The Organic Cocoa Products Market has experienced significant growth driven by the increasing digitization of content across industries. The global Organic Cocoa Products Market was valued at USD 6.62 billion in 2023 and is projected to reach USD 10.49 billion by 2030, growing at a CAGR of 6.8% during the forecast period.Organic Cocoa Products Market Overview

Organic cocoa products are developing rapidly due to customer demand for natural and organic foods. Organic cocoa and chocolate are farmed without synthetic fertilizers, pesticides, or GMOs. Organic cocoa products include chocolate, cocoa butter, powder, and beans. Dairy, baking, confectionery, and beverage industries use these commodities significantly. Organic cocoa products are popular due to their flavor, nutritional value, and lack of harmful chemical residues.To know about the Research Methodology :- Request Free Sample Report Rising disposable incomes, changing consumer lifestyles, and a focus on wellness and nutritious eating are driving the organic cocoa market. Organic cocoa products are often associated with ethical work and green manufacturing, which is helping the market flourish. North America and Europe are the top two markets for organic cocoa goods due to their well-established organic food industries and consumer awareness of such products. Organic food trends, rising disposable incomes, and a growing customer base will drive market growth in Asia-Pacific.

Organic Cocoa Products Market Driver:

Health-conscious consumers want organic and natural products without synthetic chemicals, pesticides, and GMOs. Organic cocoa goods are healthier because they are grown utilising organic methods. Organic cocoa's antioxidants and lower pesticide exposure are increasing its popularity. Sustainable and Ethically Sourced Food: Organic cocoa goods are associated with sustainable agriculture, fair trading, and local farmer assistance. Consumers want to support fair pay and environmental protection by buying organic chocolate goods. Manufacturers and merchants are adopting organic cocoa goods to fulfil consumer demands. Opportunities: Emerging Markets: Asia-Pacific and Latin America are promising markets for organic cocoa goods. Disposable incomes, urbanisation, and changing lifestyles are driving premium and organic food purchases in these regions. Organic cocoa products are expanding in these markets due to health concerns and the need for sustainable agriculture. Manufacturers and suppliers take advantage of these opportunities by expanding their distribution networks, creating brand awareness, and customising their products to local tastes. Product Innovation and Diversification: Manufacturers create new organic cocoa-based products to meet consumer demands and grow their customer base. This includes developing nutritious organic cocoa-based snacks, beverages, and functional food products. Organic cocoa goods can be differentiated by flavour, texture, or packaging. Restraints: Limited Supply and Fluctuating Prices: One of the major restraints for the organic cocoa products market is the limited supply of organic cocoa beans. Organic cocoa farming requires adherence to strict standards and certifications, which be challenging for farmers to achieve and maintain. The supply of organic cocoa beans is often lower compared to conventionally grown cocoa beans. This limited supply leads to higher prices for organic cocoa products, making them less accessible for price-sensitive consumers. Fluctuating prices of organic cocoa products due to supply and demand imbalances also pose challenges for manufacturers and retailers in terms of pricing strategies and maintaining profitability. Production and Processing Constraints: Organic cocoa farming often involves traditional and manual cultivation methods, which limit the scalability and efficiency of production. Organic certification requirements necessitate meticulous record-keeping, traceability and compliance with specific guidelines throughout the production and processing stages. Meeting these requirements increase operational costs and create complexities in the supply chain. Organic cocoa products may have shorter shelf lives compared to their conventional counterparts due to the absence of certain preservatives or additives, requiring careful inventory management and efficient distribution systems. Challenges: Education and Consumer Awareness: Many consumers may not fully understand the benefits and value proposition of organic cocoa products compared to conventional alternatives. Educating consumers about the positive environmental, health and social aspects associated with organic cocoa help drive demand. Market players need to invest in marketing campaigns, product labeling and consumer education initiatives to overcome misconceptions and highlight the unique qualities and benefits of organic cocoa products. Certification and Compliance: The certification process involves rigorous inspections, documentation and compliance with specific organic standards, which are time-consuming and resource-intensive. Ensuring supply chain transparency and traceability throughout the entire production and distribution process is essential to maintain organic integrity. Compliance with these stringent requirements pose challenges, especially for small-scale farmers or businesses with limited resources. Meeting the complex certification and compliance standards is crucial to instill trust among consumers and maintain the credibility of organic cocoa products.Market Trends in Organic Cocoa Products Market:

Rising Demand for Artisanal and Single-Origin Organic Cocoa Products: One of the prominent trends in the organic cocoa products market is the increasing consumer demand for artisanal and single-origin products. Consumers are seeking unique and high-quality cocoa products with distinct flavor profiles and traceable sourcing. Artisanal organic cocoa products, often produced in small batches using traditional methods, offer consumers a premium and indulgent experience. Single-origin organic cocoa products, sourced from specific regions or plantations, provide transparency and allow consumers to appreciate the distinct characteristics of cocoa beans from different origins. Growing Interest in Functional and Healthy Organic Cocoa Products: Consumers are increasingly seeking organic cocoa products that offer additional health benefits beyond their indulgent taste. This has led to the development of organic cocoa products fortified with functional ingredients such as vitamins, minerals and super foods. There is a growing demand for organic cocoa products with reduced sugar content, vegan formulations and free from allergens. Emergence of Direct Trade and Farmer Support Initiatives: Companies are increasingly engaging in direct partnerships with cocoa farmers and cooperatives to ensure fair prices, improve the livelihoods of farmers and promote sustainable farming practices. Direct trade initiatives aim to create a transparent and equitable supply chain, establishing long-term relationships between farmers and manufacturers. By supporting farmers' capacity building, providing technical assistance and investing in community development projects, companies in the organic cocoa products market are actively promoting social and environmental sustainability. Demand for Organic Cocoa Products in Food service and Culinary Applications: Organic cocoa products are experiencing a growing demand in the food service and culinary sectors. Restaurants, cafes and bakeries are incorporating organic cocoa into their menus, offering an array of cocoa-infused desserts, beverages and savory dishes. Chefs and culinary professionals are exploring the versatility of organic cocoa and creating unique flavor combinations to enhance the overall dining experience. The trend is further fueled by consumers' desire for premium and differentiated culinary offerings. This increased adoption of organic cocoa products in food service and culinary applications presents opportunities for manufacturers and suppliers to expand their customer base and establish partnerships with key players in the food service industry.Segmentation Analysis of Organic Cocoa Products Market:

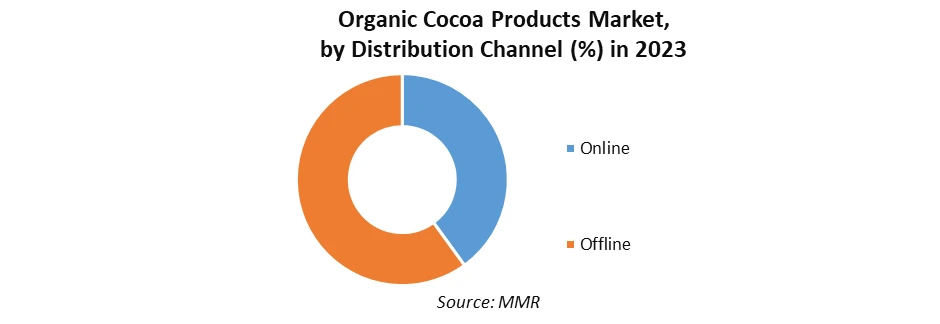

Based on Distribution Channel: The market is segmented into Online and Offline. The Offline segment held the largest Organic Cocoa Products Market share of the global market in 2023. This is attributed to factors such as Convenience for immediate purchase and trying new products, Trust and brand recognition established through physical presence and Potential for higher margins on premium products in specialty stores. The Online segment is expected to grow rapidly during the forecast period. This is attributed to the benefits of online purchases such as 24/7 accessibility and ease of comparison shopping and Potential for lower prices due to reduced overhead costs.

Regional Analysis of Organic Cocoa Products Market:

Organic cocoa products are well-established in North America, where consumers are aware of its benefits and seek quality, responsibly sourced food. Health-conscious Americans choose organic chocolate goods in the North American market. Key players, a strong retail infrastructure, and a wide selection of organic cocoa products drive this industry. Europe, with its strict organic certification criteria and focus on sustainable agriculture, is another major organic cocoa product market. European customers' preference for high-quality organic cocoa products, artisanal chocolatiers, and a strong distribution network drive market growth. The Asia-Pacific organic cocoa products industry is promising. Organic cocoa products are in demand due to rising disposable incomes, urbanisation, and changing diets in these countries. Health awareness and the perception of organic products as healthier are driving market expansion in this region. Organic cocoa farming is rising in Indonesia and the Philippines, encouraging market expansion. Latin America, home to significant cocoa producers, is important to the organic cocoa goods market. High-quality organic cocoa beans come from the region's cocoa-growing history and favourable climate. Latin American consumers are increasingly appreciating organic cocoa goods for domestic and export use. A strong agricultural basis, a developing organic farming movement, and an emphasis on conserving traditional cocoa production practises enhance this market. Organic cocoa demand is rising in the Middle East and Africa. Growing disposable incomes, retail infrastructure, and demand in healthy and premium food products are driving industry expansion. To address organic product demand, Ghana and Côte d'Ivoire, key chocolate producers, are focused on organic cocoa growing. Organic and natural food consumers are driving the Middle East market. Competitive Analysis of Organic Cocoa Products Market: The organic cocoa products industry exhibits a moderately fragmented market structure with a mix of global players, regional companies and local artisans. Global players often dominate the market, leveraging their extensive distribution networks, brand recognition and economies of scale. These companies have a wide product portfolio and strong market presence across multiple regions. Regional players focus on catering to specific markets, capitalizing on local preferences and niche segments. Local artisans and small-scale producers differentiate themselves through unique offerings, craftsmanship and close relationships with farmers. The organic cocoa products market is led by several key players who have established a strong foothold in the industry. These companies often have a global presence, extensive supply chain networks and a diverse range of product offerings. They invest significantly in research and development, sustainability initiatives and marketing to maintain a competitive edge. Examples of key players in the organic cocoa products industry include Barry Callebaut AG, Olam International Ltd, Cargill, Inc., Mondelez International and TCHO Ventures, among others. While the organic cocoa products industry offers opportunities for new entrants, the ease of entry varies depending on factors such as supply chain complexity, certification requirements and competitive intensity. Establishing a sustainable and traceable supply chain is challenging, as it requires partnerships with cocoa farmers, adherence to organic farming practices and compliance with certification standards. Competition from established players with strong brand recognition and distribution networks pose barriers to entry for new market entrants. Key players in the organic cocoa products industry deploy various competitive strategies to differentiate themselves and gain market share. These strategies include product innovation, research and development, sustainability initiatives, brand building, strategic partnerships and targeted marketing campaigns. Companies focus on offering unique product formulations, emphasizing fair trade and organic certifications and showcasing traceability and transparency in their supply chains.Organic Cocoa Products Market Scope: Inquire before buying

Global Organic Cocoa Products Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.62 Bn. Forecast Period 2024 to 2030 CAGR: 6.8% Market Size in 2030: US $ 10.49 Bn. Segments Covered: by Type Cocoa Liquor Cocoa Powder Cocoa Butter Cocoa Paste Cocoa Beans by Application Food & Beverages Bakery & Confectionery Dairy Sweet & Savory Snacks Dressings Pharmaceuticals Personal care by Distribution Channel Online Offline Organic Cocoa Products Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Organic Cocoa Products Key Players

North America: 1. Hershey's (United States) 2. Guittard Chocolate Company (United States) 3. Taza Chocolate (United States) 4. Lake Champlain Chocolates (United States) 5. Scharffen Berger Chocolate Maker (United States) Europe: 1. Lindt &Sprüngli AG (Switzerland) 2. Barry Callebaut AG (Switzerland) 3. Cemoi Chocolatier (France) 4. Valrhona (France) 5. Artisan du Chocolat (United Kingdom) Asia-Pacific: 1. Haigh's Chocolates (Australia) 2. Patchi (Lebanon) 3. Royce' Confectionery (Japan) 4. Lotte Confectionery (South Korea) 5. JBCocoaSdnBhd (Malaysia) Latin America: 1. CasaLuker (Colombia) 2.Natra SA (Spain) 3. Blommer Chocolate Company (United States, with operations in Latin America) 4. Casa Bosques (Mexico) 5. To'ak Chocolate (Ecuador) Middle East and Africa: 1. Puratos (Belgium, with operations in Middle East and Africa) 2. Theobroma Chocolat (United Arab Emirates) 3. Mars Incorporated (United States, with operations in Middle East and Africa) 4. Agostoni Chocolate (Italy, with operations in Africa) 5. Chocolaterie Robert (Mauritius) FAQs: 1. What are the growth drivers for the Organic Cocoa Products Market? Ans. The rising disposable incomes, changing consumer lifestyles and a focus on wellness and nutritious eating are the major drivers for the Organic Cocoa Products Market. 2. What is the major restraint for the Organic Cocoa Products Market growth? Ans. Limited supply, production and processing restrictions are major restraining factors for the Organic Cocoa Products Market growth. 3. Which region is expected to lead the global Organic Cocoa Products Market during the forecast period? Ans. North America and Europe are expected to lead the global Organic Cocoa Products Market during the forecast period with Asia Pacific to be the fastest growing region of the market. 4. What is the projected market size & growth rate of the Organic Cocoa Products Market? Ans. The Organic Cocoa Products Market size was valued at USD 6.62 Billion in 2023 and the total revenue is expected to grow at a CAGR of 6.8% from 2024 to 2030, reaching nearly USD 10.49 Billion. 5. What segments are covered in the Organic Cocoa Products Market report? Ans. The segments covered in the Organic Cocoa Products Market report are type, application, distribution channel and region.

