Food Aroma Market size was valued at USD 0.81 Billion in 2022 and is expected to grow at a CAGR of 6.8 percent from 2023 to 2029 to reach USD 1.28 Billion.Food Aroma Market Overview

Food aroma is a complex mixture of different organic chemical compounds that play a crucial role in determining the overall sensory experience of food and beverages. The market encompasses a wide range of sectors such as processed foods, beverages, dairy products, bakery items, confectionery and many more. The report includes a detailed analysis of production, sales, recent development, market dynamics and regional insights with an in-depth analysis of manufacturers that helps to understand the food aroma market structure.Food Aroma Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Food Aroma Market Dynamics

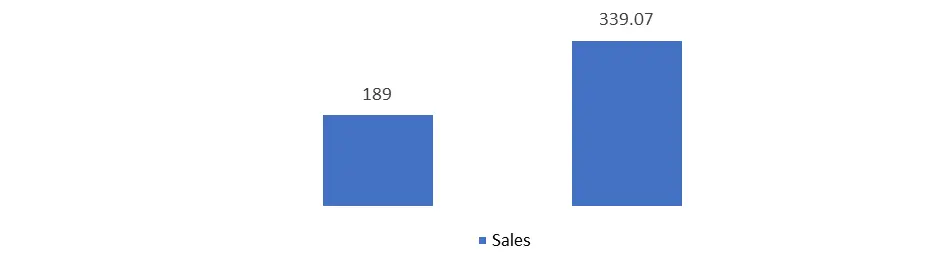

Technological Advancements shaping the global food aroma market Technological advancements are majorly revolutionizing various aspects of aroma production, formulation, application and delivery, which are contributing to the innovation, efficiency and the ability to meet consumer demands for novel and high-quality flavor experiences. Nanotechnology and microencapsulation technologies are particularly useful for applications such as beverages, confectionery, and snacks. They enhance the longevity of flavors in the products by controlling the release of aromas over time. Advanced analytical techniques such as gas chromatography-mass spectrometry (GC-MS) and nuclear magnetic resonance (NMR) spectroscopy help in providing detailed insights into the chemical composition and sensory attributes of aroma compounds. Biotechnology and fermentation processes are being used to produce aroma compounds through microbial fermentation, offering sustainable and controlled production methods. Smart packaging technologies such as QR codes and NFC tags provide information on the product's aroma and flavor profile to the consumers, which is also contributing to the market growth. Amixon precision powder mixers are in food and aroma manufacturing facilities across the world. These high-performance dry ingredient mixers are reputed for being versatile in their ability to fulfill diverse food processing requirements. Ethnic and Fusion Cuisine Trends driving the food aroma market Ethnic and Fusion Cuisine Trends include the blending of flavors, ingredients, and cooking techniques from different cultural backgrounds to create exciting and innovative culinary experiences. These trends are the significant drivers of the market. As people are traveling more and increasing exposure to different cultures through media and international interactions, their palates are becoming more diverse. This is majorly increasing the demand for aroma compounds that authentically recreate the taste of far-flung destinations. Growing Beverage Industry driving the food aroma market Aroma compounds are very essential components that enhance the flavor and overall sensory experience of beverages. They are important for maintaining flavor stability throughout the production, packaging, and shelf-life of beverages. The beverage industry is highly competitive. Companies are constantly looking for ways to differentiate their products. Aroma compounds help manufacturers to create distinct and unique flavor profiles that set their beverages apart in the market. As consumers are seeking non-alcoholic beverage alternatives, the market for alcohol-free cocktails, mocktails, and alcohol-free spirits is growing rapidly. Aroma compounds highly contribute to the creation of sophisticated and enjoyable non-alcoholic options.Global beverage market (USD Billion)

Demand for the forms of beverages flavor 2022 (in %)

Allergen Concerns to hamper the food aroma market growth Allergens are substances that trigger allergic reactions in individuals who are sensitive to them. These concerns are crucial aspects of food safety and consumer well-being that present challenges for food aroma manufacturers. Allergen concerns lead to restrictions on the use of certain aroma compounds that are derived from allergenic sources. So, manufacturers limit or avoid the use of these compounds to prevent allergen cross-contact. Sometimes, food aroma manufacturers need separate production lines or facilities to ensure allergen-free or allergen-reduced products. The cost-effectiveness and scalability is majorly impacted by this investment in infrastructure.

Food Aroma Market Regional Insights

The European Food Aroma Market is expected to dominate the global market during the forecast period. It is also expected to proliferate. In the region, the rise of artisanal and craft foods and beverages has increased the demand for high-quality and authentic flavors for which the food aromas play a crucial role in enhancing the taste and experience of these products. The rising popularity of plant-based and vegan diets has resulted in a demand for flavors that can replicate the tastes of animal-derived products. Food aromas are majorly utilized to create realistic and appealing profiles for plant-based alternatives. Asia Pacific Food Aroma Market is expected to grow at a high CAGR during the forecast period. Givaudan is one of the biggest companies present in the region, which offers a wide range of aromas to cater to various cuisines and preferences across different countries. The growing beverage industry including both alcoholic and non-alcoholic beverages is majorly contributing to the regional market growth. The flavored beverages including fruit-flavored water, flavored teas, and innovative cocktails are increasing the demand for a wide range of aroma compounds. The rising health consciousness among consumers is leading to a demand for healthier and more natural flavor options. They are increasingly looking for products that are free from artificial additives and flavors, which is majorly increasing the demand for natural and organic food aromas.Demand for types of beverages in Asia Pacific 2021-2027 (in %)

Food Aroma Market Segmentation Based on Type: The market is divided into Natural and Synthetic. The Synthetic segment held the largest Food Aroma Market share in 2022 and is expected to retain this trend during the forecast period. Synthetic aromas are more cost-effective to produce than natural aromas, which makes them an attractive option for manufacturers that are aiming to achieve desired flavors without increasing production costs. They exhibit greater stability and longer shelf-life compared to natural aromas. This makes them suitable for products with extended shelf lives. Therefore, the demand for synthetic food aroma is high compared to natural food aroma. Based on Product: The market is divided into Benzenoids, Terpene, Musk Chemicals and Others. The Terpene segment held the largest Food Aroma Market share in 2022 and is expected to retain its dominance during the forecast period. Terpene possesses anticancer, antioxidant, antiseptic and astringent properties, which makes its use more alluring. This is expected to increase the demand for terpene during the forecast period due to the growing population with an increasing number of allergens and people suffering from diseases. Food Aroma Market Competitive Landscape As per the research, the Food Aroma Market is highly competitive. This section of the report includes a detailed analysis of Food Aroma key competitors including their investments in research and development, revenue, sales, production capacities and company overview with the SWOT analysis, which helps to understand the strengths and weaknesses of key players. dsm-firmenich company is a result of a merger of two companies, Firmenich with Dutch conglomerate DSM, which took place in May 2023. The aim of these companies is to combine their respective strengths across the flavors, fragrances and nutritional ingredients. Recently, Synergy Flavors has opened a new 12,500-square-foot savory innovation center that features dedicated space for flavor development. The new culinary demonstration kitchen hoststasting and innovation sessions with customers and the pilot plant features spray dryers, flavor reactors, vacuum drying and retort capabilities.

Food Aroma Companies by Market share in % in 2022 (only some key companies)

Food Aroma Market Scope: Inquire Before Buying

Global Food Aroma Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 0.81 Bn. Forecast Period 2023 to 2029 CAGR: 6.8% Market Size in 2029: US $ 1.28 Bn. Segments Covered: by Type Natural Synthetic by Product Benzenoids Benzyl Acetate Benzoic Acid Vanillin Cinnamyl Benzaldehyde Others Terpene Limonene Pinene Myrcene Linalool Terpineol Others Musk Chemicals Muscone Musk Ambrette Musk Ketone Others by Application Beverages Bakery Dairy Confectionary Snacks Others Food Aroma Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Food Aroma Market, Key Players are

1. dsm-firmenich 2. Givaudan 3. Symrise AG 4. Takasago International Corporation 5. Hindustan Mint and Agro Products 6. Synergy Flavors 7. Aromatech Group 8. International Flavors & Fragrances, Inc (IFF) 9. Blue Pacific Flavors 10. Robertet Group 11. Huabao International Holdings Limited 12. MANEFrequently Asked Questions

1] What is the expected CAGR of the Global Food Aroma Market during the forecast period? Ans. During the forecast period, the Global Food Aroma Market is expected to grow at a CAGR of 6.8 percent. 2] What was the Food Aroma Market size in 2022? Ans. USD 0.81 Bn was the Food Aroma Market size in 2022. 3] What is the expected Food Aroma Market size by 2029? Ans. USD 1.28 Bn is the expected Food Aroma Market size by 2029. 4] What are the major Food Aroma Market segments? Ans. The market is divided by Type, Product and Application. 5] Which regional Food Aroma Market is expected to grow at a high rate during the forecast period? Ans. The Food Aroma Market of Asia Pacific is expected to grow at a high rate during the forecast period.

1. Food Aroma Market: Research Methodology 2. Food Aroma Market: Executive Summary 3. Food Aroma Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Food Aroma Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Food Aroma Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Food Aroma Market Size and Forecast, by Type (2022-2029) 5.1.1. Natural 5.1.2. Synthetic 5.2. Food Aroma Market Size and Forecast, by Product (2022-2029) 5.2.1. Benzenoids 5.2.1.1. Benzyl Acetate 5.2.1.2. Benzoic Acid 5.2.1.3. Vanillin 5.2.1.4. Cinnamyl 5.2.1.5. Benzaldehyde 5.2.1.6. other 5.2.2. Terpene 5.2.2.1. Limonene 5.2.2.2. Pinene 5.2.2.3. Myrcene 5.2.2.4. Linalool 5.2.2.5. Terpineol 5.2.2.6. others 5.2.3. Musk Chemicals 5.2.3.1. Muscone 5.2.3.2. Musk Ambrette 5.2.3.3. Musk Ketone 5.2.4. Others 5.3. Food Aroma Market Size and Forecast, by Application (2022-2029) 5.3.1. Beverages 5.3.2. Bakery 5.3.3. Dairy 5.3.4. Confectionery 5.3.5. Snacks 5.3.6. Others 5.4. Food Aroma Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Food Aroma Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Food Aroma Market Size and Forecast, by Type (2022-2029) 6.1.1. Natural 6.1.2. Synthetic 6.2. North America Food Aroma Market Size and Forecast, by Product (2022-2029) 6.2.1. Benzenoids 6.2.1.1. Benzyl Acetate 6.2.1.2. Benzoic Acid 6.2.1.3. Vanillin 6.2.1.4. Cinnamyl 6.2.1.5. Benzaldehyde 6.2.1.6. other 6.2.2. Terpene 6.2.2.1. Limonene 6.2.2.2. Pinene 6.2.2.3. Myrcene 6.2.2.4. Linalool 6.2.2.5. Terpineol 6.2.2.6. others 6.2.3. Musk Chemicals 6.2.3.1. Muscone 6.2.3.2. Musk Ambrette 6.2.3.3. Musk Ketone 6.2.4. Others 6.3. North America Food Aroma Market Size and Forecast, by Application (2022-2029) 6.3.1. Beverages 6.3.2. Bakery 6.3.3. Dairy 6.3.4. Confectionery 6.3.5. Snacks 6.3.6. Others 6.4. North America Food Aroma Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Food Aroma Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Food Aroma Market Size and Forecast, by Type (2022-2029) 7.1.1. Natural 7.1.2. Synthetic 7.2. Europe Food Aroma Market Size and Forecast, by Product (2022-2029) 7.2.1. Benzenoids 7.2.1.1. Benzyl Acetate 7.2.1.2. Benzoic Acid 7.2.1.3. Vanillin 7.2.1.4. Cinnamyl 7.2.1.5. Benzaldehyde 7.2.1.6. other 7.2.2. Terpene 7.2.2.1. Limonene 7.2.2.2. Pinene 7.2.2.3. Myrcene 7.2.2.4. Linalool 7.2.2.5. Terpineol 7.2.2.6. others 7.2.3. Musk Chemicals 7.2.3.1. Muscone 7.2.3.2. Musk Ambrette 7.2.3.3. Musk Ketone 7.2.4. Others 7.3. Europe Food Aroma Market Size and Forecast, by Application (2022-2029) 7.3.1. Beverages 7.3.2. Bakery 7.3.3. Dairy 7.3.4. Confectionery 7.3.5. Snacks 7.3.6. Others 7.4. Europe Food Aroma Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Food Aroma Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Food Aroma Market Size and Forecast, by Type (2022-2029) 8.1.1. Natural 8.1.2. Synthetic 8.2. Asia Pacific Food Aroma Market Size and Forecast, by Product (2022-2029) 8.2.1. Benzenoids 8.2.1.1. Benzyl Acetate 8.2.1.2. Benzoic Acid 8.2.1.3. Vanillin 8.2.1.4. Cinnamyl 8.2.1.5. Benzaldehyde 8.2.1.6. other 8.2.2. Terpene 8.2.2.1. Limonene 8.2.2.2. Pinene 8.2.2.3. Myrcene 8.2.2.4. Linalool 8.2.2.5. Terpineol 8.2.2.6. others 8.2.3. Musk Chemicals 8.2.3.1. Muscone 8.2.3.2. Musk Ambrette 8.2.3.3. Musk Ketone 8.2.4. Others 8.3. Asia Pacific Food Aroma Market Size and Forecast, by Application (2022-2029) 8.3.1. Beverages 8.3.2. Bakery 8.3.3. Dairy 8.3.4. Confectionery 8.3.5. Snacks 8.3.6. Others 8.4. Asia Pacific Food Aroma Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Food Aroma Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Food Aroma Market Size and Forecast, by Type (2022-2029) 9.1.1. Natural 9.1.2. Synthetic 9.2. Middle East and Africa Food Aroma Market Size and Forecast, by Product (2022-2029) 9.2.1. Benzenoids 9.2.1.1. Benzyl Acetate 9.2.1.2. Benzoic Acid 9.2.1.3. Vanillin 9.2.1.4. Cinnamyl 9.2.1.5. Benzaldehyde 9.2.1.6. other 9.2.2. Terpene 9.2.2.1. Limonene 9.2.2.2. Pinene 9.2.2.3. Myrcene 9.2.2.4. Linalool 9.2.2.5. Terpineol 9.2.2.6. others 9.2.3. Musk Chemicals 9.2.3.1. Muscone 9.2.3.2. Musk Ambrette 9.2.3.3. Musk Ketone 9.2.4. Others 9.3. Middle East and Africa Food Aroma Market Size and Forecast, by Application (2022-2029) 9.3.1. Beverages 9.3.2. Bakery 9.3.3. Dairy 9.3.4. Confectionery 9.3.5. Snacks 9.3.6. Others 9.4. Middle East and Africa Food Aroma Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Food Aroma Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Food Aroma Market Size and Forecast, by Type (2022-2029) 10.1.1. Natural 10.1.2. Synthetic 10.2. South America Food Aroma Market Size and Forecast, by Product (2022-2029) 10.2.1. Benzenoids 10.2.1.1. Benzyl Acetate 10.2.1.2. Benzoic Acid 10.2.1.3. Vanillin 10.2.1.4. Cinnamyl 10.2.1.5. Benzaldehyde 10.2.1.6. other 10.2.2. Terpene 10.2.2.1. Limonene 10.2.2.2. Pinene 10.2.2.3. Myrcene 10.2.2.4. Linalool 10.2.2.5. Terpineol 10.2.2.6. others 10.2.3. Musk Chemicals 10.2.3.1. Muscone 10.2.3.2. Musk Ambrette 10.2.3.3. Musk Ketone 10.2.4. Others 10.3. South America Food Aroma Market Size and Forecast, by Application (2022-2029) 10.3.1. Beverages 10.3.2. Bakery 10.3.3. Dairy 10.3.4. Confectionery 10.3.5. Snacks 10.3.6. Others 10.4. South America Food Aroma Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. dsm-firmenich 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Givaudan 11.3. Symrise AG 11.4. Takasago International Corporation 11.5. Hindustan Mint and Agro Products 11.6. Synergy Flavors 11.7. Aromatech Group 11.8. International Flavors & Fragrances, Inc 11.9. Blue Pacific Flavors 11.10. Robertet Group 11.11. Huabao International Holdings Limited 11.12. MANE 12. Industry Recommendation