Global Still Wine Market was valued at USD 178.82 Bn in 2022 and is expected to reach USD 364.29 Bn by 2029, at a CAGR of 10.7 %.Still Wine Market Overview

The Still Wines are dry wines and have an alcohol content that ranges from a minimum of 8.5º to a maximum of 14.5º. These wines have various varieties such as red wine, white wine, and rosé wine, but never sparkling. Wine is produced through the fermentation of grape juice without any additional carbonation or alcohol fortification processes. It is the most common and traditional form of wine, which is regularly enjoyed with meals and others. The growth of e-commerce and the rise of direct-to-consumer (DTC) models are expected to boost the Still Wine Market. This DTC model allows wineries to establish a direct relationship with consumers, bypassing traditional distribution channels and gaining more control over pricing, branding, and customer engagement. This shift towards online sales and DTC models helps to expand their variety of products in the market.To know about the Research Methodology :- Request Free Sample Report

Still Wine Market Dynamics

Changing Consumer Preferences and High Wine Production to Drive the Market Growth The changing consumer preference for wine as a beverage choice is the main driver for market growth. Across the world, wine has gained popularity as a versatile and sophisticated drink that is enjoyed on various occasions. The growing awareness of the wine culture due to the changing people’s lifestyle, growth of disposable income and high demand for still wine influences the market. Consumers are increasingly exploring different wine varieties, flavors, and styles are expected to fuel the growth of the global still wine market. Developing markets, such as China, India, and Brazil, have witnessed a significant increase in wine production and consumption. In India, 34.4 million liters of wine were consumed in 2022. The 19 million liters of wine consumed were still light grape wine in the South Asian country. According to our research, a compound annual growth rate of wine consumption of over 11.08 percent was estimated in 2021. India's wine market is currently equivalent to around 200 people sharing one bottle but it is likely to grow at a projected 22.1 % in the next three years due to the rise in domestic consumption. The current consumption is 5m bottles a year. The increased wine international trade and globalization have made still wine more accessible, allowing consumers in emerging markets to explore and appreciate different wine styles and brands. The rise in wine production and consumption in these markets is driving the growth of the global still wine market. This growth in consumption is driven by the wine’s fastest-growing consumer segment young adults (20-35).Wine is increasingly being recognized for its potential health benefits when consumed in moderation. Research and development suggesting that moderate wine consumption may have positive effects on heart health and overall well-being have contributed to its growing popularity as a health-conscious choice. Consumers are seeking out still wines that offer not only enjoyment but also potential health advantages, such as red wines rich in antioxidants. This health-conscious trend is influencing the global still wine market, as consumers choose wine as a preferred alcoholic beverage option over other options with potentially higher health risks. Expansion of Online Wine Retail Channels to Boost the Market The growth of online and offline wine retail channels is a key influencing factor for the Still Wine Market growth. E-commerce platforms and online wine retailers provide consumers with a convenient and accessible way to explore and purchase a wide range of still wines from across the world. Wineries are increasingly partnering with online platforms or developing their own e-commerce channels to tap into this growing market and reach a broader consumer base. The ease of browsing through extensive selections, reading reviews, and accessing detailed product information has contributed to the growth of online wine sales. However, Wine-producing regions worldwide are attracting tourists who are interested in vineyard tours, wine tastings, and cellar visits and drive the Market. Wine and Food Pairing Culture Trend to Fuel the Market The growing culture of wine and food pairing is another key growth driver for the global still wine market. Consumers are increasingly interested in enhancing their dining experiences by pairing specific wines with different cuisines and dishes. This trend has led to an increased demand for still wines that complement various types of food, including fine dining, casual dining, and home cooking. Wineries are leveraging this trend by providing guidance and recommendations on wine and food pairing, collaborating with restaurants and chefs to create unique dining experiences, and promoting the versatility of still wine in enhancing the flavors of different dishes. The e-commerce share of wine sales in the U.S. went from 0.32% in 2018 to nearly 3% in 2022. These platforms provide API integrations with various payment processors such as PayPal, Stripe and Square. According to our research, 45.9% of wine sellers surveyed planned to increase their digital marketing budget in 2022. This growth is driven by a rise in the use of technology, wine club subscriptions and Eco-conscious wineries will focus on using sustainable packaging, reducing their carbon footprint, and supporting environmentally-friendly practices. There are some other trends that are expected to influence the Still Wine Market growth. 1. Rise in Demand for Premium and Ultra-Premium Wines 2. Emphasis on Sustainability and Green Practices 3. Premiumization and Trading Up 4. Increasing Popularity of Indigenous and Lesser-Known Grape Varieties 5. Online Wine Education and Virtual Tastings 6. Blurring of Traditional Wine Categories and Styles Growing Demand for Organic and Sustainable Still Wine to Create Lucrative Opportunity for the Market Growth The increasing consumer demand for organic and sustainable wines is due to consumers becoming more conscious of their environmental footprint and health. There is a growing preference for still wine to be produced by using organic farming practices and sustainable winemaking techniques. Organic wines are made from grapes grown without synthetic pesticides, herbicides, or fertilizers, while sustainable winemaking focuses on reducing water usage, energy consumption, and carbon emissions. Wineries that embrace these practices tap into the growing market segment of eco-conscious consumers seeking high-quality still wines that align with their values. Such all factors are expected to boost the Still Wine Market growth during the forecast period.

