Tempered Glass Cutting Machine Market was valued at US$ 3691.5 Mn. in 2022 and the total revenue is expected to grow at 5.7% of CAGR through 2023 to 2029, reaching nearly US$ 5441.72 Mn.Tempered Glass Cutting Machine Market Overview:

Tempered glass cutting machines are used to cut tempered glass, which is also known as toughened glass. As compared to regular or annealed glass, tempered glass is nearly four times stronger. It is created by thermally processing annealed glass to produce edges with at least 9700 psi of edge compression and compressive stresses on the surface between 11,000 and 20,000 pounds per square inch (psi). Thanks to its robustness and safety features, tempered glass is widely used in modern buildings. Tempered glass cutting machine is high in demand thanks to the machine having compact footprint, easy and safe operation, high speed and precision, high-cost performance, high safety, high cutting rate, good stability, full function, and saving manpower. Tempered glass cutting machine automatically load and cut the glass with its innovative mechanical structure, which supports glass or micro sensitive cutting and system optimization. They also increase the machine’s stability and enhance the quality, which have been driving the market for Tempered glass cutting machine. Tempered glass cutting machine can carry out automated glass loading, automatic cutting, automatic placement, and automatic optimization. CMS Glass Machinery, Intermac, Biesse Group, Bottero S.p.A., Tuomas, Vetromac SRL are some of the market’s key players, which are studied, analysed and benchmarked in the report. The report covered details analyses of these market key players by region and their supply chain strategy in detailed.To know about the Research Methodology :- Request Free Sample Report

Tempered Glass Cutting Machine Market Dynamics:

Technological advancement creating opportunities for new tempered glass cutting machine market Recently, there have been some significant developments in the field of glass tempering cutting machine technologies. Key manufacturers are introducing new technologies and innovations to automate the flat tempering process, including an online stress calculation system that uses observed process data to determine temperature and stress distribution in the tempering process's quenching phase. With process control without parameters, the tempering autopilot requires less operator input. Customers that use these most recent improvements benefit from improved bed utilization, which raises energy efficiency and capacity and improves quality, repeatability, and operational safety. Every piece of equipment has the ability to manage its predictive maintenance and recommend spare parts as necessary based on data. The increased utilization of structural interlayers is a new development in flat lamination. The processing of this sort of glass has been made possible by Glaston's revolutionary convection control technology, which even with complicated laminates gives a substantially larger working window. The lamination process is expected to also include a high level of automation. Instead of requiring human modifications from the operator, the oven learns to attain optimal functioning through the lamination process autopilot to drive the tempered glass cutting machine market during the forecast period. Challenges faced by machine manufactures The global market for tempered glass cutting machine systems is impacted by factors including high operating expenses, expensive initial expenditures, and lack of transportation. Another significant factor harming the worldwide market is the fact that toughened glass cannot be resized, recut, or otherwise modified once it has been tempered. Some of the APEJ's solar manufacturers are currently experiencing a period of financial collapse. This is a result of Chinese producers' low prices and the government's preference for cheap electricity over the domestic industry. The market for local manufacturers is impacted by the rise in Chinese manufacturers' sales in APEJ and the APEJ subcontinent. Advanced building and construction penetrate the tempered glass cutting machine market The total tempered glass machine market in China is expected to grow at an annual growth rate of 4.2% from 2022 to 2032 due to increased production and consumption of flat tempered glass because of the increasing automotive and construction industries. Since China is the world's top manufacturer of tempered flat glass, sales of glass tempering equipment there have indirectly increased. In order to make goods that fulfill production goals and environmental regulations, several Chinese manufacturers have made adjustments. Building and construction applications are mostly responsible for the country's rapid increase in demand for flat glass. Although yearly growth was less than in 2018, the construction sector saw robust growth in 2019. The country’s economy grew with the help of the building industry. China was on track to achieve its 2020 goal of encouraging a continuous process of urbanization at a rate of 60%. Urbanization's increasing demand for housing and middle-class urban inhabitants' desire to better their living conditions may have a significant influence on the market's overall growth. As a result, demand for flat-tempered tempered glass is expected to increase exponentially over the next years as the country's housing industry grows. As a result, the demand for glass tempering machines is expected to grow during the forecast period. In addition, China has the largest automobile sector in the world, which is accepted to generate enormous demand in the future for the market that is being targeted globally. The demand of tempered glass cutting machines in automobile vehicles Tempered glass is float glass that has been tempered by a special process. Float glass undergoes a heating procedure before being quenched. Glass's quick cooling causes compressive tension on its surface and internal stress on its body. This assists the glass in becoming physically and thermally stronger than standard glass. It is stronger than a glass of the same thickness and resistant to tensile stress. Tempered automobile glass is extremely good in reducing impact-related damage. If the glass is broken by an external force, and, car safety will not be compromised because it shatters into little trashes. Tempered automotive glass is also extremely robust and effective at minimizing noise and vibrations inside the car. It also provides a clear view for a comfortable riding experience thanks to these features creating a high demand for the tempered glass cutting machine market. Temperlite-LT automobile glass from AIS Glass is typically used for side windows and rear windshields. This glass is sturdier and tougher than regular glass since it has undergone improved processing. It can also resist higher temperature differences, which improves performance and drive the tempered glass cutting machine market during the forecast period. Manufacturing automobile glass is a difficult process. It is also growing. According to the International Organization of Motor Vehicle Automakers, manufacturers manufactured an average of 90 million passenger automobiles and commercial vehicles each year during the last ten years. According to industry observers, that figure will rise gradually over the next decade. According to market research, the global automotive glass machine market will nearly double from $15.5 billion in 2021 to $31.1 billion in 2028. Because of the scale of the market, recyclers are coming up with new techniques to recover waste car glass and transform it into useful goods, lowering the industry's environmental impact and creating new oppurchunies for new market players. The report covered detailed analyses of recycling glass machines and market players globally.Tempered Glass Cutting Machine Market Segment Analysis:

Based on Automation Type, the Tempered Glass Cutting Machine Market is segmented into auto and semi-automatic machines. The automatic machine held the largest market share in 2021. The SprintCut series automatic glass cutting machine combines cutting-edge drive technology with decades of LiSEC technology in flat glass processing, and theses technology is creating oppurchinity for new tempered glass cutting machine market players during the forecast period. The linear drive mechanism ensures maximum cutting speed and exceptional dynamics in the highly demanding tempered glass cutting machine market. The highest acceleration is around 16 m/s2 and the maximum speed is approximately 310 m/min. With only a few moving components, the SprintCut provides optimum availability while requiring little maintenance and replacement part expenses. The high-performance line is further characterized by an integrated measurement system, which assures +/- 0.10 mm precision. The automated cutting pressure and updated grinding pressure control make operation even easier, particularly for companies that work with a wide range of glass kinds and coatings. Furthermore, automatically established pressures are communicated to the control system, allowing for dynamic countermeasures in the event of changes. Cutting oil and cutting wheel monitoring reveals usage and inform of a change in advance. Stock plates are automatically delivered through belt transport, and glass positioning aids provide all-automatic alignment. Designers cut without a zero cut as a regular feature also these automatic tempered glass cutting machine is more precise than semi-automatic glass cutting machine.The Asia Pacific region dominated the market with a 45 % share in 2021. Because of the region's rising car output and numerous automotive tempared glass machine manufacturers, China dominates the regional industry. Because of rising automotive demand and the existence of multiple automotive manufacturers in the region, the industry is rapidly growing in India, Thailand, and Malaysia. Europe had the second-largest market share, which may be ascribed to the region's growing electric car sales and tough automotive glass rules and regulations. This can be attributed to rapid growth in the car and construction industries, increased R&D spending, and favorable government backing. The bulk of glass industry technical leaders are headquartered in Europe and in china. The key trend identified in the glass industry is a focus on innovation and the creation of improved goods. Manufacturers are prioritizing the use of modern materials to achieve greater strength, compatibility with a wider range of applications, improved finishing, and recyclability. Furthermore, they are concentrating on creating low-cost manufacturing methods that can lead to large-scale product commercialization. During the forecast period, the glass tempering system market in Germany will be driven by the development of energy-efficient buildings and the rehabilitation of existing infrastructure projects.

Tempered Glass Cutting Machine Market Regional Insights:

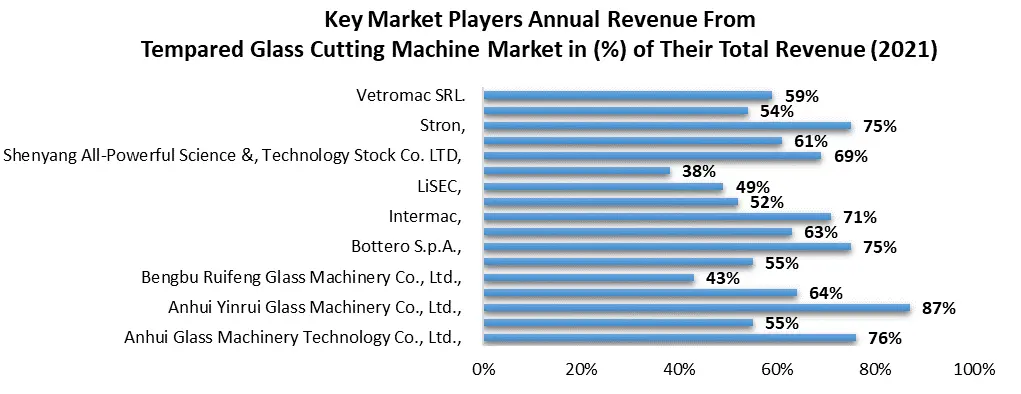

Competitive landscape

Key tempering glass cutting machine manufacturers are concentrating on growing their customer base by participating in and showcasing their innovative machines at high-profile events. In addition, they are constantly improving their existing product line, generating innovative high-quality trustworthy products, and aggressively participating in merger and acquisition operations to grow their global footprint. The companies are also working to automate the glass tempering process through the use of artificial intelligence. For example, Glaton Corporation revealed one of its recent breakthroughs in automating the flat tempering process on August 17, 2022. This is an online stress calculation solution that calculates temperature and stress distribution in the quench part of the tempering process using measured process data. Bengbu Ruifeng Glass Machinery Co., Ltd creates intelligent software used by robotic glass-cutting machines that comes in a variety of types. It is quick and simple to typeset and optimize. It is far more efficient than traditional cutting, which is extremely beneficial to traditional companies. People recognize the power and usefulness of automation when these high-quality elements are combined in a tempered glass cutting machine. Some automatic glass-cutting machines contain functions such as air flotation devices and pneumatic cymbals if specifically explored, to increase performance and provide consumers with considerate service. As can be seen, the present development of glass-cutting machine technology is quite urbane; customers may buy local brands without fear, and I believe they will be satisfied with their function.

Tempered Glass Cutting Machine Market Scope: Inquiry Before Buying

Tempered Glass Cutting Machine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3691.5 Mn. Forecast Period 2023 to 2029 CAGR: 5.7% Market Size in 2029: US $ 5441.72 Mn. Segments Covered: by Machine Power 1.Below 100W 2.100w and above by Automation 1.Semi-automatic 2.Automatic by Cut Type 1.Single piece 2.Multiple pieces Tempered Glass Cutting Machine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tempered Glass Cutting Machine Market, Key Players are:

1.Anhui Glass Machinery Technology Co., Ltd. 2.Anhui Jingling Glass Co., Ltd. 3.Anhui Yinrui Glass Machinery Co., Ltd 4.Beijing Pujinli Technology Co., Ltd 5.Bengbu Ruifeng Glass Machinery Co., Ltd. 6.Biesse Group 7.Bottero S.p.A. 8.CMS Glass Machinery 9. Intermac 10.Jinan Sintech CNC Equipment Co.,Ltd 11.LiSEC 12.Luoyang North Glass Technology Co., Ltd. 13. Shenyang All-Powerful Science &, Technology Stock Co. LTD 14. Solaronix SA 15. Stron 16.Turomas 17.Vetromac SRL Frequently Asked Questions: 1] What segments are covered in the Global Tempered Glass Cutting Machine Market report? Ans. The segments covered in the Tempered Glass Cutting Machine Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Tempered Glass Cutting Machine Market? Ans. The Asia Pasific region is expected to hold the highest share in the Tempered Glass Cutting Machine Market. 3] What is the market size of the Global Tempered Glass Cutting Machine Market by 2029? Ans. The market size of the Tempered Glass Cutting Machine Market by 2029 is expected to reach US$ 5451.72 Mn. 4] What is the forecast period for the Global Tempered Glass Cutting Machine Market? Ans. The forecast period for the Tempered Glass Cutting Machine Market is 2023-2029. 5] What was the market size of the Global Tempered Glass Cutting Machine Market in 2022? Ans. The market size of the Tempered Glass Cutting Machine Market in 2022 was valued at US$ 3691.5 Mn.

1. Global Tempered Glass Cutting Machine Market Size: Research Methodology 2. Global Tempered Glass Cutting Machine Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Tempered Glass Cutting Machine Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Tempered Glass Cutting Machine Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Tempered Glass Cutting Machine Market Size Segmentation 4.1. Global Tempered Glass Cutting Machine Market Size, by Machine Power (2022-2029) • Below 100W • 100w and above 4.2. Global Tempered Glass Cutting Machine Market Size, by Automation (2022-2029) • Semi-automatic • Automatic 4.3. Global Tempered Glass Cutting Machine Market Size, by Cut Type (2022-2029) • Single piece • Multiple piece 5. North America Tempered Glass Cutting Machine Market (2022-2029) 5.1. North America Tempered Glass Cutting Machine Market Size, by Machine Power (2022-2029) • Below 100W • 100w and above 5.2. North America Tempered Glass Cutting Machine Market Size, by Automation (2022-2029) • Semi-automatic • Automatic 5.3. North America Tempered Glass Cutting Machine Market Size, by Cut Type (2022-2029) • Single piece • Multiple piece 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Tempered Glass Cutting Machine Market (2022-2029) 6.1. European Tempered Glass Cutting Machine Market, by Machine Power (2022-2029) 6.2. European Tempered Glass Cutting Machine Market, by Automation (2022-2029) 6.3. European Tempered Glass Cutting Machine Market, by Cut Type (2022-2029) 6.4. European Tempered Glass Cutting Machine Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Tempered Glass Cutting Machine Market (2022-2029) 7.1. Asia Pacific Tempered Glass Cutting Machine Market, by Machine Power (2022-2029) 7.2. Asia Pacific Tempered Glass Cutting Machine Market, by Automation (2022-2029) 7.3. Asia Pacific Tempered Glass Cutting Machine Market, by Cut Type (2022-2029) 7.4. Asia Pacific Tempered Glass Cutting Machine Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Tempered Glass Cutting Machine Market (2022-2029) 8.1. Middle East and Africa Tempered Glass Cutting Machine Market, by Machine Power (2022-2029) 8.2. Middle East and Africa Tempered Glass Cutting Machine Market, by Automation (2022-2029) 8.3. Middle East and Africa Tempered Glass Cutting Machine Market, by Cut Type (2022-2029) 8.4. Middle East and Africa Tempered Glass Cutting Machine Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Tempered Glass Cutting Machine Market (2022-2029) 9.1. South America Tempered Glass Cutting Machine Market, by Machine Power (2022-2029) 9.2. South America Tempered Glass Cutting Machine Market, by Automation (2022-2029) 9.3. South America Tempered Glass Cutting Machine Market, by Cut Type (2022-2029) 9.4. South America Tempered Glass Cutting Machine Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Anhui Glass Machinery Technology Co., Ltd., 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Anhui Jingling Glass Co., Ltd., 10.3. Anhui Yinrui Glass Machinery Co., Ltd., 10.4. Beijing Pujinli Technology Co., Ltd., 10.5. Bengbu Ruifeng Glass Machinery Co., Ltd., 10.6. Biesse Group, 10.7. Bottero S.p.A., 10.8. CMS Glass Machinery, 10.9. Intermac, 10.10. Jinan Sintech CNC Equipment Co.,Ltd, 10.11. LiSEC, 10.12. Luoyang North Glass Technology Co., Ltd., 10.13. Shenyang All-Powerful Science &, Technology Stock Co. LTD, 10.14. Solaronix SA, 10.15. Stron, 10.16. Turomas, 10.17. Vetromac SRL.