The Global Suture Needles Market size was valued at USD 588.13 Million in 2023 and the total Suture Needles Market revenue is expected to grow at a CAGR of 5.77 % from 2024 to 2030, reaching nearly USD 840.9 Million.Suture Needles Market Overview

Suture needles are medical instruments used for suturing or stitching wounds or incisions in surgical procedures. Needles are used to close skin invisibly, strengthen wounds until they are healed, reduce the risk of bleeding, and make scars aesthetically attractive. These needles are typically made of high-grade stainless steel, nickel, or titanium, and are available in various sizes, shapes, and configurations to meet the specific needs of different surgical procedures. The selection of suture needles depends on the type of tissue it is to be used on. Taper point needles are preferred for soft tissues while cutting or taper cut needles are used for hard tissues.To know about the Research Methodology :- Request Free Sample Report

Suture Needle Market Dynamics

Increasing demand for advanced suture needles to boost the market growth The straight-shaped needles are expected to drive the Suture Needle Market at a CAGR of 5.7% as compared to a historical CAGR of 5% this growth is attributed to the increasing popularity of abdominal surgery and healthcare. The straight-body needle is used in stitching tissues that are easily accessible by hand. The demand for surgeries continues to grow, there is increasing demand for advanced suture needles that help reduce the size of incisions and improve patient outcomes. This has led to the development of new and innovative suture needles that are designed to be more precise, efficient, and effective. For example, some new suture needles feature a smaller diameter, which reduces tissue trauma and leads to faster healing times. Additionally, there is a growing trend towards the use of absorbable sutures, which eliminates the need for suture removal and reduces the risk of infection. The increasing Prevalence of Chronic Diseases drives the market growth The increasing dominance of chronic diseases such as cardiovascular disease, cancer, and orthopedic disorders is a major driver of the suture needles market. Chronic diseases are long-lasting conditions that require ongoing medical attention and impact a patient's quality of life. These conditions require surgical intervention, which increases the demand for suture needles and increases competition in the industry. The World Health Organization (WHO) reports that chronic diseases are the leading cause of death globally, accounting for 71% of all deaths in 2022. With the aging population and changes in lifestyle factors such as diet and physical activity, chronic diseases are expected to drive the Suture Needle Market demand for suture needles during the forecast period. Surgeries offer advantages over traditional open surgeries, including shorter recovery times, less pain, and reduced scarring. This has led to a growing demand for surgical instruments, such as suture needles, that are designed specifically for minimally invasive procedures. In the needle suture industry many manufacturers are developing suture needles that are smaller, more precise, and easy to use in surgeries. This trend is expected to continue to drive the Suture Needle Market in upcoming years, as more patients and healthcare providers seek out the benefits of minimally invasive procedures. Suture Needle Market Restraints Rising demand for suture needle market due to the High Cost of Surgical Procedures The high cost of surgical operations is the main restraint in the Suture Needle Market for suture needles market. Many patients postpone procedures and surgeries due to rising healthcare expenses, which cause a decrease in the demand for surgical supplies like suture needles. Additionally, the cost of surgical treatments can differ significantly based on location, procedure type, and insurance coverage, which can pose major access challenges for some patients. As a result, manufacturers may have trouble growing their clientele, which could have an effect on the overall growth of the suture needle market. The suture needles market may see various challenges that could slow its expansion throughout the anticipated time frame. The danger of infections brought on by using suture needles is one of these restrictions.Suture Needle Market Segment Analysis

