The Rotavirus Vaccine Market size was valued at USD 7.42 Billion in 2023 and the total Rotavirus Vaccine revenue is expected to grow at a CAGR of 6.4% from 2024 to 2030, reaching nearly USD 11.46 Billion in 2030.Rotavirus Vaccine Market Overview

The report provides a comprehensive analysis of the global rotavirus vaccine market, aiming to assess its current landscape, trends, and prospects. The introduction outlines the scope and objectives, focusing on the importance of rotavirus vaccination in combating this prevalent gastrointestinal infection, particularly in infants and young children. The executive description of the report encapsulates key findings, highlighting market trends, challenges, and opportunities, thereby setting the stage for deeper exploration. Following this, the report analyses market dynamics, including drivers, restraints, and opportunities driving or hindering market growth. Market segmentation is explored concerning vaccine types and distribution channels, providing insights into market share and distribution strategies. The increasing number of rotavirus-related deaths worldwide, which are more severe in developing countries, underlines the significance it is to vaccinate everyone. Raising the use of rotavirus vaccinations in National Immunization Programs (NIPs) improves the stability and accessibility of the market. A focus on price, as demonstrated by the creation of affordable solutions such as Rotavac, promotes market growth and enhanced accessibility. Changes in the population, such as increased birth rates in some areas, increase the need for childhood vaccinations. Also, continued research on booster dosages, novel delivery methods, and multivalent vaccinations enhances market potential, showing a dynamic environment ready for growth and creativity in the fight against rotavirus infections. The rotavirus vaccine market offers investors several options to think about. Leading firms including GSK, Merck & Co., and Bharat Biotech provide prospects for direct investment, capitalizing on their market dominance to generate prospective dividend income and capital gains on shares. Promising growth potential is presented by emerging firms such as BioFarma and Serum Institute of India in developing markets. Investing in biotechnology or healthcare-themed exchange-traded funds (ETFs) gives exposure to the larger vaccination market. In addition, early-stage businesses developing rotavirus vaccines or technology can benefit from venture capital and private equity alternatives, which present the possibility of high-risk, high-reward returns in this exciting industry.To know about the Research Methodology :- Request Free Sample Report

Rotavirus Vaccine Market Dynamics

Disease Burden and Public Health Impact Rotavirus is a leading cause of severe diarrhea in infants and young children worldwide, resulting in significant morbidity and mortality, especially in developing countries. The high disease burden and public health impact drive the need for vaccination to reduce the incidence and severity of Rotavirus infections. Rotavirus is a major public health concern, and increasing vaccination rates are necessary to address this issue, especially in poor nations. By helping 59 countries integrate rotavirus vaccines into national programs, Gavi, the Vaccine Alliance, helped to prevent an estimated 6.4 Million newborn deaths between 2000 and 2019. Recognizing the difficulties faced by low- and middle-income nations, producers are creating more accessible solutions, such as Rotavac from Bharat Biotech, which increased immunization rates in India. To further reduce the illness burden, research and development activities are concentrated on improving vaccine efficacy, creating novel formulations, and increasing coverage against various Rotavirus strains. Global deaths were attributed to rotavirus as reported by MMR, This figure decreased worldwide.Growing Immunization Programs Many countries have incorporated rotavirus vaccination into their national immunization programs, leading to increased demand for vaccines. The World Health Organization (WHO) recommends rotavirus vaccination as part of routine immunization for all infants. Including in National Immunization Programs (NIPs) guarantees demand supported by the government, increasing market size and stability. By extending vaccination accessibility and reaching previously untapped markets, NIP inclusion opens up new business prospects. Contracts with governments that are extended over time provide steady cash streams, which encourage investment in research and production. Prestigious NIP connections increase brand awareness and legitimacy and give manufacturers a competitive advantage. 1. Globally, rotavirus vaccine coverage for infants increased from XX% in 2018 to an estimated XX% in 2023, according to the MMR Analysis. 2. India's NIP inclusion of Rotavac led to a significant increase in vaccination rates, contributing to a 70% reduction in rotavirus deaths in children under 5. 3. Globally, the rotavirus vaccine coverage for infants witnessed an increase from 69% in 2018 to an estimated 80% in 2023, according to data from the World Health Organization (WHO). The report delineates the correlation between the upward trend and enhanced accessibility, showcasing the effective implementation of vaccination initiatives. These programs strategically aim to mitigate rotavirus infections among young children on a global scale, focusing on the positive impact on public health and the market for rotavirus vaccines.

Duration of Protection The duration of protection provided by rotavirus vaccines is another area of concern. While vaccines have demonstrated efficacy in preventing severe rotavirus gastroenteritis, the duration of immunity is expected to decrease over time, leading to innovative infections in older children and adults. Falling worries about immunity contribute to market uncertainty by limiting the uptake and growth of rotavirus vaccination programs. Potential increased dose requirements would necessitate more development, production, and research, which would increase costs and complexity for producers. Manufacturers prioritize long-term protection by investigating novel formulations or vaccination schedules that aim to achieve persistent immunity, perhaps generating new market niches and intensifying competition. 1. MMR Studies suggest protection against severe rotavirus disease is expected to decline after 2-3 years post-vaccination. 2. Several ongoing clinical trials are investigating newer rotavirus vaccines or alternative vaccination schedules aimed at achieving longer-lasting protection.

Rotavirus Vaccine Market Segment Analysis

By Type, the Rotarix segment led the global Rotavirus Vaccine market with the highest revenue share in terms of both value and volume in 2022. The well-known rotavirus vaccination Rotarix, which was released in 2006, has significantly improved public health by lowering hospitalizations and deaths caused by rotaviruses, particularly in industrialized countries. Research shows that since the vaccine's release, hospitalizations for severe rotavirus diarrhea have significantly decreased in these areas, with rates ranging from 45% to 94%. Its dominance in the market has been strengthened by its long-standing presence, which has led to great brand awareness and universal support among parents and healthcare practitioners alike. In addition, Rotarix's inclusion in vaccination programs in over 90 countries worldwide guarantees broad access to rotavirus protection, which adds to the drug's substantial use and global reach. With its shown effectiveness and track record, this vaccine is a vital component of global public health initiatives helping to prevent rotavirus infections and reduce the resulting illness load.Rotavirus Vaccine Market Regional Insights

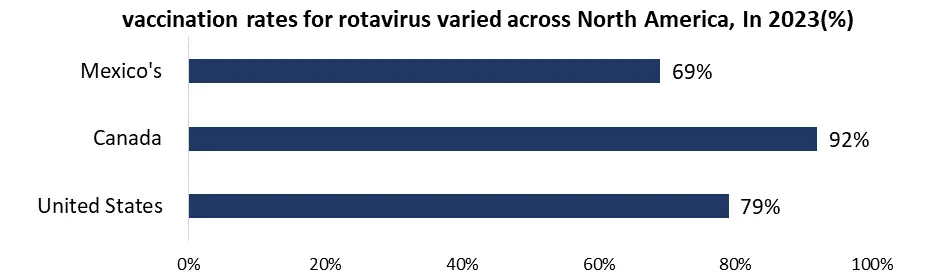

North America, holds a leading position globally thanks to the high awareness of rotavirus and its complications, robust healthcare infrastructure, and extensive insurance coverage. The widespread integration of rotavirus vaccines into national immunization programs further bolsters this dominance. Government campaigns in the US include national vaccination campaigns in which every state requires rotavirus immunization as part of their National Immunization Programs (NIPs) to guarantee vaccination coverage. Extra help is given in the form of money and subsidies through initiatives including Vaccines for Children (VFC), which expands the market and makes vaccines more accessible to children without insurance. Governments also actively support public awareness programs to inform parents of the importance of the rotavirus vaccine, which improves community knowledge and immunization efforts. A greater focus is currently being placed on affordability in the rotavirus vaccine industry due to increased competition and government programs that support less expensive choices like Rotavac. Research is also being conducted to investigate novel formulations, specifically multivalent vaccinations that are capable of targeting a wider variety of rotavirus strains, potentially increasing the market. The market continues to recover from the effects of COVID-19, despite the disruptions caused by the pandemic. As global healthcare systems stabilize and vaccine campaigns pick back up, it is expected that vaccination rates will return to their pre-pandemic levels. With the biggest market share in North America, the United States leads the rotavirus vaccine industry. This is possibly attributed to its huge population, robust healthcare system, and government support for vaccination campaigns. Canada, on the other hand, has a smaller market than its southern neighbor but has excellent immunization rates and government-sponsored programs that support affordability. The Mexican market is growing rapidly due to a deliberate attempt to increase the reach of the National Immunization Program (NIP) and improve the availability of rotavirus vaccinations. It indicates that public health interventions are becoming more important and that there is potential for market growth.

Rotavirus Vaccine Market Competitive Landscape

Industry participants are placing a higher priority on the creation of innovative formulations, multivalent vaccines, and improved delivery systems as a result of a spike in research and development spending. Manufacturers are strategically increasing their production capacities by investing in improved facilities and advanced capabilities to fulfill the increasing demand. In addition, strategic alliances formed by mergers and collaborations are becoming common, enabling businesses to combine resources and knowledge. These partnerships prepare the industry for long-term growth and competitiveness in the ever-changing rotavirus vaccine market by facilitating market access and encouraging the creation of innovative technology. Growing competition in pricing, driven by new competitors and increased capacity, benefits consumers but may put pressure on profit margins for market leaders. At the same time, higher R&D spending encourages innovation and results in improved vaccines that may expand market share and satisfy unfulfilled needs. Furthermore, accessible products and services from companies such as Bharat Biotech support accessibility and provide greater access to rotavirus vaccines in underdeveloped countries. In addition, technological advancements such as new formulations and delivery systems may draw in new user categories and improve market dynamics in general, increasing the market's competitiveness and evolution for rotavirus vaccines. 1. Biological stated on July 8, 2021, that it has signed a licensing and cooperation deal with Providence, whereby Providence committed to selling PTX-COVID-19-B vaccine doses up to 30 Million. As per the terms of the deal, Providence is going to provide Biological with the technology transfer required to produce mRNA pharmaceuticals in India, with a target volume of one billion dollars and a maximum manufacturing capacity of 600 Million units by 2022. 2. On July 8, 2021, GSK plc and Vir Biotechnology, Inc. announced that they had signed a Memorandum of Understanding with the European Commission to supply up to 220,000 doses of sotrovimab, a single dose of SARS-CoV-2 antibody for the treatment of adults and adolescents with COVID-19 (elderly 12 years and older, weighing at least 40 kg), which does not require the addition of oxygen and is susceptible to contracting severe COVID-19 again. To treat patients at high risk with COVID-19 who may benefit from early therapy with sotrovimab, the European Union (EU) Member States may engage in the immediate procurement of sotrovimab, subject to urgent local approval or approval at the EU level, through the Joint Procurement Agreement.Rotavirus Vaccine Market Scope: Inquiry Before Buying

Rotavirus Vaccine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.42 Bn. Forecast Period 2024 to 2030 CAGR: 6.4% Market Size in 2030: US $ 11.46 Bn. Segments Covered: by Type Rotarix RotaTeq Rotavac Rotavin-M1 Lanzhou lamb by End Users Hospitals Clinics Academic Research Rotavirus Vaccine Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Rotavirus Vaccine Market

1. Merck & Co., Inc. (US) 2. Bharat Biotech (India) 3. GlaxoSmithKline plc. (UK) 4. Sanofi (France) 5. Lanzhou Institute of Biologicals Products Co. Ltd (China) 6. BIOVIRx Inc (US) 7. Serum Institute of India Pvt. 8. Biological E (India) 9. Pfizer Inc. (US) 10. GlaxoSmithKline plc. (UK) 11. Bio Farma (Indonesia) 12. Novartis AG (Switzerland) 13. Berghofer Medical Research Institute (Australia) 14. Nuvonis 15. Jamanetwork 16. Thelancet 17. Kff 18. Gsk 19. journalsFAQs:

1. Is the rotavirus vaccine included in national immunization programs? Ans. Many countries include the rotavirus vaccine in their national immunization programs (NIPs) to ensure widespread access and coverage, particularly in regions with a high burden of rotavirus-related illness and mortality. 2. What are the challenges facing the rotavirus vaccine market? Ans. Challenges include ensuring access and affordability, addressing vaccine hesitancy, maintaining cold chain requirements, and addressing strain diversity. Additionally, competition, innovation, and technological advancements impact market dynamics. 3. What is the projected market size & and growth rate of the Rotavirus Vaccine Market? Ans. The Rotavirus Vaccine Market size was valued at USD 7.42 Billion in 2023 and the total Rotavirus Vaccine revenue is expected to grow at a CAGR of 6.4 % from 2023 to 2030, reaching nearly USD 11.46 Billion in 2030. 4. What segments are covered in the Rotavirus Vaccine Market report? Ans. The segments covered in the Rotavirus Vaccine market report are type and End Users.

1. Rotavirus Vaccine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rotavirus Vaccine Market: Dynamics 2.1. Rotavirus Vaccine Market Trends by Region 2.1.1. North America Rotavirus Vaccine Market Trends 2.1.2. Europe Rotavirus Vaccine Market Trends 2.1.3. Asia Pacific Rotavirus Vaccine Market Trends 2.1.4. Middle East and Africa Rotavirus Vaccine Market Trends 2.1.5. South America Rotavirus Vaccine Market Trends 2.2. Rotavirus Vaccine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rotavirus Vaccine Market Drivers 2.2.1.2. North America Rotavirus Vaccine Market Restraints 2.2.1.3. North America Rotavirus Vaccine Market Opportunities 2.2.1.4. North America Rotavirus Vaccine Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rotavirus Vaccine Market Drivers 2.2.2.2. Europe Rotavirus Vaccine Market Restraints 2.2.2.3. Europe Rotavirus Vaccine Market Opportunities 2.2.2.4. Europe Rotavirus Vaccine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rotavirus Vaccine Market Drivers 2.2.3.2. Asia Pacific Rotavirus Vaccine Market Restraints 2.2.3.3. Asia Pacific Rotavirus Vaccine Market Opportunities 2.2.3.4. Asia Pacific Rotavirus Vaccine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rotavirus Vaccine Market Drivers 2.2.4.2. Middle East and Africa Rotavirus Vaccine Market Restraints 2.2.4.3. Middle East and Africa Rotavirus Vaccine Market Opportunities 2.2.4.4. Middle East and Africa Rotavirus Vaccine Market Challenges 2.2.5. South America 2.2.5.1. South America Rotavirus Vaccine Market Drivers 2.2.5.2. South America Rotavirus Vaccine Market Restraints 2.2.5.3. South America Rotavirus Vaccine Market Opportunities 2.2.5.4. South America Rotavirus Vaccine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Clinical Trial Analysis for Rotavirus Vaccine 2.8. Key Opinion Leader Analysis For the Rotavirus Vaccine Industry 2.9. Analysis of Government Schemes and Initiatives For the Rotavirus Vaccine Industry 3. Rotavirus Vaccine Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 3.1. Global Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 3.1.1. Rotarix 3.1.2. RotaTeq 3.1.3. Rotavac 3.1.4. Rotavin-M1 3.1.5. Lanzhou lamb 3.2. Global Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 3.2.1. Hospitals 3.2.2. Clinics 3.2.3. Academic Research 3.3. Global Rotavirus Vaccine Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Rotavirus Vaccine Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 4.1. North America Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 4.1.1. Rotarix 4.1.2. RotaTeq 4.1.3. Rotavac 4.1.4. Rotavin-M1 4.1.5. Lanzhou lamb 4.2. North America Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 4.2.1. Hospitals 4.2.2. Clinics 4.2.3. Academic Research 4.3. United States 4.4. United States Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 4.4.1. Rotarix 4.4.2. RotaTeq 4.4.3. Rotavac 4.4.4. Rotavin-M1 4.4.5. Lanzhou lamb 4.5. United States Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 4.5.1. Hospitals 4.5.2. Clinics 4.5.3. Academic Research 4.6. Canada 4.7. Canada Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 4.7.1. Rotarix 4.7.2. RotaTeq 4.7.3. Rotavac 4.7.4. Rotavin-M1 4.7.5. Lanzhou lamb 4.8. Canada Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 4.8.1. Hospitals 4.8.2. Clinics 4.8.3. Academic Research 4.9. Mexico 4.10. Mexico Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 4.10.1. Rotarix 4.10.2. RotaTeq 4.10.3. Rotavac 4.10.4. Rotavin-M1 4.10.5. Lanzhou lamb 4.11. Mexico Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 4.11.1. Hospitals 4.11.2. Clinics 4.11.3. Academic Research 5. Europe Rotavirus Vaccine Market Size and Forecast by Segmentation (by Value in USD Billion ) (2022-2029) 5.1. Europe Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.2. Europe Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3. Europe Rotavirus Vaccine Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Rotavirus Vaccine Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 6.1. Asia Pacific Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Rotavirus Vaccine Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 7. The Middle East and Africa Rotavirus Vaccine Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 7.1. Middle East and Africa Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 7.2.1. South Africa 7.2.1.1. South Africa Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 7.2.1.2. South Africa Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 7.2.2. GCC 7.2.2.1. GCC Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 7.2.2.2. GCC Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 7.2.3. Rest of ME&A 7.2.3.1. Rest of ME&A Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 7.2.3.2. Rest of ME&A Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 8. South America Rotavirus Vaccine Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 8.1. South America Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 8.2. South America Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 8.2.1. Brazil 8.2.1.1. Brazil Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 8.2.1.2. Brazil Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 8.2.2. Argentina 8.2.2.1. Argentina Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 8.2.2.2. Argentina Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 8.2.3. Rest Of South America 8.2.3.1. Rest of South America Rotavirus Vaccine Market Size and Forecast, by Type (2023-2030) 8.2.3.2. Rest of South America Rotavirus Vaccine Market Size and Forecast, by End User (2023-2030) 9. Global Rotavirus Vaccine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Rotavirus Vaccine Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Merck & Co., Inc. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bharat Biotech (India) 10.3. GlaxoSmithKline plc. (UK) 10.4. Sanofi (France) 10.5. Lanzhou Institute of Biologicals Products Co. Ltd (China) 10.6. BIOVIRx Inc (US) 10.7. Serum Institute of India Pvt. 10.8. Biological E (India) 10.9. Pfizer Inc. (US) 10.10. GlaxoSmithKline plc. (UK) 10.11. Bio Farma (Indonesia) 10.12. Novartis AG (Switzerland) 10.13. Berghofer Medical Research Institute (Australia) 10.14. Nuvonis 10.15. Jamanetwork 10.16. Thelancet 10.17. Kff 10.18. Gsk 10.19. journals 11. Key Findings 12. Industry Recommendations 13. Rotavirus Vaccine Market: Research Methodology