Oryzenin Market size was valued at USD 199.01 Million in 2023 and the total Oryzenin Market revenue is expected to grow at a CAGR of 11.8% from 2024 to 2030, reaching nearly USD 434.48 Million by 2030.Oryzenin Market Overview

Oryzenin is a glutelin component of rice and is responsible for a significant portion of the protein in the rice. Rice only contains 7% protein as compared to other cereals. Glutelins have a distinct structure. Oryzenin has a low molecular weight and does not dissolve in alcohol or water. It contains amino acids as well as branch chain amino acids, and helps in increasing strength, increasing skeletal muscle size, and achieving leaner and stronger bodies. Due to its high protein content, Oryzenin has applications in certain food and beverages industries due to its properties such as Emulsification Texturizing Gelling Foaming Solubility Viscosity Water binding. Some Oryzenin-based products are safe for individuals with gluten intolerance. Oryzenin is used in the food and beverages industry due to growing food industry around the world, its high gelling properties and its high protein content. The growing awareness of health and the increasing consumption of oryzenin for sports nutrition, and its nutritional value driving the market demand of oryzenin. The lack of awareness of the benefits of oryzenin among the people is likely to limit its growth. The growth of health awareness and sporting activities is expected to open up a number of new opportunities in the future. The North American market for oryzenin is expected to remain most prominent in the region over the next few years. This is due to increasing demand for dairy-free alternatives and other oryzenin-based food and beverage. The Asia-Pacific market is expected to develop the fastest over the forecast period, owing to a growing producer's segment and a preference for foreign manufacturers to benefit from cost economies.To know about the Research Methodology :- Request Free Sample Report

Oryzenin Market Scope and Research Methodology

The report highlights the competitive market view, segment analysis based on the Type, Form, Application and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Oryzenin Market. The Market is segmented by the type such as Isolate and Concentrate. It is segmented by Form such as Dry and Liquid. Market also segmented by application including Food and beverages, Sports and Energy Nutrition, Animal feed and Bakery and Confectionary. The market size and trends for the Oryzenin Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Oryzenin Market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Oryzenin Market Dynamics