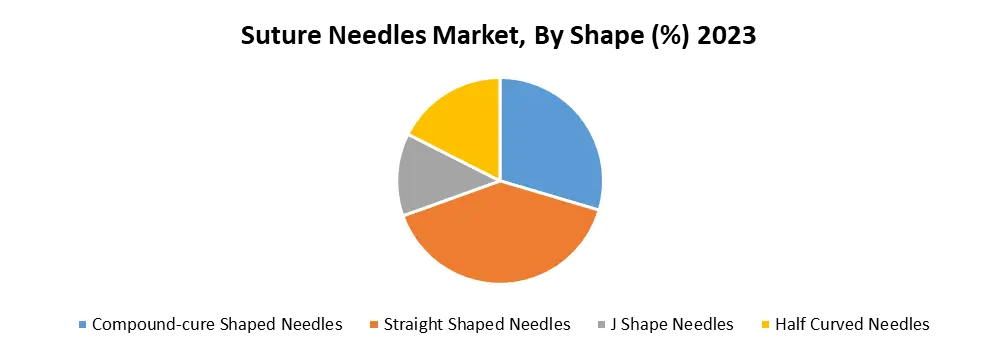

Based on application, the cardiovascular segment accounted for the largest revenue share of over 38.23% in 2022. This is due to an increase in the frequency of cardiovascular diseases and technical breakthroughs in diagnosis, surgical equipment, and imaging. The segment includes gastrointestinal surgery, obstetrics surgery, urology, and oral surgery. This category is expected to grow significantly over the expected period due to an increase in the number of women's health difficulties and an increase in the number of obese people.Based on shape, the straight-shaped needles accounted for the highest share of 38.20% in Suture Needle Market due to their used in abdominal surgery, rhinoplasty, and microsurgery for nerve and vascular healing. Straight needles are favoured for their precision in suturing delicate tissues and are particularly suitable for easily accessible tissues that can be operated by hand.

Suture Needles Market Regional insights

North America accounts for the largest revenue share in the global suture needles market North America dominated the Suture Needle Market with a revenue share of over 39% in 2022 owing to the high prevalence of cardiovascular illnesses and the high rate of adoption of minimally invasive treatments for cardiovascular and orthopaedic diseases, which currently accounted for more than one-third of all deaths in the United States The Suture Needle Market is primarily driven by the increasing demand for surgical procedures and the growing prevalence of chronic diseases. The region also has a high adoption rate of technologically advanced suture needles, which has further boosted the Suture Needle Market growth. Asia Pacific continues to lead in terms of revenue CAGR, The Asia Pacific Suture Needle Market is expected to grow the fastest CAGR over the forecast period the region's growth is driven by a large patient pool, rising healthcare spending, rising frequency of road accidents, rising prevalence of chronic diseases, and increasing government initiatives to improve healthcare infrastructure. Countries such as China, India, and Japan are expected to drive the suture needle market Europe is another major Suture Needle Market for suture needles, with countries such as Germany, France, and the United Kingdom being the leading Suture Needle Market. The growth in the region is driven by an aging population, an increase in surgical procedures, and the rise in chronic diseases. The Suture Needle Market is also witnessing significant technological advancements in suture needles, which is further driving market growth. The Latin American market is expected to witness steady growth during the forecasted period, driven by an increase in surgical procedures and the growing prevalence of chronic diseases. Brazil and Mexico are the leading markets in the region, with a high demand for technologically advanced suture needles. The Middle East and Africa market is expected to witness moderate growth, driven by an increase in healthcare spending and the growing demand for minimally invasive surgical procedures. South Africa and Saudi Arabia are expected to be the major markets in the region. Similarly, the regionals are tracked by the maximize market research which is available in the Market report. Suture