1. Organic Cocoa Products Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Organic Cocoa Products Market: Dynamics 2.1. Organic Cocoa Products Market Trends by Region 2.1.1. North America Organic Cocoa Products Market Trends 2.1.2. Europe Organic Cocoa Products Market Trends 2.1.3. Asia Pacific Organic Cocoa Products Market Trends 2.1.4. Middle East and Africa Organic Cocoa Products Market Trends 2.1.5. South America Organic Cocoa Products Market Trends 2.2. Organic Cocoa Products Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Organic Cocoa Products Market Drivers 2.2.1.2. North America Organic Cocoa Products Market Restraints 2.2.1.3. North America Organic Cocoa Products Market Opportunities 2.2.1.4. North America Organic Cocoa Products Market Challenges 2.2.2. Europe 2.2.2.1. Europe Organic Cocoa Products Market Drivers 2.2.2.2. Europe Organic Cocoa Products Market Restraints 2.2.2.3. Europe Organic Cocoa Products Market Opportunities 2.2.2.4. Europe Organic Cocoa Products Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Organic Cocoa Products Market Drivers 2.2.3.2. Asia Pacific Organic Cocoa Products Market Restraints 2.2.3.3. Asia Pacific Organic Cocoa Products Market Opportunities 2.2.3.4. Asia Pacific Organic Cocoa Products Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Organic Cocoa Products Market Drivers 2.2.4.2. Middle East and Africa Organic Cocoa Products Market Restraints 2.2.4.3. Middle East and Africa Organic Cocoa Products Market Opportunities 2.2.4.4. Middle East and Africa Organic Cocoa Products Market Challenges 2.2.5. South America 2.2.5.1. South America Organic Cocoa Products Market Drivers 2.2.5.2. South America Organic Cocoa Products Market Restraints 2.2.5.3. South America Organic Cocoa Products Market Opportunities 2.2.5.4. South America Organic Cocoa Products Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Organic Cocoa Products Industry 2.8. Analysis of Government Schemes and Initiatives For Organic Cocoa Products Industry 2.9. Organic Cocoa Products Market Trade Analysis 2.10. The Global Pandemic Impact on Organic Cocoa Products Market 3. Organic Cocoa Products Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 3.1.1. Cocoa Liquor 3.1.2. Cocoa Powder 3.1.3. Cocoa Butter 3.1.4. Cocoa Paste 3.1.5. Cocoa Beans 3.2. Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 3.2.1. Food & Beverages 3.2.2. Pharmaceuticals 3.2.3. Personal care 3.3. Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Online 3.3.2. Offline 3.4. Organic Cocoa Products Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Organic Cocoa Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 4.1.1. Cocoa Liquor 4.1.2. Cocoa Powder 4.1.3. Cocoa Butter 4.1.4. Cocoa Paste 4.1.5. Cocoa Beans 4.2. North America Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 4.2.1. Food & Beverages 4.2.2. Pharmaceuticals 4.2.3. Personal care 4.3. North America Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Online 4.3.2. Offline 4.4. North America Organic Cocoa Products Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Cocoa Liquor 4.4.1.1.2. Cocoa Powder 4.4.1.1.3. Cocoa Butter 4.4.1.1.4. Cocoa Paste 4.4.1.1.5. Cocoa Beans 4.4.1.2. United States Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Food & Beverages 4.4.1.2.2. Pharmaceuticals 4.4.1.2.3. Personal care 4.4.1.3. United States Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Online 4.4.1.3.2. Offline 4.4.2. Canada 4.4.2.1. Canada Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Cocoa Liquor 4.4.2.1.2. Cocoa Powder 4.4.2.1.3. Cocoa Butter 4.4.2.1.4. Cocoa Paste 4.4.2.1.5. Cocoa Beans 4.4.2.2. Canada Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Food & Beverages 4.4.2.2.2. Pharmaceuticals 4.4.2.2.3. Personal care 4.4.2.3. Canada Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Online 4.4.2.3.2. Offline 4.4.3. Mexico 4.4.3.1. Mexico Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Cocoa Liquor 4.4.3.1.2. Cocoa Powder 4.4.3.1.3. Cocoa Butter 4.4.3.1.4. Cocoa Paste 4.4.3.1.5. Cocoa Beans 4.4.3.2. Mexico Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Food & Beverages 4.4.3.2.2. Pharmaceuticals 4.4.3.2.3. Personal care 4.4.3.3. Mexico Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Online 4.4.3.3.2. Offline 5. Europe Organic Cocoa Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.2. Europe Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.3. Europe Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Organic Cocoa Products Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Organic Cocoa Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Organic Cocoa Products Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Organic Cocoa Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Organic Cocoa Products Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Organic Cocoa Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 8.2. South America Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 8.3. South America Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Organic Cocoa Products Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Organic Cocoa Products Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Organic Cocoa Products Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Organic Cocoa Products Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Organic Cocoa Products Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Organic Cocoa Products Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hershey's (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Guittard Chocolate Company (United States) 10.3. Taza Chocolate (United States) 10.4. Lake Champlain Chocolates (United States) 10.5. Scharffen Berger Chocolate Maker (United States) 10.6. Lindt &Sprüngli AG (Switzerland) 10.7. Barry Callebaut AG (Switzerland) 10.8. Cemoi Chocolatier (France) 10.9. Valrhona (France) 10.10. Artisan du Chocolat (United Kingdom) 10.11. Haigh's Chocolates (Australia) 10.12. Patchi (Lebanon) 10.13. Royce' Confectionery (Japan) 10.14. Lotte Confectionery (South Korea) 10.15. CasaLuker (Colombia) 10.16. Natra SA (Spain) 10.17. Blommer Chocolate Company (United States, with operations in Latin America) 10.18. Casa Bosques (Mexico) 10.19. To'ak Chocolate (Ecuador) 10.20. Puratos (Belgium, with operations in Middle East and Africa) 10.21. Theobroma Chocolat (United Arab Emirates) 10.22. Mars Incorporated (United States, with operations in Middle East and Africa) 10.23. Agostoni Chocolate (Italy, with operations in Africa) 10.24. Chocolaterie Robert (Mauritius) 11. Key Findings 12. Industry Recommendations 13. Organic Cocoa Products Market: Research Methodology 14. Terms and Glossary