The North America Synthetic Biology Market size was valued at USD 3.50 Billion in 2023 and the total North America Synthetic Biology revenue is expected to grow at a CAGR of 17.1 % from 2024 to 2030, reaching nearly USD 10.57 Billion by 2030.North America Synthetic Biology Market Overview:

Synthetic Biology is an interdisciplinary field of science and engineering that focuses on the design, construction, and modification of biological systems or components to achieve specific functions or outcomes. It involves the application of principles from biology, chemistry, engineering, and computer science to engineer new biological entities or redesign existing ones. The goal of synthetic biology is to create artificial biological systems with desired functionalities, enabling the development of novel applications in areas such as medicine, energy, agriculture, and industry. The field encompasses a wide range of techniques, including genetic engineering, DNA synthesis, and bioinformatics, to design and construct biological entities for practical purposes in the North America Synthetic Biology Market.To know about the Research Methodology :- Request Free Sample Report The North America Synthetic Biology market stands at the forefront of technological innovation and biological engineering, reflecting a dynamic landscape of scientific advancements and industrial applications. With a focus on redesigning and constructing biological components, organisms, or systems, the market has emerged as a pivotal player in shaping the future of diverse industries across the region. The North America Synthetic Biology market is characterized by robust growth driven by key factors such as substantial investments in research and development, a flourishing biotechnology industry, and strong funding support. This region's commitment to sustainable practices further propels the market, as it aligns with the escalating demand for bio-based products and environmentally friendly solutions. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global North America Synthetic Biology Market. Competitive Landscapes:

North America Synthetic Biology Market Dynamics

Research and Development Initiatives with Growing Biotechnology Industry Boosting the North America Synthetic Biology Market Growth The North America Synthetic Biology Market is experiencing significant growth due to robust investments in research and development (R&D). Various stakeholders, including academia, private institutions, and government-backed initiatives, are making concerted efforts to drive continuous innovation. This collaborative approach fosters the evolution of synthetic biology applications across sectors such as pharmaceuticals, agriculture, and industrial processes. A key driver for the North America Synthetic Biology Market is the well-established biotechnology industry in the region. Advances in genetic engineering, DNA synthesis, and gene editing technologies are fuelling the demand for synthetic biology solutions. These technological advancements find applications in crucial sectors like pharmaceuticals, agriculture, and industrial processes, contributing to the market's overall growth. The North America Synthetic Biology Market is witnessing substantial growth supported by strong funding from both public and private entities. This financial support enhances the ecosystem, providing companies and research institutions with the resources needed to undertake ambitious projects. The availability of funding facilitates the commercialization of synthetic biology applications, driving further growth in the market. Another significant driver for the adoption of synthetic biology in North America is the increasing consumer preference for sustainable and bio-based products. The ability to engineer microorganisms for the production of biofuels, biochemical, and sustainable materials aligns with the region's emphasis on environmentally friendly solutions. This growing demand for bio-based products is propelling the growth of the North America synthetic biology market. Ethical and Regulatory Challenges with Complexity in Genetic Engineering Restraining North America Synthetic Biology Market Growth The North America Synthetic Biology Market faces challenges related to ethical considerations and regulatory uncertainties. As technology evolves, concerns regarding biosecurity, environmental impact, and ethical use of synthetic biology applications are emerging. This has the potential to lead to more stringent regulations, creating hurdles and affecting the growth trajectory of the market. A notable restraint for the North America Synthetic Biology Market is the technical intricacies involved in genetic engineering and synthetic biology processes. The complexity of designing and manipulating biological systems poses a barrier to widespread adoption. This technical challenge limits the accessibility of synthetic biology solutions across a broader range of industries. The North America Synthetic Biology Market encounters the challenge of high initial costs associated with research and implementation. Investments in advanced laboratory equipment, specialized infrastructure, and skilled personnel create entry barriers, potentially deterring smaller companies and startups from entering the market. The upfront financial requirements impact the market's inclusivity. Public perception and acceptance play a crucial role in shaping the North America Synthetic Biology Market. Concerns related to genetically modified organisms (GMOs) and potential environmental consequences influence public opinion, impacting market dynamics. Building public trust and awareness becomes essential for market players to overcome these challenges and foster a positive perception of synthetic biology applications.North America Synthetic Biology Market Segment Analysis

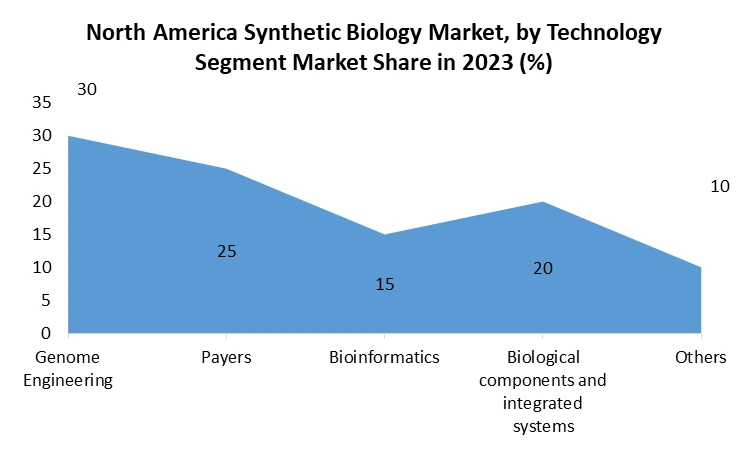

Tool: The North America Synthetic Biology Market segment analysis reveals that oligonucleotides and synthetic DNA have a significant market share, establishing themselves as the dominant segment in the region. The demand for these tools is driven by their pivotal role in gene synthesis, genetic engineering, and DNA assembly processes. This major segment continues to grow, with key trends including increased applications in gene editing technologies and DNA sequencing. Oligonucleotides and synthetic DNA are indispensable tools, contributing to the region's booming synthetic biology market. This segment, enzymes, they play a crucial role in synthetic biology applications, facilitating DNA replication, transcription, and translation. The market dynamics of synthetic biology enzymes show a growing demand, especially with the rising adoption of CRISPR-Cas9 technology and other gene editing tools. Continuous advancements in enzyme engineering further contribute to the expansion of this major segment in the North America Synthetic Biology Market. In the realm of cloning technology kits, the market landscape is characterized by various kits catering to different cloning techniques. Innovative technologies such as Golden Gate and Gibson Assembly are gaining traction, making this segment an emerging and major player in the North America Synthetic Biology Market. The demand for these kits is driven by their efficiency and ease of use, reflecting the region's emphasis on cutting-edge technologies. Synthetic cells, a cutting-edge segment, are positioned uniquely in the Market. Their ability to design and construct artificial cells for specific purposes attracts significant attention, positioning them as a major segment in the market. With applications in drug delivery, biofuel production, and environmental remediation, synthetic cells contribute to the regional market's dynamic growth. Chassis organisms, acting as hosts for synthetic biology constructs, play a crucial role in the North America Synthetic Biology Market. Key players in this segment focus on developing versatile and easily modifiable organisms, making it a major segment. Applications in various industries, including the production of bio-based chemicals, pharmaceuticals, and biofuels, drive the growth of this regional segment. Xeno-nucleic acids represent a niche segment in the North America Synthetic Biology Market, with ongoing research and development activities exploring their potential applications. This niche market involves the incorporation of non-natural nucleic acids into DNA or Rmolecules. As research progresses, xeno-nucleic acids may carve out their unique space in the regional synthetic biology market, reflecting the diversity within the broader industry.Technology: Genome Engineering takes the lead in the Market segment share, standing out as a dominant segment. Precise manipulation of genetic material for modifying or introducing specific traits positions this technology as a major driver for creating customized biological systems. Genome Engineering significantly contributes to the overall market growth, holding a prominent share. Within the technology segment of the North America Synthetic Biology Market, Payers technology showcases its dominance. Focusing on the design and construction of synthetic DNA sequences, it plays a critical role in influencing the market's technological landscape. The Payers segment holds a substantial share, emphasizing innovation and potential applications across various industries. Bioinformatics, a pivotal technology in the Market segment analysis, contributes to computational tools for analysing biological data. In the design and optimization of synthetic DNA sequences, predictive modelling, and data-driven decision-making, Bioinformatics enhances efficiency. This technology segment holds a significant share, making it an integral part of the market ecosystem. The Biological Components and Integrated Systems segment drive the North America Synthetic Biology Market's booming segment. Encompassing the assembly of synthetic biological parts into functional systems, it creates sophisticated and tailored entities. This technology segment holds a major share, increasing possibilities for applications across diverse sectors. In the technology segment's analysis for the Market, the category signifies emerging and niche technologies contributing to market dynamics. Novel methodologies, experimental techniques, or evolving technologies within this segment continuously add layers of innovation and complexity. The exploration and adoption of these technologies contribute to the dynamic nature of the market. Application: In the Market, the Chemicals application segment emerges as a major and dominant segment. Focusing on leveraging synthetic biology for specialty chemicals and bio-based materials, this segment significantly drives market growth. Engineered microorganisms contributing to sustainable chemical manufacturing processes position the Chemicals segment as a key player. Healthcare takes a prominent position in the North America Synthetic Biology Market's major segment within the application category. The use of synthetic biology in medical research, drug development, and personalized medicine highlights its transformative impact on the healthcare industry. This segment holds a substantial share, contributing to advancements in diagnostics and therapeutic interventions. The Agriculture application segment is a major contributor, emphasizing the role of synthetic biology in enhancing crop yield and developing bio-based agricultural solutions. Genetic modifications and engineered microorganisms contribute to sustainable agricultural practices, positioning the Agriculture segment as a significant driver in the market landscape. The others category within the application segment showcases diverse and evolving uses of synthetic biology across industries. This category, holding a considerable share, includes applications in environmental remediation, energy production, and other niche areas. The adaptability and potential for future growth of synthetic biology contribute to the significant share held by the others category.

North America Synthetic Biology Market Country Insights

The United States plays a pivotal role in the regional growth of the North America Synthetic Biology Market, particularly in the US. The country commands a dominant position, contributing a major share to market activities. With substantial investments in research and development, the US Synthetic Biology Market benefits from a robust ecosystem. The presence of leading biotechnology companies, academic institutions, and supportive government initiatives positions the United States as a key player in shaping the regional Synthetic Biology Market. The market in the United States demonstrates steady growth, driven by advancements in genome engineering, bioinformatics, and the widespread application of synthetic biology across diverse industries such as healthcare, agriculture, and chemicals. In the Market regional analysis, Canada emerges as a significant contributor, influencing the market share in the US, Canada, and Mexico. The Canadian synthetic biology landscape thrives on a well-established research infrastructure and collaborations between academic institutions and industry players. Canada's focus on sustainable practices aligns seamlessly with synthetic biology applications in bio-based products, agriculture, and healthcare. The market in Canada presents a potential for expansion, supported by ongoing innovations, favorable regulatory environments, and a growing awareness of the advantages offered by synthetic biology across the North American region. Mexico plays a noteworthy role in the North America Synthetic Biology Market regional analysis, contributing to market share in the US, Canada, and Mexico. The market in Mexico is characterized by an increasing adoption of synthetic biology technologies across various sectors. Although in the emerging stages, Mexico's strategic position as a hub for manufacturing and participation in regional research initiatives adds considerable value. The Synthetic Biology Market in Mexico showcases opportunities for penetration and growth, propelled by a proactive approach to technological advancements and applications in key industries such as healthcare and agriculture. The North America Synthetic Biology Market regional analysis highlights the distinctive contributions of the United States, Canada, and Mexico to overall market dynamics. The United States leads with a mature and dynamic synthetic biology landscape, while Canada and Mexico present growth potential and emerging opportunities. Recognizing variations in research capabilities, industry collaborations, and regulatory landscapes within these regions is crucial for stakeholders aiming to navigate and capitalize on the evolving Synthetic Biology Market in North America. Continuous monitoring of regional trends and swift adaptation to market conditions are essential elements for sustained success in this dynamic and innovative industry.North America Synthetic Biology Market Scope: Inquire before buying

North America Synthetic Biology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.50 Bn. Forecast Period 2024 to 2030 CAGR: 17.1% Market Size in 2030: US $ 10.57 Bn. Segments Covered: by Product Oligonucleotides and Synthetic DNA Enzymes Cloning Technologies Kits Synthetic Cells Chassis Organisms Xeno-nucleic Acids by Technology Genome Engineering Payers Bioinformatics Biological components and integrated systems Others by Application Chemicals Healthcare Agriculture Others North America Synthetic Biology Market by North America:

United States Canada MexicoNorth America Synthetic Biology Market Key Players:

Leading Key Players in United States: 1. Amyris, Inc. (Emeryville, California) 2. Ginkgo Bioworks (Boston, Massachusetts) 3. Intrexon Corporation (Germantown, Maryland) 4. Zymergen Inc. (Emeryville, California) 5. Twist Bioscience Corporation (South San Francisco, California) Prominent Key Player in Canada: 1. Genome Compiler Corporation (Montreal, Quebec) 2. Conagen Inc. (Bedford, Nova Scotia) 3. Sustainable Development Technology Canada (SDTC) (Ottawa, Ontario) 4. Bioscience Solutions Inc. (Toronto, Ontario) Major Key Players in Mexico: 1. Mexel Industries S.A. de C.V. (Mexico City, Mexico) 2. CINVESTAV-IPN (Center for Research and Advanced Studies of the National Polytechnic Institute) (Mexico City, Mexico) 3. PROBIOMED S.A. de C.V. (Mexico City, Mexico) FAQ’s: 1. What is the Market? Ans: The Market refers to the application of engineering principles to design and construct biological components, organisms, or systems for various industrial applications. 2. What are the key growth factors influencing the market in North America? Ans: Factors such as robust research and development initiatives, a growing biotechnology industry, strong funding support, and an increasing demand for bio-based products are driving the growth of the Synthetic Biology Market in North America. 3. Which countries play a significant role in the Market? Ans: The United States, Canada, and Mexico are key participants in the Market, each contributing to the market's dynamics and growth. 4. What are the major product segments in the North America Synthetic Biology Market? Ans: The market is segmented into Enabling and Core products, with enabling products providing tools and technologies, while Core products represent foundational components developed through synthetic biology processes. 5. What applications are driving the demand for synthetic biology in North America? Ans: The major applications include Chemicals, Healthcare, Agriculture, and various other sectors, where synthetic biology is utilized for producing specialty chemicals, advancing medical research, enhancing agriculture, and more.

1. North America Synthetic Biology Market: Research Methodology 2. North America Synthetic Biology Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. North America Synthetic Biology Market: Dynamics 3.1. North America North America Synthetic Biology Market Trends 3.2. North America Synthetic Biology Market Dynamics by Region 3.2.1. North America North America Synthetic Biology Market Drivers 3.2.2. North America North America Synthetic Biology Market Restraints 3.2.3. North America North America Synthetic Biology Market Opportunities 3.2.4. North America North America Synthetic Biology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.5.1. Regulatory Landscape by North America 3.6. Key Opinion Leader Analysis For North America Synthetic Biology Market 3.7. Analysis of Government Schemes and Initiatives For North America Synthetic Biology Market 3.8. The Pandemic Impact on North America Synthetic Biology Market 4. North America North America Synthetic Biology Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America North America Synthetic Biology Market Size and Forecast, By Tool (2023-2030) 4.1.1. Oligonucleotides and Synthetic DNA 4.1.2. Enzymes 4.1.3. Cloning Technologies Kits 4.1.4. Synthetic Cells 4.1.5. Chassis Organisms 4.1.6. Xeno-nucleic Acids 4.2. North America North America Synthetic Biology Market Size and Forecast, By Technology (2023-2030) 4.2.1. Genome Engineering 4.2.2. Payers 4.2.3. Bioinformatics 4.2.4. Biological components and integrated systems 4.2.5. Others 4.3. North America North America Synthetic Biology Market Size and Forecast, By Application (2023-2030) 4.3.1. Chemicals 4.3.2. Healthcare 4.3.3. Agriculture 4.3.4. Others 4.4. North America North America Synthetic Biology Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States North America Synthetic Biology Market Size and Forecast, By Tool (2023-2030) 4.4.1.1.1. Oligonucleotides and Synthetic DNA 4.4.1.1.2. Enzymes 4.4.1.1.3. Cloning Technologies Kits 4.4.1.1.4. Synthetic Cells 4.4.1.1.5. Chassis Organisms 4.4.1.1.6. Xeno-nucleic Acids 4.4.1.2. United States North America Synthetic Biology Market Size and Forecast, By Technology (2023-2030) 4.4.1.2.1. Genome Engineering 4.4.1.2.2. Payers 4.4.1.2.3. Bioinformatics 4.4.1.2.4. Biological components and integrated systems 4.4.1.2.5. Others 4.4.1.3. United States North America Synthetic Biology Market Size and Forecast, By Application (2023-2030) 4.4.1.3.1. Chemicals 4.4.1.3.2. Healthcare 4.4.1.3.3. Agriculture 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada North America Synthetic Biology Market Size and Forecast, By Tool (2023-2030) 4.4.2.1.1. Oligonucleotides and Synthetic DNA 4.4.2.1.2. Enzymes 4.4.2.1.3. Cloning Technologies Kits 4.4.2.1.4. Synthetic Cells 4.4.2.1.5. Chassis Organisms 4.4.2.1.6. Xeno-nucleic Acids 4.4.2.2. Canada North America Synthetic Biology Market Size and Forecast, By Technology (2023-2030) 4.4.2.2.1. Genome Engineering 4.4.2.2.2. Payers 4.4.2.2.3. Bioinformatics 4.4.2.2.4. Biological components and integrated systems 4.4.2.2.5. Others 4.4.2.3. Canada North America Synthetic Biology Market Size and Forecast, By Application (2023-2030) 4.4.2.3.1. Chemicals 4.4.2.3.2. Healthcare 4.4.2.3.3. Agriculture 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico North America Synthetic Biology Market Size and Forecast, By Tool (2023-2030) 4.4.3.1.1. Oligonucleotides and Synthetic DNA 4.4.3.1.2. Enzymes 4.4.3.1.3. Cloning Technologies Kits 4.4.3.1.4. Synthetic Cells 4.4.3.1.5. Chassis Organisms 4.4.3.1.6. Xeno-nucleic Acids 4.4.3.2. Mexico North America Synthetic Biology Market Size and Forecast, By Technology (2023-2030) 4.4.3.2.1. Genome Engineering 4.4.3.2.2. Payers 4.4.3.2.3. Bioinformatics 4.4.3.2.4. Biological components and integrated systems 4.4.3.2.5. Others 4.4.3.3. Mexico North America Synthetic Biology Market Size and Forecast, By Application (2023-2030) 4.4.3.3.1. Chemicals 4.4.3.3.2. Healthcare 4.4.3.3.3. Agriculture 4.4.3.3.4. Others 5. North America Synthetic Biology Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2023) 5.3.5. Company Locations 5.4. Leading North America Synthetic Biology Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Amyris, Inc. (Emeryville, California) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. Ginkgo Bioworks (Boston, Massachusetts) 6.3. Intrexon Corporation (Germantown, Maryland) 6.4. Zymergen Inc. (Emeryville, California) 6.5. Twist Bioscience Corporation (South San Francisco, California) 6.6. Genome Compiler Corporation (Montreal, Quebec) 6.7. Conagen Inc. (Bedford, Nova Scotia) 6.8. Sustainable Development Technology Canada (SDTC) (Ottawa, Ontario) 6.9. Bioscience Solutions Inc. (Toronto, Ontario) 6.10. Mexel Industries S.A. de C.V. (Mexico City, Mexico) 6.11. CINVESTAV-IPN (Center for Research and Advanced Studies of the National Polytechnic Institute) (Mexico City, Mexico) 6.12. PROBIOMED S.A. de C.V. (Mexico City, Mexico) 7. Key Findings 8. Industry Recommendations