Asia Pacific Automotive Telematics Market was valued at US$ 8.2 Bn in 2019 and is expected to reach US$ 47.9 Bn by 2027, at a CAGR of 24.6 % during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

Asia Pacific Automotive Telematics Market Dynamics:

The automotive industry is observing a phase of the digital revolution. Over the next few years, automobiles will be totally transformed into communication objects. So, the telematics market is expected to grow at a hopeful rate because of the rising consumer demands for staying connected 24*7 even while travelling. Telematics adds functionality to the automotive sector and offers risk assessment data which makes driving a secure experience. In making telematics a mandatory requirement for the automotive industry, governments play an important role as, through telecommunications, they can avoid the number of road accidents, traffic jams owing to car breakups, over-speed etc. Government organizations can use telematics data for a number of uses, such as the collection of accident statistics, regulatory information, safety data retrieval and improved road design. Government orders and similar measures already provide telematics systems with needs. Hand-free mandates for mobile telephones are growing quickly because of driver distraction problems. The preferred solutions will maybe be low-end telematics with a voice user interface and radio system integration. Additionally, the government provides electronic toll collection, information on the road and active security.Asia Pacific Automotive Telematics Market Segment Analysis:

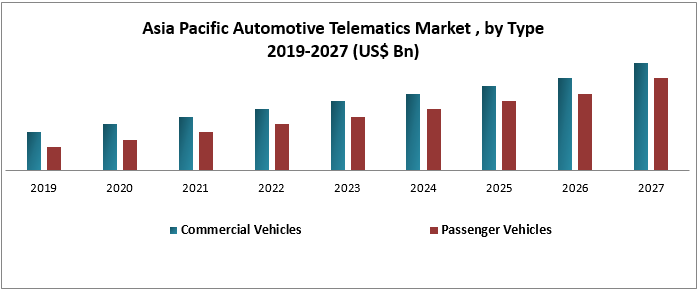

Passenger vehicles segment accounted for the largest revenue share of the market in 2019. The automotive production in 2013 was more than 45.4 Mn and the passenger car segment captures 81% of the total automotive production in the APAC. The increase in the production of passenger vehicles and commercial vehicles has enhanced the market for automotive telematics in the Asia Pacific. Fleet Management segment dominated the Asia Pacific telematics solution market by application and would garner market revenue of $5.7 Mn by 2027. Fleet telematics is composed to keep increasing exponentially as computer applications are developed to take advantage of the rising number of GPS units, increased processing power and widespread use of mobile devices.Asia Pacific Automotive Telematics Market Regional Analysis:

Country-wise, China is the most prominent Asia Pacific market for automotive telematics. Growing demand from automotive OEMs along with the growing aftermarket is expected to fuel the growth of automotive telematics in China. Due to increasing disposable income, consumers are moving towards premium, mid-size and sports utility vehicles, which in turn, will lead to increased vehicle production and further upsurge the usage and adoption of automotive telematics. The automotive telematics market in China is projected to grow at a significant CAGR of 11.6% and is estimated to represent the total incremental opportunity of US$ 3.3 Bn in terms of value throughout the forecast period. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding Asia Pacific Automotive Telematics Market dynamics, structure by identifying and analyzing the market segments and project the market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and country presence.Scope of the Asia Pacific Automotive Telematics Market Report: Inquire before buying

Asia Pacific Automotive Telematics Market, By Type

• Commercial Vehicles • Passenger VehiclesAsia Pacific Automotive Telematics Market, By Application

• Satellite Navigation • Vehicle Safety Communication • Entertainment • Fleet Management • Remote Diagnostics • Vehicle Tracking • OthersAsia Pacific Automotive Telematics Market, By Country

• China • Japan • India • ASEAN • Rest of Asia PacificKey Players Operating in the Asia Pacific Automotive Telematics Market

• Agero • Airbiquity • Continental • Verizon Telematics • Visteon • Bynx • Connexis • Ericsson • Fleetmatics • Luxoft • Magneti Marelli • WirelessCar AB • NTT Docomo. • AT&T Inc. • Ford Motor Company • BMW AG • Robert Bosch GmbH • Valeo S.A • Harman International Industries, Incorporated • Vodafone Group Plc • TELEFÓNICA, S.A

Asia Pacific Automotive Telematics Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Asia Pacific Automotive Telematics Market Size, by Market Value (US$ Bn) and Volume (Units) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Asia Pacific Automotive Telematics Market Industry Trends 4.8. Patent Registration 4.9.Asia Pacific Automotive Telematics Market Competitive Landscape 5. Supply Side and Demand Side Indicators 6. Asia Pacific Automotive Telematics Market Analysis and Forecast 6.1. Asia Pacific Automotive Telematics Market Size & Y-o-Y Growth Analysis 6.1.1. India 6.1.2. China 6.1.3. Japan 6.1.4. ASEAN 6.1.5. Rest of Asia Pacific 7. Asia Pacific Automotive Telematics Market Analysis and Forecast, By Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Asia Pacific Automotive Telematics Market Value Share Analysis, By Type 7.4. Asia Pacific Automotive Telematics Market Size (US$ Bn) Forecast, By Type 7.5. Asia Pacific Automotive Telematics Market Analysis, By Type 7.6. Asia Pacific Automotive Telematics Market Attractiveness Analysis, By Type 8. Asia Pacific Automotive Telematics Market Analysis and Forecast, By Application 8.1. Introduction and Definition 8.2. Key Findings 8.3. Asia Pacific Automotive Telematics Market Value Share Analysis, By Application 8.4. Asia Pacific Automotive Telematics Market Size (US$ Bn) Forecast, By Application 8.5. Asia Pacific Automotive Telematics Market Analysis, By Application 8.6. Asia Pacific Automotive Telematics Market Attractiveness Analysis, By Application 9. Asia Pacific Automotive Telematics Market Analysis 9.1. Key Findings 9.2. Asia Pacific Automotive Telematics Market Overview 9.3. Asia Pacific Automotive Telematics Market Value Share Analysis, By Type 9.4. Asia Pacific Automotive Telematics Market Forecast, By Type 9.4.1. Commercial Vehicles 9.4.2. Passenger Vehicles 9.5. Asia Pacific Automotive Telematics Market Value Share Analysis, By Application 9.6. Asia Pacific Automotive Telematics Market Forecast, By Application 9.6.1. Satellite Navigation 9.6.2. Vehicle Safety Communication 9.6.3. Entertainment 9.6.4. Fleet Management 9.6.5. Remote Diagnostics 9.6.6. Vehicle Tracking 9.6.7. Others 9.7. Asia Pacific Automotive Telematics Market Value Share Analysis, by Country 9.8. Asia Pacific Automotive Telematics Market Forecast, by Country 9.8.1. China 9.8.2. India 9.8.3. Japan 9.8.4. ASEAN 9.8.5. Rest of Asia Pacific 9.9. Asia Pacific Automotive Telematics Market Analysis, by Country 9.10. China Automotive Telematics Market Forecast, By Type 9.10.1. Commercial Vehicles 9.10.2. Passenger Vehicles 9.11. China Automotive Telematics Market Forecast, By Application 9.11.1. Satellite Navigation 9.11.2. Vehicle Safety Communication 9.11.3. Entertainment 9.11.4. Fleet Management 9.11.5. Remote Diagnostics 9.11.6. Vehicle Tracking 9.11.7. Others 9.12. India Automotive Telematics Market Forecast, By Type 9.12.1. Commercial Vehicles 9.12.2. Passenger Vehicles 9.13. India Automotive Telematics Market Forecast, By Application 9.13.1. Satellite Navigation 9.13.2. Vehicle Safety Communication 9.13.3. Entertainment 9.13.4. Fleet Management 9.13.5. Remote Diagnostics 9.13.6. Vehicle Tracking 9.13.7. Others 9.14. Japan Automotive Telematics Market Forecast, By Type 9.14.1. Commercial Vehicles 9.14.2. Passenger Vehicles 9.15. Japan Automotive Telematics Market Forecast, By Application 9.15.1. Satellite Navigation 9.15.2. Vehicle Safety Communication 9.15.3. Entertainment 9.15.4. Fleet Management 9.15.5. Remote Diagnostics 9.15.6. Vehicle Tracking 9.15.7. Others 9.16. ASEAN Automotive Telematics Market Forecast, By Type 9.16.1. Commercial Vehicles 9.16.2. Passenger Vehicles 9.17. ASEAN Automotive Telematics Market Forecast, By Application 9.17.1. Satellite Navigation 9.17.2. Vehicle Safety Communication 9.17.3. Entertainment 9.17.4. Fleet Management 9.17.5. Remote Diagnostics 9.17.6. Vehicle Tracking 9.17.7. Others 9.18. Rest of Asia Pacific Automotive Telematics Market Forecast, By Type 9.18.1. Commercial Vehicles 9.18.2. Passenger Vehicles 9.19. Rest of Asia Pacific Automotive Telematics Market Forecast, By Application 9.19.1. Satellite Navigation 9.19.2. Vehicle Safety Communication 9.19.3. Entertainment 9.19.4. Fleet Management 9.19.5. Remote Diagnostics 9.19.6. Vehicle Tracking 9.19.7. Others 9.20. Asia Pacific Automotive Telematics Market Attractiveness Analysis 9.20.1. By Type 9.20.2. By Application 9.21. PEST Analysis 9.22. Key Trend 9.23. Key Development 10. Company Profiles 10.1. Market Share Analysis, by Company 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 10.2.2. New Product Launches and Product Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Regions, Investment and Applications 10.2.3.2. M&A Key Players, Forward Integration and Backward Integration 10.3. Company Profiles: Key Players 10.3.1. Agero 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Product Portfolio 10.3.1.4. Business Strategy 10.3.1.5. Recent Developments 10.3.1.6. Manufacturing Footprint 10.3.2. Airbiquity 10.3.3. Continental 10.3.4. Verizon Telematics 10.3.5. Visteon 10.3.6. Bynx 10.3.7. Connexis 10.3.8. Ericsson 10.3.9. Fleetmatics 10.3.10. Luxoft 10.3.11. Magneti Marelli 10.3.12. WirelessCar AB 10.3.13. NTT Docomo. 10.3.14. AT&T Inc. 10.3.15. Ford Motor Company 10.3.16. BMW AG 10.3.17. Robert Bosch GmbH 10.3.18. Valeo S.A 10.3.19. Harman International Industries, Incorporated 10.3.20. Vodafone Group Plc 10.3.21. TELEFÓNICA, S.A. 11. Primary Key Insights