Pitched Roof And Facade Membranes Market size was valued at USD 1617.3 Mn. in 2022 and the total Pitched Roof And Facade Membranes revenue is expected to grow by 10.5% from 2023 to 2029, reaching nearly USD 3253.32 Mn.Pitched Roof And Facade Membranes Market Overview:

The Pitched Roof and Facade membranes are both vapor-permeable and water-resistant and are commonly used in between walls, roofs, and other construction elements to protect against moisture. Polypropylene, polyethylene, and other materials are used to make breathable membranes. Pitched Roof and Facade Membranes Market are sheets or foils that allow water vapor to pass through while blocking liquid water. They can be used in external wall and roof constructions, such as tiled roofs or framed wall constructions, when the outer cladding may not be completely water-tight or moisture-resistant. Pitched Roof and Facade Membranes Market films are commonly used in areas with high precipitation, snowfall, and atmospheric moisture due to their water resistance. They are also used for wall coverings, house wraps, and roof underlays to enhance thermal efficiency and reduce energy consumption. Pitched Roof and Facade Membranes prevent issues like mold growth, moisture stains, corrosion, deterioration, and poor insulation caused by excessive humidity in buildings. The Pitched Roof and Facade Membranes Market is propelled by the membrane's affordability, the growing popularity of timber framing construction in European countries, and its superior UV resistance and facade characteristics compared to non-facade membranes and asphaltic papers. Additionally, growing environmental consciousness, efforts to protect building resources from moisture, and government regulations for construction to reduce energy consumption are driving factors in the global market.To know about the Research Methodology :- Request Free Sample Report

Pitched Roof And Facade Membranes Market Dynamics:

Pitched Roof And Facade Membranes Market Drivers: Rising Investment in Infrastructure Development to Pitched Roof And Facade Membranes Market Growth The number of construction, renovation, and refurbishing activities is increasing globally. Additionally, governments of various countries are investing significantly in developing prime and essential infrastructures, such as airports, stadiums, parking lots, and other facilities. Membrane structures offer fascinating appearances and several functional properties, such as corrosion, water, and fire resistance, which help construct state-of-the-art structures that can survive for longer periods. Modern-day construction demands innovative technologies that involve the use of energy-efficient resources. The pitched roof and facade membranes market is a tensile membrane structure made of fabric that offers several benefits, including high inherent strength, extended service life, excellent translucency, acoustical properties, and resistance to environmental attacks. The enormous range of spanning capabilities of fabrics further adds to the performance of the material. Being pliable, it has a higher potential for folding that can conveniently change its function at different times of the day or seasons of the year, further driving the popularity of tensile structures.Pitched Roof And Facade Membranes Market Restraints:

Stringent Government Regulations for Manufacturing Polyvinyl Chloride(PVC) to Restrain Market Growth The manufacturing of chlorinated plastic, including polyvinyl chloride, requires extremely toxic chemicals during the production and disposable process. The chlorine content of PVC has a high potential to produce dioxins that possess a threat to humans. Similarly, phthalates and semi-volatile organic compounds added as softeners or plasticizers can have harmful effects on the reproductive, respiratory, and endocrine systems. The market for any material or substance that possesses a threat to human health or the environment and may limit or ban the manufacturing of the substance. PTFE and ETFE are prime components used in the manufacturing of Buoropolymer, which hampers the market growth Pitched Roof And Facade Membranes Market Opportunity: The increasing waterproofing membrane in Pitched Roof And Facade Membranes Waterproofing membrane solutions also prevent moisture and water seepage in walls and ceilings that can lead to fungus or mold growth, which could cause health issues such as allergies, asthma, and other infections. The market ensures a cleaner and safer environment for inhabitants and simultaneously reduces maintenance costs. Waterproofing membranes are widely used on roofs, balconies, and terraces, among other areas. Waterproofing membrane solutions are also used for foundation waterproofing to prevent water and moisture ingress. The growing need to protect landmark buildings and residential and commercial buildings, and rising investment to develop state-of-the-art wastewater treatment facilities are further boosting demand for waterproofing membranes. In addition, rising awareness regarding the importance of waterproofing and the increasing need to reduce maintenance and remedial work are some other key factors contributing to the revenue growth of the market.Competitive Landscape:

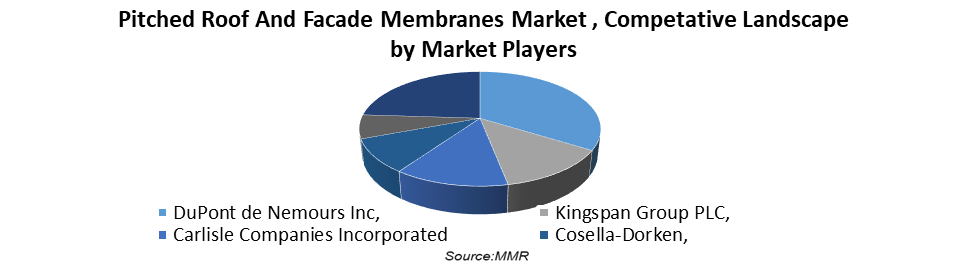

The pitched roof and facade membranes market is mergers and acquisitions, joint ventures, capacity expansion, significant distribution, and branding decisions by established industry players to improve market share and regional presence. They are also engaged in ongoing R&D activities to develop new products and are focused on expanding the product portfolio. This is expected to increase competition and pose a threat to new entrants into the market. There is no part of the house being exposed more to wind and weather than the roof. Though, the owners often underestimate the need for a complete renovation. In this condition, a well-thought-out innovation offers many advantages and the resulting renovation costs can be repaid after a few years. When it comes to the renovation of your pitched roof, we at the company DÖRKEN would like to benefit from our competence and our smart solutions for the pitched roof renovation. In addition to our standard renovation solutions, we also offer you personalized advice for an individual proposal for your roof structure. For the subsequent thermal insulation, DELTA offers an extensive range of system solutions either as above-rafter insulation or in combination with above-support insulation with between-support protection always optimally tailored to the builder's requirements and needs when it comes to energy-related aspects. The advantages of these system solutions: The renovation work can be carried out from the outside without interfering with the extended living space. The Knauf Group announced its plans to increase Mineral Wool production capacity within Central and Eastern Europe by investing near to €135 million in Knauf Insulation's facility in Tarnaveni, Romania, and Kruf Insulation signed a contract to acquire a Glass Mineral Wool plant in Central Romania

Pitched Roof And Facade Membranes Market Segment Analysis:

Based on Type, The Polyethylene segment dominated the market in the year 2022 & is expected to continue its dominance during the forecast period The breathable membranes market is divided into types such as polyethylene, polypropylene, and others. Polyethylene-based breathable membranes are expected to contribute significantly to the market during the forecast period due to their exceptional properties, including long-term UV resistance and water resistance, and increasing demand in pitched roof applications.Based on the Application, The Pitched roofs segment dominated the Pitched roof and facade membranes market in the year 2022 & is expected to continue its dominance during the forecast period. The breathable membranes market is divided by application into walls and pitched roofs. Pitched roofs offer benefits such as maintaining thermal efficiency and shielding building materials from excess moisture. The demand for better air quality, increased investments in pair and redevelopment of residential and commercial buildings, and greater attention to creating more energy-efficient building construction are expected to support market expansion. The market's growth is also fueled by the exceptional qualities of breathable membranes, such as resistance to constant UV rays and water, which have increased demand in pitched roof applications.

Based on the Region, The Asia –Pacific region segment dominated the Pitched roof and facade membranes market in the year 2022 & is expected to continue its dominance during the forecast period. Asia-Pacific, North America, Western Europe, Central & Eastern Europe, and RoW are considered the main regions of the breathable membranes market. Western Europe dominates the market, in terms of volume, owing to the increased population and nung demand for residential buildings. The rising demand for high-quality Pitched roof and facade membranes products with superior prolonged UV resistance properties and airtightness characteristics has significantly triggered the demand for breathable membranes Pitched roof and walls end-use application is contributing to the growing demand for Pitched roof and facade membranes in Western Europe

Pitched Roof And Facade Membranes Market End-Usersal Insights: Asia Pacific region segment dominated the market in the year 2022 & is expected to continue its dominance during the forecast period. The attributed to the rising demand for waterproofing membranes due to the sharp incline in the number of infrastructure development projects, rapid urbanization, increasing construction of luxurious and modern buildings, and initiatives by governments to promote the development of energy-efficient and safe commercial and residential buildings. In addition, increasing awareness regarding clean and potable water, development of water conservation infrastructure to address water shortages in developing countries, and rapid growth of the building and construction sector in countries in the region are some other factors driving revenue growth of the APAC market.

Pitched Roof And Facade Membranes Market Scope: Inquire before buying

Pitched Roof And Facade Membranes Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 1617.3 Mn. Forecast Period 2023 to 2029 CAGR: 10.5% Market Size in 2029: US$ 3253.32 Mn. Segments Covered: by Type Polyethylene (PE) Polypropylene (PP) Others by Application Pitched Roof Walls Pitched Roof And Facade Membranes Market Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Cosella-Dorken, 2. Dow, Inc., 3. DuPont de Nemours Inc, 4. GAF, 5. IKO Industries Ltd., 6. Kingspan Group PLC, 7. Knauf Insulation, 8. Low & Bonar PLC, 9. Riwega S.R.L., 10. Saint-Gobain SA, 11. Soprema Group 12. Sika AG 13. GCP Applied Technologies 14. Carlisle Companies Incorporated 15. SOPREMA Group 16. Johns Manville 17. BASF SE 18. DÖRKEN 19. Fosroc 20. Pidilite Industries Limited 21. GAF Materials Corporation Minerals Technologies Inc.Frequently Asked Questions: 1] What segments are covered in the Global Pitched Roof And Facade Membranes Market report? Ans. The segments covered in the Market report are based on Type, Application, and Region. 2] Which End-Users are expected to hold the highest share in the Global Pitched Roof And Facade Membranes Market? Ans. The Asia Pacific End-Users are expected to hold the highest share of the Pitched Roof And Facade Membranes Market. 3] What is the market size of the Global Pitched Roof And Facade Membranes Market by 2029? Ans. The market size of the Pitched Roof And Facade Membranes Market by 2029 is expected to reach US$ 3253.32 Mn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Pitched Roof And Facade Membranes Market is 2023-2029. 5] What was the market size of the Global Pitched Roof And Facade Membranes Market in 2022? Ans. The market size of the Pitched Roof And Facade Membranes Market in 2022 was valued at US$ 1617.3 Mn.

1. Pitched Roof And Facade Membranes Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pitched Roof And Facade Membranes Market: Dynamics 2.1. Pitched Roof And Facade Membranes Market Trends by Region 2.1.1. North America Pitched Roof And Facade Membranes Market Trends 2.1.2. Europe Pitched Roof And Facade Membranes Market Trends 2.1.3. Asia Pacific Pitched Roof And Facade Membranes Market Trends 2.1.4. Middle East and Africa Pitched Roof And Facade Membranes Market Trends 2.1.5. South America Pitched Roof And Facade Membranes Market Trends 2.2. Pitched Roof And Facade Membranes Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pitched Roof And Facade Membranes Market Drivers 2.2.1.2. North America Pitched Roof And Facade Membranes Market Restraints 2.2.1.3. North America Pitched Roof And Facade Membranes Market Opportunities 2.2.1.4. North America Pitched Roof And Facade Membranes Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pitched Roof And Facade Membranes Market Drivers 2.2.2.2. Europe Pitched Roof And Facade Membranes Market Restraints 2.2.2.3. Europe Pitched Roof And Facade Membranes Market Opportunities 2.2.2.4. Europe Pitched Roof And Facade Membranes Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pitched Roof And Facade Membranes Market Drivers 2.2.3.2. Asia Pacific Pitched Roof And Facade Membranes Market Restraints 2.2.3.3. Asia Pacific Pitched Roof And Facade Membranes Market Opportunities 2.2.3.4. Asia Pacific Pitched Roof And Facade Membranes Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pitched Roof And Facade Membranes Market Drivers 2.2.4.2. Middle East and Africa Pitched Roof And Facade Membranes Market Restraints 2.2.4.3. Middle East and Africa Pitched Roof And Facade Membranes Market Opportunities 2.2.4.4. Middle East and Africa Pitched Roof And Facade Membranes Market Challenges 2.2.5. South America 2.2.5.1. South America Pitched Roof And Facade Membranes Market Drivers 2.2.5.2. South America Pitched Roof And Facade Membranes Market Restraints 2.2.5.3. South America Pitched Roof And Facade Membranes Market Opportunities 2.2.5.4. South America Pitched Roof And Facade Membranes Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pitched Roof And Facade Membranes Industry 2.8. Analysis of Government Schemes and Initiatives For Pitched Roof And Facade Membranes Industry 2.9. Pitched Roof And Facade Membranes Market Trade Analysis 2.10. The Global Pandemic Impact on Pitched Roof And Facade Membranes Market 3. Pitched Roof And Facade Membranes Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 3.1.1. Polyethylene (PE) 3.1.2. Polypropylene (PP) 3.1.3. Others 3.2. Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 3.2.1. Pitched Roof 3.2.2. Walls 3.3. Pitched Roof And Facade Membranes Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Pitched Roof And Facade Membranes Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 4.1.1. Polyethylene (PE) 4.1.2. Polypropylene (PP) 4.1.3. Others 4.2. North America Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 4.2.1. Pitched Roof 4.2.2. Walls 4.3. North America Pitched Roof And Facade Membranes Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 4.3.1.1.1. Polyethylene (PE) 4.3.1.1.2. Polypropylene (PP) 4.3.1.1.3. Others 4.3.1.2. United States Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 4.3.1.2.1. Pitched Roof 4.3.1.2.2. Walls 4.3.2. Canada 4.3.2.1. Canada Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 4.3.2.1.1. Polyethylene (PE) 4.3.2.1.2. Polypropylene (PP) 4.3.2.1.3. Others 4.3.2.2. Canada Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 4.3.2.2.1. Pitched Roof 4.3.2.2.2. Walls 4.3.3. Mexico 4.3.3.1. Mexico Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 4.3.3.1.1. Polyethylene (PE) 4.3.3.1.2. Polypropylene (PP) 4.3.3.1.3. Others 4.3.3.2. Mexico Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 4.3.3.2.1. Pitched Roof 4.3.3.2.2. Walls 5. Europe Pitched Roof And Facade Membranes Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.1. Europe Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3. Europe Pitched Roof And Facade Membranes Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.1.2. United Kingdom Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.2. France 5.3.2.1. France Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.2.2. France Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.3.2. Germany Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.4.2. Italy Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.5.2. Spain Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.6.2. Sweden Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.7.2. Austria Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 5.3.8.2. Rest of Europe Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.1.2. China Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.2.2. S Korea Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.3.2. Japan Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.4. India 6.3.4.1. India Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.4.2. India Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.5.2. Australia Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.6.2. Indonesia Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.7.2. Malaysia Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.8.2. Vietnam Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.9.2. Taiwan Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Pitched Roof And Facade Membranes Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Pitched Roof And Facade Membranes Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 7.3.1.2. South Africa Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 7.3.2.2. GCC Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 7.3.3.2. Nigeria Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 7.3.4.2. Rest of ME&A Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 8. South America Pitched Roof And Facade Membranes Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 8.2. South America Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 8.3. South America Pitched Roof And Facade Membranes Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 8.3.1.2. Brazil Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 8.3.2.2. Argentina Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Pitched Roof And Facade Membranes Market Size and Forecast, by Type (2022-2029) 8.3.3.2. Rest Of South America Pitched Roof And Facade Membranes Market Size and Forecast, by Application (2022-2029) 9. Global Pitched Roof And Facade Membranes Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pitched Roof And Facade Membranes Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cosella-Dorken, 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Dow, Inc., 10.3. DuPont de Nemours Inc, 10.4. GAF, 10.5. IKO Industries Ltd., 10.6. Kingspan Group PLC, 10.7. Knauf Insulation, 10.8. Low & Bonar PLC, 10.9. Riwega S.R.L., 10.10. Saint-Gobain SA, 10.11. Soprema Group 10.12. Sika AG 10.13. GCP Applied Technologies 10.14. Carlisle Companies Incorporated 10.15. SOPREMA Group 10.16. Johns Manville 10.17. BASF SE 10.18. DÖRKEN 10.19. Fosroc 10.20. Pidilite Industries Limited 10.21. GAF Materials Corporation 11. Key Findings 12. Industry Recommendations 13. Pitched Roof And Facade Membranes Market: Research Methodology 14. Terms and Glossary