The Refurbished Computers and Laptops Market size was valued at USD 5.12 Billion in 2023 and the total Refurbished Computers and Laptops revenue is expected to grow at a CAGR of 11.2 % from 2024 to 2030, reaching nearly USD 10.76 Billion by 2030. Refurbished computers and laptops are electronic devices that have been returned to manufacturers or retailers for various reasons, such as minor defects, customer dissatisfaction, or lease agreements. These devices undergo thorough inspection, repair, and restoration processes to meet original specifications before being resold. They offer cost-effective alternatives to brand-new devices while maintaining quality and functionality. The refurbished computers and laptops market has experienced significant growth driven by various factors. With increasing environmental consciousness and cost considerations among consumers, the market has witnessed a surge in demand. This sector's growth is further propelled by technological advancements, efficient refurbishment processes, and the expanding refurbished computers and laptops market presence of e-commerce platforms offering refurbished electronics. As a result, key players in the electronics industry, including Amazon Renewed, Best Buy, and several OEMs, have strategically diversified their product offerings to include refurbished devices, tapping into this burgeoning refurbished computers and laptops market. The current refurbished computers and laptops market presents a robust landscape, driven by factors such as the growing preference for sustainable consumption, cost-effectiveness, and the availability of quality refurbished products. There has been an increased reliance on technology, fostering a higher demand for affordable yet reliable devices, thereby further boosting the refurbished electronics market. This scenario has led to the emergence of specialized refurbishment centers and increased collaborations between original manufacturers and refurbishing entities, aiming to ensure quality refurbishment processes. The growth of the refurbished computers and laptops market is propelled by several driving factors, including cost-effectiveness, environmental sustainability, technological advancements, and increasing consumer awareness. The market growth is further supported by the circular economy concept, where reusing and recycling electronics plays a pivotal role in reducing electronic waste and conserving resources. Additionally, the market's growth is driven by innovative business models, efficient supply chains, and increased adoption of refurbished devices in emerging economies. Recent trends in the refurbished electronics market include a shift towards online platforms for refurbished product sales, an increased focus on quality certifications and warranties, and an expanding product range including smartphones, tablets, and other electronic devices. Moreover, opportunities in this market lie in expanding the refurbished electronics offerings, especially in developing regions and enhancing the refurbishment processes to meet evolving consumer expectations. Key refurbished computers and laptops market players like Amazon Renewed have been at the forefront, continuously expanding their refurbished product lineups, improving refurbishment standards, and collaborating with various manufacturers and retailers to drive market growth.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

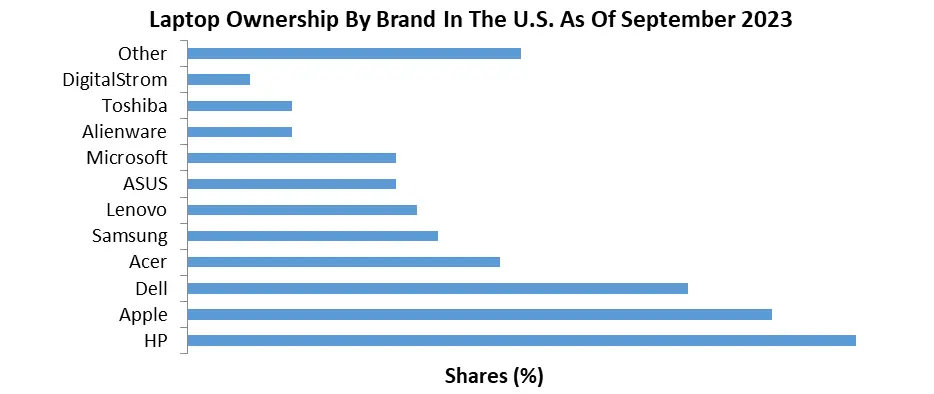

Corporate Adoption of Refurbished IT Assets drives the market: Growing awareness of e-waste minimization drives refurbished computers and laptops market demand. For instance, Apple's Renew program refurbishes devices, reducing environmental impact and enhancing sustainability. Affordability attracts consumers; Dell Outlet offers refurbished laptops at discounted prices, appealing to budget-conscious buyers without compromising quality. Advancements in refurbishment techniques and stringent quality checks improve product reliability. Lenovo's robust refurbishing process ensures high-quality laptops, fostering consumer trust. Manufacturer warranties and certifications like Amazon Renewed reassure buyers. Amazon's certified refurbished products come with warranties, elevating consumer confidence in refurbished items. Refurbished electronics extend their product lifecycles. Companies like HP extend the life of computers through refurbishing, reducing electronic waste, and supporting sustainability efforts. Economic downturns prompt consumers to opt for refurbished devices. During economic uncertainties, consumers choose cost-effective options like refurbished laptops, driving refurbished computers and laptops market growth. Increased online sales platforms like eBay Refurbished provide easy access to refurbished electronics, expanding refurbished computers and laptops market reach and convenience for consumers. Corporate firms are adopting refurbished IT assets for cost savings and environmental benefits. Large corporations, like Google, embrace refurbished devices, setting an example and bolstering refurbished computers and laptops market growth. Frequent technological advancements encourage users to upgrade, leading to a surplus of returned electronics. Samsung's refurbishment program ensures returned devices are renewed and resold, curbing electronic waste. Initiatives promoting E-waste reduction encourage refurbished electronics. Regulatory policies promoting sustainable practices in electronics disposal propel refurbished computers and laptops market growth, aligning with global sustainability goals.EU Circular Economy Action Plan Boosting the Refurbished Electronics Market: Increased environmental awareness drives demand. For instance, Dell's "Dell Reconnect" program refurbishes electronics for resale, promoting sustainability while meeting consumer needs. Supportive regulations can boost refurbished computers and laptops market growth. The EU's Circular Economy Action Plan encourages refurbishment, aiding market growth through incentivized recycling and refurbishment programs. Innovation in refurbishment techniques improves product quality. Companies like Apple refurbish and sell their products with warranties, ensuring consumer trust and fostering refurbished computers and laptops market growth. Cost-effective options attract price-conscious consumers. HP Renew offers discounted, certified refurbished products, expanding market reach to budget-centric buyers. Online marketplaces facilitate global access. Amazon Renew sells refurbished electronics, leveraging its platform to reach a vast consumer base, propelling market growth. Offering warranties on refurbished items enhances consumer confidence. Best Buy's Geek Squad Certified Refurbished program provides warranties, assuring buyers of product reliability, thus driving refurbished computers and laptops market growth. Collaborations with educational institutions can drive demand. Microsoft's "Microsoft Authorized Refurbisher" program supplies refurbished products to schools, stimulating market growth by catering to institutional needs. Providing customization options can attract tech-savvy consumers. Companies like Newegg offer customizable refurbished laptops, appealing to buyers seeking specific configurations, thereby fostering refurbished computers and laptops market growth. Educating consumers about the benefits of refurbished devices can expand the market. Lenovo's informational campaigns highlight the cost-effectiveness and environmental benefits of refurbished electronics, increasing market acceptance. Emphasizing the durability and longevity of refurbished products can attract environmentally conscious consumers. Samsung's Galaxy Certified Pre-Owned program showcases the durability and extended use of refurbished smart phones, contributing to refurbished computers and laptops market growth. These opportunities present avenues for market growth and consolidation within the refurbished computers and laptops industry. Limited Warranties and Perceived inferior quality of Refurbished Devices Hinders Market Acceptance: Refurbished products often come with limited warranties compared to new ones, posing a challenge to customer satisfaction. For instance, while a new laptop might offer a three-year warranty, a refurbished model might have only a six-month warranty. This disparity in after-sales support could deter potential buyers concerned about the longevity of their purchase and potential repair costs. Despite rigorous refurbishment processes, some consumers perceive refurbished devices as inferior in quality to new ones. For instance, even if a refurbished computer functions flawlessly, skepticism regarding its durability and performance compared to its brand-new counterpart may impact consumer trust and impede refurbished computers and laptops market growth. The rapid pace of technological advancements leads to shorter product life cycles. Refurbished computers and laptops might become outdated quicker than new models, discouraging consumers from purchasing refurbished devices due to concerns about obsolescence. The constant influx of new computer and laptop models with upgraded features creates intense competition for refurbished devices. Customers might opt for the latest technology rather than refurbished gadgets, impacting the refurbished computers and laptops market growth potential. Securing a consistent supply of quality refurbished components might be challenging, affecting the refurbishment process. For instance, a shortage of specific parts could delay refurbishment timelines, limiting the availability of refurbished devices on the refurbished computers and laptops market. Refurbished devices often contain previously used storage drives, raising concerns about data security. Despite data wiping procedures, consumers might worry about residual personal information left on these devices, dissuading them from purchasing refurbished electronics. The market might struggle to offer a wide range of specific models, especially for niche or less popular devices. Customers seeking a particular model or configuration may find limited options in the refurbished refurbished computers and laptops market, pushing them towards new products. Adhering to varying regional regulations and standards for refurbishing electronics presents logistical challenges. For instance, ensuring compliance with different environmental and safety regulations across regions might add complexity and cost to the refurbishment process. Despite cost savings, some consumers perceive buying refurbished electronics as a risk due to uncertainties about the device's history, leading to hesitation in making a purchase. While refurbished electronics aim to reduce e-waste, some consumers perceive them as contributing to environmental degradation due to misconceptions about the refurbishment process's environmental impact, which could hinder refurbished computers and laptops market growth.

Refurbished Computers and Laptops Market Segment Analysis:

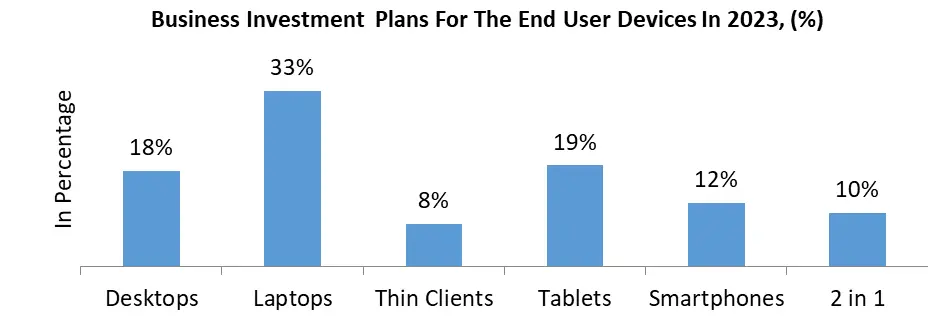

Based on Type, The refurbished computers and laptops market showcases diverse dynamics across different segments, computers, laptops, and tablets, each presenting unique trends and refurbished computers and laptops market dominance patterns. Laptops stand as the dominant segment within the refurbished electronics market, marked by increased adoption and consumer preference for their portability, functionality, and versatility. The extensive application of laptops across various industries, including education, business, and personal use, fuels their dominance, with the segment expected to maintain its leadership owing to ongoing technological advancements, catering to evolving consumer needs. While computers, including desktops and workstations, hold their position, laptops outpace them due to mobility advantages and compactness. However, tablets, although a smaller segment currently, exhibit a rising trend in adoption, particularly in education and certain business sectors. Tablets' portability, ease of use, and touch-based interfaces have increased their appeal, especially in educational settings for interactive learning experiences. Looking ahead, laptops are expected to continue dominating the refurbished computers and laptops market due to persistent demand for mobile computing devices, especially in remote working environments and the educational sector. Computers, while maintaining relevance, might see a slower growth rate compared to laptops due to the latter's increasing consumer preference for mobility and compactness. Tablets, although growing, might take time to catch up with laptops and computers due to their distinct user base and specific application scenarios, predominantly focused on content consumption, entertainment, and certain professional tasks.

Refurbished Computers and Laptops Market Regional Insights:

The refurbished computers and laptops market displays distinctive regional dominance, with varying growth trajectories and key refurbished computers and laptops market drivers across North America, Europe, and Asia Pacific. North America holds a prominent position in the refurbished computers and laptops market, characterized by significant refurbished computers and laptops market share and technological advancements driving growth. For instance, the United States boasts a thriving refurbished electronics sector, led by established players such as Best Buy and Amazon Renewed. These platforms offer a wide array of refurbished devices, capitalizing on consumer trust and the eco-conscious trend of reusing electronics. Moreover, technological innovation in regions like Silicon Valley fuels the refurbished computers and laptops market with cutting-edge refurbishment processes and fosters consumer confidence in refurbished products. Europe has emerged as a prominent region in the refurbished computers and laptops market, witnessing substantial growth and market dominance. Countries like the United Kingdom, Germany, and France stand as key contributors to this growth. For example, the United Kingdom has a flourishing market for refurbished electronics, with companies like MusicMagpie and CeX driving the refurbished computers and laptops market by offering quality-assured refurbished devices with warranties. Moreover, governmental initiatives promoting sustainability and circular economy principles foster a favorable environment for the refurbished electronics market's growth in Europe. Asia Pacific showcases a burgeoning refurbished electronics market, indicating a growing influence in the industry. Countries like India, China, and Japan witness increasing consumer demand for refurbished devices due to cost-effectiveness and a growing emphasis on environmental sustainability. For instance, platforms like Cashify in India and JD.com in China facilitate the sale and purchase of refurbished electronics, catering to the region's burgeoning consumer base seeking affordable yet reliable gadgets. Furthermore, e-commerce giants in the region actively promote the sale of refurbished devices, contributing to refurbished computers and laptops market growth. These regional insights underscore the diversified market dynamics and varying market drivers shaping the refurbished computers and laptops market across North America, Europe, and the Asia Pacific. Competitive Landscape Recent strategic moves within the refurbished electronics market have catalyzed a competitive landscape, driving innovation and accessibility while addressing societal needs. Initiatives like XtraCover's BuyBack Guarantee program redefine customer engagement by offering a safety net, boosting consumer confidence, and promoting sustained usage of refurbished laptops and smartphones. Li-Cycle Holdings Corp. and Shift2's donation of refurbished laptops to graduating seniors exemplifies corporate social responsibility, showcasing the potential for refurbished devices to empower educational pursuits. AT&T's initiative, providing free laptops to underserved families in Vanderburgh County, not only bridges the digital divide but also amplifies societal impact, setting a precedent for corporate involvement in community welfare. ASUS' refurbished PC Select Store in India diversifies the retail landscape, enhancing accessibility for consumers seeking affordable yet quality refurbished computers. CDI Technologies' acquisition of Troxell Communications underscores a strategic expansion within the education sector, reinforcing the refurbished computers and laptops market potential to cater to specific industry demands for reliable refurbished devices. These developments collectively amplify the market growth by fostering consumer trust, addressing social needs, expanding accessibility, and catering to niche market segments. In June 2023, XtraCover introduced a pioneering BuyBack Guarantee program for refurbished laptops and smartphones, permitting customers to sell their XtraCover-purchased devices at a guaranteed price. In May 2023, Li-Cycle and Shift2 collaborated to donate 60 refurbished laptops to Edison Career and Technology High School seniors, focusing on college applicants, financial aid seekers, and job seekers. In June 2023, AT&T's initiative provided free refurbished laptops to families and students in Vanderburgh County to bridge the digital divide, along with updates on rural broadband expansion. In March 2023, ASUS launched its inaugural Select Store for refurbished personal computers in India, facilitating access to quality refurbished PCs at affordable prices. In August 2020, CDI Technologies acquired Troxell Communications to broaden its educational market presence and deliver high-quality refurbished devices to K-12 schools.Refurbished Computers and Laptops Market Scope: Inquire before buying

Refurbished Computers and Laptops Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.12 Bn. Forecast Period 2024 to 2030 CAGR: 11.2% Market Size in 2030: US $ 10.76 Bn. Segments Covered: by Type Computer Laptop Tablets by OS Windows macOS Linux by Distribution Supermarkets and Hypermarkets Convenience Stores E-commerce Specialty Stores by End User Corporate Offices Educational Institutes Government Offices Personal Others Refurbished Computers and Laptops Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Refurbished Computers and Laptops Market Key Players:

1. Acer Inc. 2. Amazon Renewed 3. Apple Inc 4. AsusTek Computer Inc. 5. Back Market 6. Best Buy Refurbished 7. Cisco Systems, Inc. 8. Dell Technologies Inc. 9. Fujitsu Limited 10. Gazelle (ecoATM) 11. Google LLC 12. HCL Technologies Limited 13. HP Inc. 14. Huawei Technologies Co., Ltd. 15. IBM Corporation 16. Intel Corporation 17. Lenovo Group Limited 18. LG Electronics Inc. 19. Microsoft Corporation 20. Newegg Refurbished 21. Oracle Corporation 22. Panasonic Corporation 23. Samsung Electronics Co., Ltd. 24. Sony Corporation 25. TechSoup 26. Toshiba Corporation 27. Xiaomi Corporation FAQs: 1. What are the growth drivers for the Market? Ans. Corporate Adoption of Refurbished IT Assets drives the market and is expected to be the major driver for the Refurbished Computers and Laptops Market. 2. What is the major restraint for the Refurbished Computers and Laptops Market growth? Ans. Limited Warranties and Perceived inferior quality of Refurbished Devices Hinders Market Acceptance is expected to be major restraints In the Refurbished Computers and Laptops Market. 3. Which country is expected to lead the global Market during the forecast period? Ans. North America is expected to lead the Market during the forecast period. 4. What is the projected market size and growth rate of the Market? Ans. The Market size was valued at USD 5.12 Billion in 2023 and the total Refurbished Computers and Laptops revenue is expected to grow at a CAGR of 11.2 % from 2024 to 2030, reaching nearly USD 10.76 Billion by 2030. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are by Type, OS, Distribution, End-User, and Region.

1. Refurbished Computers and Laptops Market: Research Methodology 2. Refurbished Computers and Laptops Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Refurbished Computers and Laptops Market: Dynamics 3.1 Refurbished Computers and Laptops Market Trends by Region 3.1.1 North America Refurbished Computers and Laptops Market Trends 3.1.2 Europe Refurbished Computers and Laptops Market Trends 3.1.3 Asia Pacific Refurbished Computers and Laptops Market Trends 3.1.4 Middle East and Africa Refurbished Computers and Laptops Market Trends 3.1.5 South America Refurbished Computers and Laptops Market Trends 3.2 Refurbished Computers and Laptops Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Refurbished Computers and Laptops Market Drivers 3.2.1.2 North America Refurbished Computers and Laptops Market Restraints 3.2.1.3 North America Refurbished Computers and Laptops Market Opportunities 3.2.1.4 North America Refurbished Computers and Laptops Market Challenges 3.2.2 Europe 3.2.2.1 Europe Refurbished Computers and Laptops Market Drivers 3.2.2.2 Europe Refurbished Computers and Laptops Market Restraints 3.2.2.3 Europe Refurbished Computers and Laptops Market Opportunities 3.2.2.4 Europe Refurbished Computers and Laptops Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Refurbished Computers and Laptops Market Drivers 3.2.3.2 Asia Pacific Refurbished Computers and Laptops Market Restraints 3.2.3.3 Asia Pacific Refurbished Computers and Laptops Market Opportunities 3.2.3.4 Asia Pacific Refurbished Computers and Laptops Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Refurbished Computers and Laptops Market Drivers 3.2.4.2 Middle East and Africa Refurbished Computers and Laptops Market Restraints 3.2.4.3 Middle East and Africa Refurbished Computers and Laptops Market Opportunities 3.2.4.4 Middle East and Africa Refurbished Computers and Laptops Market Challenges 3.2.5 South America 3.2.5.1 South America Refurbished Computers and Laptops Market Drivers 3.2.5.2 South America Refurbished Computers and Laptops Market Restraints 3.2.5.3 South America Refurbished Computers and Laptops Market Opportunities 3.2.5.4 South America Refurbished Computers and Laptops Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Refurbished Computers and Laptops Industry 3.8 The Global Pandemic and Redefining of The Refurbished Computers and Laptops Industry Landscape 3.9 Technological Road Map 4. Global Refurbished Computers and Laptops Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 4.1 Global Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 4.1.1 Computer 4.1.2 Laptop 4.1.3 Tablets 4.2 Global Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 4.2.1 Windows 4.2.2 macOS 4.2.3 Linux 4.3 Global Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 4.3.1 Supermarkets and Hypermarkets 4.3.2 Convenience Stores 4.3.3 E-commerce 4.3.4 Specialty Stores 4.4 Global Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 4.4.1 Corporate Offices 4.4.2 Educational Institutes 4.4.3 Government Offices 4.4.4 Personal 4.4.5 Others 4.5 Global Refurbished Computers and Laptops Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Refurbished Computers and Laptops Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 5.1 North America Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 5.1.1 Computer 5.1.2 Laptop 5.1.3 Tablets 5.2 North America Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 5.2.1 Windows 5.2.2 macOS 5.2.3 Linux 5.3 North America Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 5.3.1 Supermarkets and Hypermarkets 5.3.2 Convenience