The Proton Therapy Market size was valued at USD 0.9 Billion in 2023 and the total Proton Therapy revenue is expected to grow at a CAGR of 8.4% from 2024 to 2030, reaching nearly USD 1.58 Billion in 2030.Proton Therapy Market Overview

The MMR report a detailed analysis of the proton therapy market and its growth factors because of technological advancements, rising cancer rates, and expanded oncology applications. Also, the report covers key players' investments and their business strategies for further market growth and innovations. Investing in R&D for next-generation, cost-effective, and compact proton treatment devices has enormous promise for technological advancement. Partnerships or investments in additional proton therapy centers, particularly in disadvantaged areas, present promising opportunities for treatment center expansion. The development of software solutions for treatment planning, optimization, and patient data management opens up numerous prospects in data and analytics. Innovative finance strategies targeted at reducing high treatment costs and increasing patient affordability are viable areas for improvement. These programs jointly help to advance proton therapy technology, increase treatment accessibility, and improve patient results. Technological advancements are pushing the development of proton treatment systems that are smaller, faster, and less expensive, hence increasing their reach and enhancing patient access. Efforts to improve insurance coverage through campaigning and regulatory reforms are going to improve affordability and ensure greater access to proton therapy treatments. The focus on customized medicine is growing, with specific treatment programs that employ modern technology such as proton therapy gaining traction. In addition, developing healthcare infrastructure and rising income in emerging economies are opening up new markets for proton treatment, giving prospects for continued market growth and innovation in the field.To know about the Research Methodology :- Request Free Sample Report

Proton Therapy Market Dynamics

Increasing Incidence of Cancer Proton treatment outperforms traditional radiation therapy by delivering precise beams of protons that deposit the majority of their energy within the tumor, reducing harm to surrounding healthy tissues and increasing patient outcomes. According to MMR analysis, expecting 21.5 million new cancer cases worldwide in 2024 and a projected increase to 23 million by 2030, demand for advanced and targeted therapies such as proton therapy is predicted to soar. It is especially important in delicate cases such as pediatric cancers and tumors near essential organs, highlighting the growing need for accurate and effective cancer treatment options. The growing demand for proton treatment is pushing more investment in facilities and technological developments. Globally, operational proton treatment centers increased from 127 in 2018 to 154 in 2023, showing this upward trend. Also, the growing industry is encouraging research and development activities to investigate new applications for proton therapy, broadening its potential for treating diverse cancers. It shows the dynamic environment of proton therapy, with continual advancements aimed at meeting the changing demands of cancer patients globally.Increased awareness among patients and healthcare providers Traditional attitudes about proton therapy are changing as awareness campaigns and media coverage point out its benefits. Proton therapy, unlike standard radiation therapy, reduces collateral damage to healthy tissues, lowering toxicity and adverse effects. It correlates to a higher quality of life after treatment, potentially reducing long-term consequences. Patient advocacy groups, medical associations, and treatment centers use targeted outreach initiatives to educate patients, including informational campaigns and patient testimonials. The shift in mindset promotes a better understanding and acceptance of proton therapy as a useful and less invasive therapeutic alternative. Rising patient awareness causes a surge in demand for proton therapy, resulting in expenditures in facility expansion, equipment upgrades, and clinical research, which drives market growth. It informed patient demand reshapes treatment paradigms, prompting healthcare professionals to investigate proton therapy for qualified patients, driving its acceptance in the healthcare landscape.

High Initial Investment Establishing a proton therapy center incurs significant costs for specialized infrastructure construction, which includes storing complicated equipment such as synchrotrons, cyclotrons, and gantry. In addition, significant expenditure is required for staff training to operate and maintain this complex technology. Financial costs range between USD 100 million and USD 300 million, providing issues for smaller healthcare organizations. Limited accessibility further limits patient access, especially in underserved areas. Overall, the high expenditures of building, equipment, and training, combined with limited accessibility, provide substantial challenges for healthcare providers seeking to create proton treatment clinics. Market growth for proton therapy faces limitations due to the high initial investment, potentially hindering widespread adoption. Geographic disparities are expected to arise, with availability concentrated in developed regions or major healthcare institutions, leading to unequal access. Additionally, healthcare providers are expected to prioritize cost-effective treatment options over proton therapy, even if they offer less precise targeting. These factors collectively impede the increase of the proton therapy market, as healthcare organizations grapple with investment challenges, geographic inequalities, and the balancing act between precision and affordability in cancer treatment strategies.

According to MMR analysis, it showed that 38% of cancer patients were aware of proton therapy, as compared to 25% in 2018. The number of news articles mentioning "proton therapy" increased from 2,500 in 2018 to 4,200 in 2023. Globally, 27 new proton therapy centers opened between 2018 and 2023. Proton Therapy Market Segment Analysis

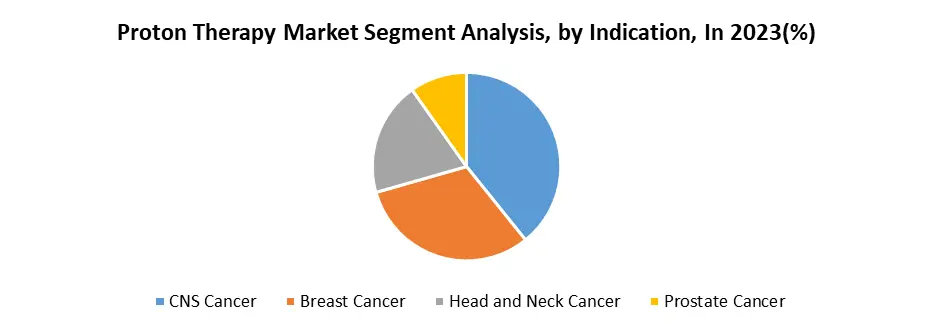

By Indication, The CNS Cancer segment accounts for an estimated 40% of the overall Proton Therapy Market. Proton treatment provides unmatched precision in delivering doses to cancers near vital organs in the brain and spine while reducing irradiation of healthy tissues when compared to standard X-ray radiotherapy. The resulting accuracy reduces the danger of neurocognitive side effects, improves quality of life by preserving memory, learning, and balance, and lowers the chance of subsequent malignancies due to less harm to surrounding tissues. Increased awareness of these benefits among patients and healthcare professionals increases demand for proton treatment for CNS malignancies, which is supported by strong clinical research and encouraging results from ongoing trials. The increasing demand for CNS cancer treatment drives the need for more proton therapy centers, resulting in market growth for manufacturers and service providers. Focused research and development efforts aim to design smaller, more cost-effective proton therapy systems tailored for treating CNS malignancies, hence increasing accessibility. Expanded insurance coverage for proton therapy in CNS cancer cases, driven by growing data and activism, makes treatment more affordable for patients. Collaborations between healthcare facilities, research centers, and technology companies strive to improve treatment procedures and patient access for CNS malignancies, thereby advancing the field.

Proton Therapy Market Regional Insights

North America has emerged as the dominant player in the worldwide proton treatment industry, with a significant 32.5% share projected by 2034. The leadership position is supported by a strong healthcare infrastructure, superior medical technology, and extensive insurance coverage. Also, the region is seeing an increase in demand as cancer rates rise, people become more aware of treatment possibilities, and the government takes steps to help. These combined variables contribute to proton treatment's high acceptance rates in North America, indicating how important it is in defining the trajectory of the global proton therapy industry. Technological advancements in the proton treatment field, identified by inventions such as Mevion's S250i, aim to improve accessibility through smaller, more affordable devices. The rise in demand is consistent with rising market investment, aided by public-private partnerships and venture capital backing, as illustrated by ProNova Solutions' $40 million investment in the United States in 2023. Also, growing knowledge of the benefits of proton therapy is driving increased insurance coverage, making treatment more affordable for patients. These combined efforts highlight a positive trend in the proton therapy sector toward increased accessibility, affordability, and market development, driven by technology advancements, financial investments, and changing insurance coverage rules. The National Cancer Institute (NCI) funds research and clinical trials to determine the efficacy of proton therapy across a variety of cancer types. The Centers for Medicare and Medicaid Services (CMS) have expanded coverage for select diseases that can be treated with proton therapy. At the national level, a variety of initiatives provide financial assistance or tax breaks to develop proton treatment centers. In the North American market, the United States dominates, holding more than 80% of operational centers as of 2023. The dominance is supported by reasons such as increased healthcare spending, sophisticated medical infrastructure, and a large cancer patient population, focusing on the country's essential role in creating the proton therapy landscape. 1. As of 2023, North America has 89 proton therapy centres, followed by Europe with 42 2. According To MMR studies, 30% of all cancer patients in North America have access to proton Therapy. Proton Therapy Market Competitive Landscape IBA Worldwide, headquartered in Belgium, is a major global company known for its ProteusPLUS and PencilBeam technologies. Varian Medical Systems, established in the United States, provides a wide range of proton therapy products, including the ProBeam system, and underscores major investments in R&D. Hitachi, a major participant in Japan, specializes in compact and cost-effective solutions with its Mevion S250i system, which dominates the Asian market. Proton Partners International, established in the United States, manages proton treatment centers and encourages collaborations to improve accessibility. Sumitomo Heavy Industries, based in Japan, provides HIROSHIMA MC40 cyclotron technology for proton treatment facilities, contributing to technological developments in the industry. Varian will launch the Ethos Alpha, a cutting-edge proton therapy device with AI-powered capabilities, in 2023. The same year, IBA introduced the ProteusPLUS PencilBeam 360°, which offers improved dose conformity and treatment efficiency. In 2022, Mevion will introduce the S250i ProBeam, an updated and more compact version of its flagship technology. Also in 2022, ProNova Solutions received FDA certification for its radiate proton therapy system, which has the potential to transform the market environment. These achievements illustrate the ongoing innovation in the proton therapy field, with each new system offering enhanced capabilities and promising to change the future of cancer treatment. 1. In the year 2021 April, the Collaboration of Tractebel and IBA worldwide with increased support to the agreement and increased designing of the proton therapy and improved infrastructures. 2. Covenant Health, one of the leading integrated healthcare delivery systems, recently acquired Provision CARES Proton Therapy Center in Knoxville, and as a result, The Thompson Cancer Survival Center, the health system's comprehensive oncology service line, is going to provide a new treatment option in July 2022. The acquisition would help the health system achieve its goal of improving the area's quality of life through better health. Thanks to this investment, cancer patients in the area are going to able to continue receiving services.Proton Therapy Market Scope: Inquire before buying

Global Proton Therapy Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 0.9 Bn. Forecast Period 2024 to 2030 CAGR: 8.4% Market Size in 2030: US $ 1.58 Bn. Segments Covered: by Product Accelerator Patient Positioning System Beam Transport System Nozzle and Image Viewers Beam Delivery System by Indication CNS Cancer Breast Cancer Head and Neck Cancer Prostate Cancer by End User Hospitals Proton Therapy Centers Proton Therapy Market, by Region:

1. North America (United States, Canada, and Mexico) 2. Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) 3. Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) 4. Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) 5. South America (Brazil, Argentina Rest of South America)Key Players in the Proton Therapy Market

1. IBA 2. Varian Medical Systems. 3. Hitachi. 4. Mevion. 5. Sumitomo Heavy Industries. 6. ProNova (Provision Healthcare) 7. ProTom International. 8. Francis H 9. Paul Scherrer Institute (PSI) - Switzerland 10. Proton Therapy Center Czech - Czech Republic. 11. Curie Institute - France. 12. Samsung Medical Center (South Korea) 13. Apollo Proton Cancer center (India) 14. Shenzhen Tumor Hospital (China) 15. Hitachi 16. Mevion Medical Systems 17. ProNova Solutions 18. ProTom International 19. Varian Medical Systems 20. protontherapy.sahmri.org 21. tractebel FAQs: 1. Which types of cancers can be treated with proton therapy? Ans. Proton therapy can be used to treat a wide range of cancers, including prostate cancer, breast cancer, lung cancer, brain tumors, pediatric cancers, and others. It is particularly beneficial for tumors located near critical organs or in pediatric patients. 2. What factors are driving the growth of the proton therapy market? Ans. Factors driving market growth include the increasing incidence of cancer, advancements in technology, rising awareness and acceptance of proton therapy, government initiatives, and funding, the establishment of new proton therapy centers, growing clinical evidence supporting its efficacy, and partnerships and collaborations in the healthcare industry. 3. What is the projected market size & and growth rate of the proton therapy Market? Ans. The Proton Therapy Market size was valued at USD 0.9 Billion in 2023 and the total Proton Therapy revenue is expected to grow at a CAGR of 8.4% from 2023 to 2030, reaching nearly USD 1.58 Billion in 2030. 4. What segments are covered in the Proton Therapy Market report? Ans. The segments covered in the Proton Therapy market report are Product, Indication, and End-Users.

1. Proton Therapy Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Proton Therapy Market: Dynamics 2.1. Proton Therapy Market Trends by Region 2.1.1. North America Proton Therapy Market Trends 2.1.2. Europe Proton Therapy Market Trends 2.1.3. Asia Pacific Proton Therapy Market Trends 2.1.4. Middle East and Africa Proton Therapy Market Trends 2.1.5. South America Proton Therapy Market Trends 2.2. Proton Therapy Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Proton Therapy Market Drivers 2.2.1.2. North America Proton Therapy Market Restraints 2.2.1.3. North America Proton Therapy Market Opportunities 2.2.1.4. North America Proton Therapy Market Challenges 2.2.2. Europe 2.2.2.1. Europe Proton Therapy Market Drivers 2.2.2.2. Europe Proton Therapy Market Restraints 2.2.2.3. Europe Proton Therapy Market Opportunities 2.2.2.4. Europe Proton Therapy Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Proton Therapy Market Drivers 2.2.3.2. Asia Pacific Proton Therapy Market Restraints 2.2.3.3. Asia Pacific Proton Therapy Market Opportunities 2.2.3.4. Asia Pacific Proton Therapy Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Proton Therapy Market Drivers 2.2.4.2. Middle East and Africa Proton Therapy Market Restraints 2.2.4.3. Middle East and Africa Proton Therapy Market Opportunities 2.2.4.4. Middle East and Africa Proton Therapy Market Challenges 2.2.5. South America 2.2.5.1. South America Proton Therapy Market Drivers 2.2.5.2. South America Proton Therapy Market Restraints 2.2.5.3. South America Proton Therapy Market Opportunities 2.2.5.4. South America Proton Therapy Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Proton Therapy Industry 2.8. Analysis of Government Schemes and Initiatives For Proton Therapy Industry 2.9. Proton Therapy Market Trade Analysis 2.10. The Global Pandemic Impact on Proton Therapy Market 3. Proton Therapy Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Proton Therapy Market Size and Forecast, by Product (2023-2030) 3.1.1. Accelerator 3.1.2. Patient Positioning System 3.1.3. Beam Transport System 3.1.4. Nozzle and Image Viewers 3.1.5. Beam Delivery System 3.2. Proton Therapy Market Size and Forecast, by Indication (2023-2030) 3.2.1. CNS Cancer 3.2.2. Breast Cancer 3.2.3. Head and Neck Cancer 3.2.4. Prostate Cancer 3.3. Proton Therapy Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals 3.3.2. Proton Therapy Centers 3.4. Proton Therapy Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Proton Therapy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Proton Therapy Market Size and Forecast, by Product (2023-2030) 4.1.1. Accelerator 4.1.2. Patient Positioning System 4.1.3. Beam Transport System 4.1.4. Nozzle and Image Viewers 4.1.5. Beam Delivery System 4.2. North America Proton Therapy Market Size and Forecast, by Indication (2023-2030) 4.2.1. CNS Cancer 4.2.2. Breast Cancer 4.2.3. Head and Neck Cancer 4.2.4. Prostate Cancer 4.3. North America Proton Therapy Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Proton Therapy Centers 4.4. North America Proton Therapy Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Proton Therapy Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Accelerator 4.4.1.1.2. Patient Positioning System 4.4.1.1.3. Beam Transport System 4.4.1.1.4. Nozzle and Image Viewers 4.4.1.1.5. Beam Delivery System 4.4.1.2. United States Proton Therapy Market Size and Forecast, by Indication (2023-2030) 4.4.1.2.1. CNS Cancer 4.4.1.2.2. Breast Cancer 4.4.1.2.3. Head and Neck Cancer 4.4.1.2.4. Prostate Cancer 4.4.1.3. United States Proton Therapy Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospitals 4.4.1.3.2. Proton Therapy Centers 4.4.2. Canada 4.4.2.1. Canada Proton Therapy Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Accelerator 4.4.2.1.2. Patient Positioning System 4.4.2.1.3. Beam Transport System 4.4.2.1.4. Nozzle and Image Viewers 4.4.2.1.5. Beam Delivery System 4.4.2.2. Canada Proton Therapy Market Size and Forecast, by Indication (2023-2030) 4.4.2.2.1. CNS Cancer 4.4.2.2.2. Breast Cancer 4.4.2.2.3. Head and Neck Cancer 4.4.2.2.4. Prostate Cancer 4.4.2.3. Canada Proton Therapy Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospitals 4.4.2.3.2. Proton Therapy Centers 4.4.3. Mexico 4.4.3.1. Mexico Proton Therapy Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Accelerator 4.4.3.1.2. Patient Positioning System 4.4.3.1.3. Beam Transport System 4.4.3.1.4. Nozzle and Image Viewers 4.4.3.1.5. Beam Delivery System 4.4.3.2. Mexico Proton Therapy Market Size and Forecast, by Indication (2023-2030) 4.4.3.2.1. CNS Cancer 4.4.3.2.2. Breast Cancer 4.4.3.2.3. Head and Neck Cancer 4.4.3.2.4. Prostate Cancer 4.4.3.3. Mexico Proton Therapy Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospitals 4.4.3.3.2. Proton Therapy Centers 5. Europe Proton Therapy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.2. Europe Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.3. Europe Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4. Europe Proton Therapy Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.1.3. United Kingdom Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.2.3. France Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.3.3. Germany Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.4.3. Italy Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.5.3. Spain Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.6.3. Sweden Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.7.3. Austria Proton Therapy Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Proton Therapy Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Proton Therapy Market Size and Forecast, by Indication (2023-2030) 5.4.8.3. Rest of Europe Proton Therapy Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Proton Therapy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.3. Asia Pacific Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Proton Therapy Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.1.3. China Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.2.3. S Korea Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.3.3. Japan Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.4.3. India Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.5.3. Australia Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.6.3. Indonesia Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.7.3. Malaysia Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.8.3. Vietnam Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.9.3. Taiwan Proton Therapy Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Proton Therapy Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Proton Therapy Market Size and Forecast, by Indication (2023-2030) 6.4.10.3. Rest of Asia Pacific Proton Therapy Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Proton Therapy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Proton Therapy Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Proton Therapy Market Size and Forecast, by Indication (2023-2030) 7.3. Middle East and Africa Proton Therapy Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Proton Therapy Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Proton Therapy Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Proton Therapy Market Size and Forecast, by Indication (2023-2030) 7.4.1.3. South Africa Proton Therapy Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Proton Therapy Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Proton Therapy Market Size and Forecast, by Indication (2023-2030) 7.4.2.3. GCC Proton Therapy Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Proton Therapy Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Proton Therapy Market Size and Forecast, by Indication (2023-2030) 7.4.3.3. Nigeria Proton Therapy Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Proton Therapy Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Proton Therapy Market Size and Forecast, by Indication (2023-2030) 7.4.4.3. Rest of ME&A Proton Therapy Market Size and Forecast, by End User (2023-2030) 8. South America Proton Therapy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Proton Therapy Market Size and Forecast, by Product (2023-2030) 8.2. South America Proton Therapy Market Size and Forecast, by Indication (2023-2030) 8.3. South America Proton Therapy Market Size and Forecast, by End User(2023-2030) 8.4. South America Proton Therapy Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Proton Therapy Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Proton Therapy Market Size and Forecast, by Indication (2023-2030) 8.4.1.3. Brazil Proton Therapy Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Proton Therapy Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Proton Therapy Market Size and Forecast, by Indication (2023-2030) 8.4.2.3. Argentina Proton Therapy Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Proton Therapy Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Proton Therapy Market Size and Forecast, by Indication (2023-2030) 8.4.3.3. Rest Of South America Proton Therapy Market Size and Forecast, by End User (2023-2030) 9. Global Proton Therapy Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Proton Therapy Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. IBA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Varian Medical Systems. 10.3. Hitachi. 10.4. Mevion. 10.5. Sumitomo Heavy Industries. 10.6. ProNova (Provision Healthcare) 10.7. ProTom International. 10.8. Francis H 10.9. Paul Scherrer Institute (PSI) - Switzerland 10.10. Proton Therapy Center Czech - Czech Republic. 10.11. Curie Institute - France. 10.12. Samsung Medical Center (South Korea) 10.13. Apollo Proton Cancer center (India) 10.14. Shenzhen Tumor Hospital (China) 10.15. Hitachi 10.16. Mevion Medical Systems 10.17. ProNova Solutions 10.18. ProTom International 10.19. Varian Medical Systems 10.20. protontherapy.sahmri.org 10.21. tractebel 11. Key Findings 12. Industry Recommendations 13. Proton Therapy Market: Research Methodology 14. Terms and Glossary