RFID Sensor Market size is expected to reach nearly US $ 23.32 Bn by 2029 with the CAGR of 8% during the forecast period. The Global RFID Sensor market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The Global RFID Sensor report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

RFID Sensor Market Overview:

RFID sensor is an abbreviation of Radio Frequency Identification. RFID sensors are used for measuring physical variables range including measurement of oil and gas from pipelines, inventory, and supply chain monitoring using wireless communication technology. Moreover, RFID sensors are used in tracking the shipments and logistics of manufacturers on a time to time basis. The increasing need for the Internet of Things (IoT) in smart technology framework is the key factor considered to drive the growth of the market. Global RFID sensor market was accounted for approximately 9.4 billion USD in the year 2019 registering a CAGR of approximately 10.3%.RFID Sensor Market Dynamics:

The increasing popularity of sensing technologies uses in various applications and increasing government initiatives for smart and efficient industry planning are the factors considered to drive the RFID sensor market growth. Moreover, the need for calculating the exact life cycle of the equipment sales from manufacturer to consumer is the key supporting factor considered to drive the growth of the market. In addition, the need for reduction in system failure and improvements in quality management tools are the factors attributing to growth in the market. Zebra RFID has launched a new tracker and sensor for the logistics and healthcare sector to track vaccine imports and patient data tracking. High purchase and maintenance costs are the factors considered to restrain the growth of the market. Furthermore, high investment is required to implement the RFID system IOT integration and high replacement cost need to improve the system are the factors hampering the market growth. Lack of an expert workforce is the key challenge expected to hamper the market growth during the forecast period. Increasing demand for contract tracing solutions in manufacturing facilities and the need for remote monitoring for high telehealth monitoring for a wide array of applications are the factors expected to create opportunities for the prominent players in the market. Moreover, increasing investments of government organizations into the oil and gas sector for power generation processes is the key factor expected to increase the RFID sensors market growth during the forecast period.RFID Sensor Market Segment Analysis:

Passive RFID Tags Segment is dominating the RFID Sensor Market: Passive tags do not require any external source of power and are pretty much affordable for manufacturing than active tags present in the market. Moreover, compact design and improved strength of connectivity are the factors considered to drive the market growth of the segment. The passive segment was accounted for approximately 3.2 billion USD in the year 2019 registering a CAGR of approximately 6% from the past decade. Retail, inventory control, and enterprises are the key end-users for the passive tags in the market.

Ultra-high Frequency Tags Accounted for Highest Share in RFID Sensor Market:

UHF tags are comprised of a higher read range and high-frequency speed of 920 MHz average distance of UHF passive tags read range is 6-7 meters. But, UHF active tags range from 150 meters and above. In supply chain and inventory control mechanisms, UHF tags are mostly used owing to their integrated system and improved tagging control. Moreover, automotive parts and equipment tagging are some of the few applications of UHF tags in the market.Healthcare Sector is considered to augment the RFID Sensor Market:

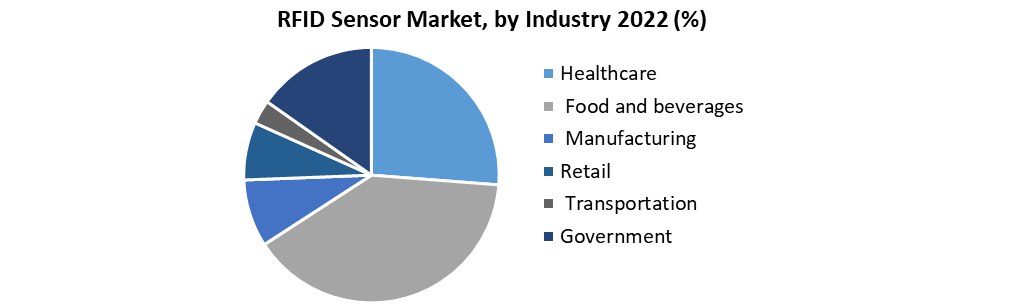

Increasing use of RFID tags in the healthcare sector in EU, APAC and North America have considered to encourage technological adoptions in the market. RFID tags are used in hospital monitoring for support staff as well as for patients tracking and identifying the location. Moreover, RFID tags are proven useful in real-time vaccine tracing and plasma collection and distribution across the EU and across the globe as well. The Healthcare sector accounted for approximately 185 billion USD in the year 2019. Hence, to compel with the ever-growing demand of the healthcare segment during the pandemic period and track data for vaccine management, many manufacturers of RFID are concentrating on the healthcare segment. Hence, the RFID sensor market in the healthcare sector is expected to boom during the forecast period.Impact of Covid pandemic on the RFID Sensor market:

Covid pandemic has posed a moderate impact on the market as semiconductor manufacturers have sustained heavy damage during the pandemic period. RFID are made of 3 basic components including Integrated IC circuit, Antenna, and Substrates. As a basic component for RFID tag manufacturing, semiconductors poses an important role in the working of the tags. The semiconductor industry has contributed approximately 4.77% in 2019 to the overall GDP of the world. RFID tags are accounted for approximately 38% in terms of market share in the world semiconductors industry in 2019. According to EU ICT Company Internal Assessment, in the 1st quarter of the pandemic, the demand for RFID tags has reduced by 13.6% owing to disruption in the supply chain and stopping of production for IC chips in many countries across the globe. Moreover, in Q2 and Q3 of 2020, 10.2% recession is seen in the semiconductors industry and 5% recession is seen in the RFID tags market.RFID Sensor Market Regional Insights:

North America holds the major share in the RFID Sensor market with approximately 49% market share. Well established Healthcare, retail, IT asset tracking, and defense segment in the region is the key factor considered to drive the market growth. Moreover, increasing inclination of manufacturers towards research and development in the RFID Sensor manufacturing is the key supporting factor considered to drive the growth of the market. USA holds the dominant share in the North American region with approximately 60% market share in the year 2019 owing to easy product accessibility and investment of key players for product development in the region. APAC is expected to pose as the fastest-growing region in the RFID Sensor Market with approximately 34% market share. Progressive adoption of innovative products is the key factor attributing to market growth in the region. China holds a prominent share in the market as the logistics and supply chain management sector is on the rise in the country. Moreover, large-scale RFID tags manufacturing bases in China are the key supporting factor considered to drive the growth of the APAC market. Europe holds the prominent share in the market owing to low-cost RFID tags manufacturing in the market and increasing need for RFID in security and access control and retail sector in the European region are the factors attributing growth in the region. The objective of the report is to present a comprehensive analysis of the Global RFID Sensor Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global RFID Sensor Market dynamics, structure by analyzing the market segments and project the Global RFID Sensor Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Global RFID Sensor Market make the report investor’s guideRFID Sensor Market Scope: Inquire before buying

RFID Sensor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 13.61 Bn. Forecast Period 2023 to 2029 CAGR: 8 % Market Size in 2029: US $ 23.32 Bn. Segments Covered: by Product Type • Software • Tags • Reader by Frequency Band •Low frequency • Medium frequency • Ultra-High frequency by Tag Types • Passive • Active by Application • Inventory management • Livestock tracking • Access control • Cashless payment by Industry • Healthcare • Food and beverages • Manufacturing • Retail • Transportation • Government RFID Sensor Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)RFID Sensor Market Key Players

• Zebra Technologies • NXP Semiconductors • Lmpnj • Avery Dennison • Honeywell • Omni ID • Thingmagic • Alien Technology • Nedap • Checkpoint Systems • Tyco retail Solutions • Radiant RFID • Alliance Tech • Smartrac • Mojix • Orbcomm • GlobeRanger • ThinkMagic • Caen RFID • Gao RFID • Broadcomm Frequently Asked Questions: 1. Which region has the largest share in Global RFID Sensor Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global RFID Sensor Market? Ans: The Global RFID Sensor Market is growing at a CAGR of 8% during forecasting period 2023-2029. 3. What is scope of the Global RFID Sensor Market report? Ans: Global RFID Sensor Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global RFID Sensor Market? Ans: The important key players in the Global RFID Sensor Market are – Zebra Technologies, NXP Semiconductors, Lmpnj, Avery Dennison, Honeywell, Omni ID, Thingmagic, Alien Technology, Nedap, Checkpoint Systems, Tyco retail Solutions, Radiant RFID, Alliance Tech, Smartrac, Mojix, Orbcomm, GlobeRanger, ThinkMagic, Caen RFID, Gao RFID, Broadcomm 5. What is the study period of this Market? Ans: The Global RFID Sensor Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global RFID Sensor Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the RFID Sensor Type Market 3.4. Geographical Snapshot of the RFID Sensor Market, By Manufacturer share 4. Global RFID Sensor Market Overview, 22022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Technologies 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global RFID Sensor Market 5. Supply Side and Demand Side Indicators 6. Global RFID Sensor Market Analysis and Forecast, 22022-2029 6.1. Global RFID Sensor Market Size & Y-o-Y Growth Analysis. 7. Global RFID Sensor Market Analysis and Forecasts, 22022-2029 7.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 7.1.1. Software 7.1.2. Tags 7.1.3. Reader 7.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 7.2.1. Low frequency 7.2.2. Medium frequency 7.2.3. Ultra-High frequency 7.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 7.3.1. Passive 7.3.2. Active 7.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 7.4.1. Inventory management 7.4.2. Livestock tracking 7.4.3. Access control 7.4.4. Cashless payment 7.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 7.5.1. Healthcare 7.5.2. Food and beverages 7.5.3. Manufacturing 7.5.4. Retail 7.5.5. Transportation 7.5.6. Government 8. Global RFID Sensor Market Analysis and Forecasts, By Region 8.1. Market Type (Value) Estimates & Forecast By Region, 22022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America RFID Sensor Market Analysis and Forecasts, 22022-2029 9.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 9.1.1. Software 9.1.2. Tags 9.1.3. Reader 9.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 9.2.1. Low frequency 9.2.2. Medium frequency 9.2.3. Ultra-High frequency 9.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 9.3.1. Passive 9.3.2. Active 9.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 9.4.1. Inventory management 9.4.2. Livestock tracking 9.4.3. Access control 9.4.4. Cashless payment 9.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 9.5.1. Healthcare 9.5.2. Food and beverages 9.5.3. Manufacturing 9.5.4. Retail 9.5.5. Transportation 9.5.6. Government 10. North America RFID Sensor Market Analysis and Forecasts, By Country 10.1. Market Type (Value) Estimates & Forecast By Country, 22022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. RFID Sensor Market Analysis and Forecasts, 22022-2029 11.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 11.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 11.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 11.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 11.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 12. Canada RFID Sensor Market Analysis and Forecasts, 22022-2029 12.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 12.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 12.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 12.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 12.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 13. Mexico RFID Sensor Market Analysis and Forecasts, 22022-2029 13.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 13.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 13.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 13.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 13.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 14. Europe RFID Sensor Market Analysis and Forecasts, 22022-2029 14.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 14.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 14.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 14.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 14.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 15. Europe RFID Sensor Market Analysis and Forecasts, By Country 15.1. Market Type (Value) Estimates & Forecast By Country, 22022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. RFID Sensor Market Analysis and Forecasts, 22022-2029 16.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 16.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 16.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 16.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 16.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 17. France RFID Sensor Market Analysis and Forecasts, 22022-2029 17.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 17.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 17.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 17.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 17.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 18. Germany RFID Sensor Market Analysis and Forecasts, 22022-2029 18.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 18.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 18.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 18.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 18.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 19. Italy RFID Sensor Market Analysis and Forecasts, 22022-2029 19.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 19.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 19.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 19.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 19.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 20. Spain RFID Sensor Market Analysis and Forecasts, 22022-2029 20.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 20.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 20.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 20.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 20.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 21. Sweden RFID Sensor Market Analysis and Forecasts, 22022-2029 21.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 21.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 21.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 21.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 21.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 22. CIS Countries RFID Sensor Market Analysis and Forecasts, 22022-2029 22.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 22.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 22.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 22.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 22.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 23. Rest of Europe RFID Sensor Market Analysis and Forecasts, 22022-2029 23.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 23.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 23.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 23.