The Oilfield Chemical Market size was valued at USD 28.30 Billion in 2023 and the total Oilfield Chemical Market revenue is expected to grow at a CAGR of 5.2% from 2024 to 2030, reaching nearly USD 40.35 Billion in 2030.Oilfield Chemical Market Overview:

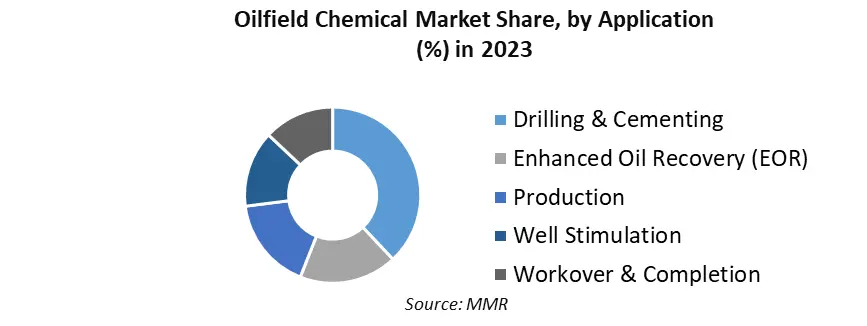

Oilfield chemicals are used in the oil & gas industry to improve the quality of various operations, such as efficiency and effectiveness of oil and gas extraction, processing, and transportation. The chemical finds application under drilling, production, competition, and several other operations under the conditions. The global oilfield chemicals market is expected to maintain steady growth through 2024-2030, driven by rising demand for energy and advancements in oil and gas exploration technologies. The integration of automation technologies with specialty oilfield chemicals is contributing to operational efficiency and overall performance improvement, also Production and Exploration are increasing the result of energy. The global Oilfield Chemical Market is segmented by type, application, and region. The market is predicted to be driven by increased product demand from various petroleum operations, including drilling, well stimulation, cementing, and enhanced oil recovery. Demulsifiers are the most dominant factor in the Oilfield Chemical Market. Drilling and cementing categories held the largest share in the application segment and the North America region is the leading market growth in Global Oilfield Chemical Market. The challenges arise from changing rules and regulations, particularly in countries like China, Japan, Vietnam, and India. As the industry moves forward, companies are likely to emphasize the long-term viability of their product portfolios, aligning with sustainability goals and engaging in asset-oriented deal-making. Oilfield Chemical Market Production:

To know about the Research Methodology:-Request Free Sample Report

Oilfield Chemicals Market Dynamics:

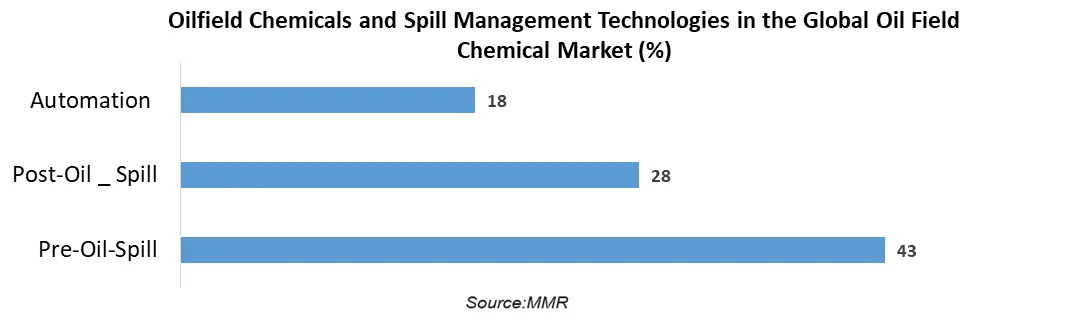

Oilfield Chemicals and Spill Management Technologies in the Global Oil Field Chemical Market Key drivers of oilfield chemical development includes drilling, cementing, well completion, and well stimulation. Increasing energy demand globally is driving the need for more efficient and cost-effective extraction, refining, and distribution of oil and gas. In addition, Automation technology also helps companies meet the demand by optimizing processes and reducing operational costs. Pre-oil spill and post-oil spill are the two major oil spill management technologies used in the market. The pre-oil spill management technology is further bifurcated into double-hull, pipeline leak detection, and blowout preventers. In 2023, over 69% of double-hulling technology is used as a major pre-oil spill management. The marine trade holds a majority part of oil & gas product transportation. They play a pivotal role in safeguarding equipment and pipes against corrosion and facilitating the separation of oil and water, preventing the formation of emulsions during the oil drilling process.

Insights into the Oil Field Chemical Market:

Key trends of the Oil field chemical Market are Decarburization, Digitalization, Sustainability, Circularity, And Energy transition. As per the MMR analysis, Refiners processed 734.8 million metric tons of crude oil in 2023, or about 14.7 million barrels per day (bpd). In 2023, the chemical industry is in a strong financial position. The year ahead possibly resolves to be a turning point when companies emphasize the long-term viability of product portfolios in the context of sustainability in a move toward asset-oriented deal-making. The integration of automation technologies with specialty oilfield chemicals has enhanced operational efficiency and improved overall performance. Global Oil and Gas Industry Surges with Unconventional Onshore Oil Production Set to Double by 2030. Production and exploration are increasing as a result of increased energy demand and lucrative investment opportunities in the oil and gas industry. By 2030 unconventional onshore oil production has been bound to have more than doubled to approximately 22Mbpd, accounting for nearly 30% of global crude oil production. Countries such as China, Japan, Vietnam, India, and others focusing on revising their existing chemical regulation. Hence changing rules and regulations is hampering the market growth. The rising demand for crude oil and its by-products is expected to propel the growth of the oilfield chemicals market going forward. Oilfield chemicals help to enhance the environmental performance of the oil and gas industry by reducing the use of water and other resources, and also help to protect the environment and conserve natural resources. Impacts on the Global Oilfield Chemicals Market: There are several chemicals present in the process of oil and gas, which are harmful. Treated water contains several chemicals, and when released it is harmful to vegetation and fauna. These environmental concerns are projected to restrain the worldwide global oilfield chemicals market during the forecast period 2024-2030. The factor has been affected by the expansion of the oilfield chemicals industry. The essential challenges that the oil industry is facing towards the production of refined industrial products of crude oil and refined industrial products at a lower cost. Oil Field Market Segment: By Type, the Demulsifiers segment is expected to dominate the market in the forecast year of 2023 and grow at a CAGR of 8.42 %. Demulsifiers are widely used to separate water and oil from crude water-oil emulsion, reducing the risk of oil adulteration. Demulsify boosts crude oil export value and the factor drives demulsified specialty oilfield chemicals. Demulsifiers, or emulsion breakers, separate water in oil emulsions. They process crude oil, usually produced with a lot of saline water. The corrosion & scale inhibitor has dominated the market and is growing at the compounded annual growth rate (CAGR) of 6.2% from 2024 to 2030. The use of oilfield chemicals is highly beneficial in reducing expensive equipment downtimes that result from scale build-up in oilfield water systems. The global oilfield equipment rental market was valued at US$ 24.60 Billion in 2023 and is expected to grow at the global oilfield equipment rental market to exhibit a CAGR of 3.70% during 2024-2030. By Application, Drilling is another segment projected to witness growth over the forecast period. The Drilling segment is the highest contributor to the market and is expected to grow at a CAGR of 5.1 % during 2024-2030. Hydraulic fracturing and drilling are a boost to oil chemical and gas operation industry growth. Drilling fluid additives maintain hydrostatic pressure and prevent wellbore cutting. Drilling fluids helps companies drill faster, deeper, longer, and in more challenging conditions. Drilling fluids play an effective role in oilfield chemicals. Oil and gas companies must effectively manage healthy pressure, stabilizing exposed rock, buoyancy, cooling, and lubrication during drilling. Oilfield drilling fluid contains fibers, suspension, clay control, biocides, polymers, suspension, rheology chemicals, surface modifiers, filters, and particles. Driller prevents losses with specialty cement and membrane-sealing solution.

Oilfield Chemical by Regional Insight:

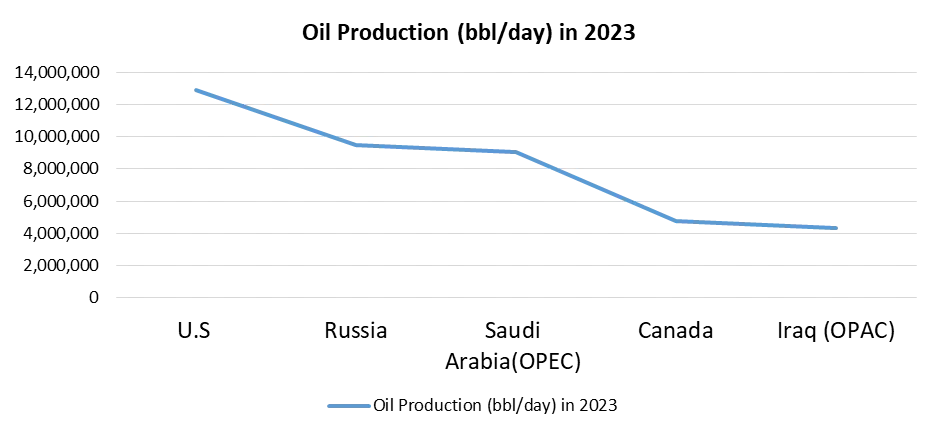

North America region dominated the market with a share of 41% in 2023. The attributed fact is that North America is a key producer of oil and associated products owing to the presence of major oil-producing economies such as the U.S., Canada, and Mexico in the country. U.S. oil supply growth continues to defy expectations, with output shattering the 20 mb/d mark. The United States, in particular, has experienced a surge in domestic oil and gas production, significantly reducing its dependence on imports. Canada's vast oil sands reserves and natural gas resources contribute to the region's energy prowess and strategic importance in the market and Canada has a thriving offshore oil & gas industry. It is the fourth-largest producer of crude oil in the world.Asia Pacific: Asia Pacific region is expected to grow at a CAGR of 6.50 % during the forecast period. The government is expanding oil and gas refining infrastructure to boost productivity. The Indian Ministry of Petroleum & Natural Gas approved US$ 3.8 billion for the Numaligarh Refinery Expansion Project to increase its refining capacity from 3 mmtpa to 9 mmtpa. India’s rising oilfield chemical sales are to help the Asia Pacific market hold 27 % of the value share. Exploration activities and local vendors also drive market growth in the region. The Market of Asia Pacific in oilfield Chemicals has the highest growth rate in terms of value during the forecast period. The increase in consumption and demand for shale gas from various industries, rapid urbanization, and population growth in the region are attributed to industry growth. As per the MMR analysis, approximately 29,813,635 TJ amount of energy was produced using natural gas, and 62,177,573 TJ amount of energy was produced using oil in the Asia Pacific region. Oilfield Chemical Market Competitive Landscape: - Strategic Ventures and Industry Expansions: Recent Developments in the Global Oilfield Chemical Market" 1. In December 2022, ChampionX announced that it has opened a new oilfield services chemical lab and a facility designed to perform analysis tests, which are corrosion coupon analysis, chemical compatibility testing, and bacteria level determination in produced water. 2. In March 2023, North American Land Oil business acquired by Dorf Ketal for USD 14.5 million. 3. In June 2023, Aether Industries, a specialty chemical manufacturer, has signed a Letter of Intent (LoI) with a prominent US-based global oilfield services company to become a strategic supplier and contract manufacturing partner and it is expected to bring significant growth to the oilfield chemicals market, as Aether will manufacture four essential products for the customer, with a substantial portion supplied to India's domestic oil and gas applications, aligning with the 'Make in India' initiative.

Oilfield Chemical Market Scope: Inquire before buying

Global Oilfield Chemical Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 28.30 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 40.35 Bn. Segments Covered: by Type Corrosion & scale inhibitor. Demulsifiers Water Clarifies Equipment Rental Field Operation. Analytical Services. Biocides Scale Inhibitors Paraffin Inhibitors by Application Production Well Stimulation Drilling Fluids Enhanced oil Recovery Cementing Work over & Competition Oilfield Chemical Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Industry Player In The Oilfield Chemical Market

1. BASF SE (Germany) 2. Dow. (U.S.) 3. Halliburton (U.S.) 4. Schlumberger Limited (U.S.) 5. Nouryon (Netherlands) 6. Baker Hughes Company (U.S.) 7. Kemira (Finland) 8. Huntsman International LLC (U.S.) 9. Croda plc (U.K.) 10. Albermarle Corporation (U.S.) 11. Chevron Philips Chemical Company LLC (U.S.) 12. Innospec (U.S.) 13. NOV Inc., (U.S.) 14. Geo (U.S.) 15. KRATON CORPORATION (U.S.) 16. Thermax Limited (India) 17. Oleon N.V. (Belgium) 18. Ashland (U.S.) 19. Stepan Company (U.S.) 20. PureChem Services (Canada) 21. Elementis plc (U.S.) 22. Clariant Frequently Asked Questions: 1] What segments are covered in the Oilfield Chemical Market report? Ans. The segments covered in the Oilfield Chemical Market report are based on Type Application, and Location. 2] Which region is expected to hold the highest share in the Oilfield Chemical Market? Ans. The North American region is expected to hold the highest share of the Oilfield Chemical Market. 3] What is the market size of the Oilfield Chemical Market by 2030? Ans. The market size of the Oilfield Chemical Market by 2030 is US$ 40.35 Bn. 4] What is the forecast period for the Oilfield Chemical Market? Ans. The Forecast period for the Oilfield Chemical Market is 2024- 2030. 5] What was the market size of the Oilfield Chemical Market in 2023? Ans. The market size of the Oilfield Chemical Market in 2023 was USD 28.30 billion.

