In 2023, the Paint Stripper Market showed strong performance and reached a value of USD 1.67 billion. Looking ahead, there's an expected 4.6% increase in revenue from 2024 to 2030, expected to reach USD 2.29 billion. This growth presents an appealing opportunity for investors and stakeholders in the Paint Stripper industry.Paint Stripper Market: Overview

The paint stripper market is experiencing growth in recent years, thanks to the growing paint industry. The escalating demand for paints in diverse sectors including construction, automotive, and furniture boosted the need for effective paint removal solutions. Paint strippers are important in surface preparation for repainting, becoming indispensable in the maintenance and refurbishment processes. With an increasing focus on environmental sustainability and safety, there's a significant shift towards the development of eco-friendly and less hazardous paint stripper formulations. Manufacturers are actively innovating to align with evolving industry standards. The dynamic interplay between the growing paint industry and the demand for efficient, environmentally conscious paint-stripping solutions positions this Paint Stripper market for sustained growth. As the paint industry thrives, the paint stripper market is set to continue driven by the ongoing need for quality surface preparation solutions. For instance, according to the MMR Study Report, the revenue generated by the paint and coatings market across the world is estimated to increase by 12.1 percent in 2022, and an additional 7.2 percent in 2023. The market experiences its greatest growth in Latin America, closely followed by North America. Nevertheless, the volume of the paint and coatings market in North America is expected to drop both in 2022 and 2023. this factor is significantly responsible for the growth of the Paint Stripper Market growth.To know about the Research Methodology :- Request Free Sample Report

Paint Stripper Market Dynamics:

Driver Innovation and Product Development as well as Growth in Construction are the major drivers of the Paint Stripper Market The expanding construction industry, particularly in emerging economies, necessitates the use of paint strippers for surface preparation in new construction ventures. This demand further augments the paint stripper market's growth. Manufacturers are consistently engaged in innovation to develop paint stripper formulations that are not only safer but also more efficient and faster-acting. These innovations provide for the evolving demands of both consumers and industries. The escalating stringency of environmental regulations, coupled with a growing focus on eco-conscious products, is propelling the demand for paint strippers that meet criteria such as being non-toxic, biodegradable, and having reduced volatile organic compound (VOC) levels. The persistent trend of residential and commercial property renovations and remodeling projects is generating a heightened requirement for effective paint strippers. These products are essential for preparing surfaces, ensuring they are ready for fresh coats of paint or coatings.The automotive and industrial sectors depend on paint strippers for critical tasks like maintenance, repair, and refurbishment. This reliance contributes to the steady and consistent growth paint stripper market. The imperative to refurbish and maintain aging infrastructure, such as bridges and buildings, underscores the need for paint strippers to facilitate effective surface preparation before repainting or restoration. The rising motor vehicle production significantly helps to boost the market growth.

Restrain Rising Environmental Concerns Limit the Market Growth The paint stripper market faces a significant growth constraint due to escalating environmental concerns. The traditional formulations of paint strippers often contain harsh chemicals, including methylene chloride and N-methyl-2-pyrrolidone (NMP), known for their adverse environmental impact. These chemicals contribute to air and water pollution, soil contamination, and harm to ecosystems. Increasing awareness of these environmental repercussions has led to stringent regulations restricting the use of such hazardous substances in paint strippers. Consumers are now gravitating towards eco-friendly and sustainable alternatives, demanding products with minimal environmental footprints. Consequently, manufacturers in the paint stripper industry are compelled to invest in research and development to formulate environmentally safe options. The rising tide of environmental consciousness not only influences consumer preferences but also shapes regulatory frameworks, making it imperative for companies to navigate these challenges to ensure market growth and sustainability. Embracing green technologies and adopting eco-conscious practices are becoming pivotal for the future viability of the paint stripper market. Increasing Demand for Environmentally-Friendly Formulations and Transition to Low-VOC and Non-Toxic Products are growing trends in the paint stripper market A notable uptick in environmental consciousness and regulatory pressures is fueling a heightened demand for eco-friendly and biodegradable paint strippers. Manufacturers are actively formulating products that not only safeguard users but also mitigate their impact on the environment in the paint stripper market. Both consumers and industry professionals are displaying a growing preference for paint strippers featuring low levels of volatile organic compounds (VOCs) and non-toxic constituents. This shift mirrors the broader trend towards healthier and safer product choices. Relentless research and development efforts have yielded more efficient and rapid-acting paint-stripping solutions in the paint-stripper market. These advanced formulations frequently diminish the need for labor-intensive scraping or sanding procedures. Addressing Environmental Impact and Balancing Product Effectiveness are the biggest challenges in the paint stripper industry Disposing of waste materials generated during the paint stripping process adversely affects the environment. Effectively managing disposal methods and implementing recycling practices presents a persistent challenge. Striking a harmonious balance between an effective paint stripper and one that is safe for users and the environment remains a formidable challenge. Some eco-friendly formulations did not deliver the same level of speed and efficiency as their more hazardous counterparts. Paint stripping operations involve handling chemicals that pose potential health hazards. Ensuring the safety of users constitutes a substantial challenge for both manufacturers and end-users. The paint stripper industry confronts evolving regulations concerning the use of hazardous chemicals in paint strippers. Manufacturers must continually adapt their products to meet these stringent requirements, incurring both financial and time-related costs in the Paint Stripper Market.

Paint Stripper Market Segment Analysis

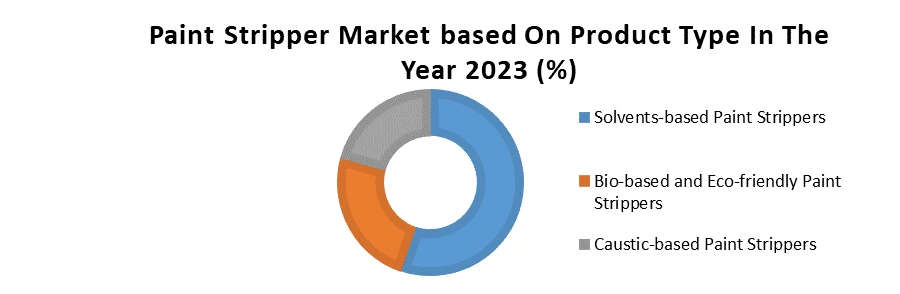

Based On Application, The Architectural and Construction subsegment dominated the application segment of the Paint Stripper Market in the year 2023. In architectural settings, paint strippers are essential for refurbishing and restoring historical structures, removing layers of old paint to reveal the original surfaces. Construction projects often involve the stripping of surfaces like wood, metal, or concrete to prepare them for painting or finishing. The versatility of paint strippers makes them indispensable in addressing various materials and surfaces commonly encountered in architectural and construction endeavors. As these industries witness continuous growth globally, driven by urbanization and infrastructure development, the demand for effective paint-stripping solutions remains robust, consolidating the architectural and construction subsegment's dominance in the overall market. The efficiency of paint strippers in facilitating surface preparation and renovation activities further solidifies their prevalence in these key application areas.Based On Product Type: Solvent-based paint dominated the product type segment of the paint stripers Market in the year 2023. The paint strippers are long-standing favorites due to their effectiveness in removing various paint types and coatings. While demand for solvent-based products endures. These products find common use in industrial settings and for heavy-duty paint removal tasks, owing to their potent chemical composition. Solvent-based paint strippers exhibit remarkable versatility, demonstrating their applicability across diverse surfaces, including wood, metal, and masonry. This inherent adaptability renders them suitable for an extensive spectrum of tasks, ranging from the meticulous restoration of architectural structures to the precise refinishing of automobiles. The swiftness with which solvent-based paint strippers operate is a noteworthy attribute. Their rapid action significantly diminishes the time and labor invested in paint removal endeavors. This characteristic holds particular significance for professional users, as it enables them to execute projects with heightened efficiency and cost-effectiveness in the paint stripper market. Solvent-based paint strippers excel in heavy-duty applications, exemplified by their effectiveness in tasks such as industrial equipment maintenance and the removal of tenacious industrial coatings. Their robust performance in these demanding scenarios surpasses the capabilities of less potent paint strippers, further solidifying their reputation as formidable solutions for challenging undertakings.

Paint Stripper Market Regional Analysis

North America dominated the Paint Stripper Market in the year 2023. Due to Increased demand for environmentally friendly and low-VOC (volatile organic compounds) paint strippers. Manufacturers are compelled to develop and market these products to align with regional environmental standards, subsequently bolstering the paint stripper for eco-conscious paint stripping solutions in the paint stripper market. North American consumers have become increasingly conscientious about the health and safety aspects of the products they use. Eco-friendly and low-toxicity paint strippers resonate with these preferences and are favored choices among both DIY enthusiasts and professionals. As consumers gain greater insight into the potential health risks associated with conventional paint strippers, the demand for safer alternatives experiences growth in the paint stripper market. North America serves as a hub for research and innovation. Manufacturers in the region continually allocate resources to research and development, resulting in the creation of more efficient, user-friendly, and environmentally responsible paint-stripping solutions. This continuous innovation introduces advanced and effective products into the paint stripper market, driving overall paint stripper market growth. North America showcases a wide spectrum of end-user applications for paint strippers. These encompass architectural restoration, automotive refinishing, furniture restoration, industrial maintenance, and more. This diversified array of applications ensures a consistent demand for various types of paint strippers, thereby contributing to the growth of the paint stripper market.Competitive Landscape: Paint Stripper Market

Paint Stripper Market is competitive in nature the key players mainly focus on mergers, acquisitions, partnerships as well innovation. For example, Green Products Co. has emerged as a frontrunner in the paint stripper market with the relaunch of its acclaimed wood preservative, now named Green's Water-Based Wood Preservative. This EPA-approved solution boasts a potent formula containing copper 8-quinolinolate, effectively protecting wood from decay, staining, mold, rot, mildew, and termite infestation. Its colorless and user-friendly composition makes it ideal for above-ground applications on various surfaces, such as window sills, trellises, foundations, decks, and more. Cleanup is effortless with just soap and water, enhancing user convenience. The company's revamped packaging for leading wood preservatives, including Copper-Green and Copper-Green Brown, adds a contemporary touch to its product line. This redesign complements Green's Water-Based Wood Preservative, showcasing a cohesive and modern product family. In contrast, DULUX™ Paints by PPG introduces a new perspective in the market with Limitless (DLX1091-3), its 2024 Colour of the Year. This invigorating yellow-beige neutral shade blends primary color vibrancy with warm versatility, reflecting consumer sentiments for energy and optimism in home decor. The competitive landscape is now defined by Green Products Co.'s innovative wood preservatives and DULUX's forward-thinking approach, setting new standards in the Paint Stripper Market.Paint Stripper Market Scope: Inquire before buying

Paint Stripper Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.67 Bn. Forecast Period 2024 to 2030 CAGR: 4.6% Market Size in 2030: US $ 2.29 Bn. Segments Covered: by Product Type Solvents-based Paint Strippers Bio-based and Eco-friendly Paint Strippers Caustic-based Paint Strippers by Application Architectural and Construction Automotive Refinishing Marine Industry Industrial and Manufacturing Furniture and Woodworking by End-User Professional Users DIY/Home Users Aerospace & Automotive Industry Paint Stripper Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Paint Stripper Market

Paint Stripper Market Key Players 1. AkzoNobel 2. PPG Industries 3. The Sherwin-Williams Company 4. RPM International Inc. 5. Henkel AG & Co. KGaA 6. 3M Company 7. BASF SE 8. Axalta Coating Systems 9. The Dow Chemical Company 10. Jotun 11. Nippon Paint Holdings Co., Ltd. 12. Kansai Paint Co., Ltd. 13. Asian Paints Limited 14. Hempel A/S 15. Sika AG Frequently Asked Questions: 1] What segments are covered in the Global Paint Stripper Market report? Ans. The segments covered in the Paint Stripper Market report are based on Product Type, Application, End User, and Regions. 2] Which region is expected to hold the highest share in the Global Paint Stripper Market? Ans. The North American region is expected to hold the highest share of the Paint Stripper Market. 3] What is the market size of the Global Paint Stripper Market by 2030? Ans. The market size of the Paint Stripper Market by 2030 is expected to reach US$ 2.29 Bn. 4] What is the forecast period for the Global Paint Stripper Market? Ans. The forecast period for the Paint Stripper Market is 2024-2030. 5] What was the market size of the Global Paint Stripper Market in 2023? Ans. The market size of the Paint Stripper Market in 2023 was valued at US$1.67 Bn.

1. Paint Stripper Market: Research Methodology 2. Paint Stripper Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Paint Stripper Market: Dynamics 3.1. Paint Stripper Market Trends by Region 3.1.1. North America Paint Stripper Market Trends 3.1.2. Europe Paint Stripper Market Trends 3.1.3. Asia Pacific Paint Stripper Market Trends 3.1.4. Middle East and Africa Paint Stripper Market Trends 3.1.5. South America Paint Stripper Market Trends 3.2. Paint Stripper Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Paint Stripper Market Drivers 3.2.1.2. North America Paint Stripper Market Restraints 3.2.1.3. North America Paint Stripper Market Opportunities 3.2.1.4. North America Paint Stripper Market Challenges 3.2.2. Europe 3.2.2.1. Europe Paint Stripper Market Drivers 3.2.2.2. Europe Paint Stripper Market Restraints 3.2.2.3. Europe Paint Stripper Market Opportunities 3.2.2.4. Europe Paint Stripper Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Paint Stripper Market Market Drivers 3.2.3.2. Asia Pacific Paint Stripper Market Restraints 3.2.3.3. Asia Pacific Paint Stripper Market Opportunities 3.2.3.4. Asia Pacific Paint Stripper Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Paint Stripper Market Drivers 3.2.4.2. Middle East and Africa Paint Stripper Market Restraints 3.2.4.3. Middle East and Africa Paint Stripper Market Opportunities 3.2.4.4. Middle East and Africa Paint Stripper Market Challenges 3.2.5. South America 3.2.5.1. South America Paint Stripper Market Drivers 3.2.5.2. South America Paint Stripper Market Restraints 3.2.5.3. South America Paint Stripper Market Opportunities 3.2.5.4. South America Paint Stripper Market Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Bargaining Power Of Suppliers 3.3.2. Bargaining Power Of Buyers 3.3.3. Threat Of New Entrants 3.3.4. Threat Of Substitutes 3.3.5. Intensity Of Rivalry 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Analysis of Government Schemes and Initiatives For the Paint Stripper Industry 3.8. The Global Pandemic and Redefining of The Paint Stripper Industry Landscape 3.9. Price Trend Analysis 3.10. Technological Road Map 3.11. Global Paint Stripper Trade Analysis (2018-2023) 3.11.1. Global Import of Paint Stripper 3.11.2. Global Export of Paint Stripper 3.12. Global Paint Stripper Production Capacity Analysis 3.12.1. Chapter Overview 3.12.2. Key Assumptions and Methodology 3.12.3. Paint Stripper Manufacturers: Global Installed Capacity 3.12.4. Analysis by Size of Manufacturer 4. Global Paint Stripper Market: Global Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 4.1. Global Paint Stripper Market Size and Forecast, by Product End-User (2023-2030) 4.1.1. Solvents-based Paint Strippers 4.1.2. Bio-based and Eco-friendly Paint Strippers 4.1.3. Caustic-based Paint Strippers 4.2. Global Paint Stripper Market Size and Forecast, by Application (2023-2030) 4.2.1. Architectural and Construction 4.2.2. Automotive Refinishing 4.2.3. Marine Industry 4.2.4. Industrial and Manufacturing 4.2.5. Furniture and Woodworking 4.3. Global Paint Stripper Market Size and Forecast, by End-User (2023-2030) 4.3.1. Professional Users 4.3.2. DIY/Home Users 4.3.3. Aerospace & Automotive Industry 4.4. Global Paint Stripper Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Paint Stripper Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 5.1. North America Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 5.1.1. Solvents-based Paint Strippers 5.1.2. Bio-based and Eco-friendly Paint Strippers 5.1.3. Caustic-based Paint Strippers 5.2. North America Paint Stripper Market Size and Forecast, by Application (2023-2030) 5.2.1. Architectural and Construction 5.2.2. Automotive Refinishing 5.2.3. Marine Industry 5.2.4. Industrial and Manufacturing 5.2.5. Furniture and Woodworking 5.3. North America Paint Stripper Market Size and Forecast, by End-User (2023-2030) 5.3.1. Professional Users 5.3.2. DIY/Home Users 5.3.3. Aerospace & Automotive Industry 5.4. North America Paint Stripper Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 5.4.1.1.1. Solvents-based Paint Strippers 5.4.1.1.2. Bio-based and Eco-friendly Paint Strippers 5.4.1.1.3. Caustic-based Paint Strippers 5.4.1.2. United States Paint Stripper Market Size and Forecast, by Application (2023-2030) 5.4.1.2.1. Architectural and Construction 5.4.1.2.2. Automotive Refinishing 5.4.1.2.3. Marine Industry 5.4.1.2.4. Industrial and Manufacturing 5.4.1.2.5. Furniture and Woodworking 5.4.1.3. United States Paint Stripper Market Size and Forecast, by End-User (2023-2030) 5.4.1.3.1. Professional Users 5.4.1.3.2. DIY/Home Users 5.4.1.3.3. Aerospace & Automotive Industry 5.4.2. Canada 5.4.2.1. Canada Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 5.4.2.1.1. Solvents-based Paint Strippers 5.4.2.1.2. Bio-based and Eco-friendly Paint Strippers 5.4.2.1.3. Caustic-based Paint Strippers 5.4.2.2. Canada Paint Stripper Market Size and Forecast, by Application (2023-2030) 5.4.2.2.1. Architectural and Construction 5.4.2.2.2. Automotive Refinishing 5.4.2.2.3. Marine Industry 5.4.2.2.4. Industrial and Manufacturing 5.4.2.2.5. Furniture and Woodworking 5.4.2.3. Canada Paint Stripper Market Size and Forecast, by End-User (2023-2030) 5.4.2.3.1. Professional Users 5.4.2.3.2. DIY/Home Users 5.4.2.3.3. Aerospace & Automotive Industry 5.4.3. Mexico 5.4.3.1. Mexico Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 5.4.3.1.1. Solvents-based Paint Strippers 5.4.3.1.2. Bio-based and Eco-friendly Paint Strippers 5.4.3.1.3. Caustic-based Paint Strippers 5.4.3.2. Mexico Paint Stripper Market Size and Forecast, by Application (2023-2030) 5.4.3.2.1. Architectural and Construction 5.4.3.2.2. Automotive Refinishing 5.4.3.2.3. Marine Industry 5.4.3.2.4. Industrial and Manufacturing 5.4.3.2.5. Furniture and Woodworking 5.4.3.3. Mexico Paint Stripper Market Size and Forecast, by End-User (2023-2030) 5.4.3.3.1. Professional Users 5.4.3.3.2. DIY/Home Users 5.4.3.3.3. Aerospace & Automotive Industry 6. Europe Paint Stripper Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 6.1. Europe Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.2. Europe Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.3. Europe Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4. Europe Paint Stripper Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. United Kingdom Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.1.3. United Kingdom Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.2. France 6.4.2.1. France Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. France Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.2.3. France Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Germany Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Germany Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. Italy Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.4.3. Italy Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Spain Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Spain Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Sweden Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Sweden Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Austria Paint Stripper Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Austria Paint Stripper Market Size and Forecast, by End-User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Rest of Europe Paint Stripper Market Size and Forecast, by Application (2023-2030). 6.4.8.3. Rest of Europe Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7. Asia Pacific Paint Stripper Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 7.1. Asia Pacific Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.2. Asia Pacific Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.3. Asia Pacific Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4. Asia Pacific Paint Stripper Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. China Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.1.3. China Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.2. South Korea 7.4.2.1. S Korea Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. S Korea Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.2.3. S Korea Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Japan Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Japan Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.4. India 7.4.4.1. India Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. India Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.4.3. India Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.5.2. Australia Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.5.3. Australia Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.6.2. Indonesia Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.6.3. Indonesia Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.7.2. Malaysia Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.7.3. Malaysia Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.8.2. Vietnam Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.8.3. Vietnam Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.9.2. Taiwan Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.9.3. Taiwan Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.10. Bangladesh 7.4.10.1. Bangladesh Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.10.2. Bangladesh Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.10.3. Bangladesh Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.11. Pakistan 7.4.11.1. Pakistan Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.11.2. Pakistan Paint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.11.3. Pakistan Paint Stripper Market Size and Forecast, by End-User (2023-2030) 7.4.12. Rest of Asia Pacific 7.4.12.1. Rest of Asia Pacific Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 7.4.12.2. Rest of Asia PacificPaint Stripper Market Size and Forecast, by Application (2023-2030) 7.4.12.3. Rest of Asia Pacific Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8. Middle East and Africa Paint Stripper Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 8.1. Middle East and Africa Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.2. Middle East and Africa Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.3. Middle East and Africa Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8.4. Middle East and Africa Paint Stripper Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. South Africa Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.4.1.3. South Africa Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. GCC Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.4.2.3. GCC Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8.4.3. Egypt 8.4.3.1. Egypt Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Egypt Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Egypt Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8.4.4. Nigeria 8.4.4.1. Nigeria Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.4.4.2. Nigeria Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.4.4.3. Nigeria Paint Stripper Market Size and Forecast, by End-User (2023-2030) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 8.4.5.2. Rest of ME&A Paint Stripper Market Size and Forecast, by Application (2023-2030) 8.4.5.3. Rest of ME&A Paint Stripper Market Size and Forecast, by End-User (2023-2030) 9. South America Paint Stripper Market Size and Forecast by Segmentation (Value and Volume) (2023-2030) 9.1. South America Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 9.2. South America Paint Stripper Market Size and Forecast, by Application (2023-2030) 9.3. South America Paint Stripper Market Size and Forecast, by End-User (2023-2030) 9.4. South America Paint Stripper Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 9.4.1.2. Brazil Paint Stripper Market Size and Forecast, by Application (2023-2030) 9.4.1.3. Brazil Paint Stripper Market Size and Forecast, by End-User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 9.4.2.2. Argentina Paint Stripper Market Size and Forecast, by Application (2023-2030) 9.4.2.3. Argentina Paint Stripper Market Size and Forecast, by End-User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Paint Stripper Market Size and Forecast, by Product Type (2023-2030) 9.4.3.2. Rest Of South America Paint Stripper Market Size and Forecast, by Application (2023-2030) 9.4.3.3. Rest Of South America Paint Stripper Market Size and Forecast, by End-User (2023-2030) 10. Global Paint Stripper Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Product Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Manufacturing Locations 10.4. Market Analysis by Organized Players vs. Unorganized Players 10.4.1. Organized Players 10.4.2. Unorganized Players 10.5. Leading Paint Stripper Global Companies, by market capitalization 10.6. Market Structure 10.6.1. Market Leaders 10.6.2. Market Followers 10.6.3. Emerging Players 10.7. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. AkzoNobel 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. PPG Industries 11.3. The Sherwin-Williams Company 11.4. RPM International Inc. 11.5. Henkel AG & Co. KGaA 11.6. 3M Company 11.7. BASF SE 11.8. Axalta Coating Systems 11.9. The Dow Chemical Company 11.10. Jotun 11.11. Nippon Paint Holdings Co., Ltd. 11.12. Kansai Paint Co., Ltd. 11.13. Asian Paints Limited 11.14. Hempel A/S 11.15. Sika AG 11.16. . 12. Key Findings 13. Industry Recommendations