The Solvent Recovery and Recycling Market size was valued at USD 1247.56 Million in 2025 and the total Solvent Recovery and Recycling revenue is expected to grow at a CAGR of 5.89% from 2026 to 2032, reaching nearly USD 1862.29 Million by 2032.Solvent Recovery and Recycling Market Overview

Solvents are substances that can dissolve other materials while solvent recovery and recycling is a process designed to reclaim and reuse solvents in industrial applications.To know about the Research Methodology :- Request Free Sample Report 1.The top five key players including Veolia, Clean Planet Chemical, CycleSolv, Tradebe, and Clean Harbors occupied about 55% of sales revenue in 2024. The global solvent recovery and recycling market witnesses significant growth by xx%, driven by various factors such as stringent regulations promoting emission reduction, and increasing demand for solvent recovery in end-use industries that are studied in the report. The solvent recovery and recycling market offers a sustainable and cost-effective solution, transforming waste into valuable resources and reducing environmental impact. Companies provide solutions to recover and recycle solvents from industrial processes, which can include distillation, filtration, and other separation techniques. The recovered solvents can be reused in similar processes, leading to cost savings and environmental benefits. Industries such as pharmaceuticals, chemicals, automotive, electronics, and coatings are the primary consumers of solvent recovery and recycling solutions. The market is witnessing significant investment activities by key players, and it is expected to grow during its forecast period. 1.The production of Hazardous Waste has increased by 40,000%, from 1 to 400 million tons in 2024. In 2024, Asia Pacific held a market share of 30% and is the fastest-growing Solvent Recovery and Recycling Market. The region's robust economic growth and vibrant industrial landscape are responsible for the surge. Rapid development has led to an increase in the usage of solvents, particularly in China and India, requiring efficient recovery techniques. The region's growing emphasis on environmental sustainability and stringent regulations have led to a major growth in the requirement for solvent recovery technologies. Asia Pacific's position as the main driver of the solvent recovery and recycling market's rapid growth is further covered by the company's strategic commitment to environmentally friendly methods and the ongoing expansion of industrial activities.

