North America Engines Market is expected to reach US$4.2 Bn. by 2026, at a CAGR of 5.25% during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

North America Engines Market Dynamics:

The increase in demand for commercial vessels is because of the rise in seaborne trade. The rise in the number of power outages, growing demand for uninterrupted & reliable power supply for industrial applications, increasing demand for commercial vessels owing to increase in seaborne trade, and high demand from power supply utilities to ensure proper functioning of data centers & IT facilities are expected to drive the North America engines market during the forecast period. This growth can be attributed to the demand for reliable and uninterrupted power supply and commercial vessels. Increase in demand for hybrid fuel engines is an opportunity for the North America Engines Market.North America Engines Market Segment Analysis:

On the basis of type, the power generation segment is expected to grow at the fastest rate during the forecast period. Increasing gas-based generation, distributed power generation, rising number of power outages, and the need for reliable power are some of the major factors driving the growth of the power generation segment. Based on power rating, above 700 HP segment led the North America Engines Market in 2019 and is estimated to be the largest market throughout the forecast period. The main production growth is projected to come from natural gas units owing to the increase in shale gas production in the US and gas from oil sands in Canada. Growing demand from the offshore and industrial applications in the US and Canada is expected to drive the above 700 HP segment during the forecast period. The above 700 HP segment is projected to experience a slower growth during the forecast period because of investments uncertainties in the oil & gas industry.North America Engines Market Country Insights:

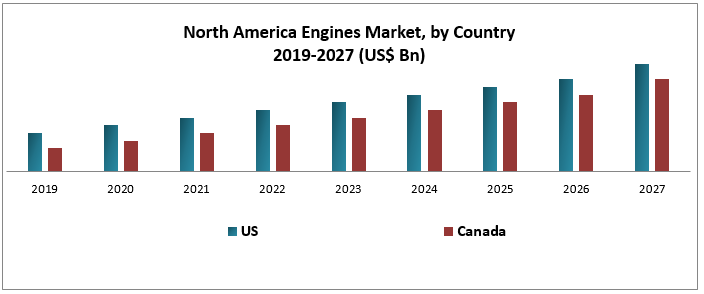

Country-wise, The US is expected to be the largest and fastest North America engines market by 2027 and is projected to grow at the highest CAGR. The main production growth is projected to come from natural gas units due to the increase in shale gas production in the US and gas from oil sands in Canada. Emergency generators are the most attractive application owing to numerous events hosted by the nation as well as due to grid maintenance activities. Therefore, increasing focus on construction and event activities would drive the North America engines market. Recent Developments in North America Engine Market. In July 2017, Volvo Penta acquired widely held stakes in Seven Marine, which is an innovative outboard motor manufacturer. The acquisition would support the company’s footprint in the U.S marine engine market. The objective of the report is to present a comprehensive assessment of the market and contain insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding North America Engines Market dynamics, structure by identifying and analyzing the market segments and project the market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence.Scope of the North America Engines Market Report: Inquire before buying

North America Engines Market, By Type

• Power Generation • MarineNorth America Engines Market, By Power Rating

• 0–60 HP • 60–100 HP • 101–300 HP • 301–500 HP • 501–700 HP • Above 700 HPNorth America Engines Market, By Country

• US • CanadaKey Players Operating in the North America Engines Market:

• Cummins • Caterpillar • Rolls-Royce • Wartsila • John Deere • Kohler • Yanmar Holdings • Mitsubishi Heavy Industries • Volvo Group • Doosan Corporation • MAN SE • DEUTZ AG Asia Pacific Automotive Telematics Market

North America Engines Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Engines Market Size, by Market Value (US$ Bn) & Volume (Units) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. North America Engines Market Industry Trends 4.8. North America Engines Market Competitive Landscape 5. Supply Side and Demand Side Indicators 6. North America Engines Market Analysis and Forecast 6.1. North America Engines Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. North America Engines Market Analysis and Forecast, By Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. North America Engines Market Value Share Analysis, By Type 7.4. North America Engines Market Size (US$ Bn) Forecast, By Type 7.5. North America Engines Market Analysis, By Type 7.6. North America Engines Market Attractiveness Analysis, By Type 8. North America Engines Market Analysis and Forecast, By Power Rating 8.1. Introduction and Definition 8.2. Key Findings 8.3. North America Engines Market Value Share Analysis, By Power Rating 8.4. North America Engines Market Size (US$ Bn) Forecast, By Power Rating 8.5. North America Engines Market Analysis, By Power Rating 8.6. North America Engines Market Attractiveness Analysis, By Power Rating 9. North America Engines Market Analysis, by Country 9.1. North America Engines Market Value Share Analysis, by Country 9.2. North America Engines Market Size (US$ Bn) Forecast, by Country 9.3. North America Engines Market Attractiveness Analysis, by Country 10. North America Engines Market Analysis 10.1. Key Findings 10.2. North America Engines Market Overview 10.3. North America Engines Market Value Share Analysis, By Type 10.4. North America Engines Market Forecast, By Type 10.4.1. Power Generation 10.4.2. Marine 10.5. North America Engines Market Value Share Analysis, By Power Rating 10.6. North America Engines Market Forecast, By Power Rating 10.6.1. 0–60 HP 10.6.2. 60–100 HP 10.6.3. 101–300 HP 10.6.4. 301–500 HP 10.6.5. 501–700 HP 10.6.6. Above 700 HP 10.7. North America Engines Market Value Share Analysis, by Country 10.8. North America Engines Market Forecast, by Country 10.8.1. U.S. 10.8.2. Canada 10.9. North America Engines Market Analysis, by Country 10.10. U.S. Engines Market Forecast, By Type 10.10.1. Power Generation 10.10.2. Marine 10.11. U.S. Engines Market Forecast, By Power Rating 10.11.1. 0–60 HP 10.11.2. 60–100 HP 10.11.3. 101–300 HP 10.11.4. 301–500 HP 10.11.5. 501–700 HP 10.11.6. Above 700 HP 10.12. Canada Engines Market Forecast, By Type 10.12.1. Power Generation 10.12.2. Marine 10.13. Canada Engines Market Forecast, By Power Rating 10.13.1. 0–60 HP 10.13.2. 60–100 HP 10.13.3. 101–300 HP 10.13.4. 301–500 HP 10.13.5. 501–700 HP 10.13.6. Above 700 HP 10.14. North America Engines Market Attractiveness Analysis 10.14.1. By Type 10.14.2. By Power Rating 10.15. PEST Analysis 10.16. Key Trends 10.17. Key Development 11. Company Profiles 11.1. Market Share Analysis, by Company 11.2. Competition Matrix 11.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 11.2.2. New Product Launches and Product Enhancements 11.2.3. Market Consolidation 11.2.3.1. M&A by Countrys, Investment and Applications 11.2.3.2. M&A Key Players, Forward Integration and Backward Integration 11.3. Company Profiles: Key Players 11.3.1. Cummins 11.3.1.1. Company Overview 11.3.1.2. Financial Overview 11.3.1.3. Product Portfolio 11.3.1.4. Business Strategy 11.3.1.5. Recent Developments 11.3.1.6. Manufacturing Footprint 11.3.2. Caterpillar 11.3.3. Rolls-Royce 11.3.4. Wartsila 11.3.5. John Deere 11.3.6. Kohler 11.3.7. Yanmar Holdings 11.3.8. Mitsubishi Heavy Industries 11.3.9. Volvo Group 11.3.10. Doosan Corporation 11.3.11. MAN SE 11.3.12. DEUTZ AG 12. Primary Key Insights