Needles Market Competitive landscape The competitiveness in the Suture Needles industry is increasing due to the ultimate innovations and productions, in a fight to stay ahead in the market. Companies are focusing on improving their product offerings and increasing their distribution networks through partnerships and collaboration to get a larger portion of the Suture Needle Market growing start-ups, mergers, and increasing trends of organic and inorganic growth are being witnessed. The key players in the Market such as Medtronic, Futura Surgicare Pvt. Ltd., and Johnson & Johnson Medical N.V. Aurolab are using strategies such as acquisition and mergers, partnerships, and investment and divestment, fueling industry growth. Furthermore, large and medium-scale companies are offering highly improved product-type portfolios and customer services. This trend is projected to positively impact the global market during the forecast period. Suture Needles Market Recent development In March 2022, Medtronic announced a partnership with Vizient for Al powered video management system. This will provide surgical teams with easy access of procedural videos. In November 2021, b.braun and REVA Medical hereby announce the strategic partnership for the distribution for Fantom encore- a bioresorbable scaffold for coronary intervention, manufactured with REVA’s patented material tyrocore.B. Braun will start active distribution of the product in Germany and Switzerland in November 2021 with additional countries follow soon In November 2020, smith and Nephew declared that their newly developed novostitch meniscal repair system has achieved an 82.6% success rate in treating horizontal cleavage tears. Similarly, recent developments related to companies offering suture needles have been tracked by the maximize market research which is available in the report.Suture Needles Market Scope: Inquire before buying

Global Suture Needles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 588.13 Mn. Forecast Period 2024 to 2030 CAGR: 5.77% Market Size in 2030: US $ 840.9 Mn. Segments Covered: by Shape Compound-cure Shaped Needles Straight Shaped Needles J Shape Needles Half Curved Needles by Type Taper cut Needle Blunt Point Needle Reverse Cutting Needle Round Bodied Needle Conventional Cutting Needle Spatula Needle by Application Cardiovascular Surgeries General Surgeries Gynaecological Surgeries Orthopaedic Surgeries Ophthalmic Surgeries Other Surgeries by End-User Hospitals and Clinics Ambulatory Surgical Centres Diagnostic Centre Suture Needles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Suture Needle Key Players

1.B. Braun Melsungen AG 2.Boston Scientific Corporation 3.ConMed Corporation 4.DemeTECH Corporation 5.Healthium MedTech 6.Johnson & Johnson 7.Medtronic Plc. 8.Peters Surgical 9.Surgical Specialties Corporation 10.W. L. Gore & Associates, Inc. 11. Sklar Surgical Instruments 12.Medline Industries 13.Sutures India 14.Nordent Manufacturing, 15.SOMATEX Medical Technologies GmbH, 16.KLS Martin Group 17.CareFusion Corporation 18.Schweickhardt GmbH & Co. KG 19.SERAG-WIESSNER 20.Eli Lilly and Company Frequently Asked Questions: 1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 5.77% during the forecast period. 2] Which region is expected to dominate the Global Market? Ans. North America is expected to dominate the Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The Market size is expected to reach USD 840.9 million by 2030. 4] Which are the top players in the Global Market? Ans. The major top players in the Global Market are B. Braun Melsungen AG, Boston Scientific Corporation, ConMed Corporation, DemeTECH Corporation, Healthium MedTech 5] What are the applications studied in the Global Market? Ans. These sutures are often used for cardiovascular, general, gynecological, orthopaedic, ophthalmic, and other surgeries.