Solvent Recovery and Recycling Market Dynamics

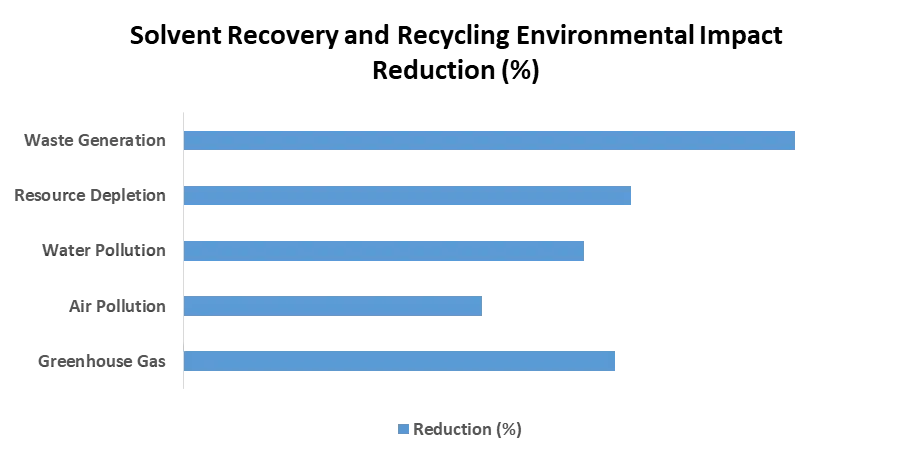

Industry expansion and increased solvent usage to spur the market. The Solvent Recovery and Recycling Market growth is fuelled by industry expansion and increasing solvent usage. Governments worldwide are applying stringent regulations on hazardous waste disposal, including spent solvents, and falling out of traditional methods pushes industries towards sustainable alternatives of solvent recovery and recycling. Technological advancements are emerging, offering higher efficiency, lower energy consumption, and better selectivity in solvent separation making solvent recovery more attractive and feasible for a wider range of industries, further propelling the market growth. With the expansion of industries the demand for resources like fossil fuels, from which many solvents are derived rises and it contributes to a more sustainable future and aligns with growing environmental concerns. Consumers demand eco-friendly products and services, directly addressing these concerns by minimizing environmental impact promoting resource conservation, and making it a choice for companies to align with sustainability goals and enhance the brand image.High Initial Investment Costs The solvent recovery and recycling market holds immense promise for environmental and economic benefits. Distillation units, filtration systems, and solvent concentrators form the backbone of recovery processes. And the technologies especially those catering to complex solvent mixtures are expensive to purchase and install. The high initial investment often leads to a lengthy payback period and discourages companies from committing to long-term investments. Smaller companies with new technologies struggle to secure funding, hampering the development of more efficient and cost-effective recovery solutions. The recovery systems require trained staff to operate and maintain while the operational budget is impacted by continuing expenses for utilities, trash disposal, and possible permits. High initial investment costs pose a significant challenge to the widespread adoption of solvent recovery and recycling technologies.

Solvent Recovery and Recycling Market Segment Analysis

Based on Application, the Printing segment held the largest market share of about 30% in the global solvent recovery and recycling market in 2025. According to MMR analysis, the segment is further expected to grow at a CAGR of 5.89% during the forecast period and remains the dominant segment within the Solvent Recovery and Recycling Market. The function of printing inks is very dependent on the solvent, from dissolving pigments to ensuring a smooth flow. Strict regulations on volatile organic compounds (VOC) emissions drive the industry towards recovery and recycling technologies. Solvent recycling increases environmental responsibility by minimizing harmful emissions and conserving natural resources. Advances in technology have made recycling processes more efficient and cost-effective and encouraged its adoption. Additionally, the growth of sustainable awareness is pushing printing companies to adopt greener practices and solvent recovery. The printing industry and its dominance in solvent recovery and recycling is driven by several factors, from high solvent usage and strict regulations for economic benefits and environmental awareness. The technological advances and sustainable development accelerate the segment to maintain its dominance.Additionally, the paint & coating segment is expected to grow at a significant CAGR of xx% during the forecast period. Solvents play a crucial role in formulations, making recovery essential. The environmental consciousness and stringent regulations drive the adoption of recycling promoting sustainability. Demand from regulations and the growing need for environmentally friendly paints and coatings make the industry a major driver of the market's growth. Additionally, as countries like China and India rapidly industrialize, the amount of solvent they use rises, requiring effective recovery techniques. 1. The net sales of RPM International, a company specializing in coatings, sealants, and building materials with headquarters in the United States, were valued at over 7 billion U.S. dollars in 2024.

Solvent Recovery and Recycling Market Regional Insights

North America dominated the Global Solvent Recovery and Recycling Market with the highest share of over 35% in 2025. The region is expected to grow at a CAGR of 5.89% during the forecast period and maintain its dominance during the forecast period. The North American market prominence stems from advanced technological capabilities, a well-established industrial infrastructure, and a heightened emphasis on sustainable practices. The Environment Protection Agency (EPA) of North America enforces strict regulations on solvent emissions and waste disposal promoting companies to adopt recycling technologies. The region is home to leading companies like Veolia, Clean Harbors, and Renew Life Inc., which are constantly innovating new and efficient solvent recovery and recycling technologies. The availability of a skilled workforce, growing public awareness about the impact of solvent waste, and financial initiatives make North America the dominating region in the Solvent Recovery and Recycling Market. Additionally, stringent environmental regulations and a growing awareness of the benefits of solvent recovery and recycling have likely driven the adoption of these technologies in the region. In 2025, Europe held a significant second-largest position with a market share of about 30% in the global solvent recovery and recycling market. The European Union’s (EU) Waste Framework Directive and Industrial Emissions Directive play a key role in driving the adoption of recovery and recycling technologies. Europe possesses well-established chemical and manufacturing sectors including pharmaceutical, paints & coating, and electronics which are the major solvent consumers. Additionally, the European Union promotes the circular economy concept, awareness about sustainability, efficient waste management infrastructure, and growing demand for on-site solutions making the region the second largest in the global market. 1. Germany tops the Europe solvent recycler market accounting for 25% market share. 2. The German chemical company BASF ranked number one in the ranking of the world's leading chemical companies based on revenue, generating a revenue of approximately 94.85 billion U.S. dollars in 2022. Solvent Recovery and Recycling Market Competitive Landscapes The solvent recovery and recycling market boasts a dynamic competitive landscape, characterized by established players and innovative newcomers. Leading chemical companies like Veolia, Clean Harbors, and Tradebe, leverage their extensive infrastructure and are constantly innovating, offering advanced technologies, and expanding their global reach. Additionally, start-ups are emerging with technologies, such as bio-based solvents and AI-powered optimization systems, injecting fresh ideas into the market. Players are constantly innovating to offer more efficient, cost-effective, and sustainable solutions while expanding to cater to diverse customer needs. Collaboration through partnerships and acquisitions is also increasingly allowing companies to combine expertise and resources to gain a competitive edge. 1. Veolia acquired SARPI Recycling Solutions in July 2024 to strengthen its position in hazardous waste management, including solvent waste streams.Solvent Recovery and Recycling Market Scope: Inquire before buying

Global Solvent Recovery and Recycling Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 1247.56 Mn. Forecast Period 2026 to 2032 CAGR: 5.89% Market Size in 2032: USD 1862.29 Mn. Segments Covered: by Product Type On-site Solvent Recycling Off-site Solvent Recycling by Process Technology Adsorption Distillation Liquid-Liquid Extraction Membrane Separation by Solvent Type Alcohols Amides Esters Ketones Aromatic solvents Chlorinated solvents by Application Paints & Coatings Printing Chemicals Electronics Pharmaceuticals Solvent Recovery and Recycling Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solvent Recovery and Recycling Market, Key Players

1. Maratek 2. Envirotec 3. Tradebe 4. Novasys Group 5. OFRU Recycling 6. Indaver 7. Veolia 8. Clean Planet Chemical 9. CycleSolv 10. Tradebe 11. Clean Harbors 12. Nippon Refine 13. Shinko Organic Chemical Industry 14. Yang Linhong 15. Maratek Environmental 16. IST Pure 17. CBG Technologies 18. Quanzhou Tianlong 19. CBG Biotech 20. Clean Harbors Inc. 21. CleanPlanet Chemical 22. GFL Environmental Inc. 23. Grupo Tradebe Medio Ambiente Sociedad Limitada 24. Maratek Environmental Inc 25. Polaris Srl 26. Shinko Organic Chemical Industry Ltd FAQs: 1. What are the growth drivers for the Solvent Recovery and Recycling market? Ans. Environmental Regulations, economic benefits, technological benefits, and sustainability are the drivers of the Global Solvent Recovery and Recycling Market. 2. What are the major challenges for the Solvent Recovery and Recycling market growth? Ans. High initial investment costs and infrastructure limitations are the major challenges for the Solvent Recovery and Recycling Market. 3. Which region is expected to lead the global Solvent Recovery and Recycling market during the forecast period? Ans. Asia Pacific is expected to lead the global solvent recovery and recycling market during the forecast period. 4. What is the projected market size & and growth rate of the Solvent Recovery and Recycling Market? Ans. The Solvent Recovery and Recycling Market size was valued at USD 1247.56 Million in 2025 and the total Solvent Recovery and Recycling revenue is expected to grow at a CAGR of 5.89% from 2026 to 2032, reaching nearly USD 1862.29 Million by 2032. 5. What segments are covered in the Solvent Recovery and Recycling Market report? Ans. The segments covered in the Solvent Recovery and Recycling market report are product type, process technology, type, application, and region.

1. Solvent Recovery and Recycling Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solvent Recovery and Recycling Market: Dynamics 2.1. Solvent Recovery and Recycling Market Trends by Region 2.1.1. North America Solvent Recovery and Recycling Market Trends 2.1.2. Europe Solvent Recovery and Recycling Market Trends 2.1.3. Asia Pacific Solvent Recovery and Recycling Market Trends 2.1.4. Middle East and Africa Solvent Recovery and Recycling Market Trends 2.1.5. South America Solvent Recovery and Recycling Market Trends 2.2. Solvent Recovery and Recycling Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Solvent Recovery and Recycling Market Drivers 2.2.1.2. North America Solvent Recovery and Recycling Market Restraints 2.2.1.3. North America Solvent Recovery and Recycling Market Opportunities 2.2.1.4. North America Solvent Recovery and Recycling Market Challenges 2.2.2. Europe 2.2.2.1. Europe Solvent Recovery and Recycling Market Drivers 2.2.2.2. Europe Solvent Recovery and Recycling Market Restraints 2.2.2.3. Europe Solvent Recovery and Recycling Market Opportunities 2.2.2.4. Europe Solvent Recovery and Recycling Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Solvent Recovery and Recycling Market Drivers 2.2.3.2. Asia Pacific Solvent Recovery and Recycling Market Restraints 2.2.3.3. Asia Pacific Solvent Recovery and Recycling Market Opportunities 2.2.3.4. Asia Pacific Solvent Recovery and Recycling Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Solvent Recovery and Recycling Market Drivers 2.2.4.2. Middle East and Africa Solvent Recovery and Recycling Market Restraints 2.2.4.3. Middle East and Africa Solvent Recovery and Recycling Market Opportunities 2.2.4.4. Middle East and Africa Solvent Recovery and Recycling Market Challenges 2.2.5. South America 2.2.5.1. South America Solvent Recovery and Recycling Market Drivers 2.2.5.2. South America Solvent Recovery and Recycling Market Restraints 2.2.5.3. South America Solvent Recovery and Recycling Market Opportunities 2.2.5.4. South America Solvent Recovery and Recycling Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Solvent Recovery and Recycling Industry 2.8. Analysis of Government Schemes and Initiatives For Solvent Recovery and Recycling Industry 2.9. Solvent Recovery and Recycling Market Trade Analysis 2.10. The Global Pandemic Impact on Solvent Recovery and Recycling Market 3. Solvent Recovery and Recycling Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 3.1. Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 3.1.1. On-site Solvent Recycling 3.1.2. Off-site Solvent Recycling 3.2. Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 3.2.1. Adsorption 3.2.2. Distillation 3.2.3. Liquid-Liquid Extraction 3.2.4. Membrane Separation 3.3. Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 3.3.1. Alcohols 3.3.2. Amides 3.3.3. Esters 3.3.4. Ketones 3.3.5. Aromatic solvents 3.3.6. Chlorinated solvents 3.4. Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 3.4.1. Paints & Coatings 3.4.2. Printing 3.4.3. Chemicals 3.4.4. Electronics 3.4.5. Pharmaceuticals 3.5. Solvent Recovery and Recycling Market Size and Forecast, by Region (2025-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Solvent Recovery and Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 4.1. North America Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 4.1.1. On-site Solvent Recycling 4.1.2. Off-site Solvent Recycling 4.2. North America Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 4.2.1. Adsorption 4.2.2. Distillation 4.2.3. Liquid-Liquid Extraction 4.2.4. Membrane Separation 4.3. North America Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 4.3.1. Alcohols 4.3.2. Amides 4.3.3. Esters 4.3.4. Ketones 4.3.5. Aromatic solvents 4.3.6. Chlorinated solvents 4.4. North America Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 4.4.1. Paints & Coatings 4.4.2. Printing 4.4.3. Chemicals 4.4.4. Electronics 4.4.5. Pharmaceuticals 4.5. North America Solvent Recovery and Recycling Market Size and Forecast, by Country (2025-2032) 4.5.1. United States 4.5.1.1. United States Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 4.5.1.1.1. On-site Solvent Recycling 4.5.1.1.2. Off-site Solvent Recycling 4.5.1.2. United States Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 4.5.1.2.1. Adsorption 4.5.1.2.2. Distillation 4.5.1.2.3. Liquid-Liquid Extraction 4.5.1.2.4. Membrane Separation 4.5.1.3. United States Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 4.5.1.3.1. Alcohols 4.5.1.3.2. Amides 4.5.1.3.3. Esters 4.5.1.3.4. Ketones 4.5.1.3.5. Aromatic solvents 4.5.1.3.6. Chlorinated solvents 4.5.1.4. United States Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 4.5.1.4.1. Paints & Coatings 4.5.1.4.2. Printing 4.5.1.4.3. Chemicals 4.5.1.4.4. Electronics 4.5.1.4.5. Pharmaceuticals 4.5.2. Canada 4.5.2.1. Canada Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 4.5.2.1.1. On-site Solvent Recycling 4.5.2.1.2. Off-site Solvent Recycling 4.5.2.2. Canada Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 4.5.2.2.1. Adsorption 4.5.2.2.2. Distillation 4.5.2.2.3. Liquid-Liquid Extraction 4.5.2.2.4. Membrane Separation 4.5.2.3. Canada Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 4.5.2.3.1. Alcohols 4.5.2.3.2. Amides 4.5.2.3.3. Esters 4.5.2.3.4. Ketones 4.5.2.3.5. Aromatic solvents 4.5.2.3.6. Chlorinated solvents 4.5.2.4. Canada Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 4.5.2.4.1. Paints & Coatings 4.5.2.4.2. Printing 4.5.2.4.3. Chemicals 4.5.2.4.4. Electronics 4.5.2.4.5. Pharmaceuticals 4.5.3. Mexico 4.5.3.1. Mexico Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 4.5.3.1.1. On-site Solvent Recycling 4.5.3.1.2. Off-site Solvent Recycling 4.5.3.2. Mexico Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 4.5.3.2.1. Adsorption 4.5.3.2.2. Distillation 4.5.3.2.3. Liquid-Liquid Extraction 4.5.3.2.4. Membrane Separation 4.5.3.3. Mexico Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 4.5.3.3.1. Alcohols 4.5.3.3.2. Amides 4.5.3.3.3. Esters 4.5.3.3.4. Ketones 4.5.3.3.5. Aromatic solvents 4.5.3.3.6. Chlorinated solvents 4.5.3.4. Mexico Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 4.5.3.4.1. Paints & Coatings 4.5.3.4.2. Printing 4.5.3.4.3. Chemicals 4.5.3.4.4. Electronics 4.5.3.4.5. Pharmaceuticals 5. Europe Solvent Recovery and Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. Europe Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.2. Europe Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.3. Europe Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.4. Europe Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5. Europe Solvent Recovery and Recycling Market Size and Forecast, by Country (2025-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.1.2. United Kingdom Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.1.3. United Kingdom Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.1.4. United Kingdom Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.2. France 5.5.2.1. France Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.2.2. France Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.2.3. France Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.2.4. France Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.3. Germany 5.5.3.1. Germany Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.3.2. Germany Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.3.3. Germany Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.3.4. Germany Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.4. Italy 5.5.4.1. Italy Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.4.2. Italy Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.4.3. Italy Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.4.4. Italy Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.5. Spain 5.5.5.1. Spain Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.5.2. Spain Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.5.3. Spain Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.5.4. Spain Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.6. Sweden 5.5.6.1. Sweden Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.6.2. Sweden Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.6.3. Sweden Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.6.4. Sweden Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.7. Austria 5.5.7.1. Austria Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.7.2. Austria Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.7.3. Austria Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.7.4. Austria Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 5.5.8.2. Rest of Europe Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 5.5.8.3. Rest of Europe Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 5.5.8.4. Rest of Europe Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.2. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.3. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.4. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5. Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Country (2025-2032) 6.5.1. China 6.5.1.1. China Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.1.2. China Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.1.3. China Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.1.4. China Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.2. S Korea 6.5.2.1. S Korea Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.2.2. S Korea Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.2.3. S Korea Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.2.4. S Korea Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.3. Japan 6.5.3.1. Japan Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.3.2. Japan Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.3.3. Japan Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.3.4. Japan Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.4. India 6.5.4.1. India Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.4.2. India Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.4.3. India Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.4.4. India Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.5. Australia 6.5.5.1. Australia Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.5.2. Australia Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.5.3. Australia Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.5.4. Australia Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.6.2. Indonesia Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.6.3. Indonesia Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.6.4. Indonesia Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.7.2. Malaysia Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.7.3. Malaysia Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.7.4. Malaysia Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.8.2. Vietnam Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.8.3. Vietnam Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.8.4. Vietnam Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.9.2. Taiwan Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.9.3. Taiwan Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.9.4. Taiwan Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 6.5.10.2. Rest of Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 6.5.10.3. Rest of Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 6.5.10.4. Rest of Asia Pacific Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 7. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 7.2. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 7.3. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 7.4. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 7.5. Middle East and Africa Solvent Recovery and Recycling Market Size and Forecast, by Country (2025-2032) 7.5.1. South Africa 7.5.1.1. South Africa Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 7.5.1.2. South Africa Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 7.5.1.3. South Africa Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 7.5.1.4. South Africa Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 7.5.2. GCC 7.5.2.1. GCC Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 7.5.2.2. GCC Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 7.5.2.3. GCC Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 7.5.2.4. GCC Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 7.5.3.2. Nigeria Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 7.5.3.3. Nigeria Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 7.5.3.4. Nigeria Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 7.5.4.2. Rest of ME&A Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 7.5.4.3. Rest of ME&A Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 7.5.4.4. Rest of ME&A Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 8. South America Solvent Recovery and Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. South America Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 8.2. South America Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 8.3. South America Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type(2025-2032) 8.4. South America Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 8.5. South America Solvent Recovery and Recycling Market Size and Forecast, by Country (2025-2032) 8.5.1. Brazil 8.5.1.1. Brazil Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 8.5.1.2. Brazil Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 8.5.1.3. Brazil Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 8.5.1.4. Brazil Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 8.5.2. Argentina 8.5.2.1. Argentina Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 8.5.2.2. Argentina Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 8.5.2.3. Argentina Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 8.5.2.4. Argentina Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Solvent Recovery and Recycling Market Size and Forecast, by Product Type (2025-2032) 8.5.3.2. Rest Of South America Solvent Recovery and Recycling Market Size and Forecast, by Process Technology (2025-2032) 8.5.3.3. Rest Of South America Solvent Recovery and Recycling Market Size and Forecast, by Solvent Type (2025-2032) 8.5.3.4. Rest Of South America Solvent Recovery and Recycling Market Size and Forecast, by Application (2025-2032) 9. Global Solvent Recovery and Recycling Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Solvent Recovery and Recycling Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Maratek 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Envirotec 10.3. Tradebe 10.4. Novasys Group 10.5. OFRU Recycling 10.6. Indaver 10.7. Veolia 10.8. Clean Planet Chemical 10.9. CycleSolv 10.10. Tradebe 10.11. Clean Harbors 10.12. Nippon Refine 10.13. Shinko Organic Chemical Industry 10.14. Yang Linhong 10.15. Maratek Environmental 10.16. IST Pure 10.17. CBG Technologies 10.18. Quanzhou Tianlong 10.19. CBG Biotech 10.20. Clean Harbors Inc. 10.21. CleanPlanet Chemical 10.22. GFL Environmental Inc. 10.23. Grupo Tradebe Medio Ambiente Sociedad Limitada 10.24. Maratek Environmental Inc 10.25. Polaris Srl 10.26. Shinko Organic Chemical Industry Ltd 11. Key Findings 12. Industry Recommendations 13. Solvent Recovery and Recycling Market: Research Methodology 14. Terms and Glossary