Surgical Hat Market size was valued at USD 141 Mn. in 2022 and the total Surgical Hat revenue is expected to grow by 8.3 % from 2023 to 2029, reaching nearly USD 246.39 Mn.Surgical Hat Market Overview:

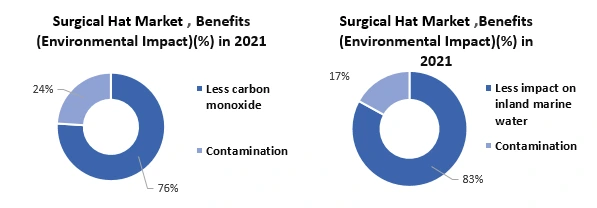

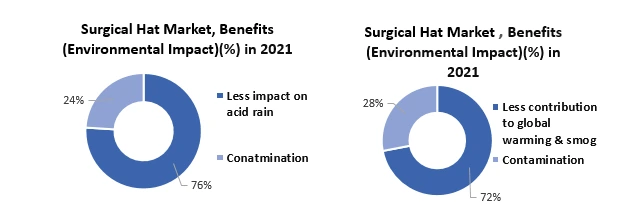

Surgical hats, also known as scrub caps, are specially designed headwear for surgeons to wear in operating rooms to prevent contamination of the sterile area. Surgical hats are used to prevent microorganisms from the staff's hair or scalp from contaminating the surgical site. Surgical hats are now widely used in hospitals, special clinics, and Emergency Medical Services (EMS). Several hospitals all over the world use single-use disposable surgical hats to comply with operating room hair covering standards. MMR analyzed that the use of surgical caps by healthcare workers was 43% in 2020 and 52% in 2021 all over the world. Disposable scrub caps are marketed as more sanitary and less expensive than reusable alternatives. These aspects are boosting the growth of the surgical hat market. Moreover, surgical caps benefit healthcare workers by allowing them to quickly dispose of caps that are no longer needed or clean, which explains why surgical hats are becoming more popular. Additionally, many hospitals in the United States have set sustainability goals in order to address the healthcare industry's significant carbon footprint. However, many hospitals now rely on single-use items such as surgical caps and disposable medical devices for the majority of patient treatment. These items generate millions of pounds of waste each year, significantly increasing the environmental impact of hospitals. The growing demand for high-quality patient care in healthcare facilities is expected to boost the surgical hat market growth. Medical protective clothing, hats, and gloves protect both doctors and patients from harmful pathogens. This clothing aids in the prevention of infections and is thus widely used during the COVID-19 pandemic to protect healthcare workers, including doctors, nursing professionals, and other hospital staff. In the United States, 600,000 Total Knee Arthroplasty (TKA) surgeries were performed in 2020, with over 3.5 million TKA procedures expected by 2029. The increasing number of surgeries in the country is expected to drive growth in the surgical market in the United States.To know about the Research Methodology :- Request Free Sample Report

Surgical Hat Market Dynamics:

Surgical Hat Market Drivers Growing importance of hygiene from healthcare workers to boost the surgical hat market The growing importance of hygiene is driving up demand for surgical hats. Furthermore, surgical hats are used to mitigate the effects of various diseases and infections. The growth of the healthcare business is boosting the global surgical hat market forward. The COVID-19 pandemic boosted demand for surgical caps. Moreover, the United States has become one of the countries hardest hit by the COVID-19 epidemic. The country had over 35.9 million cases and 617 thousand deaths as of August 2021. PPE kits, as well as surgical hats and face masks, were in high demand. This had a direct impact on the global surgical hat market's growth. One of the key factors driving the growth of the market is the growing geriatric population. The elderly are vulnerable to a variety of disorders and diseases. As a result of this factor, there is an increase in the demand for hygiene and dressing products. Additionally, technological advancements are hastening the global surgical hat market's growth and development. Raw materials for surgical hats include polypropylene, cotton, and polyamide. These materials are combined to make surgical hats on the global market. Increasing demand for surgical hat Many hospitals reject disposable hats because nurses may be unfamiliar with the concept of bringing a surgical hat home to wash. Some argue that 'using washable goods' increases the risk of infection, but in most cases, these regulations are out of date. According to Linda Comyns of Walsgrave Theatres, using cloth hats in theatres was previously prohibited due to infection control concerns. However, studies have shown that it makes no difference whether the hats are disposable or cloth, as long as the cloth hats are changed on a daily basis. To help ensure compliance, each member of staff has been given one hat more than the number of shifts they work each week. Using one hat on a daily basis is harmful to the human body. Many hospitals in the United States have set sustainability goals in order to address the healthcare industry's significant carbon footprint. However, in many institutions, single-use, disposable medical equipment is currently used to provide the majority of patient care. These items generate millions of pounds of waste each year, significantly increasing the environmental impact of hospitals. Non-hazardous medical waste, such as PPE used in infection control, accounts for 88% of all medical waste generated by hospitals. As a result, using reusable PPE would significantly reduce hospital waste and assist hospitals in becoming more sustainable. These factors are expected to drive growth in the surgical hat market in the near future.

Surgical Hat Market Restraints

Lower Penetration of Surgical Apparel in undeveloped Countries Lack of knowledge about surgical apparel such as drapes and gowns, head ware, gloves, and others in hospitals in middle- and low-income countries is expected to limit the surgical hat market trend during the forecast period. According to an Institute of Medicine study on patient outcomes, using a disposable alternative such as a mask, surgical hat, or gown. Many serious patient safety incidents are blamed on communication errors. When there is a breakdown in communication in the operating room, patient safety incidents can occur. The use of disposable reasons results in poor communication within and across surgical teams. Moreover, increased acceptance of robotic operations, particularly in North America and Europe, will have a significant impact on future market growth.Surgical Hat Market Opportunity

Recent advancements in the medical science and textile industry Medical textiles are becoming increasingly popular. As health and hygiene facilities improve around the world, medical textile technology is rapidly growing. Large corporations are investing in research and development to create higher-quality PPE kits, hats, and gloves. Researchers are working hard to create a market for a surgical hat that has the stability, elasticity, and porosity required for a wide range of applications. Consumers are becoming more health-conscious, and companies are developing PPE kits, hats, and gloves that are biocompatible, non-toxic, anti-allergic, and anti-bacterial throughout their life cycle usage in response to stringent government health and environmental regulations. Cotton, polyester, and linen have all been used successfully in medical textile development. This will provide significant growth potential for the surgical hat market during the forecast period.Surgical Hat Market Segment Analysis:

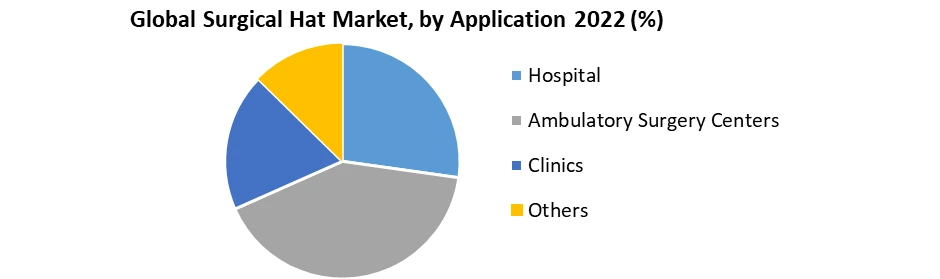

Based on Type, The non-woven sub-type is expected to have a dominant market share and generate $135 million in revenue by 2029, up from $55 million in 2021. Spun bond polymer non-woven fabric is used to make non-woven hats. Because of its lightweight, this material is popular. It has a lower gravity than hydrophobic PP fibers, so it repels water and allows air to pass through, resulting in comfort and dryness, as well as antibacterial and antifungal resistance. The significant growth of the non-woven fabric surgical hat market is primarily driven by important characteristics such as good comfort, stability, low cost, and environmental friendliness. These caps are widely used in hospitals worldwide, primarily because they are one of the best solutions for preventing filthy hair and contamination during surgical procedures. It also helps to maintain a cleaner working environment in surgical settings.Based on Application, The market has been segmented into hospitals, ambulatory surgery centers, clinics, and other segments. The hospital sub-segment accounted for the highest revenue share in 2021. The hospital sub-segment is growing primarily as a result of factors such as strategic collaborations between innovative firms and hospitals, an aging population, and the establishment of specialty hospitals. Because of improved outpatient services and increased patient satisfaction, the hospital sector is regarded as one of the most critical components of healthcare infrastructure. As a result, the demand for surgical apparel in the hospital sub-segment is expected to skyrocket, potentially boosting the surgical hat market in the forecast years. The ambulatory surgery center sub-segment, on the other hand, is expected to grow the fastest during the forecast period. The growing number of ambulatory surgery centers is a critical factor assisting the global surgical hat sector to thrive tremendously. Moreover, authorities all over the world are taking strategic actions, such as the United Nations Children's Fund (UNICEF), an institution responsible for providing developmental assistance to children. For example, UNICEF stated in April 2020 that it will provide Lebanon with technical assistance and medical supplies to combat the COVID-19 epidemic. These factors may have a positive impact on surgical apparel demand, which supports the global surgical hat market growth during the forecast period.

Based on the Application, The market has been divided into two sections: online and offline. The offline sub-segment accounted for the highest revenue share in 2021. Shops, wholesalers, hypermarkets, convenience stores, brand outlets, and direct selling are the most common ways disposable surgical hats are distributed. Several companies have decided to promote and sell their products through pharmacies and medicine stores, which stock a wide range of surgical hats. Furthermore, customers can evaluate different goods in terms of quality and material used by visiting these establishments in person.

Surgical Hat Market Regional Insights:

North America dominated the surgical hat market and accounted for the largest revenue share of 31.5% in 2021 owing to well-developed end-use industries along with extensive adoption of products in the healthcare sector. In the United States, high product penetration is attributed to a strict regulatory environment with severe penalties for noncompliance, which drives businesses to use surgical hats on a regular basis. Asia Pacific is expected to grow at the fastest CAGR of 8.5% during the forecast period. According to the International Society of Aesthetic Plastic Surgery, 28% of women in Seoul had plastic surgery in 2020. South Korea had over 980,000 operations in 2020, according to a plastic surgeon, because women in Eastern Asia have "monolid eyes," so eyelid surgery is the most popular in the country, followed by body contouring, which is cheaper in South Korea compared to other countries. During the forecast period, an increase in the number of plastic surgeries is expected to boost demand for the surgical hat market. Japan is prone to natural disasters and has numerous hospitals, outpatient surgical/day centers, and emergency medical services (EMS). Furthermore, the country's high prevalence of chronic diseases has prompted the government to implement cost-cutting measures such as preventive care and chronic disease self-management. Japan accounted for 11.4% of total revenue in Asia Pacific in 2019 due to rising medical innovation in the country.Surgical Hat Market Scope: Inquiry Before Buying

Surgical Hat Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 141 Mn. Forecast Period 2023 to 2029 CAGR: 8.3% Market Size in 2029: US$ 246.39 Mn. Segments Covered: by Type 1.Non-woven 2.Cotton 3.Others by Application 1.Hospital 2.Ambulatory Surgery Centers 3.Clinics 4.Others by Distribution Channel 1.Online 2.Offline Surgical Hat Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Surgical Hat Market, Key Players are:

1.Alpha Pro Tech 2. Ansell 3. Cardinal Health Inc. 4.Delta Plus 5.Derekduck Industries Corp. 6.GRI-Alleset, Inc. 7.Halyard HealthMedicom 8. HARTMANN GROUP 9.Henry Schein, Inc. 10.International group llc lp 11.Kimberly-Clark Worldwide, Inc. 12. KimKaps 13. Lakeland Inc. 14. Medline industries, inc. 15. Mölnlycke Health Care AB. 16.Molnlycke health care us 17. Owens & Minor Inc. 18.3M 19.Plasti Surge Industries Pvt. 20.SEE KATE SEW 21. Tronex International, Inc. 22.Zarys Frequently Asked Questions: 1] What segments are covered in the Global Surgical Hat Market report? Ans. The segments covered in the Surgical Hat Market report are based on Type, Application, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Surgical Hat Market? Ans. The North America region is expected to hold the highest share of the Surgical Hat Market. 3] What is the market size of the Global Surgical Hat Market by 2029? Ans. The market size of the Surgical Hat Market by 2029 is expected to reach US$ 246.39 Mn. 4] What is the forecast period for the Global Surgical Hat Market? Ans. The forecast period for the Surgical Hat Market is 2023-2029. 5] What was the market size of the Global Surgical Hat Market in 2022? Ans. The market size of the Surgical Hat Market in 2022 was valued at US$ 141 Mn.

1. Global Surgical Hat Market Size: Research Methodology 2. Global Surgical Hat Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Surgical Hat Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Surgical Hat Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Surgical Hat Market Size Segmentation 4.1. Global Surgical Hat Market Size, by Type (2022-2029) • Non-woven • Cotton • Others 4.2. Global Surgical Hat Market Size, by Application (2022-2029) • Hospital • Ambulatory Surgery Centers • Clinics • Others 4.3. Global Surgical Hat Market Size, by Distribution Channel (2022-2029) • Online • Offline 5. North America Surgical Hat Market (2022-2029) 5.1. North America Surgical Hat Market Size, by Type (2022-2029) • Non-woven • Cotton • Others 5.2. North America Surgical Hat Market Size, by Application (2022-2029) • Hospital • Ambulatory Surgery Centers • Clinics • Others 5.3. North America Surgical Hat Market Size, by Distribution Channel (2022-2029) • Online • Offline 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Surgical Hat Market (2022-2029) 6.1. European Surgical Hat Market, by Type (2022-2029) 6.2. European Surgical Hat Market, by Application (2022-2029) 6.3. European Surgical Hat Market, by Distribution Channel (2022-2029) 6.4. European Surgical Hat Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Surgical Hat Market (2022-2029) 7.1. Asia Pacific Surgical Hat Market, by Type (2022-2029) 7.2. Asia Pacific Surgical Hat Market, by Application (2022-2029) 7.3. Asia Pacific Surgical Hat Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Surgical Hat Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Surgical Hat Market (2022-2029) 8.1. Middle East and Africa Surgical Hat Market, by Type (2022-2029) 8.2. Middle East and Africa Surgical Hat Market, by Application (2022-2029) 8.3. Middle East and Africa Surgical Hat Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Surgical Hat Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Surgical Hat Market (2022-2029) 9.1. South America Surgical Hat Market, by Type (2022-2029) 9.2. South America Surgical Hat Market, by Application (2022-2029) 9.3. South America Surgical Hat Market, by Distribution Channel (2022-2029) 9.4. South America Surgical Hat Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Alpha Pro Tech 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Ansell 10.3. Cardinal Health Inc. 10.4. Delta Plus 10.5. Derekduck Industries Corp. 10.6. GRI-Alleset, Inc. 10.7. Halyard HealthMedicom 10.8. HARTMANN GROUP 10.9. Henry Schein, Inc. 10.10. International group llc lp 10.11. Kimberly-Clark Worldwide, Inc. 10.12. KimKaps 10.13. Lakeland Inc. 10.14. Medline industries, inc. 10.15. Mölnlycke Health Care AB. 10.16. Molnlycke health care us 10.17. Owens & Minor Inc. 10.18. 3M 10.19. Plasti Surge Industries Pvt. 10.20. SEE KATE SEW 10.21. Tronex International, Inc. 10.22. Zarys