Increasing demand for plant-based proteins drives the growth of Oryzenin Market The market for oryzenin is driven by the growing demand for high-quality plat-based proteins. Due to various health, environmental and ethical reasons consumers are significantly turning towards plant based foods. As more people move to plant-based diets for health, environmental, and ethical reasons, there is a growing demand for high-quality protein sources that can replace animal-derived proteins. Because of its protein level, allergen-friendliness, and adaptability in a variety of culinary products, oryzenin, derived from rice, is an popular alternative. It fulfil consumer demand for plant-based protein in goods such as vegan meat substitutes, dairy-free beverages, and protein bars. As the plant-based protein trend gains traction, the oryzenin industry is positioned to expand, responding to the changing tastes of health-conscious and ecologically sensitive consumers. Expansion in Food and Beverage Industry The increasing popularity of food & beverage industry is a key driver of demand for the oxyzenin market. Because of its adoptability and functional qualities, oxyzenin is a perfect ingredient for manufacturers who are seeking to meet growing customer demand for plant-based, allergen-free, and nutrionally balanced products. It can be used in a variety of food & beverage applications, such as vegan meat substitutes, dairy substitutes, protein bars, snacks, and beverages. As food & beverage sector continues to innovate and adopt to varied dietary choices, the use of oxyzenin as a crucial component helps companies to create new, enticing products that corresponds with healthy and sustainability trends, ultimately driving the oxyzenin market forward. Market Trends Growing popularity of oryzenin in the sports nutrition sector The rise of oryzenin in the sports nutrition sector is one of the most significant developments in the market for oryzenin. Oryzenin has become increasingly popular as a sustainable and effective plant-based protein for athletes and fitness aficionados. Its high protein content, varied amino acid profile and ease of digestion make it a valuable component in sports nutrition products like protein supplements, bars and beverages. As more and more people in the sports & fitness sector opt for plant-based & allergen free solutions to aid their training and recovery, the demand for or oryzenin in this sector will continue to grow, contributing significantly to the overall growth in the or oryzenin market. Growth of regional market The growth of the regional market is one of the most important trends in the market of oryzenins. The global demand for oryzenin is growing due to the suitability of the product for various dietary needs and trends. However, there is a noticeable growth in certain regions. For example, the Asian-Pacific countries like China and India are growing rapidly. Health-conscious consumers are looking for plant based protein alternatives. Rice-derived oryzenin is in line with their dietary needs. With rice being a staple crop, the production of oryzenin in these regions is more accessible. This means that the oryzenin market is expanding and diversifying on a regional level. Market Opportunities The rising demand for plant-based proteins creates an opportunity in the oryzenin market. As consumers choose for plant-based diets for health, environmental, and ethical reasons, the demand for high-quality, sustainable, and allergen-friendly protein sources grows. This necessity is perfectly met by oryzenin, which is derived from rice. Its plant-based origins and nutritional benefits make it an appealing option for anyone wishing to substitute animal-derived proteins in their diets. The oryzenin market aims to get benefit from this shift in consumer preferences, tapping into a rapidly developing market sector seeking new and sustainable protein alternatives. Oryzenin is a valuable ingredient in the sports and fitness nutrition market. Its amino acid profile is rich, digestibility is low and it is allergy friendly. This makes it an excellent source of protein for athletes, fitness enthusiasts and those looking to build muscle. Manufacturers of of sports and fitness nutrition products can take advantage of the growing demand for plant based protein supplements, protein bars, and protein shakes. Consumers are increasingly looking for clean, plant based alternatives to help them train, recover and build muscle. Oryzenin has the potential to fulfil these nutritional needs, making it a valuable ingredient for manufacturers in a rapidly growing and niche market segment. Due to the increasing emphasis on the sustainability and ethical aspects of food production, there is a growing demand for protein sources such as oryzenin, which is a renewable source of protein derived from rice and does not require animal products to be produced. This presents an additional significant opportunity for producers of oryzenin. Oryzenin manufacturers have the opportunity to expand into new markets. As consumers become more aware of the health advantages and the versatility of Oryzenin, manufacturers can enter new markets or enter markets with limited or no exposure to Oryzenin. Manufacturers can take advantage of their experience and product offering to introduce Oryzenin based products in areas where new plant-based or allergen friendly dietary trends are taking shape. By expanding into new markets, manufacturers can expand their customer base and diversify revenue streams. This strategy not only expands the market reach but also reduces reliance on existing markets, increasing the long term sustainability of the Oryzenin industry. Market Challenges Low consumer awareness is a major challenge to the success of the oryzenin market. As the ingredient is relatively new in the market so many consumers are unaware of its advantages and have lack of knowledge. This can lead to product adoption and a decrease in demand, as customers may turns to more established protein source. Limited awareness can have an impact on marketing efforts, requiring educational campaigns to communicate the benefits of oryzenin, such as its allergen and gluten-free properties, as well as its plant-based nature. To address this issue, manufacturers must work together to increase awareness and emphasize the benefits of oryzenin in a variety of dietary applications, which will ultimately stimulate consumer interest and stimulate market growth. Oryzenin comes from the extraction of rice bran which is produced as a by product of rice milling. The availability of high quality rice bran varies from region to region. This can lead to supply chain disruption and price volatility. One of the biggest change in the market is lack of raw material availability. Companies may lead to setup secure supply chains and diversify their sourcing strategies. They may also need to invest in technologies to improve the processing efficiency of rice bran. All of this can help to ensure that raw materials are always available and that the production of oryzenin remains consistent.Oryzenin Market segment Analysis

