Global Petrochemical Feedstock Market size was valued at USD 313 Bn in 2023 and Petrochemical Feedstock market revenue is expected to reach USD 420.28 Bn by 2030, at a CAGR of 4.3% over the forecast period.Petrochemical Feedstock Market Overview

Petrochemical feedstock are produced from refined or partially refined petroleum fraction, used in the manufacturing or production of chemicals, synthetic rubber, and a variety of plastics. Fossil fuels are primary sources of basic petrochemicals and 9 to 10 % of global fossil fuel production is ultimately used as a petrochemical feedstock used in the production of energy. Naphtha, and crude oil are the feedstock often used in processes like steam cracking to produce basic petrochemicals like ethylene and propylene.To know about the Research Methodology :- Request Free Sample Report As environmental consciousness burgeons, renewable feedstock are emerging as a focal point. Derived from sources such as vegetable oils, sugarcane, and even waste materials, these bio-based feedstock are paving the way for sustainable production practices. They offer the potential to reduce the environmental impact associated with conventional fossil fuel-based feedstock. The significance of petrochemical feedstock extends beyond the manufacturing realm. The availability, cost, and composition of these raw materials wield considerable influence over the petrochemical feedstock market dynamics, as well as the broader economy.

Petrochemical Feedstock Market Dynamics

Technological Advancement in the production of petrochemical feedstock to boost the Petrochemical Feedstock Market growth Technological advancement in petrochemical production lead to more efficient conversion of feedstock into desired chemicals. These technologies reduce production costs and increase the yield of valuable products, which is expected to boost the Petrochemical Feedstock Market growth. The quest for sustainability fuels interest in renewable and alternative feedstock. Biomass, waste materials, and bio-based sources reduce reliance on fossil fuels, aligning with environmental goals. Consumer preferences for eco-friendly products influence demand for sustainable and bio-based materials, driving feedstock choices in Petrochemical Feedstock manufacturing. Rising industrialization and expanding middle classes increase the need for items derived from petrochemicals, such as plastics and synthetic fibers. Concurrently, environmental regulations shape the industry by influencing feedstock selection and production methods. Stringent regulations promoting sustainability drive the adoption of cleaner and more eco-friendly feedstock and practices. Investments in new facilities and capacity expansion significantly influence Petrochemical feedstock markets. Such developments impact petrochemical supply and feedstock availability, affecting regional production balances. Global economic conditions, including growth and recession cycles, impact demand for petrochemical products and feedstock. The demand for crude oil is increasing day by day, which significantly contributes to the growth of the market. Petrochemicals are becoming the largest driver of global oil consumption. The combination of a growing global economy and technological development translates into an increasing demand for petrochemical products. Four crucial factors govern the choice of feedstock in petrochemical plants: availability, cost, power consumption, and the product portfolio to be produced. With respect to availability, the plant owners need to be assured of continuous availability of feedstock. Even though power accounts for 10 % of the cost involved in the cracking of feedstock, interrupted high-quality power is required for the same. Hence, many petrochemical complexes use captive power. As per the portfolio of products, naphtha is used when a wide range of co-products (including propylene and butadiene derivatives) is desired while natural gas and NGL are preferred when the ethylene.Petrochemical Feedstock Market Crude Oil Demand by 2030

Price Volatility of feedstock to restrain the Petrochemical Feedstock Market growth Petrochemical feedstock prices are linked to crude oil and natural gas prices and are highly volatile. Sudden fluctuations in oil and gas markets disrupt cost structures for petrochemical producers, making it difficult to plan and manage budgets effectively. The cost of feedstock is the single largest cost in the production of petrochemicals. Estimates show that the cost of feedstock accounts for 40-60 % of total costs. However, while availability is not much of an issue for naphtha, demand for propane and butane is curtailed due to both pricing as well as domestic unavailability. LNG imports are, therefore, an increasingly sought option. Petrochemical production is associated with environmental issues such as carbon emissions and plastic waste. Stricter regulations and growing public awareness about environmental impacts are pressuring the industry to adopt cleaner and more sustainable practices, which increase costs and limit the Petrochemical Feedstock Market growth. Political conflicts, trade disputes, and international tensions disrupt supply chains and lead to feedstock supply uncertainties. Geopolitical events have far-reaching effects on petrochemical feedstock availability and pricing. The growing interest in renewable and bio-based feedstock poses a challenge to traditional Petrochemical Feedstock. As technologies for producing chemicals from renewable sources improve, there is potential for increased competition in the Petrochemical Feedstock industry. Petrochemical feedstock’s price impact on companies share price The price of petrochemical feedstock have a significant impact on the share price of companies that are involved in the production and utilization of petrochemicals. 1. Cost of Production 2. Earning and Profits 3. Demand and Consumption 4. Investor Sentiment 5. Competitive Landscape 6. Hedging and Risk Management

Petrochemical Feedstock Market Regional Analysis

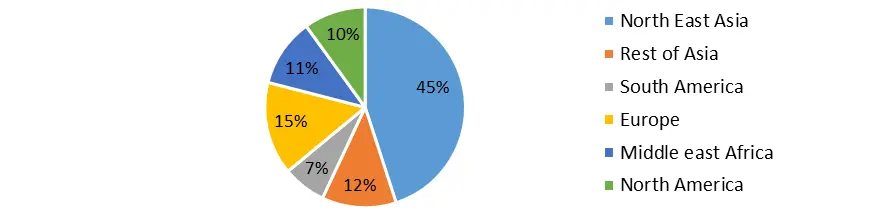

Asia Pacific dominated the market in 2023 and is expected to hold the largest Petrochemical Feedstock Market share over the forecast period. The Asia LPG demand depends heavily on the behemothic Chinese market, where the fallout from poor downstream margins has so far eclipsed the potential for fresh demand from the new buyers and the Petrochemical Feedstock key players. China imported 26.6 Mn mt of LPG in 2022, retaining its position as Asia largest LPG importer by far. 8.6% year-on-year growth in its import volume was a sharp fall from the 24.8% increase between 2020 to 2021, more than enough to take a toll on Asia LPG prices. Asia’s rising crude oil refining capacity is focused on addressing the growing demand for consumer goods and fuels and is a significant driver of the petrochemical feedstock projects in Asia Pacific. Refining capacity in China is the world’s largest automobile market and is expected to have 20 Mn barrels per day by 2025, which is expected to boost the Petrochemical Feedstock industry growth over the forecast period. The rise in Asia’s refining capacity has increased the supply of feedstock, such as naphtha, LPG, and basic petrochemicals such as ethylene and propylene, that is available in the region for petrochemical projects. Due to this factor, the regional demand for petrochemical blend stocks has increased and are used in fuel additives, such as toluene, xylenes, and MTBE. In the Middle East, where petrochemical feedstocks are cheap, and in China, where demand is surging, producers are substantially increasing capacity for a wide range of petrochemicals including polypropylene and polyethylene, which is expected to boost the Petrochemical Feedstock Market growth. Despite its extensive investment in petrochemical capacities, China is expected to remain one of the world’s largest petrochemical importers as demand continues to outstrip capacity. Increasing emphasis on sustainable and environmentally friendly practices in the petrochemical industry. Efforts are being made to optimize processes, reduce emissions, and explore alternative feedstocks.Petrochemical Feedstock Market World Consumption of Petrochemical Feedstocks in 2023

Petrochemical Feedstock Market Segmentation

Based on the Type of Feedstock, the market is segmented into Crude Oil, Natural Gas, Naphtha, and Liquefied Petroleum Gas (LPG). The naphtha segment is expected to dominate the petrochemical feedstock market over the forecast period. Naphtha is volatile and has a relatively low boiling point compared to heavier crude oil fractions. Certain types of naphtha are used as lighter fluid for lighting charcoal grills, campfires, and other outdoor fires. Naphtha is a primary feedstock used in the production of petrochemicals in consumer and industrial products and is expected to boost the Petrochemical Feedstock market. The steam cracking process is the primary application of petrochemical feedstock. The molecules produced from the steam cracking process is used to produce a wide range of product in different industry verticals. Based on End use industry, the market is segmented into Plastics and Polymers, Automotive Packaging, Construction, Textiles, Cosmetics and Personal Care, Pharmaceuticals, Agrochemicals, and Others. The automotive segment is expected to hold the largest Petrochemical Feedstock Market share over the forecast period. This segment is pivotal to the automotive industry's evolution toward more advanced and sustainable solutions. Petrochemical-based materials are used for insulation and soundproofing in vehicles, contributing to passenger comfort by reducing noise and maintaining appropriate temperatures. Petrochemical-derived adhesives and sealants are used in assembling various parts of vehicles, ensuring structural integrity and preventing leaks. The feedstock is used to develop lightweight components that contribute to improved fuel efficiency, which significantly contributes to the growth of the Petrochemical Feedstock industry.Petrochemical Feedstock Market Competitive Landscape

Petrochemical feedstock manufacturers are increasingly focusing on sustainable practices, recycling, and using renewable feedstock to reduce environmental impacts. Advances in technology, such as advanced catalysts and process optimization, are enhancing feedstock conversion efficiency has been adopted by the Petrochemical Feedstock key players. Petrochemical Feedstock Companies are looking at vertical integration to enhance their presence and strengthen their value chain. With the growth potential of the petrochemical industry, new entrants, especially in emerging markets, are challenging established players. The strategies adopted by the major player, such as expansion of product portfolio, mergers & acquisitions, geographical expansion, and collaborations, to enhance the Petrochemical Feedstock Market penetration. BASF is one of the world's leading producers of Petrochemicals Company. It is investing heavily in the development of new bio-based feedstock and technologies.Petrochemical Feedstock Market Report Scope: Inquire Before Buying

Global Petrochemical Feedstock Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 313 Bn. Forecast Period 2024 to 2030 CAGR: 4.3% Market Size in 2030: US $ 420.28 Bn. Segments Covered: by Type of Feedstock Crude Oil Natural Gas Naphtha Liquefied Petroleum Gas (LPG) by End Use Industry Plastics and Polymers Automotive Packaging Construction Textiles Cosmetics and Personal Care Pharmaceuticals Agrochemicals Others Petrochemical Feedstock Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Petrochemical Feedstock Key Players

1. Royal Dutch Shell plc 2. Saudi Arabian Oil Co. (Saudi Aramco) 3. TotalEnergies SE 4. BP plc 5. Shell Global 6. Dow Inc. 7. SABIC (Saudi Basic Industries Corporation) 8. SAE Manufacturing Specialties Corp 9. LyondellBasell Industries 10. Westlake Chemical Corp. 11. Marathon Petroleum Corporation 12. Motosel Industrial Group Inc. and MotoCare International LLC 13. Nova Chemicals Corp. 14. Patcham USA, LLC 15. China Petroleum & Chemical Corporation (Sinopec) 16. Reliance Industries Limited 17. BASFFrequently Asked Questions:

1] What is the growth rate of the Global Petrochemical Feedstock Market? Ans. The Global Petrochemical Feedstock Market is growing at a significant rate of 4.3 % over the forecast period. 2] Which region is expected to dominate the Global Petrochemical Feedstock Market? Ans. Asia Pacific region is expected to dominate the Petrochemical Feedstock Market over the forecast period. 3] What is the expected Global Petrochemical Feedstock Market size by 2030? Ans. The market size of the Petrochemical Feedstock Market is expected to reach USD 420.28 Bn by 2030. 4] Who are the top players in the Global Petrochemical Feedstock Industry? Ans. The major key players in the Global Petrochemical Feedstock Market are Saudi Arabian Oil Co. (Saudi Aramco), TotalEnergies SE, BP Plc, and Shell Global. 5] Which factors are expected to drive the Global Petrochemical Feedstock Market growth by 2030? Ans. Technological advancement in petrochemical feedstock manufacturing is expected to drive the Petrochemical Feedstock Market growth over the forecast period (2024-2030).

1. Petrochemical Feedstock Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Petrochemical Feedstock Market: Dynamics 2.1 Petrochemical Feedstock Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Petrochemical Feedstock Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Petrochemical Feedstock Market Restraints 2.4 Petrochemical Feedstock Market Opportunities 2.5 Petrochemical Feedstock Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Petrochemical Feedstock Industry 2.11 The Global Pandemic and Redefining of The Petrochemical Feedstock Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Petrochemical Feedstock Trade Analysis (2018-2023) 2.14.1 Global Import of Petrochemical Feedstock 2.14.1.1 Ten largest Importer 2.14.2 Global Export of Petrochemical Feedstock 2.14.2.1 Ten largest Exporter 2.15 Petrochemical Feedstock Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 Petrochemical Feedstock Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Petrochemical Feedstock Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 3.1.1 Crude Oil 3.1.2 Natural Gas 3.1.3 Naphtha 3.1.4 Liquefied Petroleum Gas (LPG) 3.2 Global Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 3.2.1 Plastics and Polymers 3.2.2 Automotive 3.2.3 Packaging 3.2.4 Construction 3.2.5 Textiles 3.2.6 Cosmetics and Personal Care 3.2.7 Pharmaceuticals 3.2.8 Agrochemicals 3.2.9 Others 3.3 Global Petrochemical Feedstock Market, by Region (2023-2030) 3.3.1 North America 3.3.2 Europe 3.3.3 Asia Pacific 3.3.4 Middle East and Africa 3.3.5 South America 4. North America Petrochemical Feedstock Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 4.1.1 Crude Oil 4.1.2 Natural Gas 4.1.3 Naphtha 4.1.4 Liquefied Petroleum Gas (LPG) 4.2 North America Petrochemical Feedstock Market, by End-Use Industry(2023-2030) 4.2.1 Plastics and Polymers 4.2.2 Automotive 4.2.3 Packaging 4.2.4 Construction 4.2.5 Textiles 4.2.6 Cosmetics and Personal Care 4.2.7 Pharmaceuticals 4.2.8 Agrochemicals 4.2.9 Others 4.3 North America Petrochemical Feedstock Market, by Country (2023-2030) 4.3.1 United States 4.3.1.1 United States Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 4.3.1.1.1 Crude Oil 4.3.1.1.2 Natural Gas 4.3.1.1.3 Naphtha 4.3.1.1.4 Liquefied Petroleum Gas (LPG) 4.3.1.2 United States Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 4.3.1.2.1 Plastics and Polymers 4.3.1.2.2 Automotive 4.3.1.2.3 Packaging 4.3.1.2.4 Construction 4.3.1.2.5 Textiles 4.3.1.2.6 Cosmetics and Personal Care 4.3.1.2.7 Pharmaceuticals 4.3.1.2.8 Agrochemicals 4.3.1.2.9 Others 4.3.2 Canada 4.3.2.1 Canada Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 4.3.2.1.1 Crude Oil 4.3.2.1.2 Natural Gas 4.3.2.1.3 Naphtha 4.3.2.1.4 Liquefied Petroleum Gas (LPG) 4.3.2.2 Canada Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 4.3.2.2.1 Plastics and Polymers 4.3.2.2.2 Automotive 4.3.2.2.3 Packaging 4.3.2.2.4 Construction 4.3.2.2.5 Textiles 4.3.2.2.6 Cosmetics and Personal Care 4.3.2.2.7 Pharmaceuticals 4.3.2.2.8 Agrochemicals 4.3.2.2.9 Others 4.3.3 Mexico 4.3.3.1 Mexico Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 4.3.3.1.1 Crude Oil 4.3.3.1.2 Natural Gas 4.3.3.1.3 Naphtha 4.3.3.1.4 Liquefied Petroleum Gas (LPG) 4.3.3.2 Mexico Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 4.3.3.2.1 Plastics and Polymers 4.3.3.2.2 Automotive 4.3.3.2.3 Packaging 4.3.3.2.4 Construction 4.3.3.2.5 Textiles 4.3.3.2.6 Cosmetics and Personal Care 4.3.3.2.7 Pharmaceuticals 4.3.3.2.8 Agrochemicals 4.3.3.2.9 Others 5. Europe Petrochemical Feedstock Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.2 Europe Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3 Europe Petrochemical Feedstock Market, by Country (2023-2030) 5.3.1 United Kingdom 5.3.1.1 United Kingdom Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.1.2 United Kingdom Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.2 France 5.3.2.1 France Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.2.2 France Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.3 Germany 5.3.3.1 Germany Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.3.2 Germany Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.4 Italy 5.3.4.1 Italy Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.4.2 Italy Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.5 Spain 5.3.5.1 Spain Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.5.2 Spain Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.6 Sweden 5.3.6.1 Sweden Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.6.2 Sweden Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.7 Austria 5.3.7.1 Austria Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.7.2 Austria Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 5.3.8 Rest of Europe 5.3.8.1 Rest of Europe Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 5.3.8.2 Rest of Europe Petrochemical Feedstock Market, by End-Use Industry (2023-2030). 6. Asia Pacific Petrochemical Feedstock Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.2 Asia Pacific Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3 Asia Pacific Petrochemical Feedstock Market, by Country (2023-2030) 6.3.1 China 6.3.1.1 China Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.1.2 China Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.2 South Korea 6.3.2.1 S Korea Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.2.2 S Korea Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.3 Japan 6.3.3.1 Japan Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.3.2 Japan Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.4 India 6.3.4.1 India Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.4.2 India Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.5 Australia 6.3.5.1 Australia Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.5.2 Australia Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.6 Indonesia 6.3.6.1 Indonesia Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.6.2 Indonesia Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.7 Malaysia 6.3.7.1 Malaysia Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.7.2 Malaysia Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.8 Vietnam 6.3.8.1 Vietnam Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.8.2 Vietnam Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.9 Taiwan 6.3.9.1 Taiwan Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.9.2 Taiwan Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.10 Bangladesh 6.3.10.1 Bangladesh Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.10.2 Bangladesh Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.11 Pakistan 6.3.11.1 Pakistan Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.11.2 Pakistan Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 6.3.12 Rest of Asia Pacific 6.3.12.1 Rest of Asia Pacific Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 6.3.12.2 Rest of Asia PacificPetrochemical Feedstock Market, by End-Use Industry (2023-2030) 7. Middle East and Africa Petrochemical Feedstock Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.2 Middle East and Africa Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 7.3 Middle East and Africa Petrochemical Feedstock Market, by Country (2023-2030) 7.3.1 South Africa 7.3.1.1 South Africa Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.3.1.2 South Africa Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 7.3.2 GCC 7.3.2.1 GCC Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.3.2.2 GCC Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 7.3.3 Egypt 7.3.3.1 Egypt Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.3.3.2 Egypt Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 7.3.4 Nigeria 7.3.4.1 Nigeria Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.3.4.2 Nigeria Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 7.3.5 Rest of ME&A 7.3.5.1 Rest of ME&A Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 7.3.5.2 Rest of ME&A Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 8. South America Petrochemical Feedstock Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 8.2 South America Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 8.3 South America Petrochemical Feedstock Market, by Country (2023-2030) 8.3.1 Brazil 8.3.1.1 Brazil Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 8.3.1.2 Brazil Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 8.3.2 Argentina 8.3.2.1 Argentina Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 8.3.2.2 Argentina Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 8.3.3 Rest Of South America 8.3.3.1 Rest Of South America Petrochemical Feedstock Market, by Type of Feedstock (2023-2030) 8.3.3.2 Rest Of South America Petrochemical Feedstock Market, by End-Use Industry (2023-2030) 9. Global Petrochemical Feedstock Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2023) 9.3.5 Manufacturing Locations 9.3.6 SKU Details 9.3.7 Production Capacity 9.3.8 Production for 2023 9.3.9 No. of Stores 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Petrochemical Feedstock Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Royal Dutch Shell plc 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 Saudi Arabian Oil Co. (Saudi Aramco) 10.3 TotalEnergies SE 10.4 BP plc 10.5 Shell Global 10.6 Dow Inc. 10.7 SABIC (Saudi Basic Industries Corporation) 10.8 SAE Manufacturing Specialties Corp 10.9 LyondellBasell Industries 10.10 Westlake Chemical Corp. 10.11 Marathon Petroleum Corporation 10.12 Motosel Industrial Group Inc. and MotoCare International LLC 10.13 Nova Chemicals Corp. 10.14 Patcham USA, LLC 10.15 China Petroleum & Chemical Corporation (Sinopec) 10.16 Reliance Industries Limited 10.17 BASF 11. Key Findings 12. Industry Recommendations 13. Petrochemical Feedstock Market: Research Methodology 14. Terms and Glossary