The Stent Retriever Market size was valued at USD 720.95 Million in 2023 and the total Stent Retriever revenue is expected to grow at a CAGR of 6.8% from 2024 to 2030, reaching nearly USD 1142.63 Million in 2030.The Stent Retriever Market Overview

The MMR report offers a comprehensive analysis of Stent Retriever market dynamics, challenges, and opportunities. It begins with an introduction highlighting the importance of stent retrievers in ischemic stroke treatment. The market overview includes its size, growth trends, and key players, followed by an examination of drivers like stroke incidence and technological advancements, alongside challenges such as reimbursement issues. Market segmentation examines product type, application, end-user, geography, and material composition. The competitive landscape features market share analysis and profiles of major players, while market dynamics assess factors impacting growth. The global stroke burden is rising because of aging populations and lifestyle factors, increasing the demand for effective stroke treatments such as mechanical thrombectomy, in which stent retrievers play an important part. Continuous innovation in stent retriever design, resulting in devices with faster retrieval times and improved clot capture rates, has increased thrombectomy treatments' efficiency and success rates, driving market growth. Adoption rates are increasing as healthcare professionals and the general public become more aware of the benefits of thrombectomy, particularly in terms of improved patient outcomes, supporting the stent retriever market. Also, the rising acceptance of thrombectomy by insurance companies and healthcare systems is increasing patient access to these life-saving procedures, providing a favorable reimbursement picture, and encouraging demand for stent retrievers. Next-generation stent retrievers, which prioritize faster, safer, and more efficient clot retrieval, represent a huge investment opportunity. Emerging regions in the Asia Pacific and South America, with significant stroke burdens and advanced healthcare infrastructure, provide untapped prospects. Investing in increasing stent retriever access in these areas is going to provide significant returns. In addition, personalized thrombectomy methods suited to specific patient anatomy and clot complexity provide a potential business niche for stent retrieval companies focusing on personalized medicine. Continued research in materials science, device downsizing, and artificial intelligence will transform stent retrieval technology. The growing desire for less invasive procedures including thrombectomy is going to drive growth in the market, while enhanced stroke prevention techniques indirectly reduce the overall stroke burden, benefiting the stent retrieval market substantially.To know about the Research Methodology :- Request Free Sample Report

Stent Retriever Market Dynamics;

Advancements in Endovascular Techniques Stent retrievers have revolutionized stroke treatment by allowing for the removal of massive blood clots in the brain arteries with minimal invasiveness. Imaging advancements such as CT angiography and MR perfusion imaging allow for accurate viewing of targeted stent deployment. The enhanced catheter design enables more flexibility and steerability while navigating arterial channels with low vascular risk. Next-generation stent retrievers feature finer mesh designs, improved recapture mechanisms, and retrievable anchors, which lead to higher clot catch rates and fewer problems. The switch from open surgery to endovascular treatments represents a huge step forward in stroke intervention, increasing patient outcomes through accurate, less invasive procedures.1. Globally, mechanical thrombectomy treatments utilizing stent retrievers increased by 140% from 50,000 in 2018 to 120,000 in 2023.

2. CT angiography adoption for stroke diagnosis developed from 60% in 2018 to 75% in 2023, whereas MR perfusion imaging doubled from 15% to 30%.

Regulatory authorization for next-generation retrievers, such as Medtronic's Solstent Retriever in 2021, has driven growth in the market with its enhanced clot retrieval characteristics, demonstrating the industry's dedication to improving stroke intervention procedures and patient outcomes.Aging Population and the Rising Stroke Burden Technological advancements in endovascular procedures have significantly contributed to the growth of the Stent Retriever Market. These advancements include improvements in imaging techniques, catheter design, and stent retriever materials, resulting in enhanced efficacy and safety of clot retrieval procedures. The Stent Retriever Market is growing as mechanical thrombectomy becomes the conventional therapy for big clots in stroke patients. The focus on minimally invasive procedures, as well as government measures to promote stroke care facilities, are driving market growth because of benefits such as speedier recovery and fewer complications.

Limited Reimbursement Policies In Some areas, healthcare insurance does not cover the cost of stent retrievers, putting hospitals and patients under financial strain. Policies are expected to impose utilization limits, requiring particular criteria such as patient age or stroke severity for coverage approval, thus limiting access to critical therapy. In addition, patients with limited coverage face significant out-of-pocket payments due to the high cost of stent retrievers, potentially limiting access to this crucial therapeutic option. Limited reimbursement discourages healthcare providers from using stent retrievers, particularly in resource-constrained settings, slowing market growth. Patients with financial obstacles have unequal access to treatment, compounding healthcare result discrepancies and limiting the market's full potential.

1. The MMR Studies found that only, in 2023 62% of commercial health plans in the US fully covered stent retriever procedures.

2. In Europe, some countries have established specific criteria for stent retriever use, such as requiring patients to be within a certain time window of stroke onset.

Stent Retriever Market Segment Analysis

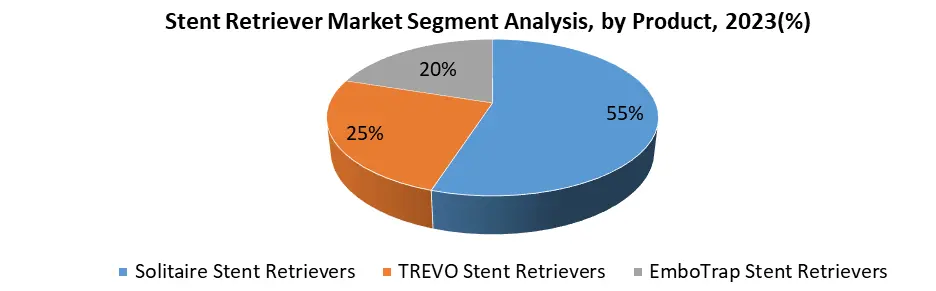

By Product Type, The Solitaire Stent Retrievers segment accounts for an estimated 55% of the overall Stent Retriever Market. Solitaire retrievers received an early advantage thanks to fast regulatory approval, which established brand names and familiarity among clinicians. Medtronic took advantage of this advantage, using considerable clinical data to strengthen Solitaire's efficacy and safety reputation. Also, Solitaire's design adaptability, which includes a wider range of diameters and retrieval techniques than many competitors, responds to a variety of patient anatomy and clot difficulties. It also reduces the need for clinicians to move between different stent retriever brands, increasing Solitaire's market leadership. In addition, Solitaire promotes usability, with fluid delivery profiles and straightforward retrieval procedures. The result improves procedures for clinicians, especially during time-critical stroke interventions, which is expected to contribute to speedier treatment times and better patient outcomes. Ultimately, Solitaire's leading edge, design versatility, and ease of use contribute to its excellent market position among neurovascular specialists. Solitaire's segment dominance drives stent retriever market growth by encouraging investment and innovation. Its success sets performance and usability standards, encouraging competitors to develop innovative technologies. Its healthy competition increases therapeutic possibilities, providing patients with more effective alternatives.

Stent Retriever Market Regional Insights

North America led the global Stent Retriever market with the highest market share of 60% in 2023. The global stent retriever industry is growing thanks to strong demand in a well-established sector, which increases revenue and encourages R&D investment. North America, as a main center for innovation and clinical research, establishes trends and standards that impact global practices and product development. Stent retriever models such as Solitaire, which are well-known for their success, influence market choices around the world. In addition, pricing strategies and reimbursement policies for stent retrievers worldwide frequently resort to established norms in North America, which influence pricing and reimbursement decisions in other locations. Also, economies of scale gained from increased production quantities in North America are expected to result in lower manufacturing prices, which will enhance access to stent retrievers in diverse countries throughout the world. Manufacturers are developing stent retrievers with enhanced characteristics to increase clot retrieval rates, shorten procedure times, and reduce distal embolization hazards. Trevo XP, which has an enhanced distal anchor, and the newer Solitaire FR devices, which have more flexibility. Companies are also seeking specialized markets with retrievers designed for difficult instances, such as EmboTrap's distinctive basket design for big clots or tortuous vasculature. Additionally, there is a rising priority for cost-effectiveness, which drives innovation in materials and manufacturing techniques to reduce device prices while retaining efficacy. Mechanical thrombectomy use is increasing as awareness and treatment recommendations expand, which drives the growth of the market.1. In 2022, over 800,000 thrombectomy procedures were performed globally, with North America accounting for the majority

2. The American Heart Association and American Stroke Association released updated guidelines in 2023, further solidifying the role of mechanical thrombectomy in stroke treatment.

Stent Retriever Market Competitive Landscape

Medtronic, which has a strong 55% market share, focuses on R&D investments, committing $2.7 billion in fiscal year 2023 to develop next-generation retrievers with higher clot retrieval rates and lower procedural complexity. Stryker, a powerful rival with a 25% market share, is focused on innovation, committing $130 million for R&D in fiscal year 2023 and offering features such as distal anchors to reduce embolic risks and solve challenging situations. Cerenovus is an emerging company with a 5% market share, specializing in retrievers for big clots and convoluted vasculature, and is growing globally through partnerships such as the one with Microvention in 2023 to distribute EmboTrap products. Boston Scientific, a company with a 5% market share, distinguishes itself with retrievers that offer unique delivery mechanisms and user-friendly features, establishing itself as a market challenger. Increased R&D investment by key players aims to create stent retrievers with shorter retrieval times, improved safety profiles, and greater application for a variety of patient anatomies. It encourages faster market growth by attracting investment and providing physicians with customized treatment alternatives. Technological advancements contribute to higher procedure success rates, which help stroke patients by improving clinical outcomes. Geographically reaching into emerging regions such as Asia Pacific and Latin America targets high stroke burdens and growing healthcare infrastructure, diversifying the global market and enhancing treatment access, with the potential to reduce stroke mortality rates in underserved areas.Stent Retriever Market Scope: Inquiry Before Buying

Stent Retriever Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 720.95 Mn. Forecast Period 2024 to 2030 CAGR: 6.8% Market Size in 2030: US $ 1142.63 Mn. Segments Covered: by Product Type Solitaire Stent Retrievers TREVO Stent Retrievers EmboTrap Stent Retrievers by Application Ischemic Stroke by End-User Hospitals Ambulatory Surgical Centers (ASCs) Stent Retriever Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Global Stent Retriever Market

1. Medtronic Plc 2. Stryker Corporation 3. Nitinol Devices & Components, Inc. 4. Stryker, Medtronic Plc 5. STI Laser Industries, Ltd. 6. Norman Noble INC. 7. Hobbs Medical IN 8. Akron Inc. 9. Advent Devices Pvt. 10. Cerenovus 11. Penumbra, Inc 12. Neuronewsinternational 13. cookmedical.eu 14. dicardiology 15. evtoday 16. massdevice 17. nsmedicaldevices 18. jnjmedtech 19. neurosafemed 20. medicaldevice-network 21. volza 22. pulsara 23. baltgroupFAQs:

1. What are the primary indications for using a Stent Retriever? Ans. Stent retrievers are primarily indicated for mechanical thrombectomy in patients with acute ischemic stroke caused by large vessel occlusions in the brain. 2. What are the key benefits of using Stent Retrievers in stroke treatment? Ans. Stent retrievers offer several benefits in stroke treatment, including rapid restoration of blood flow, improved clinical outcomes, reduced disability and mortality rates, and potential for extended treatment time windows. 3. What is the projected market size & and growth rate of the Stent Retriever Market? Ans. The Stent Retriever Market size was valued at USD 720.95 million in 2023 and the total Stent Retriever revenue is expected to grow at a CAGR of 6.8% from 2023 to 2030, reaching nearly USD 1142.63 Million in 2030. 4. What segments are covered in the Stent Retriever Market report? Ans. The segments covered in the Software market report are Type, Application, and End-Users.

1. Stent Retriever Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Stent Retriever Market: Dynamics 2.1. Stent Retriever Market Trends by Region 2.1.1. North America Stent Retriever Market Trends 2.1.2. Europe Stent Retriever Market Trends 2.1.3. Asia Pacific Stent Retriever Market Trends 2.1.4. Middle East and Africa Stent Retriever Market Trends 2.1.5. South America Stent Retriever Market Trends 2.2. Stent Retriever Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Stent Retriever Market Drivers 2.2.1.2. North America Stent Retriever Market Restraints 2.2.1.3. North America Stent Retriever Market Opportunities 2.2.1.4. North America Stent Retriever Market Challenges 2.2.2. Europe 2.2.2.1. Europe Stent Retriever Market Drivers 2.2.2.2. Europe Stent Retriever Market Restraints 2.2.2.3. Europe Stent Retriever Market Opportunities 2.2.2.4. Europe Stent Retriever Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Stent Retriever Market Drivers 2.2.3.2. Asia Pacific Stent Retriever Market Restraints 2.2.3.3. Asia Pacific Stent Retriever Market Opportunities 2.2.3.4. Asia Pacific Stent Retriever Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Stent Retriever Market Drivers 2.2.4.2. Middle East and Africa Stent Retriever Market Restraints 2.2.4.3. Middle East and Africa Stent Retriever Market Opportunities 2.2.4.4. Middle East and Africa Stent Retriever Market Challenges 2.2.5. South America 2.2.5.1. South America Stent Retriever Market Drivers 2.2.5.2. South America Stent Retriever Market Restraints 2.2.5.3. South America Stent Retriever Market Opportunities 2.2.5.4. South America Stent Retriever Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Clinical Trial Analysis for Stent Retriever 2.8. Key Opinion Leader Analysis For Stent Retriever Industry 2.9. Analysis of Government Schemes and Initiatives For the Stent Retriever Industry 3. Stent Retriever Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2023-2030) 3.1. Global Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Solitaire Stent Retrievers 3.1.2. TREVO Stent Retrievers 3.1.3. EmboTrap Stent Retrievers 3.2. Global Stent Retriever Market Size and Forecast, by Application (2023-2030) 3.2.1. Ischemic Stroke 3.3. Global Stent Retriever Market Size and Forecast, by End-User (2023-2030) 3.3.1. Hospitals 3.3.2. Ambulatory Surgical Centers (ASCs) 3.4. Global Stent Retriever Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Stent Retriever Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Solitaire Stent Retrievers 4.1.2. TREVO Stent Retrievers 4.1.3. EmboTrap Stent Retrievers 4.2. North America Stent Retriever Market Size and Forecast, by Application (2023-2030) 4.2.1. Ischemic Stroke 4.3. North America Stent Retriever Market Size and Forecast, by End-User(2023-2030) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers (ASCs) 4.4. North America Stent Retriever Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.2. Canada 4.4.3. Mexico 4.5. United States 4.5.1. United States Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 4.5.1.1. Solitaire Stent Retrievers 4.5.1.2. TREVO Stent Retrievers 4.5.1.3. EmboTrap Stent Retrievers 4.5.2. United States Stent Retriever Market Size and Forecast, by Application (2023-2030) 4.5.2.1. Ischemic Stroke 4.5.3. United States Stent Retriever Market Size and Forecast, by End-User (2023-2030) 4.5.3.1. Hospitals 4.5.3.2. Ambulatory Surgical Centers (ASCs) 4.6. Canada 4.6.1. Canada Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 4.6.1.1. Solitaire Stent Retrievers 4.6.1.2. TREVO Stent Retrievers 4.6.1.3. EmboTrap Stent Retrievers 4.6.2. Canada Stent Retriever Market Size and Forecast, by Application (2023-2030) 4.6.2.1. Ischemic Stroke 4.6.3. Canada Stent Retriever Market Size and Forecast, by End-User (2023-2030) 4.6.3.1. Hospitals 4.6.3.2. Ambulatory Surgical Centers (ASCs) 4.6.4. Mexico 4.6.5. Mexico Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 4.6.5.1. Solitaire Stent Retrievers 4.6.5.2. TREVO Stent Retrievers 4.6.5.3. EmboTrap Stent Retrievers 4.6.6. Mexico Stent Retriever Market Size and Forecast, by Application (2023-2030) 4.6.6.1. Ischemic Stroke 4.6.7. Mexico Stent Retriever Market Size and Forecast, by End-User (2023-2030) 4.6.7.1. Hospitals 4.6.7.2. Ambulatory Surgical Centers (ASCs) 5. Europe Stent Retriever Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2030) 5.1. Europe Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.3. Europe Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Stent Retriever Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Stent Retriever Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Stent Retriever Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Stent Retriever Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Stent Retriever Market Size and Forecast, by Application(2023-2030) 6.3. Asia Pacific Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Stent Retriever Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. S Korea Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. S Korea Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.3.3. S Korea Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Stent Retriever Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Stent Retriever Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Stent Retriever Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Stent Retriever Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Stent Retriever Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Stent Retriever Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Stent Retriever Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Stent Retriever Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Stent Retriever Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Stent Retriever Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Stent Retriever Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Stent Retriever Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Stent Retriever Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Stent Retriever Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Stent Retriever Market Size and Forecast, by End-User (2023-2030) 8. South America Stent Retriever Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. South America Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Stent Retriever Market Size and Forecast, by Application (2023-2030) 8.3. South America Stent Retriever Market Size and Forecast, by End-User (2023-2030) 8.4. South America Stent Retriever Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Stent Retriever Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Stent Retriever Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Stent Retriever Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Stent Retriever Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Stent Retriever Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Stent Retriever Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Stent Retriever Market Size and Forecast, by End-User (2023-2030) 9. Global Stent Retriever Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Stent Retriever Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Medtronic Plc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Stryker Corporation 10.3. Nitinol Devices & Components, Inc. 10.4. Stryker, Medtronic Plc 10.5. STI Laser Industries, Ltd. 10.6. Norman Noble INC. 10.7. Hobbs Medical IN 10.8. Akron Inc. 10.9. Advent Devices Pvt. 10.10. Cerenovus 10.11. Penumbra, Inc 10.12. Neuronewsinternational 10.13. cookmedical.eu 10.14. dicardiology 10.15. evtoday 10.16. massdevice 10.17. nsmedicaldevices 10.18. jnjmedtech 10.19. neurosafemed 10.20. medicaldevice-network 10.21. volza 10.22. pulsara 10.23. baltgroup 11. Key Findings 12. Industry Recommendations 13. Stent Retriever Market: Research Methodology