The Semiconductor Chip Ecosystem Market Size was valued at USD 549.08 Billion in 2023 and the total Global Semiconductor Chip Ecosystem revenue is expected to grow at a CAGR of 11.15 % from 2024 to 2030, reaching nearly USD 1,150.81 Billion by 2030Semiconductor Chip Ecosystem Market Overview

A semiconductor chip, often known as an integrated circuit (IC), is a miniature electronic device constructed from materials like silicon. It incorporates a variety of interconnected electronic elements, including transistors, diodes, resistors, and capacitors, all fabricated onto a solitary semiconductor substrate. These components are intricately patterned onto the semiconductor material's surface through advanced manufacturing techniques. Surged demand for products powered by semiconductors resulted in a higher push for semiconductor chips. Smart electric cars, mobile devices, communication infrastructure, and IoT devices in particular are responsible for driving the semiconductor chip market. Distributed architectures, AI, wideband gap materials, chiplets, and higher frequency devices are the new technologies driving a new era of innovation and have led to collaboration between car makers and chip makers driving the demand for semiconductors chip ecosystem market. Innovation in the segments, such as electric and autonomous vehicles, advanced infotainment, connectivity, and security has fuelled the market growth. Investors from countries such as China, the US, and Israel are focusing on investing in domestic startup ecosystems. A few others, such as Japan and Taiwan, show more diverse activities targeted toward foreign ecosystems. The US has the strongest chip design ecosystem with a higher share in the global design market. 1.According to MMR analysis, 1418 funding rounds where tracked, around 19% have partially disclosed amounts and around 16% have entirely undisclosed funding amounts. 2.In February 2023, TSMC and Samsung Foundries had foundries capable of manufacturing the most advanced generations of logic chip technologies. These include chips labeled by the industry as 5 nanometers (nm) and 3 nm. 3.Europe is the sole producer of manufacturing equipment required for the production of leading-edge microchips, and a major supplier of other specialized equipment, materials, and IP.To know about the Research Methodology :- Request Free Sample Report

Semiconductor Chip Ecosystem Market Dynamics

The Semiconductor Chip Market Thrives on Automotive and Technological Advancements Surged in The advancement of AI models, access to large amounts of data, and massively increased computing power have propelled the market growth. Automotive applications are a key factor that influences growth in semiconductor technology, including electric vehicles (EVs) and autonomous driving. In addition, to advanced battery management systems, the future car requires next-generation sensing combining multiple multispectral cameras and multiple radars, including short-range and long-range radars resulting in demand for semiconductor chips. The rise in the number of electronic devices and innovative semiconductor products across end applications boosts the semiconductor chip market. Thanks to the Increase in Integrated Circuits, big data technology, and automotive sectors, companies have begun to design semiconductor chips. Chips are used to optimize performance in electric vehicles, self-driving automobiles, and other transportation technologies that reduce dependence on fossil fuels which influence the growth of the market. In the era of 5G and AI, the rapid development and adoption of technologies such as blockchain and big data have driven enormous demand for the high-end chip market.Semiconductor Chip Ecosystem Market Challenges Navigating Complexities in the Semiconductor Chip Ecosystem Market Continuous advancements in development have brought new complexities such as testing semiconductors with process nodes of 5nm or smaller is a challenging task in the semiconductor chip market. Geopolitical tensions, rigid supply chains, and high barriers to entry have led to the global chip shortage that has hampered the production of electronics in various regions. The increasing demand for semiconductor chips has led to increased complex manufacturing, which resulted in environmental degradation, resource depletion, and asset distribution disparities. In addition, the growing reliance on processors emphasizes the need to promote sustainable practices in the semiconductor market to protect the environment and care for socioeconomic prospects. According to MMR analysis, Small and medium-sized semiconductor companies face challenges in securing manufacturing capacity due to the prioritization of higher-volume orders from larger businesses. Globally, the cost of prototyping and test design has risen and the market has no agreed-upon roadmaps to guide the simultaneous development of tools, materials, and manufacturing processes. The industry is finding it difficult to attract and retain domestic and international researchers in a highly competitive global market for technology talent.

