Global Rodenticides Market size was valued at USD 2.71 Bn in 2023 and is expected to reach USD 3.47 Bn by 2030, at a CAGR of 3.6 %.Rodenticides Market Overview

Rodenticides are chemical substances or formulations used to kill or control rodents such as rats and mice. They are used in agricultural settings, residential areas, and commercial facilities to maintain rodent populations and prevent damage to property and potential health risks. Rodenticides have several forms such as pellets, granules, blocks, powders, and liquids. They are designed to be attractive to rodents, to encourage them to consume the toxic substance. The report includes historical data, present and future trends, competitive environment of the Rodenticides industry. The bottom-up approach was used to estimate the market size. For a deeper knowledge of Rodenticides market penetration, competitive structure, pricing and demand analysis are included in the report. The qualitative and quantitative methods are included in the report for the analysis of the data of the Rodenticides market.To know about the Research Methodology :- Request Free Sample Report

Rodenticides Market Dynamics

Drivers Increasing Rodent Infestations to Boost the Rodenticides Market Growth Rodents contain various diseases and pathogens that have been transmitted to humans and they have spread diseases such as Hantavirus, leptospirosis, plague and salmonellosis. The rising awareness of these health risks resulted in to increase in the demand for effective rodent control measures such as the use of Rodenticides. Rodents have caused huge damage to characteristics such as agricultural fields, residential buildings and commercial establishments. They have been chewed through electrical wires, insulation and wooden structures and contaminate stored goods leading to financial losses. The need to prevent property damage and protect investments fuels Rodenticides Market growth. Rodents pose a significant threat to agricultural crops by feeding on plants, seeds, and stored grains. They have been destroying entire crops and reducing yields, affecting farmers' income and food production. To mitigate these losses and protect agricultural investments, farmers and agricultural industries rely on rodenticides as an essential part of their pest management strategies. Rapid urbanization and population growth result in increased waste generation, creating favorable conditions for rodent populations to thrive. Urban areas with inadequate waste management systems give ample food sources for rodents resulting in higher infestations. With the increasing expansion of urban areas, the demand for rodenticides to control rodent populations in cities as well as residential areas increases which drives the Rodenticides Market growth. Growing Awareness of Health Risks to Fuel the Rodenticides Market Growth Rodents infesting homes have been directly impacting the well-being and health of residents. Asthma, allergies and other respiratory diseases have been triggered by the disclosure of rodent allergens. The rodents also cause property damage, contaminate food, and create unsanitary living conditions. The increasing awareness of these health risks leads homeowners to search for effective rodent control solutions. Rodents are a public health concern as they have been contaminating food supplies, food preparation areas, and water sources. This contamination has been resulting in foodborne illnesses and outbreaks, affecting public health on a larger scale. The awareness of these risks boosts the requirement for rodenticides as a portion of comprehensive pest control programs for the protection of public health. Rodent infestations in workplaces such as warehouses, food processing facilities and agricultural settings, bear risks to the health and safety of workers. Employees resolved to rodent-borne diseases or allergens from rodent droppings and urine have been experiencing health issues. To ensure a secure working environment and comply with occupational health and safety regulations, businesses have been implementing rodent control measures including the use of rodenticides. The increasing access to information through the internet, education, and media coverage has rising awareness regarding the health risks associated with rodents. This increased awareness about the preventive measure such as Rodenticides and boosts the Rodenticides Market growth.Rodenticides Market Trend

Shift toward Integrated Pest Management (IPM) IPM strategies focus to reduce the assurance of chemical pesticides such as rodenticides, as the first line of defense against pests. Instead, IPM emphasizes prevention, monitoring and the use of non-chemical control methods. This approach supports minimizing the environmental and health risks associated with extensive use of pesticides. There is rising awareness and concern regarding the environmental impact of pesticides including rodenticides. Pesticides have unplanned consequences such as harming non-target species, contaminating water sources, and disrupting ecosystems. IPM practices prioritize the use of non-chemical alternatives, which helps reduce these adverse effects and promote a more sustainable approach to pest control. Pests such as rodents, has been develop resistance to pesticides over time. This act is a challenge to effectively control them and has led to the need for stronger and more toxic pesticides and thus it influences the Rodenticides Market growth. IPM approaches, on the other hand, incorporate a variety of control methods, making it more crucial for pests to develop resistance and ensure long-term effectiveness. To achieve effective and long-lasting results, IPM focuses on integrating multiple pest control strategies. This has been involving the implementation of physical barriers, adopting cultural practices, using biological controls and utilizing targeted chemical interventions when requires. By combining several methods, IPM offers a comprehensive approach to pest management and is expected to drive the Rodenticides Market growth. Rodenticides Market Restraints Environmental Concerns to Hamper the Rodenticides Market Growth Rodenticides are designed to kill rodents, but they also harm non-target species including birds of prey, mammals, reptiles, and amphibians, which has been consume poisoned rodents or feed on contaminated prey. These secondary poisonings has been disrupt ecosystems and have cascading effects on wildlife populations. The persistence of rodenticides in the environment has been led to long-term contamination of soil, water bodies and vegetation, posing risks to biodiversity and ecosystem health. Many rodenticides are persistent chemicals that has been accumulate in the tissues of organisms over time. This bioaccumulation has resulted in high concentrations of rodenticides in certain species, particularly those at the top of the food chain. Through biomagnification, the toxic load increases as predators consume prey with accumulated rodenticides, leading to potentially harmful levels of exposure for wildlife. This phenomenon affects wildlife populations as well as raises concerns about the potential transfer of rodenticides into the human food chain. As a result, the increasing environmental concerns impede Rodenticides Market Growth.Rodenticides Market Regional Insights

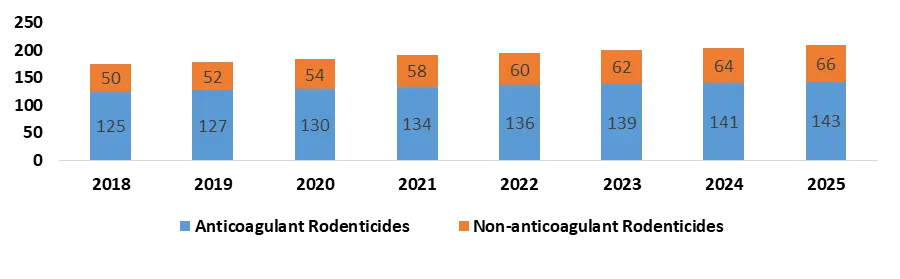

North America held the largest Rodenticides Market share and is expected to have the highest CAGR for the market during the forecast period. Urban areas in the region are favorable habitats for rodents due to the presence of food sources, shelter, and waste generation. With growing urbanization, there is increasing demand for effective rodent control measures such as rodenticides, increases to address the growing rodent populations in cities as well as residential areas. This region has robust food safety regulations that need businesses in the food processing, storage and distribution sectors to maintain high standards of hygiene and pest control. Compliance with these regulations prevents rodent infestations and drive drives the demand for rodenticides. There is rising awareness of the health risks inherent in rodent-borne diseases such as Hantavirus and leptospirosis in North America. This awareness boosts the demand for rodenticides as part of comprehensive pest control programs to safeguard public health. The region experiences diverse climates, ranging from arid regions to temperate zones. Climate variations have been affecting rodent populations, with changes in temperature, precipitation, and ecological conditions influencing their abundance. Also, natural disasters such as hurricanes and floods have been displacing rodents, resulting in increased infestations and the requirement for rodenticides as a control measure. The United States experiences an increasing problem with rodent infestations. Rapid urbanization, climate change and changing agricultural practices have resulted in growing rodent populations. As the number of rodent infestations rises, there is an increasing demand for effective rodenticides to control and manage these pests. The United States has regulations in place to ensure the safe and responsible use of rodenticides. These regulations set standards for product safety, efficacy and environmental impact which boosts the demand for approved rodenticides that meet the needed standards, creating growth opportunities in the Rodenticides market. The United States is the dominant country for Anticoagulant Rodenticides its high effective prevention capacity to control rodent population.Rodenticides Market Size in the United States from 2018-2025, by Type (in USD Million)

