The Real Time Location System Market size was valued at USD 5.91 Billion in 2023 and the total Real Time Location System revenue is expected to grow at a CAGR of 27.34% from 2024 to 2030, reaching nearly USD 32.09 Billion by 2030.Real Time Location System Market Overview:

Real-time locating systems (RTLS), sometimes are local systems that identify and track the position of assets and/or people in real-time or near-real-time. An Real-time locating systems (RTLS) is made up of specialized fixed receivers or readers (location sensors) that receive wireless signals from tiny ID badges or tags affixed to items of interest and/or people to establish their location within a building or other limited indoor or outdoor environment. Each tag sends out its unique ID. The tag ID is associated with the item or person to which it is linked.To know about the Research Methodology:-Request Free Sample Report Real-time locating systems (RTLS) have evolved into an essential component of many existing ubiquitous location-aware technologies. While GPS (global positioning system) has been extremely effective as an outdoor real-time locating solution, it has not been as successful indoors. Several RTLS solutions have been utilized to address indoor tracking issues. The capacity to precisely locate items and humans indoors has several uses in healthcare. Report Scope: The Real Time Location System Market report includes comprehensive information on the strategies of the industry's top players, as well as an examination of the various segments and geographies. The Real Time Location System Market research report examines the global market size, growth tendencies, competitor analysis analyses, and regional economic situation. Initiatives, growth possibilities, manufacturing techniques, and cost structures are all assessed. Figures for import/export consumption, supply and demand, cost, price, revenue, and gross margins are also included in this report. The study focuses on significant breakthroughs in the industry, as well as organic and inorganic growth strategies. Multinational enterprises are emphasizing organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth techniques found in the market analysed in the report included mergers, collaborations, and partnerships. These measures have paved the way for market participants to grow their businesses and customer base. Industry participants in the market are estimated to benefit from attractive growth prospects in the future due to rising demand in the global market. The research focuses on the key industry participants, including business profiles, components, and services provided, financial data from the preceding three years, and significant changes in the previous five years. In addition, important company profiles, SWOT analysis, and market strategies in the embedded software industry are included in the Real Time Location System Market report.

Research Methodology:

The Real Time Location System Market report is conducted with the help of both primary and secondary data sources. During the qualitative research, the government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and the technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges, are all investigated. To provide the final quantitative and qualitative data, all potential influences on the markets covered by this research study were studied, extensively researched, confirmed by primary research, and assessed. Market size is balanced for top-level markets and sub-segments, and market forecasting takes into account the impact of inflation, economic downturns, policy changes, and other variables. Comprehensive primary research was carried out to gather information and validate and verify the essential facts arrived at after extensive market engineering and estimates for industry statistics; market size estimations; market forecasts segmentation; and data triangulation. To do market estimation and forecasting for the overall market segments and sub-segments included in this research, the bottom-up strategy is frequently used in the whole market engineering process, along with different data triangulation techniques. Secondary data sources include nationalized and global data sources, annual and financial reports from significant market participants, press releases, and so on, whereas primary data was collected through interviews, surveys, expert and trained professional opinions, etc.Real Time Location System Market Dynamics

Higher ROIs can be achieved because of RTLS solutions. The use of Real Time Location System solutions may result in a reduction in the number of capital investments or inventories. Real Time Location systems precisely track asset location, allowing companies to record when a product is out of service and also how long it spends in maintenance, which is a significant cost-cutting strategy. Customers may restrict their purchases and avoid owning more equipment than necessary by utilizing RTLS to better assess real-time use (dwell times vs. time in use). Thus, reducing excessive capital expenditure, assuring on-time availability of equipment, and limiting or reducing maintenance downtime, damage, robbery, and day-to-day accidental loss can all result in a high return on investment (RoI). Real Time Location System enhance productivity by reducing the time it takes to identify an asset, which is especially beneficial for transportation, biomedical engineering, and nursing employees. Equipment searches and documentation connected to assets cause delays in the whole process, reducing productivity. RTLS systems reduce that period and give real-time data on all of these assets with accurate locations, resulting in increased productivity. The Real Time Location System solutions are rapidly being used in supply chain operations across sectors to save time and reduce mistakes while increasing the inventory turnover ratio, lowering costs, and enhancing return on investment. RTLS systems do more than simply track assets and workers; they also allow businesses to manage their assets to increase efficiency by analysing data and forecasting possible problems. Many organizations are delivering big data analytics in collaboration with RTLS to give corporations with higher ROI and to help them manage their assets and staff better. RTLS also saves money in the healthcare business by preventing unneeded rents. As a result, the Real Time Location System Market is expected to grow through the forecast period. Concerns about integrity and confidentiality restrict RTLS deployment. Data integrity and confidentiality are key concerns for employees in a variety of sectors, notably in the health sector. Cyber-attacks in healthcare have never been more frequent, and they are a big concern for any business wanting to build an RTLS access point into their network and systems. RTLSs are transforming a variety of sectors where resource utilization is essential. RTLS correctly identifies an individual's location at all times and gives the visibility essential to keep people safe. However, union members in many sectors claim that an RTLS system might be used to unfairly monitor certain employees' break time and working hours, while in other circumstances, people are concerned about losing their independence. The volume of electronic data in the United States doubles every three years, owing to the growing usage of the Internet, smartphones, social media networks, and the proliferation of machine-generated data, such as RFID tags, sensors, and video surveillance. For example, a patient's medical and health data can be disclosed outside of HIPAA protection by several sources while engaging in routine healthcare activities such as credit card transactions for physician visit copays and over-the-counter medications, as well as visits to alternative medical practitioners. As a result, as the digital world grows, so does public anxiety about privacy, which in turn Real Time Location System Market growth. Indoor proximity services using BLE and UWB Indoor location technologies are evolving as companies consider new methods to improve user experience and make profits. Businesses and organizations are increasingly attempting to leverage these services, which include indoor navigation, asset monitoring, analytics, and proximity-based services. BLE Beacons have made a range of indoor proximity services widely available in recent years with their low-cost, simple-to-use solutions. They are useful for low-accuracy location services in which the smartphone detects proximity to beacons and determines the room or department the user is in. However, beacons are insufficient for use cases that require a more exact position, which is where the UWB solution comes in, delivering indoor precision in millimetres. The FCC authorized the UWB spectrum for commercial usage in 2005 for pulse-based transmission in the 3 to 10.5 GHz frequency range. The focus here is on sensor data collecting and accuracy locating and tracking applications. They use UWB to compute the distance in centimetres by measuring the time it takes a signal to travel from a transmitter to a receiver. This approach provides significantly more accurate distance information than measuring distance using iBeacons based on signal strength. The apps can get precise location data (within a 20-cm margin of error), and position updates can be given every 100 ms if needed. A tiny UWB tag will be worn by the user to track their exact position. The tag has a UWB transmitter and may be powered by the phone's USB connection or a coin-size battery with a one-year lifespan. It sends a ping signal over UWB for every position update and has an acceleration meter that keeps it at rest if it is not moving. Innovative Breakthrough: Next-Gen RTLS Unveiled, Meeting High Precision, Bandwidth, and Energy Efficiency Standards. Various RTLS solution vendors supply various technology for various applications. These systems provide a variety of technological improvements, including long-range, low power, and great precision. However, vendors of RTLS solutions face the problem of delivering a single solution that provides all of the benefits. RTLS is made up of hardware and software that are used to track and transmit real-time locations of assets and resources. Tags, readers, or sensors are utilized to track and monitor assets, people, or any valuable resource with great accuracy and mobility everywhere in the network's coverage area. RTLS tags, on the other hand, have difficulties due to a complex trade-off between accuracy, power consumption, and range. Narrowband tags lack the accuracy necessary for some applications, whereas wideband tags give accuracy but have a restricted range; also, some wideband tags are big and consume more power. The trade-off between range, precision, and power consumption must be reduced or eliminated by RTLS providers. The amount of tags per network cell in RTLSs is a significant consideration since it varies based on the application, such as human tracking in a hospital or asset tracking in a storehouse or other facilities. A large number of tags necessary for particular applications may provide a challenge for RTLS systems. When evaluating tag density, two elements are crucial to consider: the duration of the broadcast packet and blink rate (the rate of transmission). The loss of packets may be tolerated if the network protocol's efficiency and blink rate (short blink interval) is increased, increasing the overall number of tags while maintaining tracking speed.Real Time Location System Market Segment Analysis

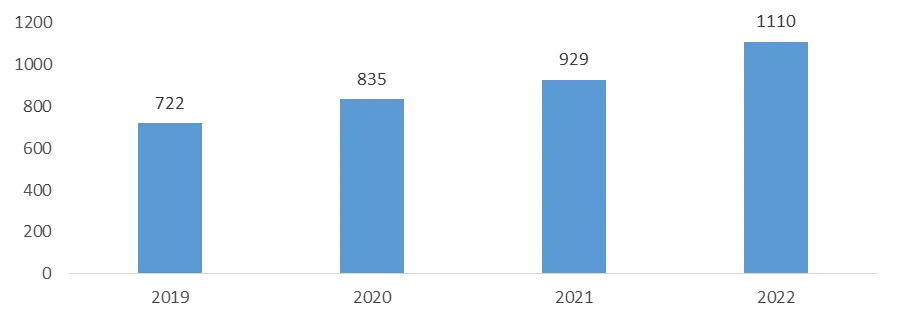

By Vertical, the Healthcare segment dominated the market in 2023 with the largest market share and is expected to maintain its dominance at the end of the forecast period due to its wide range of applications in the healthcare industry. The healthcare industry utilizes Real-Time Location Systems (RTLS) to enhance patient experiences, reduce processing times, and ensure high-quality care. Advantech's MSDF technology simplifies medical treatment, improving efficiency and safety in healthcare environments. RTLS is crucial in emergencies, tracking patient movements, ensuring safety, and addressing issues like Alzheimer's and dementia. It aids in throughput management, diagnosing bottlenecks, and optimizing workflows. Amid challenges like the current outbreak, aging populations, and workforce shortages, hospitals are turning to RTLS to enhance efficiency and address obstacles. The growing trend of connected wearables further fuels the Real Time Location System market growth.Number of connected wearable devices worldwide from 2019 to 2022 (in millions)

Real Time Location System Market Regional Analysis:

North America held the largest market share of the Real Time Location System Market in 2023 and is expected to grow substantially during the forecast period, as the high demand for the healthcare sector is one of the primary drivers for the regional market. Because of the area's healthcare revolution, the region is one of the main contributors to the RTLS market for the healthcare vertical. Many healthcare facilities and senior care centers in North America, particularly in the United States, are utilizing RTLS systems for a variety of applications. Multinational enterprises that provide RTLS solutions have a presence in this region, which contributes to the growth of the Real Time Location System Market in North America. North America is a leading market for cutting-edge technology used in real-time applications of tracking and monitoring assets in enterprises due to its technological advancement and development. The United States is the largest RTLS market in North America, and the country's development may be ascribed to its well-established economy, which allows for investments in new technologies. The increased acceptance of RTLS solutions in healthcare, industrial, manufacturing, and commercial applications is also contributing to the Real Time Location System Market's growth in North America. The Asia Pacific market is expected to grow at the highest CAGR during the forecast period owing to the untapped applications of RTLS solutions in different industries. Healthcare has been the most important industry for RTLS solutions and is expected to grow significantly during the forecast period. The healthcare industry is increasing in developing countries like India and China, and the growing working population has boosted the growth of the Real Time Location System Market in the Asia Pacific region. The real-time location system (RTLS) industry is being shaped by technological advancements. The majority of RTLS organizations are focused on providing technical solutions for real-time asset and personnel tracking. For example, Advantech, a China-based provider of industrial computing platform solutions, introduced a real-time location system solution-ready package (SRP) based on multi-mode sensing dynamic fusion (MSDF) technology in July 2020. Along with the healthcare organization, the industrialization and manufacturing sectors are increasing in Asia Pacific's emerging countries, which is important for the growth of the RLTS market. India's manufacturing sector has the potential to reach USD 1 trillion by the end of the forecast period, and India is placed among the world's top three growth economies and manufacturing markets in 2023. The rising industrialization also benefits sectors such as warehouse management, shipping, and logistics management, eventually fueling the growth of the Real Time Location System Market. In addition, the European market is also expected to grow substantially during the forecast period. The market is increasing due to increased demand in the manufacturing and healthcare sectors. Considerable healthcare and stringent regulation are driving market growth in the European area. The European RTLS market was worth USD 500.2 million in 2018. During the forecast period, this region is expected to grow at a CAGR of 30%. High technological awareness, a growing trend in the deployment of real-time locating systems in government applications and other industries, the presence of a well-established economy, substantial investment by government and the private sector in technological innovations, people's high purchasing power, and early adoption of this technology are all factors contributing to Real Time Location System Market growth.Real Time Location System Market Scope: Inquire before buying

Real Time Location System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.91 Bn. Forecast Period 2024 to 2030 CAGR: 27.34% Market Size in 2030: US $ 32.09 Bn. Segments Covered: by Offering Hardware Software Services by Technology RFID Wi-Fi UWB Bluetooth Low Energy (BLE) Infrared (IR) Ultrasound GPS Others by Application Inventory/asset tracking & management Personnel/staff locating & monitoring (includes patient tracking) Access control/security Environmental monitoring Yard, dock, fleet & warehouse management & monitoring Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) Others by Vertical Healthcare Manufacturing and Automotive Retail Transportation and logistics Government and defense Education Oil & gas, mining Sports & Entertainment Others Real Time Location System Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Real Time Location System Market Key Players:

North America: 1. Stanley Healthcare, USA 2. Zebra Technologies, USA 3. Aruba Networks, USA 4. Impinj. USA 5. Savi Technology, USA 6. Awarepoint, USA 7. ien Technology , USA 8. DecaWave, Ireland 9. Redpine Signals, USA 10. Visible Assets, USA 11. Mojix, USA 12. CenTrak, USA 13. Cerner Corporation, USA 14. GE Healthcare, USA 15. Cisco Systems, USA 16. IBM Corporation, USA Europe: 17. eleTracking Technologies, United Kingdom 18. Ubisense Group, United Kingdom 19. AiRISTA Flow, France 20. Identec Group, Austria 21. Litum Technologies, Turkey 22. Tracktio, Spain 23. OpenRTLS, Turkey 24. Sonitor Technologies, Norway 25. STATSports Technologies, United Kingdom FAQs: 1. Which region has the largest share in Global Real Time Location System Market? Ans: North America region holds the highest share in 2023. 2. What is the growth rate of Global Real Time Location System Market? Ans: The Global Real Time Location System Market is growing at a CAGR of 27.34% during forecasting period 2024-2030. 3. What segments are covered in Global Real Time Location System market? Ans: Global Real Time Location System Market is segmented into Technology, Application, Vertical, Offering and region. 4. Who are the key players in Global Real Time Location System market? Ans: The important key players in the Global Real Time Location System Market are – Zebra Technologies, Aruba Networks, IMPINJ, Savi Technology, eleTracking Technologies, Ubisense Group, AiRISTA Flow, Awarepoint, Identec Group, Alien Technology, DecaWave. 5. What is the study period of this market? Ans: The Global Real Time Location System Market is studied from 2023 to 2030.

1. Real Time Location System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Real Time Location System Market: Dynamics 2.1. Real Time Location System Market Trends by Region 2.1.1. North America Real Time Location System Market Trends 2.1.2. Europe Real Time Location System Market Trends 2.1.3. Asia Pacific Real Time Location System Market Trends 2.1.4. Middle East and Africa Real Time Location System Market Trends 2.1.5. South America Real Time Location System Market Trends 2.2. Real Time Location System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Real Time Location System Market Drivers 2.2.1.2. North America Real Time Location System Market Restraints 2.2.1.3. North America Real Time Location System Market Opportunities 2.2.1.4. North America Real Time Location System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Real Time Location System Market Drivers 2.2.2.2. Europe Real Time Location System Market Restraints 2.2.2.3. Europe Real Time Location System Market Opportunities 2.2.2.4. Europe Real Time Location System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Real Time Location System Market Drivers 2.2.3.2. Asia Pacific Real Time Location System Market Restraints 2.2.3.3. Asia Pacific Real Time Location System Market Opportunities 2.2.3.4. Asia Pacific Real Time Location System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Real Time Location System Market Drivers 2.2.4.2. Middle East and Africa Real Time Location System Market Restraints 2.2.4.3. Middle East and Africa Real Time Location System Market Opportunities 2.2.4.4. Middle East and Africa Real Time Location System Market Challenges 2.2.5. South America 2.2.5.1. South America Real Time Location System Market Drivers 2.2.5.2. South America Real Time Location System Market Restraints 2.2.5.3. South America Real Time Location System Market Opportunities 2.2.5.4. South America Real Time Location System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Real Time Location System Industry 2.8. Analysis of Government Schemes and Initiatives For Real Time Location System Industry 2.9. Real Time Location System Market Trade Analysis 2.10. The Global Pandemic Impact on Real Time Location System Market 3. Real Time Location System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Real Time Location System Market Size and Forecast, by Offering (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Real Time Location System Market Size and Forecast, by Technology (2023-2030) 3.2.1. RFID 3.2.2. Wi-Fi 3.2.3. UWB 3.2.4. Bluetooth Low Energy (BLE) 3.2.5. Infrared (IR) 3.2.6. Ultrasound 3.2.7. GPS 3.2.8. Others 3.3. Real Time Location System Market Size and Forecast, by Application (2023-2030) 3.3.1. Inventory/asset tracking & management 3.3.2. Personnel/staff locating & monitoring (includes patient tracking) 3.3.3. Access control/security 3.3.4. Environmental monitoring 3.3.5. Yard, dock, fleet & warehouse management & monitoring 3.3.6. Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) 3.3.7. Others 3.4. Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 3.4.1. Healthcare 3.4.2. Manufacturing and Automotive 3.4.3. Retail 3.4.4. Transportation and logistics 3.4.5. Government and defense 3.4.6. Education 3.4.7. Oil & gas, mining 3.4.8. Sports & Entertainment 3.4.9. Others 3.5. Real Time Location System Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Real Time Location System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Real Time Location System Market Size and Forecast, by Offering (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Real Time Location System Market Size and Forecast, by Technology (2023-2030) 4.2.1. RFID 4.2.2. Wi-Fi 4.2.3. UWB 4.2.4. Bluetooth Low Energy (BLE) 4.2.5. Infrared (IR) 4.2.6. Ultrasound 4.2.7. GPS 4.2.8. Others 4.3. North America Real Time Location System Market Size and Forecast, by Application (2023-2030) 4.3.1. Inventory/asset tracking & management 4.3.2. Personnel/staff locating & monitoring (includes patient tracking) 4.3.3. Access control/security 4.3.4. Environmental monitoring 4.3.5. Yard, dock, fleet & warehouse management & monitoring 4.3.6. Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) 4.3.7. Others 4.4. North America Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 4.4.1. Healthcare 4.4.2. Manufacturing and Automotive 4.4.3. Retail 4.4.4. Transportation and logistics 4.4.5. Government and defense 4.4.6. Education 4.4.7. Oil & gas, mining 4.4.8. Sports & Entertainment 4.4.9. Others 4.5. North America Real Time Location System Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Real Time Location System Market Size and Forecast, by Offering (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.2. United States Real Time Location System Market Size and Forecast, by Technology (2023-2030) 4.5.1.2.1. RFID 4.5.1.2.2. Wi-Fi 4.5.1.2.3. UWB 4.5.1.2.4. Bluetooth Low Energy (BLE) 4.5.1.2.5. Infrared (IR) 4.5.1.2.6. Ultrasound 4.5.1.2.7. GPS 4.5.1.2.8. Others 4.5.1.3. United States Real Time Location System Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Inventory/asset tracking & management 4.5.1.3.2. Personnel/staff locating & monitoring (includes patient tracking) 4.5.1.3.3. Access control/security 4.5.1.3.4. Environmental monitoring 4.5.1.3.5. Yard, dock, fleet & warehouse management & monitoring 4.5.1.3.6. Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) 4.5.1.3.7. Others 4.5.1.4. United States Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 4.5.1.4.1. Healthcare 4.5.1.4.2. Manufacturing and Automotive 4.5.1.4.3. Retail 4.5.1.4.4. Transportation and logistics 4.5.1.4.5. Government and defense 4.5.1.4.6. Education 4.5.1.4.7. Oil & gas, mining 4.5.1.4.8. Sports & Entertainment 4.5.1.4.9. Others 4.5.2. Canada 4.5.2.1. Canada Real Time Location System Market Size and Forecast, by Offering (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada Real Time Location System Market Size and Forecast, by Technology (2023-2030) 4.5.2.2.1. RFID 4.5.2.2.2. Wi-Fi 4.5.2.2.3. UWB 4.5.2.2.4. Bluetooth Low Energy (BLE) 4.5.2.2.5. Infrared (IR) 4.5.2.2.6. Ultrasound 4.5.2.2.7. GPS 4.5.2.2.8. Others 4.5.2.3. Canada Real Time Location System Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Inventory/asset tracking & management 4.5.2.3.2. Personnel/staff locating & monitoring (includes patient tracking) 4.5.2.3.3. Access control/security 4.5.2.3.4. Environmental monitoring 4.5.2.3.5. Yard, dock, fleet & warehouse management & monitoring 4.5.2.3.6. Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) 4.5.2.3.7. Others 4.5.2.4. Canada Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 4.5.2.4.1. Healthcare 4.5.2.4.2. Manufacturing and Automotive 4.5.2.4.3. Retail 4.5.2.4.4. Transportation and logistics 4.5.2.4.5. Government and defense 4.5.2.4.6. Education 4.5.2.4.7. Oil & gas, mining 4.5.2.4.8. Sports & Entertainment 4.5.2.4.9. Others 4.5.3. Mexico 4.5.3.1. Mexico Real Time Location System Market Size and Forecast, by Offering (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico Real Time Location System Market Size and Forecast, by Technology (2023-2030) 4.5.3.2.1. RFID 4.5.3.2.2. Wi-Fi 4.5.3.2.3. UWB 4.5.3.2.4. Bluetooth Low Energy (BLE) 4.5.3.2.5. Infrared (IR) 4.5.3.2.6. Ultrasound 4.5.3.2.7. GPS 4.5.3.2.8. Others 4.5.3.3. Mexico Real Time Location System Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Inventory/asset tracking & management 4.5.3.3.2. Personnel/staff locating & monitoring (includes patient tracking) 4.5.3.3.3. Access control/security 4.5.3.3.4. Environmental monitoring 4.5.3.3.5. Yard, dock, fleet & warehouse management & monitoring 4.5.3.3.6. Supply chain management & operational automation/visibility (includes container tracking and work-in-progress tracking) 4.5.3.3.7. Others 4.5.3.4. Mexico Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 4.5.3.4.1. Healthcare 4.5.3.4.2. Manufacturing and Automotive 4.5.3.4.3. Retail 4.5.3.4.4. Transportation and logistics 4.5.3.4.5. Government and defense 4.5.3.4.6. Education 4.5.3.4.7. Oil & gas, mining 4.5.3.4.8. Sports & Entertainment 4.5.3.4.9. Others 5. Europe Real Time Location System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.2. Europe Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.4. Europe Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5. Europe Real Time Location System Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.1.2. United Kingdom Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.1.3. United Kingdom Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.2.2. France Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.2.3. France Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.3.2. Germany Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.3.3. Germany Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.4.2. Italy Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.4.3. Italy Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.5.2. Spain Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.5.3. Spain Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.6.2. Sweden Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.6.3. Sweden Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.7.2. Austria Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.7.3. Austria Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Real Time Location System Market Size and Forecast, by Offering (2023-2030) 5.5.8.2. Rest of Europe Real Time Location System Market Size and Forecast, by Technology (2023-2030) 5.5.8.3. Rest of Europe Real Time Location System Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Real Time Location System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.2. Asia Pacific Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5. Asia Pacific Real Time Location System Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.1.2. China Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. China Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.2.2. S Korea Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. S Korea Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.3.2. Japan Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Japan Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.4.2. India Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. India Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.5.2. Australia Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Australia Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.6.2. Indonesia Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Indonesia Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.7.2. Malaysia Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Malaysia Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.8.2. Vietnam Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Vietnam Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.9.2. Taiwan Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.9.3. Taiwan Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Real Time Location System Market Size and Forecast, by Offering (2023-2030) 6.5.10.2. Rest of Asia Pacific Real Time Location System Market Size and Forecast, by Technology (2023-2030) 6.5.10.3. Rest of Asia Pacific Real Time Location System Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Real Time Location System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Real Time Location System Market Size and Forecast, by Offering (2023-2030) 7.2. Middle East and Africa Real Time Location System Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Real Time Location System Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 7.5. Middle East and Africa Real Time Location System Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Real Time Location System Market Size and Forecast, by Offering (2023-2030) 7.5.1.2. South Africa Real Time Location System Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. South Africa Real Time Location System Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Real Time Location System Market Size and Forecast, by Offering (2023-2030) 7.5.2.2. GCC Real Time Location System Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. GCC Real Time Location System Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Real Time Location System Market Size and Forecast, by Offering (2023-2030) 7.5.3.2. Nigeria Real Time Location System Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Nigeria Real Time Location System Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Real Time Location System Market Size and Forecast, by Offering (2023-2030) 7.5.4.2. Rest of ME&A Real Time Location System Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. Rest of ME&A Real Time Location System Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 8. South America Real Time Location System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Real Time Location System Market Size and Forecast, by Offering (2023-2030) 8.2. South America Real Time Location System Market Size and Forecast, by Technology (2023-2030) 8.3. South America Real Time Location System Market Size and Forecast, by Application(2023-2030) 8.4. South America Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 8.5. South America Real Time Location System Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Real Time Location System Market Size and Forecast, by Offering (2023-2030) 8.5.1.2. Brazil Real Time Location System Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. Brazil Real Time Location System Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Real Time Location System Market Size and Forecast, by Offering (2023-2030) 8.5.2.2. Argentina Real Time Location System Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. Argentina Real Time Location System Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Real Time Location System Market Size and Forecast, by Offering (2023-2030) 8.5.3.2. Rest Of South America Real Time Location System Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Rest Of South America Real Time Location System Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Real Time Location System Market Size and Forecast, by Vertical (2023-2030) 9. Global Real Time Location System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Real Time Location System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Stanley Healthcare, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Zebra Technologies, USA 10.3. Aruba Networks, USA 10.4. Impinj. USA 10.5. Savi Technology, USA 10.6. Awarepoint, USA 10.7. ien Technology , USA 10.8. DecaWave, Ireland 10.9. Redpine Signals, USA 10.10. Visible Assets, USA 10.11. Mojix, USA 10.12. CenTrak, USA 10.13. Cerner Corporation, USA 10.14. GE Healthcare, USA 10.15. Cisco Systems, USA 10.16. IBM Corporation, USA 10.17. eleTracking Technologies, United Kingdom 10.18. Ubisense Group, United Kingdom 10.19. AiRISTA Flow, France 10.20. Identec Group, Austria 10.21. Litum Technologies, Turkey 10.22. Tracktio, Spain 10.23. OpenRTLS, Turkey 10.24. Sonitor Technologies, Norway 10.25. STATSports Technologies, United Kingdom 11. Key Findings 12. Industry Recommendations 13. Real Time Location System Market: Research Methodology 14. Terms and Glossary