India Bio Plastics Market size was valued at USD 447.25 Mn in 2023 and the India Bio Plastics Market revenue is expected to reach USD 1809.51 Mn by 2030, at a CAGR of 22.1 % over the forecast period.India Bio Plastics Market Overview

Bioplastics are a type of plastic derived from renewable biomass sources, such as plants, rather than traditional petrochemical sources like oil and natural gas. These plastics are considered more environmentally friendly compared to conventional plastics because they often have a smaller carbon footprint and are derived from renewable resources. India has shown increasing interest in bio-plastics due to growing environmental concerns and a focus on sustainability. The Indian government has been taking steps to promote sustainable practices, and initiatives supporting bio-based products, including bio-plastics, have gained attention. Incentives, subsidies, and regulations promoting environmentally friendly alternatives that influence the India Bio Plastics market. India has a significant agricultural sector, providing a potential source for bio-based feedstocks used in the production of bioplastics.To know about the Research Methodology:-Request Free Sample Report

India Bio Plastics Market Dynamics

Environmental Awareness and Sustainability to boost the India Bio Plastics Market growth Growing environmental concerns and increased awareness of the impact of traditional plastics on ecosystems have driven interest in bio-plastics as more sustainable alternatives. Consumers and businesses are seeking eco-friendly solutions, contributing to the demand for bio-degradable and bio-based materials. The Indian government has been implementing policies and initiatives to promote sustainable practices and reduce environmental pollution. Incentives, subsidies, and regulations supporting the use of bio-based and biodegradable materials have encouraged businesses to adopt bio-plastics, which significantly boost the India Bio Plastics Market growth. India's significant agricultural sector provides a rich source of bio-based feedstocks for the production of bioplastics. Crops such as sugarcane, corn, and other biomass materials are utilized in Bio Plastics manufacture, contributing to the growth of the industry. Many bio-plastics companies in India are incorporating sustainability into their business strategies, including the adoption of bio-plastics to reduce their environmental footprint. Corporate social responsibility (CSR) initiatives often involve the use of eco-friendly materials, further boosting the demand for bioplastics. Bio-plastics are finding applications in various industries, such as packaging, agriculture, automotive, and textiles. The versatility of bio-plastics and their suitability for different uses contribute to their adoption in diverse sectors. Commitment by large companies (both Indian and MNCs) is expected to move towards 100% recyclable plastic packaging by 2025. Plastics circularity in packaging sector:Cost of Production to limit the India Bio Plastics Market growth Bio-plastics are more expensive to produce compared to traditional petroleum-based plastics. The higher production costs are a significant barrier to widespread adoption, especially in price-sensitive markets. The availability of feedstock, such as crops and biomass, is constrained by factors like climate conditions, land use, and competition with food production. Dependence on specific feedstocks create challenges in ensuring a stable and sustainable supply chain, which significantly restrains the India Bio Plastics Market growth. While bio-plastics are often marketed as biodegradable, the conditions required for effective biodegradation are present in all environments. Improper disposal practices, including sending bio-plastics to landfills without the right conditions for degradation, undermine their environmental benefits. Evolving and uncertain regulatory frameworks impact the Indian bio-plastics market. The lack of clear standards and regulations creates uncertainties for businesses and investors.

Circularity Aspect Existing Practices/Scope(International and Indian context) Opportunities Use of bioplastics 1. Largest application (60% of total bio-plastic consumption) in India for packaging. 2. Used in bottles, loose-fill, cups, pots, blows, flexible films, etc. 3. In India, selected FMCG companies aim for 100%. biodegradable plastic for packaging ready-to-eat and cosmetic products. 1. Use of PBS as an alternatives in packaging, including the use in fresh food packaging to enhance lifespan. 2. With bans against SUPs and economies of scale setting in for bio-plastics, their share in packaging sector is expected to increase. Reusable packaging 1. Pepsico India, scaling up its nonreturnable glass bottles for its packaging. 2. Leadec India provides reusable crating solutions for automotive components made of HDPE which can be folded. 3. Reffin aims to offer restaurants with an alternative means of delivering their foods to consumers by using tiffin carriers, generally made out of stainless steel. 1. Many reuse opportunities in business-tobusiness (B2B) applications, which are generally better understood and adopted at scale already. 2. Designing packaging solutions in business-to-consumer (B2C) applications. 3. Potential to meet individual needs, specificities for packaging, improved user experience and create brand loyalty. 4 Replacing existing SUP containers in the growing online food delivery services by using re-usable containers. India Bio Plastics Market Segment Analysis

