The Testing, Inspection and Certification Market size was valued at US 223.90 Bn in 2023 and market revenue is growing at a CAGR of 3.4 % from 2023 to 2030, reaching nearly USD 282.94 Bn by 2030.Testing, Inspection and Certification Market Overview:

The testing, inspection, and certification (TIC) sector consists of conformity assessment bodies that provide services ranging from auditing and inspection to testing, verification, quality assurance, and certification. The sector consists of both in-house and outsourced services. The Testing, Inspection and Certification Market is an important sector ensuring the safety, quality, and compliance of products and services across various industries globally. With increasing regulatory complexities and the growing emphasis on quality assurance, the Testing, Inspection, and Certification industry continues to grow. Stringent regulations, globalization of trade, and advancements in technology.To know about the Research Methodology :- Request Free Sample Report Major players in the TIC industry offer a wide range of services such as product testing, quality assurance, certification, and supply chain auditing. The market is highly fragmented, with both global giants as well as local players competing for market share. Emerging trends include the adoption of digitalization, automation, and the integration of artificial intelligence and IoT in testing processes. Sustainability and environmental concerns also influence the market, with a rising demand for eco-friendly certification and compliance services. The Testing, Inspection and Certification Market is poised for steady growth as businesses prioritize quality, safety, and regulatory compliance in an increasingly complex global marketplace.

Testing, Inspection and Certification Market: Dynamics

Driver Increasing Trade in counterfeit and Defective Pharmaceutical products boosts the Testing, Inspection and Certification Market growth The rise in counterfeit and defective pharmaceutical products presents a significant challenge to public health and safety worldwide. As illicit trade in such products proliferates, consumers face grave risks, including ineffective treatment, adverse reactions, and even fatalities. Consequently, there's an urgent need for stringent measures to ensure the authenticity and quality of pharmaceuticals entering the market. This demand has led to a surge in the Testing, Inspection and Certification Market. TIC services are important in combating the proliferation of counterfeit and defective pharmaceuticals by verifying the integrity and quality of products through rigorous testing and inspection protocols. These services encompass a range of activities, including chemical analysis, microbiological testing, packaging inspection, and compliance verification with regulatory standards. By leveraging advanced technologies and expertise, TIC companies identify counterfeit drugs and detect deviations from quality standards, thereby safeguarding public health and mitigating risks for pharmaceutical manufacturers. The escalating trade in counterfeit and defective pharmaceuticals has catalysed the growth of the Testing, Inspection and Certification Market as regulatory authorities, healthcare organizations, and pharmaceutical companies increasingly rely on third-party verification services to ensure product integrity and compliance. Also, the expanding global pharmaceutical supply chain necessitates comprehensive testing and inspection protocols to address the complexities and vulnerabilities associated with cross-border trade. The proliferation of counterfeit and defective pharmaceutical products underscores the critical importance of the Testing, Inspection and Certification Market. As stakeholders intensify their efforts to combat illicit trade and uphold quality standards, the demand for TIC services is poised to escalate, driving market growth and fostering a safer and more reliable pharmaceutical ecosystem. According to the MMR Study Report The high concentration of authorized foreign food testing facilities in China, comprising 50% of South Korea's recognized labs by 2021, drives the Testing, Inspection and Certification Market by facilitating efficient and reliable import inspections, enhancing quality assurance, and meeting regulatory standards, fostering trade relations between the two countries.Restrain High Cost of Testing, Inspection, and Certification limits the Testing, Inspection and Certification Market growth The Testing, Inspection and Certification Market faces a prominent impediment to its growth in the form of high costs associated with its operations. These expenses stem from various factors, including the need for specialized equipment and facilities, the requirement for a skilled workforce, and the complexities of regulatory compliance. Industries reliant on TIC services, such as manufacturing and healthcare, often incur significant overheads in maintaining laboratories, hiring qualified personnel, and ensuring adherence to evolving standards. The globalization of supply chains adds another layer of complexity, necessitating compliance with diverse regulatory frameworks across different regions. With the stakes high in terms of product safety, quality assurance, and risk management, companies cannot afford to cut corners in their TIC processes. While these costs serve essential purposes in safeguarding consumer interests and maintaining industry integrity, they also act as a barrier to market growth. Collaborative efforts between stakeholders, including industry players, governments, and technological innovators, are crucial in mitigating these challenges. By embracing technological advancements, streamlining regulatory processes, and promoting international standards harmonization, the Testing, Inspection and Certification Market overcome its cost limitations and realize its full potential in supporting global trade and consumer protection. Opportunity Increasing Adoption of AI and ML Creates Lucrative Growth Opportunities for the Testing, Inspection and Certification Market The rapid uptake of Artificial Intelligence (AI) and Machine Learning (ML) is reshaping industries, presenting lucrative avenues within the Testing, Inspection and Certification Market. AI and ML integration across sectors such as healthcare, automotive, manufacturing, and finance boosts efficiency and decision-making but also introduces complexities requiring rigorous testing, inspection, and certification. Within this landscape, the Testing, Inspection and Certification Market assumes a critical role in validating the reliability, safety, and compliance of AI and ML systems. These services ensure the accuracy of algorithms, data models, and applications while confirming adherence to industry standards and regulations, thus mitigating risks and protecting stakeholders. With the escalating demand for AI and ML technologies, the necessity for robust TIC services grows. This trend unlocks promising growth prospects for TIC providers. They innovate testing methods, inspection techniques, and certification frameworks tailored for AI and ML applications, cementing their position as trustworthy partners in quality assurance. By offering specialized solutions for the unique challenges of AI and ML implementations, TIC companies seize opportunities in this growing Testing, Inspection and Certification Market, fostering sustained business growth and client confidence.

Testing, Inspection and Certification Market Segment Analysis:

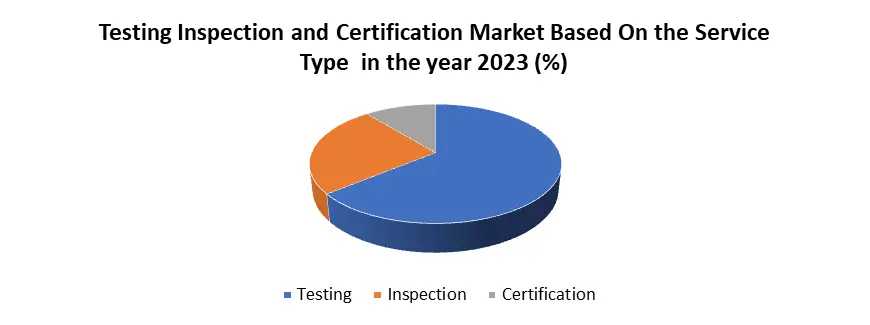

Based On the Service Type, the Testing Subsegment dominated the service type segment of the Testing, Inspection and Certification Market in the year 2023. Increasing regulatory requirements across various industries have compelled businesses to undergo rigorous testing processes to ensure compliance and safety standards. The growing emphasis on quality assurance and risk management has driven organizations to prioritize comprehensive testing procedures to mitigate potential liabilities and safeguard their reputation. Technological advancements, such as automation and artificial intelligence, have revolutionized testing methodologies, making them more efficient, accurate, and cost-effective. Also, the proliferation of new products and technologies in sectors such as healthcare, automotive, and electronics has boosted the demand for specialized testing services tailored to specific industry needs. Combined, these factors have driven the Testing Subsegment to the forefront of the Testing, Inspection and Certification Market, strengthening its dominance and significance in ensuring product quality, safety, and regulatory compliance.

Testing, Inspection and Certification Market Regional Analysis

Asia Pacific region dominated the Testing, Inspection and Certification Market in the year 2023. The region's rapid industrialization, particularly in countries such as China, India, and Southeast Asian nations, has led to a surge in demand for TIC services across various sectors. This growth is driven by the need to ensure product quality, safety, and compliance with regulations amidst expanding manufacturing activities. Also, stringent regulatory requirements imposed by governments and international bodies necessitate thorough testing and inspection processes. Testing, Inspection, and Certification companies operating in the region adhere to these standards to maintain Testing, Inspection and Certification Market access and ensure consumer trust, driving the demand for Testing, Inspection, and Certification services. The Asia Pacific region's increasing participation in international trade has further boosted the need for TIC services. With globalization, businesses face diverse regulatory frameworks and quality standards, requiring comprehensive testing and certification to meet export requirements and access global markets effectively. Robust economic growth in the region has boosted investments in infrastructure projects, such as construction, transportation, and energy. These large-scale developments necessitate rigorous testing and inspection to ensure safety, quality, and compliance with regulatory standards, thereby boosting demand for TIC services. For Example, TIC Council India serves as the leading advocate for the independent Testing, Inspection, and Certification Industry within India. As a registered entity, it actively engages with governmental bodies and stakeholders, advocating for effective solutions that ensure public safety, promote innovation, and facilitate trade while enhancing consumer quality. With a focus on promoting best practices in safety, quality, health, ethics, and sustainability, TIC Council India is important in shaping policies and regulations. Through a diverse range of activities, it works towards bolstering consumer confidence in products by ensuring they meet stringent regulatory standards for safety, security, and sustainability through third-party conformity assessment, which significantly boosts the Testing, Inspection and Certification Market growth. The presence of a substantial manufacturing base in the region, coupled with advancements in technology, has created opportunities for TIC providers to offer specialized testing solutions tailored to specific industries and applications. This capability enhances the region's competitiveness in the global Testing, Inspection and Certification Market.Testing, Inspection and Certification Market Scope: Inquire before buying

Global Testing, Inspection and Certification Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 223.90 Bn. Forecast Period 2024 to 2030 CAGR: 3.4% Market Size in 2030: US $ 282.94 Bn. Segments Covered: by Service Type Testing Inspection Certification by Sourcing Type In House Outsourced by Application Medical Life Science Food Telecommunication Testing, Inspection and Certification Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Testing, Inspection, and Certification Key Players

North America 1. UL LLC (Underwriters Laboratories) (United States) 2. MISTRAS Group, Inc. (United States) Europe 1. SGS Group (Switzerland) 2. Bureau Veritas (France) 3. Intertek Group plc (United Kingdom) 4. DEKRA SE (Germany) 5. TUV SUD AG (Germany) 6. Applus+ (Spain) 7. Eurofins Scientific (Luxembourg) 8. TÜV Rheinland (Germany) 9. DNV GL (Norway) 10. Lloyd's Register Group Limited (United Kingdom) 11. Element Materials Technology (United Kingdom) 12. TÜV Nord Group (Germany) 13. Kiwa (Netherlands) 14. Cotecna Inspection SA (Switzerland) 15. SOCOTEC Group (France) Asia Pacific 1. SAI Global (Australia) 2. ALS Limited (Australia) Frequently Asked Questions 1] What segments are covered in the Global Testing, Inspection, and Certification report? Ans. The segments covered in the Testing, Inspection, and Certification report are based on, Service Type, Sourcing Type, Application, and Regions. 2] Which region is expected to hold the highest share of the Global Testing, Inspection, and Certification? Ans. The Asia Pacific region is expected to hold the highest share of the Testing, Inspection, and Certification. 3] What is the market size of the Global Testing, Inspection, and Certification by 2030? Ans. The market size of the Testing, Inspection, and Certification by 2030 is expected to reach US$ 282.94 Bn. 4] What was the market size of the Global Testing, Inspection, and Certification in 2023? Ans. The market size of the Testing, Inspection, and Certification in 2023 was valued at US$ 223.90 Bn. 5] Key players in the Testing, Inspection, and Certification. Ans. SGS Group (Switzerland), Bureau Veritas (France), Intertek Group plc (United Kingdom), DEKRA SE (Germany), and TÜV SÜD (Germany)

1. Testing, Inspection and Certification Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Testing, Inspection and Certification Market: Dynamics 2.1. Testing, Inspection and Certification Market Trends by Region 2.1.1. North America Testing, Inspection and Certification Market Trends 2.1.2. Europe Testing, Inspection and Certification Market Trends 2.1.3. Asia Pacific Testing, Inspection and Certification Market Trends 2.1.4. Middle East and Africa Testing, Inspection and Certification Market Trends 2.1.5. South America Testing, Inspection and Certification Market Trends 2.2. Testing, Inspection and Certification Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Testing, Inspection and Certification Market Drivers 2.2.1.2. North America Testing, Inspection and Certification Market Restraints 2.2.1.3. North America Testing, Inspection and Certification Market Opportunities 2.2.1.4. North America Testing, Inspection and Certification Market Challenges 2.2.2. Europe 2.2.2.1. Europe Testing, Inspection and Certification Market Drivers 2.2.2.2. Europe Testing, Inspection and Certification Market Restraints 2.2.2.3. Europe Testing, Inspection and Certification Market Opportunities 2.2.2.4. Europe Testing, Inspection and Certification Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Testing, Inspection and Certification Market Drivers 2.2.3.2. Asia Pacific Testing, Inspection and Certification Market Restraints 2.2.3.3. Asia Pacific Testing, Inspection and Certification Market Opportunities 2.2.3.4. Asia Pacific Testing, Inspection and Certification Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Testing, Inspection and Certification Market Drivers 2.2.4.2. Middle East and Africa Testing, Inspection and Certification Market Restraints 2.2.4.3. Middle East and Africa Testing, Inspection and Certification Market Opportunities 2.2.4.4. Middle East and Africa Testing, Inspection and Certification Market Challenges 2.2.5. South America 2.2.5.1. South America Testing, Inspection and Certification Market Drivers 2.2.5.2. South America Testing, Inspection and Certification Market Restraints 2.2.5.3. South America Testing, Inspection and Certification Market Opportunities 2.2.5.4. South America Testing, Inspection and Certification Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Testing, Inspection and Certification Industry 2.8. Analysis of Government Schemes and Initiatives For Testing, Inspection and Certification Industry 2.9. Testing, Inspection and Certification Market Trade Analysis 2.10. The Global Pandemic Impact on Testing, Inspection and Certification Market 3. Testing, Inspection and Certification Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 3.1.1. Testing 3.1.2. Inspection 3.1.3. Certification 3.2. Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 3.2.1. In House 3.2.2. Outsourced 3.3. Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 3.3.1. Medical 3.3.2. Life Science 3.3.3. Food 3.3.4. Telecommunication 3.4. Testing, Inspection and Certification Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Testing, Inspection and Certification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 4.1.1. Testing 4.1.2. Inspection 4.1.3. Certification 4.2. North America Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 4.2.1. In House 4.2.2. Outsourced 4.3. North America Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 4.3.1. Medical 4.3.2. Life Science 4.3.3. Food 4.3.4. Telecommunication 4.4. North America Testing, Inspection and Certification Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 4.4.1.1.1. Testing 4.4.1.1.2. Inspection 4.4.1.1.3. Certification 4.4.1.2. United States Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 4.4.1.2.1. In House 4.4.1.2.2. Outsourced 4.4.1.3. United States Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Medical 4.4.1.3.2. Life Science 4.4.1.3.3. Food 4.4.1.3.4. Telecommunication 4.4.2. Canada 4.4.2.1. Canada Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 4.4.2.1.1. Testing 4.4.2.1.2. Inspection 4.4.2.1.3. Certification 4.4.2.2. Canada Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 4.4.2.2.1. In House 4.4.2.2.2. Outsourced 4.4.2.3. Canada Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Medical 4.4.2.3.2. Life Science 4.4.2.3.3. Food 4.4.2.3.4. Telecommunication 4.4.3. Mexico 4.4.3.1. Mexico Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 4.4.3.1.1. Testing 4.4.3.1.2. Inspection 4.4.3.1.3. Certification 4.4.3.2. Mexico Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 4.4.3.2.1. In House 4.4.3.2.2. Outsourced 4.4.3.3. Mexico Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Medical 4.4.3.3.2. Life Science 4.4.3.3.3. Food 4.4.3.3.4. Telecommunication 5. Europe Testing, Inspection and Certification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.3. Europe Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4. Europe Testing, Inspection and Certification Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.1.2. United Kingdom Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.1.3. United Kingdom Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.2.2. France Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.2.3. France Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.3.2. Germany Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.3.3. Germany Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.4.2. Italy Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.4.3. Italy Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.5.2. Spain Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.5.3. Spain Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.6.2. Sweden Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.6.3. Sweden Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.7.2. Austria Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.7.3. Austria Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 5.4.8.2. Rest of Europe Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 5.4.8.3. Rest of Europe Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Testing, Inspection and Certification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.3. Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.1.2. China Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.1.3. China Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.2.2. S Korea Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.2.3. S Korea Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.3.2. Japan Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.3.3. Japan Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.4.2. India Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.4.3. India Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.5.2. Australia Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.5.3. Australia Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.6.2. Indonesia Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.6.3. Indonesia Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.7.2. Malaysia Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.7.3. Malaysia Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.8.2. Vietnam Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.8.3. Vietnam Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.9.2. Taiwan Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.9.3. Taiwan Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Testing, Inspection and Certification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 7.3. Middle East and Africa Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Testing, Inspection and Certification Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 7.4.1.2. South Africa Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 7.4.1.3. South Africa Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 7.4.2.2. GCC Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 7.4.2.3. GCC Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 7.4.3.2. Nigeria Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 7.4.3.3. Nigeria Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 7.4.4.2. Rest of ME&A Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 7.4.4.3. Rest of ME&A Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 8. South America Testing, Inspection and Certification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 8.2. South America Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 8.3. South America Testing, Inspection and Certification Market Size and Forecast, by Application(2023-2030) 8.4. South America Testing, Inspection and Certification Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 8.4.1.2. Brazil Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 8.4.1.3. Brazil Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 8.4.2.2. Argentina Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 8.4.2.3. Argentina Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Testing, Inspection and Certification Market Size and Forecast, by Service Type (2023-2030) 8.4.3.2. Rest Of South America Testing, Inspection and Certification Market Size and Forecast, by Sourcing Type (2023-2030) 8.4.3.3. Rest Of South America Testing, Inspection and Certification Market Size and Forecast, by Application (2023-2030) 9. Global Testing, Inspection and Certification Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Testing, Inspection and Certification Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. UL LLC (Underwriters Laboratories) (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. MISTRAS Group, Inc. (United States) 10.3. SGS Group (Switzerland) 10.4. Bureau Veritas (France) 10.5. Intertek Group plc (United Kingdom) 10.6. DEKRA SE (Germany) 10.7. TÜV SÜD (Germany) 10.8. Applus+ (Spain) 10.9. Eurofins Scientific (Luxembourg) 10.10. TÜV Rheinland (Germany) 10.11. DNV GL (Norway) 10.12. Lloyd's Register Group Limited (United Kingdom) 10.13. Element Materials Technology (United Kingdom) 10.14. TÜV Nord Group (Germany) 10.15. Kiwa (Netherlands) 10.16. Cotecna Inspection SA (Switzerland) 10.17. SOCOTEC Group (France) 10.18. SAI Global (Australia) 10.19. ALS Limited (Australia) 11. Key Findings 12. Industry Recommendations 13. Testing, Inspection and Certification Market: Research Methodology 14. Terms and Glossary