IREL) (Mumbai, India) 10.9. Cristal (Tianjin) Co., Ltd. (Jiaozhou, Qingdao, China) 10.10. Osaka Titanium Technologies Co., Ltd. (Osaka, Japan) 10.11. Kishore Kumar & Co. (Mumbai, India) 10.12. Iluka Resources Limited (Australia) 10.13. Rio Tinto Limited (Australia) 10.14. Astron Limited (Sydney, Australia) 10.15. Venator Materials PLC(UK) 10.16. Bluejay Mining plc(London, United Kingdom) 10.17. VSMPO-AVISMA Corporation (Verkhnyaya Salda, Russia) 10.18. Titanium Metals Corporation (TIMET) – A PCC Company (Dallas, Texas, USA) 10.19. Arihant Metallica (Mumbai, India) 10.20. Aerospace Metal Finishers (AMF) (USA) 10.21. Lomon Billions Group Co., Ltd. (Henan, China) 10.22. TASMAN Metals Ltd. (Canada) 10.23. Kenmare Resources plc (Dublin, Ireland – Mozambique operations) 10.24. Base Titanium Limited (Nairobi, Kenya – Kwale Mineral Sands) 10.25. Sumitomo Corporation (Tokyo, Japan – Titanium materials & trading) 10.26. Allegheny Technologies Incorporated (ATI) (Pittsburgh, Pennsylvania, USA) 10.27. Western Titanium Technologies Ltd. (China) 10.28. OSAKA Titanium Technologies America (USA – subsidiary of Osaka Titanium) 10.29. Norsk Titanium AS (Hønefoss, Norway) 10.30. Toho International Inc. (USA – titanium trading & supply) 11. Key Findings 12. Industry Recommendations 13. Titanium Market: Research Methodology 14. Terms and Glossary