Spiral Heat Exchanger Market is expected to reach a readjusted size of USD 837.24 Million by 2029 with an impressive 3.81% CAGR during the forecast period, from an expected value of USD 644.43 Million in 2022.Spiral Heat Exchanger Market Overview:

Two concentric spiral flow channels, one for each fluid, are included in spiral heat exchangers, which are circular in shape. The two media flow counters are now set up so that one fluid enters the unit from the center and travels outward, while the other enters from the outside and advances inward. The channels have a homogeneous cross section and are curved. No danger of mixing exists. A spiral heat exchanger used in applications with considerable fouling potential. Even with thick process slurries, its single-channel design prevents fouling and erosion and helps to ensure high flow velocities. The biggest cause of maintenance expenses and downtime is heat exchanger fouling and restraing market growth. Fouling is expected to cost the American industrial sector more than $5 billion a year. A conventional heat exchanger's heat transfer surfaces collect material over time, which eventually forms an insulating layer that slows down heat transmission and raises pressure drop across the exchanger. To recover the heat transfer rates and pressure drops necessary by the process, the heat exchanger must eventually be cleaned. Many conventional heat exchanger designs require periodic cleaning, which may be expensive and time-consuming. These issues can be prevented by processors using a spiral heat exchanger. The report addresses a detailed review of the restraints shows the contrast to drivers and allows for strategic planning. Factors that influence market growth are important because they may be used to design diverse strategies for capturing the profitable possibilities that exist.To know about the Research Methodology :- Request Free Sample Report

Spiral Heat Exchanger Market Dynamics:

Thermal performance penetrate spiral heat exchanger market

The advantages that modern spiral heat exchangers have over traditional ones are a key factor in the growth of the global market for welded spiral heat exchangers. The global spiral heat exchangers market is expected to increase between 2020 to 2029 due to factors such as improved performance and consistent heat exchange. Additionally, the market for welded spiral heat exchangers is growing due to features like greater thermal performance. SHEs have a larger surface area and true counter-current flow than traditional smooth surface tube designs, which makes them theoretically more thermally efficient. This, however, provides that the barrier between the product and service fluids is always clean and operating efficiently. Fouling happens often in practice, interfering with heat transmission. This fouling layer can form a double barrier to effective heat transmission when employed in sludge-to-sludge applications. These comparisons apply to smooth tube heat exchangers but not usually to curved tube heat exchangers. The tube-in-tube HRS DTI Series, for example, is a genuine counter-current heat exchanger, with the product flowing through the inner tube and the service fluid flowing through the surrounding shell, similar to SHEs. HRS corrugation technique improves heat transmission and operating efficiency while reducing fouling. Better applications for handling harsh fluids and the prevention of fluid leakage are some other reasons that will propel the growth of the global market for welded spiral heat exchangers in the years to come.Future risk of GPHEs

Fouling is only one of the dangers of GPHE failure. Major operational risks include gasket failure and corrosion. And these highly restrain the market growth Despite metal's durability, corrosion is an unavoidable side effect of its usage over time. Due to the considerable sealing that is necessary for GPHEs along each plate's edge, crevice corrosion may develop underneath gaskets. Chemicals emitted from the polymers used to create gaskets may accelerate localized corrosion. Polymer gaskets can degrade over time in addition to the aforementioned mechanisms. No material is completely impervious, which is why the material selection is essential. This might be because of UV radiation impairing performance, incompatible fluids being heated to their maximum temperatures for extended periods, or extreme pressure.Market restraint

Ironically, problems are primarily caused by solutions. Unintended effects may increase when industries develop and adopt more advanced technologies. This is how plate heat exchanger cleaning and fouling work. The spiral heat exchanger industry recently recognized a fresh set of difficulties it was facing. For instance, more natural goods that provide a variety of heat transfer issues are a result of food and beverage diversity. As opposed to substances like sugars and other tried-and-true compounds, certain natural goods have a lesser tolerance for heat. The food and beverage sector has to build operations to handle increased processing capabilities due to the pace of change and rate of population development. It must concurrently generate more while minimizing downtime, which obviously increases the danger of errors and unforeseen effects.Spiral Heat Exchanger Market Segment Analysis:

By Type,

The Spiral Heat Exchanger Market is segmented into Type I, type III, Type G. Type I expected to dominate the market during forecast period. The Type II Spiral was designed to meet the process industries' increased demand for vaporizing and condensing capabilities. Although it functions on the same basic idea as Type I, the channel shape is drastically different. It just has one medium that flows spirally. The other flows crosswise, parallel to the spiral element's axis. With the crossflow fluid flowing through the spiral annulus, the spiral channel is closed on both sides. Type II spirals are used in jobs that require huge amounts of vapor, vapor/gas, or vapor/liquid combinations. The channel shape allows for great liquid velocity in the Spiral tunnel while maintaining a very low-pressure drop on the vapor/mixture side. They are also employed in liquid/liquid applications, such as fermenter cooling cases, where one side must deal with a substantially higher amount of liquid than the other. Type III is held the second largest market share in 2022. Type III is used as a condenser, the Type II accomplishes relatively little subcooling of the vapors or condensate. A second form of Spiral, the Type III, has to be designed for applications where this is a vital element of the process. The unit is made of (typically) alternatively welded channels. The bottom face of the body has a cover, and the top face has a distribution cone with the outer turns closed and the inner turns open to the crossflow of the fluid entering the unit. The unit's perimeter is equipped with an upper connection for removing residual gas/vapor and a lower connection for condensate. The cooling medium is flowing in a spiral pattern. The unit's role is to condensate a vapor or vapor mixture with or without non-condensable gas, with the leftover vapor/gas combination being cooled to as low a temperature as feasible to achieve maximum condensation. The condensate is effectively subcooled since the outer turns are in countercurrent flow to the coolant. Because the flow is in spiral mode at the outer turns, the heat and mass transfer coefficients are larger than if the vapor was solely in crossflow. The SHE type III is best suited for vapor mixes having small to moderate volumes of noncondensable gas at moderate pressure. It is rare to be able to operate at very low absolute pressure ("high vacuum").is seldom feasible due to the resulting excessive pressure drop in the outer turns.Based on Product Type,

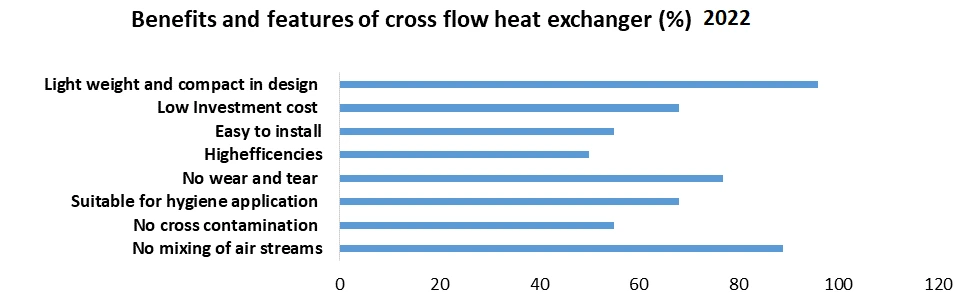

The Spiral Heat Exchanger Market has been segmented into Counter-current, Cross-flow, Cross-flow, and Counter-current Paths in the Same Unit. Cross flow held the largest market share in 2022. Cross Flow Heat Exchangers in the industrial sector are used to transfer heat between two gas streams or between a liquid and a gas. Examples include stack gas heat recovery, as in Waste Heat Recovery Units (WHRU), combustion air preheating, and process fluid heating. Cross-flow heat exchangers are constructed of thin metal panels, which are often made of aluminum. Thermal energy is transferred. through these panels Cross flow heat exchangers feature a square cross-section with thermal efficiency ranging from 40 to 65%. For higher thermal efficiencies, counterflow or twin cross-flow heat exchangers with 75-85% efficiency can be used. The exhaust and fresh air streams run through channels constructed between the plates. Each air stream flows in alternating channels, with supply air flowing in one and return air flowing in the next. Sensible energy derived from heated air passing through one side of the exchanger is transferred to the cold air going through the other. Because the two air streams do not mingle, there is no short-circuiting or cross-contamination. There is no mixing of dirt, odors, moisture, or bacteria, and only heat is transmitted from exhaust air to fresh air via conduction as a result of temperature differences between the two air streams. These devices are less costly than other types of energy recovery devices on the market. It is typically utilized when sanitary requirements demand that both airstreams be maintained totally distinct from one another. It is frequently utilized in big heat recovery installations in canteens, hospitals, and the food sector. these industries drive the market growth more details about heat exchanger is given in the report.

Based on the Application

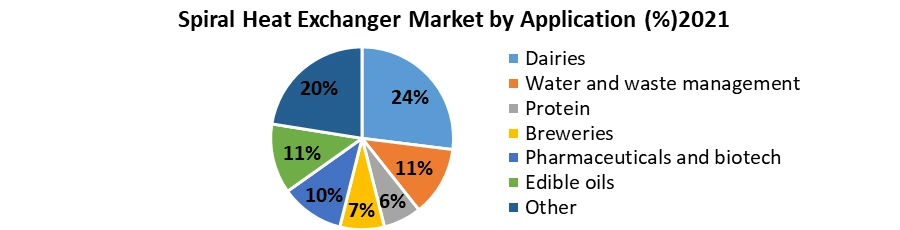

The Spiral Heat Exchanger Market is segmented into Chemical Industry, Food Industry, and Others. The food Industry held the largest market share in 2022. A heat exchanger is a device designed to successfully transfer heat between two fluids of different temperatures. The media might be separated by a complete wall to prevent mixing, or they could be in direct touch. Spiral Heat exchangers are widely utilized in the food processing, dairy, biochemical, pharmaceutical, chemical, and petroleum industries, to mention a few. Heat exchangers are widely used in the bioprocess sector, from high-temperature pasteurization to low-temperature freezing. Spiral Heat exchangers have long been used in pasteurization, sterilizing, and other food processing applications. And, even if the technology is mature, there is still an opportunity for innovation. Heat exchangers are extensively used in the food and beverage industries to reduce or destroy microbes, making items safe for ingestion and increasing shelf life. A heat exchanger can also be used to heat or cool goods before filling, drying, concentrating, or performing other procedures. Highest possible demands on food processing technology since they both depend heavily on the highest possible standards for chilling, shelf life, process cleaning, disinfection, and drying. Companies in the food and beverage sector must simultaneously compete on a global scale and develop sustainable solutions in their business. As a result, efforts made to assure quality, effectiveness, and dependability must work together seamlessly. As essential parts for the food and beverage sector, we provide plate heat exchangers, finned tube heat exchangers, shell and tube heat exchangers, and modular cooling towers from a single source, ranging from highly standardized solutions to custom implementation. When it comes to heating or cooling, you can depend on us to provide an integrated solution that considers both your interests and the interests of your clients. All throughout the value-added process chain, we are your dependable collaborators.

Spiral Heat Exchanger Market Regional Insights:

The Asia Pacific region dominated the market with xx % share in 2022. The Spiral Heat Exchanger Market region is expected to witness significant growth at a CAGR of xx% through the forecast period. In 2022, Asia Pacific made up 37.6% of the market in total. From 2023 to 2029, it is expected to grow at a considerable pace of 5.2%, making it the largest regional market. The chemical sector is anticipated to drive the market in the area throughout the forecast period due to the soaring demand for petrochemical derivatives in a variety of end-use industries including plastics and packaging. In 2022, Europe held 28.4% of the global market share. Due to the growing automotive and construction sectors, it is expected to grow to be the second-largest regional market throughout the projection period. Due to stringent regulatory requirements, the usage of welded plate heat exchangers in refineries and the chemical industry is expected to increase.Market Insights

The global welded spiral heat exchangers industry is very competitive in general. As a result of the presence of multiple market players, the market is also fragmented. However, certain prominent companies dominate the worldwide spiral welded heat exchangers market. These companies shape the market's dynamics and account for the majority of the market's development. However, the presence of several competitors in the industry makes it difficult for a new company to enter the worldwide spiral heat exchangers market. The new players are taking a number of smart actions to overcome these obstacles. They are leaning toward strategic alliances and mergers in order to have a long-term future in the market for welded spiral heat exchangers. These tactics are also enabling company to get the resources they need to compete with some of the market's major competitors in welded spiral heat exchangers. While some of the industry's seasoned players are substantially spending on customer-focused methods including product launches, promotional discounts, and other customer-focused events to strengthen their brand visibility. Additionally, these firms are spending a sizable sum of money on R&D operations in order to provide clients with snipping items. However, several other major players in the global spiral heat exchangers market are acquiring numerous small and medium-sized companies in an effort to increase their production capacity and expand into new markets.Spiral Heat Exchanger Market Scope: Inquire before buying

