Port Equipment Market was valued at US$ 8.26 Bn. in 2023. Global Port Equipment Market size is estimated to grow at a CAGR of 4.93%.Port Equipment Market Overview:

Port equipment is used to handle various types of material at the port, including cargo and machinery. Port equipment is a material handling solution for port infrastructure and application, which is used for loading and unloading commodities and passengers. The port equipment consists of reach tractors, goosenecks, stackers, forklift trucks, trailers, and ship-to-shore cranes. This equipment is very important for every operation and functioning of the port. The port equipment's effectiveness determines the amount of material, which port handles, and which ports receive the most cargo. Equipment with the most up-to-date technology is expected at the busiest ports to allow for optimal load management. As ports are the linking point between land and sea trade, port equipment is important in the broader trade and distribution network of products and services.To know about the Research Methodology :- Request Free Sample Report

Port Equipment Market Dynamics:

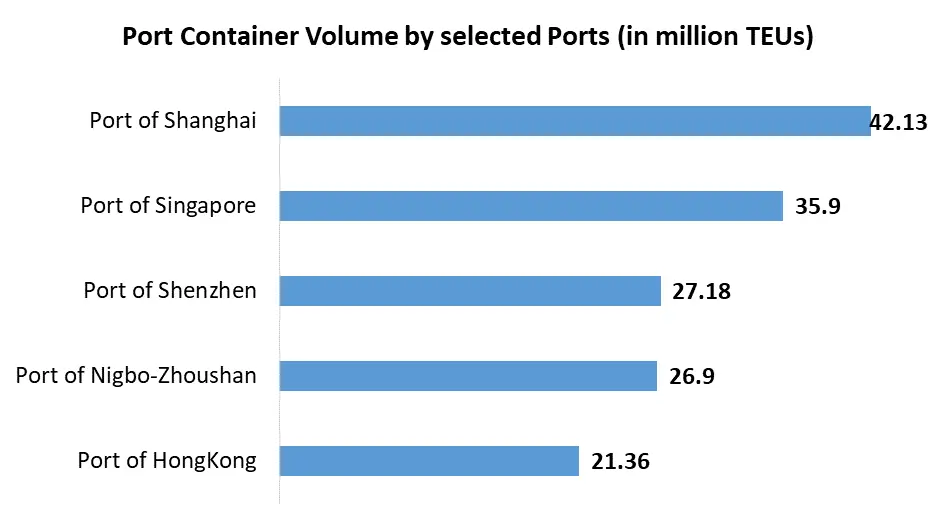

Growing seaborne trade across the globe, as port equipment is utilized to transfer cargo between ships and land-based modes of transportation, is driving the port equipment market growth. In addition, the growing quantity of container exports in emerging nations, such as India, and China are boosting the demand for port equipment. In recent years, the global shipping industry has experienced significant growth, with growing liner shipping at the forefront. This growth has been fueled by increased international trade volumes. As a result, the logistical requirements to manage this large volume are expanding, which in turn increased the usage of port material handling equipment. The use of forklift trucks, automated transit vehicles, ship loaders, reach stackers, cranes, and container lift trucks have increased with the development of ports across the globe, which in turn is expected to uplift the port equipment market growth during the forecast period. Growing awareness of carbon footprint and inclination toward environmentally friendly transportation is expected to increase the port equipment product demand during the forecast period. When compared to marine transportation, land and air transportation have a higher carbon impact. According to the International Chamber of Shipping (ICS), shipping emits 3-8 grams per tonne-kilometer, whereas trucks emit 80 grams per tonne-kilometer. As a result, the government's stringent regulations across the globe are limiting the carbon emission from port equipment leading to the adoption of alternate fuel for equipment. The ports are implementing alternative fuel equipment to reduce the logistical carbon impact, which in turn supports the market's growth. For instance, Europe has allocated more than US$ 4.5 million for the H2Port initiative, to adopt hydrogen fuel cell equipment at the ports. Different free-trade agreements, such as the Trans-Pacific Strategic Economic Partnership (TPSEP), NAFTA, AFTA, and other initiatives, have helped countries across the globe to boost their economies by increasing the import and export of goods and commodities through seaports. As a result, the market for port equipment is expected to grow significantly during the forecast period.

Port Equipment Market Segment Analysis:

Based on the Equipment Type, the Port Equipment Market is segmented into Mooring Systems, Tug Boats, Cranes, Ship loaders, Container Lift Trucks, and Others. The Cranes segment held the largest market share, accounting for 34.1% in 2023. The segment growth is attributed to the growing adoption of cranes in port, to reduce cost per move. Cranes enable port operators to handle a greater variety of vessels. To reduce noise and carbon emissions, port owners are replacing older cranes with advanced models. In addition, the current ongoing port expansion projects to accommodate a bigger number of boats are expected to fuel the port equipment market growth for this segment. The Ship loaders segment is expected to witness significant growth at a CAGR of 4.81% during the forecast period. The growing number of loading and unloading operations, leading to increasing use of ship loaders in port equipment types. It provides flexibility in handling large cargo at a faster rate of transfer. In addition, mobile ship loaders are being installed in several ports across the globe to improve operational efficiency, which in turn is expected to fuel the port equipment market growth for this segment. Based on the Application, the Port Equipment Market is segmented into Ship Handling, Bulk Handling, Container Handling, and Others. The Container Handling segment held the largest market share, accounting for 41% in 2023. The necessity for diverse port operations such as heavy lifting, stacking, loading, and unloading, among others, is driving the port equipment market growth for this segment. Manufacturers are also incorporating various auction procedures to improve the overall system's performance, which is expected to uplift the port equipment market growth for this segment during the forecast period.Port Equipment Market Regional Insights:

Asia Pacific region held the largest market share accounted for 53.7% in 2023. The region’s growth is attributed to the rise in maritime commerce transport activity in the region. With the presence of some of the world's most populous emerging countries, such as China and India, the region has seen significant government investment in the port industry. In India, almost 95% of trade by volume is carried out by sea, hence there is a need for more established and massive ports along with sufficient equipment in the region. For instance, the Indian government has launched Project Unnati in 2022, which aims to upgrade and increase the efficiency of 12 ports around the country. Yangshan Port, from China, opened an automated container terminal port in 2018 with a US$ 2.15 billion investment. As a result, the port equipment market is expected to grow significantly during the forecast period.North America region is expected to witness significant growth at a CAGR of 5.12% during the forecast period. The region’s growth is attributed to the increasing cargo commerce in countries such as the United States and Canada. According to the US Department of Commerce and Bureau of Labor Statistics, the material handling and logistics is one of America's largest and fastest-growing businesses. The annual consumption of material handling and logistics equipment and systems in the United States exceeds $156 billion, which in turn driving the port equipment market growth in the region. The objective of the report is to present a comprehensive analysis of the global Port Equipment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Port Equipment Market dynamic, structure by analyzing the market segments and projecting the Port Equipment Market size. Clear representation of competitive analysis of key players by End-Users, price, financial position, product portfolio, growth strategies, and regional presence in the Port Equipment Market make the report investor’s guide.

Port Equipment Market Scope: Inquire before buying

Port Equipment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.26 Bn. Forecast Period 2024 to 2030 CAGR: 4.93% Market Size in 2030: US $ 11.58 Bn. Segments Covered: by Type Electric Hybrid Diesel by Equipment Type Mooring Systems Tug Boats Cranes Ship loaders Container Lift Trucks Others by Application Ship Handling Bulk Handling Container Handling Others Port Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Port Equipment Market, Key Players are

1. ABB 2. American Crane & Equipment 3. Anhui Heli 4. Baltkran 5. Cavotec 6. CVS Ferrari 7. Famur Famak 8. Hyster 9. Kalmar 10. Konecranes 11. Liebherr 12. Lonking Holdings Limited 13. Mcnally Bharat Engineering 14. Prosertek 15. Sany 16. Til Limited 17. Timars Svets & Smide Ab 18. TTSFrequently Asked Questions:

1] What segments are covered in the Port Equipment Market report? Ans. The segments covered in the Port Equipment Market report are based on Type, by Equipment type, and Application. 2] Which region is expected to hold the highest share in the Port Equipment Market? Ans. The Asia Pacific region is expected to hold the highest share in the Port Equipment Market. 3] What is the market size of the Port Equipment Market by 2030? Ans. The market size of the Market by 2030 is US$ 11.58 Bn. 4] What is the forecast period for the Market? Ans. The forecast period for the Market is 2024-2030. 5] What was the market size of the Market in 2023? Ans. The market size of the Market in 2023 was US$ 8.26 Bn.

1. Port Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Port Equipment Market: Dynamics 2.1. Port Equipment Market Trends by Region 2.1.1. North America Port Equipment Market Trends 2.1.2. Europe Port Equipment Market Trends 2.1.3. Asia Pacific Port Equipment Market Trends 2.1.4. Middle East and Africa Port Equipment Market Trends 2.1.5. South America Port Equipment Market Trends 2.2. Port Equipment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Port Equipment Market Drivers 2.2.1.2. North America Port Equipment Market Restraints 2.2.1.3. North America Port Equipment Market Opportunities 2.2.1.4. North America Port Equipment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Port Equipment Market Drivers 2.2.2.2. Europe Port Equipment Market Restraints 2.2.2.3. Europe Port Equipment Market Opportunities 2.2.2.4. Europe Port Equipment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Port Equipment Market Drivers 2.2.3.2. Asia Pacific Port Equipment Market Restraints 2.2.3.3. Asia Pacific Port Equipment Market Opportunities 2.2.3.4. Asia Pacific Port Equipment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Port Equipment Market Drivers 2.2.4.2. Middle East and Africa Port Equipment Market Restraints 2.2.4.3. Middle East and Africa Port Equipment Market Opportunities 2.2.4.4. Middle East and Africa Port Equipment Market Challenges 2.2.5. South America 2.2.5.1. South America Port Equipment Market Drivers 2.2.5.2. South America Port Equipment Market Restraints 2.2.5.3. South America Port Equipment Market Opportunities 2.2.5.4. South America Port Equipment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Port Equipment Industry 2.8. Analysis of Government Schemes and Initiatives For Port Equipment Industry 2.9. Port Equipment Market Trade Analysis 2.10. The Global Pandemic Impact on Port Equipment Market 3. Port Equipment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Port Equipment Market Size and Forecast, by Type (2023-2030) 3.1.1. Electric 3.1.2. Hybrid 3.1.3. Diesel 3.2. Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 3.2.1. Mooring Systems 3.2.2. Tug Boats 3.2.3. Cranes 3.2.4. Ship loaders 3.2.5. Container Lift Trucks 3.2.6. Others 3.3. Port Equipment Market Size and Forecast, by Application (2023-2030) 3.3.1. Ship Handling 3.3.2. Bulk Handling 3.3.3. Container Handling 3.3.4. Others 3.4. Port Equipment Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Port Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Port Equipment Market Size and Forecast, by Type (2023-2030) 4.1.1. Electric 4.1.2. Hybrid 4.1.3. Diesel 4.2. North America Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 4.2.1. Mooring Systems 4.2.2. Tug Boats 4.2.3. Cranes 4.2.4. Ship loaders 4.2.5. Container Lift Trucks 4.2.6. Others 4.3. North America Port Equipment Market Size and Forecast, by Application (2023-2030) 4.3.1. Ship Handling 4.3.2. Bulk Handling 4.3.3. Container Handling 4.3.4. Others 4.4. North America Port Equipment Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Port Equipment Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Electric 4.4.1.1.2. Hybrid 4.4.1.1.3. Diesel 4.4.1.2. United States Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 4.4.1.2.1. Mooring Systems 4.4.1.2.2. Tug Boats 4.4.1.2.3. Cranes 4.4.1.2.4. Ship loaders 4.4.1.2.5. Container Lift Trucks 4.4.1.2.6. Others 4.4.1.3. United States Port Equipment Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Ship Handling 4.4.1.3.2. Bulk Handling 4.4.1.3.3. Container Handling 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Port Equipment Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Electric 4.4.2.1.2. Hybrid 4.4.2.1.3. Diesel 4.4.2.2. Canada Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 4.4.2.2.1. Mooring Systems 4.4.2.2.2. Tug Boats 4.4.2.2.3. Cranes 4.4.2.2.4. Ship loaders 4.4.2.2.5. Container Lift Trucks 4.4.2.2.6. Others 4.4.2.3. Canada Port Equipment Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Ship Handling 4.4.2.3.2. Bulk Handling 4.4.2.3.3. Container Handling 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Port Equipment Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Electric 4.4.3.1.2. Hybrid 4.4.3.1.3. Diesel 4.4.3.2. Mexico Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 4.4.3.2.1. Mooring Systems 4.4.3.2.2. Tug Boats 4.4.3.2.3. Cranes 4.4.3.2.4. Ship loaders 4.4.3.2.5. Container Lift Trucks 4.4.3.2.6. Others 4.4.3.3. Mexico Port Equipment Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Ship Handling 4.4.3.3.2. Bulk Handling 4.4.3.3.3. Container Handling 4.4.3.3.4. Others 5. Europe Port Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Port Equipment Market Size and Forecast, by Type (2023-2030) 5.2. Europe Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.3. Europe Port Equipment Market Size and Forecast, by Application (2023-2030) 5.4. Europe Port Equipment Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.1.3. United Kingdom Port Equipment Market Size and Forecast, by Application(2023-2030) 5.4.2. France 5.4.2.1. France Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.2.3. France Port Equipment Market Size and Forecast, by Application(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.3.3. Germany Port Equipment Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.4.3. Italy Port Equipment Market Size and Forecast, by Application(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.5.3. Spain Port Equipment Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.6.3. Sweden Port Equipment Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.7.3. Austria Port Equipment Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Port Equipment Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 5.4.8.3. Rest of Europe Port Equipment Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Port Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Port Equipment Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.3. Asia Pacific Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Port Equipment Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.1.3. China Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.2.3. S Korea Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.3.3. Japan Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.4.3. India Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.5.3. Australia Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.6.3. Indonesia Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.7.3. Malaysia Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.8.3. Vietnam Port Equipment Market Size and Forecast, by Application(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.9.3. Taiwan Port Equipment Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Port Equipment Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Port Equipment Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Port Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Port Equipment Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 7.3. Middle East and Africa Port Equipment Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Port Equipment Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Port Equipment Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 7.4.1.3. South Africa Port Equipment Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Port Equipment Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 7.4.2.3. GCC Port Equipment Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Port Equipment Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 7.4.3.3. Nigeria Port Equipment Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Port Equipment Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 7.4.4.3. Rest of ME&A Port Equipment Market Size and Forecast, by Application (2023-2030) 8. South America Port Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Port Equipment Market Size and Forecast, by Type (2023-2030) 8.2. South America Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 8.3. South America Port Equipment Market Size and Forecast, by Application(2023-2030) 8.4. South America Port Equipment Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Port Equipment Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 8.4.1.3. Brazil Port Equipment Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Port Equipment Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 8.4.2.3. Argentina Port Equipment Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Port Equipment Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Port Equipment Market Size and Forecast, by Equipment Type (2023-2030) 8.4.3.3. Rest Of South America Port Equipment Market Size and Forecast, by Application (2023-2030) 9. Global Port Equipment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Port Equipment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ABB 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. American Crane & Equipment 10.3. Anhui Heli 10.4. Baltkran 10.5. Cavotec 10.6. CVS Ferrari 10.7. Famur Famak 10.8. Hyster 10.9. Kalmar 10.10. Konecranes 10.11. Liebherr 10.12. Lonking Holdings Limited 10.13. Mcnally Bharat Engineering 10.14. Prosertek 10.15. Sany 10.16. Til Limited 10.17. Timars Svets & Smide Ab 10.18. TTS 11. Key Findings 12. Industry Recommendations 13. Port Equipment Market: Research Methodology 14. Terms and Glossary