Still Wine Market Challenges and Restrain:

Regulatory and Trade Barriers: Different countries across the regions have various regulations and restrictions on the production, labeling, and import/export of still wine. These regulations are expected to pose challenges for wine producers who aim to expand their market reach and comply with multiple sets of rules. Also, trade barriers such as tariffs, duties, and import restrictions are expected to hinder the growth of the global still wine market and increase the cost of importing and exporting wine. Another is intense competition from other alcoholic beverages, such as craft beer, spirits, and ready-to-drink cocktails. To sustain growth, wine producers need to invest in market research, product development, marketing strategies, and brand positioning to stay relevant and capture consumer attention amidst a diverse range of beverage options.Regional Still Wine Market Analysis

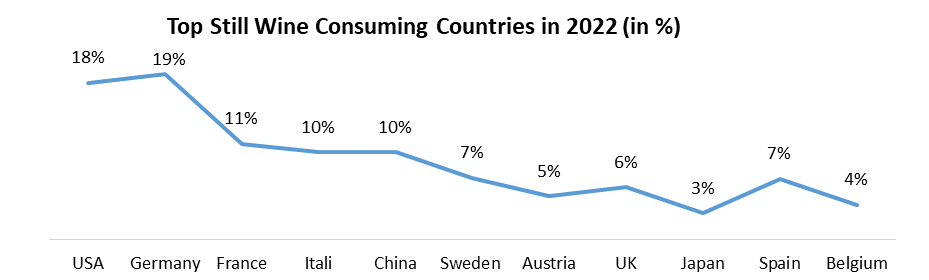

Europe held the largest market share in 2022 and is expected to sustain its position at a CAGR over the forecast period. The region has a well-established domestic market for still wines, and European wines have a strong presence in international markets as well. The increasing popularity of this product among the youngster and the growth of the working population and the acceptance of low-ABV beverages in their busy daily routine are expected to influence the Still Wine Market growth potential. While Germany is a large wine-producing country and delivers 60% of global production. Total consumption of still and sparkling wines in recent years fluctuated between 18.4 and 20.18 million hl. Similarly, per capita consumption was undulated between 23.4 and 24.6 liters in 2022. Sustainability and organic production methods, with many wineries adopting eco-friendly practices and certifications, are expected to drive regional market growth and set the benchmark for quality in the industry.North America, particularly the United States and Canada, has seen remarkable growth in the Still Wine Market. The United States is one of the largest wine-consuming countries in the world, and California, with its renowned Napa and Sonoma regions, stands out as a significant producer. A diverse range of still wines, including varietals such as Cabernet Sauvignon, Chardonnay, and Pinot Noir are gaining popularity in recent years. Also, there has been a surge in boutique wineries and small-scale producers focusing on crafting premium and artisanal still wines. The influence of online retail platforms is expected to boost the market. The Asia Pacific region has emerged as a significant growth market for still wines. The increasing demand for both domestic and imported still wines due to the growing middle-class population & disposable incomes, and evolving consumer tastes contribute to the growth of the still wine market in Asia Pacific. Wineries are adapting their strategies including producing wines with lower alcohol content, offering sweeter or fruit-forward styles, and incorporating cultural elements in branding and marketing. These are some major factors for the regional Still Wine Market growth during the forecast period.