1. Suture Needles Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Suture Needles Market: Dynamics 2.1. Suture Needles Market Trends by Region 2.1.1. North America Suture Needles Market Trends 2.1.2. Europe Suture Needles Market Trends 2.1.3. Asia Pacific Suture Needles Market Trends 2.1.4. Middle East and Africa Suture Needles Market Trends 2.1.5. South America Suture Needles Market Trends 2.2. Suture Needles Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Suture Needles Market Drivers 2.2.1.2. North America Suture Needles Market Restraints 2.2.1.3. North America Suture Needles Market Opportunities 2.2.1.4. North America Suture Needles Market Challenges 2.2.2. Europe 2.2.2.1. Europe Suture Needles Market Drivers 2.2.2.2. Europe Suture Needles Market Restraints 2.2.2.3. Europe Suture Needles Market Opportunities 2.2.2.4. Europe Suture Needles Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Suture Needles Market Drivers 2.2.3.2. Asia Pacific Suture Needles Market Restraints 2.2.3.3. Asia Pacific Suture Needles Market Opportunities 2.2.3.4. Asia Pacific Suture Needles Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Suture Needles Market Drivers 2.2.4.2. Middle East and Africa Suture Needles Market Restraints 2.2.4.3. Middle East and Africa Suture Needles Market Opportunities 2.2.4.4. Middle East and Africa Suture Needles Market Challenges 2.2.5. South America 2.2.5.1. South America Suture Needles Market Drivers 2.2.5.2. South America Suture Needles Market Restraints 2.2.5.3. South America Suture Needles Market Opportunities 2.2.5.4. South America Suture Needles Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Suture Needles Industry 2.8. Analysis of Government Schemes and Initiatives For Suture Needles Industry 2.9. Suture Needles Market Trade Analysis 2.10. The Global Pandemic Impact on Suture Needles Market 3. Suture Needles Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Suture Needles Market Size and Forecast, by Shape (2023-2030) 3.1.1. Compound-cure Shaped Needles 3.1.2. Straight Shaped Needles 3.1.3. J Shape Needles 3.1.4. Half Curved Needles 3.2. Suture Needles Market Size and Forecast, by Type (2023-2030) 3.2.1. Taper cut Needle 3.2.2. Blunt Point Needle 3.2.3. Reverse Cutting Needle 3.2.4. Round Bodied Needle 3.2.5. Conventional Cutting Needle 3.2.6. Spatula Needle 3.3. Suture Needles Market Size and Forecast, by Application (2023-2030) 3.3.1. Cardiovascular Surgeries 3.3.2. General Surgeries 3.3.3. Gynaecological Surgeries 3.3.4. Orthopaedic Surgeries 3.3.5. Ophthalmic Surgeries 3.3.6. Other Surgeries 3.4. Suture Needles Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospitals and Clinics 3.4.2. Ambulatory Surgical Centres 3.4.3. Diagnostic Centre 3.5. Suture Needles Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Suture Needles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Suture Needles Market Size and Forecast, by Shape (2023-2030) 4.1.1. Compound-cure Shaped Needles 4.1.2. Straight Shaped Needles 4.1.3. J Shape Needles 4.1.4. Half Curved Needles 4.2. North America Suture Needles Market Size and Forecast, by Type (2023-2030) 4.2.1. Taper cut Needle 4.2.2. Blunt Point Needle 4.2.3. Reverse Cutting Needle 4.2.4. Round Bodied Needle 4.2.5. Conventional Cutting Needle 4.2.6. Spatula Needle 4.3. North America Suture Needles Market Size and Forecast, by Application (2023-2030) 4.3.1. Cardiovascular Surgeries 4.3.2. General Surgeries 4.3.3. Gynaecological Surgeries 4.3.4. Orthopaedic Surgeries 4.3.5. Ophthalmic Surgeries 4.3.6. Other Surgeries 4.4. North America Suture Needles Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospitals and Clinics 4.4.2. Ambulatory Surgical Centres 4.4.3. Diagnostic Centre 4.5. North America Suture Needles Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Suture Needles Market Size and Forecast, by Shape (2023-2030) 4.5.1.1.1. Compound-cure Shaped Needles 4.5.1.1.2. Straight Shaped Needles 4.5.1.1.3. J Shape Needles 4.5.1.1.4. Half Curved Needles 4.5.1.2. United States Suture Needles Market Size and Forecast, by Type (2023-2030) 4.5.1.2.1. Taper cut Needle 4.5.1.2.2. Blunt Point Needle 4.5.1.2.3. Reverse Cutting Needle 4.5.1.2.4. Round Bodied Needle 4.5.1.2.5. Conventional Cutting Needle 4.5.1.2.6. Spatula Needle 4.5.1.3. United States Suture Needles Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Cardiovascular Surgeries 4.5.1.3.2. General Surgeries 4.5.1.3.3. Gynaecological Surgeries 4.5.1.3.4. Orthopaedic Surgeries 4.5.1.3.5. Ophthalmic Surgeries 4.5.1.3.6. Other Surgeries 4.5.1.4. United States Suture Needles Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospitals and Clinics 