The Organic Baby Food Market size was valued at USD 6.68 Bn in 2022 and market revenue is growing at a CAGR of 9.7% from 2023 to 2029, reaching nearly USD 12.77 Bn by 2029.Organic Baby Food Market

The global organic baby food market has experienced significant growth, reflecting a shift in consumer preferences towards healthier and more sustainable options for their children. The market boasts a diverse array of products, spanning organic infant formula, baby cereals, snacks, and purees. As an escalating number of parents embrace organic alternatives, the market stands at the threshold of sustained growth. Also, the growing awareness among parents regarding the significance of offering wholesome and chemical-free nutrition to their infant’s development further boosts the market's growth. Against the backdrop of a global health crisis, a study by MMR highlights alarming rates of malnutrition among children under 5, emphasizing the urgent need for a comprehensive approach to reshape food systems and prioritize children's nutrition. This crisis, marked by the triple burden of undernutrition, hidden hunger, and overweight affecting millions, is primarily rooted in poor-quality diets. In 2022, over 200 million children suffer from stunting or wasting, with at least 340 million experiencing hidden hunger. Addressing the issue of hidden hunger becomes crucial, and ensuring children receive a proper diet emerges as a key solution. This necessity creates abundant growth opportunities for the Organic Baby Food Market. As parents increasingly seek nutritious and safe options for their children, the market is well-positioned to meet this demand and contribute to reshaping global food systems for a healthier futureTo know about the Research Methodology :- Request Free Sample Report

Organic Baby Food Market Dynamics

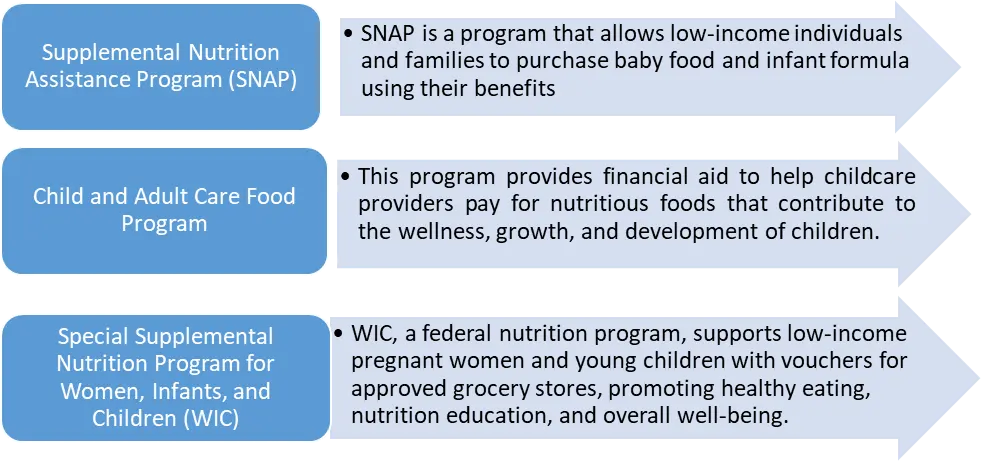

Driver Growing Awareness and Sustainable Choices in Infant Nutrition Boosts the Organic Baby Food Market Growth The organic baby food market is experiencing growth driven by a surge in awareness and demand for healthier and sustainable choices in infant nutrition. Parents and caregivers are increasingly recognizing the importance of nutrition during the critical early stages of a child's life, boosting the market forward. The escalating rates of childhood malnutrition, as evidenced by the triple burden of undernutrition, hidden hunger, and overweight among children under 5, have heightened the global consciousness around the importance of providing optimal nutrition. In light of this crisis, consumers are proactively exploring alternatives that resonate with their aspirations for their child's well-being. This inclination is important to the increasing favorability of organic baby foods, regarded as a healthier and safer choice. The market gains momentum from a broader societal transition towards sustainable and ethical consumption. Parents are progressively embracing environmental consciousness, and this mindfulness extends to the dietary decisions they make for their little ones. The focus on locally sourced organic products signifies a commitment to diminishing the ecological impact linked to food production, promoting a lifestyle that is more sustainable and eco-friendly. The Organic Baby food market's growth is also attributed to the proven nutritional benefits observed in infants consuming organic options. For Example, According To the MMR Study, in the years 2020 and 2021, organic sales surpassed $63 billion, with $1.4 billion total growth over the year. Food sales, which comprise over 90 percent of organic sales, rose to $57.5 billion and non-food sales reached $6 billion in sales. This indicates that the demand for organic food is rapidly growing.Restrain High costs and short shelf life of organic food to hamper the market The organic baby food market faces challenges attributed to the elevated costs and limited shelf life associated with organic products. Despite the increasing demand from consumers for organic baby food, the substantial economic and logistical obstacles present formidable barriers to consistent market growth. The production of organic baby food necessitates strict adherence to organic farming practices, leading to higher costs compared to conventional methods. This involves the use of specialized techniques, organic fertilizers, and the avoidance of synthetic pesticides and genetically modified organisms. These factors contribute to elevated production expenses that are inevitably passed on to consumers. Therefore, the premium pricing of organic baby food dissuades cost-conscious parents from choosing these products over more affordable conventional alternatives. Also, the short shelf life of organic baby food presents a logistical challenge for both manufacturers as well as retailers. Organic products typically lack the synthetic preservatives commonly found in conventional counterparts. This absence of preservatives makes organic baby food more susceptible to spoilage and bacterial contamination, necessitating stringent storage and transportation conditions. The need for quick turnover further complicates supply chain management and increases the risk of product wastage, posing financial challenges for producers. The high costs and short shelf life may limit the accessibility of organic baby food to a niche market, potentially excluding a significant portion of consumers with more budgetary constraints. The overall market reach and penetration are constrained, hindering the industry's potential for widespread adoption. Opportunity The positive government initiatives related to organic baby food Create lucrative growth opportunities for the Market Growth Positive government initiatives related to organic baby food create a favorable environment for market growth, fostering lucrative opportunities for industry growth. These initiatives take the form of regulatory support, financial incentives, and awareness campaigns that collectively contribute to the burgeoning success of the organic baby food market. Government regulations and standards are important in shaping the organic baby food landscape. When governments actively promote and enforce stringent regulations pertaining to the production, labeling, and certification of organic products, it instills confidence in consumers. This regulatory framework ensures that products labeled as "organic" adhere to specific criteria, addressing concerns related to authenticity and quality. Such a regulatory environment not only safeguards consumer interests but also provides a level playing field for businesses, encouraging fair competition within the market. Financial incentives and subsidies offered by governments further stimulate growth within the organic baby food sector. These incentives may include tax breaks, grants, or financial support for organic farming practices. By reducing financial barriers for producers, governments actively encourage the adoption of organic methods, ultimately leading to an increase in the supply of organic ingredients. This, in turn, supports the growth of the organic baby food market by addressing cost challenges and promoting affordability for both producers and consumers. Government-led awareness campaigns also play a pivotal role in shaping consumer perceptions and preferences. When authorities invest in educating the public about the health benefits of organic baby food and the importance of sustainable agricultural practices, it creates a more informed and receptive consumer base. Increased awareness often translates into a higher demand for organic products, driving market growth.

Trend

Nurturing Growth through Innovative Diversification Diversification of product offerings emerges as a distinctive trend in the organic baby food market. Brands are strategically broadening their portfolios to encompass a diverse array of options, including innovative purees, nutritious snacks, and convenient ready-to-eat meals. This trend reflects a proactive response to the evolving preferences and needs of parents seeking a comprehensive range of organic choices for their infants. The market is experiencing a shift towards increased variety and customization, allowing parents to select from an expanded menu of natural and wholesome ingredients tailored to their preferences and nutritional requirements. This unique trend not only enhances consumer satisfaction by providing more options but also positions organic baby food brands as dynamic and responsive to the changing landscape of parental preferences in the realm of infant nutrition.Organic Baby Food Market Segment Analysis

Based on Food Type, Wet food dominates the type segment of the Organic Baby Food Market in the year 2022. Due to its perceived nutritional advantages and convenience. Parents often favor wet organic baby food, such as purees and jarred options, as they are perceived to retain more nutrients and offer a smoother texture for infants transitioning to solid foods. The convenience of ready-to-eat, easily digestible options appeals to busy parents seeking hassle-free meal solutions. Moreover, the controlled packaging ensures hygiene and portion control. The popularity of wet organic baby food aligns with parental preferences for convenient and nutritionally rich alternatives, contributing significantly to the prominence of this segment in the market. The milk and infant milk formula segment is the fastest-growing segment due to the increasing working women population worldwide. The shift in lifestyles and a growing population of working parents has sparked an increased demand for convenient feeding options. Infant milk formulas serve as a practical and readily available substitute for breastfeeding, enabling parents to guarantee that their infants receive essential nutrients, especially in situations where breastfeeding may not be feasible or preferred.Revised Regulations for Safe Baby Food The growing demand for easily consumable and competitive baby food products such as baby cereals, bottled baby foods, frozen baby foods, baby snacks, and soups, it is imperative to establish comprehensive regulations to ensure the safety and quality of these products. In light of the global expansion into untapped markets, especially in developing countries such as Asia, where evolving food technologies and diverse flavors and textures are prevalent, the following revised regulations aim to safeguard the well-being of infants and young children

Regulation Description European Union Regulations The 2006 European Commission Directive 'Foods for Infants and Young Children' sets comprehensive regulations for the baby food market, including strict limits on essential nutrients, prohibitions on toxic agents and pesticides, and hygiene guidelines. Directive 2006/125/EC specifically addresses processed cereal-based foods with strict nutrient criteria United States Regulations The United States maintains parallel regulations through the FDA's Center for Food Safety and Applied Nutrition, ensuring baby food manufacturing aligns with approved standards. Success requires high-quality products, rigorous testing, and regulatory compliance. Chinese Regulations In the 2008 Sanlu infant formula scandal, Chinese regulators heightened efforts to fortify food regulations, particularly in the infant formula and nutritional additives sector. Government bodies, including the Food and Drug Safety Administration, Ministry of Industry and Information Technology, AQISQ, and AIC, conduct extensive safety measures, aiming to globally prioritize the health of the youngest consumers in baby food production and distribution. Regional Analysis

North America region dominates the Organic Baby Food Market in the year 2022. Consumers in these regions have a higher disposable income, which allows them to spend more on organic products. Parents in North America are increasingly aware of the importance of healthy eating for their children. This has led to a growing demand for organic baby food, which is perceived as being healthier and more nutritious than conventional baby food. Governments in North America have implemented policies that promote the production and consumption of organic food. This has helped to make organic baby food more widely available and affordable.The organic baby food market in Europe has experienced substantial growth, driven by a increasing demand for premium products adhering to stringent organic standards. Renowned brands such as HiPP, Holle, and Lebenswert lead with high-quality organic baby formulas sourced from biodynamic farms. The surge in popularity is attributed to a rising preference for formulas derived from free-range cows and goats on certified organic, biodynamic European farms. The market's strength lies in its strict regulations, ensuring the safety and quality of products. European organic baby food, spanning formulas, cereals, and fruit pouches, enjoys broad availability and accessibility within Europe and through international shipping. Consumers globally trust and find satisfaction in these natural, nutritious options, further accelerating the growth of the global organic baby food market. Competitive Analysis The Organic Baby Food market is dynamic. The market includes top manufacturers of organic baby foods such as Hipp GmbH & Co. Vertrieb KG, Organix Brands Ltd., and The Hain Celestial Group, Inc., showcasing the industry's diversity across regional and international levels. These companies are actively investing in research and development, aiming to meet and exceed consumer expectations, to expand their product portfolios. Strategic partnerships, mergers, and acquisitions are prevalent strategies, enabling companies to broaden their global footprint. The companies have a strong focus on innovation and diversification. For example, Cerebelly's launch of science-backed baby food, specifically designed for optimal brain development, and Serenity Kids' introduction of Meat + Herb infant food purees aligned with the Veggies Early and Often initiative exemplify this commitment to advancing nutritional offerings. Gerber's introduction of the "Plant-tastic" organic plant-based line, certified as carbon neutral by the Carbon Trust, underscores a strategic move toward sustainability and providing to the increasing demand for plant-based options.

Organic Baby Food Market Scope Table: Inquire Before Buying

Global Organic Baby Food Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 6.68 Bn. Forecast Period 2023 to 2029 CAGR: 9.7% Market Size in 2029: US $ 12.77 Bn. Segments Covered: by Type Wet Food Infant Milk Formula Dry Food by Distribution Channel Supermarket/Hypermarket Specialty Stores Online Sales Channel Others Organic Baby Food Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Organic Baby Food Market key players

1. Hipp GmbH & Co. Vertrieb KG 2. Organix Brands Ltd. 3. The Hain Celestial Group, Inc. 4. Plum, PBC 5. Healthy Sprouts Foods 6. Baby Gourmet Foods Inc. 7. Abbott Nutrition (Similac Organic) 8. Nestlé S.A. (Gerber Organic) 9. Happy Family Organics 10. Little Duck Organics 11. Olli 12. Earth's Best (The Hain Celestial Group) 13. Amara Organic Foods 14. Babylicious 15. Bellamy's Organic 16. Piccolo 17. Tasty Brands, LLC 18. Ella's Kitchen FAQ 1] What segments are covered in the Global Organic Baby Food Market report? Ans. The segments covered in the Organic Baby Food Market report are based on, Type, Distribution Channel, and Regions. 2] Which region is expected to hold the highest share of the Global Organic Baby Food Market? Ans. The North America region is expected to hold the highest share of the Organic Baby Food Market. 3] What is the market size of the Global Organic Baby Food Market by 2029? Ans. The market size of the Organic Baby Food Market by 2029 is expected to reach US$ 12.77 Bn. 4] What was the market size of the Global Organic Baby Food Market in 2022? Ans. The market size of the Organic Baby Food Market in 2022 was valued at US$ 6.68 Bn. 5] Key players in the Global Organic Baby Food Market. Ans. Hipp GmbH & Co. Vertrieb KG, Organix Brands Ltd., The Hain Celestial Group, Inc., Plum, PBC, Healthy Sprouts Foods, Baby Gourmet Foods Inc.

1. Organic Baby Food Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Organic Baby Food Market: Dynamics 2.1. Organic Baby Food Market Trends by Region 2.1.1. North America Organic Baby Food Market Trends 2.1.2. Europe Organic Baby Food Market Trends 2.1.3. Asia Pacific Organic Baby Food Market Trends 2.1.4. Middle East and Africa Organic Baby Food Market Trends 2.1.5. South America Organic Baby Food Market Trends 2.1.6. Preference Analysis 2.2. Organic Baby Food Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Organic Baby Food Market Drivers 2.2.1.2. North America Organic Baby Food Market Restraints 2.2.1.3. North America Organic Baby Food Market Opportunities 2.2.1.4. North America Organic Baby Food Market Challenges 2.2.2. Europe 2.2.2.1. Europe Organic Baby Food Market Drivers 2.2.2.2. Europe Organic Baby Food Market Restraints 2.2.2.3. Europe Organic Baby Food Market Opportunities 2.2.2.4. Europe Organic Baby Food Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Organic Baby Food Market Drivers 2.2.3.2. Asia Pacific Organic Baby Food Market Restraints 2.2.3.3. Asia Pacific Organic Baby Food Market Opportunities 2.2.3.4. Asia Pacific Organic Baby Food Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Organic Baby Food Market Drivers 2.2.4.2. Middle East and Africa Organic Baby Food Market Restraints 2.2.4.3. Middle East and Africa Organic Baby Food Market Opportunities 2.2.4.4. Middle East and Africa Organic Baby Food Market Challenges 2.2.5. South America 2.2.5.1. South America Organic Baby Food Market Drivers 2.2.5.2. South America Organic Baby Food Market Restraints 2.2.5.3. South America Organic Baby Food Market Opportunities 2.2.5.4. South America Organic Baby Food Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For the Organic Baby Food Industry 2.9. Analysis of Government Schemes and Initiatives For the Organic Baby Food Industry 2.10. The Global Pandemic's Impact on the Organic Baby Food Market 2.11. Organic Baby Food Price Trend Analysis (2021-22) 3. Organic Baby Food Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Organic Baby Food Market Size and Forecast, by Type (2022-2029) 3.1.1. Wet Food 3.1.2. Infant Milk Formula 3.1.3. Dry Food 3.2. Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 3.2.1. Supermarket/Hypermarket 3.2.2. Specialty Stores 3.2.3. Online Sales Channel 3.2.4. Others 3.3. Organic Baby Food Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Organic Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Organic Baby Food Market Size and Forecast, by Type (2022-2029) 4.1.1. Wet Food 4.1.2. Infant Milk Formula 4.1.3. Dry Food 4.2. North America Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Supermarket/Hypermarket 4.2.2. Specialty Stores 4.2.3. Online Sales Channel 4.2.4. Others 4.3. North America Organic Baby Food Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Organic Baby Food Market Size and Forecast, by Type (2022-2029) 4.3.1.1.1. Wet Food 4.3.1.1.2. Infant Milk Formula 4.3.1.1.3. Dry Food 4.3.1.2. United States Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1.2.1. Supermarket/Hypermarket 4.3.1.2.2. Specialty Stores 4.3.1.2.3. Online Sales Channel 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Organic Baby Food Market Size and Forecast, by Type (2022-2029) 4.3.2.1.1. Wet Food 4.3.2.1.2. Infant Milk Formula 4.3.2.1.3. Dry Food 4.3.2.2. Canada Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.2.2.1. Supermarket/Hypermarket 4.3.2.2.2. Specialty Stores 4.3.2.2.3. Online Sales Channel 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Organic Baby Food Market Size and Forecast, by Type (2022-2029) 4.3.3.1.1. Wet Food 4.3.3.1.2. Infant Milk Formula 4.3.3.1.3. Dry Food 4.3.3.2. Mexico Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.3.2.1. Supermarket/Hypermarket 4.3.3.2.2. Specialty Stores 4.3.3.2.3. Online Sales Channel 4.3.3.2.4. Others 5. Europe Organic Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.2. Europe Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3. Europe Organic Baby Food Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.1.2. United Kingdom Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.2. France 5.3.2.1. France Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.2.2. France Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.3.2. Germany Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.4.2. Italy Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.5.2. Spain Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.6.2. Sweden Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.7.2. Austria Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Organic Baby Food Market Size and Forecast, by Type (2022-2029) 5.3.8.2. Rest of Europe Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Organic Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Asia Pacific Organic Baby Food Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.1.2. China Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.2.2. S Korea Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.3.2. Japan Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.4. India 6.3.4.1. India Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.4.2. India Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.5.2. Australia Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.6.2. Indonesia Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.7.2. Malaysia Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.8.2. Vietnam Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.9.2. Taiwan Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Organic Baby Food Market Size and Forecast, by Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Organic Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Organic Baby Food Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Organic Baby Food Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Organic Baby Food Market Size and Forecast, by Type (2022-2029) 7.3.1.2. South Africa Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Organic Baby Food Market Size and Forecast, by Type (2022-2029) 7.3.2.2. GCC Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Organic Baby Food Market Size and Forecast, by Type (2022-2029) 7.3.3.2. Nigeria Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Organic Baby Food Market Size and Forecast, by Type (2022-2029) 7.3.4.2. Rest of ME&A Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Organic Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. South America Organic Baby Food Market Size and Forecast, by Type (2022-2029) 8.2. South America Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. South America Organic Baby Food Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Organic Baby Food Market Size and Forecast, by Type (2022-2029) 8.3.1.2. Brazil Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Organic Baby Food Market Size and Forecast, by Type (2022-2029) 8.3.2.2. Argentina Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Organic Baby Food Market Size and Forecast, by Type (2022-2029) 8.3.3.2. Rest Of South America Organic Baby Food Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Organic Baby Food Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Organic Baby Food Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hipp GmbH & Co. Vertrieb KG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Organix Brands Ltd. 10.3. The Hain Celestial Group, Inc. 10.4. Plum, PBC 10.5. Healthy Sprouts Foods 10.6. Baby Gourmet Foods Inc. 10.7. Abbott Nutrition (Similac Organic) 10.8. Nestlé S.A. (Gerber Organic) 10.9. Happy Family Organics 10.10. Little Duck Organics 10.11. Olli 10.12. Earth's Best (The Hain Celestial Group) 10.13. Amara Organic Foods 10.14. Babylicious 10.15. Bellamy's Organic 10.16. Piccolo 10.17. Tasty Brands, LLC 10.18. Ella's Kitchen 11. Key Findings 12. Industry Recommendations 13. Organic Baby Food Market: Research Methodology