The Global Pet Tech Market size was valued at USD 5.9 Bn in 2023 and is expected to reach USD 33.1 Bn by 2030, at a CAGR of 14.8 %.Overview of the Pet Tech Market

Pet Technology, often abbreviated as "Pet Tech," denotes the application of technological advancements and solutions within the domain of pet care and pet ownership. This multifaceted field encompasses diverse products and services meticulously crafted to augment the welfare, security, and overall quality of life for pets and their caregivers. Pet Tech innovations range from intelligent pet feeding systems and GPS tracking devices tailored for pets to mobile applications that provide a spectrum of pet-related services and telemedicine solutions dedicated to veterinary care. The overarching objective of Pet Tech is to elevate the standards of pet care, surveillance, and convenience associated with pet ownership by harnessing the cutting-edge capabilities of modern technology. The graphical representation and structural exclusive information showed the dominating region of the Pet Tech Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Pet Tech Market.To know about the Research Methodology :- Request Free Sample Report

Pet Tech Market Dynamics

Convenience and Efficiency and focus on Technological Advancement are the major drivers of the Pet Tech Market A noticeable upswing in pet ownership, particularly prevalent among urban populations, has notably enlarged the potential customer base for Pet Tech offerings. With more individuals welcoming pets into their households, there has been a commensurate surge in demand for inventive solutions to efficiently care for and oversee their pets. Pets are increasingly perceived as integral members of the family, marking a significant shift in their role in our lives. Artificial intelligence and machine learning technologies are being used to develop Pet Tech solutions that can analyze and interpret pet behavior, health data, and activity patterns. These systems can provide insights into a pet's well-being and even predict health issues. Advanced pet feeders use technology to dispense food at scheduled times, often controllable via smartphone apps. Pet cameras offer live streaming and two-way communication, allowing pet owners to check in on their pets and speak to them while away from home. Some models feature interactive play capabilities, providing mental stimulation for pets. GPS and RFID-based tracking devices have become more accurate and smaller, making it easier for pet owners to locate lost pets quickly. These devices can be attached to collars or implanted under the skin. Self-cleaning litter boxes and robotic cleaning devices have improved efficiency and convenience, reducing the time and effort required for pet owners to maintain cleanliness in their pet's living environment. Biometric technology, such as fingerprint and facial recognition, is being applied to pet identification and tracking, ensuring secure access to pet-related data and services. Mobile applications dedicated to pet health management have become more comprehensive. These apps allow pet owners to track vaccinations, medication schedules, and health records, ensuring proactive and organized pet care. Voice-activated devices like smart speakers can be integrated with Pet Tech products, enabling pet owners to control and monitor their pet-related devices using voice commands. Pet Telemedicine and Virtual Veterinary Services as well as Pet Health and Wellness Monitoring are the biggest opportunities in the Pet Tech Market Telemedicine and virtual veterinary services overcome geographical limitations by enabling pet owners to consult with qualified veterinarians remotely. This is especially valuable in rural or underserved areas where access to veterinary care is limited. Pet telemedicine services often provide round-the-clock access to veterinarians, ensuring that pet owners can seek advice or assistance at any time, including emergencies. Virtual consultations can significantly reduce the time pet owners need to wait for appointments, leading to quicker diagnoses and treatments. Virtual veterinary consultations are typically more affordable than in-person visits, making healthcare more accessible to a broader range of pet owners. This can lead to increased demand for veterinary services in the Pet Tech Market. Pet health and wellness monitoring devices allow pet owners to track their pets' health metrics, such as heart rate, activity level, and temperature, in real-time. This proactive approach to pet care can lead to early detection of health issues. The data collected through monitoring devices can empower pet owners and veterinarians to make informed decisions about a pet's diet, exercise, and overall well-being, contributing to better health outcomes in the Pet Tech market.

Pet Tech Market Segment Analysis

Type: RFID technology is utilized for pet identification and tracking. It enables seamless monitoring and quick identification of pets through radio waves. Growing popularity in pet tracking and security applications. Increasing demand for smart pet doors and automatic feeders integrated with RFID technology. Limited range in comparison to GPS. Initial implementation costs may be a deterrent for some consumers. GPS technology allows real-time tracking of pets, offering precise location data. It is widely used for ensuring the safety and security of pets. Rising demand for GPS-enabled collars and tags. Integration with smartphone apps for easy pet monitoring. Increased focus on geofencing features for pet safety. Higher power consumption, necessitating frequent recharging. Reliability may be compromised in areas with poor satellite signals. Sensors include a range of technologies such as motion sensors, temperature sensors, and health monitoring sensors. The insights into a pet's behavior and well-being. Increasing adoption of health monitoring sensors for preventive pet healthcare. Integration of sensors in pet toys for interactive play. Demand for smart pet beds with environmental sensors. Data privacy concerns related to continuous monitoring. Accuracy and reliability of certain sensor types. This category encompasses emerging technologies in the pet tech market, such as biometric identification and advanced pet communication devices. Growing interest in biometric pet identification methods. Development of AI-driven pet communication devices. Continuous innovation in this segment. Limited market awareness. Potential resistance due to the perceived complexity of new technologies. Product: Devices designed to monitor various aspects of a pet's health, behavior, and environment. Increasing demand for smart pet cameras and environmental monitors. Integration with mobile apps for remote monitoring. Focus on real-time alerts for pet owners. Initial setup complexity. Balancing features with affordability for widespread adoption. Products specifically designed for tracking a pet's location, movement, and activities. Compact and lightweight GPS trackers gaining popularity. Integration with smart collars for seamless tracking. Focus on durability and water resistance. Balancing size and battery life. Cost considerations for widespread adoption. Devices and gadgets aimed at providing entertainment and mental stimulation for pets. Growing demand for interactive smart toys. Integration of AI for personalized play experiences. Focus on enhancing the overall well-being of pets. Ensuring the safety and durability of interactive toys. Addressing diverse preferences among pets. Smart devices are designed to automate and enhance the pet feeding process. Rise in demand for automatic feeders with scheduling capabilities. Integration with mobile apps for remote feeding control. Focus on portion control and nutritional insights. Compatibility with various pet food types. Ensuring reliability in dispensing accurate portions. Wearable devices like smart collars, tags, and health monitors are designed to be worn by pets. Increasing adoption of multi-functional smart collars. Emphasis on lightweight and waterproof designs. Integration with vet health records and mobile apps. Balancing aesthetics and functionality. Ensuring comfort and safety for pets.Pet Tech Market Regional Analysis

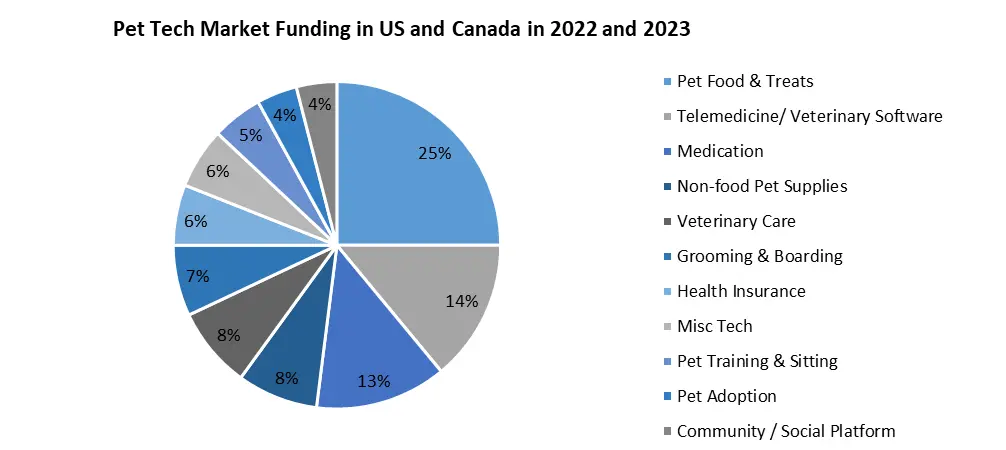

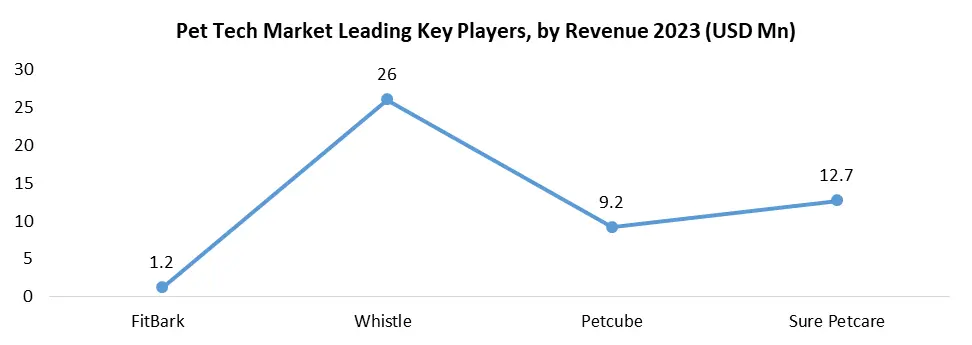

Europe is on the brink of experiencing substantial growth in the Pet Tech industry, driven by an escalating concern for the welfare of homeless dogs and cats. A noteworthy leader in this trend is Germany, which has taken proactive measures by establishing private shelters known as "Tierheim" dedicated to providing refuge for abandoned animals. These shelters, numbering in the thousands, extend care to a considerable population of animals annually, ranging from 10,000 to 15,000 animals. Their funding sources encompass a diverse array, including grants, bequests, governmental support, and nonprofit organizations. The region's heightened consciousness regarding animal welfare and health is expected to stimulate the adoption of cutting-edge technologies such as smart leashes, smart vests, and smart harnesses, thus further elevating the standards of care and well-being for animals. In response to these concerns, numerous companies have innovatively crafted low-power wireless smart collars, equipped with non-invasive sensors. These advanced collars empower pet owners to monitor various facets of their pets' well-being, including location, calorie intake and expenditure, respiration, heartbeat, movement, temperature, and heart-rate fluctuations. This comprehensive oversight contributes to the optimal health and safety of cherished pets. Furthermore, the rapid proliferation of pet shops, pet healthcare establishments, and the availability of pet-sitting services in the region collectively facilitate enhanced accessibility to these state-of-the-art technologies for household pet owners. As Europe's steadfast commitment to animal welfare continues to gain momentum, the Pet Tech industry stands poised for significant expansion in the foreseeable future.Pet Tech Market Competitive Landscape Analysis FitBark GPS recently launched in the Kansas City-based startup’s U.S. market, said Davide Rossi, co-founder and CEO, detailing new features that allow owners to pinpoint their dogs’ locations in case of emergency via embedded Verizon cell service. The small FitBark device is placed at the collar and primarily functions to measure such health factors as heart rate, activity, and sleeping patterns. All of the results are displayed on the FitBark app dashboard. Petcube Cam, an affordable smart pet camera with an online vet chat built-in. The new device pairs the advanced pet monitoring functions with online veterinarian advice powered by Fuzzy Pet Health, making on-demand pet care accessible to every pet parent. Petcube Cam is currently available for purchase on Amazon exclusively for $39.99. Besides the affordable price, all Cam users will have the first vet consultation available for free via a chat in the Petcube app. For continuous use, subscription options are available. Cam marks the most compact camera in Petcube’s line of products and comes with a minimalist 2.1-inch cube design, mounted on a flexible stand that you can tilt up and down for the perfect angle. Made entirely of hard plastic, the camera is pet-proof even with larger dogs. Sure Petcare, the Pet Technology specialist, launched the SureFeed Microchip Pet Feeder Connect, the next generation of the best-selling SureFeed Microchip Pet Feeder, which monitors the eating behavior of pets. The smart feeder monitors how much and when a pet eats, sending real-time updates directly to the pet owner’s phone. The new product also features integrated scales, which enable owners to provide accurate food portions to their pet at every meal. Feeding behavior is a key indicator of health for pets with a loss of appetite or change in feeding habits often being one of the first signs of illness. The SureFeed Microchip Pet Feeder Connect records the time and weight of food consumed by a pet each time they eat from the feeder, reporting it directly to the Sure Petcare app. Over time, this enables pet owners to build a comprehensive understanding of their pet’s unique feeding patterns, making it easier for them to spot changes in their pet’s health and well-being earlier than they may otherwise have been able to do so.

Pet Tech Market Scope: Inquiry Before Buying

Global Pet Tech Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.9 Bn. Forecast Period 2024 to 2030 CAGR: 14.8% Market Size in 2030: US $ 33.1 Bn. Segments Covered: by Type RFID GPS Sensors Others by Product Monitoring Equipment Tracking Equipment Entertainment Equipment Feeding Equipment Pet Wearables Others by Application Pet Safety Pet Healthcare Pet Owner Convenience Communication & Entertainment by End-User Household Commercial by Distribution Channel Online Offline Pet Tech Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Pet Tech Market

1. FitBark 2. Whistle 3. Petcube 4. Sure Petcare 5. Furbo 6. Pawbo 7. PetSafe 8. Animo 9. iFetch 10. Petnet 11. PetPace 12. Nestle Purina 13. Hill's Pet Nutrition 14. Bissell Frequently Asked Questions and Answers about Pet Tech Market 1. What is the Pet Tech Market? Ans: The Pet Tech Market refers to the emerging industry focused on technologies and methods to capture and store carbon dioxide from the atmosphere using ocean-based solutions. 2. What are some key market trends in the Pet Tech industry? Ans: Growing demand for eco-friendly options, shift toward low-VOC and non-toxic products, and the rise of e-commerce are notable trends. 3. What is the Market Size for the Pet Tech Market? Ans: The Pet Tech Market CAGR 14.8 % with 33.1 Bn in 2030. 4. What challenges does the Pet Tech industry face? Ans: Challenges include regulatory compliance, safety concerns, environmental impact, and market competition. 5. What are some well-established global Pet Tech manufacturers? Ans: Some prominent manufacturers include Sherwin-Williams, AkzoNobel, PPG Industries, Henkel, and 3M, among others.

1. Pet Tech Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pet Tech Market: Dynamics 2.1. Pet Tech Market Trends by Region 2.1.1. North America Pet Tech Market Trends 2.1.2. Europe Pet Tech Market Trends 2.1.3. Asia Pacific Pet Tech Market Trends 2.1.4. Middle East and Africa Pet Tech Market Trends 2.1.5. South America Pet Tech Market Trends 2.2. Pet Tech Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pet Tech Market Drivers 2.2.1.2. North America Pet Tech Market Restraints 2.2.1.3. North America Pet Tech Market Opportunities 2.2.1.4. North America Pet Tech Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pet Tech Market Drivers 2.2.2.2. Europe Pet Tech Market Restraints 2.2.2.3. Europe Pet Tech Market Opportunities 2.2.2.4. Europe Pet Tech Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pet Tech Market Drivers 2.2.3.2. Asia Pacific Pet Tech Market Restraints 2.2.3.3. Asia Pacific Pet Tech Market Opportunities 2.2.3.4. Asia Pacific Pet Tech Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pet Tech Market Drivers 2.2.4.2. Middle East and Africa Pet Tech Market Restraints 2.2.4.3. Middle East and Africa Pet Tech Market Opportunities 2.2.4.4. Middle East and Africa Pet Tech Market Challenges 2.2.5. South America 2.2.5.1. South America Pet Tech Market Drivers 2.2.5.2. South America Pet Tech Market Restraints 2.2.5.3. South America Pet Tech Market Opportunities 2.2.5.4. South America Pet Tech Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pet Tech Industry 2.8. Analysis of Government Schemes and Initiatives For Pet Tech Industry 2.9. Pet Tech Market Trade Analysis 2.10. The Global Pandemic Impact on Pet Tech Market 3. Pet Tech Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pet Tech Market Size and Forecast, by Type (2023-2030) 3.1.1. RFID 3.1.2. GPS 3.1.3. Sensors 3.1.4. Others 3.2. Pet Tech Market Size and Forecast, by Product (2023-2030) 3.2.1. Monitoring Equipment 3.2.2. Tracking Equipment 3.2.3. Entertainment Equipment 3.2.4. Feeding Equipment 3.2.5. Pet Wearables 3.2.6. Others 3.3. Pet Tech Market Size and Forecast, by Application (2023-2030) 3.3.1. Pet Safety 3.3.2. Pet Healthcare 3.3.3. Pet Owner Convenience 3.3.4. Communication & Entertainment 3.4. Pet Tech Market Size and Forecast, by End user (2023-2030) 3.4.1. Household 3.4.2. Commercial 3.5. Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 3.5.1. Online 3.5.2. Offline 3.6. Pet Tech Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Pet Tech Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pet Tech Market Size and Forecast, by Type (2023-2030) 4.1.1. RFID 4.1.2. GPS 4.1.3. Sensors 4.1.4. Others 4.2. North America Pet Tech Market Size and Forecast, by Product (2023-2030) 4.2.1. Monitoring Equipment 4.2.2. Tracking Equipment 4.2.3. Entertainment Equipment 4.2.4. Feeding Equipment 4.2.5. Pet Wearables 4.2.6. Others 4.3. North America Pet Tech Market Size and Forecast, by Application (2023-2030) 4.3.1. Pet Safety 4.3.2. Pet Healthcare 4.3.3. Pet Owner Convenience 4.3.4. Communication & Entertainment 4.4. North America Pet Tech Market Size and Forecast, by End user (2023-2030) 4.4.1. Household 4.4.2. Commercial 4.5. North America Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.1. Online 4.5.2. Offline 4.6. North America Pet Tech Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Pet Tech Market Size and Forecast, by Type (2023-2030) 4.6.1.1.1. RFID 4.6.1.1.2. GPS 4.6.1.1.3. Sensors 4.6.1.1.4. Others 4.6.1.2. United States Pet Tech Market Size and Forecast, by Product (2023-2030) 4.6.1.2.1. Monitoring Equipment 4.6.1.2.2. Tracking Equipment 4.6.1.2.3. Entertainment Equipment 4.6.1.2.4. Feeding Equipment 4.6.1.2.5. Pet Wearables 4.6.1.2.6. Others 4.6.1.3. United States Pet Tech Market Size and Forecast, by Application (2023-2030) 4.6.1.3.1. Pet Safety 4.6.1.3.2. Pet Healthcare 4.6.1.3.3. Pet Owner Convenience 4.6.1.3.4. Communication & Entertainment 4.6.1.4. United States Pet Tech Market Size and Forecast, by End user (2023-2030) 4.6.1.4.1. Household 4.6.1.4.2. Commercial 4.6.1.5. United States Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.1.5.1. Online 4.6.1.5.2. Offline 4.6.2. Canada 4.6.2.1. Canada Pet Tech Market Size and Forecast, by Type (2023-2030) 4.6.2.1.1. RFID 4.6.2.1.2. GPS 4.6.2.1.3. Sensors 4.6.2.1.4. Others 4.6.2.2. Canada Pet Tech Market Size and Forecast, by Product (2023-2030) 4.6.2.2.1. Monitoring Equipment 4.6.2.2.2. Tracking Equipment 4.6.2.2.3. Entertainment Equipment 4.6.2.2.4. Feeding Equipment 4.6.2.2.5. Pet Wearables 4.6.2.2.6. Others 4.6.2.3. Canada Pet Tech Market Size and Forecast, by Application (2023-2030) 4.6.2.3.1. Pet Safety 4.6.2.3.2. Pet Healthcare 4.6.2.3.3. Pet Owner Convenience 4.6.2.3.4. Communication & Entertainment 4.6.2.4. Canada Pet Tech Market Size and Forecast, by End user (2023-2030) 4.6.2.4.1. Household 4.6.2.4.2. Commercial 4.6.2.5. Canada Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.2.5.1. Online 4.6.2.5.2. Offline 4.6.3. Mexico 4.6.3.1. Mexico Pet Tech Market Size and Forecast, by Type (2023-2030) 4.6.3.1.1. RFID 4.6.3.1.2. GPS 4.6.3.1.3. Sensors 4.6.3.1.4. Others 4.6.3.2. Mexico Pet Tech Market Size and Forecast, by Product (2023-2030) 4.6.3.2.1. Monitoring Equipment 4.6.3.2.2. Tracking Equipment 4.6.3.2.3. Entertainment Equipment 4.6.3.2.4. Feeding Equipment 4.6.3.2.5. Pet Wearables 4.6.3.2.6. Others 4.6.3.3. Mexico Pet Tech Market Size and Forecast, by Application (2023-2030) 4.6.3.3.1. Pet Safety 4.6.3.3.2. Pet Healthcare 4.6.3.3.3. Pet Owner Convenience 4.6.3.3.4. Communication & Entertainment 4.6.3.4. Mexico Pet Tech Market Size and Forecast, by End user (2023-2030) 4.6.3.4.1. Household 4.6.3.4.2. Commercial 4.6.3.5. Mexico Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.3.5.1. Online 4.6.3.5.2. Offline 5. Europe Pet Tech Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pet Tech Market Size and Forecast, by Type (2023-2030) 5.2. Europe Pet Tech Market Size and Forecast, by Product (2023-2030) 5.3. Europe Pet Tech Market Size and Forecast, by Application (2023-2030) 5.4. Europe Pet Tech Market Size and Forecast, by End user (2023-2030) 5.5. Europe Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6. Europe Pet Tech Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.1.2. United Kingdom Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.1.3. United Kingdom Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.1.4. United Kingdom Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.1.5. United Kingdom Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.2. France 5.6.2.1. France Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.2.2. France Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.2.3. France Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.2.4. France Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.2.5. France Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.3.2. Germany Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.3.3. Germany Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.3.4. Germany Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.3.5. Germany Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.4.2. Italy Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.4.3. Italy Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.4.4. Italy Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.4.5. Italy Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.5.2. Spain Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.5.3. Spain Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.5.4. Spain Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.5.5. Spain Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.6.2. Sweden Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.6.3. Sweden Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.6.4. Sweden Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.6.5. Sweden Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.7.2. Austria Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.7.3. Austria Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.7.4. Austria Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.7.5. Austria Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Pet Tech Market Size and Forecast, by Type (2023-2030) 5.6.8.2. Rest of Europe Pet Tech Market Size and Forecast, by Product (2023-2030) 5.6.8.3. Rest of Europe Pet Tech Market Size and Forecast, by Application (2023-2030) 5.6.8.4. Rest of Europe Pet Tech Market Size and Forecast, by End user (2023-2030) 5.6.8.5. Rest of Europe Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Pet Tech Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pet Tech Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Pet Tech Market Size and Forecast, by Product (2023-2030) 6.3. Asia Pacific Pet Tech Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Pet Tech Market Size and Forecast, by End user (2023-2030) 6.5. Asia Pacific Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6. Asia Pacific Pet Tech Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.1.2. China Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.1.3. China Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.1.4. China Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.1.5. China Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.2.2. S Korea Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.2.3. S Korea Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.2.4. S Korea Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.2.5. S Korea Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.3.2. Japan Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.3.3. Japan Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.3.4. Japan Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.3.5. Japan Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.4. India 6.6.4.1. India Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.4.2. India Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.4.3. India Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.4.4. India Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.4.5. India Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.5.2. Australia Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.5.3. Australia Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.5.4. Australia Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.5.5. Australia Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.6.2. Indonesia Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.6.3. Indonesia Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.6.4. Indonesia Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.6.5. Indonesia Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.7.2. Malaysia Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.7.3. Malaysia Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.7.4. Malaysia Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.7.5. Malaysia Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.8.2. Vietnam Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.8.3. Vietnam Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.8.4. Vietnam Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.8.5. Vietnam Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.9.2. Taiwan Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.9.3. Taiwan Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.9.4. Taiwan Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.9.5. Taiwan Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Pet Tech Market Size and Forecast, by Type (2023-2030) 6.6.10.2. Rest of Asia Pacific Pet Tech Market Size and Forecast, by Product (2023-2030) 6.6.10.3. Rest of Asia Pacific Pet Tech Market Size and Forecast, by Application (2023-2030) 6.6.10.4. Rest of Asia Pacific Pet Tech Market Size and Forecast, by End user (2023-2030) 6.6.10.5. Rest of Asia Pacific Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Pet Tech Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pet Tech Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Pet Tech Market Size and Forecast, by Product (2023-2030) 7.3. Middle East and Africa Pet Tech Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Pet Tech Market Size and Forecast, by End user (2023-2030) 7.5. Middle East and Africa Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 7.6. Middle East and Africa Pet Tech Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Pet Tech Market Size and Forecast, by Type (2023-2030) 7.6.1.2. South Africa Pet Tech Market Size and Forecast, by Product (2023-2030) 7.6.1.3. South Africa Pet Tech Market Size and Forecast, by Application (2023-2030) 7.6.1.4. South Africa Pet Tech Market Size and Forecast, by End user (2023-2030) 7.6.1.5. South Africa Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Pet Tech Market Size and Forecast, by Type (2023-2030) 7.6.2.2. GCC Pet Tech Market Size and Forecast, by Product (2023-2030) 7.6.2.3. GCC Pet Tech Market Size and Forecast, by Application (2023-2030) 7.6.2.4. GCC Pet Tech Market Size and Forecast, by End user (2023-2030) 7.6.2.5. GCC Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Pet Tech Market Size and Forecast, by Type (2023-2030) 7.6.3.2. Nigeria Pet Tech Market Size and Forecast, by Product (2023-2030) 7.6.3.3. Nigeria Pet Tech Market Size and Forecast, by Application (2023-2030) 7.6.3.4. Nigeria Pet Tech Market Size and Forecast, by End user (2023-2030) 7.6.3.5. Nigeria Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Pet Tech Market Size and Forecast, by Type (2023-2030) 7.6.4.2. Rest of ME&A Pet Tech Market Size and Forecast, by Product (2023-2030) 7.6.4.3. Rest of ME&A Pet Tech Market Size and Forecast, by Application (2023-2030) 7.6.4.4. Rest of ME&A Pet Tech Market Size and Forecast, by End user (2023-2030) 7.6.4.5. Rest of ME&A Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Pet Tech Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pet Tech Market Size and Forecast, by Type (2023-2030) 8.2. South America Pet Tech Market Size and Forecast, by Product (2023-2030) 8.3. South America Pet Tech Market Size and Forecast, by Application(2023-2030) 8.4. South America Pet Tech Market Size and Forecast, by End user (2023-2030) 8.5. South America Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 8.6. South America Pet Tech Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Pet Tech Market Size and Forecast, by Type (2023-2030) 8.6.1.2. Brazil Pet Tech Market Size and Forecast, by Product (2023-2030) 8.6.1.3. Brazil Pet Tech Market Size and Forecast, by Application (2023-2030) 8.6.1.4. Brazil Pet Tech Market Size and Forecast, by End user (2023-2030) 8.6.1.5. Brazil Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Pet Tech Market Size and Forecast, by Type (2023-2030) 8.6.2.2. Argentina Pet Tech Market Size and Forecast, by Product (2023-2030) 8.6.2.3. Argentina Pet Tech Market Size and Forecast, by Application (2023-2030) 8.6.2.4. Argentina Pet Tech Market Size and Forecast, by End user (2023-2030) 8.6.2.5. Argentina Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Pet Tech Market Size and Forecast, by Type (2023-2030) 8.6.3.2. Rest Of South America Pet Tech Market Size and Forecast, by Product (2023-2030) 8.6.3.3. Rest Of South America Pet Tech Market Size and Forecast, by Application (2023-2030) 8.6.3.4. Rest Of South America Pet Tech Market Size and Forecast, by End user (2023-2030) 8.6.3.5. Rest Of South America Pet Tech Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Pet Tech Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pet Tech Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. FitBark 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Whistle 10.3. Petcube 10.4. Sure Petcare 10.5. Furbo 10.6. Pawbo 10.7. PetSafe 10.8. Animo 10.9. iFetch 10.10. Petnet 10.11. PetPace 10.12. Nestle Purina 10.13. Hill's Pet Nutrition 10.14. Bissell 11. Key Findings 12. Industry Recommendations 13. Pet Tech Market: Research Methodology 14. Terms and Glossary