Position Sensor Market size was valued at USD 6.50 Billion in 2023 and the total Position Sensor Revenue is expected to grow at a CAGR of 8.5 % from 2024 to 2030, reaching nearly USD 11.51 Billion in 2030.Position Sensor Market Overview:

Position Sensor is a sensor, used to detect the object’s movement & convert it into signals that are suitable for transmission, control, or processing. The sensors are normally used for measuring the distance of the body from a reference position. So, it detects how far the body has moved from one position to another, and the output is frequently used as feedback to the control system to take appropriate action. Smart position sensors are trending across the globe on account of their non-contact-sensing nature, which allows them to calibrate motion, and be used in demand settings, such as in the aerospace and healthcare sectors. With time, key players in the position sensor industry have started laughing at advanced variants.To know about the Research Methodology :- Request Free Sample Report The growing demand for the automotive industry is expected to propel the growth going advancing of the position sensors market. The automotive industry refers to the collection of companies, organizations, and activities involved in the design, development, manufacturing, marketing, sale, and maintenance of motor vehicles. Position sensors are widely use in the automotive industry for various applications owing to their ability to measure the position or movement of components and provide critical data for the proper functioning of vehicle systems. Agriculture 4.0, a term coined at the World Government Summit in the form of smart agricultural practices and precision farming, is increasingly driving the position sensor market globally. Position sensor also gains awareness, and sensors are used for generating real-time information after the analysis of the data and causing the corresponding changes in the application rate. Conventional models of the utilization of a map-based approach are considered to be more productive.

Position Sensor Market Dynamics:

The Surge of Position Sensor Market in Advanced Automobiles Rise in concern among the manufacturing industry to have in-depth and accurate information about the operations. An increasing demand for position sensors within the advanced automobile is the one factor responsible for the position sensor market. The industry is experiencing a significant thrust thanks to the escalating adoption of advanced driver assistance systems (ADAS) in vehicles. ADAS encompasses a range of safety and convenience features, such as lane-keeping assistance, adaptive cruise control, and collision avoidance systems. The systems rely heavily on accurate position sensors to monitor the vehicle's surroundings and make real-time decisions to enhance driver safety. Additionally, the growing emphasis on vehicle electrification and the burgeoning demand for electric vehicles (EVs) have created a heightened demand for precise position sensors to ensure accurate control and safety, which is bolstering the market growth.Challenges and Opportunities in Position Sensor Manufacturing for Increased Capacity Assembling or manufacturing a position sensor is done using numerous components, such as sensing rods, diagnostic light-emitting diodes (LEDs), position magnets, electronics housing fixtures, and connectors; which are delivered by various vendors. Thereby, high costs are associated with the manufacturing of the position sensor. The product profitability depends on the availability and cost of raw materials and components along with the time consumed till the launch of the end product in the market. Increasing manufacturing capabilities, providing improved quality products, and reducing the overall cost of production are the major challenges faced by the companies functioning in this segment. Increasing manufacturing capacity, producing better products, and reducing overall production costs are the key challenges, facing the position sensor market. A wide range of manufacturing from various industries and locales are investing heavily in bolstering their production infrastructure using fully automated machine tools, which is driving up demand for position sensors.

Position Sensor Market Segment Analysis:

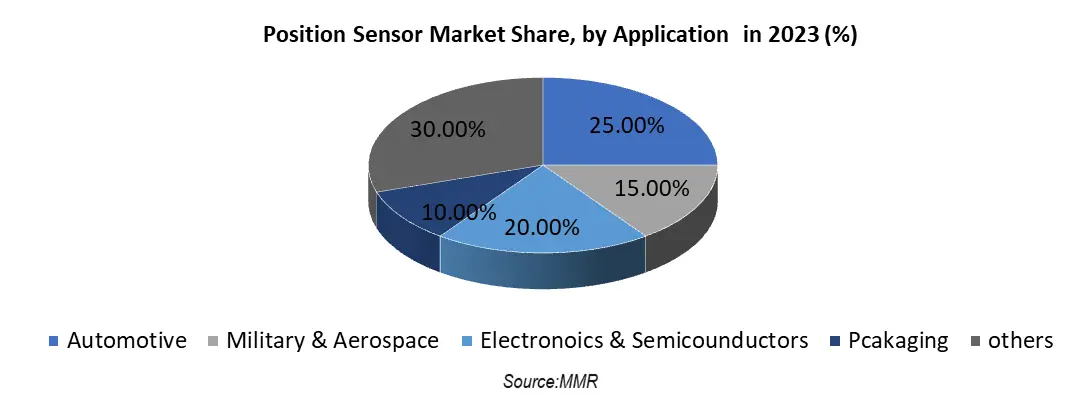

By Application, Automotive is fastest-growing segment with a market share of 25 % in 2023. Automotive sensors integrated with Internet connectivity have increased driving safety and propelled the growth of the automotive sector. The debut of innovative vehicle technologies such as self-driving cars and the rising global automobile sales are the main drivers of the automotive sensor's market development. As environmental regulations, airbag technology, comfort aspects, and electronic stability programs progress, there is an increasing demand for sensors in the industry. automotive sensors (especially LIDAR sensors) are too expensive, which makes it difficult to afford for common people, thereby plummeting the market expedition. LIDAR sensors are far more costly compared to radar sensors used in A.V.s because rare earth metals are required to produce them. While the top LIDAR sensor used by Google and Uber costs up to $80,000, the systems needed for autonomous driving also range well over $10,000. Another issue is snow and fog obscure LIDAR sensors, thereby making it difficult for them to detect any sort of thing on the road. Technological advancements in position sensor technologies, such as the development of MEMS (Micro- Electro- Mechanical Systems) sensors, optical sensors, and magnetic sensors, have automotive position sensors. The advancement has led to increased adoption of vehicles, as they offer higher accuracy, compact size, and improved durability.

Position Sensor Market Regional Analysis:

North America region holds the largest share of 30% in the Position Sensor Market. A key factor driving growth in North America is the increased emphasis on industrial automation and the integration of cutting-edge technology like Advanced Driver assistance systems and Automated Guided Vehicles in the automotive sector. The increasing dependence on position sensors for accuracy and control over movements inside automated systems is driving up demand for the technology. In the United States, larger farms are increasing their use of precision agriculture to cover the increased farm size and overcome technological barriers to implementing practices. Among the small farms in the United States, which make up greater than 85% of United States farm totals, only a few have adopted precision agriculture. According to USDA, the adoption of precision technology in corn cultivation adds marginal gains of USD 3.73 to the net returns of USD 85.0 fetched by the US corn farmers. Proximity to the U.S. market and free trade agreements with the U.S., Canada, Japan, and the European Union have propelled packaging machinery manufacturers to start manufacturing and assembly components in countries such as Brazil and Mexico. It has resulted in the high adoption of position sensors in the Latin American region. Rising trends towards the adoption of wireless sensor technology are expected to trigger industry growth in North America and Europe. Asia-Pacific has been a significant contributor to the position sensor market, owing to the presence of major manufacturing hubs, particularly in countries like China, Japan, South Korea, and India. The region's share in the position sensor market has been substantial owing to the growth of the automotive, electronics, and industrial sectors. Also, digital position sensors offer huge potential in a variety of automation applications for precise and dependable position feedback. Additionally, the growing adoption of automation and robotics in industries across the Asia Pacific region is fueling the demand for position sensors, as the sensors play a crucial role in ensuring precise and accurate positioning of robotic systems.Position Sensor Market Competitive Landscape: 1. In July 2023, Bourns, Inc. acquired the fuel level sensor product line of CTS Corporation. Adding Bourn’s sensors to CTS’s product line provides advanced sensor solutions to Bourn’s transportation customers. 2. In February 2023, CTS acquired Mag Lab AG innovator in Electric Vehicle Sensors. The acquisition provided additional abilities in sensors and electric motor control technologies. The new high-speed inductive e-motor sensor is used for detecting the precise position of the rotor in synchronous electric machines and facilitates increased efficiency and smoother operations. 3. In February 2023, Magnasphere Corporation, a US based manufacturer of magnetic contact sensor technology, acquired Variohm Group for an undisclosed amount. Through the acquisition, Magnasphere Corporation aims to expand its product portfolio and customer base, gain access to Variohm Group’s patented technology, and strengthen its position in the EV market. Variohm Group is a UK-based manufacturer.

Position Sensor Market Scope: Inquire before buying

Global Position Sensor Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.50 Bn. Forecast Period 2024 to 2030 CAGR: 8.5% Market Size in 2030: US $ 11.51 Bn. Segments Covered: by Technology Photoelectric Linear Proximity Rotary by Application Automotive Military & Aerospace Electronics & Semiconductors Packaging by Output Digital Output Analog Output Position Sensor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Position Sensor Market Key Players:

1 TE Connectivity Ltd. (Switzerland) 2. Honeywell International Inc. (United States) 3. AMS AG (Austria) 4. Allegro MicroSystems, LLC (United States) 5. Infineon Technologies AG (Germany) 6. Renishaw plc (United Kingdom) 7. MTS Systems Corporation (United States) 8.Novotechnik U.S. Inc. (United States) 9. Vishay Intertechnology, Inc. (United States) 10. ams AG (Austria) 11. Balluff GmbH (Germany) 12. Bourns, Inc. (United States) 13. Curtiss-Wright Corporation (United States) 14. Dynapar Corporation (United States) 15. Fargo Controls, Inc. (United States) 16. Hamamatsu Photonics K.K. (Japan) 17.HEIDENHAIN (Germany) 18. ifm electronic gmbh (Germany) 19. Magna International Inc. (Canada) 20.Pepperl+Fuchs GmbH (Germany) Frequently Asked Questions: 1] What segments are covered in the Position Sensor Market report? Ans. The segments covered in the Position Sensor Market report are based on, Technology, Application, and Output. 2] Which region is expected to hold the highest share in the Position Sensor Market? Ans. The North American region is expected to hold the highest share of the Position Sensor Market. 3] What is the market size of the Position Sensor Market by 2030? Ans. The market size of the Position Sensor Market by 2030 will be USD 11.51 Billion. 4] What is the forecast period for the Position Sensor Market? Ans. The Forecast period for the Position Sensor Market is 2024- 2030.

1. Position Sensor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Position Sensor Market: Dynamics 2.1. Position Sensor Market Trends by Region 2.1.1. North America Position Sensor Market Trends 2.1.2. Europe Position Sensor Market Trends 2.1.3. Asia Pacific Position Sensor Market Trends 2.1.4. Middle East and Africa Position Sensor Market Trends 2.1.5. South America Position Sensor Market Trends 2.2. Position Sensor Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Position Sensor Market Drivers 2.2.1.2. North America Position Sensor Market Restraints 2.2.1.3. North America Position Sensor Market Opportunities 2.2.1.4. North America Position Sensor Market Challenges 2.2.2. Europe 2.2.2.1. Europe Position Sensor Market Drivers 2.2.2.2. Europe Position Sensor Market Restraints 2.2.2.3. Europe Position Sensor Market Opportunities 2.2.2.4. Europe Position Sensor Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Position Sensor Market Drivers 2.2.3.2. Asia Pacific Position Sensor Market Restraints 2.2.3.3. Asia Pacific Position Sensor Market Opportunities 2.2.3.4. Asia Pacific Position Sensor Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Position Sensor Market Drivers 2.2.4.2. Middle East and Africa Position Sensor Market Restraints 2.2.4.3. Middle East and Africa Position Sensor Market Opportunities 2.2.4.4. Middle East and Africa Position Sensor Market Challenges 2.2.5. South America 2.2.5.1. South America Position Sensor Market Drivers 2.2.5.2. South America Position Sensor Market Restraints 2.2.5.3. South America Position Sensor Market Opportunities 2.2.5.4. South America Position Sensor Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Position Sensor Industry 2.8. Analysis of Government Schemes and Initiatives For Position Sensor Industry 2.9. Position Sensor Market Trade Analysis 2.10. The Global Pandemic Impact on Position Sensor Market 3. Position Sensor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Position Sensor Market Size and Forecast, by Technology (2023-2030) 3.1.1. Photoelectric 3.1.2. Linear 3.1.3. Proximity 3.1.4. Rotary 3.2. Position Sensor Market Size and Forecast, by Applications (2023-2030) 3.2.1. Automotive 3.2.2. Military & Aerospace 3.2.3. Electronics & Semiconductors 3.2.4. Packaging 3.3. Position Sensor Market Size and Forecast, by Output (2023-2030) 3.3.1. Digital Output 3.3.2. Analog Output 3.4. Position Sensor Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Position Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Position Sensor Market Size and Forecast, by Technology (2023-2030) 4.1.1. Photoelectric 4.1.2. Linear 4.1.3. Proximity 4.1.4. Rotary 4.2. North America Position Sensor Market Size and Forecast, by Applications (2023-2030) 4.2.1. Automotive 4.2.2. Military & Aerospace 4.2.3. Electronics & Semiconductors 4.2.4. Packaging 4.3. North America Position Sensor Market Size and Forecast, by Output (2023-2030) 4.3.1. Digital Output 4.3.2. Analog Output 4.4. North America Position Sensor Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Position Sensor Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. Photoelectric 4.4.1.1.2. Linear 4.4.1.1.3. Proximity 4.4.1.1.4. Rotary 4.4.1.2. United States Position Sensor Market Size and Forecast, by Applications (2023-2030) 4.4.1.2.1. Automotive 4.4.1.2.2. Military & Aerospace 4.4.1.2.3. Electronics & Semiconductors 4.4.1.2.4. Packaging 4.4.1.3. United States Position Sensor Market Size and Forecast, by Output (2023-2030) 4.4.1.3.1. Digital Output 4.4.1.3.2. Analog Output 4.4.2. Canada 4.4.2.1. Canada Position Sensor Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. Photoelectric 4.4.2.1.2. Linear 4.4.2.1.3. Proximity 4.4.2.1.4. Rotary 4.4.2.2. Canada Position Sensor Market Size and Forecast, by Applications (2023-2030) 4.4.2.2.1. Automotive 4.4.2.2.2. Military & Aerospace 4.4.2.2.3. Electronics & Semiconductors 4.4.2.2.4. Packaging 4.4.2.3. Canada Position Sensor Market Size and Forecast, by Output (2023-2030) 4.4.2.3.1. Digital Output 4.4.2.3.2. Analog Output 4.4.3. Mexico 4.4.3.1. Mexico Position Sensor Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. Photoelectric 4.4.3.1.2. Linear 4.4.3.1.3. Proximity 4.4.3.1.4. Rotary 4.4.3.2. Mexico Position Sensor Market Size and Forecast, by Applications (2023-2030) 4.4.3.2.1. Automotive 4.4.3.2.2. Military & Aerospace 4.4.3.2.3. Electronics & Semiconductors 4.4.3.2.4. Packaging 4.4.3.3. Mexico Position Sensor Market Size and Forecast, by Output (2023-2030) 4.4.3.3.1. Digital Output 4.4.3.3.2. Analog Output 5. Europe Position Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.3. Europe Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4. Europe Position Sensor Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.1.3. United Kingdom Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.2. France 5.4.2.1. France Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.2.3. France Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.3.3. Germany Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.4.3. Italy Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.5.3. Spain Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.6.3. Sweden Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.7.3. Austria Position Sensor Market Size and Forecast, by Output (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Position Sensor Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe Position Sensor Market Size and Forecast, by Applications (2023-2030) 5.4.8.3. Rest of Europe Position Sensor Market Size and Forecast, by Output (2023-2030) 6. Asia Pacific Position Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.3. Asia Pacific Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4. Asia Pacific Position Sensor Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.1.3. China Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.2.3. S Korea Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.3.3. Japan Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.4. India 6.4.4.1. India Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.4.3. India Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.5.3. Australia Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.6.3. Indonesia Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.7.3. Malaysia Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.8.3. Vietnam Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.9.3. Taiwan Position Sensor Market Size and Forecast, by Output (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Position Sensor Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific Position Sensor Market Size and Forecast, by Applications (2023-2030) 6.4.10.3. Rest of Asia Pacific Position Sensor Market Size and Forecast, by Output (2023-2030) 7. Middle East and Africa Position Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Position Sensor Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Position Sensor Market Size and Forecast, by Applications (2023-2030) 7.3. Middle East and Africa Position Sensor Market Size and Forecast, by Output (2023-2030) 7.4. Middle East and Africa Position Sensor Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Position Sensor Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa Position Sensor Market Size and Forecast, by Applications (2023-2030) 7.4.1.3. South Africa Position Sensor Market Size and Forecast, by Output (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Position Sensor Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC Position Sensor Market Size and Forecast, by Applications (2023-2030) 7.4.2.3. GCC Position Sensor Market Size and Forecast, by Output (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Position Sensor Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria Position Sensor Market Size and Forecast, by Applications (2023-2030) 7.4.3.3. Nigeria Position Sensor Market Size and Forecast, by Output (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Position Sensor Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A Position Sensor Market Size and Forecast, by Applications (2023-2030) 7.4.4.3. Rest of ME&A Position Sensor Market Size and Forecast, by Output (2023-2030) 8. South America Position Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Position Sensor Market Size and Forecast, by Technology (2023-2030) 8.2. South America Position Sensor Market Size and Forecast, by Applications (2023-2030) 8.3. South America Position Sensor Market Size and Forecast, by Output(2023-2030) 8.4. South America Position Sensor Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Position Sensor Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil Position Sensor Market Size and Forecast, by Applications (2023-2030) 8.4.1.3. Brazil Position Sensor Market Size and Forecast, by Output (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Position Sensor Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina Position Sensor Market Size and Forecast, by Applications (2023-2030) 8.4.2.3. Argentina Position Sensor Market Size and Forecast, by Output (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Position Sensor Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America Position Sensor Market Size and Forecast, by Applications (2023-2030) 8.4.3.3. Rest Of South America Position Sensor Market Size and Forecast, by Output (2023-2030) 9. Global Position Sensor Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Position Sensor Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. TE Connectivity Ltd. (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Honeywell International Inc. (United States) 10.3. AMS AG (Austria) 10.4. Allegro MicroSystems, LLC (United States) 10.5. Infineon Technologies AG (Germany) 10.6. Renishaw plc (United Kingdom) 10.7. MTS Systems Corporation (United States) 10.8. Novotechnik U.S. Inc. (United States) 10.9. Vishay Intertechnology, Inc. (United States) 10.10. ams AG (Austria) 10.11. Balluff GmbH (Germany) 10.12. Bourns, Inc. (United States) 10.13. Curtiss-Wright Corporation (United States) 10.14. Dynapar Corporation (United States) 10.15. Fargo Controls, Inc. (United States) 10.16. Hamamatsu Photonics K.K. (Japan) 10.17. HEIDENHAIN (Germany) 10.18. ifm electronic gmbh (Germany) 10.19. Magna International Inc. (Canada) 10.20. Pepperl+Fuchs GmbH (Germany) 11. Key Findings 12. Industry Recommendations 13. Position Sensor Market: Research Methodology 14. Terms and Glossary