Semiconductor Chip Ecosystem Market Segment Analysis

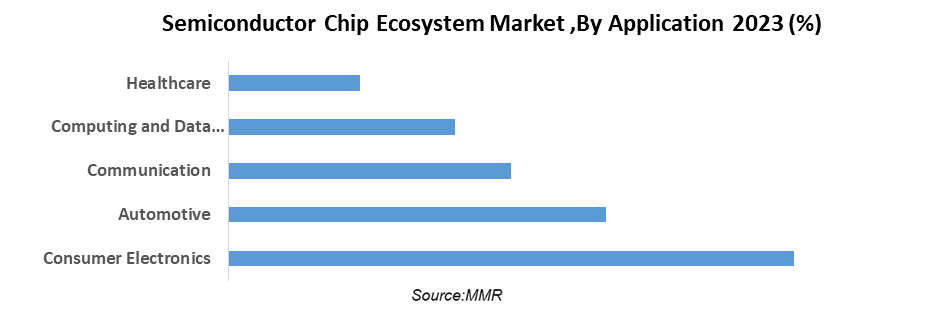

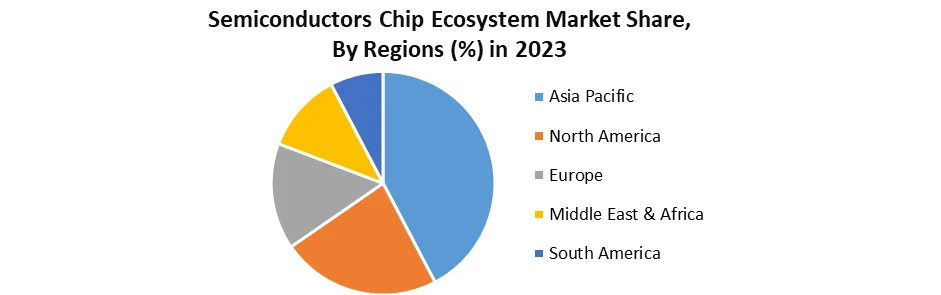

Based on the End user, the Consumer electronics segment dominated the market with a market share of 30% and growing at a CAGR of 11.25%. The Rise in Consumer electronics with the increasing use of advancement in technology and innovations in the market has led to market growth. Consumers are increasingly using devices that can connect to both the Internet and each other, resulting in rapid growth in the consumer electronics market. The key factor that drives the market is a surge in internet consumption resulting in demand for semiconductor chips that support devices such as application processors, microcontrollers, and wireless communication chips. Asia Pacific region is expected to dominate the market with a share of 35%. Thanks to increasing economic development, a large population results in rising disposable income and improved rules and regulations related to technology adoption. The increasing ownership and use of consumer electronics causes dramatic social changes and brings. Rapid technological progress, the constant introduction of newer products with better and faster functions, and continuous cost reduction in consumer electronics have resulted in market growth. The demand for premium devices which include automotive chips has boosted the growth in the market in the region.

Semiconductor Chip Ecosystem Market Regional Insights

Asia Pacific region holds the highest number of market share of 55% with an increasing CAGR of 12.40% during the forecast period. The key factor that propels the market is technological advancements with the increasing population in the region. The rising automotive market such as Analog ICs, Microcontrollers, sensors, discrete components etc influence the market growth. The innovations in driving with the help of the semiconductor chip have led to market growth. Asia Pacific countries have accelerated the R&D and innovation of semiconductors, to maintain their dominance in the regions. Countries like South Korea, Japan, Mainland China and Taiwan (China) have each played a critical role in the development of the semiconductor chip market. South Korea also had taken the initiative regarding the R&D of AI and 5 G-related semiconductor products. Japan's strength lies in semiconductor materials and is striving for the development of both mid- and downstream, as well as reviving its semiconductor industry. Additionally, China is towards a development of self-sufficiency, As for Taiwan (China), although it has already played a leading role in semiconductor manufacturing, the island continues to reinvent itself to achieve a comprehensive tech ecosystem while devoting itself to the research of sustainable and green semiconductors. Most of the world's top chip design companies today rely on manufacturers in the Asia Pacific region to manufacture semiconductor chips. The Key players such as TSMC and Samsung, which collectively own over 70% of the total manufacturing market, have in recent years become the only suppliers of cutting-edge chips. To maintain its dominance in the future, Taiwan (China) is rapidly reinventing its techniques, proposing the most advanced 3nm technology which is planned to be implemented in the second half of 2023.

Semiconductor Chip Ecosystem Market Competitive Landscape

In 2023, The US CHIPS Act, offering $52 billion in subsidies for domestic chip manufacturing, spurred companies to seek acquisitions for expanding capabilities and accessing funding. In 2023, NXP Semiconductors acquired Marvell Technology’s infrastructure processing group for $6 Billion, a deal that strengthened NXP’s position in networking and industrial automation chips. In 2023, Analog Devices acquired Maxim Integrated for $21 billion, combining analog and mixed-signal expertise for a broader product range. In 2023, Shift from shortage to potential oversupply due to increased production capacity and softening demand.Semiconductor Chip Ecosystem Market Scope: Inquire before buying

Semiconductor Chip Ecosystem Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2024: US $ 549.08 Bn. Forecast Period 2024 to 2029 CAGR: 11.15% Market Size in 2030: US $ 1,150.81 Bn. Segments Covered: by Product Type Microprocessors Memory chips Graphic processing units (GPUs) Analog chips Digital signal processors (DSPs) Application-specific integrated circuits (ASICs) Field-programmable gate arrays (FPGAs) System-on-Chip (SoC) by Application Smartphones Internet of Things (IoT) Devices Medical Devices by End-Use Industry Consumer Electronics Communications Computing Automotive Industrial Semiconductor Chip Ecosystem Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Semiconductor Chip Ecosystem Market Key Players

1. Intel Corporation 2. Samsung Electronics Co., Ltd. 3. Taiwan Semiconductor Manufacturing Company Limited (TSMC) 4. SK Hynix Inc. 5. Micron Technology, Inc. 6. Qualcomm Incorporated 7. Broadcom Inc. 8. Advanced Micro Devices, Inc. (AMD) 9. NVIDIA Corporation 10. Texas Instruments Incorporated 11. Applied Materials, Inc. 12. ASML Holding N.V. 13. NXP Semiconductors N.V. 14. Infineon Technologies AG 15. MediaTek Inc. 16. Renesas Electronics Corporation 17. STMicroelectronics N.V. 18. Analog Devices, Inc. 19. Xilinx, Inc. 20. Microchip Technology Inc. Frequently Asked Questions: 1] What is the projected market size & and growth rate of the Semiconductor Chip Ecosystem Market? Ans. The Semiconductor Chip Ecosystem Market size was valued at USD 549.08 Billion in 2023 and the total Global Semiconductor Chip Ecosystem revenue is expected to grow at a CAGR of 11.15 % from 2024 to 2030, reaching nearly USD 1,150.81 Billion By 2030 2] What segments are covered in the Semiconductor Chip Ecosystem Market report? Ans. The segments covered in the Semiconductor Chip Ecosystem Market report are based on Product type, Application, and End-use. 3] Which region is expected to hold the highest share in the Global Semiconductor Chip Ecosystem Market? Ans. The Asia Pacific region is expected to hold the highest share of the Semiconductor Chip Ecosystem Market. 4] What are the growth drivers for the Semiconductor Chip Ecosystem market? Ans. Innovation in technology, etc. is expected to be the major driver for the Semiconductor Chip Ecosystem market. 5] What is the forecast period for the Semiconductor Chip Ecosystem Market? Ans. The forecast period for the Semiconductor Chip Ecosystem Market is 2024-2030.

1. Semiconductor Chip Ecosystem Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Semiconductor Chip Ecosystem: Dynamics 2.1. Semiconductor Chip Ecosystem Trends by Region 2.1.1. North America Semiconductor Chip Ecosystem Trends 2.1.2. Europe Semiconductor Chip Ecosystem Trends 2.1.3. Asia Pacific Semiconductor Chip Ecosystem Trends 2.1.4. Middle East and Africa Semiconductor Chip Ecosystem Trends 2.1.5. South America Semiconductor Chip Ecosystem Trends 2.2. Semiconductor Chip Ecosystem Dynamics by Region 2.2.1. North America 2.2.1.1. North America Semiconductor Chip Ecosystem Drivers 2.2.1.2. North America Semiconductor Chip Ecosystem Restraints 2.2.1.3. North America Semiconductor Chip Ecosystem Opportunities 2.2.1.4. North America Semiconductor Chip Ecosystem Challenges 2.2.2. Europe 2.2.2.1. Europe Semiconductor Chip Ecosystem Drivers 2.2.2.2. Europe Semiconductor Chip Ecosystem Restraints 2.2.2.3. Europe Semiconductor Chip Ecosystem Opportunities 2.2.2.4. Europe Semiconductor Chip Ecosystem Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Semiconductor Chip Ecosystem Drivers 2.2.3.2. Asia Pacific Semiconductor Chip Ecosystem Restraints 2.2.3.3. Asia Pacific Semiconductor Chip Ecosystem Opportunities 2.2.3.4. Asia Pacific Semiconductor Chip Ecosystem Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Semiconductor Chip Ecosystem Drivers 2.2.4.2. Middle East and Africa Semiconductor Chip Ecosystem Restraints 2.2.4.3. Middle East and Africa Semiconductor Chip Ecosystem Opportunities 2.2.4.4. Middle East and Africa Semiconductor Chip Ecosystem Challenges 2.2.5. South America 2.2.5.1. South America Semiconductor Chip Ecosystem Drivers 2.2.5.2. South America Semiconductor Chip Ecosystem Restraints 2.2.5.3. South America Semiconductor Chip Ecosystem Opportunities 2.2.5.4. South America Semiconductor Chip Ecosystem Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For Semiconductor Chip Ecosystem Market 2.7. Analysis of Government Schemes and Initiatives For Semiconductor Chip Ecosystem Market 2.8. Global Import of Semiconductors Chips 2.8.1. Ten Largest Importer 2.9. Global Export of Semiconductors Chips 2.9.1. Ten Largest Exporter 3. Semiconductor Chip Ecosystem: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 3.1. Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 3.1.1. Microprocessors 3.1.2. Memory chips 3.1.3. Graphic processing units (GPUs) 3.1.4. Analog chips 3.1.5. Digital signal processors (DSPs) 3.1.6. Application-specific integrated circuits (ASICs) 3.1.7. Field-programmable gate arrays (FPGAs) 3.1.8. System-on-Chip (SoC) 3.2. Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 3.2.1. Smartphones 3.2.2. Internet of Things (IoT) Devices 3.2.3. Medical Devices 3.3. Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 3.3.1. Consumer Electronics 3.3.2. Communications 3.3.3. Computing 3.3.4. Automotive 3.3.5. Industrial 3.4. Semiconductor Chip Ecosystem Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Semiconductor Chip Ecosystem Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.1. North America Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 4.1.1. Microprocessors 4.1.2. Memory chips 4.1.3. Graphic processing units (GPUs) 4.1.4. Analog chips 4.1.5. Digital signal processors (DSPs) 4.1.6. Application-specific integrated circuits (ASICs) 4.1.7. Field-programmable gate arrays (FPGAs) 4.1.8. System-on-Chip (SoC) 4.2. North America Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 4.2.1. Smartphones 4.2.2. Internet of Things (IoT) Devices 4.2.3. Medical Devices 4.3. North America Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 4.3.1. Consumer Electronics 4.3.2. Communications 4.3.3. Computing 4.3.4. Automotive 4.3.5. Industrial 4.4. North America Semiconductor Chip Ecosystem Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Microprocessors 4.4.1.1.2. Memory chips 4.4.1.1.3. Graphic processing units (GPUs) 4.4.1.1.4. Analog chips 4.4.1.1.5. Digital signal processors (DSPs) 4.4.1.1.6. Application-specific integrated circuits (ASICs) 4.4.1.1.7. Field-programmable gate arrays (FPGAs) 4.4.1.1.8. System-on-Chip (SoC) 4.4.1.2. United States Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Smartphones 4.4.1.2.2. Internet of Things (IoT) Devices 4.4.1.2.3. Medical Devices 4.4.1.3. United States Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Consumer Electronics 4.4.1.3.2. Communications 4.4.1.3.3. Computing 4.4.1.3.4. Automotive 4.4.1.3.5. Industrial 4.4.2. Canada 4.4.2.1. Canada Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Microprocessors 4.4.2.1.2. Memory chips 4.4.2.1.3. Graphic processing units (GPUs) 4.4.2.1.4. Analog chips 4.4.2.1.5. Digital signal processors (DSPs) 4.4.2.1.6. Application-specific integrated circuits (ASICs) 4.4.2.1.7. Field-programmable gate arrays (FPGAs) 4.4.2.1.8. System-on-Chip (SoC) 4.4.2.2. Canada Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Smartphones 4.4.2.2.2. Internet of Things (IoT) Devices 4.4.2.2.3. Medical Devices 4.4.2.3. Canada Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 4.4.2.4. Consumer Electronics 4.4.2.5. Communications 4.4.2.6. Computing 4.4.2.7. Automotive 4.4.2.8. Industrial 4.4.3. Mexico 4.4.3.1. Mexico Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Microprocessors 4.4.3.1.2. Memory chips 4.4.3.1.3. Graphic processing units (GPUs) 4.4.3.1.4. Analog chips 4.4.3.1.5. Digital signal processors (DSPs) 4.4.3.1.6. Application-specific integrated circuits (ASICs) 4.4.3.1.7. Field-programmable gate arrays (FPGAs) 4.4.3.1.8. System-on-Chip (SoC) 4.4.3.2. Mexico Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Smartphones 4.4.3.2.2. Internet of Things (IoT) Devices 4.4.3.2.3. Medical Devices 4.4.3.3. Mexico Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Consumer Electronics 4.4.3.3.2. Communications 4.4.3.3.3. Computing 4.4.3.3.4. Automotive 4.4.3.3.5. Industrial 5. Europe Semiconductor Chip Ecosystem Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 5.1. Europe Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.2. Europe Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.3. Europe Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4. Europe Semiconductor Chip Ecosystem Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.2.3. France Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6. Asia Pacific Semiconductor Chip Ecosystem Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.1. Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.1.3. China Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.4.3. India Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Semiconductor Chip Ecosystem Size and Forecast (by Value in USD Billion) (2023-2030) 7.1. Middle East and Africa Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Semiconductor Chip Ecosystem Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 8. South America Semiconductor Chip Ecosystem Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 8.1. South America Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 8.2. South America Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 8.3. South America Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 8.4. South America Semiconductor Chip Ecosystem Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Semiconductor Chip Ecosystem Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Semiconductor Chip Ecosystem Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Semiconductor Chip Ecosystem Size and Forecast, by End User (2023-2030) 9. Global Semiconductor Chip Ecosystem: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Semiconductor Chip Ecosystem Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Intel Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Samsung Electronics Co., Ltd. 10.3. Taiwan Semiconductor Manufacturing Company Limited (TSMC) 10.4. SK Hynix Inc. 10.5. Micron Technology, Inc. 10.6. Qualcomm Incorporated 10.7. Broadcom Inc. 10.8. Advanced Micro Devices, Inc. (AMD) 10.9. NVIDIA Corporation 10.10. Texas Instruments Incorporated 10.11. Applied Materials, Inc. 10.12. ASML Holding N.V. 10.13. NXP Semiconductors N.V. 10.14. Infineon Technologies AG 10.15. MediaTek Inc. 10.16. Renesas Electronics Corporation 10.17. STMicroelectronics N.V. 10.18. Analog Devices, Inc. 10.19. Xilinx, Inc. 10.20. Microchip Technology Inc. 11. Key Findings 12. Industry Recommendations 13. Semiconductor Chip Ecosystem: Research Methodology