The Functional Safety Market size was valued at USD 4.91 Billion in 2023 and the total Functional Safety Market revenue is expected to grow at a CAGR of 3.83 % from 2024 to 2030, reaching nearly USD 6.39 Billion. The Functional Safety Market is experiencing robust growth in the current landscape, driven by a confluence of factors that prioritize safety in various industries. The global functional safety market is currently in a state of rapid expansion, underpinned by several key factors. With increasing automation across various industries, there's a growing emphasis on ensuring that safety systems are in place to prevent accidents and protect both humans and assets. This trend is driven by stringent government regulations and industry standards that mandate functional safety measures. Industries such as automotive, manufacturing, oil and gas, and healthcare are adopting functional safety solutions to mitigate risks. The ongoing digitization of industrial processes, the integration of IoT devices, and the advent of Industry 4.0 have further accelerated the adoption of functional safety systems. The ongoing emphasis on regulatory compliance and safety standards, such as ISO 26262 for automotive or IEC 61508 for general industries, is compelling businesses to invest in functional safety systems. Key market players like Siemens, Honeywell, and ABB are continually innovating and developing advanced safety solutions that leverage technologies such as artificial intelligence, machine learning, and real-time monitoring to enhance safety measures. Recent developments include the integration of safety features into industrial control systems and the development of more comprehensive safety frameworks. The functional safety market is expected to continue its robust growth in the coming years as industries prioritize safety alongside operational efficiency and compliance, making it a pivotal component of the broader Industrial Functional Safety landscape. Functional Safety Market Scope and Research Methodology: The research methodology employed in the Functional Safety Market analysis follows a comprehensive and systematic approach to gathering, assessing, and analyzing data. It begins with extensive secondary research, involving the review of existing literature, reports, and databases to gain a thorough understanding of the market landscape. Primary research is conducted through in-depth interviews with industry experts, key stakeholders, and market participants to collect first-hand insights, validate findings, and identify emerging trends. Quantitative data is obtained through surveys, questionnaires, and data collection from various sources. Market trends, drivers, and challenges are analyzed to provide a holistic view of the Functional Safety Market. Furthermore, both top-down and bottom-up approaches are utilized to estimate market size and revenue. The research process encompasses qualitative and quantitative assessments, offering a robust foundation for accurate and actionable insights. The gathered data is rigorously scrutinized, interpreted, and presented in a clear, concise, and comprehensive manner to support informed decision-making in the field of functional safety.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

IoT Integration Boosts Safety and Efficiency in the Functional Safety Market: The rapid proliferation of automation in industries like manufacturing, oil and gas, and chemical processing necessitates stringent safety measures. For instance, in the automotive sector, the growth of autonomous vehicles demands robust functional safety systems to ensure safe operations and risk mitigation. Increasing government regulations and safety standards, such as ISO 26262 for Automotive Functional Safety, compel companies to invest in functional safety solutions to meet compliance requirements, boosting market growth. With the advent of IoT and smart manufacturing, the need for integrated safety systems has surged. Companies like Rockwell Automation offer IoT-enabled functional safety solutions that enhance overall equipment efficiency while maintaining safety. Rapid industrialization in emerging markets like China and India creates significant opportunities for functional safety solutions. The demand for safety systems, exemplified by Siemens' expansion in these regions, continues to grow. In the aerospace and defense sectors, the growing complexity of systems, such as unmanned aerial vehicles (UAVs), necessitates advanced safety solutions. Honeywell's offerings for UAVs exemplify this trend. The energy sector's expansion, especially in renewable energy projects and nuclear power plants, propels the need for functional safety. Companies like ABB provide safety solutions for nuclear power plants, highlighting the sector's significance. The healthcare industry's reliance on life-critical medical devices necessitates robust safety systems. Advancements in medical technology, like robotic surgery, require stringent safety measures, as demonstrated by safety systems from companies like Medtronic. Growing awareness of the importance of functional safety and its role in risk reduction fosters market growth. Industries like pharmaceuticals are increasingly adopting safety measures in their production processes. Continuous technological innovations in functional safety solutions, including the integration of artificial intelligence and real-time Functional Safety Monitoring, drive market expansion. Companies like Schneider Electric offer next-generation safety solutions. The global interconnectedness of industries and the need for cross-border safety standards stimulate the demand for harmonized functional safety solutions. The recent cooperation between international organizations to create unified safety standards is a testament to this driver's importance.Shortage of Skilled Professionals Affects Safety System Maintenance: The intricacy of implementing functional safety measures, particularly in industries with diverse and complex systems, can pose a significant challenge. For example, in the aviation sector, integrating functional safety systems into aircraft with multiple components and systems requires meticulous planning and execution, which can lead to delays and increased costs. The adoption of functional safety systems often entails substantial upfront expenses. For instance, in the chemical processing industry, the implementation of safety instrumentation systems (SIS) can be costly, which may deter smaller companies from investing in these critical safety measures. The shortage of skilled professionals well-versed in functional safety engineering is a restraint. Without qualified experts, industries like nuclear power generation may face challenges in effectively maintaining and upgrading safety systems to meet evolving standards. The fast-paced evolution of technology can make it challenging for companies to keep functional safety systems up-to-date. In the Functional safety market in automotive sector, the integration of new sensor technologies and autonomous features demands constant adaptations to safety protocols. In industries where different equipment and systems need to work together seamlessly, ensuring the interoperability of functional safety systems can be a challenge. For example, in the oil and gas sector, integrating safety systems across various equipment from different manufacturers can be complex and may lead to compatibility issues. Varied safety standards and regulations across different regions can lead to complexities in compliance. Companies operating internationally, like those in the pharmaceutical sector, must navigate a maze of regional safety requirements, making global consistency a challenge. The collection and storage of sensitive data within functional safety systems can be a security risk, particularly in critical infrastructure like power grids or water treatment facilities. Cyberattacks on safety systems can result in significant disruptions, exemplified by the Stuxnet virus targeting Iran's nuclear facilities. Industries with established practices and traditional safety measures may resist transitioning to functional safety solutions. For instance, in the mining sector, where conventional safety protocols are deeply ingrained, convincing stakeholders to adopt new safety technologies can be challenging. Rising Demand for Comprehensive Safety Solutions in Industries: Advanced technology and functional safety create a safer, more efficient, and cost-effective industrial landscape. As industries increasingly prioritize functional safety, the demand for comprehensive safety solutions, including drives, safety devices, and networking components, is on the rise. These Functional Safety Solutions not only ensure the safety of equipment and personnel but also contribute to operational efficiency. Opportunity is the integration of safety functionalities into the machine's control system. By seamlessly incorporating safety measures, industries not only meet regulatory requirements but also save on costs associated with stand-alone safety systems. The all-compatible drives, equipped with built-in safety functions like safe torque off (STO), exemplify this trend. These systems are not only cost-effective but also promote a more streamlined and efficient safety approach. The introduction of advanced safety networking components, such as the CIP Safety I/O module, facilitates the seamless connection of sensors and actuators to industrial controllers, even in challenging environments. This technology ensures the safe exchange of data over a single Ethernet network, enhancing both safety and standard control data communication. The concept of smart proof testing through actionable diagnostics and safety parameters offers the potential to extend proof test intervals, reducing risks, lowering costs, and improving availability. The integration of smart sensors and instruments into the safety ecosystem can revolutionize safety practices. The opportunity for functional safety lies in the synergy of technology, compliance, and efficiency. By embracing these innovative safety solutions and streamlining safety practices, industries can achieve a safer and more profitable future. It's a path towards not only meeting safety requirements but also enhancing operational excellence in an increasingly complex industrial landscape.

Standard System Safety Integrity Architectural Metric Architectural Requirement Specific MCU Self-Test Requirements IEC 61508 Programmable E/E Systems SIL-1,2,3,4 SFF HFT>0 for SIL 4 No ISO 26262 Automotive ASIL-A, B, C, D SPFM/LFM No No EN 50129 Railway SIL-1,2,3,4 N/A Follow IEC 61508 CPU, Memory ISO 22201 Elevator SIL-1,2,3 N/A Dual channels for SIL3 CPU, Memory, Interrupt, Clock, I/O, Comm IEC 61800 Drive SIL-1,2,3 SIL4 Apply IEC 61508 SFF PFH (no PFD) IEC 62061 Machinery SIL 1,2,3 SIL4 Apply IEC 61508 SFF Supports ISO 13849 categories No IEC 61511 Process Automation SIL-1,2,3 SIL4 Apply IEC 61508 SFF See IEC 61508 No ISO 13849 Machinery PL a,b,c,d,e DC avg CAT B,1,2,3,4 No IEC 60730 Home Appliances Class A, B, C No Yes (Class C) CPU, Memory, Interrupt, Clock, I/O, Comms

Functional Safety Market Segment Analysis:

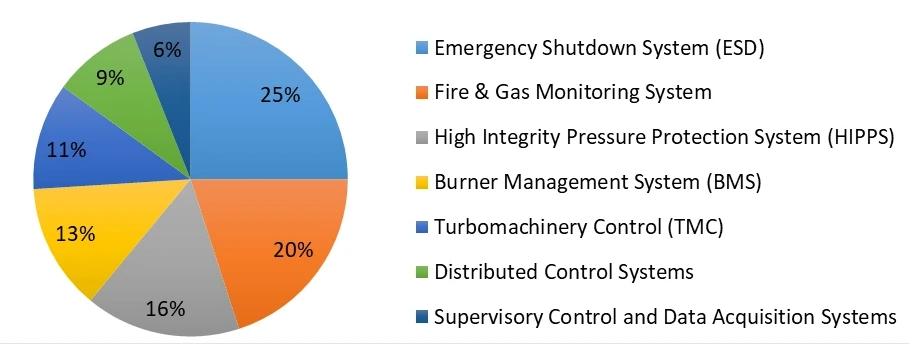

Based on System, The Functional Safety Market is segmented based on different safety systems, including Emergency Shutdown Systems (ESD), Fire and gas Monitoring Systems, High Integrity Pressure Protection Systems (HIPPS), Burner Management Systems (BMS), and Turbomachinery Control (TMC). These Functional Safety Software safety systems cater to various applications, with varying levels of adoption. Emergency Shutdown Systems (ESD) dominate the Functional Safety Market due to their extensive adoption in high-risk industries like oil and gas, where rapid response to critical situations is a top priority. Emergency Shutdown Systems are widely adopted in industries where rapid response to critical situations is paramount, such as oil and gas and petrochemical plants. Their ability to shut down operations swiftly in an emergency makes them a dominant choice in these sectors. Fire and gas Monitoring Systems are crucial in industries where the detection and mitigation of fire and gas-related risks are vital, like chemical processing and power generation. These systems are extensively adopted to ensure the safety of personnel and assets. High Integrity Pressure Protection Systems (HIPPS) are prevalent in applications involving high-pressure equipment, notably in the oil and gas sector. They are adopted to prevent overpressure incidents, safeguarding both equipment and personnel. Burner Management Systems (BMS) find prominence in applications related to combustion processes, as seen in industries such as refineries and power plants.Functional Safety Market, in 2023 (%)

Their adoption is driven by the need for controlled and safe combustion. Turbomachinery Control (TMC) systems are crucial in industries like aerospace and energy, where precise control and monitoring of turbomachinery are essential. These systems play a dominant role in ensuring operational safety and efficiency.Functional Safety Market Regional Insights:

The Functional Safety Market exhibits distinctive regional insights, with variations in large producing and consuming regions. Europe emerges as a significant hub for functional safety solutions, with countries like Germany and the United Kingdom leading the way. These nations host a plethora of manufacturers and suppliers, contributing to the development of advanced safety technologies. North America, particularly the United States, is a noteworthy producer, emphasizing technological innovation and the development of safety systems. The presence of major industrial players in these regions is a driving force behind their production capabilities. North America stands out as a substantial consumer of functional safety solutions, with industries like automotive, aerospace, and energy showing strong adoption rates. The region's stringent adherence to safety standards and the continuous quest for technological advancements in safety measures contribute to this high consumption. Europe, with its focus on automotive and industrial safety, is another significant consumer region, notably driven by the automotive sector's demand for advanced safety features. Asia-Pacific, including countries like China and Japan, is witnessing an upsurge in the consumption of functional safety solutions, particularly in the rapidly growing automotive and manufacturing sectors. As emerging economies modernize their industries, the adoption of safety systems is on the rise. North America and Europe lead in consumption, and Asia-Pacific's increasing adoption, driven by its growing industrial landscape, positions it as a dynamic consumer region in the Functional Safety Market.Competitive Landscape

Key Players of the Functional Safety Market profiled in the report are ABB Ltd., Balluff GmbH, Emerson Electric Co., Endress+Hauser Management AG, General Electric Co, Honeywell International Inc., Intel Corporation, Moore Industries, Omron Corporation, PHOENIX CONTACT, Renesas Electronics Corporation., Rockwell Automation Inc, Schneider Electric SE, Siemens AG, TUV Rheinland, Yokogawa Electric Corporation. This provides huge opportunities to serve many End-users and customers and expand the Functional Safety Market. In July 2022, ABB Ltd. and SKF initiated a memorandum of understanding (MoU) with the aim of exploring potential collaboration in the automation of manufacturing processes. This strategic partnership intends to leverage synergies to identify and evaluate solutions that can bolster production capabilities and elevate production efficiency for their clients. In September 2022, Yokogawa Electric Corporation made an acquisition that underscores its commitment to providing comprehensive solutions. They announced the purchase of Votiva Singapore Pte Ltd, a well-established IT consultancy firm in Southeast Asia specializing in the deployment of enterprise resource planning (ERP) and customer relationship management (CRM) software. This move bolsters Yokogawa's ability to offer end-to-end Functional Safety Services in the information technology domain. In May 2022, Schneider Electric SE introduced a transformative addition to its portfolio, the Grid Operations Platform as a Service. As part of their EcoStruxure Grid lineup, this platform offers a cloud-based environment for grid planning and operations solutions. Leveraging the capabilities of the Microsoft Azure open cloud computing platform, Schneider Electric is providing a flexible and scalable solution for hosting and managing critical grid operations.Functional Safety Market Scope: Inquiry Before Buying

Functional Safety Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.91 Bn. Forecast Period 2024 to 2030 CAGR: 3.83 % Market Size in 2030: US $ 6.39 Bn. Segments Covered: by System Emergency Shutdown System (ESD) Fire & Gas Monitoring System High Integrity Pressure Protection System (HIPPS) Burner Management System (BMS) Turbomachinery Control (TMC) by Devices Safety Sensors Safety Controllers/Modules/Relays Programmable Safety Systems Safety Switches Others by End-User Oil & Gas ower Generation Chemicals Food & Beverages Water & Wastewater Pharmaceuticals Metal & Mining Others Functional Safety Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Functional Safety Market, Key Players are

1. ABB Ltd. 2. Balluff GmbH 3. Emerson Electric Co 4. Endress+Hauser Management AG 5. General Electric Co 6. HIMA Paul Hildebrandt GmbH 7. Honeywell International Inc. 8. Intel Corporation 9. Mangan Software Solutions 10. Moore Industries 11. Omron Corporation 12. Pepperl+Fuchs Factory Automation Pvt. Ltd. 13. Perforce 14. PHOENIX CONTACT 15. Renesas Electronics Corporation. 16. Rockwell Automation Inc 17. Schneider Electric SE 18. Siemens AG 19. TUV Rheinland 20. Yokogawa Electric Corporation FAQs: 1. What are the growth drivers for the Functional Safety Market? Ans. IoT Integration Boosts Safety and Efficiency in the Functional Safety Market and is expected to be the major driver. 2. What is the major Opportunity for the Functional Safety Market growth? Ans. The rising Demand for Comprehensive Safety Solutions in Industries is expected to be a major Opportunity in the Functional Safety Market. 3. Which country is expected to lead the Functional Safety Market during the forecast period? Ans. Europe is expected to lead the Functional Safety Market during the forecast period. 4. What is the projected market size and growth rate of the Functional Safety Market? Ans. The Functional Safety Market size was valued at USD 4.91 Billion in 2023 and the total Functional Safety Market revenue is expected to grow at a CAGR of 3.83 % from 2024 to 2030, reaching nearly USD 6.39 Billion. 5. What segments are covered in the Functional Safety Market report? Ans. The segments covered in the Functional Safety Market report are by System, Devices, End-Users, and Region.

1. Functional Safety Market: Research Methodology 2. Functional Safety Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Functional Safety Market: Dynamics 3.1 Functional Safety Market Trends by Region 3.1.1 Functional Safety Market Trends 3.1.2 North America Functional Safety Market Trends 3.1.3 Europe Functional Safety Market Trends 3.1.4 Asia Pacific Functional Safety Market Trends 3.1.5 Middle East and Africa Functional Safety Market Trends 3.1.6 South America Functional Safety Market Trends 3.2 Functional Safety Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Functional Safety Market Drivers 3.2.1.2 North America Functional Safety Market Restraints 3.2.1.3 North America Functional Safety Market Opportunities 3.2.1.4 North America Functional Safety Market Challenges 3.2.2 Europe 3.2.2.1 Europe Functional Safety Market Drivers 3.2.2.2 Europe Functional Safety Market Restraints 3.2.2.3 Europe Functional Safety Market Opportunities 3.2.2.4 Europe Functional Safety Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Functional Safety Market Drivers 3.2.3.2 Asia Pacific Functional Safety Market Restraints 3.2.3.3 Asia Pacific Functional Safety Market Opportunities 3.2.3.4 Asia Pacific Functional Safety Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Functional Safety Market Drivers 3.2.4.2 Middle East and Africa Functional Safety Market Restraints 3.2.4.3 Middle East and Africa Functional Safety Market Opportunities 3.2.4.4 Middle East and Africa Functional Safety Market Challenges 3.2.5 South America 3.2.5.1 South America Functional Safety Market Drivers 3.2.5.2 South America Functional Safety Market Restraints 3.2.5.3 South America Functional Safety Market Opportunities 3.2.5.4 South America Functional Safety Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Functional Safety Industry 3.8 The Global Pandemic and Redefining of The Functional Safety Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Functional Safety Trade Analysis (2017-2023) 3.11.1 Global Import of Functional Safety 3.11.2 Global Export of Functional Safety 3.12 Functional Safety Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Analysis by Size of Manufacturer 4. Functional Safety Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Functional Safety Market Size and Forecast, By System (2023-2030) 4.1.1 Emergency Shutdown System (ESD) 4.1.2 Fire & Gas Monitoring System 4.1.3 High Integrity Pressure Protection System (HIPPS) 4.1.4 Burner Management System (BMS) 4.1.5 Turbomachinery Control (TMC) 4.2 Functional Safety Market Size and Forecast, By Devices (2023-2030) 4.2.1 Safety Sensors 4.2.2 Safety Controllers/Modules/Relays 4.2.3 Programmable Safety Systems 4.2.4 Safety Switches 4.2.5 Others 4.3 Functional Safety Market Size and Forecast, By End User (2023-2030) 4.3.1 Oil & Gas 4.3.2 Power Generation 4.3.3 Chemicals 4.3.4 Food & Beverages 4.3.5 Water & Wastewater 4.3.6 Pharmaceuticals 4.3.7 Metal & Mining 4.3.8 Others 4.4 Functional Safety Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Functional Safety Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Functional Safety Market Size and Forecast, By System (2023-2030) 5.1.1 Emergency Shutdown System (ESD) 5.1.2 Fire & Gas Monitoring System 5.1.3 High Integrity Pressure Protection System (HIPPS) 5.1.4 Burner Management System (BMS) 5.1.5 Turbomachinery Control (TMC) 5.2 North America Functional Safety Market Size and Forecast, By Devices (2023-2030) 5.2.1 Safety Sensors 5.2.2 Safety Controllers/Modules/Relays 5.2.3 Programmable Safety Systems 5.2.4 Safety Switches 5.2.5 Others 5.3 North America Functional Safety Market Size and Forecast, By End User (2023-2030) 5.3.1 Oil & Gas 5.3.2 Power Generation 5.3.3 Chemicals 5.3.4 Food & Beverages 5.3.5 Water & Wastewater 5.3.6 Pharmaceuticals 5.3.7 Metal & Mining 5.3.8 Others 5.4 North America Functional Safety Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Functional Safety Market Size and Forecast, By System (2023-2030) 5.4.1.1.1 Emergency Shutdown System (ESD) 5.4.1.1.2 Fire & Gas Monitoring System 5.4.1.1.3 High Integrity Pressure Protection System (HIPPS) 5.4.1.1.4 Burner Management System (BMS) 5.4.1.1.5 Turbomachinery Control (TMC) 5.4.1.2 United States Functional Safety Market Size and Forecast, By Devices (2023-2030) 5.4.1.2.1 Safety Sensors 5.4.1.2.2 Safety Controllers/Modules/Relays 5.4.1.2.3 Programmable Safety Systems 5.4.1.2.4 Safety Switches 5.4.1.2.5 Others 5.4.1.3 United States Functional Safety Market Size and Forecast, By End User (2023-2030) 5.4.1.3.1 Oil & Gas 5.4.1.3.2 Power Generation 5.4.1.3.3 Chemicals 5.4.1.3.4 Food & Beverages 5.4.1.3.5 Water & Wastewater 5.4.1.3.6 Pharmaceuticals 5.4.1.3.7 Metal & Mining 5.4.1.3.8 Others 5.4.2 Canada 5.4.2.1 Canada Functional Safety Market Size and Forecast, By System (2023-2030) 5.4.2.1.1 Emergency Shutdown System (ESD) 5.4.2.1.2 Fire & Gas Monitoring System 5.4.2.1.3 High Integrity Pressure Protection System (HIPPS) 5.4.2.1.4 Burner Management System (BMS) 5.4.2.1.5 Turbomachinery Control (TMC) 5.4.2.2 Canada Functional Safety Market Size and Forecast, By Devices (2023-2030) 5.4.2.2.1 Safety Sensors 5.4.2.2.2 Safety Controllers/Modules/Relays 5.4.2.2.3 Programmable Safety Systems 5.4.2.2.4 Safety Switches 5.4.2.2.5 Others 5.4.2.3 Canada Functional Safety Market Size and Forecast, By End User (2023-2030) 5.4.2.3.1 Oil & Gas 5.4.2.3.2 Power Generation 5.4.2.3.3 Chemicals 5.4.2.3.4 Food & Beverages 5.4.2.3.5 Water & Wastewater 5.4.2.3.6 Pharmaceuticals 5.4.2.3.7 Metal & Mining 5.4.2.3.8 Others 5.4.3 Mexico 5.4.3.1 Mexico Functional Safety Market Size and Forecast, By System (2023-2030) 5.4.3.1.1 Emergency Shutdown System (ESD) 5.4.3.1.2 Fire & Gas Monitoring System 5.4.3.1.3 High Integrity Pressure Protection System (HIPPS) 5.4.3.1.4 Burner Management System (BMS) 5.4.3.1.5 Turbomachinery Control (TMC) 5.4.3.2 Mexico Functional Safety Market Size and Forecast, By Devices (2023-2030) 5.4.3.2.1 Safety Sensors 5.4.3.2.2 Safety Controllers/Modules/Relays 5.4.3.2.3 Programmable Safety Systems 5.4.3.2.4 Safety Switches 5.4.3.2.5 Others 5.4.3.3 Mexico Functional Safety Market Size and Forecast, By End User (2023-2030) 5.4.3.3.1 Oil & Gas 5.4.3.3.2 Power Generation 5.4.3.3.3 Chemicals 5.4.3.3.4 Food & Beverages 5.4.3.3.5 Water & Wastewater 5.4.3.3.6 Pharmaceuticals 5.4.3.3.7 Metal & Mining 5.4.3.3.8 Others 6. Europe Functional Safety Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Functional Safety Market Size and Forecast, By System (2023-2030) 6.2 Europe Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.3 Europe Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4 Europe Functional Safety Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.1.2 United Kingdom Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.1.3 United Kingdom Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.2 France 6.4.2.1 France Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.2.2 France Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.2.3 France Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.3.2 Germany Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.3.3 Germany Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.4.2 Italy Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.4.3 Italy Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.5.2 Spain Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.5.3 Spain Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.6.2 Sweden Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.6.3 Sweden Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.7.2 Austria Functional Safety Market Size and Forecast, By Devices (2023-2030) 6.4.7.3 Austria Functional Safety Market Size and Forecast, By End User (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Functional Safety Market Size and Forecast, By System (2023-2030) 6.4.8.2 Rest of Europe Functional Safety Market Size and Forecast, By Devices (2023-2030). 6.4.8.3 Rest of Europe Functional Safety Market Size and Forecast, By End User (2023-2030) 7. Asia Pacific Functional Safety Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Functional Safety Market Size and Forecast, By System (2023-2030) 7.2 Asia Pacific Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.3 Asia Pacific Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4 Asia Pacific Functional Safety Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.1.2 China Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.1.3 China Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.2.2 S Korea Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.2.3 S Korea Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.3.2 Japan Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.3.3 Japan Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.4 India 7.4.4.1 India Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.4.2 India Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.4.3 India Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.5.2 Australia Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.5.3 Australia Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.6.2 Indonesia Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.6.3 Indonesia Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.7.2 Malaysia Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.7.3 Malaysia Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.8.2 Vietnam Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.8.3 Vietnam Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.9.2 Taiwan Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.9.3 Taiwan Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.10.2 Bangladesh Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.10.3 Bangladesh Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.11.2 Pakistan Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.11.3 Pakistan Functional Safety Market Size and Forecast, By End User (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Functional Safety Market Size and Forecast, By System (2023-2030) 7.4.12.2 Rest of Asia Pacific Functional Safety Market Size and Forecast, By Devices (2023-2030) 7.4.12.3 Rest of Asia Pacific Functional Safety Market Size and Forecast, By End User (2023-2030) 8. Middle East and Africa Functional Safety Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Functional Safety Market Size and Forecast, By System (2023-2030) 8.2 Middle East and Africa Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.3 Middle East and Africa Functional Safety Market Size and Forecast, By End User (2023-2030) 8.4 Middle East and Africa Functional Safety Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Functional Safety Market Size and Forecast, By System (2023-2030) 8.4.1.2 South Africa Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.4.1.3 South Africa Functional Safety Market Size and Forecast, By End User (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Functional Safety Market Size and Forecast, By System (2023-2030) 8.4.2.2 GCC Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.4.2.3 GCC Functional Safety Market Size and Forecast, By End User (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Functional Safety Market Size and Forecast, By System (2023-2030) 8.4.3.2 Egypt Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.4.3.3 Egypt Functional Safety Market Size and Forecast, By End User (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Functional Safety Market Size and Forecast, By System (2023-2030) 8.4.4.2 Nigeria Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.4.4.3 Nigeria Functional Safety Market Size and Forecast, By End User (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Functional Safety Market Size and Forecast, By System (2023-2030) 8.4.5.2 Rest of ME&A Functional Safety Market Size and Forecast, By Devices (2023-2030) 8.4.5.3 Rest of ME&A Functional Safety Market Size and Forecast, By End User (2023-2030) 9. South America Functional Safety Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Functional Safety Market Size and Forecast, By System (2023-2030) 9.2 South America Functional Safety Market Size and Forecast, By Devices (2023-2030) 9.3 South America Functional Safety Market Size and Forecast, By End User (2023-2030) 9.4 South America Functional Safety Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Functional Safety Market Size and Forecast, By System (2023-2030) 9.4.1.2 Brazil Functional Safety Market Size and Forecast, By Devices (2023-2030) 9.4.1.3 Brazil Functional Safety Market Size and Forecast, By End User (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Functional Safety Market Size and Forecast, By System (2023-2030) 9.4.2.2 Argentina Functional Safety Market Size and Forecast, By Devices (2023-2030) 9.4.2.3 Argentina Functional Safety Market Size and Forecast, By End User (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Functional Safety Market Size and Forecast, By System (2023-2030) 9.4.3.2 Rest Of South America Functional Safety Market Size and Forecast, By Devices (2023-2030) 9.4.3.3 Rest Of South America Functional Safety Market Size and Forecast, By End User (2023-2030) 10. Functional Safety Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 Production Capacity 10.3.7 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Functional Safety Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 ABB Ltd. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Balluff GmbH 11.3 Emerson Electric Co 11.4 Endress+Hauser Management AG 11.5 General Electric Co 11.6 HIMA Paul Hildebrandt GmbH 11.7 Honeywell International Inc. 11.8 Intel Corporation 11.9 Mangan Software Solutions 11.10 Moore Industries 11.11 Omron Corporation 11.12 Pepperl+Fuchs Factory Automation Pvt. Ltd. 11.13 Perforce 11.14 PHOENIX CONTACT 11.15 Renesas Electronics Corporation. 11.16 Rockwell Automation Inc 11.17 Schneider Electric SE 11.18 Siemens AG 11.19 TUV Rheinland 11.20 Yokogawa Electric Corporation 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary