The Ricotta Market size was valued at USD 790.24 Million in 2024 and the total Ricotta revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 1212.78 Million.Ricotta Market Overview

Ricotta, a cherished cheese originating from Italy, boasts a compelling tale steeped in both tradition and modernity. Its inception dates back centuries to the Roman era, its name "ricotta" derived from the Italian term for "recooked," reflecting its genesis in the process of reheating whey, a byproduct of cheese production. This innovative technique not only reduced waste but birthed a creamy yet slightly granular cheese, earning its revered place in Italian gastronomy. The meticulous craft of ricotta involves heating whey until its proteins coagulate, forming delicate curds that, when meticulously strained through cheesecloth, yield the signature creamy ricotta texture. The Ricotta Market presents an array of variations, from classic cow's milk ricotta to sheep or goat milk renditions, diversifying flavor and texture. This sector embodies traditional ricotta, solely whey-crafted, and whey-based ricotta, incorporating extra milk for enhanced creaminess, reflecting consumer preferences for nuanced and versatile ricotta offerings. Ricotta, beyond its cultural heritage, emerges as a culinary marvel, effortlessly blending into an extensive repertoire of savory and sweet dishes. Its nuanced yet unmistakable flavor harmonizes beautifully with Italian favorites such as lasagna or stuffed shells, infusing them with a velvety richness within desserts including cannoli or cheesecake, ricotta's presence adds a luxurious creaminess, enhancing these sweet delights, reflecting its versatile role in the expansive ricotta market. Ricotta's allure extends beyond its culinary charm, offering a nutritional bounty appreciated by health-conscious consumers. Laden with protein, calcium, and essential nutrients, it stands as a favorable option amidst the realm of cheeses, boasting relatively lower fat and calorie content. Its nutritional profile aligns harmoniously with dietary preferences emphasizing protein-rich, low-fat foods, making it an ally for endeavors in muscle development and weight management. Its calcium abundance fortifies bone health, amplifying its value beyond mere gustatory pleasure. The global ricotta market reflects its universal allure, transcending Italian origins to become a kitchen staple worldwide. Its mild yet unique taste and creamy texture have won over chefs and home cooks globally. Innovations drive its expansion, reflected in diverse distribution channels, from traditional uses to inventive applications such as ricotta-based dips, spreads, and breakfast variations, showcasing its adaptability.To know about the Research Methodology :- Request Free Sample Report

Ricotta Market Dynamics

Increased Health Consciousness and Demand for Nutrient-rich Foods Ricotta cheese distinguishes itself in the culinary landscape for its relatively lower fat and calorie content compared to its counterparts. It serves as a valuable source of high-quality protein, essential minerals such as calcium, and various nutrients. This nutritional profile aligns with the preferences of health-conscious consumers, making ricotta an appealing choice within the expansive ricotta market. Its suitability for diverse dietary needs, including weight management, muscle building, and overall wellness, positions it as a versatile and nutritious option in modern diets. The contemporary emphasis on healthier eating habits has propelled the popularity of ricotta. It caters to evolving dietary trends that prioritize balanced nutrition without compromising on taste. The cheese's ability to contribute to a well-rounded diet while offering a creamy texture and versatile flavor enhances its appeal to health-conscious individuals and those following specific dietary plans. Ricotta's versatility extends beyond taste; it serves as a versatile ingredient in health-focused recipes. Its adaptability allows for integration into various dishes without overwhelming flavors, making it a favorable choice for health-conscious cooking. From incorporating ricotta into salads, dips, and spreads to using it as a substitute in healthier dessert options, its multifaceted nature aligns with consumers seeking nutritious yet delicious meal options. Efforts in marketing and consumer education have highlighted the nutritional benefits of ricotta. Manufacturers, retailers, and culinary influencers often emphasize its protein content, calcium levels, and lower fat content compared to other cheeses. This increased awareness regarding ricotta's health advantages has driven consumer preferences towards incorporating it into their diets, fueling Ricotta Market growth. Culinary Innovation and Diverse Applications to Boost Market Growth Ricotta's versatility in the culinary realm serves as a significant growth driver. Its mild flavor profile and creamy texture allow it to seamlessly integrate into a wide array of dishes, spanning both savory and sweet cuisines. This adaptability positions ricotta as a valuable ingredient that chefs and home cooks employ across diverse recipes, from traditional Italian fare to modern fusion creations. In an era where consumers seek novel and diverse dining experiences, ricotta's ability to be utilized in various culinary applications meets this demand. Its incorporation into innovative recipes, such as flavored or infused ricotta blends, gourmet pizzas, artisanal dips, and breakfast items, resonates with a market eager for unique and flavorful food options. Ricotta's role as a canvas for culinary experimentation encourages chefs, food manufacturers, and culinary enthusiasts to explore new possibilities. This experimentation drives the development of innovative ricotta-based products, ranging from specialty blends to convenient, ready-to-use variations. These offerings provide evolving consumer preferences, thereby expanding the Ricotta Market's offerings and reach. As consumer preferences evolve, so do the culinary uses of ricotta. Its integration into diverse cuisines and meal occasions be it as a component in savory main courses, enhancing desserts, or as a versatile topping aligns with changing dietary habits and lifestyles. This adaptability positions ricotta as a go-to ingredient in response to the dynamic culinary preferences of consumers. The introduction of innovative ricotta-based dishes in restaurants, food blogs, social media, and cooking shows enhances consumer awareness and stimulates curiosity. This exposure not only drives consumer interest but also creates a demand for ricotta as an ingredient that transforms and elevates various culinary creations which boosts Ricotta Market growth.Ricotta Market Growth Opportunities

Ricotta Market Trend

Increasing Demand for Plant-Based Alternatives A significant portion of consumers are embracing plant-based diets for health reasons, seeking alternatives to dairy products. Plant-based ricotta offers a solution for individuals with lactose intolerance, dairy allergies, or those simply opting for a dairy-free lifestyle. This aligns with the broader trend of seeking healthier, cleaner, and more natural food options. The growing popularity of veganism and flexitarianism, where individuals occasionally incorporate plant-based meals into their diet fuels the demand for plant-based ricotta. Vegan ricotta alternatives cater to this expanding consumer base, providing options that align with ethical, environmental, or dietary choices. Consumers are increasingly aware of the environmental impact of food production such as the dairy industry. Plant-based ricotta, derived from sources including almonds, soy, or oats, typically has a lower environmental footprint compared to traditional dairy-based ricotta. This appeals to environmentally conscious consumers seeking sustainable food choices which Ricotta Market growth. Advancements in food technology have significantly enhanced the taste, texture, and overall quality of plant-based ricotta alternatives. Manufacturers are continually refining their formulations to mimic the creamy texture and flavor of traditional ricotta, thereby attracting consumers who value taste and texture in their food choices. In recent years, plant-based ricotta alternatives have seen a notable surge in accessibility and availability. These products have become increasingly widespread, gracing the shelves of mainstream grocery stores, health food outlets, and online marketplaces. This expansion makes it far more convenient for consumers to explore and experiment with these alternatives which drive Ricotta industry growth. Plant-based ricotta serves as a worthwhile option for individuals with dietary restrictions or allergies. It addresses concerns related to dairy allergies, lactose intolerance, or dietary choices that exclude animal products.Ricotta Market Growth Restraint

Supply Chain Vulnerability to hamper Ricotta Market Growth Ricotta's production heavily relies on a consistent supply of milk, sourced predominantly from dairy farms. Any disruption in milk production due to environmental factors affecting cattle, shifts in farming practices, or diseases impacting dairy herds directly affects the quantity and quality of milk available for ricotta production. For plant-based ricotta alternatives using ingredients such as almonds, soy, or oats, sourcing challenges pose significant hurdles. Issues such as crop failures, supply chain disruptions, or market fluctuations in these raw materials impact the availability, cost and quality of ingredients, thereby affecting the production and pricing of plant-based ricotta. The movement of dairy products and ingredients from farms to manufacturing facilities and then to marketplaces involves intricate logistics. Any disruptions in transportation, such as delays, logistical bottlenecks, or interruptions in distribution channels, impede the timely delivery of ricotta to consumers, leading to potential shortages or irregular availability and this hamper Ricotta Market growth.Ricotta Market Segment Analysis

Based on Source, the market is segmented into the Dairy and Non-Dairy. Dairy Source dominated the Ricotta Market in 2024 and is expected to maintain its dominance over the forecast period. Dairy-based ricotta's dominance in the culinary landscape stems from its rich historical heritage and deeply entrenched production techniques. Across centuries, its traditional creation from whey, a byproduct of cheese production, has been a cornerstone of dairy cultures worldwide. This lengthy legacy and the refined methods passed down through generations have solidified dairy ricotta's status as a familiar and widely available choice. Its creamy texture and versatile, mildly sweet flavor profile provide diverse culinary needs, seamlessly integrating into an array of dishes, from savory pasta fillings to delectable desserts. This inherent adaptability has not only established it as a preferred ingredient in traditional recipes but has also sustained its allure among contemporary chefs and home cooks seeking both authenticity and versatility in their culinary creations. Beyond its inherent qualities, the richness and creaminess of dairy-sourced ricotta have captured the palates of numerous consumers. Its prominent place in classic cuisines, especially in Italian culinary traditions, is exemplified by its integral role in iconic dishes including lasagna, cannoli, and various stuffed pastas. This entrenched position in revered and time-honored recipes has contributed significantly to its continued demand and dominance in the Ricotta Market. Its widespread availability across grocery stores, specialty food shops, and restaurants cements its place as a household staple. This ubiquity not only reinforces its market presence but also ensures its recognition as an essential ingredient in numerous beloved and culturally significant recipes, strengthening its foothold as a culinary cornerstone. The longevity of its presence and its indispensable role in cherished culinary traditions collectively underscore dairy-based ricotta's enduring prominence in the ever-evolving landscape of food preferences and gastronomic heritage. While the rise of non-dairy alternatives reflects evolving dietary preferences and ethical considerations, the resilience of dairy-based ricotta lies in its rich historical tapestry, versatile appeal, and cultural significance. Its creamy texture, mild flavor, and unwavering presence in culinary traditions continue to make it a go-to choice for chefs, home cooks, and consumers seeking both authenticity and quality in their culinary endeavors.

Ricotta Market Regional Insights

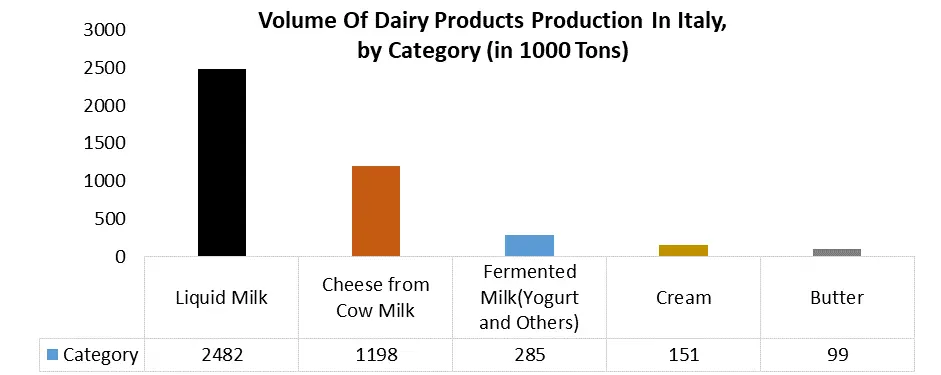

Europe dominated the largest Ricotta Market share in 2024 and is expected to continue its dominance during the forecast period. Europe, especially Italy, has a deep-rooted culinary heritage where ricotta holds a significant place. Ricotta originated in Italy, and its traditional use in Italian cuisine has solidified its presence in the European market. The cheese is an integral part of various classic dishes, from lasagna to cannoli, ingrained in European culinary traditions. European countries, particularly Italy, and are known for their dedication to artisanal production methods and a commitment to quality. The production of ricotta in Europe often follows traditional methods, emphasizing authenticity and craftsmanship. This adherence to traditional techniques enhances the reputation and perceived quality of European ricotta among consumers. The European Ricotta Market has matured over the years, and consumers in the region have developed a strong preference for high-quality, premium dairy products. Ricotta, being a staple in European cuisines, enjoys widespread acceptance and demand, with consumers seeking authentic and locally produced varieties. Ricotta's versatility allows it to be incorporated into various European cuisines, ranging from savory to sweet dishes. Its mild flavor and creamy texture make it a versatile ingredient in pasta, desserts, pastries, and appetizers, contributing to its widespread use and demand across different culinary traditions. Europe boasts a robust dairy industry with well-established infrastructure and production capabilities. Europe's commanding position in the ricotta market is owed to its advantageous access to top-tier milk sources, cutting-edge dairy processing technologies, and rigorous quality benchmarks. These factors combine to ensure a consistent and reliable production of ricotta, meeting the market's demands with assurance. Europe's profound impact on the global food market, particularly in cheese and dairy products, is undeniable. Renowned for its exceptional quality and authenticity, European ricotta is exported to numerous regions worldwide, cementing its supremacy in the global ricotta landscape. Italy ranks among the top producers of dairy products globally. In Italy, ricotta stands as a significant dairy category, contributing notably to the country's dairy production volume alongside popular items such as liquid milk, Cheese from cow milk, etc.

Ricotta Market Competitive Landscape

The Competitive Landscape of the Ricotta market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers and substitute products that drive the profitability of the companies in the Ricotta industry. The global Ricotta markets include several market players at the country, regional and global levels. Some of the key players are Galbani (Italy), BelGioioso Cheese Inc. (United States), Saputo Inc. (Canada), Granarolo Group (Italy), Lactalis Group (France), Arla Foods (Denmark), EMMI (Switzerland), Calabro Cheese Corporation (United States), Locatelli Cheese (United States), Fattorie Garofalo (Italy), Zanetti S.p.A. (Italy), Murray's Cheese (United States), Lion Dairy & Drinks (Australia), Tre Stelle (Canada) and others. Many companies conducted research and development activities to increase their product portfolio and fulfil Ricotta Market. For instance, Galbani, an Italian dairy company, has a long history of innovation in the ricotta market. In 2024, the company continued to invest in research and development to improve its ricotta products and expand its market reach. 1. Galbani has developed a new ricotta-based spread that is a healthier alternative to butter. The spread is made with a combination of ricotta, mozzarella, and mascarpone cheeses, and it is lower in fat and calories than traditional butter or margarine. The spread is also a good source of protein and calcium. 2. Galbani has improved the process for making ricotta to reduce the amount of whey waste. Whey is a byproduct of cheesemaking, and it is often discarded because it is difficult to process. Galbani has developed a new process that allows the company to recover and reuse whey, which reduces waste and improves sustainability. The company has introduced a variety of ricotta products, including a ricotta-based spread, a ricotta-filled ravioli, and a ricotta-flavored ice cream.Ricotta Market Scope: Inquiry Before Buying

Ricotta Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 790.24 Mn. Forecast Period 2025 to 2032 CAGR: 5.5% Market Size in 2032: USD 1212.78 Mn. Segments Covered: by Source Dairy Non- Dairy by Distribution Channel Supermarkets Specialty Stores Online Ricotta Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Ricotta Market, Key players are:

1. Galbani (Italy) 2. BelGioioso Cheese Inc. (United States) 3. Saputo Inc. (Canada) 4. Granarolo Group (Italy) 5. Lactalis Group (France) 6. Arla Foods (Denmark) 7. EMMI (Switzerland) 8. Calabro Cheese Corporation (United States) 9. Locatelli Cheese (United States) 10. Fattorie Garofalo (Italy) 11. Zanetti S.p.A. (Italy) 12. Murray's Cheese (United States) 13. Lion Dairy & Drinks (Australia) 14. Tre Stelle (Canada) 15. Ambrosi (Italy) 16. Frigo Cheese (United States) 17. Pecorino Sardo (Italy) 18. Di Stefano Cheese (United States) 19. Lioni Latticini (United States) 20. Calabraittica (Italy) 21. Käserei Champignon (Germany) 22. Maplebrook Farm (United States)Frequently Asked Questions:

1] What was the Global Ricotta Market size in 2024? Ans: The Global Ricotta Market size was USD 790.24 Million in 2024. 2] Which region is expected to dominate the Global Ricotta Market? Ans. Europe is expected to dominate the Ricotta Market during the forecast period. 3] What is the expected Global Ricotta Market size by 2032? Ans. The Ricotta Market size is expected to reach USD 1212.78 Mn. by 2032. 4] Which are the top players in the Global Ricotta Market? Ans. The major top players in the Global Ricotta Market are Galbani (Italy), BelGioioso Cheese Inc. (United States), Saputo Inc. (Canada), Granarolo Group (Italy), Lactalis Group (France), Arla Foods (Denmark), EMMI (Switzerland), Calabro Cheese Corporation (United States), Locatelli Cheese (United States), Fattorie Garofalo (Italy), Zanetti S.p.A. (Italy), Murray's Cheese (United States), Lion Dairy & Drinks (Australia), Tre Stelle (Canada) and others. 5] What are the factors driving the Global Ricotta Market growth? Ans. The increased health consciousness and demand for nutrient-rich foods and culinary innovation and diverse applications are expected to drive market growth during the forecast period.

