The Recycled Glass Market size was valued at USD 3.83 Billion in 2022 and is expected to grow by 6.31% from 2023 to 2029, reaching nearly USD 5.88 Billion. Glass can be recycled multiple times without losing any of its quality or purity. It is completely recyclable. It can be recycled and then molded into brand-new products like bottles and jars by being crushed and melted. Additionally, it is widely utilized for decorative purposes or alternative duties like producing masonry. Glass recycling is gaining popularity all over the world as a result of its incredible benefits. Glass is frequently totally recyclable numerous times without sacrificing any of its integrity or quality. Recycled glass may take the place of about 95% of the raw materials required in the production of glass. It significantly aids in the preservation of soda ash, silica, and limestone. These unprocessed materials are extracted from the Earth's crust through mining. Utilizing products can help to reduce the cost of mining and transportation associated with it. When making glass, it helps to lower the levels of carbon dioxide, sulfur dioxide, and nitrogen oxide emissions. For glass manufacturers, using recycled glass during manufacturing can save energy costs as well as furnace maintenance and repair costs. According to MMR analysis, Every tonne of recycled glass reduces the need for 1.2 tonnes of raw materials, such as the sand and soda ash that are used to produce new glass. The amount of recycled glass that's been recorded in 2021 was more than 36 million tonnes or around 24.8% of the total amount of glass produced across the world. The growing industrialization that generates waste landfills primarily drives the growth of the recycled glass market across the world. The global market is growing as a result of factors like sustainable development, growing government awareness agendas, and increased government activities. Additionally, the rise in glass waste is one of the major issues faced globally. Global warming and climate change are exacerbated by the fact that most of these wastes are burned or dumped in landfills.To know about the Research Methodology :- Request Free Sample Report Recycled Glass Market Market Scope and Research Methodology The report is a compilation of information gathered directly from industry participants and specialists along the value chain, as well as qualitative and quantitative evaluations by industry analysts. The research offers an in-depth analysis of market trends in the primary market, macroeconomic data, controlling variables, and market attractiveness per segment. The qualitative effects of key market parameters on market segments and geographic regions are also detailed in the report. To estimate and authenticate the global market size of the Recycled Glass Market, bottom-up methodologies are used. Secondary research has been used to identify the major market participants, and primary and secondary research has been used to estimate their market shares. All percentage share distributions and breakdowns were determined using secondary sources and verified original sources.

Recycled Glass Market Dynamics:

Growing Demand for Recycled Glass in Industries like Automobile, Food Processing, and others to Boost the Recycled Glass Market Growth The primary driver of the recycled glass market's revenue growth is an increase in demand for recycled glass attributed to its use in a wide range of industries, including automotive, aerospace and defense, manufacturing, food processing, and others. Recycling waste glass is used in a variety of industries, as it can be melted to make new items of various sizes and shapes, such as bottles, jars, abrasives, containers, and insulating materials. Glass has a wide range of uses, including making windows, storage bins, bottles, and drinking glasses, which is driving market revenue growth. Companies that use glass containers, such as the food and beverage sectors and the pharmaceutical industry, which regularly uses glass containers to store drugs, use bottles and containers made from recycled glass. Additionally, the production of tiles, landscaping materials, and paving materials from smaller glass materials is used in construction, which is in turn boosting recycled glass market revenue growth. The increase in demand for recycled glass in the construction sector for filler aggregate, pipe bedding material, drainage, and asphalt aggregate is driving the product demand for the product across the world. Polymer concrete is made by replacing sand with crushed recycled glass. For instance, in regions with heavy activity, such as petrol stations, forklift operation zones, and airports, recycled glass produces a high-strength, water-resistant material that is perfect for industrial flooring and infrastructure drainage, fueling recycled glass market revenue growth. Growing Environmental Concerns about Recycled Glass Growing glass waste is one of the biggest issues in the world. The majority of this waste is dumped in landfills and garbage dumps, which contributes to climate change and global warming. However, the accumulation of glass waste in landfills can result in the emission of greenhouse gases. Heat sources release a lot of pollutants into the atmosphere. Glass recycling, which is more effective and ecologically sound, plays a significant part in waste management. Additionally, by implementing incentives, programs, and subsidies, the majority of developed nations encourage glass recycling. Rising setups of glass recycling facilities around the world would further boost the growth of the recycled glass market by raising awareness of recycled glass' potential to address climate challenges.Higher Energy Consumption and Inadequate Waste Collecting Systems are Hampering the Growth of the Recycled Glass Market The recycled glass includes ceramics and other contaminants that contaminate the entire recycling process. Glass contaminates one recycling stream at a time. Other recyclables, such as paper and cardboard, become contaminated by shattered glass, which in turn, decreased their value, hence hindering market revenue growth. Additionally, glass contaminates other recyclables, such as paper and cardboard, lowering their value and impeding the growth of the market's revenue. The environment and human health are also expected to be negatively affected by improper recycling. The greenhouse gas methane, which is produced when recycling glass and can contribute to global warming and ozone depletion, which is expected to hamper the product demand through the forecast period. The glass recycling industry faces significant barriers as a result of inadequate waste collecting systems in many countries across the world. For instance, municipalities in a developed country like the U.S. lack a system for collecting glass waste. Municipalities in the United States primarily use the curbside single-stream collection to manage residential recycling. As a result, the glass waste is combined with other trash, including plastic, cardboard, newspaper, and other paper goods, as well as metal cans (aluminum & steel). It makes sorting incredibly expensive and complicated. As a result, just 33% of glass waste is recycled annually in the United States.

Recycled Glass Market Segment Analysis:

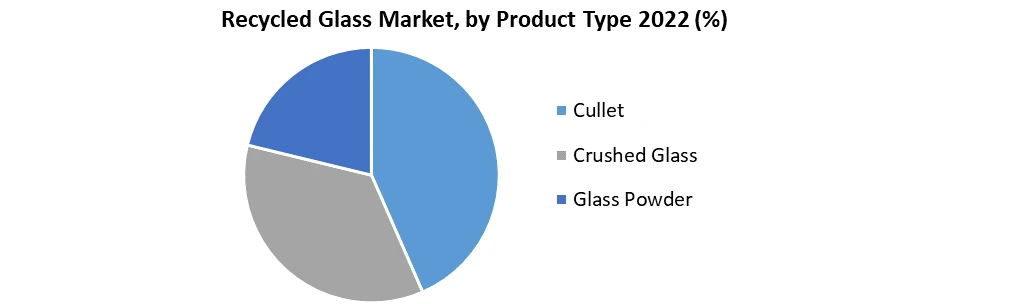

By Product Type, the Recycled Glass Market is segmented into Cullet, Crushed Glass, and Glass Powder. The Cullet type segment accounted for the largest market share in 2022. The Cullet is a glass that has been recycled and is ready to be recycled. Glass bottles, glass jars, fiberglass and glass windows, ballotin, etc. can all be made from cullet. Cullet has various advantages, including reduced melting power requirements, a reduction in the number of raw materials required, and an increase in furnace life of at least 30%. It is used by numerous industries. These factors are expected to boost segment demand through the forecast period. By Application, the Recycled Glass Market is segmented into Glass Bottle & Containers, Flat Glass, Fiber Glass, Highway Beads, Abrasives, Fillers, and others. The Fiber Glass segment held the largest market share accounting in 2022. Fiberglass has a number of advantages, including excellent insulation, resistivity, and a low coefficient of linear growth, all of which are contributing to the segment's revenue growth. This segment's revenue is growing as it is used in a variety of industries, including automotive, aerospace and defense, manufacturing, food processing, power generation, metals and mining, pulp and paper, and others. Natural sound-dampening properties of fiberglass can considerably minimize outside noise in a residence. In order to lessen sound transmission, it is also used as acoustic insulation in walls, ceilings, and even ducts. As a result, the demand for fiberglass in the industrial and commercial sectors is rising, which is fueling the growth of the recycled glass market.

Recycled Glass Market Regional Insights:

Europe held the largest market share accounting for more than 30% in 2022. Government programs promoting the use of recycled glass as well as increased public awareness of recycling methods are driving market revenue growth in this region. The Circular Economy Package was already implemented by the European Union to promote effective recycling and waste management techniques. In order to prevent the disposal of glass waste in landfills, European nations like Germany and the UK are raising landfill tax rates, which is propelling market revenue growth. Regarding current recycling rates, adoption patterns, governmental strategies, and public awareness, the regional glass recycling landscape is substantially different. The European region is driven by nations like Switzerland and Germany, which have a glass recycling rate of approximately 90% and have taken an active approach to build technical know-how and coordinating infrastructure. In terms of overall waste management, Asian countries lag far behind, with issues arising from a lack of awareness, inadequate infrastructure, and a low market value for recycled raw materials. As natural raw materials are preferred, China's recycling percentage is still considered to be significantly below 20%.The North American market is expected to witness a moderate revenue growth rate over the forecast period. Each year, Americans dispose of almost 10 million metric tonnes of glass. Most of it is thrown away. Only a third of it is recycled. Additionally, the US's a low rate of glass recycling—about 33% compared to Germany, Switzerland, and other European nations' 90% rates. Additionally, in Spain and the UK, the percentage of recycled glass has doubled and tripled over the past 25 years, respectively, while the figures in the US have hardly changed. The majority of the initiatives in the US to increase glass recycling rates have been in state and local initiatives. For instance, quite a bottle bill that mandates consumers to make deposits on beverage bottles has been passed in 10 states in 2019. In order to recover their deposits, consumers should be encouraged to recycle the bottles. The effects of the laws are as intended. Compared to the national average of approximately 33%, 98% of bottles are recycled in states with those regulations. Competitive Landscape: The recycled glass market's competitive environment is fragmented, with a number of major competitors active on both a global and regional scale. The high threat posed by new entrants as a result of high end-user demand has fragmented the market. Major industry players are collaborating with packaging and container producers to get a competitive edge over competing companies. Many companies are investing in research and technologies to obtain a competitive advantage as the demand for recycled glass in various applications rises. To increase their individual product portfolios and establish a solid foothold in the global market, key players are working on product development and strategic alliances. Some of the major key players in the recycled glass industry are Consol Glass (Pty) Ltd., Dlubak Glass Company, Vitro Minerals, Inc., Glasrecycling NV, Harsco Minerals International, Coloured Aggregates, Gallo Glass Company, Strategic Materials, Inc., Vetropack Holding, and Berryman Glass Recycling. The demand for a long-term solution is in line with developments in the recycled glass industry. Participants in the recycled glass industry are always analyzing recycling processes and looking for new, more efficient ways to produce recycled glass. Additionally, glass bottle manufacturers are competing for more revenues by streamlining procedures for recycling glass using new technology and software. Examples of market participants who are making significant efforts to improve glass recycling include Momentum, Rocky Mountain Bottle Co., and various other companies. They accomplish this by utilizing sophisticated tracking software developed by the End of Waste Foundation's BWTS or Blockchain Waste Traceability Software. The device can be used by waste management companies, material recovery facilities (MRFs), and other market participants to track glass from new items to curbside bins.

Recycled Glass Market Scope: Inquiry Before Buying

Recycled Glass Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: USD 3.83 Bn Forecast Period 2023 to 2029 CAGR: 6.31% Market Size in 2029: USD 5.88 Bn Segments Covered: by Product Type 1. Cullet 2. Crushed Glass 3. Glass Powder by Application 1. Glass Bottle & Containers 2. Flat Glass 3. Fiber Glass 4. Highway Beads 5. Abrasives 6. Fillers 7. Others Recycled Glass Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Recycled Glass Market, Key Players are

1. Consol Glass (Pty) Ltd. 2. Dlubak Glass Company 3. Vitro Minerals, Inc. 4. Glasrecycling NV 5. Harsco Minerals International 6. Coloured Aggregates 7. Gallo Glass Company 8. Strategic Materials, Inc., 9. Vetropack Holding 10. Berryman Glass Recycling 11. Glass Recycled Surfaces 12. Momentum Recycling, LLC 13. Trivitro Corporation 14. O-I Glass Inc. 15. Reiling GmbH & Co. KG 16. Strategic Materials Inc 17. United Resource Management 18. Verallia and Vetropack Holding Ltd. 19. Ardagh Group S.A. 20. Glasrecycling FAQs: 1. What was the global market size of the Recycled Glass Market in 2022? Ans. The Global Recycled Glass Market size was valued at USD 3.83 Billion. 2. What is the study period for the Recycled Glass Market? Ans. 2018-2029 is the study period for the Recycled Glass Market. 3. What is the growth rate of the Recycled Glass Market? Ans. The Recycled Glass Market is growing at a CAGR of 6.31% over forecast the period. 4. What are the major key players in the Global Recycled Glass Market? Ans. The major key players in the Global Recycled Glass Market are Consol Glass (Pty) Ltd., Dlubak Glass Company, Vitro Minerals, Inc., Glasrecycling NV, Harsco Minerals International, Coloured Aggregates, Gallo Glass Company, Strategic Materials, Inc., Vetropack Holding, and Berryman Glass Recycling. 5. What is the forecast period for the Recycled Glass Market? Ans. The forecast period for the Recycled Glass Market is 2023-2029.

1. Recycled Glass Market: Research Methodology 2. Recycled Glass Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Recycled Glass Market: Dynamics 3.1 Recycled Glass Market Trends by Region 3.1.1 Global Recycled Glass Market Trends 3.1.2 North America Recycled Glass Market Trends 3.1.3 Europe Recycled Glass Market Trends 3.1.4 Asia Pacific Recycled Glass Market Trends 3.1.5 Middle East and Africa Recycled Glass Market Trends 3.1.6 South America Recycled Glass Market Trends 3.2 Recycled Glass Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Recycled Glass Market Drivers 3.2.1.2 North America Recycled Glass Market Restraints 3.2.1.3 North America Recycled Glass Market Opportunities 3.2.1.4 North America Recycled Glass Market Challenges 3.2.2 Europe 3.2.2.1 Europe Recycled Glass Market Drivers 3.2.2.2 Europe Recycled Glass Market Restraints 3.2.2.3 Europe Recycled Glass Market Opportunities 3.2.2.4 Europe Recycled Glass Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Recycled Glass Market Market Drivers 3.2.3.2 Asia Pacific Recycled Glass Market Restraints 3.2.3.3 Asia Pacific Recycled Glass Market Opportunities 3.2.3.4 Asia Pacific Recycled Glass Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Recycled Glass Market Drivers 3.2.4.2 Middle East and Africa Recycled Glass Market Restraints 3.2.4.3 Middle East and Africa Recycled Glass Market Opportunities 3.2.4.4 Middle East and Africa Recycled Glass Market Challenges 3.2.5 South America 3.2.5.1 South America Recycled Glass Market Drivers 3.2.5.2 South America Recycled Glass Market Restraints 3.2.5.3 South America Recycled Glass Market Opportunities 3.2.5.4 South America Recycled Glass Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Recycled Glass Industry 3.8 The Global Pandemic and Redefining of The Recycled Glass Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Recycled Glass Trade Analysis (2017-2022) 3.11.1 Global Import of Recycled Glass 3.11.2 Global Export of Recycled Glass 3.12 Global Recycled Glass Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Recycled Glass Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Recycled Glass Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 4.1.1 Cullet 4.1.2 Crushed Glass 4.1.3 Glass Powder 4.2 Global Recycled Glass Market Size and Forecast, By Application (2022-2029) 4.2.1 Glass Bottle & Containers 4.2.2 Flat Glass 4.2.3 Fiber Glass 4.2.4 Highway Beads 4.2.5 Abrasives 4.2.6 Fillers 4.2.7 Others 4.3 Global Recycled Glass Market Size and Forecast, by Region (2022-2029) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Recycled Glass Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 5.1.1 Cullet 5.1.2 Crushed Glass 5.1.3 Glass Powder 5.2 North America Recycled Glass Market Size and Forecast, By Application (2022-2029) 5.2.1 Glass Bottle & Containers 5.2.2 Flat Glass 5.2.3 Fiber Glass 5.2.4 Highway Beads 5.2.5 Abrasives 5.2.6 Fillers 5.2.7 Others 5.3 North America Recycled Glass Market Size and Forecast, by Country (2022-2029) 5.3.1 United States 5.3.1.1 United States Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 5.3.1.1.1 Cullet 5.3.1.1.2 Crushed Glass 5.3.1.1.3 Glass Powder 5.3.1.2 United States Recycled Glass Market Size and Forecast, By Application (2022-2029) 5.3.1.2.1 Glass Bottle & Containers 5.3.1.2.2 Flat Glass 5.3.1.2.3 Fiber Glass 5.3.1.2.4 Highway Beads 5.3.1.2.5 Abrasives 5.3.1.2.6 Fillers 5.3.1.2.7 Others 5.3.2 Canada 5.3.2.1 Canada Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 5.3.2.1.1 Cullet 5.3.2.1.2 Crushed Glass 5.3.2.1.3 Glass Powder 5.3.2.2 Canada Recycled Glass Market Size and Forecast, By Application (2022-2029) 5.3.2.2.1 Glass Bottle & Containers 5.3.2.2.2 Flat Glass 5.3.2.2.3 Fiber Glass 5.3.2.2.4 Highway Beads 5.3.2.2.5 Abrasives 5.3.2.2.6 Fillers 5.3.2.2.7 Others 5.3.3 Mexico 5.3.3.1 Mexico Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 5.3.3.1.1 Cullet 5.3.3.1.2 Crushed Glass 5.3.3.1.3 Glass Powder 5.3.3.2 Mexico Recycled Glass Market Size and Forecast, By Application (2022-2029) 5.3.3.2.1 Glass Bottle & Containers 5.3.3.2.2 Flat Glass 5.3.3.2.3 Fiber Glass 5.3.3.2.4 Highway Beads 5.3.3.2.5 Abrasives 5.3.3.2.6 Fillers 5.3.3.2.7 Others 6. Europe Recycled Glass Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.2 Europe Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3 Europe Recycled Glass Market Size and Forecast, by Country (2022-2029) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.1.2 United Kingdom Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.2 France 6.3.2.1 France Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.2.2 France Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.3 Germany 6.3.3.1 Germany Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.3.2 Germany Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.4 Italy 6.3.4.1 Italy Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.4.2 Italy Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.5 Spain 6.3.5.1 Spain Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.5.2 Spain Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.6 Sweden 6.3.6.1 Sweden Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.6.2 Sweden Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.7 Austria 6.3.7.1 Austria Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.7.2 Austria Recycled Glass Market Size and Forecast, By Application (2022-2029) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 6.3.8.2 Rest of Europe Recycled Glass Market Size and Forecast, By Application (2022-2029). 7. Asia Pacific Recycled Glass Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.2 Asia Pacific Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3 Asia Pacific Recycled Glass Market Size and Forecast, by Country (2022-2029) 7.3.1 China 7.3.1.1 China Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.1.2 China Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.2 South Korea 7.3.2.1 S Korea Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.2.2 S Korea Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.3 Japan 7.3.3.1 Japan Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.3.2 Japan Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.4 India 7.3.4.1 India Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.4.2 India Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.5 Australia 7.3.5.1 Australia Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.5.2 Australia Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.6 Indonesia 7.3.6.1 Indonesia Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.6.2 Indonesia Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.7 Malaysia 7.3.7.1 Malaysia Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.7.2 Malaysia Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.8 Vietnam 7.3.8.1 Vietnam Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.8.2 Vietnam Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.9 Taiwan 7.3.9.1 Taiwan Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.9.2 Taiwan Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.10.2 Bangladesh Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.11 Pakistan 7.3.11.1 Pakistan Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.11.2 Pakistan Recycled Glass Market Size and Forecast, By Application (2022-2029) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 7.3.12.2 Rest of Asia PacificRecycled Glass Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Recycled Glass Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.2 Middle East and Africa Recycled Glass Market Size and Forecast, By Application (2022-2029) 8.3 Middle East and Africa Recycled Glass Market Size and Forecast, by Country (2022-2029) 8.3.1 South Africa 8.3.1.1 South Africa Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.3.1.2 South Africa Recycled Glass Market Size and Forecast, By Application (2022-2029) 8.3.2 GCC 8.3.2.1 GCC Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.3.2.2 GCC Recycled Glass Market Size and Forecast, By Application (2022-2029) 8.3.3 Egypt 8.3.3.1 Egypt Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.3.3.2 Egypt Recycled Glass Market Size and Forecast, By Application (2022-2029) 8.3.4 Nigeria 8.3.4.1 Nigeria Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.3.4.2 Nigeria Recycled Glass Market Size and Forecast, By Application (2022-2029) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 8.3.5.2 Rest of ME&A Recycled Glass Market Size and Forecast, By Application (2022-2029) 9. South America Recycled Glass Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 9.2 South America Recycled Glass Market Size and Forecast, By Application (2022-2029) 9.3 South America Recycled Glass Market Size and Forecast, by Country (2022-2029) 9.3.1 Brazil 9.3.1.1 Brazil Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 9.3.1.2 Brazil Recycled Glass Market Size and Forecast, By Application (2022-2029) 9.3.2 Argentina 9.3.2.1 Argentina Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 9.3.2.2 Argentina Recycled Glass Market Size and Forecast, By Application (2022-2029) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Recycled Glass Market Size and Forecast, By Product Type (2022-2029) 9.3.3.2 Rest Of South America Recycled Glass Market Size and Forecast, By Application (2022-2029) 10. Global Recycled Glass Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Recycled Glass Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Consol Glass (Pty) Ltd. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Dlubak Glass Company 11.3 Vitro Minerals, Inc. 11.4 Glasrecycling NV 11.5 Harsco Minerals International 11.6 Coloured Aggregates 11.7 Gallo Glass Company 11.8 Strategic Materials, Inc., 11.9 Vetropack Holding 11.10 Berryman Glass Recycling 11.11 Glass Recycled Surfaces 11.12 Momentum Recycling, LLC 11.13 Trivitro Corporation 11.14 O-I Glass Inc. 11.15 Reiling GmbH & Co. KG 11.16 Strategic Materials Inc 11.17 United Resource Management 11.18 Verallia and Vetropack Holding Ltd. 11.19 Ardagh Group S.A. 11.20 Glasrecycling 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary