Project Portfolio Management Market size was valued at US$ 4.73 Bn. in 2022 and the total revenue is expected to grow at 6.2% through 2023 to 2029, reaching nearly US$ 7.21 Bn.Project Portfolio Management Market Overview:

Project portfolio management (PPM) is a term that refers to a set of tools and solutions that businesses use to prioritise and manage activities inside interconnected, dependent, and linked projects. PPM assists in estimating prospective project costs and returns, combining data for business analytics, and projecting market trends. It entails using various heuristic models, scoring methodologies, and visual or mapping tools to foresee future problems, assess progress toward operational goals, manage budgets, and resolve stakeholders' concerns. As a result, it is widely used in a variety of industries, including energy, telecommunications, defense, banking, financial services and insurance (BFSI), and manufacturing.To know about the Research Methodology :- Request Free Sample Report

Project Portfolio Management Market Dynamics:

One of the primary reasons driving the market's growth is the rising trend of digitalization, as well as the growing requirement for automation across sectors. Additionally, increased integration of cloud computing services and growing prevalence of connected devices, particularly in small and medium-sized businesses, are boosting market development. PPM providers are offering sophisticated solutions to businesses that can support agile approaches, allowing them to obtain end-to-end project transparency, control project costs, and reduce failure rates. As per a PMI poll, 87 percent of marketer’s executives say their company fully comprehends the benefits of project management. As per a 2022 poll by Wellingtone Limited, 83 percent of participants claimed they have one or more PMOs. Businesses may use project portfolio management software to boost efficiency, accelerate innovation, and react to quickly changing economic and competitive dynamics. Time monitoring, data analytics, and cost management are just a few of the features included in the PPM programme. The industry's development prospects are likely to be buoyed by rising adoption of connected devices in emerging economies such as Brazil, China, and India. Also, a surge in the trend of bringing your own device (BYOD), along with companies' rising worry about obtaining a faster Return on Investment (ROI) and the requirement for prompt and effective administration, is likely to propel market growth throughout the forecast period. Also, the healthcare industry's extensive use of PPM is a growth-inducing driver. These tools help healthcare organisations manage and assess a huge number of projects by combining them into strategic portfolios and simplifying their processes for greater efficiency. Other factors, such as rising urbanisation and broad software use in the healthcare and life sciences industries, as well as strong research and development (R&D) efforts in the realm of information technology (IT), are expected to fuel the market even further. However, Cost and project difficulties, as well as personal data protection and privacy concerns, particularly in the case of cloud deployment, are some of the challenges that impede the implementation of PPM solutions, limiting market development.Project Portfolio Management Market Segment Analysis:

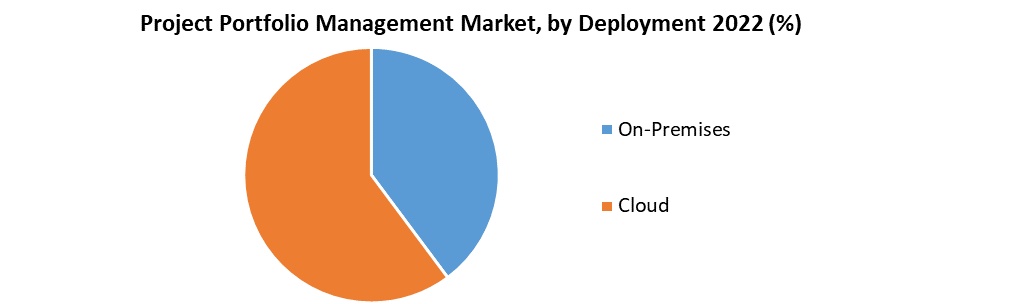

The Project Portfolio Management Market is segmented by Offering, Deployment, Organization Size and End-User. Based on The Offering, the global Project Portfolio Management market is sub-segmented into Solution and Services. The Services segment held the largest market share of xx% in 2022. The market participants' novel services, such as process evaluation, process improvement, and reporting and analysis, may be credited for the surge in demand. Project portfolio management services including on-the-job communication, assignment regulating regulations, and programme facilitation services have improved, allowing firms to compare macro-environmental elements that contribute to greater productivity and ROI. The operation & maintenance service segment is estimated to grow at the highest rate percentage throughout the forecast period. The increasing number of SMEs employing project portfolio management systems has had a beneficial impact on the demand for installation and maintenance services. Based on The Deployment, the global Project Portfolio Management market is sub-segmented into On-Premises and Cloud. The On-Premises segment held the largest market share of xx% in 2022. Because all sensitive data is held inside and there is no possibility of it being exposed to a third-party, an on-premise solution gives you complete control over the programme. Companies have much more customizable options with on-premise deployment. Businesses are increasingly turning to cloud-based options, as on-premise systems have higher operational costs. Additional point of concern is the high maintenance requirements, as it is the business's responsibility to maintain and expand the system as necessary. However, the cloud segment is expected to grow at CAGR of xx% in the global project portfolio management market during the forecast period. Because cloud-based solutions are more cost-effective and flexible, users are more likely to use them. Cloud solutions provide better scalability, lower deployment costs, and ongoing development. Because of its virtual presence, cloud-based solutions facilitate the delivery of services by allowing enterprises to access data across linked devices at any time.

Project Portfolio Management Market Regional Insights:

North America held the 2nd largest market share of 27% in 2022. As a result of a huge number of firms spending heavily in projects each year, the PPM industry in this region has seen tremendous growth. Users have been pushed to embrace more PPM solutions with growing integration platforms as a result of technological breakthroughs like cloud computing and BYOD (Bring Your Own Device). MCAD (Mechanical Computer-Aided Design) is in high demand in nations like the United States and Canada, while ECAD (Electronic Computer-Aided Design) in project software design is also boosting market growth. In addition, the rising focus of enterprises on encouraging employee cooperation and increasing team efficiency is fueling market growth in North America. According to a LinkedIn poll conducted in 2022, 72.3% of Teenagers in the United States valued the option to collaborate with others when completing a course. Asia Pacific is expected to grow at a highest CAGR of xx% in the global Project Portfolio Management market during the forecast period. As a result of the presence of emerging economies such as China and India The increased use of portable devices such as mobile phones, laptops, and tablets is propelling the PPM industry in this region forward. As corporate procedures become more difficult as a result of region-wide operations and telecommuting, the region's use of project portfolio management technologies is expected to rise. The objective of the report is to present a comprehensive analysis of the global Project Portfolio Management Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Project Portfolio Management Market dynamic, structure by analyzing the market segments and project the global Project Portfolio Management Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Project Portfolio Management Market make the report investor’s guide.Project Portfolio Management Market Scope: Inquire before buying

Project Portfolio Management Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.73 Bn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US $ 7.21 Bn. Segments Covered: by Offering Solution Services by Deployment On-Premises Cloud by Organization Size Small and Medium Size Enterprise Large Enterprise by End-User Banking, Financial Services and Insurance (BFSI) IT and Telecom Consumer Goods and Retail Healthcare and Life Sciences Manufacturing Government and Defense Energy and Utilities Others (Transportation and Logistics, and Marine and Shipbuilding) Project Portfolio Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Project Portfolio Management Market Key Players are:

1. Broadcom 2. Celoxis Technologies Pvt. Ltd. 3. Changepoint Corporation 4. HP Development Company, L.P. 5. ServiceNow 6. Planview, Inc. 7. Planisware 8. Microsoft 9. Oracle 10.Workfront, Inc. 11.CA Technologies 12.SAP 13.Software AG 14.Upland 15.Hexagon 16.Clarizen 17.Sciforma 18.Micro Focus 19.One2Team 20.WorkOtter 21.Monday.comFrequently Asked Questions:

1] What segments are covered in Project Portfolio Management Market report? Ans. The segments covered in Project Portfolio Management Market report are based on Offering, Deployment, Organization Size and End-User. 2] Which region is expected to hold the highest share in the global Project Portfolio Management Market? Ans. North America is expected to hold the highest share in the global Project Portfolio Management Market. 3] What is the market size of global Project Portfolio Management Market by 2029? Ans. The market size of global Project Portfolio Management Market is expected to reach US $ 7.21 Bn. by 2029. 4] Who are the top key players in the global Project Portfolio Management Market? Ans. Broadcom, Celoxis Technologies Pvt. Ltd., Changepoint Corporation, HP Development Company, L.P., ServiceNow, Planview, Inc. and Planisware are the top key players in the global Project Portfolio Management Market. 5] What was the market size of global Project Portfolio Management Market in 2022? Ans. The market size of global Project Portfolio Management Market in 2022 was US $ 4.73 Bn.

1. Global Project Portfolio Management Market: Research Methodology 2. Global Project Portfolio Management Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Project Portfolio Management Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Project Portfolio Management Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Project Portfolio Management Market Segmentation 4.1 Global Project Portfolio Management Market, by Offering (2022-2029) • Solution • Services 4.2 Global Project Portfolio Management Market, by Deployment (2022-2029) • On-premises • Cloud 4.3 Global Project Portfolio Management Market, by Organization Size (2022-2029) • Small and Medium Size Enterprise • Large Enterprise 4.4 Global Project Portfolio Management Market, by End-User (2022-2029) • Banking, Financial Services and Insurance (BFSI) • IT and Telecom • Consumer Goods and Retail • Healthcare and Life Sciences • Manufacturing • Government and Defense • Energy and Utilities • Others (Transportation and Logistics, and Marine and Shipbuilding) 5. North America Project Portfolio Management Market(2022-2029) 5.1 Global Project Portfolio Management Market, by Offering (2022-2029) • Solution • Services 5.2 Global Project Portfolio Management Market, by Deployment (2022-2029) • On-premises • Cloud 5.3 Global Project Portfolio Management Market, by Organization Size (2022-2029) • Small and Medium Size Enterprise • Large Enterprise 5.4 Global Project Portfolio Management Market, by End-User (2022-2029) • Banking, Financial Services and Insurance (BFSI) • IT and Telecom • Consumer Goods and Retail • Healthcare and Life Sciences • Manufacturing • Government and Defense • Energy and Utilities • Others (Transportation and Logistics, and Marine and Shipbuilding) 5.4 North America Project Portfolio Management Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Project Portfolio Management Market (2022-2029) 6.1. Asia Pacific Project Portfolio Management Market, by Offering (2022-2029) 6.2. Asia Pacific Project Portfolio Management Market, by Deployment (2022-2029) 6.3. Global Project Portfolio Management Market, by Organization Size (2022-2029) 6.4. Asia Pacific Project Portfolio Management Market, by End-User (2022-2029) 6.4. Asia Pacific Project Portfolio Management Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Project Portfolio Management Market (2022-2029) 7.1 Middle East and Africa Project Portfolio Management Market, by Offering (2022-2029) 7.2. Middle East and Africa Project Portfolio Management Market, by Deployment (2022-2029) 7.3. Middle East and Africa Project Portfolio Management Market, by Organization Size (2022-2029) 7.4. Middle East and Africa Project Portfolio Management Market, by End-User (2022-2029) 7.5. Middle East and Africa Project Portfolio Management Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Project Portfolio Management Market (2022-2029) 8.1. Latin America Project Portfolio Management Market, by Type (2022-2029) 8.2. Latin America Project Portfolio Management Market, by Deployment (2022-2029) 8.3. Latin America Project Portfolio Management Market, by Organization Size (2022-2029) 8.4. Latin America Project Portfolio Management Market, by End-User (2022-2029) 8.5 Latin America Project Portfolio Management Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Project Portfolio Management Market (2022-2029) 9.1. European Project Portfolio Management Market, by Offering (2022-2029) 9.2. European Project Portfolio Management Market, by Deployment (2022-2029) 9.3. European Project Portfolio Management Market, by Organization Size (2022-2029) 9.4. Latin America Project Portfolio Management Market, by End-User (2022-2029) 9.5. European Project Portfolio Management Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Broadcom 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Celoxis Technologies Pvt. Ltd. 10.3. Changepoint Corporation 10.4. HP Development Company, L.P. 10.5. ServiceNow 10.6. Planview, Inc. 10.7. Planisware 10.8. Microsoft 10.9. Oracle 10.10. Workfront, Inc. 10.11. CA Technologies 10.12. SAP 10.13. Software AG 10.14. Upland 10.15. Hexagon 10.16. Clarizen 10.17. Sciforma 10.18. Micro Focus 10.19. One2Team 10.20. WorkOtter 10.21. Monday.com