Still Wine Market Segment Analysis

By Distribution Channel: Based on the distribution channel, the liquor store segment is expected to grow at a significant CAGR over the forecast period. A growing number of supermarket chains, along with their in-store promotions in the developing economy, are expected to drive this growth in the market. Specialist alcohol retailers hold a major share of the offline sales of the product. The adoption of e-commerce among the population is a key factor propelling the growth Still Wine Market.By Type: Based on type, the still red wine segment dominated the largest market share in 2022. The segment growth is influenced due to its high antioxidant and strong plant chemical properties. It is widely drunk around the world and has a variety of benefits, including an improvement in consumers' healthy lifestyles after regular drinking of red wine in moderation. As a result, all variables are expected to contribute to the segment's growth in the market during the forecast period.

Competitive Analysis

The global Still Wine Market is highly competitive and reports provide company profiles of major players such as E. & J. Gallo Winery, Constellation Brands, Treasury Wine Estates, The Wine Group, and Pernod Ricard SA vying for market share. These companies have strengths such as a strong brand reputation, diverse product portfolios, extensive distribution networks, and a focus on innovation. They also face challenges such as changing consumer preferences, intense competition, regulatory hurdles, and potential disruptions in the supply chain. To succeed in this market, companies should focus on expanding into emerging markets, investing in sustainability, diversifying product offerings, leveraging digital marketing strategies, and capitalizing on premium and organic wine segments. Key players of Still Wine will create and explore opportunities in direct-to-consumer sales channels, leverage e-commerce platforms, and expand into untapped regions.Still Wine Market Scope: Inquire before buying

Still Wine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 178.82 Bn Forecast Period 2023 to 2029 CAGR: 10.7% Market Size in 2029: USD 364.29 Bn Segments Covered: by Type Still Red Wine Still White Wine Still Rose Wine Still Orange Wine other by Distribution Channel Liquor stores Internet Retailing Pubs, bars & retardants Online platform Supermarkets Other by Price Range Premium Economy/Low-priced Mid-priced by Packaging Cans Bottles Still Wine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Still Wine Key players are:

1. E. & J. Gallo Winery (United States) 2. Constellation Brands, Inc. (United States) 3. Treasury Wine Estates Limited (Australia) 4. The Wine Group LLC (United States) 5. Pernod Ricard SA (France) 6. Accolade Wines Ltd. (Australia) 7. Viña Concha y Toro SA (Chile) 8. Castel Group (France) 9. Jackson Family Wines (United States) 10. Caviro S.C. (Italy) 11. Grupo Peñaflor (Argentina) 12. Familia Torres (Spain) 13. Trinchero Family Estates (United States) 14. Sogrape Vinhos, SA (Portugal) 15. Brown-Forman Corporation (United States) 16. LVMH Moët Hennessy Louis Vuitton SE (France) 17. Marqués de Riscal (Spain) 18. Symington Family Estates (Portugal) 19. Santa Rita Estates (Chile) 20. Yantai Changyu Pioneer Wine Company Limited (China) Frequently Asked Questions: 1] What is the growth rate of the Global Still Wine Market? Ans. The Global Still Wine Market is growing at a significant rate of 10.7% during the forecast period. 2] Which region is expected to dominate the Global Still Wine Market? Ans. Europe is expected to hold the Still Wine Market growth potential over the forecast period. 3] What is the expected Global Still Wine Market size by 2029? Ans. The Still Wine Market size is expected to reach USD 364.29 Bn by 2029. 4] Which are the top players in the Global Still Wine Market? Ans. The major top players in the Global Still Wine Market are E. & J. Gallo Winery, Constellation Brands, Inc.and others. 5] What are the factors driving the Global Still Wine Market growth? Ans. The growing demand for Still Wine due to the changing consumer preference and test is the primary driver for the Still Wine Market growth.

1. Still Wine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Still Wine Market: Dynamics 2.1. Still Wine Market Trends by Region 2.1.1. North America Still Wine Market Trends 2.1.2. Europe Still Wine Market Trends 2.1.3. Asia Pacific Still Wine Market Trends 2.1.4. Middle East and Africa Still Wine Market Trends 2.1.5. South America Still Wine Market Trends 2.2. Still Wine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Still Wine Market Drivers 2.2.1.2. North America Still Wine Market Restraints 2.2.1.3. North America Still Wine Market Opportunities 2.2.1.4. North America Still Wine Market Challenges 2.2.2. Europe 2.2.2.1. Europe Still Wine Market Drivers 2.2.2.2. Europe Still Wine Market Restraints 2.2.2.3. Europe Still Wine Market Opportunities 2.2.2.4. Europe Still Wine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Still Wine Market Drivers 2.2.3.2. Asia Pacific Still Wine Market Restraints 2.2.3.3. Asia Pacific Still Wine Market Opportunities 2.2.3.4. Asia Pacific Still Wine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Still Wine Market Drivers 2.2.4.2. Middle East and Africa Still Wine Market Restraints 2.2.4.3. Middle East and Africa Still Wine Market Opportunities 2.2.4.4. Middle East and Africa Still Wine Market Challenges 2.2.5. South America 2.2.5.1. South America Still Wine Market Drivers 2.2.5.2. South America Still Wine Market Restraints 2.2.5.3. South America Still Wine Market Opportunities 2.2.5.4. South America Still Wine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Still Wine Industry 2.8. Analysis of Government Schemes and Initiatives For Still Wine Industry 2.9. Still Wine Market price trend Analysis (2021-22) 2.10. Still Wine Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Still Wine 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Still Wine 2.11. Still Wine Production Analysis 2.12. The Global Pandemic Impact on Still Wine Market 3. Still Wine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2022-2029 3.1. Still Wine Market Size and Forecast, by Type (2022-2029) 3.1.1. Still Red Wine 3.1.2. Still White Wine 3.1.3. Still Rose Wine 3.1.4. Still Orange Wine 3.1.5. other 3.2. Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 3.2.1. Liquor stores 3.2.2. Internet Retailing 3.2.3. Pubs, bars & retardants 3.2.4. Online platform 3.2.5. Supermarkets 3.2.6. Other 3.3. Still Wine Market Size and Forecast, by Price Range (2022-2029) 3.3.1. Premium 3.3.2. Economy/Low-priced 3.3.3. Mid-priced 3.4. Still Wine Market Size and Forecast, by Packaging (2022-2029) 3.4.1. Cans 3.4.2. Bottles 3.5. Still Wine Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Still Wine Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 4.1. North America Still Wine Market Size and Forecast, by Type (2022-2029) 4.1.1. Still Red Wine 4.1.2. Still White Wine 4.1.3. Still Rose Wine 4.1.4. Still Orange Wine 4.1.5. other 4.2. North America Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Liquor stores 4.2.2. Internet Retailing 4.2.3. Pubs, bars & retardants 4.2.4. Online platform 4.2.5. Supermarkets 4.2.6. Other 4.3. North America Still Wine Market Size and Forecast, by Price Range (2022-2029) 4.3.1. Premium 4.3.2. Economy/Low-priced 4.3.3. Mid-priced 4.4. North America Still Wine Market Size and Forecast, by Packaging (2022-2029) 4.4.1. Cans 4.4.2. Bottles 4.5. North America Still Wine Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Still Wine Market Size and Forecast, by Type (2022-2029) 4.5.1.1.1. Still Red Wine 4.5.1.1.2. Still White Wine 4.5.1.1.3. Still Rose Wine 4.5.1.1.4. Still Orange Wine 4.5.1.1.5. other 4.5.1.2. United States Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1.2.1. Liquor stores 4.5.1.2.2. Internet Retailing 4.5.1.2.3. Pubs, bars & retardants 4.5.1.2.4. Online platform 4.5.1.2.5. Supermarkets 4.5.1.2.6. Other 4.5.1.3. United States Still Wine Market Size and Forecast, by Price Range (2022-2029) 4.5.1.3.1. Premium 4.5.1.3.2. Economy/Low-priced 4.5.1.3.3. Mid-priced 4.5.1.4. United States Still Wine Market Size and Forecast, by Packaging (2022-2029) 4.5.1.4.1. Cans 4.5.1.4.2. Bottles 4.5.2. Canada 4.5.2.1. Canada Still Wine Market Size and Forecast, by Type (2022-2029) 4.5.2.1.1. Still Red Wine 4.5.2.1.2. Still White Wine 4.5.2.1.3. Still Rose Wine 4.5.2.1.4. Still Orange Wine 4.5.2.1.5. other 4.5.2.2. Canada Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.2.2.1. Liquor stores 4.5.2.2.2. Internet Retailing 4.5.2.2.3. Pubs, bars & retardants 4.5.2.2.4. Online platform 4.5.2.2.5. Supermarkets 4.5.2.2.6. Other 4.5.2.3. Canada Still Wine Market Size and Forecast, by Price Range (2022-2029) 4.5.2.3.1. Premium 4.5.2.3.2. Economy/Low-priced 4.5.2.3.3. Mid-priced 4.5.2.4. Canada Still Wine Market Size and Forecast, by Packaging (2022-2029) 4.5.2.4.1. Cans 4.5.2.4.2. Bottles 4.5.3. Mexico 4.5.3.1. Mexico Still Wine Market Size and Forecast, by Type (2022-2029) 4.5.3.1.1. Still Red Wine 4.5.3.1.2. Still White Wine 4.5.3.1.3. Still Rose Wine 4.5.3.1.4. Still Orange Wine 4.5.3.1.5. other 4.5.3.2. Mexico Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.3.2.1. Liquor stores 4.5.3.2.2. Internet Retailing 4.5.3.2.3. Pubs, bars & retardants 4.5.3.2.4. Online platform 4.5.3.2.5. Supermarkets 4.5.3.2.6. Other 4.5.3.3. Mexico Still Wine Market Size and Forecast, by Price Range (2022-2029) 4.5.3.3.1. Premium 4.5.3.3.2. Economy/Low-priced 4.5.3.3.3. Mid-priced 4.5.3.4. Mexico Still Wine Market Size and Forecast, by Packaging (2022-2029) 4.5.3.4.1. Cans 4.5.3.4.2. Bottles 5. Europe Still Wine Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 5.1. Europe Still Wine Market Size and Forecast, by Type (2022-2029) 5.2. Europe Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.3. Europe Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.4. Europe Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5. Europe Still Wine Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.1.2. United Kingdom Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.1.3. United Kingdom Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.1.4. United Kingdom Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.2. France 5.5.2.1. France Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.2.2. France Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2.3. France Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.2.4. France Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.3.2. Germany Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3.3. Germany Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.3.4. Germany Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.4.2. Italy Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.4.3. Italy Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.4.4. Italy Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.5.2. Spain Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.5.3. Spain Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.5.4. Spain Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.6.2. Sweden Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.6.3. Sweden Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.6.4. Sweden Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.7.2. Austria Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.7.3. Austria Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.7.4. Austria Still Wine Market Size and Forecast, by Packaging (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Still Wine Market Size and Forecast, by Type (2022-2029) 5.5.8.2. Rest of Europe Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.8.3. Rest of Europe Still Wine Market Size and Forecast, by Price Range (2022-2029) 5.5.8.4. Rest of Europe Still Wine Market Size and Forecast, by Packaging (2022-2029) 6. Asia Pacific Still Wine Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 6.1. Asia Pacific Still Wine Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Asia Pacific Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.4. Asia Pacific Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5. Asia Pacific Still Wine Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.1.2. China Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.1.3. China Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.1.4. China Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.2.2. S Korea Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2.3. S Korea Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.2.4. S Korea Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Japan Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3.3. Japan Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.3.4. Japan Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.4. India 6.5.4.1. India Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.4.2. India Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4.3. India Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.4.4. India Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Australia Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5.3. Australia Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.5.4. Australia Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Indonesia Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6.3. Indonesia Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.6.4. Indonesia Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Malaysia Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7.3. Malaysia Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.7.4. Malaysia Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Vietnam Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8.3. Vietnam Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.8.4. Vietnam Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.9.2. Taiwan Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.9.3. Taiwan Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.9.4. Taiwan Still Wine Market Size and Forecast, by Packaging (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Still Wine Market Size and Forecast, by Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.10.3. Rest of Asia Pacific Still Wine Market Size and Forecast, by Price Range (2022-2029) 6.5.10.4. Rest of Asia Pacific Still Wine Market Size and Forecast, by Packaging (2022-2029) 7. Middle East and Africa Still Wine Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 7.1. Middle East and Africa Still Wine Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Still Wine Market Size and Forecast, by Price Range (2022-2029) 7.4. Middle East and Africa Still Wine Market Size and Forecast, by Packaging (2022-2029) 7.5. Middle East and Africa Still Wine Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Still Wine Market Size and Forecast, by Type (2022-2029) 7.5.1.2. South Africa Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.1.3. South Africa Still Wine Market Size and Forecast, by Price Range (2022-2029) 7.5.1.4. South Africa Still Wine Market Size and Forecast, by Packaging (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Still Wine Market Size and Forecast, by Type (2022-2029) 7.5.2.2. GCC Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2.3. GCC Still Wine Market Size and Forecast, by Price Range (2022-2029) 7.5.2.4. GCC Still Wine Market Size and Forecast, by Packaging (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Still Wine Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Nigeria Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3.3. Nigeria Still Wine Market Size and Forecast, by Price Range (2022-2029) 7.5.3.4. Nigeria Still Wine Market Size and Forecast, by Packaging (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Still Wine Market Size and Forecast, by Type (2022-2029) 7.5.4.2. Rest of ME&A Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4.3. Rest of ME&A Still Wine Market Size and Forecast, by Price Range (2022-2029) 7.5.4.4. Rest of ME&A Still Wine Market Size and Forecast, by Packaging (2022-2029) 8. South America Still Wine Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 8.1. South America Still Wine Market Size and Forecast, by Type (2022-2029) 8.2. South America Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. South America Still Wine Market Size and Forecast, by Price Range(2022-2029) 8.4. South America Still Wine Market Size and Forecast, by Packaging (2022-2029) 8.5. South America Still Wine Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Still Wine Market Size and Forecast, by Type (2022-2029) 8.5.1.2. Brazil Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.1.3. Brazil Still Wine Market Size and Forecast, by Price Range (2022-2029) 8.5.1.4. Brazil Still Wine Market Size and Forecast, by Packaging (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Still Wine Market Size and Forecast, by Type (2022-2029) 8.5.2.2. Argentina Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2.3. Argentina Still Wine Market Size and Forecast, by Price Range (2022-2029) 8.5.2.4. Argentina Still Wine Market Size and Forecast, by Packaging (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Still Wine Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Rest Of South America Still Wine Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3.3. Rest Of South America Still Wine Market Size and Forecast, by Price Range (2022-2029) 8.5.3.4. Rest Of South America Still Wine Market Size and Forecast, by Packaging (2022-2029) 9. Global Still Wine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Still Wine Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Still Wine Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. E. & J. Gallo Winery (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Constellation Brands, Inc. (United States) 10.3. Treasury Wine Estates Limited (Australia) 10.4. The Wine Group LLC (United States) 10.5. Pernod Ricard SA (France) 10.6. Accolade Wines Ltd. (Australia) 10.7. Viña Concha y Toro SA (Chile) 10.8. Castel Group (France) 10.9. Jackson Family Wines (United States) 10.10. Caviro S.C. (Italy) 10.11. Grupo Peñaflor (Argentina) 10.12. Familia Torres (Spain) 10.13. Trinchero Family Estates (United States) 10.14. Sogrape Vinhos, SA (Portugal) 10.15. Brown-Forman Corporation (United States) 10.16. LVMH Moët Hennessy Louis Vuitton SE (France) 10.17. Marqués de Riscal (Spain) 10.18. Symington Family Estates (Portugal) 10.19. Santa Rita Estates (Chile) 10.20. Yantai Changyu Pioneer Wine Company Limited (China) 11. Key Findings 12. Industry Recommendations 13. Still Wine Market: Research Methodology 14. Terms and Glossary