Stores 5.3.3 E-commerce 5.3.4 Specialty Stores 5.4 North America Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 5.4.1 Corporate Offices 5.4.2 Educational Institutes 5.4.3 Government Offices 5.4.4 Personal 5.4.5 Others 5.5 North America Refurbished Computers and Laptops Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 5.5.1.1.1 Computer 5.5.1.1.2 Laptop 5.5.1.1.3 Tablets 5.5.1.2 United States Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 5.5.1.2.1 Windows 5.5.1.2.2 macOS 5.5.1.2.3 Linux 5.5.1.3 United States Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 5.5.1.3.1 Supermarkets and Hypermarkets 5.5.1.3.2 Convenience Stores 5.5.1.3.3 E-commerce 5.5.1.3.4 Specialty Stores 5.5.1.4 United States Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 5.5.1.4.1 Corporate Offices 5.5.1.4.2 Educational Institutes 5.5.1.4.3 Government Offices 5.5.1.4.4 Personal 5.5.1.4.5 Others 5.5.2 Canada 5.5.2.1 Canada Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 5.5.2.1.1 Computer 5.5.2.1.2 Laptop 5.5.2.1.3 Tablets 5.5.2.2 Canada Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 5.5.2.2.1 Windows 5.5.2.2.2 macOS 5.5.2.2.3 Linux 5.5.2.3 Canada Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 5.5.2.3.1 Supermarkets and Hypermarkets 5.5.2.3.2 Convenience Stores 5.5.2.3.3 E-commerce 5.5.2.3.4 Specialty Stores 5.5.2.4 Canada Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 5.5.2.4.1 Corporate Offices 5.5.2.4.2 Educational Institutes 5.5.2.4.3 Government Offices 5.5.2.4.4 Personal 5.5.2.4.5 Others 5.5.3 Mexico 5.5.3.1 Mexico Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 5.5.3.1.1 Computer 5.5.3.1.2 Laptop 5.5.3.1.3 Tablets 5.5.3.2 Mexico Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 5.5.3.2.1 Windows 5.5.3.2.2 macOS 5.5.3.2.3 Linux 5.5.3.3 Mexico Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 5.5.3.3.1 Supermarkets and Hypermarkets 5.5.3.3.2 Convenience Stores 5.5.3.3.3 E-commerce 5.5.3.3.4 Specialty Stores 5.5.3.4 Mexico Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 5.5.3.4.1 Corporate Offices 5.5.3.4.2 Educational Institutes 5.5.3.4.3 Government Offices 5.5.3.4.4 Personal 5.5.3.4.5 Others 6. Europe Refurbished Computers and Laptops Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 6.1 Europe Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.2 Europe Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.3 Europe Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.4 Europe Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5 Europe Refurbished Computers and Laptops Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.1.2 United Kingdom Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.1.3 United Kingdom Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.1.4 United Kingdom Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.2 France 6.5.2.1 France Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.2.2 France Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.2.3 France Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.2.4 France Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.3.2 Germany Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.3.3 Germany Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.3.4 Germany Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.4.2 Italy Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.4.3 Italy Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.4.4 Italy Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.5.2 Spain Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.5.3 Spain Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.5.4 Spain Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.6.2 Sweden Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.6.3 Sweden Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.6.4 Sweden Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.7.2 Austria Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 6.5.7.3 Austria Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.7.4 Austria Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 6.5.8.2 Rest of Europe Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030). 6.5.8.3 Rest of Europe Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 6.5.8.4 Rest of Europe Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7. Asia Pacific Refurbished Computers and Laptops Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 7.1 Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.2 Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.3 Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.4 Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5 Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.1.2 China Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.1.3 China Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.1.4 China Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.2.2 S Korea Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.2.3 S Korea Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.2.4 S Korea Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.3.2 Japan Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.3.3 Japan Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.3.4 Japan Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.4 India 7.5.4.1 India Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.4.2 India Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.4.3 India Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.4.4 India Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.5.2 Australia Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.5.3 Australia Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.5.4 Australia Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.6.2 Indonesia Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.6.3 Indonesia Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.6.4 Indonesia Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.7.2 Malaysia Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.7.3 Malaysia Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.7.4 Malaysia Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.8.2 Vietnam Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.8.3 Vietnam Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.8.4 Vietnam Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.9.2 Taiwan Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.9.3 Taiwan Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.9.4 Taiwan Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.10.2 Bangladesh Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.10.3 Bangladesh Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.10.4 Bangladesh Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.11.2 Pakistan Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.11.3 Pakistan Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.11.4 Pakistan Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 7.5.12.2 Rest of Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 7.5.12.3 Rest of Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 7.5.12.4 Rest of Asia Pacific Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8. Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 8.1 Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.2 Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.3 Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.4 Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8.5 Middle East and Africa Refurbished Computers and Laptops Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.5.1.2 South Africa Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.5.1.3 South Africa Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.5.1.4 South Africa Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.5.2.2 GCC Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.5.2.3 GCC Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.5.2.4 GCC Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.5.3.2 Egypt Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.5.3.3 Egypt Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.5.3.4 Egypt Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.5.4.2 Nigeria Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.5.4.3 Nigeria Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.5.4.4 Nigeria Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 8.5.5.2 Rest of ME&A Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 8.5.5.3 Rest of ME&A Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 8.5.5.4 Rest of ME&A Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 9. South America Refurbished Computers and Laptops Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 9.1 South America Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 9.2 South America Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 9.3 South America Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 9.4 South America Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 9.5 South America Refurbished Computers and Laptops Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 9.5.1.2 Brazil Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 9.5.1.3 Brazil Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 9.5.1.4 Brazil Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 9.5.2.2 Argentina Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 9.5.2.3 Argentina Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 9.5.2.4 Argentina Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Refurbished Computers and Laptops Market Size and Forecast, By Type (2023-2030) 9.5.3.2 Rest Of South America Refurbished Computers and Laptops Market Size and Forecast, By OS (2023-2030) 9.5.3.3 Rest Of South America Refurbished Computers and Laptops Market Size and Forecast, By Distribution (2023-2030) 9.5.3.4 Rest Of South America Refurbished Computers and Laptops Market Size and Forecast, By End-User (2023-2030) 10. Global Refurbished Computers and Laptops Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Refurbished Computers and Laptops Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Acer Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Amazon Renewed 11.3 Apple Inc. 11.4 AsusTek Computer Inc. 11.5 Back Market 11.6 Best Buy Refurbished 11.7 Cisco Systems, Inc. 11.8 Dell Technologies Inc. 11.9 Fujitsu Limited 11.10 Gazelle (ecoATM) 11.11 Google LLC 11.12 HCL Technologies Limited 11.13 HP Inc. 11.14 Huawei Technologies Co., Ltd. 11.15 IBM Corporation 11.16 Intel Corporation 11.17 Lenovo Group Limited 11.18 LG Electronics Inc. 11.19 Microsoft Corporation 11.20 Newegg Refurbished 11.21 Oracle Corporation 11.22 Panasonic Corporation 11.23 Samsung Electronics Co., Ltd. 11.24 Sony Corporation 11.25 TechSoup 11.26 Toshiba Corporation 11.27 Xiaomi Corporation 12. Key Findings 13. Industry Recommendations