Spiral Heat Exchanger Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 644.43 Mn. Forecast Period 2023 to 2029 CAGR: 3.81% Market Size in 2029: US $ 837.24 Mn. Segments Covered: by Type 1. Type I 2. Type III 3. Type G by Product Type 1. Counter-current 2. Cross-flow 3. Cross-flow and Counter-current Paths in the Same Unit by Application 1. Chemical Industry 2. Food Industry 3. Others Application Spiral Heat Exchanger Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Spiral Heat Exchanger Market, Key Players are:

1. Sentry Equipment Corp 2. COSMOTEC 3. AViTEQ Vibrationstechnik GmbH 4. VAU Thermotech GmbH and Co. KG 5. Alfa Laval 6. Polytetra GmbH 7. Accessen Group 8. AKG 9. AerofinFrequently Asked Questions:

1] What segments are covered in the Global Spiral Heat Exchanger Market report? Ans. The segments covered in the Spiral Heat Exchanger Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Spiral Heat Exchanger Market? Ans. The North America region is expected to hold the highest share in the Spiral Heat Exchanger Market. 3] What is the market size of the Global Spiral Heat Exchanger Market by 2029? Ans. The market size of the Spiral Heat Exchanger Market by 2029 is expected to reach US$ 837.24 Mn. 4] What is the forecast period for the Global Spiral Heat Exchanger Market? Ans. The forecast period for the Spiral Heat Exchanger Market is 2023-2029. 5] What was the market size of the Global Spiral Heat Exchanger Market in 2022? Ans. The market size of the Spiral Heat Exchanger Market in 2022 was valued at US$ 644.43 Mn.

1. Spiral Heat Exchanger Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Spiral Heat Exchanger Market: Dynamics 2.1. Spiral Heat Exchanger Market Trends by Region 2.1.1. North America Spiral Heat Exchanger Market Trends 2.1.2. Europe Spiral Heat Exchanger Market Trends 2.1.3. Asia Pacific Spiral Heat Exchanger Market Trends 2.1.4. Middle East and Africa Spiral Heat Exchanger Market Trends 2.1.5. South America Spiral Heat Exchanger Market Trends 2.2. Spiral Heat Exchanger Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Spiral Heat Exchanger Market Drivers 2.2.1.2. North America Spiral Heat Exchanger Market Restraints 2.2.1.3. North America Spiral Heat Exchanger Market Opportunities 2.2.1.4. North America Spiral Heat Exchanger Market Challenges 2.2.2. Europe 2.2.2.1. Europe Spiral Heat Exchanger Market Drivers 2.2.2.2. Europe Spiral Heat Exchanger Market Restraints 2.2.2.3. Europe Spiral Heat Exchanger Market Opportunities 2.2.2.4. Europe Spiral Heat Exchanger Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Spiral Heat Exchanger Market Drivers 2.2.3.2. Asia Pacific Spiral Heat Exchanger Market Restraints 2.2.3.3. Asia Pacific Spiral Heat Exchanger Market Opportunities 2.2.3.4. Asia Pacific Spiral Heat Exchanger Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Spiral Heat Exchanger Market Drivers 2.2.4.2. Middle East and Africa Spiral Heat Exchanger Market Restraints 2.2.4.3. Middle East and Africa Spiral Heat Exchanger Market Opportunities 2.2.4.4. Middle East and Africa Spiral Heat Exchanger Market Challenges 2.2.5. South America 2.2.5.1. South America Spiral Heat Exchanger Market Drivers 2.2.5.2. South America Spiral Heat Exchanger Market Restraints 2.2.5.3. South America Spiral Heat Exchanger Market Opportunities 2.2.5.4. South America Spiral Heat Exchanger Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Spiral Heat Exchanger Industry 2.8. Analysis of Government Schemes and Initiatives For Spiral Heat Exchanger Industry 2.9. Spiral Heat Exchanger Market Trade Analysis 2.10. The Global Pandemic Impact on Spiral Heat Exchanger Market 3. Spiral Heat Exchanger Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 3.1.1. Type I 3.1.2. Type III 3.1.3. Type G 3.2. Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 3.2.1. Counter-current 3.2.2. Cross-flow 3.2.3. Cross-flow and Counter-current Paths in the Same Unit 3.3. Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 3.3.1. Chemical Industry 3.3.2. Food Industry 3.3.3. Others Application 3.4. Spiral Heat Exchanger Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Spiral Heat Exchanger Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 4.1.1. Type I 4.1.2. Type III 4.1.3. Type G 4.2. North America Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 4.2.1. Counter-current 4.2.2. Cross-flow 4.2.3. Cross-flow and Counter-current Paths in the Same Unit 4.3. North America Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 4.3.1. Chemical Industry 4.3.2. Food Industry 4.3.3. Others Application 4.4. North America Spiral Heat Exchanger Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Type I 4.4.1.1.2. Type III 4.4.1.1.3. Type G 4.4.1.2. United States Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 4.4.1.2.1. Counter-current 4.4.1.2.2. Cross-flow 4.4.1.2.3. Cross-flow and Counter-current Paths in the Same Unit 4.4.1.3. United States Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Chemical Industry 4.4.1.3.2. Food Industry 4.4.1.3.3. Others Application 4.4.2. Canada 4.4.2.1. Canada Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Type I 4.4.2.1.2. Type III 4.4.2.1.3. Type G 4.4.2.2. Canada Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 4.4.2.2.1. Counter-current 4.4.2.2.2. Cross-flow 4.4.2.2.3. Cross-flow and Counter-current Paths in the Same Unit 4.4.2.3. Canada Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Chemical Industry 4.4.2.3.2. Food Industry 4.4.2.3.3. Others Application 4.4.3. Mexico 4.4.3.1. Mexico Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Type I 4.4.3.1.2. Type III 4.4.3.1.3. Type G 4.4.3.2. Mexico Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 4.4.3.2.1. Counter-current 4.4.3.2.2. Cross-flow 4.4.3.2.3. Cross-flow and Counter-current Paths in the Same Unit 4.4.3.3. Mexico Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Chemical Industry 4.4.3.3.2. Food Industry 4.4.3.3.3. Others Application 5. Europe Spiral Heat Exchanger Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.2. Europe Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.3. Europe Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 5.4. Europe Spiral Heat Exchanger Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.1.3. United Kingdom Spiral Heat Exchanger Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.2.3. France Spiral Heat Exchanger Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.3.3. Germany Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.4.3. Italy Spiral Heat Exchanger Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.5.3. Spain Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.6.3. Sweden Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.7.3. Austria Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 5.4.8.3. Rest of Europe Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Spiral Heat Exchanger Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.3. Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.1.3. China Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.2.3. S Korea Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.3.3. Japan Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.4.3. India Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.5.3. Australia Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.6.3. Indonesia Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.7.3. Malaysia Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.8.3. Vietnam Spiral Heat Exchanger Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.9.3. Taiwan Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Spiral Heat Exchanger Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 7.3. Middle East and Africa Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Spiral Heat Exchanger Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 7.4.1.3. South Africa Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 7.4.2.3. GCC Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 7.4.3.3. Nigeria Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 7.4.4.3. Rest of ME&A Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 8. South America Spiral Heat Exchanger Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 8.2. South America Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 8.3. South America Spiral Heat Exchanger Market Size and Forecast, by Application(2022-2029) 8.4. South America Spiral Heat Exchanger Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 8.4.1.3. Brazil Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 8.4.2.3. Argentina Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Spiral Heat Exchanger Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Spiral Heat Exchanger Market Size and Forecast, by Product Type (2022-2029) 8.4.3.3. Rest Of South America Spiral Heat Exchanger Market Size and Forecast, by Application (2022-2029) 9. Global Spiral Heat Exchanger Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Spiral Heat Exchanger Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Sentry Equipment Corp 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. COSMOTEC 10.3. AViTEQ Vibrationstechnik GmbH 10.4. VAU Thermotech GmbH and Co. KG 10.5. Alfa Laval 10.6. Polytetra GmbH 10.7. Accessen Group 10.8. AKG 10.9. Aerofin 10.24. Wipro, Ltd. 10.25. Inovalon 11. Key Findings 12. Industry Recommendations 13. Spiral Heat Exchanger Market: Research Methodology 14. Terms and Glossary