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 23.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 24. Asia Pacific RFID Sensor Market Analysis and Forecasts, 22022-2029 24.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 24.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 24.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 24.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 24.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 25. Asia Pacific RFID Sensor Market Analysis and Forecasts, by Country 25.1. Market Type (Value) Estimates & Forecast By Country, 22022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China RFID Sensor Market Analysis and Forecasts, 22022-2029 26.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 26.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 26.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 26.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 26.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 27. India RFID Sensor Market Analysis and Forecasts, 22022-2029 27.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 27.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 27.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 27.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 27.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 28. Japan RFID Sensor Market Analysis and Forecasts, 22022-2029 28.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 28.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 28.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 28.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 28.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 29. South Korea RFID Sensor Market Analysis and Forecasts, 22022-2029 29.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 29.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 29.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 29.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 29.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 30. Australia RFID Sensor Market Analysis and Forecasts, 22022-2029 30.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 30.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 30.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 30.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 30.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 31. ASEAN RFID Sensor Market Analysis and Forecasts, 22022-2029 31.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 31.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 31.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 31.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 31.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 32. Rest of Asia Pacific RFID Sensor Market Analysis and Forecasts, 22022-2029 32.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 32.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 32.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 32.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 32.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 33. Middle East Africa RFID Sensor Market Analysis and Forecasts, 22022-2029 33.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 33.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 33.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 33.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 33.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 34. Middle East Africa RFID Sensor Market Analysis and Forecasts, by Country 34.1. Market Type (Value) Estimates & Forecast by Country, 22022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa RFID Sensor Market Analysis and Forecasts, 22022-2029 35.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 35.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 35.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 35.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 35.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 36. GCC Countries RFID Sensor Market Analysis and Forecasts, 22022-2029 36.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 36.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 36.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 36.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 36.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 37. Egypt RFID Sensor Market Analysis and Forecasts, 22022-2029 37.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 37.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 37.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 37.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 37.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 38. Nigeria RFID Sensor Market Analysis and Forecasts, 22022-2029 38.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 38.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 38.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 38.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 38.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 39. Rest of ME&A RFID Sensor Market Analysis and Forecasts, 22022-2029 39.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 39.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 39.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 39.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 39.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 40. South America RFID Sensor Market Analysis and Forecasts, 22022-2029 40.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 40.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 40.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 40.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 40.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 41. South America RFID Sensor Market Analysis and Forecasts, by Country 41.1. Market Type (Value) Estimates & Forecast by Country, 22022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil RFID Sensor Market Analysis and Forecasts, 22022-2029 42.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 42.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 42.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 42.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 42.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 43. Argentina RFID Sensor Market Analysis and Forecasts, 22022-2029 43.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 43.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 43.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 43.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 43.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 44. Rest of South America RFID Sensor Market Analysis and Forecasts, 22022-2029 44.1. Market Type (Value) Estimates & Forecast By Product Type, 22022-2029 44.2. Market Type (Value) Estimates & Forecast By Frequency Band, 22022-2029 44.3. Market Type (Value) Estimates & Forecast By Tag Types, 22022-2029 44.4. Market Type (Value) Estimates & Forecast By Application, 22022-2029 44.5. Market Type (Value) Estimates & Forecast By Industry, 22022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global RFID Sensor Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Zebra Technologies 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. NXP Semiconductors 45.3.3. Lmpnj 45.3.4. Avery Dennison 45.3.5. Honeywell 45.3.6. Omni ID 45.3.7. Thingmagic 45.3.8. Alien Technology 45.3.9. Nedap 45.3.10. Checkpoint Systems 45.3.11. Tyco retail Solutions 45.3.12. Radiant RFID 45.3.13. Alliance Tech 45.3.14. Smartrac 45.3.15. Mojix 45.3.16. Orbcomm 45.3.17. GlobeRanger 45.3.18. ThinkMagic 45.3.19. Caen RFID 45.3.20. Gao RFID 45.3.21. Broadcomm 46. Primary Key Insights