Based on type, the oryzenin market is segmented into Isolate and Concentrate. In 2023, the majority market share of oryzenin was held by oryzenin concentrate, which has a higher protein content making it suitable for applications that need a higher protein concentration such as sports nutrition and protein supplements. Oryzenin concentrate is highly sought after by the sports nutrition industry as it supports muscle recovery and muscle growth. And in the future Isolates will be the dominant type of oryzenin in the market. This is due to its high protein content and growing demand for high-protein products. Isolates can be found in a wide range of food and drink products such as sports nutrition, dietary supplements, and infant formula. They can also be found in many pharmaceutical products such as protein supplements, wound dressing, and more. Based on form, the oryzenin market is segmented into Dry and Liquid. Dry Form was the dominant market share over XX% in 2023, due to its ease of use in various applications, particularly in the sports and nutrition sector. Additionally, the transportation hurdles are lower than those of liquid Form, thus reducing the overall burden on raw material suppliers. However, the liquid form requires further processing of the dry form, which increases the investment. As supply chain pressures have been increasing, particularly in developed countries, product manufacturers are looking for more efficient sources of supply, which will not lead to increased product costs.Oryzenin Market, by Form (in %) in 2023

On the basis of application, the oryzenin market is segmented into Food and beverages, Sports and Energy Nutrition, Animal feed, and Bakery and Confectionary. The Food & Beverages segment dominated the market in 2023 due to the wide range of plant-based proteins used in a variety of food and beverage items, such as vegan meat alternatives and dairy-free drinks, protein bars, and snacks. Oryzenin has become increasingly popular due to its versatility, making it an ideal ingredient to meet the increasing demand for protein alternatives across a variety of dietary preferences. The Sports and Energy Nutrition segment also accounts for a significant portion of the market for Oryzenin, as it is suitable for protein supplements. However, it is important to note that the dynamics of the market may vary from region to region and that larger market shares may be seen in certain regions.

Oryzenin Market Regional Insights

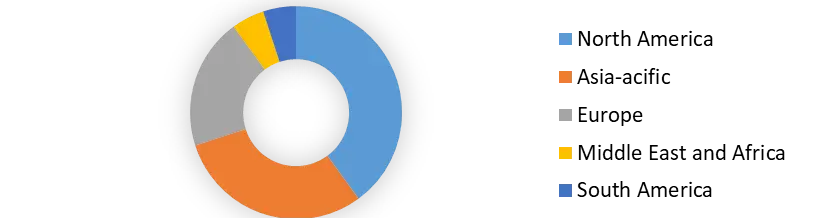

North America region is the leading market for oryzenin due to the increasing demand for processed foods and beverages, as well as various nutraceuticals. The vegan population in the US has grown by 300%, compared to 15 years ago when only around 300,000 were on a plant-based diet. Major product manufacturers and research and development specialists are working under the US demographic due to government incentives. The increasing use of plant-based protein in nutraceutical products, health supplements, and food and beverage is expected to drive the growth of the plant-based protein market. In January 2021, the company No Cow Protein Bar released their chocolate chip cookie dough which contains brown rice protein as the key ingredient. Each serving of the bar contains 190 calories or 0 calories, and provides dietary fiber at 16 grams, which is sufficient to meet the dietary needs of the diabetic population, as well as 21 grams of plant proteins. The Asia-Pacific oryzenin market has grown significantly in recent years because of increasing consumer awareness of plant-based products, particularly plant-based milk. According to a survey, in 2021, a large number of Indian consumers were aware of and had consumed plant-based milk, tofu, and vegan cheese. The food and beverage sector in Asia-Pacific is growing rapidly, especially in emerging economies. This has opened up opportunities for incorporating oryzenins into a variety of products, such as dairy substitutes, meat substitutes or sports nutrition.Oryzenin Market, by Region (%) in 2023

Oryzenin Market Competitive Landscape

The Oryzenin market is highly competitive and fragmented in nature because of existence of several regional and local market players. The most prominent players have adopted a variety of strategies to increase their market revenue, including product innovation and expansion. Furthermore, due to the potential for growth in the market, a number of players have been attempting to incorporate oryzenin into their product range. Additionally, players are working with distributors in various regions to expand their market presence and reach a wider customer base. The major players in the oryzenin market AIDP Inc., Axiom Foods Inc., BENEO GmbH (Südzucker AG), Bioway (Xi'An), Organic Ingredients Co., Ltd., Golden Grain Group Limited, Kerry Group PLC, Ribus Inc., RiceBran Technologies, Inc., The Green Labs LLC, Zedira GmbH. The leading suppliers of oryzenins are well-equipped to take advantage of the expected expansion of the market. They possess the necessary knowledge and resources to create and manufacture superior oryzenine products that satisfy the requirements of both consumers and food producers. The emerging players in the oryzenin market are Beike Biotechnology Co., Ltd. (China), Shenzhen Zhonglian Protein Technology Co., Ltd. (China), Haotian Bio-Tech Co., Ltd. (China), Oriza Green Ingredients Pvt. Ltd. (India), Oryza Protein Technologies Pvt. Ltd. (India), Oryza Labs Inc. (United States). These companies are still in the early stages of development, yet they are experiencing rapid growth. They are devoting resources to research and development in order to create new and innovative products based on oryzenins. Additionally, they are increasing their production capacity in order to satisfy the increasing demand for their products.Oryzenin Industry Ecosystem

Scope of Oryzenin Market : Inquire Before Buying

Global Oryzenin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 199.01 Mn Forecast Period 2024 to 2030 CAGR: 11.8% Market Size in 2030: USD 434.48 Mn Segments Covered: by Type Isolate Concentrate by Form Dry Liquid by Functionality Emulsifying Foaming Gelling Others by End-User Food and beverages Sports and Energy Nutrition Bakery and Confectionary Others Oryzenin Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Oryzenin Market, Key Players are

1. Axiom Foods Inc. 2. AIDP Inc. 3. BENEO GmbH (Südzucker AG) 4. Bioway (Xi'An) Organic Ingredients Co., Ltd. 5. Golden Grain Group Limited 6. Kerry Group PLC 7. Ribus Inc. 8. RiceBran Technologies, Inc. 9. The Green Labs LLC 10. Zedira GmbH 11. Beike Biotechnology Co., Ltd. 12. Shenzhen Zhonglian Protein Technology Co., Ltd. 13. Haotian Bio-Tech Co., Ltd. 14. Oriza Green Ingredients Pvt. Ltd. 15. Oryza Protein Technologies Pvt. Ltd. 16. Oryza Labs Inc.Frequently Asked Questions:

1. What segments are covered in the Global Oryzenin Market report? Ans. The segments covered in the Oryzenin Market report are based on Type, Form, Functionality, Application and Region. 2. Which region dominated the Global Oryzenin Market in 2023? Ans. The North America region dominated the global Oryzenin Market in 2023. 3. What is the market size of the Global Oryzenin Market by 2030? Ans. The market size of the Oryzenin Market by 2030 is expected to reach USD 434.48 Million. 4. What is the forecast period for the Global Oryzenin Market? Ans. The forecast period for the Oryzenin Market is 2024-2030. 5. What was the Global Oryzenin Market size in 2023?? Ans. The Global Oryzenin Market size was USD 199.01 Million in 2023..

1. Oryzenin Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Oryzenin Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Market Size Estimation Methodology 3.1.1. Bottom-Up Approach 3.1.2. Top-Down Approach 4. Market Dynamics 4.1. Oryzenin Market Trends 4.2. Oryzenin Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. PESTLE Analysis 4.5. Regulatory Landscape By Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 4.6. Analysis of Government Schemes and Initiatives For the Oryzenin Industry 4.7. Value Chain Analysis 4.8. Supply Chain Analysis 4.9. Pricing Analysis 4.10. Oryzenin Industry Ecosystem 4.10.1. Key Players in the Oryzenin Industry Ecosystem 4.10.2. Role of Companies in the Oryzenin Industry Ecosystem 4.11. Trade Analysis 4.11.1. Import Data, By Region (2018-2023) 4.11.2. Export Data, By Region (2018-2023) 4.12. Technology Analysis 5. Oryzenin Market: Global Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 5.1. Oryzenin Market Size and Forecast, By Type(2023-2030) 5.1.1. Isolate 5.1.2. Concentrate 5.2. Oryzenin Market Size and Forecast, By Form(2023-2030) 5.2.1. Dry 5.2.2. Liquid 5.3. Oryzenin Market Size and Forecast, By Functionality(2023-2030) 5.3.1. Emulsifying 5.3.2. Foaming 5.3.3. Gelling 5.3.4. Others 5.4. Oryzenin Market Size and Forecast, By Application(2023-2030) 5.4.1. Food and beverages 5.4.2. Sports and Energy Nutrition 5.4.3. Animal feed 5.4.4. Bakery and Confectionary 5.4.5. Others 5.5. Oryzenin Market Size and Forecast, By Region(2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Oryzenin Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 6.1. North America Oryzenin Market Size and Forecast, By Type(2023-2030) 6.1.1. Isolate 6.1.2. Concentrate 6.2. North America Oryzenin Market Size and Forecast, By Form(2023-2030) 6.2.1. Dry 6.2.2. Liquid 6.3. North America Oryzenin Market Size and Forecast, By Functionality(2023-2030) 6.3.1. Emulsifying 6.3.2. Foaming 6.3.3. Gelling 6.3.4. Others 6.4. North America Oryzenin Market Size and Forecast, By Application(2023-2030) 6.4.1. Food and beverages 6.4.2. Sports and Energy Nutrition 6.4.3. Animal feed 6.4.4. Bakery and Confectionary 6.4.5. Others 6.5. North America Oryzenin Market Size and Forecast, By Country (2023-2030) 6.5.1. United States 6.5.1.1. United States Oryzenin Market Size and Forecast, By Type(2023-2030) 6.5.1.1.1. Isolate 6.5.1.1.2. Concentrate 6.5.1.2. United States Oryzenin Market Size and Forecast, By Form(2023-2030) 6.5.1.2.1. Dry 6.5.1.2.2. Liquid 6.5.1.3. United States Oryzenin Market Size and Forecast, By Functionality(2023-2030) 6.5.1.3.1. Emulsifying 6.5.1.3.2. Foaming 6.5.1.3.3. Gelling 6.5.1.3.4. Others 6.5.1.4. United States Oryzenin Market Size and Forecast By Application(2023-2030) 6.5.1.4.1. Food and beverages 6.5.1.4.2. Sports and Energy Nutrition 6.5.1.4.3. Animal feed 6.5.1.4.4. Bakery and Confectionary 6.5.1.4.5. Others 6.5.2. Canada 6.5.2.1. Canada Oryzenin Market Size and Forecast, By Type(2023-2030) 6.5.2.1.1. Isolate 6.5.2.1.2. Concentrate 6.5.2.2. Canada Oryzenin Market Size and Forecast, By Form(2023-2030) 6.5.2.2.1. Dry 6.5.2.2.2. Liquid 6.5.2.3. Canada Oryzenin Market Size and Forecast, By Functionality(2023-2030) 6.5.2.3.1. Emulsifying 6.5.2.3.2. Foaming 6.5.2.3.3. Gelling 6.5.2.3.4. Others 6.5.2.4. Canada Oryzenin Market Size and Forecast, By Application(2023-2030) 6.5.2.4.1. Food and beverages 6.5.2.4.2. Sports and Energy Nutrition 6.5.2.4.3. Animal feed 6.5.2.4.4. Bakery and Confectionary 6.5.2.4.5. Others 6.5.3. Mexico 6.5.3.1. Mexico Oryzenin Market Size and Forecast, By Type(2023-2030) 6.5.3.1.1. Isolate 6.5.3.1.2. Concentrate 6.5.3.2. Mexico Oryzenin Market Size and Forecast, By Form(2023-2030) 6.5.3.2.1. Dry 6.5.3.2.2. Liquid 6.5.3.3. Mexico Oryzenin Market Size and Forecast, By Functionality(2023-2030) 6.5.3.3.1. Emulsifying 6.5.3.3.2. Foaming 6.5.3.3.3. Gelling 6.5.3.3.4. Others 6.5.3.4. Mexico Oryzenin Market Size and Forecast, By Application(2023-2030) 6.5.3.4.1. Food and beverages 6.5.3.4.2. Sports and Energy Nutrition 6.5.3.4.3. Animal feed 6.5.3.4.4. Bakery and Confectionary 6.5.3.4.5. Others 7. Europe Oryzenin Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 7.1. Europe Oryzenin Market Size and Forecast, By Type(2023-2030) 7.2. Europe Oryzenin Market Size and Forecast, By Form(2023-2030) 7.3. Europe Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.4. Europe Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5. Europe Oryzenin Market Size and Forecast, By Country (2023-2030) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.1.2. United Kingdom Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.1.3. United Kingdom Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.1.4. United Kingdom Oryzenin Market Size and Forecast By Application(2023-2030) 7.5.2. France 7.5.2.1. France Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.2.2. France Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.2.3. France Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.2.4. France Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.3. Germany 7.5.3.1. Germany Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.3.2. Germany Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.3.3. Germany Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.3.4. Germany Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.4. Italy 7.5.4.1. Italy Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.4.2. Italy Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.4.3. Italy Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.4.4. Italy Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.5. Spain 7.5.5.1. Spain Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.5.2. Spain Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.5.3. Spain Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.5.4. Spain Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.6. Sweden 7.5.6.1. Sweden Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.6.2. Sweden Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.6.3. Sweden Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.6.4. Sweden Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.7. Austria 7.5.7.1. Austria Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.7.2. Austria Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.7.3. Austria Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.7.4. Austria Oryzenin Market Size and Forecast, By Application(2023-2030) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Oryzenin Market Size and Forecast, By Type(2023-2030) 7.5.8.2. Rest of Europe Oryzenin Market Size and Forecast, By Form(2023-2030) 7.5.8.3. Rest of Europe Oryzenin Market Size and Forecast, By Functionality(2023-2030) 7.5.8.4. Rest of Europe Oryzenin Market Size and Forecast, By Application(2023-2030) 8. Asia Pacific Oryzenin Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 8.1. Asia Pacific Oryzenin Market Size and Forecast, By Type(2023-2030) 8.2. Asia Pacific Oryzenin Market Size and Forecast, By Form(2023-2030) 8.3. Asia Pacific Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.4. Asia Pacific Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5. Asia Pacific Oryzenin Market Size and Forecast, By Country (2023-2030) 8.5.1. China 8.5.1.1. China Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.1.2. China Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.1.3. China Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.1.4. China Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.2. S Korea 8.5.2.1. S Korea Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.2.2. S Korea Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.2.3. S Korea Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.2.4. S Korea Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.3. Japan 8.5.3.1. Japan Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.3.2. Japan Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.3.3. Japan Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.3.4. Japan Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.4. India 8.5.4.1. India Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.4.2. India Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.4.3. India Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.4.4. India Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.5. Australia 8.5.5.1. Australia Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.5.2. Australia Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.5.3. Australia Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.5.4. Australia Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.6. ASEAN 8.5.6.1. ASEAN Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.6.2. ASEAN Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.6.3. ASEAN Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.6.4. ASEAN Oryzenin Market Size and Forecast, By Application(2023-2030) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Oryzenin Market Size and Forecast, By Type(2023-2030) 8.5.7.2. Rest of Asia Pacific Oryzenin Market Size and Forecast, By Form(2023-2030) 8.5.7.3. Rest of Asia Pacific Oryzenin Market Size and Forecast, By Functionality(2023-2030) 8.5.7.4. Rest of Asia Pacific Oryzenin Market Size and Forecast, By Application(2023-2030) 9. South America Oryzenin Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 9.1. South America Oryzenin Market Size and Forecast, By Type(2023-2030) 9.2. South America Oryzenin Market Size and Forecast, By Form(2023-2030) 9.3. South America Oryzenin Market Size and Forecast, By Functionality(2023-2030) 9.4. South America Oryzenin Market Size and Forecast, By Application(2023-2030) 9.5. South America Oryzenin Market Size and Forecast, By Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Oryzenin Market Size and Forecast, By Type(2023-2030) 9.5.1.2. Brazil Oryzenin Market Size and Forecast, By Form(2023-2030) 9.5.1.3. Brazil Oryzenin Market Size and Forecast, By Functionality(2023-2030) 9.5.1.4. Brazil Oryzenin Market Size and Forecast, By Application(2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Oryzenin Market Size and Forecast, By Type(2023-2030) 9.5.2.2. Argentina Oryzenin Market Size and Forecast, By Form(2023-2030) 9.5.2.3. Argentina Oryzenin Market Size and Forecast, By Functionality(2023-2030) 9.5.2.4. Argentina Oryzenin Market Size and Forecast, By Application(2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Oryzenin Market Size and Forecast, By Type(2023-2030) 9.5.3.2. Rest Of South America Oryzenin Market Size and Forecast, By Form(2023-2030) 9.5.3.3. Rest Of South America Oryzenin Market Size and Forecast, By Functionality(2023-2030) 9.5.3.4. Rest Of South America Oryzenin Market Size and Forecast, By Application(2023-2030) 10. Middle East and Africa Oryzenin Market Size and Forecast By Segmentation (By Value USD Mn) (2023-2030) 10.1. Middle East and Africa Oryzenin Market Size and Forecast, By Type(2023-2030) 10.2. Middle East and Africa Oryzenin Market Size and Forecast, By Form(2023-2030) 10.3. Middle East and Africa Oryzenin Market Size and Forecast, By Functionality(2023-2030) 10.4. Middle East and Africa Oryzenin Market Size and Forecast, By Application(2023-2030) 10.5. Middle East and Africa Oryzenin Market Size and Forecast, By Country (2023-2030) 10.5.1. South Africa 10.5.1.1. South Africa Oryzenin Market Size and Forecast, By Type(2023-2030) 10.5.1.2. South Africa Oryzenin Market Size and Forecast, By Form(2023-2030) 10.5.1.3. South Africa Oryzenin Market Size and Forecast, By Functionality(2023-2030) 10.5.1.4. South Africa Oryzenin Market Size and Forecast, By Application(2023-2030) 10.5.2. GCC 10.5.2.1. GCC Oryzenin Market Size and Forecast, By Type(2023-2030) 10.5.2.2. GCC Oryzenin Market Size and Forecast, By Form(2023-2030) 10.5.2.3. GCC Oryzenin Market Size and Forecast, By Functionality(2023-2030) 10.5.2.4. GCC Oryzenin Market Size and Forecast, By Application(2023-2030) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Oryzenin Market Size and Forecast, By Type(2023-2030) 10.5.3.2. Rest Of MEA Oryzenin Market Size and Forecast, By Form(2023-2030) 10.5.3.3. Rest Of MEA Oryzenin Market Size and Forecast, By Functionality(2023-2030) 10.5.3.4. Rest Of MEA Oryzenin Market Size and Forecast, By Application(2023-2030) 11. Company Profile: Key Players 11.1. Axiom Foods Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. AIDP Inc. 11.3. BENEO GmbH (Südzucker AG) 11.4. Bioway (Xi'An) Organic Ingredients Co., Ltd. 11.5. Golden Grain Group Limited 11.6. Kerry Group PLC 11.7. Ribus Inc. 11.8. RiceBran Technologies, Inc. 11.9. The Green Labs LLC 11.10. Zedira GmbH 11.11. Beike Biotechnology Co., Ltd. 11.12. Shenzhen Zhonglian Protein Technology Co., Ltd. 11.13. Haotian Bio-Tech Co., Ltd. 11.14. Oriza Green Ingredients Pvt. Ltd. 11.15. Oryza Protein Technologies Pvt. Ltd. 11.16. Oryza Labs Inc. 12. Key Findings 13. Analyst Recommendations 13.1. Attractive Opportunities for Players in the Oryzenin Market 13.2. Future Outlooks 14. Oryzenin Market: Research Methodology