4.5.1.4.2. Ambulatory Surgical Centres 4.5.1.4.3. Diagnostic Centre 4.5.2. Canada 4.5.2.1. Canada Suture Needles Market Size and Forecast, by Shape (2023-2030) 4.5.2.1.1. Compound-cure Shaped Needles 4.5.2.1.2. Straight Shaped Needles 4.5.2.1.3. J Shape Needles 4.5.2.1.4. Half Curved Needles 4.5.2.2. Canada Suture Needles Market Size and Forecast, by Type (2023-2030) 4.5.2.2.1. Taper cut Needle 4.5.2.2.2. Blunt Point Needle 4.5.2.2.3. Reverse Cutting Needle 4.5.2.2.4. Round Bodied Needle 4.5.2.2.5. Conventional Cutting Needle 4.5.2.2.6. Spatula Needle 4.5.2.3. Canada Suture Needles Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Cardiovascular Surgeries 4.5.2.3.2. General Surgeries 4.5.2.3.3. Gynaecological Surgeries 4.5.2.3.4. Orthopaedic Surgeries 4.5.2.3.5. Ophthalmic Surgeries 4.5.2.3.6. Other Surgeries 4.5.2.4. Canada Suture Needles Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospitals and Clinics 4.5.2.4.2. Ambulatory Surgical Centres 4.5.2.4.3. Diagnostic Centre 4.5.3. Mexico 4.5.3.1. Mexico Suture Needles Market Size and Forecast, by Shape (2023-2030) 4.5.3.1.1. Compound-cure Shaped Needles 4.5.3.1.2. Straight Shaped Needles 4.5.3.1.3. J Shape Needles 4.5.3.1.4. Half Curved Needles 4.5.3.2. Mexico Suture Needles Market Size and Forecast, by Type (2023-2030) 4.5.3.2.1. Taper cut Needle 4.5.3.2.2. Blunt Point Needle 4.5.3.2.3. Reverse Cutting Needle 4.5.3.2.4. Round Bodied Needle 4.5.3.2.5. Conventional Cutting Needle 4.5.3.2.6. Spatula Needle 4.5.3.3. Mexico Suture Needles Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Cardiovascular Surgeries 4.5.3.3.2. General Surgeries 4.5.3.3.3. Gynaecological Surgeries 4.5.3.3.4. Orthopaedic Surgeries 4.5.3.3.5. Ophthalmic Surgeries 4.5.3.3.6. Other Surgeries 4.5.3.4. Mexico Suture Needles Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospitals and Clinics 4.5.3.4.2. Ambulatory Surgical Centres 4.5.3.4.3. Diagnostic Centre 5. Europe Suture Needles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.2. Europe Suture Needles Market Size and Forecast, by Type (2023-2030) 5.3. Europe Suture Needles Market Size and Forecast, by Application (2023-2030) 5.4. Europe Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5. Europe Suture Needles Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.1.2. United Kingdom Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.1.3. United Kingdom Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.2.2. France Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.2.3. France Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.3.2. Germany Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.3.3. Germany Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.4.2. Italy Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.4.3. Italy Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.5.2. Spain Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.5.3. Spain Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.6.2. Sweden Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.6.3. Sweden Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.7.2. Austria Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.7.3. Austria Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Suture Needles Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Suture Needles Market Size and Forecast, by Shape (2023-2030) 5.5.8.2. Rest of Europe Suture Needles Market Size and Forecast, by Type (2023-2030) 5.5.8.3. Rest of Europe Suture Needles Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Suture Needles Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Suture Needles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.2. Asia Pacific Suture Needles Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Suture Needles Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Suture Needles Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.1.2. China Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.1.3. China Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.2.2. S Korea Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.2.3. S Korea Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.3.2. Japan Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.3.3. Japan Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.4.2. India Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.4.3. India Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.5.2. Australia Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.5.3. Australia Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.6.2. Indonesia Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.6.3. Indonesia Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.7.2. Malaysia Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.7.3. Malaysia Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.8.2. Vietnam Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.8.3. Vietnam Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.9.2. Taiwan Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.9.3. Taiwan Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Suture Needles Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Suture Needles Market Size and Forecast, by Shape (2023-2030) 6.5.10.2. Rest of Asia Pacific Suture Needles Market Size and Forecast, by Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Suture Needles Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Suture Needles Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Suture Needles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Suture Needles Market Size and Forecast, by Shape (2023-2030) 7.2. Middle East and Africa Suture Needles Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Suture Needles Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Suture Needles Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Suture Needles Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Suture Needles Market Size and Forecast, by Shape (2023-2030) 7.5.1.2. South Africa Suture Needles Market Size and Forecast, by Type (2023-2030) 7.5.1.3. South Africa Suture Needles Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Suture Needles Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Suture Needles Market Size and Forecast, by Shape (2023-2030) 7.5.2.2. GCC Suture Needles Market Size and Forecast, by Type (2023-2030) 7.5.2.3. GCC Suture Needles Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Suture Needles Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Suture Needles Market Size and Forecast, by Shape (2023-2030) 7.5.3.2. Nigeria Suture Needles Market Size and Forecast, by Type (2023-2030) 7.5.3.3. Nigeria Suture Needles Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Suture Needles Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Suture Needles Market Size and Forecast, by Shape (2023-2030) 7.5.4.2. Rest of ME&A Suture Needles Market Size and Forecast, by Type (2023-2030) 7.5.4.3. Rest of ME&A Suture Needles Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Suture Needles Market Size and Forecast, by End User (2023-2030) 8. South America Suture Needles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Suture Needles Market Size and Forecast, by Shape (2023-2030) 8.2. South America Suture Needles Market Size and Forecast, by Type (2023-2030) 8.3. South America Suture Needles Market Size and Forecast, by Application(2023-2030) 8.4. South America Suture Needles Market Size and Forecast, by End User (2023-2030) 8.5. South America Suture Needles Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Suture Needles Market Size and Forecast, by Shape (2023-2030) 8.5.1.2. Brazil Suture Needles Market Size and Forecast, by Type (2023-2030) 8.5.1.3. Brazil Suture Needles Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Suture Needles Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Suture Needles Market Size and Forecast, by Shape (2023-2030) 8.5.2.2. Argentina Suture Needles Market Size and Forecast, by Type (2023-2030) 8.5.2.3. Argentina Suture Needles Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Suture Needles Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Suture Needles Market Size and Forecast, by Shape (2023-2030) 8.5.3.2. Rest Of South America Suture Needles Market Size and Forecast, by Type (2023-2030) 8.5.3.3. Rest Of South America Suture Needles Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Suture Needles Market Size and Forecast, by End User (2023-2030) 9. Global Suture Needles Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Suture Needles Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. B. Braun Melsungen AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Boston Scientific Corporation 10.3. ConMed Corporation 10.4. DemeTECH Corporation 10.5. Healthium MedTech 10.6. Johnson & Johnson 10.7. Medtronic Plc. 10.8. Peters Surgical 10.9. Surgical Specialties Corporation 10.10. W. L. Gore & Associates, Inc. 10.11. Sklar Surgical Instruments 10.12. Medline Industries 10.13. Sutures India 10.14. Nordent Manufacturing, 10.15. SOMATEX Medical Technologies GmbH, 10.16. KLS Martin Group 10.17. CareFusion Corporation 10.18. Schweickhardt GmbH & Co. KG 10.19. SERAG-WIESSNER 10.20. Eli Lilly and Company 11. Key Findings 12. Industry Recommendations 13. Suture Needles Market: Research Methodology 14. Terms and Glossary