The Insecticides Market is expected to reach US$ 29.42 Bn. in 2029, with a CAGR of 6.51% for the period 2023-2029, because of the growth of the commercial pest control service industry.Insecticides Market Overview:

Insecticides are chemicals that are used to kill insects. There are several different insecticides on the market that function in different ways, such as breaking the exoskeleton of the insect. It can also have an effect on the nervous system. Pyrethroids, carbamates, and organophosphates are common pesticides. Insecticides are used in the several application areas such as agriculture, horticulture, floriculture, public health, industrial applications, home, and commercial pest management programmes.To know about the Research Methodology :- Request Free Sample Report

Insecticides Market Dynamics:

Growing worries about insect-transmitted diseases, a move toward disease prevention rather than cure, and the growth of the commercial pest control service industry are all major market drivers. Also, the insecticides market is being driven by an increase in demand for food grains because of rising global population, as well as a reduction in per capita farm area due to increasing urbanisation and industrialization. The most significant recent trend in the global agrochemicals market is increased R&D in the sectors of bio-insecticides to compete with demand for health and environment friendly insecticides. Because insecticides' poisonous qualities are dangerous to small children and domestic pets, adequate handling and safe operation methods are required, which is limiting insecticides' overall acceptance for domestic application.Industrialization & Shifting Crop Mixes to Support Rising Insecticides Application Rates: Significant market prospects for agricultural insecticides is supported by rapidly developing agricultural industries in Central and South America, Asia, and Africa. Cropland area is expected to grow faster in these regions than in Europe and North America's more mature markets, and many countries in these regions are transitioning their agricultural sectors from subsistence to industrialised models. Farmers will be more motivated to maximise productivity and invest in more effective crop protection products if their focus shifts from subsistence crops to higher-value cash crops for export markets. In increasingly developed agricultural markets, limiting cropland expansion is offset by higher production per hectare, necessitating additional pesticide investment. The emphasis is on products that are both effective and environmentally friendly. These developments are supported by changing regulatory requirements and a shrinking agricultural workforce, making efficiency even more important. Nonagricultural Markets is Impacted by COVID-19 Pandemic & Changing Demographics: The COVID-19 pandemic had a significant impact on the commercial and consumer markets for insecticides in the United States and other affluent countries with significant lawn and garden cultures, resulting in a drop in residential landscaping services and a significant increase in the number of households participating in lawn and garden activities. Although the number of families with active gardeners is expected to decline over time, demand for value-added, consumer-friendly pesticides is expected to stay strong. Gains in demand in less comprehensive insecticides markets is supported by a growing middle class and a growing emphasis on the relevance of urban green spaces. On the other hand, in a number of countries, rising urban population density may limit accessible garden space, and commercial insecticides use is continue to be dominated by insect and rodent management for public health reasons in many countries.

Insecticides Market Segment Analysis:

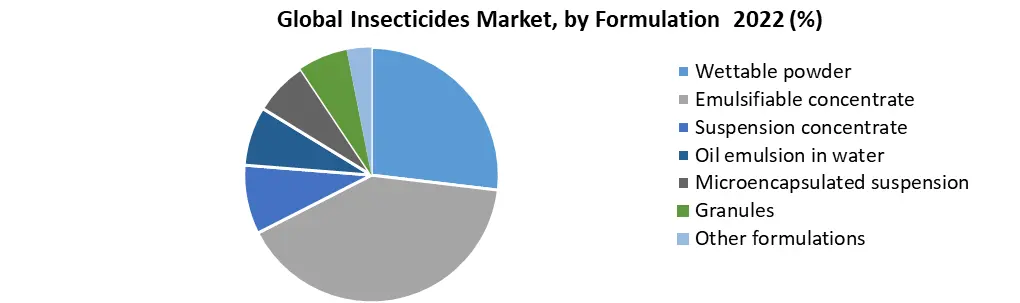

Based on Formulation: The Insecticides market is sub-segmented into Wettable powder, Emulsifiable concentrate, Suspension concentrate, Oil emulsion in water, Microencapsulated suspension, Granules, and Other formulations. Among these, the emulsifyable concentrates segment is expected to hold the highest CAGR of around 7.9% of the insecticides market during the forecast period. An oil-soluble liquid active component, one or more petroleum-based solvents, and a mixing agent are commonly found in an emulsifiable concentrate formulation. Emulsifiable concentrates are a commonly used pesticide formulation around the world, because of their adaptability in both agricultural and non-agricultural applications. They can be used with any sort of sprayer, including portable sprayers and hydraulic spraying machines. Emulsifyable concentrates dominate the pesticides market since they are relatively easier to handle for treating broad regions.

Insecticides Market Regional Insights:

Increasing Insecticide Consumption in the Asia-Pacific Region:

An increased agricultural activity in developing countries such as India and China, as the insecticides are expected to rise faster than the global average in Asia Pacific. Because of the huge production of agricultural crops such as paddy, sugarcane, and cotton, India is expected to grow significantly. Over the forecast period (2023-2029), the insecticides industry is expected to be propelled by growing population and rising food consumption. Moreover, increased output of genetically modified (GM) crops is expected to reduce demand for insecticides in developed countries such as North America and Europe. Insecticides are not required because these crops are pest resistant. This is likely to be a major restriction for the insecticide market in these regions throughout the forecast period. After the United States, China, and Japan, India is the world's fourth largest producer of pesticides. The crop protection sector in India is a capital-intensive and heavily regulated business. India is one of the world's largest importers and exporters of pesticides.Chemical insecticides have dominated the total insecticides market in India, while bio-pesticides have a smaller market share than chemical insecticides. The bio-insecticides market in India, on the other hand, has a lot of room for growth in the next years, thanks to government assistance and increased knowledge about the usage of non-toxic, environmentally friendly insecticides in the country.

The objective of the report is to present a comprehensive analysis of the global Insecticides market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Insecticides dynamics, structure by analyzing the market segments and projecting the Insecticides size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Insecticides market make the report investor’s guide.

Insecticides Market Scope: Inquire before buying

Insecticides Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 18.91 Bn. Forecast Period 2023 to 2029 CAGR: 6.51% Market Size in 2029: US $ 29.42 Bn. Segments Covered: by Crop Type 1. Cereals & grains 2. Oilseeds & pulses 3. Fruits & vegetables 4. Other crop types by Type 1. Pyrethroids 2. Organophosphorus 3. Carbamates 4. Organochlorine 5. Botanicals 6. Other types by Formulation 1. Wettable powder 2. Emulsifiable concentrate 3. Suspension concentrate 4. Oil emulsion in water 5. Microencapsulated suspension 6. Granules 7. Other formulations by Form 1. Sprays 2. Baits 3. Strips Insecticides Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Insecticides Market, Key Players are

1. BASF SE 2. Bayer AG 3. BIOBEST GROUP NV 4. Certis USA L.L.C 5. Novozymes 6. Marrone Bio Innovations 7. Syngenta 8. Nufarm 9. Som Phytopharma India Ltd. 10. Valent BioSciences LLC 11. BioWorks Inc. 12. Camson Biotechnologies Ltd 13. Andermatt Biocontrol AG 14. Kan Biosys Pvt. Ltd. 15. Futureco Bioscience S.A. 16. Kilpest India Ltd 17. BioSafe Systems, LLC. 18. Vestaron Corporation 19. SDS Biotech K.K 20. OthersFrequently Asked Questions:

1. Which region has the largest share in Insecticides Market? Ans: the Asia Pacific held the largest share in 2022. 2. What is the growth rate of the Insecticides Market? Ans: The Insecticides Market is growing at a CAGR of 6.51% during the forecasting period 2023-2029. 3. What segments are covered in the Insecticides market? Ans: Insecticides Market is segmented into Crop Type, Type, Formulation, Form, and Region. 4. Who are the key players in the Insecticides market? Ans: The important key players in the Insecticides Market are – BASF SE, Bayer AG, BIOBEST GROUP NV, Certis USA L.L.C, Novozymes, Marrone Bio Innovations, Syngenta, Nufarm, Som Phytopharma India Ltd., Valent BioSciences LLC, BioWorks Inc., Camson Biotechnologies Ltd, Andermatt Biocontrol AG, Kan Biosys Pvt. Ltd., Futureco Bioscience S.A., Kilpest India Ltd, BioSafe Systems, LLC., Vestaron Corporation, SDS Biotech K.K, and Others. 5. What is the study period of this market? Ans: The Insecticides Market is studied from 2022 to 2029.

1. Global Insecticides Market: Research Methodology 2. Global Insecticides Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Insecticides Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Insecticides Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Insecticides Market Segmentation 4.1. Global Insecticides Market, by Crop Type (2022-2029) • Cereals & grains • Oilseeds & pulses • Fruits & vegetables • Other crop types 4.2. Global Insecticides Market, by Type (2022-2029) • Pyrethroids • Organophosphorus • Carbamates • Organochlorine • Botanicals • Other types 4.3. Global Insecticides Market, by Formulation (2022-2029) • Wettable powder • Emulsifiable concentrate • Suspension concentrate • Oil emulsion in water • Microencapsulated suspension • Granules • Other formulations 4.4. Global Insecticides Market, by Form (2022-2029) • Sprays • Baits • Strips 5. North America Insecticides Market(2022-2029) 5.1. North America Insecticides Market, by Crop Type (2022-2029) • Cereals & grains • Oilseeds & pulses • Fruits & vegetables • Other crop types 5.2. North America Insecticides Market, by Type (2022-2029) • Pyrethroids • Organophosphorus • Carbamates • Organochlorine • Botanicals • Other types 5.3. North America Insecticides Market, by Formulation (2022-2029) • Wettable powder • Emulsifiable concentrate • Suspension concentrate • Oil emulsion in water • Microencapsulated suspension • Granules • Other formulations 5.4. North America Insecticides Market, by Form (2022-2029) • Sprays • Baits • Strips 5.5. North America Insecticides Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Insecticides Market (2022-2029) 6.1. European Insecticides Market, by Crop Type (2022-2029) 6.2. European Insecticides Market, by Type (2022-2029) 6.3. European Insecticides Market, by Formulation (2022-2029) 6.4. European Insecticides Market, by Form (2022-2029) 6.5. European Insecticides Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Insecticides Market (2022-2029) 7.1. Asia Pacific Insecticides Market, by Crop Type (2022-2029) 7.2. Asia Pacific Insecticides Market, by Type (2022-2029) 7.3. Asia Pacific Insecticides Market, by Formulation (2022-2029) 7.4. Asia Pacific Insecticides Market, by Form (2022-2029) 7.5. Asia Pacific Insecticides Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Insecticides Market (2022-2029) 8.1. Middle East and Africa Insecticides Market, by Crop Type (2022-2029) 8.2. Middle East and Africa Insecticides Market, by Type (2022-2029) 8.3. Middle East and Africa Insecticides Market, by Formulation (2022-2029) 8.4. Middle East and Africa Insecticides Market, by Form (2022-2029) 8.5. Middle East and Africa Insecticides Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Insecticides Market (2022-2029) 9.1. South America Insecticides Market, by Crop Type (2022-2029) 9.2. South America Insecticides Market, by Type (2022-2029) 9.3. South America Insecticides Market, by Formulation (2022-2029) 9.4. South America Insecticides Market, by Form (2022-2029) 9.5. South America Insecticides Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. BASF SE 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Bayer AG 10.3. BIOBEST GROUP NV 10.4. Certis USA L.L.C 10.5. Novozymes 10.6. Marrone Bio Innovations 10.7. Syngenta 10.8. Nufarm 10.9. Som Phytopharma India Ltd. 10.10. Valent BioSciences LLC 10.11. BioWorks Inc. 10.12. Camson Biotechnologies Ltd 10.13. Andermatt Biocontrol AG 10.14. Kan Biosys Pvt. Ltd. 10.15. Futureco Bioscience S.A. 10.16. Kilpest India Ltd 10.17. BioSafe Systems, LLC. 10.18. Vestaron Corporation 10.19. SDS Biotech K.K 10.20. Others