Slaughtering Equipment Market is anticipated to reach US$ 18.58 Bn by 2029 from US$ 12.35 Bn in 2022 at a CAGR of 6% during a forecast period.Global Slaughtering Equipment Market Overview

In the food processing sector, slaughtering equipment is used to increase production and improve the overall quality and value of meat products. While slaughtering and creating numerous slices of the animal body, slaughtering equipment increases automation and decreases energy consumption. Slaughtering equipment aids in the preservation of meat quality by ensuring that cuts are done with the least amount of risk of microbial contamination.To know about the Research Methodology :- Request Free Sample Report

Global Slaughtering Equipment Market Dynamics

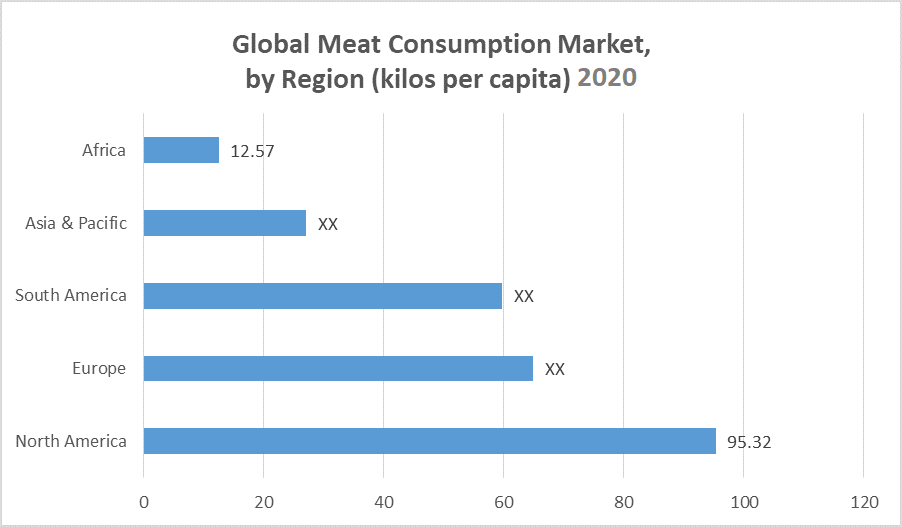

The rise of the Slaughtering Equipment Market is responsible for the increased consumption rate and overall demand for processed and packaged meat. Additionally, rapid advancements in various slaughtering equipment machinery such as meat mincers and chicken pluckers, as well as advancements in sterilization equipment and automation made in mechanization such as standard fillet size and identical cut-up size, are expected to boost the Slaughtering Equipment Market growth over the forecast period. The fundamental challenge is that the market has been going through a time in which global slaughterhouses have been processing a big quantity of livestock using their high production capacity equipment, but the cost of production per unit has been lower due to fewer trading possibilities. This might be due to strict restrictions and trade limitations on the distribution and sale of slaughtered meat in particular areas. Furthermore, the high costs associated with the installation and maintenance of this equipment may hamper the global Slaughtering Equipment market's revenue growth during the forecast period. Rising demand for meat products with extended nutritional interest Despite the increased demand for numerous processed food products with increased nutritional value, meat remains the most popular protein-rich diet among consumers. However, factors such as increased mechanization and automation of processes, awareness about quality, and sanitary meat products catered with regions. This is considered a key driver of the Slaughtering Equipment market during the forecast period.

Global Slaughtering Equipment Market Segmentation Analysis

By Automation Type, the semi-automatic slaughtering lines segment is expected to grow at the largest CAGR of nearly 2.58% during the forecast period. This is due to a semi-automatic slaughter system, including the semi-automatic deboning equipment, killers, exhaust systems, and other automated devices, and also a manual slaughter operation powered by manpower. This line allows slaughterhouses also to generate high-speed mass production of meat, guaranteeing that fast-food and restaurant businesses retain the proper cutting size. By Livestock Type, the semi-automatic slaughtering system segment is expected to grow at the largest CAGR of nearly XX% during the forecast period. The demand for poultry has grown significantly worldwide, leading to an increase in demand for poultry slaughtering equipment such as killing, cut-up, deboning & skinning, and evisceration equipment. Furthermore, the considerable growth in chicken consumption may be linked to the lack of geographical limits, which may be accounted for as a rise in poultry slaughtering equipment sales in the predicted period.Regional Analysis

In 2019, North America dominated the Slaughtering Equipment Market, accounting for 37% of the total. The use of Slaughtering Equipment has increased substantially in recent years as a result of urbanization and the growth of fast food and restaurant chains. The North American area handles the demand for processed meat to meet customer needs, which has led to the development of new slaughtering machinery. Furthermore, producers in the area are applying an optimal method to provide slaughtering equipment on time to satisfy the market need for meat products, which is expected to boost the Slaughtering Equipment Market throughout the projected period. Due to an increase in meat consumption as well as population growth and growing awareness about quality and sanitary meat products in the region, Asia Pacific is expected to be the fast-growers in the world market for slaughter equipment throughout the forecast period. The growing market for slaughter equipment in the region leads to the high consumption of meat in metropolitan areas and the growing demand for processed meat products.Competitive Landscape

Major manufacturers use a variety of techniques, including new product launches, mergers and acquisitions, and foraying into new markets to grow their footprints. As an example, on March 19, 2019, Raniche independently created the revolutionary chicken thigh deboner, which dramatically enhances production efficiency by saving manpower, cutting production time, and minimizing chicken waste, lowering production costs, and improving product quality. On April 25, 2018, Prime Equipment Group introduced the CWS-Series Semesters, which provide versatile, efficient, and space-saving solutions for cutting wings. These semesters continue to be industry leaders, with over 400 in service globally. Jarvis' new JHS-Hand Held Pneumatic Skinner is particularly intended for the rapid and effective removal of trimming strips, skin patches, rounds, butts, hindquarters, and loins from pig carcasses. It may also be used to trim and de-fat hams, skin fish, remove chicken breast skin and trim turkey membranes. The objective of the report is to present a comprehensive analysis of the Global Slaughtering Equipment Market to the stakeholders in the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Gantry CraneMarket dynamics, structure by analyzing the market segments and project the Global Slaughtering Equipment Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Slaughtering Equipment Market make the report investor’s guide.Global Slaughtering Equipment Market Scope: Inquire before buying

Global Slaughtering Equipment Market Report Coverage Details Base Year: 2022 Forecast Period: 2022-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 12.35 Bn. Forecast Period 2022 to 2029 CAGR: 6% Market Size in 2029: US $ 18.58 Bn. Segments Covered: by Product Fully automated line Semi-automated line by Livestock Type Poultry Swine Bovine Seafood Others (Ovine and caprine) Global Slaughtering Equipment Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Slaughtering Equipment Market Key Players

1. Marel (Iceland) 2. BADDER Group (Denmark) 3. BAYLE SA (France) 4. Prime Equipment Group (US) 5. CTB (US) 6. Brower Equipment (US) 7. Jarvis Equipment (India) 8. Industries Riopel (Canada) 9. ASENA (Azerbaijan) 10.Dhopeshwar Engineering Private Limited (India) 11.Meatek Food Machineries (India) 12.BANSS (Germany) 13.Limos (Slovenia) 14.Best & Donovan (US) 15.Blasau (Spain) Frequently Asked Questions: 1. Which region has the largest share in Global Slaughtering Equipment Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Slaughtering Equipment Market? Ans: The Global market is growing at a CAGR of 6% during forecasting period 2023-2029. 3. What is scope of the Global Slaughtering Equipment Market report? Ans: Global Slaughtering Equipment Market helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What was the Global Slaughtering Equipment Market size in 2022? Ans: The Global Slaughtering Equipment Market was valued at US$ 12.35 Bn. In 2022. 5. What is the study period of this Market? Ans: The Global Slaughtering Equipment Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Slaughtering Equipment Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Slaughtering Equipment Market 3.4. Geographical Snapshot of the Slaughtering Equipment Market, By Manufacturer share 4. Global Slaughtering Equipment Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Slaughtering Equipment Market 5. Supply Side and Demand Side Indicators 6. Global Slaughtering Equipment Market Analysis and Forecast, 2022-2029 6.1. Global Slaughtering Equipment Market Size & Y-o-Y Growth Analysis. 7. Global Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 7.1.1. Fully automated line 7.1.2. Semi-automated line 7.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 7.2.1. Poultry 7.2.2. Swine 7.2.3. Bovine 7.2.4. Seafood 7.2.5. Others (Ovine and caprine) 8. Global Slaughtering Equipment Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 9.1.1. Fully automated line 9.1.2. Semi-automated line 9.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 9.2.1. Poultry 9.2.2. Swine 9.2.3. Bovine 9.2.4. Seafood 9.2.5. Others (Ovine and caprine) 10. North America Slaughtering Equipment Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 12. Canada Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 13. Mexico Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 14. Europe Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 15. Europe Slaughtering Equipment Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 17. France Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 18. Germany Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 19. Italy Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 20. Spain Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 21. Sweden Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 22. CIS Countries Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 23. Rest of Europe Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 24. Asia Pacific Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 25. Asia Pacific Slaughtering Equipment Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 27. India Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 28. Japan Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 29. South Korea Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 30. Australia Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 31. ASEAN Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 32. Rest of Asia Pacific Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 33. Middle East Africa Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 34. Middle East Africa Slaughtering Equipment Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 36. GCC Countries Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 37. Egypt Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 38. Nigeria Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 39. Rest of ME&A Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 40. South America Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 41. South America Slaughtering Equipment Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 43. Argentina Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 44. Rest of South America Slaughtering Equipment Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Automation Type, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Livestock Type, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Slaughtering Equipment Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile : Key Players 45.3.1. CTB (US) 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. Marel (Iceland) 45.5. BADDER Group (Denmark) 45.6. BAYLE SA (France) 45.7. Prime Equipment Group (US) 45.8. CTB (US) 45.9. Brower Equipment (US) 45.10. Jarvis Equipment (India) 45.11. Industries Riopel (Canada) 45.12. ASENA (Azerbaijan) 45.13. Dhopeshwar Engineering Private Limited (India) 45.14. Meatek Food Machineries (India) 45.15. BANSS (Germany) 45.16. Limos (Slovenia) 45.17. Best & Donovan (US) 45.18. Blasau (Spain) 46. Primary Key Insights