Rodenticides Market Segment Analysis

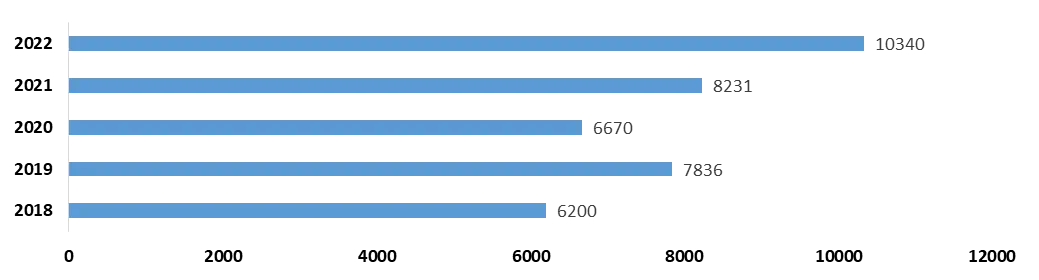

Based on Type: On the basis of the Type, the market is categorized into Anticoagulant Rodenticides and Non-anticoagulant Rodenticides. Anticoagulant Rodenticides are expected to dominate the Rodenticides Market over the forecast period. Anticoagulant rodenticides are highly effective in controlling rodent populations. They work by interposing the process of blood clotting, leading to internal bleeding in rodents. These rodenticides have a deferred action, allowing the poisoned rodents to return to their nests before dying from the effects. This characteristic increases the likelihood of eliminating entire rodent colonies, making anticoagulant rodenticides a preferred choice for pest control professionals and users. Coagulant rodenticides are available in several formulations with different active ingredients. The most commonly used active ingredients such as warfarin, coumatetralyl, bromadiolone, difenacoum and brodifacoum. This wide range of active ingredients offers options for targeting specific rodent species and managing resistance issues. Anticoagulant rodenticides offer broad-spectrum control, meaning they are effective against a wide range of rodent species such as mice, rats and voles. This versatility makes them preferable for use in several settings such as commercial establishments, agricultural fields and residential areas. Based on Application On the basis of Application, the market is categorized into Agriculture, Food Processing & Storage, Warehousing & Logistics, Residential & Commercial Construction and Others. Agriculture is expected to have the highest CAGR for the Rodenticides Market over the forecast period. Rodents have caused significant damage to agricultural crops resulting in yield losses, reduced quality and economic losses for farmers. Rodents damage crops, contaminate stored grains, and dig burrows that have been disrupting root systems. Rodenticides are an essential tool for farmers to control rodent populations and protect their crops from infestations. Rodenticides have been widely adopted in the agricultural sector for rodent control due to their effectiveness and convenience. They provide a targeted approach to maintaining rodent populations, reducing crop losses, and ensuring food security. Farmers have recognized the importance of rodenticides in safeguarding their investments and ensuring successful harvests.Global Agriculture Consumption of Rodenticides from 2018-2021 (in thousand metric tons )

Food Processing & Storage is expected to grow significantly for the Rodenticides Market during the forecast period. Rodents pose a severe risk to food processing and storage facilities. Their existence has resulted in the contamination of food products, packaging materials and storage areas with their urine and droppings. Rodents are carriers of various pathogens as well as disease-causing organisms, which have been contaminating food, resulting in foodborne ill health. The use of rodenticides helps rodent populations control and ensures the integrity of stored food products.

Rodenticides Market Competitive Landscape

The competitive analysis of the Rodenticides Market includes the Market size, growth rate and key trends. The report provides information about the Key companies, such as their size, Rodenticides market share, and geographic presence. The report provides such type of competitive landscape of all Rodenticides Key Players to assist new market entrants. The report provides such type of competitive landscape of all Key Players to assist new market entrants. The report offers Competitive benchmarking of the Rodenticides industry through the Market revenue, share and size of the key players. Some of the key players are BASF SE , Bayer AG, Syngenta AG , UPL, Liphatech Inc., JT Eaton, Neogen Chemicals, PelGar International, Senestech Inc., Bell Laboratories, Impex Europa and others. Major players are constantly launching new and innovative products to meet the changing demands of consumers.Leading Rodenticides Comapnies Revenue in 2023(Bn Euro)

BASF SE: The Company introduces newly developed rodenticides such as the Selontra rodent bait, which is effective against rodents that are resistant to anticoagulants and have been eaten even when desirable food sources are present. Also, Selontra rodent bait produces less waste due to its durability, which withstands harsh environments. As a result, it takes care of business while improving efficiency. BASF dispatches Selontra rat lure that gives quick province kill in as not many as seven days. Cholecalciferol is the active ingredient in the patented formulation of Selontra rodent bait. In U.S. field trials, rodent bait has been shown to be palatable and is readily consumed by rats and mice, even when other food sources are available.

BASF's Revenue in the Agricultural Solutions Segment from 2018-2022 (Million Euros)

Rodenticides Market Scope : Inquire Before Buying

Global Rodenticides Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.71 Bn. Forecast Period 2024 to 2030 CAGR: 3.6% Market Size in 2030: US $ 3.47 Bn. Segments Covered: by Type Anticoagulant Rodenticides Non-anticoagulant Rodenticides by Form Pellets Powders Sprays Others by Application Agriculture Food Processing & Storage Warehousing & Logistics Residential & Commercial Construction Others Rodenticides Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Rodenticides Market, Key Players are

1. BASF SE 2. Bayer AG 3. Syngenta AG 4. UPL 5. Liphatech Inc. 6. JT Eaton 7. Neogen Chemicals 8. PelGar International 9. Senestech Inc. 10. Bell Laboratories 11. Impex Europa 12. Rentokil Initial Plc 13. Terminix 14. EcoClear Products Inc. 15. Anticimex 16. Rollins 17. Truly Nolen Frequently Asked Questions: 1] What is the growth rate of the Global Rodenticides Market? Ans. The Global Rodenticides Market is growing at a significant rate of 3.6 % during the forecast period. 2] Which region is expected to dominate the Global Rodenticides Market? Ans. North America is expected to dominate the Rodenticides Market during the forecast period. 3] What is the expected Global Rodenticides Market size by 2030? Ans. The Rodenticides Market size is expected to reach USD 3.47 Bn by 2030. 4] Which are the top players in the Global Rodenticides Market? Ans. The major top players in the Global Rodenticides Market are Texas Instruments Incorporated, TE Connectivity Ltd, Omega Engineering Inc., Honeywell International Inc., Rockwell Automation Inc., Atmel Corporation, Honeywell International Inc., Infineon Technologies AG, Johnson, Controls International PLC., Robert Bosch GmbH and others. 5] What are the factors driving the Global Rodenticides Market growth? Ans. Increasing Rodent Infestations and growing awareness of health risks are expected to drive market growth during the forecast period.

1. Rodenticides Market: Research Methodology 2. Rodenticides Market: Executive Summary 3. Rodenticides Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Rodenticides Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 5.1. Rodenticides Market Size and Forecast, by Type (2023-2030) 5.1.1. Anticoagulant Rodenticides 5.1.2. Non-anticoagulant 5.2. Rodenticides Market Size and Forecast, by Form (2023-2030) 5.2.1. Pellets 5.2.2. Powders 5.2.3. Sprays 5.2.4. Others 5.3. Rodenticides Market Size and Forecast, by Application (2023-2030) 5.3.1. Agriculture 5.3.2. Food Processing & Storage 5.3.3. Warehousing & Logistics 5.3.4. Residential & Commercial Construction 5.3.5. Others 5.4. Rodenticides Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 6.1. North America Rodenticides Market Size and Forecast, by Type (2023-2030) 6.1.1. Anticoagulant Rodenticides 6.1.2. Non-anticoagulant 6.2. North America Rodenticides Market Size and Forecast, by Form (2023-2030) 6.2.1. Pellets 6.2.2. Powders 6.2.3. Sprays 6.2.4. Others 6.3. North America Rodenticides Market Size and Forecast, by Application (2023-2030) 6.3.1. Agriculture 6.3.2. Food Processing & Storage 6.3.3. Warehousing & Logistics 6.3.4. Residential & Commercial Construction 6.3.5. Others 6.4. North America Rodenticides Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 7.1. Europe Rodenticides Market Size and Forecast, by Type (2023-2030) 7.1.1. Anticoagulant Rodenticides 7.1.2. Non-anticoagulant 7.2. Europe Rodenticides Market Size and Forecast, by Form (2023-2030) 7.2.1. Pellets 7.2.2. Powders 7.2.3. Sprays 7.2.4. Others 7.3. Europe Rodenticides Market Size and Forecast, by Application (2023-2030) 7.3.1. Agriculture 7.3.2. Food Processing & Storage 7.3.3. Warehousing & Logistics 7.3.4. Residential & Commercial Construction 7.3.5. Others 7.4. Europe Rodenticides Market Size and Forecast, by Country (2023-2030) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 8.1. Asia Pacific Rodenticides Market Size and Forecast, by Type (2023-2030) 8.1.1. Anticoagulant Rodenticides 8.1.2. Non-anticoagulant 8.2. Asia Pacific Rodenticides Market Size and Forecast, by Form (2023-2030) 8.2.1. Pellets 8.2.2. Powders 8.2.3. Sprays 8.2.4. Others 8.3. Asia Pacific Rodenticides Market Size and Forecast, by Application (2023-2030) 8.3.1. Agriculture 8.3.2. Food Processing & Storage 8.3.3. Warehousing & Logistics 8.3.4. Residential & Commercial Construction 8.3.5. Others 8.4. Asia Pacific Rodenticides Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 9.1. Middle East and Africa Rodenticides Market Size and Forecast, by Type (2023-2030) 9.1.1. Anticoagulant Rodenticides 9.1.2. Non-anticoagulant 9.2. Middle East and Africa Rodenticides Market Size and Forecast, by Form (2023-2030) 9.2.1. Pellets 9.2.2. Powders 9.2.3. Sprays 9.2.4. Others 9.3. Middle East and Africa Rodenticides Market Size and Forecast, by Application (2023-2030) 9.3.1. Agriculture 9.3.2. Food Processing & Storage 9.3.3. Warehousing & Logistics 9.3.4. Residential & Commercial Construction 9.3.5. Others 9.4. Middle East and Africa Rodenticides Market Size and Forecast, by Country (2023-2030) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. Rodenticides Market Size and Forecast by Segments (by Value USD and Volume Units ) 10.1. South America Rodenticides Market Size and Forecast, by Type (2023-2030) 10.1.1. Anticoagulant Rodenticides 10.1.2. Non-anticoagulant 10.2. South America Rodenticides Market Size and Forecast, by Form (2023-2030) 10.2.1. Pellets 10.2.2. Powders 10.2.3. Sprays 10.2.4. Others 10.3. South America Rodenticides Market Size and Forecast, by Application (2023-2030) 10.3.1. Agriculture 10.3.2. Food Processing & Storage 10.3.3. Warehousing & Logistics 10.3.4. Residential & Commercial Construction 10.3.5. Others 10.4. South America Rodenticides Market Size and Forecast, by Country (2023-2030) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. BASF SE 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. BASF SE 11.3. Bayer AG 11.4. Syngenta AG 11.5. UPL 11.6. Liphatech Inc. 11.7. JT Eaton 11.8. Neogen Chemicals 11.9. PelGar International 11.10. Senestech Inc. 11.11. Bell Laboratories 11.12. Impex Europa 11.13. Rentokil Initial Plc 11.14. Terminix 11.15. EcoClear Products Inc. 11.16. Anticimex 11.17. Rollins 11.18. Truly Nolen 12. Key Findings 13. Industry Recommendation