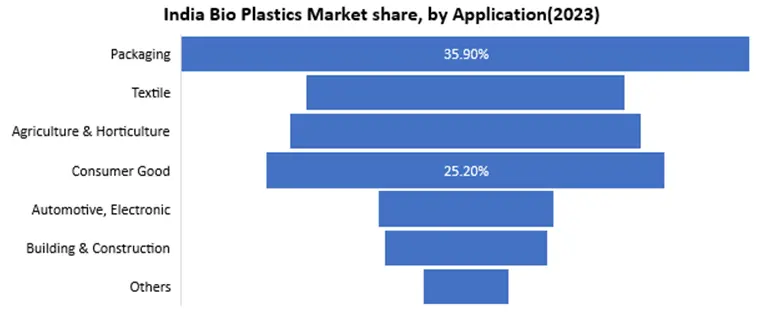

Based on Product, the market is segmented into Biodegradable bioplastics and Non-Biodegradable Bio-plastics. The biodegradable bioplastics segment dominated the market in 2023 and is expected to hold the largest India Bio Plastics Market share over the forecast period. The biodegradable bioplastics segment in the Indian bio plastics market is a specific category within the broader bioplastics industry. Bioplastics, in general, are derived from renewable resources, such as plants, and are considered more environmentally friendly than traditional petroleum-based plastics. The focus on biodegradability in bioplastics adds layer of eco-friendliness, as these materials can break down naturally into harmless substances over time. Increasing awareness of environmental issues and the need for sustainable practices has led to a growing demand for biodegradable alternatives to conventional plastics, which significantly boosted the Biodegradable bioplastics segment growth in India Bio Plastics Market. Jammu & Kashmir is the first state in India to have built a dedicated bio-plastic product manufacturing facility with an installed capacity of about 960 metric tons per annum. Based on Application, the market is segmented into Packaging, Textile, Agriculture & Horticulture, Consumer Goods, Automotive, Electronic, Building & Construction, and Others. The packaging segment dominated the market in 2023 and is expected to hold the largest India Bio Plastics Market share over the forecast period. The packaging segment in the Indian bio plastics market uses bio-based and biodegradable materials in the production of various types of packaging solutions. This sector is gaining traction as a response to environmental concerns associated with traditional packaging materials, such as petroleum-based plastics. The use of bio-plastics in packaging aims to provide more sustainable and eco-friendly alternatives. These are derived from renewable resources, such as corn, sucoulde, or other plant-based materials. Bio-based plastics are used in various types of packaging, including bags, films, and containers.

India Bio Plastics Market Regional Insight

The India bio plastics market is still in its early stages, with only a handful of companies currently operating in this segment. The support from environmental awareness programs, the ready availability of feedstock, and government backing are crucial factors bolstering bioplastics manufacturers in India, which is expected to boost the Indian Bio Plastics Market growth. However, there is a need for more initiatives to enhance production, develop raw materials, and advance technology. Initiating environmental awareness campaigns and emphasizing the long-term benefits of bio-plastics are essential steps toward instigating this change. The National Green Tribunal's state-level committee set a deadline of August 31, 2019, for the government to enforce the ban on conventional plastic, adding urgency to the need for sustainable alternatives. Scientists across India are actively involved in bioplastic development, with a recent breakthrough from IIT-Guwahati leading to the commercial production of a new bioplastic. Biogreen, India’s pioneering biotechnology company for biodegradable products, stands at the forefront of this movement. Other companies such as Truegreen, Plastobags, Ecolife, and Envigreen are already contributing to bioplastics production in India. Technological discoveries have played a pivotal role in propelling the India bio plastics market, resulting in significant industry growth. The responsibility lies with individuals to minimize the use of conventional plastics in their daily lives, contributing to the broader shift towards sustainable and environmentally friendly alternatives. India Bio Plastics Market Competitive Landscape The market has the presence of a large number of players. Major players in the India Bio Plastics market are concentrating on developing new technologies to facilitate the industry with the lowest time and low expenditure consuming technologies. In recent years there have been many discoveries in the field of technologies with regards to the market, which in turn help the industry to grow resulting in a boost to the competition too. Detailed analysis of competition, new entrants, strategic alliances, mergers, and acquisitions in the market is covered in the report. The report covers the India Bio Plastics market leaders and followers in the industry with the market dynamics by region. It also helps to understand the position of each player in the market by region, by segment with their expansion plans, R&D expenditure, and organic & and in-organic growth strategies. Long-term association, strategic alliances, supply chain agreements, and mergers & and acquisition activities are covered in the report in detail from 2018 to 2022. All major & and important players are profiled and benchmarked in the report on different parameters that help readers to gain insight into the market in minimum time. J&K Agro Industries Ltd has started its joint venture with Earthsoul India to launch the country’s first integrated biopolymer facility that manufactures 100% bio-degradable and compostable products. The facility manufactures flower pots and trays for floriculture, carry bags for shopping, packaging material for foodstuff and meats, bin liners for hotels, etc. Ravi Industries in Maharashtra, Harita NTI Ltd and Biotec Bags in Tamilnadu are also the pioneers in Bio-plastics in India.India Bio Plastics Market Scope: Inquire before buying

India Bio Plastics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 447.25 Mn. Forecast Period 2023 to 2029 CAGR: 22.1% Market Size in 2029: US $ 1809.51 Mn. Segments Covered: by Product Biodegradable bioplastics Polyester Polylactic Acid (PLA) Polyhydroxyalkanoates (PHA) Starch BlendsOthers (Cellulose Esters and others) Non-Biodegradable Bio-plastics Bio-PE (polyethylene) Bio-PET (polythene terephthalate) Bio-PA (polyamide) Others by Application Packaging Textile Agriculture & Horticulture Consumer Good Automotive, Electronic Building & Construction Others India Bio Plastics Leading Players include:

1. Envigreen 2. Ecolastic 3. Plastobags 4. Earthsoul India 5. Truegreen 6. Environmental XPRT 7. Corbion India PL 8. Envigreen Biotech India Private Ltd, 9. TORAY INDUSTRIES, INC. Frequently Asked Questions: 1. What are bioplastics, and why are they considered environmentally friendly? Ans: Bioplastics are plastics derived from renewable biomass sources, such as plants, making them more environmentally friendly than traditional petroleum-based plastics. They have a smaller carbon footprint and are derived from sustainable resources. 2. What factors contribute to the growth of the India Bio Plastics Market? Ans: Growing environmental awareness, government initiatives, and incentives promoting eco-friendly alternatives drive the market. The significant agricultural sector in India provides a potential source for bio-based feedstocks. 3. What are the key segments in the India Bio Plastics Market, and which dominates? Ans: The market is segmented into Biodegradable and Non-Biodegradable Bio-plastics. Biodegradable bioplastics dominate, driven by increased awareness and demand for sustainable alternatives. 4. Which state in India has established a dedicated bio-plastic product manufacturing facility? Ans: Jammu & Kashmir is the first state in India to have a dedicated bio-plastic product manufacturing facility with a capacity of about 960 metric tons per annum.

1. India Bio Plastics Market: Executive Summary 1.1 Market Size (2023) & Forecast (2024-2030) 1.2 Market Size (Value USD Million) and Market Share (%) - By Segments 2. India Bio Plastics Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Key Players Benchmarking 2.2.1 Company Name 2.2.2 Product Segment 2.2.3 End-User Segment 2.2.4 Revenue Details 2.2.5 Locations 2.3 Market Structure 2.3.1 Market Leaders 2.3.2 Market Followers 2.3.3 Emerging Players 2.4 Mergers and Acquisitions Details 3. Top 10 States in India to Start a Bioplastics Business 4. Emerging and Under-Research Feedstock for Bioplastics in India 5. Sectors Benefiting from the Bioplastics Sector 6. Specific Central and State Government Policies Supporting Bioplastics in India 7. Strategic Initiatives of Indian Industries in the Bioplastics Sector 8. India Bio Plastics Market: Dynamics 8.1 Market Trends 8.2 Market Dynamics 8.2.1 Drivers 8.2.2 Restraints 8.2.3 Opportunities 8.2.4 Challenges 8.3 PORTER’s Five Forces Analysis 8.4 PESTLE Analysis 8.5 Regulatory Landscape 9. India Bio Plastics Market: Market Size and Forecast by Segmentation (by Value USD Million) (2023-2030) 9.1 Market Size and Forecast, by Product 9.1.1 Biodegradable Bioplastics 9.1.1.1 Polyester 9.1.1.2 Polylactic Acid (PLA) 9.1.1.3 Polyhydroxyalkanoates (PHA) 9.1.1.4 Starch Blends 9.1.1.5 Others (Cellulose Esters and others) 9.1.2 Non-Biodegradable Bio-plastics 9.1.2.1 Bio-PE (Polyethylene) 9.1.2.2 Bio-PET (Polyethylene Terephthalate) 9.1.2.3 Bio-PA (Polyamide) 9.1.2.4 Others 9.2 Market Size and Forecast, by Application 9.2.1 Packaging 9.2.2 Textile 9.2.3 Agriculture & Horticulture 9.2.4 Consumer Goods 9.2.5 Automotive, Electronics 9.2.6 Building & Construction 9.2.7 Others 10. Company Profile: Key Players 10.1 BASF SE 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Recent Developments 10.2 Braskem 10.3 Corbion India PL 10.4 Ecolife 10.5 Envigreen 10.6 Ecolastic 10.7 Plastobags 10.8 Earthsoul India 10.9 Truegreen 10.10 Environmental XPRT 10.11 Biotech India Private Ltd 10.12 TORAY INDUSTRIES, INC. 10.13 NatureWorks LLC 10.14 Novamont 10.15 DuPont de Nemours, Inc. 10.16 Trinseo 10.17 Eastman Chemical Company 10.18 Teijin Limited 10.19 Cardia Bioplastics 10.20 XX Inc. 11. Key Findings 12. Analyst Recommendations 13. India Bio Plastics Market: Research Methodology