The global Phosphoric Acid Market Size was valued at USD 47.61 Bn in 2023 and is expected to reach USD 59.22 Bn by 2030, at a CAGR of 4.9 %.Overview

Phosphoric acid or orthophosphoric acid (H₃PO₄), is a colorless and odorless liquid with a syrupy consistency. It is widely used in various industries, including food and beverages, agriculture, pharmaceuticals, personal care, rust removal and chemical manufacturing. It is extracted from phosphate rocks, which is a purer form. Increasing use of phosphoric acid in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It is a key ingredient in carbonated drinks, particularly colas, where it provides a tangy taste and acts as a preservative to extend shelf life. The growing demand for carbonated beverages across the world is a key driver for Phosphoric Acid Market growth.To know about the Research Methodology :- Request Free Sample Report In agriculture, it is utilized for fertilizers, soil pH adjustment, and cleaning equipment. A major portion of phosphoric acid goes to the agricultural industry. Almost 80% of the phosphoric acid produced is employed in fertilizer production. It is also used as a flavoring agent in poultry feed. Also, phosphoric acid has industrial applications in detergent production, water treatment, and metal surface treatments. Additionally, it is employed as a rust remover and cleaning agent. Safety precautions should be taken when handling phosphoric acid due to its corrosive nature.

Phosphoric Acid Market Dynamics

Increasing Demand for Fertilizers across the World to Fuel the Market Growth Phosphoric acid is a main component in the production of phosphate fertilizers, such as diammonium phosphate (DAP) and mono-ammonium phosphate (MAP). The growth of the global population continues to increase, and the need for good agricultural productivity required better fertilizer. This higher demand for fertilizer for good products of crops is expected to consume high fertilizer consumption. Phosphoric acid's role in promoting plant growth and improving crop yields makes it an indispensable ingredient in the fertilizer industry. This is the key responsible factor for the growth of the Phosphoric Acid Market. Many governments in various regions are actively promoting sustainable agriculture practices and providing subsidies and incentives to farmers and encouraging the adoption of modern fertilizers. New regulations related to water treatment and environmental protection drive the demand for phosphoric acid in wastewater treatment processes. Such all favorable government regulations create a conducive environment for Phosphoric Acid Market growth and boost demand for the adoption of phosphoric acid in various sectors. For example, the demand for fertilizers has significantly grown year-to-year growth over the past several years on account of which the import of fertilizer products and inputs that are not domestically available has also increased substantially. Globally, India is the second-largest fertilizer-consuming country, the third-largest producer and the largest importer of fertilizer materials. In the last 30 years, consumption of fertilizer materials was growing at a CAGR of 3.3 % whereas production grew only by 2.18 % necessitating huge imports which grew at an astonishing 5.81 % during the same period. Thus government initiatives and policies that support agricultural development and the use of fertilizers are expected to influence the phosphoric acid Market. Expanding Industrial Applications to Drive Demand for Phosphoric Acid and Boost the Market Growth Phosphoric Acid is widely utilized in the production of phosphates used in food and beverages, detergents, water treatment, and metal surface treatment. In the food and beverage industry, it is used as a food additive and acidulant. Also, in particular, relies on phosphoric acid for its acidity-regulating properties and as an ingredient in carbonated beverages. It serves as an acidity regulator in cheese, processed meat, jams, cereal bars, and more. However, in the pharmaceutical sector for manufacturing drugs and in the metallurgical industry for rust removal and metal surface preparation. Additionally, used for preparing albumin derivatives, dental cement, teeth winter etc. As a result, the increasing demand for these diverse industrial applications contributes significantly to the growth of the phosphoric Acid Market size growth. The rise in demand for animal feed supplements is another driver for the Market growth potential. Phosphoric acid is used as a feed additive to provide essential phosphorus and calcium for livestock and poultry. High consumption of meat and dairy products among consumers and increasing demand for high-quality animal feed are expected to fuel the Industry’s growth. Phosphoric acid supplements play a major role in promoting animal growth, bone development, and overall health. As the livestock and poultry industry expands to meet the growing protein requirements of the population, the demand for phosphoric acid in animal feed supplements is expected to make substantial growth in Phosphoric Acid Market. Here are Some Key Trends that Boost the Market Growth over the Forecast Period 1. Increasing Adoption of Green and Sustainable Practices 2. Growing Demand for High-Purity Phosphoric Acid 3. Rising Demand for Food Additives and Acidulants 4. Growing Popularity of Carbonated Beverages 5. Expansion of the Pharmaceutical Industry 6. Surging Demand for Animal Feed Supplements 7. Emerging Markets and Urbanization 8. Development of Innovative Fertilizer Formulations Opportunities & Challenges in the Market Advancements in Agriculture Technology to Create Lucrative Opportunity for the Market As precision farming techniques and innovative agricultural technology boost productivity and profitability. With the help of this technology, farmers target their inputs (such as seeds, fertilizers, and pesticides) to specific areas of the field that need them the most, rather than applying them uniformly across the entire field. Also, improve the targeted approach of the farmers and save on inputs, as well as increase crop yield and quality. There is a growing emphasis on optimizing nutrient management and enhancing crop productivity. The development and adoption of new farming technologies, such as controlled-release fertilizers and soil testing methods, are expected to create opportunities for phosphoric acid manufacturers to provide tailored solutions that enhance nutrient utilization and improve crop yields. In developing countries witnessing economic growth and urbanization, the demand for fertilizers, industrial chemicals, and water treatment solutions increases. Additionally, the expansion of municipal water treatment facilities and the need for efficient wastewater management present significant growth opportunities for phosphoric acid manufacturers in the Phosphoric Acid Market. Environmental Concerns and Regulations One of the Major Challenges for the Phosphoric Acid Market The growing environmental concerns and strict regulations related to its production and usage. Phosphoric acid production involves the extraction of phosphate rock, a non-renewable resource, and the process generates waste byproducts, such as phosphogypsum, which poses environmental hazards if not managed properly. Additionally, excessive use of phosphoric acid-containing fertilizers can lead to water pollution and eutrophication. In response to these concerns, governments and regulatory bodies have implemented regulations and standards to limit environmental impact. Compliance with these regulations requires significant investments in sustainable production processes, waste management, and the adoption of cleaner technologies, which is expected to pose challenges for the Phosphoric Acid Market. Volatility in Raw Material Prices to Restrain the Market Growth Adopting sustainable production practices, investing in research and development for cleaner technologies, and ensuring compliance with environmental regulations required a high amount of investment cost. These are important factors for phosphoric acid manufacturers to take decisions. Also, diversifying the supply chain, exploring alternative sources of phosphate rock, and implementing effective risk management strategies can help mitigate the impact of raw material price volatility. Such is expected to restrain the Phosphoric Acid Market growth during the forecast period. Fluctuations in raw material prices have impacted the cost of phosphoric acid production, thus affecting profit margins for manufacturers.Phosphoric Acid Market Segment Analysis

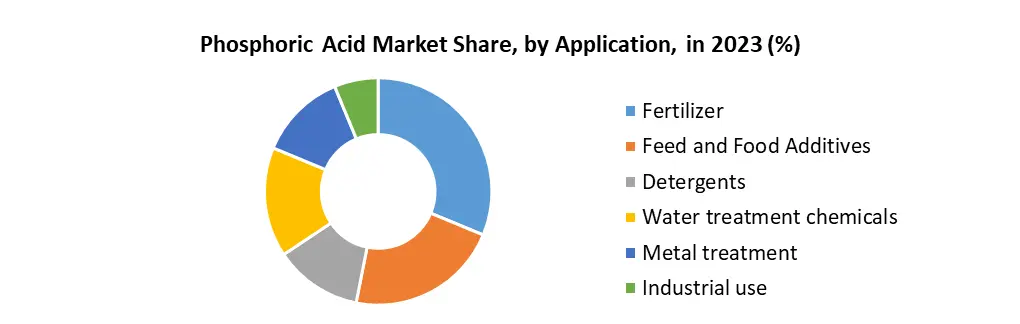

The global Phosphoric Acid Market is segmented into process type, application, grade type, industry vertical, sale and region. By Process Type: Based on the process type, the wet process segment held the largest Phosphoric Acid Market share in 2023 and is expected to grow at a significant CAGR over the forecast period. The segment growth is influenced by less cost of the wet process as heating and insulation are not required in storage or during shipment. Impurities in wet-process acid promote super cooling and minimize the tendency for crystallization. These are key drivers for the segment growth in the market. By Application: Based on the application, the fertilizer segment held the largest market share in 2023. Phosphoric acid is a key ingredient in phosphate fertilizers, such as DAP (diammonium phosphate) and MAP (monoammonium phosphate). These fertilizers provide essential nutrients such as phosphorus to enhance plant growth and improve crop yields. The increasing demand for fertilizers to meet the growing food requirements of the global population drives the dominance of this segment in the phosphoric acid market. Other various applications such as chemical manufacturing, leather and textile, cleaning agents, ceramics and refractories, agricultural fertilizers, metallurgy, water treatment, construction, mining, semiconductors, oral and dental care, pharmaceuticals and others. However, agricultural fertilizers have dominated the phosphoric acid market with a 32.49% market share due to their high essential in plant nutrition that helps in plant growth and development.

Phosphoric Acid Market Regional Analysis

The Asia Pacific region dominated the global phosphoric acid Market share with 50 % in 2023 in terms of both production and consumption. The large agricultural sectors and growing industrialization sectors are influencing demand for fertilizer and driving market growth. The presence of key manufacturers and high demand for processed food in the region shows the high consumption of fertilizer in China, India and Indonesia. Similarly, the rising population, increasing disposable incomes and expanding food and beverage industry in this region drive the demand for phosphoric acid. Government initiatives promoting sustainable agriculture practices and the use of fertilizers are expected to pose key opportunities for supporting market growth in the region. North America held the largest Phosphoric Acid Market share in 2023 and is expected to sustain its position during the forecast period. The regional growth is driven by basically, agriculture and food processing industries. The US country consumes phosphoric acid, particularly in the production of phosphate fertilizers and animal feed supplements. The well-established pharmaceutical sector and the rising use of environmentally friendly phosphoric acid-based products are expected to drive the demand for phosphoric acid in drug manufacturing. However, Europe is a developed Phosphoric Acid Market for phosphoric acid due to the well-developed agriculture sector and stringent environmental regulations. Countries like France, Germany, and Spain are major consumers of phosphoric acid, primarily for fertilizer production and water treatment applications. The region also highlights sustainable agriculture practices, which drive the demand for environmentally friendly phosphoric acid in the global market. Competitive Analysis The phosphoric acid market report includes various key players profiled such as OCP Group stands out as a dominant player with a strong global presence and a focus on expanding production capacity. The Mosaic Company excels with its diverse product portfolio and regional presence in the Americas. PhosAgro leverages its access to rich phosphate rock reserves and emphasizes quality and technological advancements. EuroChem Group, Innophos Holdings Inc., and Yara International ASA also compete strongly with their global reach, innovation focus, and sustainable practices. Other players, including Prayon Group, ICL, J.R. Simplot Company, and Ma'aden, contribute to the competitive landscape with their unique strategies and market presence. As the demand for phosphoric acid continues to grow, companies are investing in research and development while adapting to changing market dynamics to maintain their competitiveness.Phosphoric Acid Market Scope: Inquire before buying

Global Phosphoric Acid Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 47.61 Bn. Forecast Period 2024 to 2030 CAGR: 4.9% Market Size in 2030: US $ 59.22 Bn. Segments Covered: by Process Type Wet Thermal by Application Fertilizers Feed & Food Additives Detergents Water Treatment Chemicals Metal Treatment Industrial Use Others Phosphoric Acid Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argetina and Rest of South America)Phosphoric Acid Key Players

1. OCP Group 2. ICL Group Ltd 3. The Mosaic Company 4. PhosAgro 5. EuroChem Group 6. Innophos Holdings Inc. 7. Yara International ASA 8. Prayon Group 9. Israel Chemicals Ltd. (ICL) 10. J.R. Simplot Company 11. Jordan Phosphate Mines Co. (JPMC) 12. Ma'aden 13. Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) 14. CF Industries Holdings, Inc. 15. Kazphosphate LLC 16. Wengfu (Group) Co., Ltd. Frequently Asked Questions: 1] What is the growth rate of the Global Phosphoric Acid Market? Ans. The Global Phosphoric Acid Market is growing at a significant rate of 4.9 % during the forecast period. 2] Which region is expected to dominate the Global Phosphoric Acid Market? Ans. APAC region is expected to dominate the Phosphoric Acid Market growth potential during the forecast period. 3] What is the expected Global Phosphoric Acid Market size by 2030? Ans. The Phosphoric Acid Market size is expected to reach USD 59.22 Bn by 2030. 4] Which are the top players in the Global Phosphoric Acid Market? Ans. The top players in the market include OCP Group, ICL Group Ltd and others. 5] What are the factors driving the Global Phosphoric Acid Market growth? Ans. The huge population, large agriculture sector and increasing demand for fertilizer is expected to drive market growth.

1. Phosphoric Acid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Phosphoric Acid Market: Dynamics 2.1. Phosphoric Acid Market Trends by Region 2.1.1. North America Phosphoric Acid Market Trends 2.1.2. Europe Phosphoric Acid Market Trends 2.1.3. Asia Pacific Phosphoric Acid Market Trends 2.1.4. Middle East and Africa Phosphoric Acid Market Trends 2.1.5. South America Phosphoric Acid Market Trends 2.2. Phosphoric Acid Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Phosphoric Acid Market Drivers 2.2.1.2. North America Phosphoric Acid Market Restraints 2.2.1.3. North America Phosphoric Acid Market Opportunities 2.2.1.4. North America Phosphoric Acid Market Challenges 2.2.2. Europe 2.2.2.1. Europe Phosphoric Acid Market Drivers 2.2.2.2. Europe Phosphoric Acid Market Restraints 2.2.2.3. Europe Phosphoric Acid Market Opportunities 2.2.2.4. Europe Phosphoric Acid Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Phosphoric Acid Market Drivers 2.2.3.2. Asia Pacific Phosphoric Acid Market Restraints 2.2.3.3. Asia Pacific Phosphoric Acid Market Opportunities 2.2.3.4. Asia Pacific Phosphoric Acid Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Phosphoric Acid Market Drivers 2.2.4.2. Middle East and Africa Phosphoric Acid Market Restraints 2.2.4.3. Middle East and Africa Phosphoric Acid Market Opportunities 2.2.4.4. Middle East and Africa Phosphoric Acid Market Challenges 2.2.5. South America 2.2.5.1. South America Phosphoric Acid Market Drivers 2.2.5.2. South America Phosphoric Acid Market Restraints 2.2.5.3. South America Phosphoric Acid Market Opportunities 2.2.5.4. South America Phosphoric Acid Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Phosphoric Acid Industry 2.8. Analysis of Government Schemes and Initiatives For Phosphoric Acid Industry 2.9. Phosphoric Acid Market Trade Analysis 2.10. The Global Pandemic Impact on Phosphoric Acid Market 3. Phosphoric Acid Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 3.1.1. Wet 3.1.2. Thermal 3.2. Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 3.2.1. Fertilizers 3.2.2. Feed & Food Additives 3.2.3. Detergents 3.2.4. Water Treatment Chemicals 3.2.5. Metal Treatment 3.2.6. Industrial Use 3.2.7. Others 3.3. Phosphoric Acid Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Phosphoric Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 4.1.1. Wet 4.1.2. Thermal 4.2. North America Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 4.2.1. Fertilizers 4.2.2. Feed & Food Additives 4.2.3. Detergents 4.2.4. Water Treatment Chemicals 4.2.5. Metal Treatment 4.2.6. Industrial Use 4.2.7. Others 4.3. North America Phosphoric Acid Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 4.3.1.1.1. Wet 4.3.1.1.2. Thermal 4.3.1.2. United States Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Fertilizers 4.3.1.2.2. Feed & Food Additives 4.3.1.2.3. Detergents 4.3.1.2.4. Water Treatment Chemicals 4.3.1.2.5. Metal Treatment 4.3.1.2.6. Industrial Use 4.3.1.2.7. Others 4.3.2. Canada 4.3.2.1. Canada Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 4.3.2.1.1. Wet 4.3.2.1.2. Thermal 4.3.2.2. Canada Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Fertilizers 4.3.2.2.2. Feed & Food Additives 4.3.2.2.3. Detergents 4.3.2.2.4. Water Treatment Chemicals 4.3.2.2.5. Metal Treatment 4.3.2.2.6. Industrial Use 4.3.2.2.7. Others 4.3.3. Mexico 4.3.3.1. Mexico Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 4.3.3.1.1. Wet 4.3.3.1.2. Thermal 4.3.3.2. Mexico Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Fertilizers 4.3.3.2.2. Feed & Food Additives 4.3.3.2.3. Detergents 4.3.3.2.4. Water Treatment Chemicals 4.3.3.2.5. Metal Treatment 4.3.3.2.6. Industrial Use 4.3.3.2.7. Others 5. Europe Phosphoric Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.2. Europe Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3. Europe Phosphoric Acid Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.1.2. United Kingdom Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.2.2. France Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.3.2. Germany Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.4.2. Italy Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.5.2. Spain Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.6.2. Sweden Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.7.2. Austria Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 5.3.8.2. Rest of Europe Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Phosphoric Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.2. Asia Pacific Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Phosphoric Acid Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.1.2. China Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.2.2. S Korea Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.3.2. Japan Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.4.2. India Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.5.2. Australia Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.6.2. Indonesia Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.7.2. Malaysia Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.8.2. Vietnam Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.9.2. Taiwan Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Phosphoric Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 7.2. Middle East and Africa Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Phosphoric Acid Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 7.3.1.2. South Africa Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 7.3.2.2. GCC Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 7.3.3.2. Nigeria Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 7.3.4.2. Rest of ME&A Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 8. South America Phosphoric Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 8.2. South America Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 8.3. South America Phosphoric Acid Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 8.3.1.2. Brazil Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 8.3.2.2. Argentina Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Phosphoric Acid Market Size and Forecast, by Process Type (2023-2030) 8.3.3.2. Rest Of South America Phosphoric Acid Market Size and Forecast, by Application (2023-2030) 9. Global Phosphoric Acid Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Phosphoric Acid Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. OCP Group 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ICL Group Ltd 10.3. The Mosaic Company 10.4. PhosAgro 10.5. EuroChem Group 10.6. Innophos Holdings Inc. 10.7. Yara International ASA 10.8. Prayon Group 10.9. Israel Chemicals Ltd. (ICL) 10.10. J.R. Simplot Company 10.11. Jordan Phosphate Mines Co. (JPMC) 10.12. Ma'aden 10.13. Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) 10.14. CF Industries Holdings, Inc. 10.15. Kazphosphate LLC 10.16. Wengfu (Group) Co., Ltd. 11. Key Findings 12. Industry Recommendations 13. Phosphoric Acid Market: Research Methodology 14. Terms and Glossary