1. Oilfield Chemical Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Oilfield Chemical Market: Dynamics 2.1. Oilfield Chemical Market Trends by Region 2.1.1. North America Oilfield Chemical Market Trends 2.1.2. Europe Oilfield Chemical Market Trends 2.1.3. Asia Pacific Oilfield Chemical Market Trends 2.1.4. Middle East and Africa Oilfield Chemical Market Trends 2.1.5. South America Oilfield Chemical Market Trends 2.2. Oilfield Chemical Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Oilfield Chemical Market Drivers 2.2.1.2. North America Oilfield Chemical Market Restraints 2.2.1.3. North America Oilfield Chemical Market Opportunities 2.2.1.4. North America Oilfield Chemical Market Challenges 2.2.2. Europe 2.2.2.1. Europe Oilfield Chemical Market Drivers 2.2.2.2. Europe Oilfield Chemical Market Restraints 2.2.2.3. Europe Oilfield Chemical Market Opportunities 2.2.2.4. Europe Oilfield Chemical Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Oilfield Chemical Market Drivers 2.2.3.2. Asia Pacific Oilfield Chemical Market Restraints 2.2.3.3. Asia Pacific Oilfield Chemical Market Opportunities 2.2.3.4. Asia Pacific Oilfield Chemical Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Oilfield Chemical Market Drivers 2.2.4.2. Middle East and Africa Oilfield Chemical Market Restraints 2.2.4.3. Middle East and Africa Oilfield Chemical Market Opportunities 2.2.4.4. Middle East and Africa Oilfield Chemical Market Challenges 2.2.5. South America 2.2.5.1. South America Oilfield Chemical Market Drivers 2.2.5.2. South America Oilfield Chemical Market Restraints 2.2.5.3. South America Oilfield Chemical Market Opportunities 2.2.5.4. South America Oilfield Chemical Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Oilfield Chemical Industry 2.8. Analysis of Government Schemes and Initiatives For Oilfield Chemical Industry 2.9. Oilfield Chemical Market Trade Analysis 2.10. The Global Pandemic Impact on Oilfield Chemical Market 3. Oilfield Chemical Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 3.1.1. Corrosion & scale inhibitor. 3.1.2. Demulsifiers 3.1.3. Water Clarifies 3.1.4. Equipment Rental 3.1.5. Field Operation. 3.1.6. Analytical Services. 3.1.7. Biocides 3.1.8. Scale Inhibitors 3.1.9. Paraffin Inhibitors 3.2. Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 3.2.1. Production 3.2.2. Well Stimulation 3.2.3. Drilling Fluids 3.2.4. Enhanced oil Recovery 3.2.5. Cementing 3.2.6. Work over & Competitio 3.3. Oilfield Chemical Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Oilfield Chemical Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 4.1.1. Corrosion & scale inhibitor. 4.1.2. Demulsifiers 4.1.3. Water Clarifies 4.1.4. Equipment Rental 4.1.5. Field Operation. 4.1.6. Analytical Services. 4.1.7. Biocides 4.1.8. Scale Inhibitors 4.1.9. Paraffin Inhibitors 4.2. North America Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 4.2.1. Production 4.2.2. Well Stimulation 4.2.3. Drilling Fluids 4.2.4. Enhanced oil Recovery 4.2.5. Cementing 4.2.6. Work over & Competitio 4.3. North America Oilfield Chemical Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Corrosion & scale inhibitor. 4.3.1.1.2. Demulsifiers 4.3.1.1.3. Water Clarifies 4.3.1.1.4. Equipment Rental 4.3.1.1.5. Field Operation. 4.3.1.1.6. Analytical Services. 4.3.1.1.7. Biocides 4.3.1.1.8. Scale Inhibitors 4.3.1.1.9. Paraffin Inhibitors 4.3.1.2. United States Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Production 4.3.1.2.2. Well Stimulation 4.3.1.2.3. Drilling Fluids 4.3.1.2.4. Enhanced oil Recovery 4.3.1.2.5. Cementing 4.3.1.2.6. Work over & Competitio 4.3.2. Canada 4.3.2.1. Canada Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Corrosion & scale inhibitor. 4.3.2.1.2. Demulsifiers 4.3.2.1.3. Water Clarifies 4.3.2.1.4. Equipment Rental 4.3.2.1.5. Field Operation. 4.3.2.1.6. Analytical Services. 4.3.2.1.7. Biocides 4.3.2.1.8. Scale Inhibitors 4.3.2.1.9. Paraffin Inhibitors 4.3.2.2. Canada Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Production 4.3.2.2.2. Well Stimulation 4.3.2.2.3. Drilling Fluids 4.3.2.2.4. Enhanced oil Recovery 4.3.2.2.5. Cementing 4.3.2.2.6. Work over & Competitio 4.3.3. Mexico 4.3.3.1. Mexico Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Corrosion & scale inhibitor. 4.3.3.1.2. Demulsifiers 4.3.3.1.3. Water Clarifies 4.3.3.1.4. Equipment Rental 4.3.3.1.5. Field Operation. 4.3.3.1.6. Analytical Services. 4.3.3.1.7. Biocides 4.3.3.1.8. Scale Inhibitors 4.3.3.1.9. Paraffin Inhibitors 4.3.3.2. Mexico Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Production 4.3.3.2.2. Well Stimulation 4.3.3.2.3. Drilling Fluids 4.3.3.2.4. Enhanced oil Recovery 4.3.3.2.5. Cementing 4.3.3.2.6. Work over & Competitio 5. Europe Oilfield Chemical Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.2. Europe Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3. Europe Oilfield Chemical Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Oilfield Chemical Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Oilfield Chemical Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Oilfield Chemical Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Oilfield Chemical Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 8. South America Oilfield Chemical Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 8.2. South America Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 8.3. South America Oilfield Chemical Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Oilfield Chemical Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Oilfield Chemical Market Size and Forecast, by Application (2023-2030) 9. Global Oilfield Chemical Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Oilfield Chemical Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BASF SE (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Dow. (U.S.) 10.3. Halliburton (U.S.) 10.4. Schlumberger Limited (U.S.) 10.5. Nouryon (Netherlands) 10.6. Baker Hughes Company (U.S.) 10.7. Kemira (Finland) 10.8. Huntsman International LLC (U.S.) 10.9. Croda plc (U.K.) 10.10. Albermarle Corporation (U.S.) 10.11. Chevron Philips Chemical Company LLC (U.S.) 10.12. Innospec (U.S.) 10.13. NOV Inc., (U.S.) 10.14. Geo (U.S.) 10.15. KRATON CORPORATION (U.S.) 10.16. Thermax Limited (India) 10.17. Oleon N.V. (Belgium) 10.18. Ashland (U.S.) 10.19. Stepan Company (U.S.) 10.20. PureChem Services (Canada) 10.21. Elementis plc (U.S.) 10.22. Clariant 11. Key Findings 12. Industry Recommendations 13. Oilfield Chemical Market: Research Methodology 14. Terms and Glossary