1. Ricotta Market: Research Methodology 2. Ricotta Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Ricotta Market: Dynamics 3.1 Ricotta Market Trends by Region 3.1.1 North America Ricotta Market Trends 3.1.2 Europe Ricotta Market Trends 3.1.3 Asia Pacific Ricotta Market Trends 3.1.4 Middle East and Africa Ricotta Market Trends 3.1.5 South America Ricotta Market Trends 3.2 Ricotta Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Ricotta Market Drivers 3.2.1.2 North America Ricotta Market Restraints 3.2.1.3 North America Ricotta Market Opportunities 3.2.1.4 North America Ricotta Market Challenges 3.2.2 Europe 3.2.2.1 Europe Ricotta Market Drivers 3.2.2.2 Europe Ricotta Market Restraints 3.2.2.3 Europe Ricotta Market Opportunities 3.2.2.4 Europe Ricotta Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Ricotta Market Market Drivers 3.2.3.2 Asia Pacific Ricotta Market Restraints 3.2.3.3 Asia Pacific Ricotta Market Opportunities 3.2.3.4 Asia Pacific Ricotta Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Ricotta Market Drivers 3.2.4.2 Middle East and Africa Ricotta Market Restraints 3.2.4.3 Middle East and Africa Ricotta Market Opportunities 3.2.4.4 Middle East and Africa Ricotta Market Challenges 3.2.5 South America 3.2.5.1 South America Ricotta Market Drivers 3.2.5.2 South America Ricotta Market Restraints 3.2.5.3 South America Ricotta Market Opportunities 3.2.5.4 South America Ricotta Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Ricotta Industry 3.7 The Global Pandemic and Redefining of The Ricotta Industry Landscape 3.8 Technological Road Map 4. Global Ricotta Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2024-2032) 4.1 Global Ricotta Market Size and Forecast, by Source (2024-2032) 4.1.1 Dairy 4.1.2 Non- Dairy 4.2 Global Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 4.2.1 Supermarkets 4.2.2 Specialty Stores 4.2.3 Online 4.3 Global Ricotta Market Size and Forecast, by Region (2024-2032) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Ricotta Market Size and Forecast by Segmentation (By Value) (2024-2032) 5.1 North America Ricotta Market Size and Forecast, by Source (2024-2032) 5.1.1 Dairy 5.1.2 Non- Dairy 5.2 North America Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 5.2.1 Supermarkets 5.2.2 Specialty Stores 5.2.3 Online 5.3 North America Ricotta Market Size and Forecast, by Country (2024-2032) 5.3.1 United States 5.3.1.1 United States Ricotta Market Size and Forecast, by Source (2024-2032) 5.3.1.1.1 Dairy 5.3.1.1.2 Non- Dairy 5.3.1.2 United States Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1.2.1 Supermarkets 5.3.1.2.2 Specialty Stores 5.3.1.2.3 Online 5.3.2 Canada 5.3.2.1 Canada Ricotta Market Size and Forecast, by Source (2024-2032) 5.3.2.1.1 Dairy 5.3.2.1.2 Non- Dairy 5.3.2.2 Canada Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.2.2.1 Supermarkets 5.3.2.2.2 Specialty Stores 5.3.2.2.3 Online 5.3.3 Mexico 5.3.3.1 Mexico Ricotta Market Size and Forecast, by Source (2024-2032) 5.3.3.1.1 Dairy 5.3.3.1.2 Non- Dairy 5.3.3.2 Mexico Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.3.2.1 Supermarkets 5.3.3.2.2 Specialty Stores 5.3.3.2.3 Online 6. Europe Ricotta Market Size and Forecast by Segmentation (By Value) (2024-2032) 6.1 Europe Ricotta Market Size and Forecast, by Source (2024-2032) 6.2 Europe Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3 Europe Ricotta Market Size and Forecast, by Country (2024-2032) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.1.2 United Kingdom Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.2 France 6.3.2.1 France Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.2.2 France Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.3 Germany 6.3.3.1 Germany Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.3.2 Germany Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.4 Italy 6.3.4.1 Italy Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.4.2 Italy Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.5 Spain 6.3.5.1 Spain Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.5.2 Spain Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.6 Sweden 6.3.6.1 Sweden Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.6.2 Sweden Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.7 Austria 6.3.7.1 Austria Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.7.2 Austria Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Ricotta Market Size and Forecast, by Source (2024-2032) 6.3.8.2 Rest of Europe Ricotta Market Size and Forecast, by Distribution Channel (2024-2032). 7. Asia Pacific Ricotta Market Size and Forecast by Segmentation (By Value) (2024-2032) 7.1 Asia Pacific Ricotta Market Size and Forecast, by Source (2024-2032) 7.2 Asia Pacific Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3 Asia Pacific Ricotta Market Size and Forecast, by Country (2024-2032) 7.3.1 China 7.3.1.1 China Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.1.2 China Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.2 South Korea 7.3.2.1 S Korea Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.2.2 S Korea Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.3 Japan 7.3.3.1 Japan Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.3.2 Japan Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.4 India 7.3.4.1 India Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.4.2 India Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.5 Australia 7.3.5.1 Australia Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.5.2 Australia Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.6 Indonesia 7.3.6.1 Indonesia Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.6.2 Indonesia Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.7 Malaysia 7.3.7.1 Malaysia Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.7.2 Malaysia Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.8 Vietnam 7.3.8.1 Vietnam Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.8.2 Vietnam Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.9 Taiwan 7.3.9.1 Taiwan Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.9.2 Taiwan Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.10.2 Bangladesh Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.11 Pakistan 7.3.11.1 Pakistan Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.11.2 Pakistan Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Ricotta Market Size and Forecast, by Source (2024-2032) 7.3.12.2 Rest of Asia PacificRicotta Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Ricotta Market Size and Forecast by Segmentation (By Value) (2024-2032) 8.1 Middle East and Africa Ricotta Market Size and Forecast, by Source (2024-2032) 8.2 Middle East and Africa Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 8.3 Middle East and Africa Ricotta Market Size and Forecast, by Country (2024-2032) 8.3.1 South Africa 8.3.1.1 South Africa Ricotta Market Size and Forecast, by Source (2024-2032) 8.3.1.2 South Africa Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.2 GCC 8.3.2.1 GCC Ricotta Market Size and Forecast, by Source (2024-2032) 8.3.2.2 GCC Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.3 Egypt 8.3.3.1 Egypt Ricotta Market Size and Forecast, by Source (2024-2032) 8.3.3.2 Egypt Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.4 Nigeria 8.3.4.1 Nigeria Ricotta Market Size and Forecast, by Source (2024-2032) 8.3.4.2 Nigeria Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Ricotta Market Size and Forecast, by Source (2024-2032) 8.3.5.2 Rest of ME&A Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Ricotta Market Size and Forecast by Segmentation (By Value) (2024-2032) 9.1 South America Ricotta Market Size and Forecast, by Source (2024-2032) 9.2 South America Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 9.3 South America Ricotta Market Size and Forecast, by Country (2024-2032) 9.3.1 Brazil 9.3.1.1 Brazil Ricotta Market Size and Forecast, by Source (2024-2032) 9.3.1.2 Brazil Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 9.3.2 Argentina 9.3.2.1 Argentina Ricotta Market Size and Forecast, by Source (2024-2032) 9.3.2.2 Argentina Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Ricotta Market Size and Forecast, by Source (2024-2032) 9.3.3.2 Rest Of South America Ricotta Market Size and Forecast, by Distribution Channel (2024-2032) 10. Global Ricotta Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 Distribution Channel Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Ricotta Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Galbani (Italy) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 BelGioioso Cheese Inc. (United States) 11.3 Saputo Inc. (Canada) 11.4 Granarolo Group (Italy) 11.5 Lactalis Group (France) 11.6 Arla Foods (Denmark) 11.7 EMMI (Switzerland) 11.8 Calabro Cheese Corporation (United States) 11.9 Locatelli Cheese (United States) 11.10 Fattorie Garofalo (Italy) 11.11 Zanetti S.p.A. (Italy) 11.12 Murray's Cheese (United States) 11.13 Lion Dairy & Drinks (Australia) 11.14 Tre Stelle (Canada) 11.15 Ambrosi (Italy) 11.16 Frigo Cheese (United States) 11.17 Pecorino Sardo (Italy) 11.18 Di Stefano Cheese (United States) 11.19 Lioni Latticini (United States) 11.20 Calabraittica (Italy) 11.21 Käserei Champignon (Germany) 11.22 Maplebrook Farm (United States) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary