The Global Paracetamol Market Size was USD 11.10 billion in 2024 and is expected to hit USD 15.79 billion by 2032 at a 4.5% CAGR. This comprehensive analysis covers market trends, drivers, restraints, segmentation, regional insights, and competitive landscape for informed strategic decisions.Paracetamol Market Overview:

Paracetamol, also known as acetaminophen, is a widely used analgesic and antipyretic medication that helps relieve mild to moderate pain and reduce fever. It is commonly used for headaches, colds, and body aches, and is considered safe at recommended doses. The strong consumer reliance on antipyretic and analgesic medicines and robust demand across both developed and emerging regions drive the Paracetamol Market. The Paracetamol tablets market remains the largest contributor, supported by strong retail penetration and widespread household acceptance. In parallel, demand for pediatric formulations and liquid suspensions is increasing, particularly in Asia-Pacific, Africa, and Latin America, where fever-related illnesses are more prevalent. Intravenous (IV) paracetamol usage is also rising within hospitals due to improved pain management practices and higher surgical procedure volumes. On the supply side, production is heavily concentrated in India and China, which dominate the Paracetamol Market and supply a large portion of global API volumes. As regulatory frameworks evolve and digital distribution channels expand, market participants are optimizing supply chains, enhancing formulation innovations, and leveraging online pharmacy growth to strengthen their presence.To know about the Research Methodology :- Request Free Sample Report

Paracetamol Market Trend: Rising Shift Toward Liquid Suspensions and Pediatric-Friendly Formulations

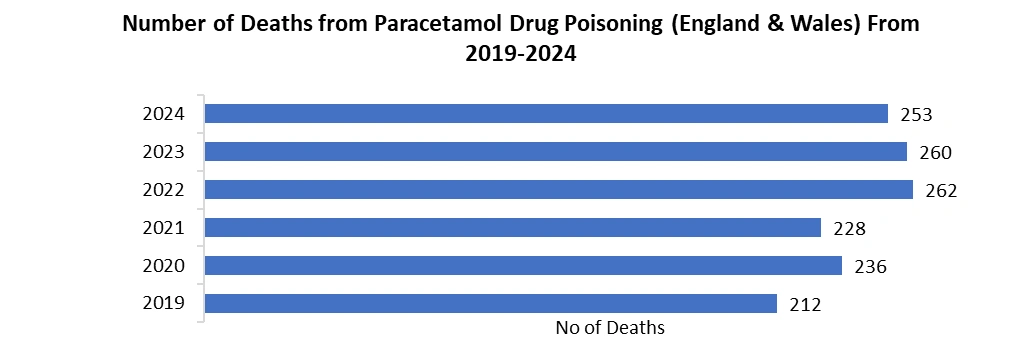

The growing shift toward pediatric-focused liquid suspensions and chewable formats, driven by changing acetaminophen consumption trends and rising pediatric fever cases worldwide. The increasing need for flexible dosing, ease of swallowing, and better palatability in children under 12 years drives the Paracetamol Market. Pediatric paracetamol products accounted for nearly 18% of global consumption in 2024, and demand is forecast to surpass 20% share by 2030, supported by the rising incidence of viral infections in Asia-Pacific, Africa, and Latin America. Innovations such as flavored suspensions, spill-proof bottles, unit-dose sachets, and QR-enabled smart packaging are enhancing compliance and safety. In markets like Southeast Asia and India, per-capita usage of liquid suspensions has grown nearly 12–14% year-on-year, reflecting strong acceptance as part of the fever medication market. The online pharmacy platforms are increasingly promoting pediatric SKUs, boosting distribution efficiency and strengthening the OTC analgesics market. As consumer preference shifts toward safer, dosage-controlled formulations, this trend is expected to influence the global paracetamol market size, positioning pediatric-friendly formats as a long-term growth pillar. High Global Prevalence of Fever and Pain Conditions to Drive Paracetamol Market Growth The consistently high global prevalence of fever, cold & flu, musculoskeletal pain, and viral infections sustains year-round demand. With more than 4.2 billion annual cases of fever and mild pain conditions globally, paracetamol remains one of the most widely consumed first-line treatments due to its safety, accessibility, and regulatory acceptance. The Oral formulations account for over 75% of total usage, demonstrating widespread dependence on the drug for everyday healthcare needs. The fever medication market in Asia-Pacific is driven by climatic variations, rising dengue incidence, and strong OTC adoption. Growing elderly populations with chronic pain issues also accelerate the Acetaminophen Market growth, as the drug is often preferred over NSAIDs due to lower gastrointestinal risk. In the Paracetamol Market, improved healthcare access and expanding pharmacy networks are further raising consumption intensity. Rising awareness programs in Africa and South America have contributed to a 15–20% rise in household-level analgesic use over the past five years. Growing Concerns Over Liver Toxicity and Regulatory Tightening to restrain the Paracetamol Market The increasing global concern around hepatotoxicity risks associated with paracetamol overdose has intensified regulatory scrutiny. More than 70,000 cases of acute liver injury worldwide are linked to incorrect dosing, particularly in regions with high self-medication rates. Regulatory agencies across North America, Europe, and parts of APAC have strengthened dosage guidelines, restricted maximum tablet strengths, and imposed tighter pack-size controls. These evolving paracetamol regulatory trends directly affect the Paracetamol Market Share, especially within retail channels. New labeling requirements, mandatory warning statements, and pharmacist-led dispensing protocols have also slowed OTC purchasing frequency in countries like the UK, Australia, and Japan. In addition, rising global awareness about safe usage has prompted consumers to reduce unnecessary analgesic consumption, impacting short-term sales fluctuations in the pain relief drug market. Stringent regulations on bulk drug manufacturing also impact the Paracetamol API market, where environmental compliance and waste management rules have increased production costs by 8–12% in key manufacturing hubs. Combined with pricing pressures and safety concerns, these limitations pose meaningful challenges to supply chain stability, dosage innovation. These measures Paracetamol Market growth by limiting high-risk formulations and tightening approval pathways, restraining the paracetamol industry growth despite strong demand for pain and fever relief.

Paracetamol Market Segment Analysis

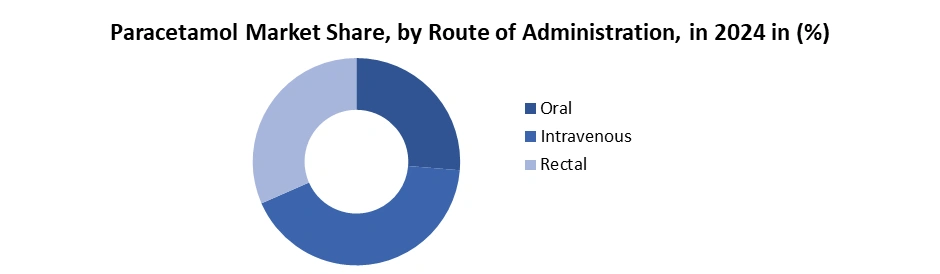

Based on Product Type, the Paracetamol Market is segmented into Tablet, Capsule, Liquid Suspension, Powder and Others. The tablet segment remains the dominant product type, driven by widespread OTC availability, affordability, long shelf-life, and strong retail penetration. Tablets are preferred for treating fever and mild-to-moderate pain, especially in adults, and form the backbone of the OTC pain reliever market across North America, Europe, Asia-Pacific, and Latin America. Rising demand for cost-effective analgesics in emerging markets, coupled with high dependence on tablets in institutional procurement systems, supports long-term growth. The segment benefits from robust manufacturing capacity in India and China, which strengthens the Paracetamol API market and ensures a reliable supply across global pharmaceutical chains. Powder sachets have notable adoption in Southeast Asia but remain supplementary. Growing online pharmacy penetration, dose innovations (extended-release 650 mg), and smart-packaging adoption reinforce tablet dominance.By Route of Administration, the market is categorised into the Oral, Intravenous and Rectal. The oral route is the dominant segment in the Paracetamol Market. Oral formulations, including tablets, capsules, chewables, dispersible forms, and pediatric liquid suspensions, are widely preferred due to convenience, rapid onset of action, and suitability for both OTC and prescription use. High usage in fever medication markets, widespread application in chronic and acute pain, and strong presence across retail pharmacies, supermarkets, and online channels contribute to its leadership position. Oral products benefit from outstanding accessibility in Asia-Pacific and Africa, where paracetamol serves as a primary line of treatment for common infections and seasonal illnesses. IV paracetamol demand is expanding within hospitals, surgical centers, and emergency care departments, supported by improved postoperative pain protocols and unmet needs where NSAID use is restricted.

Paracetamol Market Regional Insights

North America Dominated the Paracetamol Market in 2024. The North America paracetamol market continues to expand due to rising cases of fever, flu, and musculoskeletal pain, along with strong OTC drug adoption across the U.S. and Canada. The growth is supported by broader consumer access through pharmacies, supermarkets, and online platforms. Increasing awareness of safe antipyretic use and improved healthcare access are strengthening demand patterns across adult and pediatric segments. The sustained usage of oral solid formulations and the growing preference for IV dosage in hospitals. The paracetamol market share remains influenced by high OTC penetration, evolving FDA regulatory trends, and rising demand for combination fever medications. Comprehensive paracetamol industry analysis shows strong growth in pediatric syrups, extended-release formulations, and hospital-grade injectable products. Additionally, the acetaminophen market growth is supported by increasing flu-season sales, telehealth-driven e-pharmacy ordering, and heightened awareness of self-medication. At the upstream level, the paracetamol API market is shaped by supply chain optimization, pricing patterns, and import dependencies. The U.S. paracetamol market continues to grow steadily, supported by rising prescriptions, strong OTC demand, and widespread use for fever and pain management. Increasing healthcare accessibility, flu-season spikes, and the popularity of combination analgesics drive market expansion. Stable API supply and e-pharmacy adoption further strengthen overall market performance.The broader global paracetamol market influences regional pricing, while the rising OTC pain reliever market stimulates innovation in smart packaging, chewables, and extended-release tablets. Supporting themes include acetaminophen consumption trends, supply chain analysis, IV formulation demand, chronic pain treatment needs, and the expanding online pharmacy ecosystem across North America.

Paracetamol Market Competitive Landscape

The global paracetamol market is moderately consolidated, with competition driven by pricing, production efficiency, and regulatory compliance. Key players include Mallinckrodt Pharmaceuticals, Granules India, Anhui BBCA Likang, Bayer AG, Teva Pharmaceutical Industries, and Perrigo Company, all of which maintain strong manufacturing capacities and wide distribution networks. Asian producers, particularly from India and China, dominate API supply due to cost-effective large-scale production. Companies compete by optimizing yield processes, ensuring consistent quality, and meeting stringent regulatory standards from agencies such as the FDA, EMA, and WHO. Vertical integration, long-term supply contracts with pharmaceutical formulators, and investments in capacity expansion strengthen market positions. The rise of generic OTC analgesics intensifies competition among branded and private-label manufacturers. Additionally, fluctuations in raw material availability and increasing demand for paracetamol in combination drugs influence strategic pricing and sourcing decisions across the market.Recent Developments

• On April 8, 2025, Teva announced it will shift production of its widely used painkiller Acamol from the Kfar Saba plant in Israel to its Ulm, Germany facility. The move is part of Teva’s global operational restructuring aimed at streamlining manufacturing and aligning products with European standards. No layoffs are planned; Israeli employees will transition to higher-complexity drug operations. Teva confirmed that variants like Acamol Focus, Acamol Cold gel capsules, and Acamol Forte will continue to be produced in Israel. • On April 30, 2025, Sanofi finalized the sale of a 50% controlling stake in its consumer healthcare unit, Opella, to Clayton, Dubilier & Rice (CD&R). Sanofi now holds 48.2%, while Bpifrance retains 1.8%. The deal generated approximately €10 billion in net cash, strengthening Sanofi’s shift toward a biopharma-focused strategy. The transaction forms a newly structured global consumer-health leader and marks a major step in Sanofi’s long-planned separation of its consumer health operations.Paracetamol Market Scope: Inquire before buying

Global Paracetamol Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 11.10 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 15.79 Bn. Segments Covered: by Product Type Tablet Capsule Liquid Suspension Powder Others by Route of Administration Oral Intravenous Rectal by Application Headache & Fever Muscle Cramps Cold & Cough Others by Distribution Channel Hospital Pharmacies Retail Pharmacies Online Pharmacies Others Paracetamol Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Paracetamol Key Players

1. Mallinckrodt Pharmaceuticals 2. Granules India Ltd. 3. Anqiu Lu’an Pharmaceutical Co. Ltd. 4. Zhejiang Kangle Pharmaceutical Co. Ltd. 5. Anhui BBCA Pharmaceutical Co. Ltd. 6. SKPL (Sri Krishna Pharmaceuticals) 7. Farmson Pharmaceutical Gujarat Pvt. Ltd. 8. Shreeji Pharma International 9. IOL Chemicals & Pharmaceuticals Ltd. 10. AstraZeneca plc 11. GSK plc (Panadol brand) 12. Johnson & Johnson 13. Bayer AG 14. Sanofi S.A. 15. Pfizer Inc. 16. Procter & Gamble (P&G) 17. Reckitt Benckiser (RB) 18. Perrigo Company plc 19. Teva Pharmaceutical Industries Ltd. 20. Hikma Pharmaceuticals 21. Cipla Ltd. 22. Sun Pharmaceutical Industries Ltd. 23. Dr. Reddy’s Laboratories Ltd. 24. Torrent Pharmaceuticals Ltd. 25. Zydus Lifesciences Ltd. 26. Abbott Laboratories 27. Mankind Pharma Ltd. 28. Aurobindo Pharma Ltd. 29. Lupin Ltd. 30. Amneal PharmaceuticalsFrequently Asked Questions:

1] What is the growth rate of the Global Paracetamol Market? Ans. The Global Paracetamol Market is growing at a significant rate of 4.5 % during the forecast period. 2] Which region is expected to dominate the Global Paracetamol Market? Ans. Europe is expected to dominate the Paracetamol Market during the forecast period. 3] What was the Global Paracetamol Market size in 2024? Ans. The Paracetamol Market size is expected to reach USD 11.10 billion in 2024. 4] What is the expected Global Paracetamol Market size by 2032? Ans. The Paracetamol Market size is expected to reach USD 15.79 billion by 2032. 5] Which are the top players in the Global Paracetamol Market? Ans. The major players in the Global Paracetamol Market are Mallinckrodt Pharmaceuticals, Granules India Ltd., Anqiu Lu’an Pharmaceutical Co. Ltd., Zhejiang Kangle Pharmaceutical Co. Ltd., Anhui BBCA Pharmaceutical Co. Ltd. and Others. 6] What are the factors driving the Global Paracetamol Market growth? Ans. Key factors driving the Global Paracetamol Market include rising cases of fever and pain, strong OTC drug availability, expanding healthcare access, increasing pediatric usage, stable API production, and growing demand for safe, affordable analgesics.

1. Paracetamol Market: Research Methodology 2. Paracetamol Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Paracetamol Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. Application Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Paracetamol Market: Dynamics 4.1. Paracetamol Market Trends 4.2. Paracetamol Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Paracetamol Market 5. Paracetamol Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Paracetamol Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Tablet 5.1.2. Capsule 5.1.3. Liquid Suspension 5.1.4. Powder 5.1.5. Others 5.2. Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 5.2.1. Oral 5.2.2. Intravenous 5.2.3. Rectal 5.3. Paracetamol Market Size and Forecast, by Application (2024-2032) 5.3.1. Headache & Fever 5.3.2. Muscle Cramps 5.3.3. Cold & Cough 5.3.4. Others 5.4. Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1. Online 5.4.2. Offline 5.5. Paracetamol Market Size and Forecast, by Region (2024-2032) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Paracetamol Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. North America Paracetamol Market Size and Forecast, by Product Type (2024-2032) 6.1.1. Tablet 6.1.2. Capsule 6.1.3. Liquid Suspension 6.1.4. Powder 6.1.5. Others 6.2. North America Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 6.2.1. Oral 6.2.2. Intravenous 6.2.3. Rectal 6.3. North America Paracetamol Market Size and Forecast, by Application (2024-2032) 6.3.1. Headache & Fever 6.3.2. Muscle Cramps 6.3.3. Cold & Cough 6.3.4. Others 6.4. North America Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.1. Hospital Pharmacies 6.4.2. Retail Pharmacies 6.4.3. Online Pharmacies 6.4.4. Others 6.5. North America Paracetamol Market Size and Forecast, by Country (2024-2032) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Paracetamol Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Paracetamol Market Size and Forecast, by Product Type (2024-2032) 7.2. Europe Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 7.3. Europe Paracetamol Market Size and Forecast, by Application (2024-2032) 7.4. Europe Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 7.5. Europe Paracetamol Market Size and Forecast, by Country (2024-2032) 7.5.1. United Kingdom 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Russia 7.5.7. Rest of Europe 8. Asia Pacific Paracetamol Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Paracetamol Market Size and Forecast, by Product Type (2024-2032) 8.2. Asia Pacific Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 8.3. Asia Pacific Paracetamol Market Size and Forecast, by Application (2024-2032) 8.4. Asia Pacific Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 8.5. Asia Pacific Paracetamol Market Size and Forecast, by Country (2024-2032) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Rest of Asia Pacific 9. Middle East and Africa Paracetamol Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Middle East and Africa Paracetamol Market Size and Forecast, by Product Type (2024-2032) 9.2. Middle East and Africa Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 9.3. Middle East and Africa Paracetamol Market Size and Forecast, by Application (2024-2032) 9.4. Middle East and Africa Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 9.5. Middle East and Africa Paracetamol Market Size and Forecast, by Country (2024-2032) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Nigeria 9.5.4. Rest of ME&A 10. South America Paracetamol Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. South America Paracetamol Market Size and Forecast, by Product Type (2024-2032) 10.2. South America Paracetamol Market Size and Forecast, by Route of Administration (2024-2032) 10.3. South America Paracetamol Market Size and Forecast, by Application (2024-2032) 10.4. South America Paracetamol Market Size and Forecast, by Distribution Channel (2024-2032) 10.5. South America Paracetamol Market Size and Forecast, by Country (2024-2032) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Colombia 10.5.4. Chile 10.5.5. Rest Of South America 11. Company Profile: Key Players 11.1. Mallinckrodt Pharmaceuticals 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Granules India Ltd. 11.3. Anqiu Lu’an Pharmaceutical Co. Ltd. 11.4. Zhejiang Kangle Pharmaceutical Co. Ltd. 11.5. Anhui BBCA Pharmaceutical Co. Ltd. 11.6. SKPL (Sri Krishna Pharmaceuticals) 11.7. Farmson Pharmaceutical Gujarat Pvt. Ltd. 11.8. Shreeji Pharma International 11.9. IOL Chemicals & Pharmaceuticals Ltd. 11.10. AstraZeneca plc 11.11. GSK plc (Panadol brand) 11.12. Johnson & Johnson 11.13. Bayer AG 11.14. Sanofi S.A. 11.15. Pfizer Inc. 11.16. Procter & Gamble (P&G) 11.17. Reckitt Benckiser (RB) 11.18. Perrigo Company plc 11.19. Teva Pharmaceutical Industries Ltd. 11.20. Hikma Pharmaceuticals 11.21. Cipla Ltd. 11.22. Sun Pharmaceutical Industries Ltd. 11.23. Dr. Reddy’s Laboratories Ltd. 11.24. Torrent Pharmaceuticals Ltd. 11.25. Zydus Lifesciences Ltd. 11.26. Abbott Laboratories 11.27. Mankind Pharma Ltd. 11.28. Aurobindo Pharma Ltd. 11.29. Lupin Ltd. 11.30. Amneal Pharmaceuticals 12. Key Findings 13. Analyst Recommendations